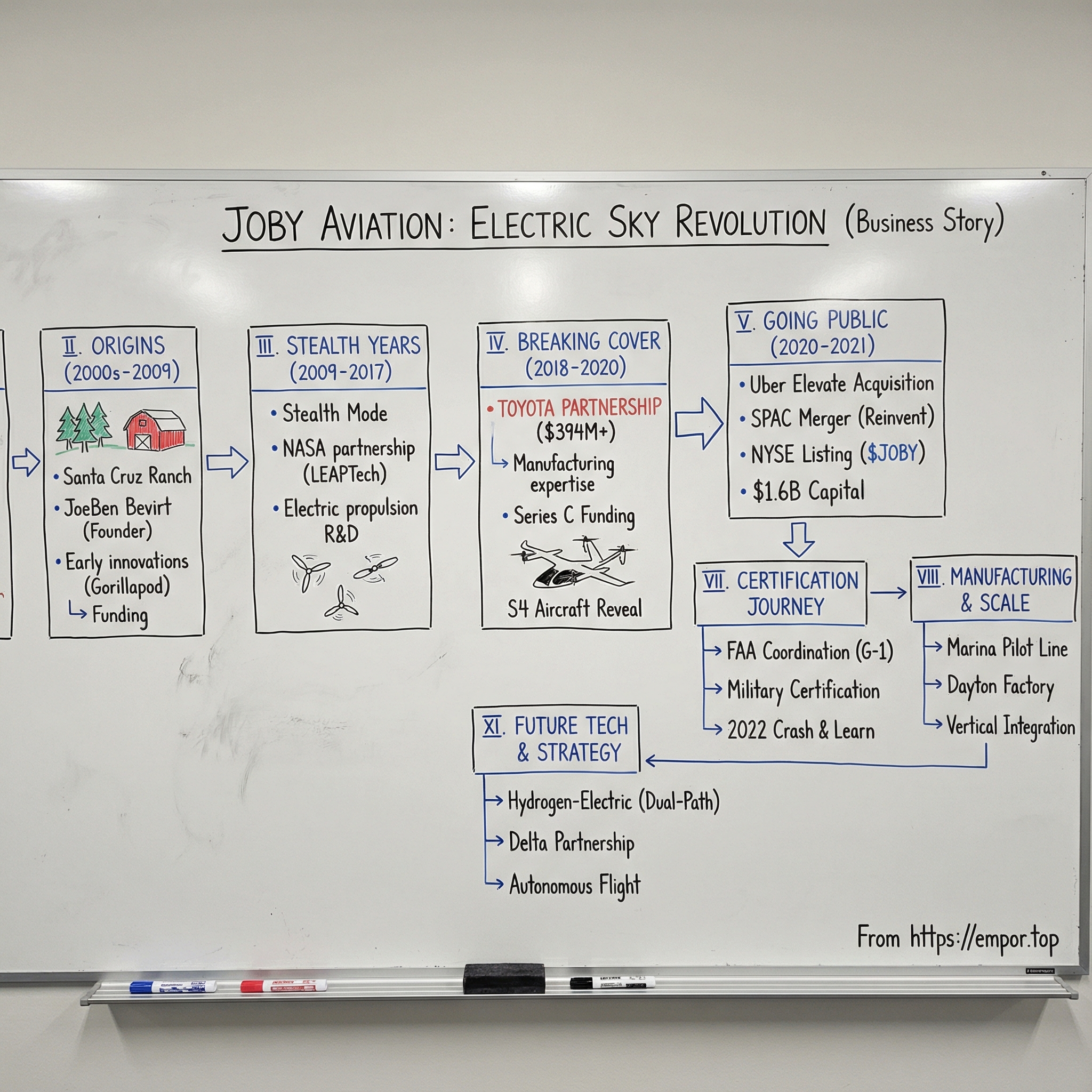

Joby Aviation: The Electric Sky Revolution

I. Introduction & The Aviation Moment

The morning of November 2, 2024, marked a moment that aviation engineers had dreamed about for decades. At 7:14 AM, a sleek, six-rotor aircraft lifted vertically from the tarmac at Manhattan's Downtown Heliport, its electric motors producing barely more sound than a conversation. Twelve minutes later, it touched down at JFK International Airport, having completed the first piloted electric vertical takeoff and landing (eVTOL) air taxi test flight between two public airports in FAA-controlled airspace. The 10 nautical mile journey that typically takes an hour by car in New York traffic had been reduced to the time it takes to grab coffee.

This wasn't some experimental prototype cobbled together in a garage. This was Joby Aviation's production-intent S4 aircraft, the culmination of fifteen years of stealth development, billions in investment, and a radical bet that electric propulsion could transform how humans move through cities. The company behind this machine carries a market capitalization that would make most aerospace startups dizzy—$11.7 billion as of late 2024. Yet here's the twist that would make any traditional investor's head spin: Joby's trailing twelve-month revenue sits at just $111,000, all from military contracts.

The trillion-dollar question hanging in the air, quite literally, is whether electric air taxis can truly revolutionize urban mobility, or if they'll join the graveyard of overhyped transportation dreams alongside flying cars and hyperloops. What makes Joby's story particularly compelling isn't just the technology—though the engineering is remarkable—but how a serial entrepreneur from the Santa Cruz Mountains managed to convince Toyota to invest nearly $900 million, get Uber to hand over its entire air taxi division, and secure certification pathways that competitors are still struggling to navigate.

This is the story of how JoeBen Bevirt, a man whose parents named him after a character in a Ken Kesey novel, built what might be the most capital-intensive startup in aviation history. It's about why the world's most conservative auto manufacturer decided to bet big on flying cars, how a company can burn through hundreds of millions quarterly while investors keep writing checks, and whether the physics and economics of electric flight can actually deliver on Silicon Valley's latest mobility moonshot.

What we're about to explore isn't just another tech unicorn story. It's a case study in patient capital, vertical integration taken to its logical extreme, and what happens when you try to build an entirely new transportation category from scratch. Along the way, we'll unpack why Joby chose to build in complete secrecy for nearly a decade, how they navigated the SPAC boom to go public with essentially no revenue, and why they're simultaneously betting on both battery-electric and hydrogen propulsion—a dual-path strategy that either demonstrates remarkable foresight or dangerous hedging.

The stakes couldn't be higher. Morgan Stanley projects the urban air mobility market could reach $1 trillion by 2040. But between here and there lies a minefield of regulatory hurdles, public acceptance challenges, and the small matter of actually manufacturing aircraft at automotive scale and cost. As one Joby engineer put it during a factory tour: "We're not trying to build a better helicopter. We're trying to build something that makes helicopters obsolete."

II. Origins: The Ranch in the Mountains

Drive ninety minutes south from San Francisco, wind through the redwood-covered Santa Cruz Mountains, and you'll eventually reach a remote stretch of land that locals call the Last Chance community. It's here, on a sprawling ranch surrounded by towering trees and morning fog, that one of the most ambitious transportation companies of the 21st century was born. Not in a Silicon Valley garage or a university lab, but in converted barns and makeshift workshops where JoeBen Bevirt had been tinkering with wild ideas since the early 2000s.The name itself was destiny wrapped in counterculture mystique. JoeBen's name was inspired by the character JoeBen in Ken Kesey's novel Sometimes a Great Notion, a connection that came through his father Ron Bevirt—better known as "Hassler" during his days as one of Ken Kesey's notorious Merry Pranksters. Ron was not only a prominent local figure in the 1960s counterculture but also co-founded Hip Pocket Books, the first counterculture business in Santa Cruz, complete with bronze statues of nude figures above its entrance. This was the intellectual and creative ecosystem that shaped young JoeBen—equal parts Silicon Valley innovation and Santa Cruz rebellion.

Growing up in Last Chance, the house sat at the edge of a meadow with fruit trees overlooking the Pacific Ocean. Each morning, JoeBen would catch a ride to school with his parents. But afternoons were different—he'd take the city bus to the transit station, then another bus up the coast, getting off at Swanton Road before walking a mile to Last Chance and then four more miles home. It gave him hours to dream about better ways of getting from point A to B.

