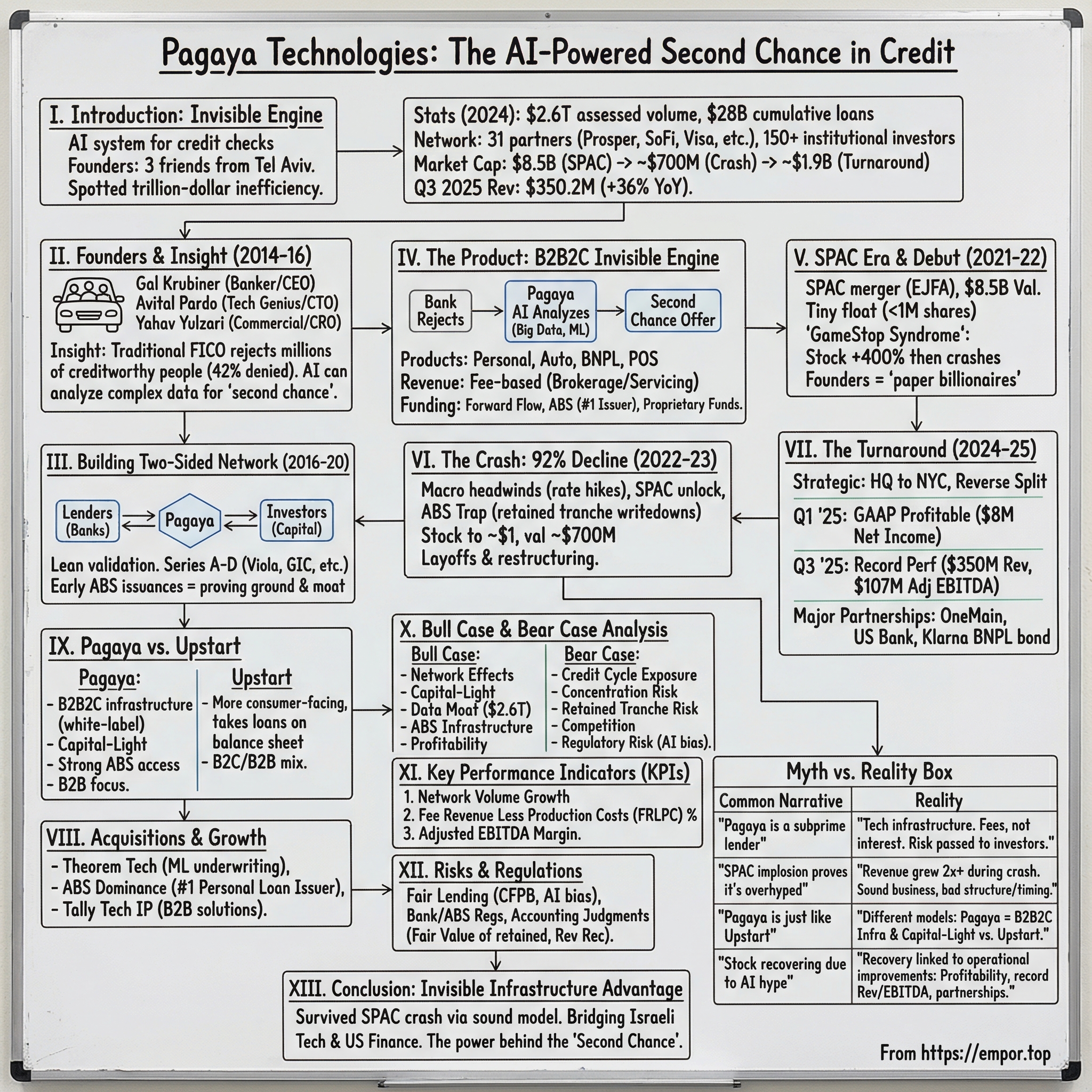

Pagaya Technologies: The AI-Powered Second Chance in Credit

I. Introduction: The Invisible Engine of American Lending

Picture this: A young couple walks into a credit union in suburban Ohio, hoping to finance their first car. The loan officer pulls up their application, reviews their credit score—a perfectly reasonable 660—and prepares to deliver the familiar rejection speech. Except something different happens. A split second after the denial flashes on the screen, another approval appears. Same bank, same customer, same car. But this time, the answer is yes.

What just happened? The couple will never know, but their loan application was just processed by an artificial intelligence system built by three friends from Tel Aviv who spotted a trillion-dollar inefficiency hiding in plain sight within the American financial system.

Pagaya Technologies is an Israeli-American financial technology company based in New York City. The company evaluates loan applications using artificial intelligence (AI) with the aim of modernizing credit checks. But that description dramatically understates what the company has built. According to its own figures, Pagaya had assessed loan applications with a volume of around US$2.6 trillion and brokered a cumulative loan volume of around US$28 billion by 2024.

The central question of this story is deceptively simple: How did three friends from Tel Aviv build the AI infrastructure quietly powering a massive chunk of U.S. consumer lending—surviving a 90%+ stock crash, the SPAC implosion, and emerging as the number one personal loan ABS issuer in America?

