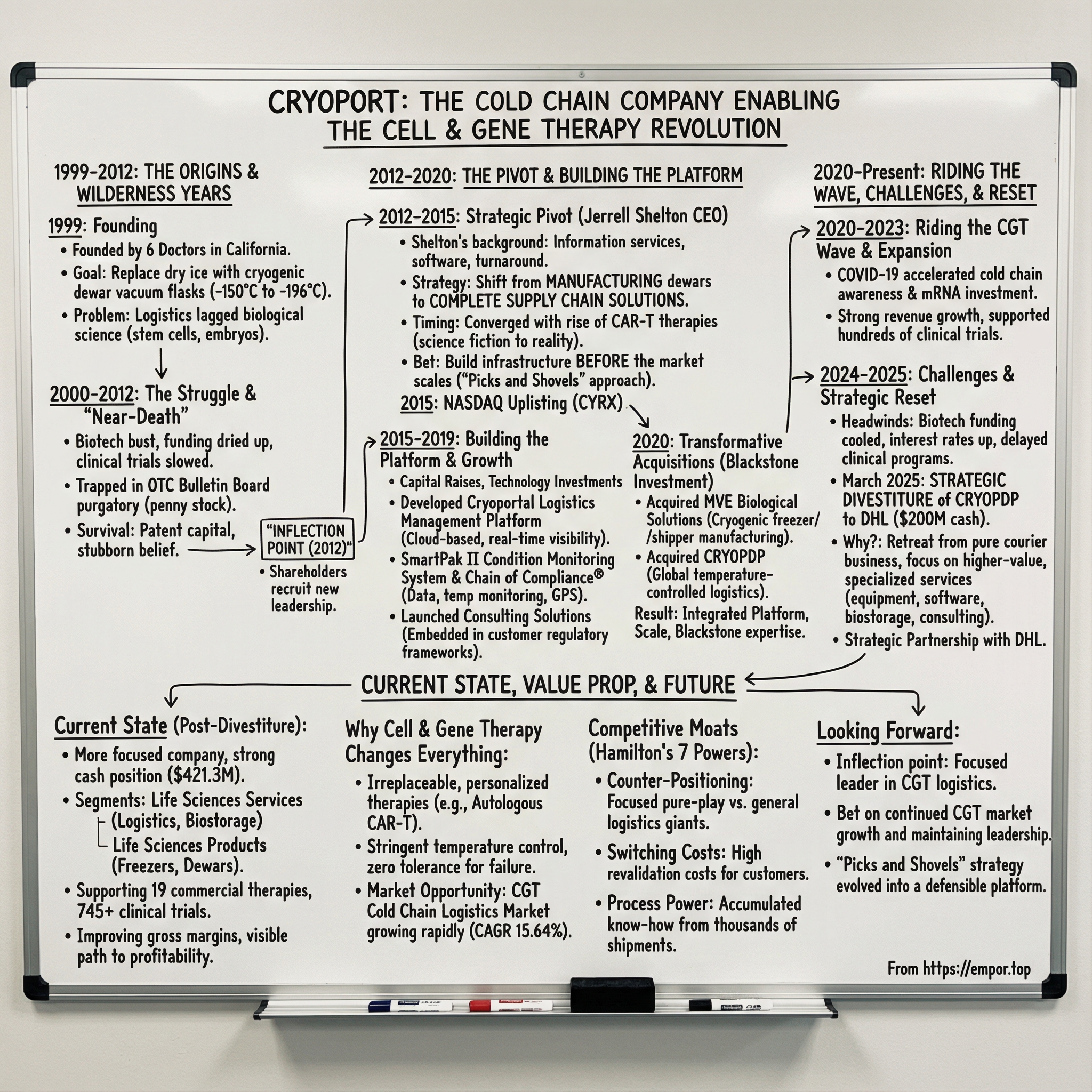

CryoPort: The Cold Chain Company Enabling the Cell & Gene Therapy Revolution

I. Introduction: The Invisible Infrastructure of Modern Medicine

Picture a vial smaller than your thumb, containing a billion genetically modified T-cells, traveling from a manufacturing facility in New Jersey to a cancer patient in Munich. The cells—extracted from that specific patient months earlier, engineered in a lab to target their unique cancer, and multiplied to therapeutic quantities—must remain at precisely -150°C throughout a journey spanning thousands of miles, multiple handling points, and at least two flights. A single temperature excursion, even for minutes, could destroy the entire batch. Unlike a pharmaceutical pill that can be remanufactured in days, this vial represents months of manufacturing time, hundreds of thousands of dollars in production costs, and for the patient—who may have run out of other options—potentially their last chance at life.

The Cell and Gene Therapy Cold Chain Logistics Market refers to the specialized supply chain infrastructure and services required for transporting, storing, and distributing temperature-sensitive CGT products. These therapies, including autologous and allogeneic treatments, require stringent conditions ranging from controlled refrigerated (+2°C to +8°C) to ultra-low and cryogenic temperatures (−80°C to −196°C). With the rise in commercial approvals of CGTs, the demand for reliable cold chain logistics has surged, ensuring product integrity, patient safety, and regulatory compliance.

This is the world that CryoPort inhabits—and increasingly dominates.

Cryoport, Inc. is a leader in temperature-controlled supply chain solutions for the life sciences industry. Through its industry-leading subsidiary companies – Cryoport Systems, MVE Biological Solutions, and CRYOGENE – the company provides an ever-evolving platform of critical products and solutions including advanced packaging, informatics, specialty logistics services, biostorage services, and cryogenic equipment.