This wasn't idle daydreaming. By seventh grade, when a math teacher told him he'd be an engineer—and had to explain it didn't mean driving trains—JoeBen had found his calling. In high school, he designed and built one of the world's first full-suspension mountain bikes, watching his friends mock him for being "weak" before the entire cycling industry adopted the innovation he'd pioneered in his garage.

But before Joby Aviation would emerge from those Santa Cruz Mountains, Bevirt needed to build the financial foundation that would sustain a moonshot. In 1999, at age 26, he co-founded Velocity11, developing high-performance robotic laboratory systems that caught the attention of Agilent Technologies, which acquired the company. Then in 2005, came the stroke of consumer genius that would fund his aviation dreams: Joby Inc. and the Gorillapod, that bendable, grippy camera tripod that became ubiquitous among photographers and vloggers worldwide. The product was so successful it spawned an entire category of flexible tripods and generated the capital Bevirt would need for his next venture.

On September 11, 2009, Joby Aviation was founded as Joby Aero, one of several projects incubated by Bevirt on his ranch in the Santa Cruz Mountains. The date itself carries its own aviation symbolism—eight years after the attacks that transformed air travel forever, Bevirt was launching a company that aimed to transform it again, this time through electrification and autonomous flight.

The company was originally self-financed by Bevirt after the sale of his previous companies. No venture capitalists knocking down doors. No pitch decks. Just a serial entrepreneur with a successful exit under his belt, converting barns into research facilities, hiring engineers one by one, and pursuing a vision that most of the aviation establishment considered impossible: an electric aircraft that could take off vertically, fly efficiently, land anywhere, and do it all while being quiet enough not to disturb neighborhoods below.

The ambition was staggering. Bevirt wasn't trying to build a better helicopter or a more efficient plane. He was attempting to create an entirely new category of aircraft that would make both obsolete for short-distance travel. The vision: transforming how people move through cities with electric aircraft that could turn hour-long commutes into ten-minute flights, all while producing zero operational emissions and minimal noise.

What's remarkable about Joby's origin story isn't just the technology ambition but the deliberate choice to build away from Silicon Valley's spotlight. While other startups were racing to TechCrunch Disrupt, Bevirt was content to work in obscurity, funded by his own capital, accountable to no one but his vision. It was a luxury few founders could afford, and one that would prove invaluable as Joby spent the next decade in what the industry calls "stealth mode"—though in Bevirt's case, it was more like witness protection.

III. The Stealth Years: Technology Development (2009–2017)

For eight years, Joby Aviation effectively didn't exist to the outside world. No website. No press releases. No conference presentations. Just whispers in aerospace circles about something happening on a ranch in the Santa Cruz Mountains. Engineers who joined the company signed NDAs that would make Apple's look permissive. Visitors—and there were precious few—had their phones confiscated at the gate. Even suppliers were kept in the dark about what their components were being used for. The early years were spent exploring different components of electric aviation, including electric motors, flight software, and lithium-ion batteries. It was methodical, almost academic in its approach. Bevirt and his small team weren't trying to build an aircraft yet—they were deconstructing the fundamental technologies that would make electric flight possible. Motors had to be reimagined for aviation's unique demands. Battery management systems needed to handle the power draws of vertical takeoff. Flight control software had to coordinate multiple rotors with millisecond precision.

In 2012, Joby's work on the Monarch, a personal electric aircraft design, led to the company's selection as a partner for NASA's Greased Lightning and Lotus projects that explored long-endurance aircraft designs with vertical takeoff and landing capability. This was the breakthrough that would accelerate everything. The LEAPTech project began in 2014 when researchers from NASA Langley Research Center and NASA Armstrong Flight Research Center partnered with Joby Aviation and Empirical Systems Aerospace.

The LEAPTech experiment was audacious even by NASA standards. The Leading Edge Asynchronous Propeller Technology project was launched to test the premise that tighter propulsion-airframe integration, made possible with electric motors, could significantly improve efficiency over traditional aircraft. Joby designed and built a 31-foot carbon composite wing section with 18 integrated Joby motors and propellers. They mounted this Frankenstein wing on a specially modified truck and drove it across Edwards Air Force Base's dry lakebed at speeds up to 70 mph, simulating wind tunnel conditions in the open desert.

The success of the truck-mounted wing led NASA to green-light its first all-electric experimental aircraft, the X-57 Maxwell. Joby, NASA, and others worked together on the design of the aircraft, with Joby designing and building the aircraft's cruise motors and power electronics. For a company that had been working in complete secrecy, suddenly collaborating with NASA represented both validation and risk. Government contracts meant scrutiny, deadlines, and the possibility that competitors would glean insights from published research.

Meanwhile, back at the ranch, Joby was evolving its own aircraft design through rapid iteration. Joby's early concept, publicly called the S2, had eight tilting propellers arrayed along the leading edge of its wing and four more tilting propellers mounted on its V-shaped tail. The S2 looked like something from a science fiction movie—twelve propellers in total, a configuration that maximized redundancy but complicated everything from weight distribution to control systems.

Through what Bevirt describes as a "multiyear study of various configurations," the team systematically tested different approaches. Tilt-rotor versus lift-and-cruise. Distributed propulsion versus concentrated thrust. Battery placement in the fuselage versus the wings. Each configuration required not just new engineering but new thinking about what an aircraft could be. Later, the company moved to a configuration that features six rotating propellers. This wasn't just simplification—it was optimization based on thousands of hours of testing and simulation.

The progression was deliberate and methodical. By 2015, the company was operating subscale prototypes of its eVTOL aircraft, moving to full-scale unmanned prototypes in 2017, and a production prototype in 2019. Each stage represented exponential increases in complexity and risk. Subscale prototypes could crash in a field with minimal consequence. Full-scale unmanned vehicles required FAA coordination and safety protocols. The production prototype would eventually carry human lives.

For its first ten years, Joby operated in stealth mode, sometimes leading to skepticism of the company's claims. Aviation forums buzzed with speculation. Was Joby real or vaporware? How could a company claim to be revolutionizing aviation without showing anything publicly? The first journalist granted access to the aircraft in 2018 agreed not to disclose details about the aircraft. Even that limited exposure was carefully orchestrated—showing just enough to prove existence without revealing competitive advantages.

The culture of secrecy extended beyond just protecting intellectual property. It allowed Joby to fail privately, iterate without scrutiny, and avoid the hype cycles that had destroyed other aviation startups. While competitors were making bold proclamations at air shows, Joby was crashing prototypes in the mountains, learning from each failure without public pressure or investor panic.

By 2017, Joby had achieved something remarkable: they had developed, tested, and refined multiple generations of eVTOL aircraft without the world knowing they existed. They had collaborated with NASA on groundbreaking research while maintaining their own parallel development program. They had solved fundamental problems in electric propulsion, battery management, and flight control that others were just beginning to understand.

The stealth years weren't just about building technology—they were about building conviction. Each crashed prototype, each late-night debugging session, each breakthrough in motor efficiency added to a body of knowledge that couldn't be replicated quickly. By the time Joby would finally emerge from the shadows, they would have nearly a decade's head start on competitors who were just beginning to understand the true complexity of electric vertical flight.

IV. Breaking Cover: The Toyota Partnership & Funding Explosion (2018–2020)

February 1, 2018, was the day the aviation world discovered that Joby Aviation actually existed. After nearly a decade of complete secrecy, the company announced it had raised $100 million in Series B funding from a consortium that read like a who's who of strategic technology investors: Intel Capital, Toyota AI Ventures, JetBlue Technology Ventures, and Tesla/SpaceX-backer Capricorn Investment Group. The aviation forums that had debated Joby's existence suddenly had proof—and funding numbers that made everyone pay attention.

But the real earthquake came on January 15, 2020. Standing at a press conference in Santa Cruz, JoeBen Bevirt unveiled not just another funding round, but a transformation in how the world would think about electric aviation. Joby Aviation had raised $590 million in Series C funding led by Toyota Motor Corporation. Toyota Motor Corp. was making a $394 million investment in Joby Aviation, the largest single investment in an eVTOL company to date.

The partnership went far beyond capital. Toyota would share its expertise in manufacturing, quality, and cost controls to support the development and production of Joby Aviation's aircraft. This wasn't just a financial bet—it was Toyota deploying its entire manufacturing playbook to help Joby scale from prototype to production.