The themes we'll explore run deeper than fintech disruption. This is a story about the two-sided marketplace problem that kills most startups, the application of AI to the ultimate trust business, the complex bridge between Israeli technology culture and American financial markets, and what the SPAC era taught us about how not to go public. Most importantly, it's a story about what happens when you build the infrastructure nobody sees but everybody needs.

Pagaya is a network of 31 lending partners and 150+ institutional investors. That network now includes names that would make any fintech founder weep with envy: Partners include Prosper, LendingClub, SoFi, U.S. Bank, Ally, Klarna, Visa, and major auto lenders.

The company's market capitalization has been on a wild ride—from an $8.5 billion valuation at its SPAC debut to a cratering low around $700 million, and now back to a roughly $1.9 billion enterprise. Revenue reached a record $350.2 million in Q3 2025, representing a 36% increase year-over-year.

For investors trying to understand Pagaya, the story divides neatly into chapters: founding and survival, the chaotic SPAC era, the brutal crash and restructuring, and finally the remarkable turnaround. Let's begin at the beginning—on a road trip in Israel.

II. The Founders & Founding Context (2014–2016): Three Friends on a Road Trip

It's the kind of car ride that tells you everything you need to know about the DNA of Pagaya's founding team. Three friends—Gal Krubiner, Yahav Yulzari, and Avital Pardo—on a road trip, deep in discussion. It was not small talk, but a full-on debate about a business problem they just couldn't let go of. Each one saw it differently. Each one brought a different perspective and challenged the others. The debate came with arguments, pushback, and laughter—the kind of exchange that only happens between people who trust each other completely. By the end of the day, they hadn't just talked—they had figured something out.

The story of Pagaya didn't begin with a startup idea. It began with three people who, long before the business existed, were building a future they hadn't yet defined—but knew would come.

The Banker: Gal Krubiner

Gal Krubiner, the co-founder and CEO of Pagaya Technologies, has been at the helm since the company's inception in 2016. With a robust background in investments and wealth management, Krubiner has a particular expertise in innovative credit structured products.

Before establishing Pagaya, he honed his skills at UBS AG, where he specialized in structuring and distributing sophisticated credit and asset-backed securities. Gal and Yahav's friendship took root in London. Gal was working as a banker at UBS, already deep in the world of private credit and asset management. He understood the system. He knew the players, the flows, the misaligned incentives. And beyond seeing how capital moved, he had the financial skillset to design a business model that could realign those incentives and make the system work better.

He pursued a Bachelor of Applied Science in Economic & Statistics at Tel Aviv University. From 2009 to 2012, Krubiner honed his analytical and statistical skills, laying a strong foundation for his future career in finance and technology.

Gal was just 26 when he started the company with two others. That youth came with a certain audacity—who else would try to convince banks to hand over their loan rejections to an unproven AI?

The Tech Genius: Avital Pardo

Avital Pardo has served as Chief Technology Officer and a director of Pagaya since co-founding the company in 2016. Mr. Pardo was instrumental in designing Pagaya's AI-based credit model and system. Prior to joining Pagaya, Mr. Pardo was one of the first employees at Fundbox and focused on the Algorithms.

Avital, a tech genius by every measure, chose to work at Fundbox to get close to the heart of lending and explore whether there was real potential in solving underwriting limitations. He saw firsthand how traditional underwriting worked—and where it fell short.

Pardo's academic background includes a Master of Science in Mathematics and a Bachelor of Science in Mathematics & Physics from The Hebrew University of Jerusalem. His earlier roles in the Israel Defense Forces as a Senior Analyst and Operation Research Analyst provided him with a strong foundation in analytical thinking and problem-solving.

The Commercial Mind: Yahav Yulzari

Yahav Yulzari has served as Chief Revenue Officer and a director of Pagaya since co-founding the company in 2016. Mr. Yulzari oversees Pagaya's growth and global commercial activities. He is a former real estate entrepreneur.

Gal Krubiner explained: "I founded Pagaya with Avital Pardo, whose background is hard-core data science, and Yahav Yulzari, whose background is capital raising."

The Insight

The core insight that drove Pagaya's creation came from a fundamental observation about how credit decisions were being made—and how technology could make them better.

The company was founded by Gal Krubiner, Avital Pardo, and Yahav Yulzari with the aim of using AI and machine learning in lending to replace traditional credit checks.

As Gal Krubiner explained in a 2019 interview: "The ah-ha moment for Pagaya came out of a long conversation with one of my partners in August 2015. We were discussing how there was a new financial state and that, literally, no one was helping the buy side for institutional clients. We understood at that moment that the way to make this happen was to use technology to create a better way for institutional investors to manage assets."

The founders saw that traditional FICO-based credit decisions were rejecting millions of creditworthy Americans—not because they were bad risks, but because the legacy systems couldn't process the complexity of modern financial lives. A gig worker with variable income, a recent immigrant with a thin credit file, a young professional who paid every bill on time but had a short credit history—all of them were being denied loans by algorithms designed for a 1970s economy.

According to data cited in Pagaya's investor presentations, 42% of U.S. consumers are denied the credit they seek under traditional models. This creates a massive "credit gap" for millions of creditworthy individuals who are overlooked. This is where Pagaya steps in.

The founding team's complementary skills—Gal's deep understanding of capital markets and ABS structures, Avital's AI and data science expertise, and Yahav's commercial and fundraising capabilities—proved crucial for tackling what would become one of the most complex business models in fintech.