The company's story is one of near-death, resurrection, and remarkable timing. The company was originally formed as a manufacturer of cryogenic dewar vacuum flasks in California. Their sole mission was to replace dry ice, which they considered an inferior method compared to cryogenic shipping. Today, this once-struggling manufacturer of specialty containers has transformed into the critical infrastructure enabling billion-dollar cell and gene therapies—a classic example of what investors call a "picks and shovels" play on one of healthcare's most transformative trends.

Cryoport, Inc. serves the biopharmaceutical/pharmaceutical, animal health, and human reproductive medicine markets on a global basis. Its primary focus is on addressing the critical temperature-controlled supply chain needs of the rapidly growing cell and gene therapy market.

The central question for investors: How did a struggling dewar flask manufacturer, once trading as a penny stock on the OTC Bulletin Board, become the critical infrastructure enabling billion-dollar cell and gene therapies? And can it maintain its position as the market expands and attracts larger competitors?

II. Founding & Early Years: The Dewar Flask Origins (1999-2012)

The story begins not in a boardroom or venture capital pitch meeting, but in the frustration of practicing physicians. Six doctors came together to found Cryoport. The company was originally formed as a manufacturer of cryogenic dewar vacuum flasks in California. Their sole mission was to replace dry ice, which they considered an inferior method compared to cryogenic shipping. The company employed eight people, including the six founders.

To understand why doctors would start a logistics company, one needs to appreciate the state of cryogenic shipping in the late 1990s. Dry ice—frozen carbon dioxide at -78.5°C—was the dominant method for shipping biological materials. But dry ice sublimates continuously, meaning shipments had a narrow time window before they warmed. Worse, dry ice created safety hazards, regulatory complexities with airlines, and couldn't reach the ultra-cold temperatures (-150°C to -196°C) that certain biological materials required.

The founders recognized a fundamental problem: the logistics infrastructure hadn't kept pace with advances in biological science. Research labs were developing increasingly sophisticated biological materials—stem cells, embryos, cell cultures—that required stringent temperature control. But the supply chain solutions were primitive.