"Air transportation has been a long-term goal for Toyota," said Toyota President and CEO Akio Toyoda. The connection ran deeper than most realized. Toyota's interest in aviation dated back to its founding family—Sakichi Toyoda had established a prize in 1925 for anyone who could develop a battery capable of powering "an airplane across the Pacific Ocean." Nearly a century later, his descendants were making that vision reality through Joby.

The manufacturing partnership was unprecedented in its scope. Toyota didn't just write a check—they embedded dozens of engineers directly into Joby's operations. These weren't consultants dropping by for meetings; they were Toyota Production System experts who relocated to California, working shoulder-to-shoulder with Joby's team to redesign everything from factory layouts to quality control processes. They brought with them decades of knowledge about high-volume production, lean manufacturing, and the thousand details that separate a prototype from a product that can be built reliably at scale.

Shigeki Tomoyama, the Executive Vice President of Toyota Motor Corporation, joined Joby Aviation's board of directors, signaling that this was a board-level strategic priority for the Japanese automaker. The partnership addressed Joby's most critical challenge: how to manufacture aircraft with automotive efficiency. Traditional aerospace manufacturing produces dozens of units per year at astronomical costs. Joby needed to produce hundreds, eventually thousands, at prices that would make air taxi services economically viable.

Toyota's engineers were stunned by what they found at Joby. The startup had developed proprietary electric motors with power-to-weight ratios that exceeded anything in automotive applications. The flight control software could coordinate six motors with response times measured in milliseconds. The composite manufacturing techniques Joby had developed for weight optimization could potentially flow back to Toyota's automotive operations.

JoeBen Bevirt captured the significance: "This collaboration with Toyota represents an unprecedented commitment of money and resources for us and this new industry from one of the world's leading automakers. Toyota is known globally for the quality and reliability of their products driven by meticulous attention to detail and manufacturing processes".

The timing of Toyota's investment was strategic. By early 2020, the eVTOL space was heating up rapidly. Competitors like Lilium and Volocopter were raising significant rounds, Uber was promoting its Elevate vision of urban air mobility, and traditional aerospace companies were beginning to take electric aviation seriously. Joby was the first air taxi startup to announce investment of this scale, having previously raised $128.3 million. Lilium and Volocopter followed closely behind, with war chests of $100.9 and $96.5 million, respectively.

But Toyota's investment changed the conversation entirely. This wasn't venture capital making a speculative bet—this was one of the world's most conservative, quality-obsessed manufacturers staking nearly $400 million and its reputation on Joby's success. For an industry where skepticism ran deep, Toyota's validation was worth more than the capital itself.

The reveal of Joby's production aircraft alongside the funding announcement was equally strategic. After years of secrecy, the world finally saw what Joby had been building: a piloted, five-seat vehicle capable of both vertical takeoff and landing and highly efficient, wingborne forward flight, capable of speeds of 200 miles per hour and able to fly over 150 miles on a single charge, while being 100 times quieter than conventional aircraft during takeoff and landing.

The partnership would prove transformative in ways neither company fully anticipated. Toyota's involvement would accelerate Joby's path to production, provide credibility with regulators and customers, and establish a template for how traditional manufacturers could participate in the electric aviation revolution. For Toyota, it was an entry into what they saw as the next frontier of mobility—and a hedge against a future where cars might not be the primary mode of urban transportation.

V. The Uber Elevate Acquisition & Going Public (2020–2021)

December 8, 2020, marked a strategic pivot that would reshape the entire urban air mobility landscape. In a complex transaction that surprised even industry insiders, Joby Aviation announced it would acquire Uber Elevate, the air taxi division that Uber had spent four years and hundreds of millions building. But this wasn't a distressed asset sale—Uber's new $75M investment brings its all-time total investment in Joby to $125 million and Joby Aviation's total funding, including previous rounds, to $820 million.

The deal structure revealed sophisticated financial engineering. Uber had previously made an undisclosed $50 million investment as part of Joby's Series C financing round in January 2020, meaning they had been quietly backing Joby even while running their own competing initiative. Now they were doubling down, effectively admitting that partnering with the leading eVTOL developer made more sense than trying to build the capability internally.

For Uber CEO Dara Khosrowshahi, this was part of a broader strategic retreat from moonshot projects. The COVID-19 pandemic had decimated Uber's core ride-hailing business, forcing the company to shed 7,000 jobs and close 40 offices. The same week Uber sold Elevate to Joby, they also offloaded their autonomous vehicle unit to Aurora for $400 million. The message was clear: Uber would focus on its platform and let specialists handle the complex technology development.

But what Joby acquired wasn't just intellectual property or brand value—it was the brain trust that had essentially created the urban air mobility market. The Elevate team consisted of about 80 employees—people deeply involved in laying the foundations for commercialization of eVTOL aircraft. These weren't just engineers; they were the strategists who had mapped out how air taxis would actually work in practice.

Eric Allison, head of Uber Elevate, would stay on as Joby's head of product. Allison brought unique credibility—he had been CEO of Zee. Aero (now Wisk) before joining Uber, making him one of the few executives who understood both aircraft development and go-to-market strategy. His team had spent years studying movement patterns, identifying optimal markets, modeling pricing, and developing relationships with cities and regulators.

The software and data assets were equally valuable. Uber Elevate had built sophisticated models for market selection, demand simulation, and multi-modal operations. They had identified ideal locations down to the city block for landing sites, developed pricing algorithms that balanced accessibility with profitability, and created seamless integration models between ground and air transportation. This was the commercialization playbook that Joby had been missing. Just two months after acquiring Uber Elevate, Joby made the move that would transform it from a well-funded startup into a public company with access to capital markets. On February 24, 2021, the company announced it would merge with Reinvent Technology Partners, a special purpose acquisition company led by LinkedIn co-founder Reid Hoffman and Zynga founder Mark Pincus.

The SPAC boom of 2020-2021 had created a unique window for capital-intensive companies to go public without the traditional IPO roadshow and scrutiny. For Joby, with no revenue beyond military contracts and years away from commercial operations, a traditional IPO would have been nearly impossible. The SPAC structure, with its emphasis on future projections rather than current financials, was perfect for a company building a new transportation category.

The deal valued Joby at $6.6 billion—a staggering number for a company with essentially no revenue. Through the transaction, Joby captured $1.6 billion in cash proceeds: $690 million from Reinvent's cash in trust and an $835 million PIPE (private investment in public equity) from blue-chip investors including The Baupost Group, BlackRock, Fidelity, and Baillie Gifford. Uber's $75 million convertible note would also convert to common stock.

Reid Hoffman's involvement was more than just financial. His thesis was that Joby represented "Tesla meets Uber in the air"—a company that could both manufacture revolutionary vehicles and operate the service layer on top. Hoffman would join Joby's board, bringing his experience scaling LinkedIn and investing in transformative companies.

The investor presentation that accompanied the SPAC announcement revealed Joby's ambitious projections for the first time. In 10 years, the company projected a presence in over 20 cities worldwide with 14,000 aircraft in service generating more than $20 billion in revenue. These weren't just numbers pulled from thin air—they were based on the modeling and market analysis that the Uber Elevate team had spent years developing.

On August 11, 2021, Joby began trading on the NYSE under the ticker "JOBY." The stock surged more than 20% on its first day, opening at $10.62. To commemorate the listing, Joby displayed its S4 aircraft outside the New York Stock Exchange—the first time many Wall Street professionals had seen an eVTOL in person. JoeBen Bevirt rang the opening bell, a moment that marked the transition from stealth startup to public company.

The timing of the public listing was strategic. Joby needed capital to fund certification, build manufacturing facilities, and prepare for commercial launch targeted for 2024. The $1.6 billion war chest would, theoretically, fund the company through initial commercial operations without needing to return to capital markets.

But going public also meant new pressures. Quarterly earnings calls. Stock price volatility. Short sellers scrutinizing every technical setback. The company that had operated in complete secrecy for a decade was now required to disclose material information immediately. For a company still years from revenue, every quarter would bring questions about cash burn, certification progress, and competitive threats.

The combination of the Uber Elevate acquisition and the SPAC merger represented a masterclass in strategic capital formation. In less than three months, Joby had acquired the leading commercialization team in urban air mobility, secured integration with the world's largest ride-sharing platform, and raised enough capital to fund operations through commercial launch. They had gone from unknown to unavoidable, from stealth to spotlight.