III. Building the Two-Sided Network (2016–2020): The Complex Path

Most startups focus on building a product, serving a customer, and proving a use case. Pagaya chose arguably the most complex path of all—building a financial network. From day one, they weren't just developing a technology and a business. They were managing two interdependent sides of a market: raising capital from institutional investors on one end, and partnering with lending institutions on the other. Balancing both sides of the market—especially through macro cycles and volatility—adds a layer of complexity that most startups never encounter. And on top of that, their business is tightly—and constantly—tied to the macroeconomy. When interest rates rise, lending slows. Capital retreats. Risk appetite shifts. Foundational rules of the game change in real time.

The Lean Validation Phase

When Pagaya started out, what they wanted was to prove a point—that their model could select risk better than the traditional system. And to do that, they needed to find a smart, lean way to validate their thesis. Becoming a lender would have required a license and operational infrastructure—it didn't make sense to build all of that just to prove a concept. So they got creative. They raised a small amount of capital from friends and family and started testing their underwriting engine on real loans. This was during the early days of peer-to-peer lending, when platforms like Prosper and LendingClub were at their peak. Instead of launching a product, they used those platforms to invest directly in loans that the model identified as high quality. No infrastructure.

Early Funding and Growth

The first major external validation came from Viola Ventures, Israel's leading early-stage tech investor. With a portfolio of over 100 companies, Viola Ventures has backed a substantial share of Israel's exits to date, including 8 of Israel's unicorns such as ironSource, Payoneer, Outbrain, Immunai, Pagaya, Redis, Lightricks and more.

Pagaya raised its Seed round of $1.25 million in May 2016 from Viola Ventures, followed by a follow-on in January 2017.

Pagaya then announced a $14 million Series B funding round co-led by Oak HC/FT and Harvey Golub, former Chairman and CEO of American Express. A diverse group of world-class investors participated in the round, including GF Investments, Siam Commercial Bank, Clal Insurance Ltd., and Pagaya's seed investor, Viola Ventures.

Pagaya then raised a $25 million Series C funding round. Oak HC/FT led the round with participation from Viola Ventures, Clal Insurance Ltd., GF Investments, Harvey Golub, and Siam Commercial Bank. The funding came on the heels of Pagaya creating the first-ever $100 million consumer credit asset-backed security (ABS) fully managed by AI, which the company announced in February. In the three years since launch, Pagaya had grown to manage $450 million for banks, insurance companies, pension funds, asset managers, and sovereign wealth funds.

The major inflection came with a $102 million Series D funding round in June 2020, led by a prominent strategic financial institution. Aflac Global Ventures, Poalim Capital Markets, Viola, Oak HC/FT, Harvey Golub, Clal Insurance Ltd., GF Investments, and Siam Commercial Bank participated in the round. In the four years since launching, Pagaya had grown to manage over $1.6 billion of assets entirely with its sophisticated AI.

Among the investors in the company was Singapore's sovereign wealth fund GIC. GIC's involvement signaled serious institutional validation—sovereign wealth funds don't invest in early-stage fintechs lightly.

The Asset Management Origins

Initially, the company acted as an asset manager for institutional clients and, at the same time, developed a data-driven credit model.

With the help of private funds and asset-backed securities (ABS), consumer loans were financed at an early stage; by 2020, Pagaya managed assets of more than US$1.6 billion for banks and other institutions and had issued over US$1 billion in ABS.

By the time of its Series D, the firm's total consumer credit ABS issuance was over $1 billion.

The early ABS issuances were crucial proving grounds. Each securitization taught the team something new about how to structure deals, how to communicate with institutional investors, and how to build the operational infrastructure required to process loans at scale. This expertise would become Pagaya's single greatest competitive advantage.

IV. The Product: How Pagaya Actually Works

Understanding Pagaya requires understanding a business model that is deliberately invisible to consumers. When a borrower gets approved through Pagaya's network, they never see the Pagaya brand—they see only their bank or lender. This is the essence of B2B2C infrastructure.

The Technical Architecture

Pagaya sees itself as a B2B platform that connects banks, lenders, and institutional investors. Its core product is an AI-powered decision-making platform that evaluates loan applications using big data sets and machine learning algorithms. This platform is embedded in the partners' processes via application programming interfaces (APIs): if a banking partner rejects an application, the anonymized data is forwarded to Pagaya. The models check creditworthiness, submit their own offer, and Pagaya assumes the credit default risk; the bank retains the customer relationship and receives servicing fees.

You integrate your origination system with our Network through an API. You approve more customers in your brand experience and service them while Pagaya facilitates the transition of the loan to the appropriate financial vehicles. Seamlessly send us customer loan applications with zero latency. Our AI model analyzes applications in real time for quick decisions. Customers receive approvals directly from your origination system.

The "Second Chance" Concept

The platform aims to provide a "second chance" (second-chance lending) in credit granting and is designed to increase the approval rate of its partners. According to the company, the database includes applications worth several trillion US dollars, which means that non-traditional creditworthiness indicators can also be used.

This "second look" model is the key innovation. When a bank declines a loan application, that data doesn't simply disappear—it flows to Pagaya's AI, which analyzes hundreds of variables beyond FICO scores. The AI might determine that while the applicant doesn't fit the bank's narrow credit box, they're actually a good risk when you consider their consistent rent payments, stable employment history, or banking behavior patterns.