Their answer was the liquid nitrogen dry vapor shipper—a double-walled vacuum flask that could maintain cryogenic temperatures for extended periods without the continuous sublimation problems of dry ice. The technology wasn't new (dewar flasks had existed for over a century), but the application to life sciences logistics was forward-thinking.

Cryoport, Inc. became a publicly traded company through a reverse merger with G.T.5-Limited, a Nevada shell corporation, trading on the OTC Bulletin Board.

The reverse merger route was telling—this wasn't a company attracting venture capital attention. The cell and gene therapy market that would eventually drive explosive demand barely existed in the late 1990s. The founders were essentially building infrastructure for a market that hadn't materialized.

The timing proved challenging. Cryoport, Inc. was founded in 1999 and is listed on the NASDAQ exchange under the symbol CYRX, and is headquartered in Brentwood, Tennessee. But between founding and that eventual NASDAQ listing lay nearly two decades of struggle.

III. The Wilderness Years & Near-Death Experience (2000-2012)

The early 2000s were brutal for CryoPort. The biotech bust that followed the broader tech crash decimated funding for early-stage life sciences companies. Research budgets contracted. Clinical trials slowed. The demand that the founders had anticipated failed to materialize at scale.

Manufacturing was shuttered. The company's original business model—selling proprietary dewar flasks—wasn't generating sufficient revenue to sustain operations. Trapped in OTC Bulletin Board purgatory with a stock price measured in pennies, CryoPort became the kind of company that most investors assumed would simply disappear.

What kept it alive? A combination of patent capital and stubborn belief. The company maintained its core intellectual property around temperature-controlled logistics. A small group of shareholders continued to believe in the underlying thesis: eventually, life sciences would need sophisticated cold chain solutions.

Driven by a belief that Cryoport has significant unfulfilled potential, a few key shareholders asked Mr. Shelton to become a member of the Board of Directors, effective October 2012. Shortly thereafter, in November 2012, Mr. Shelton was appointed President and CEO.

This moment—a group of patient shareholders recruiting an experienced turnaround operator—marked the true inflection point in CryoPort's history. It's worth pausing to appreciate how rare this outcome is. Most companies that spend a decade trading as penny stocks simply fade away. The fact that CryoPort retained believers who were actively recruiting new leadership suggests the underlying technology and market thesis remained compelling despite the company's struggles.

IV. The Turnaround: Jerrell Shelton's Strategic Pivot (2012-2015)

Jerrell Shelton was an unusual choice to lead a struggling life sciences logistics company. He has more than 40 years of executive and corporate governance experience across a host of industries. Previous to Cryoport, his experience included being visiting executive at IBM Research and president and CEO of Continental Graphics Holdings, Thomson Business Information Group and Advantage Companies. Under his leadership, each of those companies and business ventures experienced rapid revenue growth, unprecedented innovation, improved profitability and increased shareholder value.

Jerrell Shelton has more than 30 years of executive and corporate governance experience across several industries including information services, telecommunications, manufacturing and distribution. Previously, he was a visiting executive at IBM Research, where his team created and developed WebFountain, a project contributing significantly to IBM's software strategy. He was also president and CEO of NDC Holdings, Continental Graphics Holdings, Thomson Business Information Group and Advantage Companies. Under his leadership, each of those companies achieved rapid revenue growth, improved profitability and increased shareholder value.

Jerrell Shelton has a Bachelor of Science in Business Administration from University of Tennessee and a Master of Business Administration from Harvard Business School.

His background in information services and software, not logistics or life sciences, proved to be exactly what CryoPort needed. "Following his appointment to the Board last month, Jerry and the other directors reviewed the Company's requirements at the executive level, and concluded that his background and skills were the right fit for the position," said Stephen Wasserman, Cryoport's Chairman. "Jerry has led several companies to success, and we believe he has the strategic vision and hands-on management experience to do the same at Cryoport."