VI. Aircraft Technology & Design Philosophy

Standing next to Joby's S4 aircraft for the first time, what strikes you isn't its futuristic appearance or its six tilting rotors—it's how unremarkable it seems. No exposed wiring. No prototype roughness. Just smooth composite curves and an interior that feels more like a luxury SUV than an experimental aircraft. This is intentional. Every design decision reflects a philosophy that electric aviation should feel familiar, not alien.

The numbers tell one story: four passengers plus pilot, 150-mile range on a single charge, 200 mph top speed, maximum takeoff weight of approximately 5,300 pounds (up from 4,800 pounds estimated previously). But the engineering philosophy tells another—this is an aircraft designed not just to fly, but to disappear into the urban environment.

The propulsion system represents the most visible innovation. Six rotors driven by twelve motors—redundancy built into redundancy. Each rotor can tilt from vertical to horizontal, enabling the crucial transition from hover to forward flight. During takeoff, all six rotors point skyward, lifting the aircraft vertically. Once airborne, they progressively tilt forward, transforming the vehicle from a multicopter into something closer to a traditional airplane, with the wing generating lift and the rotors providing thrust.

This configuration wasn't arbitrary. Through what Joby describes as thousands of hours of simulation and testing, they determined that six rotors provided the optimal balance between redundancy, efficiency, and complexity. Fewer rotors would compromise safety—the aircraft can lose multiple motors and still land safely. More rotors would add weight and complexity without meaningful benefit.

The acoustic signature was an obsession from day one. Traditional helicopters produce around 100 decibels during takeoff—roughly as loud as a chainsaw. Joby's S4 generates just 65 decibels at takeoff from 100 meters away, quieter than normal conversation. In forward flight, it's nearly inaudible from the ground. This wasn't achieved through one breakthrough but through hundreds of optimizations: blade count, tip speed, disk loading, and individual blade pitch control all carefully tuned to minimize noise.

The propellers can individually adjust their tilt, rotational speed, and blade pitch in real-time, helping avoid the blade vortex interactions that cause the distinctive "wop wop" sound of helicopters. The flight control system performs thousands of calculations per second, constantly optimizing each rotor's performance not just for efficiency but for acoustic signature.

Joby's vertical integration strategy extends deep into the aircraft's DNA. While traditional aerospace companies source components from established suppliers, Joby manufactures most critical systems in-house. The electric motors were designed from scratch, optimized specifically for the unique demands of vertical flight and forward cruise. The motor controllers, inverters, and battery management systems—all developed internally.

This approach was born of necessity—when Joby started, there simply weren't suppliers making components for electric aircraft. But it became a competitive advantage. By controlling the entire stack, Joby could optimize each component for the others. The motors could be designed to work perfectly with their specific battery chemistry. The flight control software could be tuned to the exact characteristics of their rotors.

The battery system represents perhaps the biggest technical challenge. Aviation demands energy density, safety, and reliability beyond anything required for ground vehicles. Joby's battery packs use commercially available lithium-ion cells—similar chemistry to what Tesla uses—but packaged and managed specifically for aviation. The thermal management system keeps cells within optimal temperature ranges even during the high power draws of vertical takeoff. Multiple levels of redundancy ensure that cell failures don't cascade into system failures.

The simplified flight control system emphasizes safety through automation. While the aircraft has traditional stick and rudder controls, the fly-by-wire system handles the complex coordination of six tilting rotors. The pilot inputs desired direction and speed; the computer determines how to achieve it. This isn't just about making the aircraft easier to fly—it's about making it virtually impossible to put into an unsafe condition.

The structure itself is almost entirely carbon fiber composite, manufactured using processes Joby developed over years of iteration. Every gram matters in aviation, but especially in electric aviation where battery weight is fixed. The manufacturing process had to be precise enough for aerospace while potentially scalable to automotive volumes—a challenge that had never been solved before.

Inside the cabin, the design philosophy of familiarity continues. Four passenger seats face each other like a luxury train compartment. Large windows provide panoramic views. The noise level during cruise—around 70 decibels—allows normal conversation. USB ports and reading lights wouldn't be out of place in a business jet. The message is clear: this isn't some experimental contraption but a mature transportation product.

The entire aircraft can be recharged in minutes using Joby's proprietary charging system, though standard charging takes about an hour. The batteries are designed to maintain 80% capacity after 10,000 cycles—enough for years of commercial operation. When they do degrade, the modular design allows for replacement without major aircraft downtime.

What's remarkable about Joby's design is what it doesn't have. No complex transmission. No hydraulic systems. No fuel tanks. No oil systems. The mechanical simplicity enabled by electric propulsion eliminates thousands of parts that could fail. An electric motor has essentially one moving part; a turbine engine has thousands.

This simplicity translates directly to operating economics. Joby estimates operating costs at $1.30 per passenger mile, competitive with ground transportation when time savings are considered. Maintenance intervals are measured in thousands of flight hours rather than hundreds. The mean time between failures for electric motors is an order of magnitude better than combustion engines.

VII. Certification Journey & Regulatory Battles

The path to certifying an entirely new category of aircraft is like navigating a maze blindfolded while the walls keep moving. For Joby, the journey began in November 2018 when they applied for a type certificate for their Model JAS4-1 powered-lift aircraft. What seemed straightforward became a multi-year odyssey through uncharted regulatory territory.

The fundamental challenge: the FAA had no existing certification pathway for electric vertical takeoff and landing aircraft. Helicopters? Yes. Airplanes? Of course. But an aircraft that transitions between vertical and horizontal flight using electric motors? The regulations literally didn't exist. Joby would have to help write them while simultaneously proving their aircraft met standards that were being created in real-time.

On November 2, 2018, Joby applied for a type certificate for the Model JAS4-1 powered-lift. Because the FAA has not yet established powered-lift airworthiness standards in title 14 CFR, the FAA type certificates powered-lift as special class aircraft. The company would need to work with regulators to establish entirely new airworthiness criteria, combining elements from airplane, helicopter, and engine certification standards.

By December 2020, Joby achieved a significant milestone—becoming the first eVTOL to receive airworthiness certification from the U.S. Air Force under the Agility Prime program. This military certification provided crucial validation and allowed Joby to begin operations with government customers while civilian certification continued.

February 2021 brought another breakthrough: Joby obtained a 'G-1' certification basis for its aircraft with the FAA. The G-1 represents the agreed-upon set of regulations and special conditions that the aircraft must meet for certification. For Joby, this meant clarity on the specific tests, analyses, and demonstrations required to prove airworthiness.

The certification process involves five stages, each more complex than the last. Stage 1 is the initial application. Stage 2 establishes the certification basis. Stage 3 involves compliance planning. Stage 4 is where the real work happens—testing, analysis, and demonstration. Stage 5 is the final certification. By 2021, Joby had completed the first three stages and was deep into Stage 4.

Then came February 16, 2022—a date that would test not just Joby's aircraft but the entire eVTOL industry's credibility. Joby Aviation's first full-scale eVTOL prototype experienced a "component failure" that resulted in "substantial damage" when it crashed. Investigators said there were no injuries during the accident, which happened over an uninhabited area near Jolon, California, at around 10 a.m. PST on Feb. 16.

The crash occurred during envelope expansion testing—deliberately pushing the aircraft beyond normal operating parameters to understand its limits. The final report said the envelope expansion flight test conditions were beyond the expected operating conditions of the aircraft. The 181 KIAS dive speed achieved during the speed and altitude envelope expansion flight test along with the anomalous prop tilt system at propulsion station 3 had likely resulted in unanticipated aerodynamic interactions which excited the prop mode, leading to a non-uniform blade pitch increase beyond the design limitations of the prototype. The report said this likely caused a load exceedance and resulted in the initial blade failure. The remote aircraft control was lost as a result of the cascading effects of the initial prop separation.

The NTSB investigation revealed a critical lesson: even with extensive simulation and ground testing, real-world flight can expose unexpected aerodynamic interactions. The propeller blade separation that initiated the crash sequence occurred during conditions the aircraft would never experience in normal operations, but understanding these limits is essential for certification.