They are training their lending platform on an ocean of data of loan approvals and continually updating it as more data comes in. (They employ over 200 data scientists!) That lending platform is constantly learning, which is leading to better decisions. And the decisions they are making seem to be doing well.

Product Diversification

Pagaya's network is active in various credit segments, including unsecured consumer loans, car loans, credit cards, "buy now, pay later" models in retail, and real estate financing; in the long term, the company also wants to be present in the mortgage and insurance sectors.

With an adaptable business model and capital-efficient structure, Pagaya initially focused on personal loans. Over time, the company expanded into auto lending and point-of-sale financing, reducing exposure to any single loan type and improving resilience across economic cycles. To diversify its funding, PGY has built a network of more than 135 institutional partners and utilizes forward flow agreements—pre-arranged deals where investors commit to buying future loans.

The Revenue Model

In its business model, Pagaya focuses on fee income from brokerage and servicing, while the credit risk is largely passed on to institutional investors.

Since Pagaya isn't a lender, it doesn't primarily earn money from loan interest. Its revenue comes from fees charged to both sides of its network. Lending partners pay a fee for each new customer acquired through the platform, and funding partners pay a fee for access to the AI-sourced assets. This creates a stable, fee-driven revenue stream. The company's key profitability metric is Fee Revenue Less Production Costs (FRLPC), which represents the gross profit on each dollar of loans facilitated. As of Q2 2025, this margin was a healthy 4.80% of network volume.

Funding Mechanisms

Financing is provided through forward flow agreements, the issuance of ABS, and proprietary credit funds. For example, an agreement signed in 2024 with asset manager Castlelake enables the purchase of up to US$1 billion in consumer loans, thereby broadening refinancing options.

The Company raised $6 billion across 17 asset-backed securitizations ("ABS") in 2024 and was once again the number one personal loan ABS issuer in the US by issuance size, with a funding base of over 130 institutional investment firms.

The infrastructure advantage is crucial here. Building an ABS program from scratch requires years of work—rating agency relationships, investor roadshows, legal infrastructure, servicer agreements. Once built, it becomes an enormous moat. New entrants can't simply replicate Pagaya's funding capabilities overnight.

V. The SPAC Era & Going Public (2021–2022): A Bewildering Debut

The decision to go public via SPAC in 2021-2022 would prove to be both the company's greatest opportunity and its greatest challenge. The timing was spectacularly poor, but the strategic rationale was sound.

The Deal Structure

Pagaya Technologies Ltd. and EJF Acquisition Corp. (NASDAQ: EJFA), a publicly traded special purpose acquisition company, entered into a definitive business combination agreement. As a result of the transaction, which values the combined company at an estimated enterprise value of approximately $8.5 billion at closing, Pagaya became a publicly listed entity.

The PIPE was upsized from $200 million to $350 million earlier this year led by a group of investors including Tiger Global, Whale Rock, Singapore's sovereign wealth fund, the Healthcare of Ontario Pension Plan, and G Squared.

Pagaya announced the completion of its business combination with EJF Acquisition Corp., which was approved by Pagaya shareholders on June 16, 2022 and by EJFA's shareholders on June 17, 2022. The publicly listed company is now Pagaya Technologies Ltd. and its Class A ordinary shares and public warrants began trading on the Nasdaq stock market beginning on June 23, 2022 under the ticker symbols "PGY" and "PGYWW," respectively.

Red Flags Before Trading

Even before trading began, warning signs emerged. In a surprising twist, Barclays bank notified EJF that it would no longer serve as an underwriter for the SPAC, relinquishing any commission it was set to receive from the deal.

This is likely more than a disagreement regarding valuation, as most underwriters know how to pressure companies to adjust their valuation to a more realistic level. Therefore, the likely explanation is that a lack of trust between the parties ultimately led them to go their separate ways.

Many of the company's shareholders were quick to sell their stakes following the approval, choosing not to wait for trading in Pagaya's stock to begin. The meaning of this is that they don't believe that the Israeli company's value is set to rise from its current valuation following the completion of the SPAC deal.

The Float Problem

In late July, Pagaya disclosed that it made less than 1 million shares available on the public market, followed by a stock split at a 1-to-186.9 ratio. Later, the earnings report said that the company had 846 million shares outstanding. In other words, at least three-quarters of Pagaya's fully diluted shares appear to be in the hands of the people and companies that owned Pagaya shares before the SPAC deal. They are not yet able to sell their stock (or buy more) on the open market, with lockup periods ranging from 90 days to a full year after the SPAC deal's execution.

This tiny float would create chaos in the weeks to come.

Initial Trading Madness

Pagaya's recently launched stock rose more than 400% in July, followed by a 52% crash in August. The company entered the market through a bewildering SPAC deal, and investors are still not sure how large their share of Pagaya really is.

When it became apparent that there are fewer than one million Pagaya shares publicly available, the company began suffering from what is known as the "GameStop Syndrome", with a herd of speculators identifying the opportunity to dramatically affect the stock price due to its low liquidity.

Whatever the reason for the rise, Pagaya's three founders Gal Krubiner, Yahav Yulzari, and Avital Pardo became billionaires in dollar terms. Pardo had shares worth about $3 billion and Krubiner and Yulzari $2 billion each. Before the completion of the SPAC merger, the trio consolidated their control of the company by making their shares Class B, with preferential voting rights. All three founders were still in their 30s and together held shares worth an incredible $7.6 billion, on paper.

That paper wealth would prove extraordinarily fleeting.

VI. The Crash: From $8.5B to $700M (2022–2023)

What followed the SPAC debut was one of the most brutal stock collapses in recent fintech history. The combination of macro headwinds, SPAC structural issues, and a massive share unlock created a perfect storm.

The September Collapse

Shares of Pagaya Technologies plummeted 84.8% in September, according to data from S&P Global Market Intelligence. The artificial intelligence provider for financial companies offered a dilutive secondary-stock sale and was hit by rising interest rates and fears of loan delinquencies. As of October 4, shares were down 82% since the company went public through a SPAC earlier that year.

Near the end of the month, Pagaya released a filing with the U.S. Securities and Exchange Commission (SEC) stating it intended to sell 46.1 million new shares to the public and that 674 million existing shares from insiders would be sold as well.

This recently announced sale appears tied to the expiration of certain lock-up agreements that now could result in shares flooding the market and significantly increasing the public float.

On top of this huge stock offering, Pagaya was impacted by the Federal Reserve's decision to raise interest rates again in September. When the Fed raises rates, it makes it tougher for borrowers across the economy to obtain financing and could impact the credit markets. For Pagaya, a company that powers loans with its AI platform, this was not good news.

The 92% Decline

Israeli fintech company Pagaya lost 92% of its value since it began trading on Nasdaq in June 2022, costing investors, but mainly its executives, a lot of money. Had Pagaya, which completed its SPAC merger at a valuation of $8.5 billion, managed to maintain a value of billions of dollars, the combined salary cost of the three founders would have reached an astronomical sum of $161 million in 2022.

Although the managers and directors did not meet with the big money, these salary costs are weighing on Pagaya's books. In 2022, Pagaya's revenues grew by 58% and reached $749 million, but expenses doubled from $480 million to more than $1 billion, and the net accounting loss deepened from $91 million in 2021 to $302 million in 2022. The accounting loss was significantly affected by the equity compensation for the company's employees, primarily the managers and directors, subtracting $242 million from the bottom line.

The ABS Trap of 2023

The retained tranche problem became acute in 2023. By design, Pagaya holds the lowest-rated tranches in its ABS deals—these absorb losses first when borrower defaults occur. In a normal environment, this is manageable. But in 2023, the coupon paid to investors on senior ABS tranches was so high that Pagaya's residual equity tranches yielded very little. Even modest levels of loan defaults were enough to wipe out the thin margins built into the retained tranches. As a result, the company had to write down the fair value of these retained investments.

Layoffs and Restructuring

Pagaya laid off 20% of its workforce in January 2023. The layoffs were painful but necessary—the company needed to right-size its cost structure for the new reality of higher interest rates and tighter capital markets.

The stock hit its nadir around a dollar per share, valuing the company at roughly $700 million—a staggering 92% decline from its IPO valuation. For a company with nearly $1 billion in revenue, this represented an extreme disconnect between operating performance and market perception.

VII. The Turnaround: Strategic Pivot (2024–2025)

The Pagaya story could have ended as another SPAC cautionary tale. Instead, it became a case study in corporate resilience and strategic adaptation.

Strategic Actions

In January, management announced two specific strategic actions it would undertake to improve the stock's "marketability" and enhance long-term shareholder value. These include moving the company's headquarters from Tel Aviv to New York, and the reverse stock split. Stocks trading for $1 won't be considered for certain indexes or institutional investing accounts.

In January 2024, management also announced that it would relocate its headquarters to New York, as the majority of its partners and sales are based in the US; however, the technical development site in Tel Aviv remained unchanged.

Q1 2025: The Profitability Milestone

The company's Q1 2025 earnings presentation revealed that Pagaya has successfully transitioned to profitability, reporting net income of $8 million compared to a $21 million loss in the same period last year.

Pagaya Technologies Ltd achieved positive GAAP net income of $8 million, ahead of their second-quarter guidance and for the first time as a public company. Revenue grew by 18% year over year, reaching an annualized run rate of nearly $1.2 billion.

The achievement of GAAP profitability in Q1 2025, ahead of the previously guided Q2 2025 timeline, demonstrates Pagaya's accelerating financial performance and operational efficiency improvements.

Q3 2025: Record Performance

Record GAAP net income attributable to Pagaya shareholders of $23 million increased by $90 million year-over-year, driven primarily by revenue growth, lower expenses, and normalized impairments. Record network volume of $2.8 billion increased by 19% year-over-year, driven by growth in Auto and Point-of-Sale verticals. Record total revenue and other income of $350 million increased by 36% year-over-year. Record revenue from fees less production costs ("FRLPC") of $139 million increased by 39% year-over-year.

The company reported adjusted earnings of $1.02 per share for the third quarter, substantially beating the analyst estimate of $0.18. Revenue reached a record $350.2 million, surpassing the consensus estimate of $335.7 million. Network volume grew 19% YoY to $2.8 billion. Pagaya achieved GAAP net income attributable to shareholders of $23 million, a dramatic $90 million improvement from the same period last year. The company's Adjusted EBITDA nearly doubled to $107 million, up 91% YoY.