Industry reaction was mixed. Critics pointed to the crash as evidence that eVTOL technology wasn't ready. Supporters noted that test programs exist precisely to find and fix such issues before passenger operations begin. Boeing's 737 MAX disasters loomed large in everyone's mind—the consequences of inadequate testing and rushed certification.

Remarkably, Joby's certification timeline didn't slip. JoeBen Bevirt told shareholders: "At this stage, we do not expect the accident to have a meaningful impact on our business operations or certification timing, and I'm happy to confirm that our second pre-production prototype has already returned to flight testing." The company had learned from the failure, implemented design changes, and continued testing with their second prototype.

In May 2022, Joby achieved another crucial milestone: Joby received Part 135 air service certification from the FAA, operating a fleet of Cirrus SR22s while it continues seeking certification for its eVTOL aircraft. This certification allows Joby to operate as an air carrier, establishing the operational infrastructure, training programs, and safety management systems required for commercial passenger service.

On June 28, 2023, the company rolled out the first production version of the aircraft and announced it had received FAA approval to flight test that version, sending its stock price as high as 42% above its previous close in midday trading. This wasn't just another prototype—it was the design Joby intended to manufacture at scale, incorporating all lessons learned from years of testing.

The certification challenge extends beyond just the FAA. Different countries have different approaches to eVTOL certification. Both the Federal Aviation Administration and European Union Aviation Safety Agency have addressed propeller safety in their proposed criteria for certifying eVTOLs, although their approaches vary significantly in stringency. The FAA is prepared to accept some critical parts on eVTOLs; that is, components designed, manufactured and maintained in such a way that they generally do not fail. EASA, by contrast, wants to eliminate these single points of failure, potentially constraining the design space for weight-sensitive electric aircraft.

By late 2023, Joby had flown over 30,000 miles on full-scale prototype aircraft and was working closely with regulators in multiple countries. The certification maze that seemed impossible in 2018 was becoming navigable, though the final destination—a certified aircraft carrying paying passengers—remained tantalizingly out of reach.

VIII. Manufacturing & Scale Strategy

The gleaming white factory floor in Marina, California, looks more like a semiconductor clean room than an aircraft manufacturing facility. Workers in color-coded uniforms move with choreographed precision between stations where carbon fiber fuselages take shape alongside banks of electric motors awaiting installation. This is Joby's answer to aviation's most persistent challenge: how to build aircraft at automotive scale and cost.

Traditional aerospace manufacturing is artisanal by necessity. A Boeing 737 contains roughly 600,000 parts from thousands of suppliers, assembled by highly skilled technicians over months. Annual production rarely exceeds dozens of units for most aircraft types. Labor costs dominate. Lead times stretch years. This model works when selling aircraft for tens of millions of dollars. It fails completely for air taxis that need to be economically competitive with ground transportation.

Joby's manufacturing strategy represents a radical departure from aerospace orthodoxy. The Marina facility, initially 55,000 square feet, followed by a 500,000 square foot factory, was designed from scratch with Toyota Production System principles embedded in every process. Assembly lines, not fixed positions. Continuous flow, not batch processing. Statistical process control, not artisan intuition.

The vertical integration that defined Joby's development philosophy extends into manufacturing. While Airbus sources engines from Rolls-Royce and Boeing buys from GE, Joby manufactures its electric motors in-house. The same goes for battery packs, flight controllers, and most structural components. This isn't hubris—it's necessity. The supply chain for electric aircraft components doesn't exist, so Joby had to create it internally.

The motor manufacturing line illustrates this approach. Each motor contains precisely wound copper coils, rare earth magnets, and cooling systems that must perform flawlessly for thousands of hours. Traditional aerospace suppliers quoted two-year lead times and six-figure unit costs. Joby's solution: build them internally at a fraction of the cost with weeks of lead time. The motor line can produce a complete unit every four hours, with quality metrics that exceed aerospace standards.

Composite manufacturing presented unique challenges. Carbon fiber is notoriously difficult to work with—requiring precise temperature control, careful handling, and extensive quality validation. Joby developed proprietary processes that reduce cure times from days to hours while maintaining aerospace-grade strength. Automated fiber placement machines, typically reserved for military aircraft costing hundreds of millions, lay down material with millimeter precision.

But Marina was always intended as a pilot line. The real prize came in 2024 with the announcement of Joby's Dayton, Ohio, production facility. The 140-acre site at Dayton International Airport, when fully developed, will be capable of delivering up to 500 aircraft per year. The location wasn't random—Dayton is the birthplace of aviation, home to Wright-Patterson Air Force Base, and critically, located in a right-to-work state with a deep aerospace workforce.

The Dayton facility represents a $500 million investment and will employ up to 2,000 workers when fully operational. But unlike traditional aerospace facilities that rely on highly specialized technicians with decades of experience, Joby is designing manufacturing processes that can be executed by workers with automotive backgrounds. The difference between assembling an electric motor for a Tesla and one for a Joby aircraft is smaller than most realize.

Toyota's influence permeates the production strategy. Kanban cards track parts through the system. Andon cords allow any worker to stop the line if they spot a defect. Kaizen events continuously improve processes. The goal isn't just to build aircraft more cheaply—it's to build them with automotive reliability. A Tesla Model 3 has a failure rate measured in parts per million. Traditional aircraft accept rates orders of magnitude higher. Joby aims to achieve automotive quality at aerospace safety levels.

The production ramp strategy is deliberately conservative. Rather than the "production hell" that Tesla experienced trying to scale the Model 3, Joby plans to increase production gradually: 24 aircraft per year initially, doubling annually until reaching steady-state production of 500 units. Each doubling allows for process refinement, supply chain stabilization, and workforce training.

Quality control represents perhaps the biggest departure from automotive manufacturing. Every structural component undergoes non-destructive testing. Every motor is run through thousands of cycles before installation. Every battery cell is tested individually. The FAA requires detailed documentation of every part, every process, every technician's qualification. A car manufacturer might sample one vehicle per hundred for detailed inspection; Joby inspects every component of every aircraft.

The supply chain strategy balances vertical integration with strategic partnerships. While Joby manufactures critical components internally, commodity parts come from established suppliers. Sensors from Honeywell. Avionics from Garmin. Seats from automotive suppliers adapted for aviation. The key is maintaining control over components that drive performance, cost, and differentiation while leveraging existing supply chains for everything else.

Material costs tell the production story. A traditional small aircraft might have $500,000 in material costs for a vehicle selling for $2 million. Joby targets material costs under $150,000 for an aircraft that will generate millions in revenue over its lifetime. The difference comes from automotive-scale purchasing, simplified design, and elimination of expensive combustion propulsion systems.

The learning curve benefits are substantial. In aerospace, costs typically decline 15-20% with each doubling of cumulative production. Joby's simplified design and automated production should accelerate this curve. The hundredth aircraft will cost substantially less than the tenth. The thousandth will approach automotive unit economics.

Workforce development presents both challenge and opportunity. Dayton's aerospace heritage means skilled workers are available, but they need retraining for electric aircraft production. Joby partnered with Sinclair Community College to develop curriculum specific to eVTOL manufacturing. Students learn composite fabrication, electric motor assembly, and battery management—skills that barely existed in aerospace a decade ago.

The production system is designed for global replication. Once perfected in Dayton, the same equipment, processes, and training can be deployed to facilities worldwide. Joby envisions regional production centers serving local markets, reducing shipping costs and satisfying local content requirements that many countries impose on aircraft purchases.

By late 2024, the Marina facility was producing one aircraft per month, with each unit requiring approximately 2,000 labor hours—already an order of magnitude better than traditional aerospace. The target for mature production: under 500 labor hours per aircraft, approaching automotive efficiency. It's the difference between aircraft being hand-built curiosities and mass-market transportation tools.

IX. Strategic Partnerships & Market Entry

The art of building an entirely new transportation category isn't just about technology or capital—it's about orchestrating a complex ecosystem of partners, regulators, and customers who must all move in concert. For Joby, the partnership strategy has evolved from opportunistic to essential, transforming from a nice-to-have into the core of their go-to-market approach.