The company raised its full-year 2025 guidance, now expecting total revenue between $1.3 billion and $1.325 billion. Adjusted EBITDA is projected to be between $372 million and $382 million, with GAAP net income between $72 million and $82 million.

Major New Partnerships

In August 2024, Pagaya Technologies and OneMain Financial announced a new partnership. Pagaya's proprietary, AI-driven lending technology enables fintechs, banks, and other loan originators to provide broader credit access for their customers. Through this partnership, OneMain's auto lending business will leverage Pagaya's technology to support the company's ability to serve more qualified customers that are outside its existing credit criteria. The two firms are also working to expand their partnership towards a broader enterprise agreement.

In February 2024, Minneapolis-based lender US Bank tapped US-Israeli fintech Pagaya Technologies to leverage artificial intelligence within its credit decisioning processes for personal loan applications.

The Klarna Partnership and BNPL Expansion

Consumer lending platform Pagaya is pushing into the pay later market. The company is about to issue $300 million in bonds that will be used to fund buy now, pay later (BNPL) loans offered by Klarna. J.P. Morgan Chase and Atlas, the asset-backed finance unit of Apollo Global Management, are arranging the bond sale.

In May 2025, Pagaya made a big move: it issued a $300 million bond backed by buy now, pay later (BNPL) loans, a first for the company. It did this in partnership with Klarna, the Swedish BNPL giant. What we're seeing now is Pagaya expanding its model, not pivoting. The BNPL-backed bond is less about jumping on a trend and more about applying its proven tech stack to an adjacent product.

Klarna is Pagaya's leading logo/customer in BNPL, with B. Riley saying that they believe the Klarna/Walmart partnership will bring new application flow to Pagaya at very little, if any, incremental cost.

VIII. Key Acquisitions & Growth Initiatives

Theorem Technology Acquisition

In October 2024, Pagaya completed its acquisition of Theorem Technology, Inc., a machine-learning underwriting technology company that has powered billions of dollars of credit across its network since its founding in 2014. With a combined credit fund platform exceeding $3 billion in AUM, the transaction is expected to further strengthen Pagaya's market-leading capabilities, diversify its funding sources and drive capital efficiency. Fund investors are expected to gain access to credit assets generated by Pagaya's network of 31 of the top lenders in the U.S. The acquisition is expected to be accretive in 2025.

Founded in 2014, Theorem is a Silicon Valley-based institutional asset manager focused exclusively on the consumer credit space, managing assets for global institutional investors for more than a decade. Theorem's team of PhD researchers and technologists build machine learning models for analyzing and pricing loans. Since its inception, Theorem has acquired over $10 billion of consumer loans on behalf of its clients, $2.6 billion through custom partner integrations, and today manages over $1.7 billion for endowments, foundations, sovereign wealth funds, pensions, healthcare organizations, insurance companies and family offices worldwide.

ABS Market Dominance

The company has raised $25.2 billion over 62 ABS transactions since 2018 across multiple products. Pagaya remains the number one personal loan ABS issuer by issuance size in the U.S., solidifying its reputation as the benchmark issuer of this product.

The Company announced a forward flow agreement with Blue Owl in February totaling $2.4 billion over 24 months, its second large forward flow, together totaling ~$2 billion in annual funding capacity.

The company's fifth RPM transaction of 2025 brought Pagaya's auto ABS issuance to an annual record of approximately $1.7 billion year-to-date. One William Street Capital Management partnered with Pagaya through its acquisition of the residual certificates.

Tally Technologies IP Acquisition

In October 2024, LendingClub Corporation and Pagaya Technologies partnered together to acquire the intellectual property behind Tally Technologies, Inc. Pagaya's AI-powered network of 31 lending partners and 120 institutional investors aims to be the preeminent consumer lending technology solution for the financial ecosystem. Pagaya will focus on enhancing its white-label B2B solutions, incorporating the Tally product as a value-added offering for its network of lending partners.

IX. Pagaya vs. Upstart: Strategic Comparison

To understand Pagaya's competitive position, it's essential to compare it against its most frequently cited public competitor: Upstart Holdings.

Pagaya Technologies and Upstart Holdings are two key players operating in the AI-driven lending ecosystem that are similar in mission but structurally distinct in how they execute and scale. While Pagaya positions itself as a B2B enabler, partnering with banks, fintech lenders and institutional investors to help them originate and fund loans using its AI-based underwriting, Upstart operates much closer to a traditional lending marketplace model. However, unlike traditional lenders that rely on FICO scores, Upstart uses machine learning to evaluate non-traditional data points. Since Pagaya does not originate loans itself, its operating model is capital-light, less exposed to credit risk and more scalable.

The Capital-Light Advantage

Upstart takes loans on their own balance sheet and Pagaya does not (except for 5% mandated by the regulators).

A notable player in this space is Upstart Holdings, which also leverages AI and machine learning to evaluate creditworthiness beyond traditional FICO scores. However, Pagaya's business model, which largely avoids holding loans on its balance sheet, is often viewed as a more stable approach compared to Upstart's, which relies more on banks retaining loans or selling them through its platform. This distinction is a key element in any competitive analysis.

Pagaya has increased the number of lenders on their platform even through this difficult period. They have never lost a lender from their network.

Funding Capabilities

What I do see is that Pagaya has one big advantage over Upstart that is allowing it to outperform. That is their access to the capital markets. There are two sides to the lending business. You have to make the loan and you have to sell the loan. Pagaya's product is all about making loans. But those loans still need to be sold. Apart from a 5% regulatory residual that Pagaya must keep on their balance sheet, the rest is packaged off and sold to investors. That means a big part of increasing loan volume is finding investors that are willing to buy.

What they are doing better than competitors is: 1) Using their AI to pick better clients to lend to, and 2) finding buyers to securitize their loan books to—they oversubscribe by 200% every time lately. They are actually the largest asset-backed "securitizer" in the US right now.

X. Bull Case & Bear Case Analysis

The Bull Case

Network Effects & Scale: Pagaya's platform benefits from classic network effects. Each new lending partner brings additional loan flow, which attracts more institutional investors, which in turn makes the platform more attractive to new lending partners. With 31 lending partners and over 150 institutional investors, the company has achieved critical mass.

Capital-Light Model: Unlike traditional lenders or even competitors like Upstart, Pagaya's fee-based revenue model means it doesn't take on significant credit risk. This provides stability through economic cycles and eliminates the need for large capital buffers.

Data Moat: Having analyzed $2.6 trillion in loan applications, Pagaya has assembled one of the largest datasets of credit decisions in the world. This data continuously improves the AI models, creating a compounding advantage that's difficult for new entrants to replicate.

ABS Infrastructure: Building a programmatic ABS issuance capability requires years of work and regulatory relationships. Pagaya has completed 75+ securitizations totaling nearly $31 billion—infrastructure that represents a significant barrier to entry.

Profitability Achieved: The company has crossed the profitability threshold ahead of schedule, demonstrating operating leverage and validating the unit economics of the business model.

The Bear Case

Credit Cycle Exposure: While Pagaya doesn't hold loans on its balance sheet, its business still depends on lending volumes and investor appetite for consumer credit. A severe recession could reduce both.

Concentration Risk: The company depends on a relatively small number of large lending partners. Loss of a major partner could significantly impact network volume.

Retained Tranche Risk: Pagaya retains the equity tranches in its ABS deals, which absorb first losses. The 2023 writedowns demonstrated how quickly these positions can deteriorate in challenging credit environments.

Competition: Both traditional banks and well-funded fintechs like Upstart are competing in the AI-driven lending space. If major banks develop comparable in-house capabilities, Pagaya's value proposition could diminish.

Regulatory Risk: AI in credit decisions faces ongoing regulatory scrutiny around fair lending and algorithmic bias. New regulations could impose compliance burdens or limit the company's ability to use certain data inputs.

Porter's Five Forces Analysis

Supplier Power (Low-Medium): Pagaya's primary "suppliers" are its lending partners and institutional investors. The company has diversified across 31 lenders and 150+ investors, reducing dependency on any single supplier. However, large partners still have negotiating leverage.

Buyer Power (Medium): Borrowers have alternatives if rejected—they can apply elsewhere or use different credit products. However, Pagaya's white-label approach means consumers often don't know they're being served by Pagaya, limiting direct price sensitivity.

Threat of New Entrants (Low-Medium): Building a competitive platform requires significant data scale, regulatory relationships, and ABS infrastructure—all of which take years to develop. However, well-capitalized banks or tech giants could potentially enter.

Threat of Substitutes (Medium): Traditional FICO-based lending, peer-to-peer platforms, and embedded finance solutions represent alternatives. However, Pagaya's second-look model specifically targets applications already rejected by these alternatives.

Competitive Rivalry (Medium-High): Upstart and other AI-lending platforms compete for similar lending partnerships. However, Pagaya's B2B2C model and ABS capabilities differentiate it from more consumer-facing competitors.

Hamilton Helmer's 7 Powers Framework

Scale Economies: Pagaya's data advantage grows with each loan analyzed, while fixed technology costs spread across larger volumes. This creates meaningful scale economies.

Network Effects: Two-sided network effects exist between lenders and investors—more lenders attract more investors, and vice versa. This is a genuine competitive advantage.

Counter-Positioning: Traditional banks would need to cannibalize their existing credit decisions to adopt Pagaya's second-look model. Many choose partnership over internal development for this reason.

Process Power: The company's AI models and ABS infrastructure represent accumulated process knowledge that's difficult to replicate. The ability to execute 17 ABS deals in a single year demonstrates operational excellence.

Brand: Limited relevance in B2B2C model where consumers never see the Pagaya brand.

Cornered Resource: The $2.6 trillion in analyzed loan data represents a proprietary resource that no competitor can easily replicate.

Switching Costs: Once lending partners integrate Pagaya's API into their systems, switching costs are meaningful but not prohibitive.

XI. Key Performance Indicators to Track

For investors monitoring Pagaya's ongoing performance, three metrics stand out as the most critical indicators of business health:

1. Network Volume Growth

Network volume—the total dollar value of loans facilitated through Pagaya's platform—is the primary indicator of market share and partner adoption. This metric directly drives fee revenue and demonstrates the company's competitive position. Q3 2025 showed 19% year-over-year growth to $2.8 billion; investors should watch for continued expansion or any signs of deceleration.