October 11, 2022, marked a pivotal moment in this evolution. Delta has made an upfront equity investment of $60 million in Joby, with the opportunity to expand the total investment up to $200 million as the partners achieve substantive milestones on the development and delivery of the service. But this wasn't just another airline hedging its bets on future technology. The partnership will be mutually exclusive across the U.S. and U.K. for five years following commercial launch, with the potential to extend that period.

The Delta partnership represents a fundamentally different approach from competitors. While United Airlines invested in Archer and American Airlines backed Vertical Aerospace, those deals were primarily aircraft purchases with some investment attached. Delta's arrangement with Joby is operational—Delta CEO Ed Bastian told reporters the deal is a good one for Delta, since it will rely on Joby to be the operator and figure out the tech, while all Delta has to do is cut checks, ready the airport inf[rastructure].

The strategic logic is compelling. Joby Aviation CEO JoeBen Bevirt told The Verge Tuesday that he predicted his service could drastically reduce friction in getting to the airport, claiming that a normally 50-minute trip from Manhattan to JFK International Airport outside Queens could be shaved down to just 10 minutes with one of Joby's air taxis. For Delta's premium customers, saving forty minutes on airport transfers could be worth hundreds of dollars per trip.

But partnerships extend far beyond commercial airlines. The U.S. Department of Defense has emerged as both customer and development partner. A $131 million contract with the U.S. Air Force not only provides revenue but also accelerates certification through the military's Agility Prime program. In September 2023, Joby delivered its first eVTOL air taxi to Edwards Air Force Base in California, six months ahead of schedule—the first paying customer for any eVTOL manufacturer.

The military partnership serves multiple strategic purposes. It provides operational data in demanding conditions. It generates revenue during the pre-commercial phase. Most importantly, it demonstrates to civilian regulators that the aircraft can meet the rigorous standards of military aviation. If the Air Force trusts Joby's aircraft with military personnel, the argument goes, surely they're safe enough for civilians.

Dubai represents another strategic vector. Currently conducting tests and completing the first commercial vertiport at Dubai International Airport, Joby is positioning itself in a market where regulatory innovation often outpaces the United States. Dubai's leadership has explicitly stated their intention to have 25% of all transportation autonomous by 2030. For Joby, it's a proving ground where operations can begin even if U.S. certification faces delays.

The Uber relationship, solidified through the Elevate acquisition, provides the critical last-mile connection. The integration isn't just technical—embedding Joby flights into Uber's app—but operational. Uber's massive data set on transportation patterns, pricing elasticity, and customer behavior informs every aspect of Joby's commercial strategy. When a user opens Uber at JFK, they'll see options for UberX, Uber Black, and eventually, Uber Air powered by Joby.

Infrastructure partnerships are equally critical. Joby can't simply land at existing airports—they need dedicated vertiports in city centers. This requires partnerships with real estate developers, city governments, and airport authorities. Each vertiport represents millions in investment and years of permitting. Joby's strategy: partner with companies that already own prime real estate—parking garage operators, hotels, hospitals—and retrofit existing structures rather than building from scratch.

The charging infrastructure partnership with Electrify America demonstrates thinking beyond the aircraft. Each vertiport needs megawatt-scale charging capability to turn aircraft quickly. Rather than build proprietary charging networks, Joby is adapting automotive charging technology, leveraging billions in investment already made for electric vehicles.

Perhaps most interesting is what Joby hasn't done—sell aircraft to other operators. While competitors like Lilium and Vertical Aerospace plan to manufacture aircraft for third-party operators, Joby maintains it will own and operate every aircraft it builds. This isn't hubris—it's strategic positioning. By controlling the entire experience, Joby can ensure safety, quality, and brand consistency in a way that's impossible with third-party operators.

The partnership strategy also extends to manufacturing. While Toyota provides manufacturing expertise and capital, other partners contribute specialized capabilities. Toray supplies carbon fiber. Honeywell provides avionics. Ballard contributes fuel cell technology for the hydrogen variant. Each partner isn't just a supplier but a co-developer, investing their own R&D to advance the overall platform.

Market entry sequencing reflects careful partnership orchestration. New York and Los Angeles first, leveraging the Delta relationship and existing heliport infrastructure. Then expansion to other Delta hubs—Atlanta, Detroit, Minneapolis. International markets through local partners who understand regulatory environments and customer preferences. The goal: build density in specific markets rather than spreading thin across many.

The partnership model also de-risks the business for all parties. Delta doesn't have to develop eVTOL expertise. Joby doesn't have to build customer acquisition capabilities. Infrastructure partners don't have to understand aviation operations. Each party focuses on their core competency while benefiting from the broader ecosystem.

By 2024, Joby had assembled partnerships worth over $2 billion in combined investment, orders, and development contracts. But more than capital, these partnerships provide market access, operational expertise, and regulatory influence that no amount of money could buy independently. The lesson is clear: in building new transportation categories, the quality of your partners matters more than the quantity of your funding.

X. Competition & Market Dynamics

The electric aviation gold rush of 2021-2024 attracted over 200 companies worldwide, each claiming they would revolutionize urban transportation. By late 2024, the graveyard of failed eVTOL startups was growing rapidly. The survivors weren't necessarily those with the best technology, but those who understood that building aircraft was the easy part—building a market was the real challenge. The market projections vary wildly depending on who's doing the projecting. The eVTOL Aircraft market is valued at USD 0.76 billion in 2024 and is projected to reach USD 4.67 billion by 2030, at a CAGR of 35.3 % from 2024 to 2030 and is projected to grow from USD 6.53 billion in 2031 to USD 17.34 billion by 2035 at a CAGR of 27.6 % from 2031 to 2035. More optimistic projections suggest The eVTOL market is projected to grow at a compound annual growth rate (CAGR) of approximately 12.4% from 2024 to 2031, with expectations of reaching a market size of $12 billion by 2030. By 2040, the market could potentially reach $1 trillion, driven by technological advancements, regulatory progress, and increasing urban mobility demands.

What's clear is that the shakeout has begun. In 2024, Lilium GmbH (Germany) and Volocopter (Germany) lost funding from the German government, signaling that even government-backed champions aren't immune to market realities. The industry that once boasted over 500 active companies worldwide has already seen significant consolidation and failure.

Joby's primary competition comes from three distinct categories, each with different strengths and strategies. First are the direct competitors—other venture-backed eVTOL startups racing for the same markets. Second are the traditional aerospace incumbents slowly awakening to the electric revolution. Third, and perhaps most dangerous, are the Chinese companies operating with different economics and regulatory environments.

Archer Aviation represents Joby's most direct competitor in the U.S. market. Trading at $3.64 with a market cap of $1.1 billion, Archer has unveiled plans for an air taxi network in Los Angeles and is nearing the completion of a high-volume manufacturing facility in Georgia. Archer's Midnight eVTOL, featuring a 12-rotor system, is designed for safety and efficiency. The company has secured partnerships with United Airlines and Southwest Airlines, aiming to launch commercial services by 2025.

Where Joby chose vertical integration, Archer opted for a more traditional aerospace approach, sourcing components from established suppliers. This strategy requires less capital but potentially sacrifices control over quality, cost, and innovation speed. Archer's manufacturing facility in Georgia, while impressive, relies heavily on supplier networks that Joby has chosen to internalize.

Lilium represents a fundamentally different technical approach. Lilium, trading at $0.76 with a market cap of $454.27 million, offers a unique jet-powered eVTOL design with 36 small ducted fans. Lilium's focus on long-distance travel and its partnership with major airport operators highlight its potential in the urban air mobility market. The company plans to launch its air taxi service by the mid-2020s, with first customer deliveries targeted for 2026.

The German company's jet design promises higher speeds and longer range than propeller-based competitors. But the complexity of 36 ducted fans creates engineering challenges that have repeatedly delayed certification. Lilium's financial struggles—requiring emergency funding to avoid bankruptcy in late 2024—illustrate the capital intensity of competing approaches.

Chinese competitors operate in an entirely different universe. EHang has already achieved type certification in China and begun limited commercial operations. 2023-2024 proved to be a fruitful period, with EHang and Autoflight receiving type certification and Joby and Archer delivering the first of their aircraft. The Chinese regulatory environment, while less stringent than Western standards, allows for faster iteration and real-world testing.

Traditional aerospace giants present a different competitive threat. Airbus, Boeing (through Wisk), and Embraer have all launched eVTOL programs. These companies bring decades of certification experience, established supply chains, and deep relationships with airlines. But they also carry the burden of legacy thinking, slow decision-making, and the innovator's dilemma of potentially cannibalizing existing businesses.

The competitive dynamics are shaped by several key factors. First is certification timing—the first company to achieve commercial certification in major Western markets gains enormous advantages in customer acquisition, infrastructure partnerships, and investor confidence. Companies such as Joby Aviation (US) and Archer Aviation (US) have invested over USD 1 billion each in the development of eVTOL aircraft; however, they are still in the development stage and years behind scheduled commercial launch.

Second is manufacturing capability. The ability to produce aircraft at scale, with automotive-like reliability and cost structures, will separate winners from losers. Traditional aerospace manufacturing simply cannot achieve the unit economics required for mass-market adoption.

Third is operational expertise. Building aircraft is one challenge; operating them safely, efficiently, and profitably is another entirely. Companies that outsource operations to third parties lose control over the customer experience and operational data that drives improvement.

Market segmentation is emerging along predictable lines. The eVTOL aircraft market is expected to be headed by the air taxi segment because it has the disruptive potential to serve as a revolutionary solution that can address urban congestion and reduce travel times while offering a sustainable alternative to traditional transportation. Air taxis are for short to medium-range commutes in urban and regional areas, connecting points between city centers, airports, and suburban areas and hence the best way to handle the ever-rising traffic challenges witnessed in populous cities such as Los Angeles, Paris, and Singapore. Advances in electric propulsion systems are currently driving the market for air taxi, which promise quiet, zero-emission flight—a key requirement for urban air mobility (UAM).

The capital markets have been brutal to eVTOL companies. The global eVTOL market currently stands at $4.2 billion as of early 2025, representing a significant surge from its $2.8 billion valuation in 2023. This growth has been characterized by intense market activity across multiple segments, with commercial passenger services emerging as the dominant sector, accounting for approximately 45% of the total market value. Market concentration remains relatively high, with the top five players controlling roughly 60% of the current market share. Joby Aviation leads the commercial segment with a 22% market share, followed closely by Archer Aviation at 18%. Other significant players include Lilium, Vertical Aerospace, and Beta Technologies, each commanding between 5-8% of the market. This concentration reflects the high barriers to entry, including substantial capital requirements and complex regulatory compliance needs.

Joby's competitive advantages are substantial but not insurmountable. The company's head start in certification, deep partnerships with Toyota and Delta, acquisition of Uber Elevate's commercialization expertise, and vertical integration providing cost and quality control create significant moats. But the industry is young enough that a breakthrough in battery technology, a shift in regulatory approach, or a well-funded new entrant could reshape competitive dynamics overnight.

The reality is that the eVTOL market will likely support multiple winners, each serving different segments. Joby may dominate premium urban air mobility in the U.S. Archer might find success with a lower-cost, higher-volume approach. Lilium could own longer regional routes. Chinese companies will certainly dominate their home market and potentially other developing markets.

What's certain is that many current competitors won't survive to see commercial operations. The capital requirements, technical challenges, and regulatory hurdles are simply too high. The question isn't whether consolidation will occur, but when and how. Joby's strong balance sheet and operational progress position it well to be a consolidator rather than consolidated, but in aviation, hubris has destroyed more companies than competition ever has.

XI. Hydrogen & Future Technology

The hangar in Marina, California, houses two seemingly identical aircraft. One represents Joby's present—a battery-electric S4 ready for commercial certification. The other embodies its future—an aircraft that looks the same but carries technology that could redefine regional aviation. On June 24, 2024, Joby's hydrogen-electric technology demonstrator aircraft completed a 523-mile flight above Marina, California, with no in-flight emissions except water.

This wasn't just another range record. It was validation of a dual-path strategy that most competitors considered impossible: developing both battery-electric and hydrogen-electric aircraft simultaneously. The hydrogen variant flew more than three times the distance of the battery version, opening possibilities for regional routes that battery technology won't enable for decades.

The acquisition that made this possible happened quietly in April 2022. Joby acquired hydrogen-aviation pioneer H2Fly, a spinoff of the DLR Institute of Engineering Thermodynamics of the German Aerospace Center. H2Fly wasn't just another startup—they had already achieved world firsts in hydrogen aviation, including the first piloted flight of a liquid hydrogen-electric aircraft.

The technical achievement is remarkable. Using the same airframe and overall architecture as Joby's core, battery-electric aircraft, this demonstrator features a liquid hydrogen fuel tank, designed and built by Joby, which stores up to 40 kilograms of liquid hydrogen, alongside a reduced mass of batteries. Hydrogen is fed into a fuel cell system, designed and built by H2FLY, to produce electricity, water, and heat. The electricity produced by the hydrogen fuel cell powers the six electric motors on the Joby aircraft, with the batteries providing additional power primarily during take-off and landing.

The engineering challenges of hydrogen are fundamentally different from batteries. Liquid hydrogen must be stored at -253°C, requiring vacuum-insulated tanks that add weight and complexity. The fuel cell system generates significant heat that must be dissipated. The entire system must be aerospace-certified, a process that has never been done for hydrogen-electric aircraft.

Yet the advantages are compelling. The 175-kW H2F175 low-temperature proton-exchange membrane fuel cell developed by H2Fly provides consistent power throughout the flight, unlike batteries that degrade with each cycle. The energy density of hydrogen—even accounting for tank weight—far exceeds current battery technology. Most importantly, refueling takes minutes rather than the hours required for battery charging.

JoeBen Bevirt frames the dual-path strategy in terms of market segmentation: "We think it is very synergistic, where you have battery-electric aircraft serving short-distance trips within a metropolitan area and hydrogen-electric aircraft working side by side with them but also serving regional journeys." Imagine being able to fly from San Francisco to San Diego, Boston to Baltimore, or Nashville to New Orleans without the need to go to an airport and with no emissions except water.

The hydrogen program benefits from all the development work on the battery-electric variant. The airframe, motors, flight controls, and certification basis remain largely the same. This isn't starting from scratch—it's leveraging billions in investment and years of testing to accelerate a complementary technology path.

But hydrogen also introduces new challenges. Infrastructure is perhaps the biggest hurdle. While electric charging can piggyback on existing grid infrastructure, hydrogen requires production, storage, and distribution systems that don't exist at airports. The economics depend on green hydrogen production at scale, something that remains aspirational in most markets.

Safety perceptions present another challenge. The word "hydrogen" still evokes the Hindenburg for many, despite hydrogen's excellent safety record in industrial applications. Fuel cells are inherently safer than batteries—they can't thermal runaway—but public perception matters more than engineering reality in consumer markets.

The competitive landscape for hydrogen aviation is less crowded but more complex. Traditional aerospace companies like Airbus and Boeing have hydrogen programs. Startups like Universal Hydrogen and ZeroAvia are pursuing different approaches. But Joby's advantage is integration—they're not just developing hydrogen propulsion but integrating it into an existing, certified aircraft platform.

The acquisition of Xwing Inc. in June 2024 adds another dimension to Joby's technology portfolio. Xwing has been flying autonomous aircraft since 2020, with 250 fully autonomous flights and more than 500 auto-landings completed to date, using the Superpilot software it developed in-house. While Joby's initial commercial operations will be piloted, autonomous flight represents the long-term future of air taxis.

The convergence of electric propulsion, hydrogen fuel cells, and autonomous flight creates possibilities that seemed like science fiction a decade ago. An autonomous, hydrogen-powered aircraft could fly regional routes with zero emissions, no pilot costs, and minimal operating expenses. The technology exists—the challenge is certification, infrastructure, and public acceptance.

Joby's technology roadmap extends beyond just propulsion and autonomy. Advanced materials research continues, with next-generation composites promising further weight reduction. Motor efficiency improvements of even a few percentage points translate to meaningful range increases. Battery chemistry advances—solid-state, lithium-metal, or technologies not yet invented—could dramatic

ally improve the battery-electric variant's capabilities.

The dual-path strategy also provides optionality in an uncertain future. If battery technology advances faster than expected, Joby can focus on the electric variant. If hydrogen infrastructure develops rapidly, they can pivot to fuel cells. If different markets have different needs, they can deploy the appropriate technology. This isn't hedging—it's strategic positioning for multiple futures.