2. Fee Revenue Less Production Costs (FRLPC) as % of Network Volume

This metric measures the company's take rate and unit economics. It answers the crucial question: How much does Pagaya actually earn from each dollar of loans it facilitates? Improvement in FRLPC percentage indicates pricing power, operational efficiency, and product mix optimization. The Q3 2025 FRLPC of $139 million on $2.8 billion network volume represents approximately 5% take rate—investors should track whether this expands or compresses.

3. Adjusted EBITDA Margin

While GAAP profitability has been achieved, Adjusted EBITDA margin demonstrates the underlying operating leverage of the business model. Q3 2025's Adjusted EBITDA of $107 million on $350 million revenue represents approximately 31% margin—exceptional for a scaling fintech. This metric reveals whether growth is profitable growth.

XII. Risks & Regulatory Considerations

Material Legal and Regulatory Overhangs

Fair Lending Compliance: AI-driven credit decisions face scrutiny from regulators including the CFPB regarding potential discriminatory outcomes. While Pagaya states its systems are "fully aligned with U.S. regulations, fair lending, data security, and risk management standards," this remains an evolving regulatory area.

Bank Partner Regulations: Pagaya's lending partners (banks and credit unions) face their own regulatory requirements. Changes to bank capital requirements or lending regulations could indirectly impact Pagaya's business.

ABS Market Regulations: The securitization market faces ongoing regulatory attention. Changes to risk retention rules or rating agency requirements could affect Pagaya's capital markets operations.

Accounting Judgments to Monitor

Fair Value of Retained Securities: Pagaya holds the equity tranches of its ABS deals on the balance sheet at fair value. These valuations involve significant management judgment regarding expected credit losses and discount rates. The 2023 writedowns demonstrated how sensitive these valuations are to changing assumptions.

Revenue Recognition: Given the complex structure of Pagaya's fee arrangements with lending and funding partners, the timing and amount of revenue recognition involves judgment calls that investors should monitor through footnote disclosures.

XIII. Conclusion: The Invisible Infrastructure Advantage

The story of Pagaya Technologies is ultimately a story about building the financial infrastructure nobody sees but everybody needs. From a road trip conversation between three Israeli friends to America's largest personal loan ABS issuer, the company's journey illuminates both the extraordinary challenges and extraordinary potential of AI in financial services.

At the 2025 Mind the Tech conference in New York, CEO Gal Krubiner presented his vision of the platform serving all major US banks, with the company seeing itself as a bridge between Israeli technology culture and the US financial market.

The SPAC era taught brutal lessons about the perils of going public at elevated valuations in challenging market conditions. But it also validated a core truth: great businesses can survive terrible stock performance if the underlying model is sound. Pagaya's revenue nearly doubled from 2021 to 2024 even as its stock crashed 92%. The business kept growing because the value proposition to lending partners and investors remained compelling.

As CEO Gal Krubiner stated in November 2025: "Our results demonstrate another quarter of prudent underwriting and consistent execution across our network as we raise full-year guidance for the third consecutive quarter. Our pipeline has never been stronger as lenders across asset classes recognize the unique and powerful value proposition the Pagaya network provides. With our partners, we are committed to bridging Main Street and Wall Street for the long run."

The central question posed at the beginning of this analysis has been answered: Three friends from Tel Aviv built AI infrastructure powering a massive chunk of U.S. consumer lending by making an extraordinarily difficult choice—building a two-sided financial network from scratch rather than a simpler product company. They survived the SPAC implosion by having real revenue, real customers, and real competitive advantages that persisted through market turmoil. They emerged as the #1 personal loan ABS issuer through operational excellence, disciplined capital allocation, and strategic patience.

Whether Pagaya represents a compelling investment opportunity depends on one's views about the durability of these competitive advantages, the trajectory of U.S. consumer credit markets, and the company's ability to expand into adjacent verticals like auto lending, BNPL, and eventually mortgages.

What's certain is that every time a bank approves a loan that traditional models would have rejected—every time a young couple gets their car loan, every time a gig worker gets financing, every time someone gets a second chance at credit—there's a reasonable probability that Pagaya's AI had something to do with it. In the world of B2B2C infrastructure, that invisible influence is exactly the point.

Myth vs. Reality Box

| Common Narrative | Reality |

|---|---|

| "Pagaya is a subprime lender" | Pagaya is a technology infrastructure company that doesn't originate loans. It provides AI-based underwriting to partners and manages capital from institutional investors. The credit risk is largely passed to those investors. |

| "The SPAC implosion proves the business was overhyped" | The business grew revenue 2x+ from 2021-2024 even as the stock crashed 92%. The SPAC structure and timing were problematic; the underlying business model was not. |

| "Pagaya is just like Upstart" | The business models are fundamentally different. Pagaya is B2B2C infrastructure that white-labels to partners; Upstart is more consumer-facing. Pagaya's capital-light model and ABS capabilities differentiate it significantly. |

| "The stock is recovering because of AI hype" | Pagaya's recovery correlates directly with operational improvements: GAAP profitability achieved, record revenue and EBITDA, and successful partnerships with major institutions. |

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music