What's most remarkable about Joby's hydrogen flight isn't the distance traveled but what it represents: a company with the resources and capability to pursue multiple revolutionary technologies simultaneously. While competitors struggle to certify a single aircraft type, Joby is developing technology that could serve everything from urban air mobility to regional aviation to cargo delivery.

The 523-mile flight proves that hydrogen-electric aviation is possible. Whether it's commercially viable remains to be seen. But in a world increasingly concerned with aviation's climate impact, having options matters. Joby's bet is that the future of aviation isn't battery or hydrogen—it's both, each serving the markets where they excel.

XII. Financials & Investment Analysis

The numbers tell a story of spectacular ambition colliding with brutal reality. Current market capitalization of $12.71B sits atop a foundation of essentially no revenue—just $111,000 in trailing twelve months from military contracts. Last quarter net income: -$324.67M, versus -$82.41M the quarter before. The cash burn is accelerating even as commercial launch approaches, raising the fundamental question every investor must answer: Is this a moonshot investment or money incineration? Joby's financial statements read like a biotech company developing a blockbuster drug—massive upfront investment with the promise of exponential returns if successful. The most recent quarter tells the story: Net Loss: $144 million in Q3 2024, with Loss from Operations: $157 million in Q3 2024. Revenue remains essentially non-existent, with the company posting revenues of $0.03 million for the quarter ended September 2024.

Yet the balance sheet tells a different story. As of early 2025, Joby still generates minimal revenue, mostly from financial activities. Quite remarkably at a time where parts of the eVTOL industry face financial distress, Joby's results show a relatively strong cash position. The company ended 2024 with $932.9 million in cash, cash equivalents and liquid securities.

The cash burn rate is both alarming and expected. Joby expects its operating expenses to remain elevated as it ramps up testing and certification activities with the FAA. The company's fourth production prototype is nearing completion and will soon join the flight test program. Full Year Cash Spending Outlook: $440 to $470 million, expected towards the bottom end. Looking forward, Joby estimates that its cash burn during 2025 will be in the $500 to $540 million range.

The funding strategy has been masterful in its execution. The fact that Joby has been able to keep a solid balance sheet despite continuing to burn cash is due, in great part, to more than $350 million in fresh funds raised in 2024 through public share offerings. Expected Investment from Toyota: $500 million in two equal tranches. Total Available Balances Post-Investment: Approximately $1.4 billion.

Stock performance reflects the market's conflicted view. Shares up 66% year-to-date in 2025, yet The stock's recent performance has been mixed, with a 5.62% return over the past week but a -15.22% return over the last month. This volatility is typical for companies in emerging industries and reflects the market's ongoing assessment of Joby's progress and potential.

The revenue model remains largely theoretical. Currently, all revenue comes from Department of Defense contracts—essentially R&D funding disguised as service revenue. The real revenue model depends on commercial operations beginning in 2025-2026. Initial pricing estimates suggest $3-4 per passenger mile, targeting price parity with UberX on a time-adjusted basis.

Unit economics paint an interesting picture. With target production costs under $1.3 million per aircraft and expected revenue generation of $2-3 million annually per aircraft, payback periods could be as short as 18 months. But these projections assume utilization rates, maintenance costs, and operational efficiency that have never been demonstrated at scale.

The capital requirements for scale are staggering. To reach 14,000 aircraft in operation by 2035 (Joby's projection), the company would need to invest approximately $18 billion in aircraft production alone, not including infrastructure, operations, or working capital. Even with improving unit economics at scale, this represents one of the most capital-intensive business models ever attempted.

Valuation metrics defy traditional analysis. The Price to Book ratio of 4.99 suggests that investors are placing a premium on Joby's assets and future potential. The current market capitalization of $12.71B implies investors are valuing the company at roughly 30x projected 2030 revenues—aggressive even by tech standards.

The comparison to Tesla's early days is instructive. Tesla burned through similar amounts of capital before reaching profitability, with many quarters showing $200-300 million losses. The difference: Tesla was selling cars and generating real revenue throughout its development phase. Joby won't have that luxury until certification is complete.

Gross margins, when they eventually materialize, should be impressive. Despite impressive gross profit margins of 77.99% in the last twelve months (on minimal revenue), the real test comes with scale production. Target gross margins of 40-50% would be exceptional for transportation but necessary to justify current valuations.

The dilution question looms large. Since going public, Joby has issued substantial new equity to fund operations. Shareholders have seen their ownership diluted by approximately 20% through various capital raises. Future funding needs could dilute existing shareholders further, though strategic investments from partners like Toyota provide some protection.

Break-even analysis suggests commercial operations need to reach approximately 200 aircraft in service to achieve operational cash flow breakeven, assuming target utilization and pricing. Full profitability likely requires 500+ aircraft operating at mature utilization rates—a milestone potentially 3-5 years after commercial launch.

The financial risk factors are substantial. Certification delays could extend cash burn periods. Competitive pressure could compress margins. Infrastructure development costs could exceed projections. Any significant safety incident could destroy demand instantly. Currency fluctuations, interest rate changes, and macroeconomic conditions all impact a business model with high fixed costs and uncertain demand.

Yet the financial opportunity, if successful, is equally substantial. The urban air mobility market represents a potential trillion-dollar opportunity. First movers with certified aircraft, operational infrastructure, and brand recognition could capture disproportionate value. The winner-take-most dynamics of network effects could create enormous returns for early investors.

The financial verdict remains uncertain. Joby has enough cash to reach certification and begin commercial operations. Whether they can achieve profitability before requiring additional capital remains the key question. For investors, this represents either a generational opportunity or a spectacular example of capital destruction. The next 24 months will likely determine which narrative prevails.

XIII. Playbook: Business & Technology Lessons

The Joby story offers a masterclass in building a deep tech company in the 21st century, with lessons that extend far beyond aviation. Each strategic decision—from the decade in stealth to the SPAC merger, from vertical integration to hydrogen development—provides insights for entrepreneurs attempting similarly audacious ventures.

The Power of Patient Capital and Self-Funding Early Stages

Bevirt's decision to self-fund Joby's first years using proceeds from previous exits provided invaluable freedom. No board meetings dissecting monthly burn rates. No pressure to show quick wins. No investor vetoes on risky technical approaches. This patient capital approach allowed Joby to explore multiple dead ends—the eight-rotor configuration, various battery chemistries, different composite manufacturing techniques—without existential pressure.

The lesson extends beyond just having money. It's about timing when to take external capital. Joby waited until they had de-risked core technology before raising significant funds. When they finally took investment in 2018, they could command premium valuations and maintain control. Contrast this with competitors who raised early and often, diluting founders and losing strategic flexibility.

Vertical Integration vs. Supplier Networks in Deep Tech

Joby's radical vertical integration—making motors, batteries, flight controls, even composite structures in-house—violates conventional wisdom about focusing on core competencies. Yet in nascent industries, this approach provides crucial advantages. When suppliers don't exist, you must become your own supplier. When existing components aren't optimized for your use case, designing from scratch often makes sense.

But vertical integration isn't religious dogma at Joby. They source seats from automotive suppliers, avionics from Garmin, sensors from Honeywell. The key insight: vertically integrate where you can create competitive advantage or where suppliers don't exist; partner where established supply chains work well. This selective integration provides control without unnecessary complexity.

Strategic Partnerships: When to Partner with Incumbents

The Toyota partnership represents a textbook case of strategic alignment. Toyota brought manufacturing expertise, capital, and credibility. Joby brought innovation, speed, and vision. Neither could achieve their goals alone. The partnership worked because incentives aligned—Toyota needed to explore future mobility, Joby needed to learn mass production.

But Joby was selective about partnerships. They rebuffed early aerospace companies wanting to invest because the strategic value wasn't there. They waited for partners who could accelerate their mission, not just write checks. The Delta partnership brought customer access. Uber brought commercialization expertise. Each partnership filled specific gaps rather than general needs.

Building in Stealth vs. Building in Public

Joby's decade in stealth mode seems anachronistic in an era of building in public, Twitter threads documenting every milestone, and constant PR. Yet stealth provided enormous advantages. Competitors couldn't copy. Talent joined for the mission, not the hype. Failures remained private, preserving credibility.