Shelton immediately recognized that CryoPort's future wasn't in manufacturing dewars—it was in providing complete supply chain solutions. Mr. Shelton's initial strategy was to reposition Cryoport as a solutions-oriented Life Sciences company focused on cryogenic (-150°C) logistics. Over the next years he developed the infrastructure to be modular and agile to support the anticipated growth, enabling Cryoport to create a "first-to-market" advantage. Over time, Cryoport became a global provider of end-to-end software and logistics solutions for the Life Sciences' cold chain. We earned the reputation of the industry's most trusted partner by providing cryogenic logistic solutions to regenerative medicines, reproductive medicines, animal husbandry commodities, tissues, vaccines, biologics, and advanced therapies, which gave them dependable access to their respective markets. Mr. Shelton focused the company's attention on a strategy for capturing the regenerative medicine, animal health, and reproductive medicine markets.

The timing of Shelton's arrival coincided with something extraordinary happening in medicine. Between 2012 and 2015, the cell and gene therapy field was transitioning from science fiction to clinical reality. CAR-T therapies—engineered immune cells that could attack cancer—were showing remarkable results in clinical trials. The FDA was accelerating review pathways for breakthrough therapies. Venture capital was flowing into the space.

By way of explanation, cell therapies involve the transfer of cells themselves, while gene therapies go a level deeper by transferring genetic material into targeted cells. Both categories required sophisticated temperature-controlled logistics that didn't exist at scale.

Shelton saw this convergence and made a critical strategic bet: build the infrastructure before the market materialized at scale. It's the classic "picks and shovels" approach—rather than trying to discover the gold (develop therapies), sell the tools everyone will need to dig.

In July 2015 Cryoport uplisted to the NASDAQ stock exchange (Nasdaq: CYRX). The leadership team continued its concentrated efforts in providing technology-centric logistics solutions to support the advancement of cell & gene therapies.

The NASDAQ uplisting was more than symbolic. It signaled that CryoPort had crossed a threshold from penny-stock speculation to legitimate public company. It opened access to institutional investors and analyst coverage. And it validated Shelton's turnaround thesis.

V. Building the Platform: Capital Raises & Growth (2015-2019)

With a NASDAQ listing and a clear strategic direction, CryoPort began building the infrastructure and raising capital it needed to capture the emerging opportunity.

In March 2017, we completed a common stock offering of $12.7 million. The offering was led by Cowen and Company and Needham & Company. Subsequently, we began attracting institutional shareholder interest and were covered by a number of analysts, including Cowen and Needham.

A record year that reflects our value to the Life Sciences industry. Revenue of $19.0 million, a record year reflecting our value to the cell & gene therapy industry. In June, CYRX added to the broad-market Russell 3000® Index and the small-cap Russell 2000® Index.

The technology investments during this period were crucial. CryoPort developed the Cryoportal Logistics Management Platform—a cloud-based system that provided real-time visibility into shipments, from order entry through delivery. At Cryoport, we use technology in all the areas mentioned in your question. In our field teams, we use our proprietary Cryoportal™ Logistics Management Platform. In sales/channel management, we use a CRM system. In shipment tracking, we use our leading-edge SmartPak II™ Condition Monitoring System which communicates with our Cryoportal™ Logistics Management Platform and our Logistics Managers. In employee engagement, we use Loopup, GoToMeetings, Skype for Business, etc. and in customer retention, we supplement the information we gather from other systems with anonymous customer satisfaction surveys.

The SmartPak II Condition Monitoring System and Chain of Compliance® platform became key differentiators. Rather than simply shipping packages, CryoPort was providing data—continuous temperature monitoring, GPS tracking, humidity readings—that pharmaceutical companies needed for regulatory compliance.

In late 2019, we launched our Consulting Solutions operations as a part of Cryoport Systems, giving customers access to the industry's best technical resources in engineering, design, and logistics consultation. Services continue to include shipping risk assessments; shipping lane validation; global regulatory and trade compliance services; training services; import/export, SOP's and documentation; packaging validation; packaging and accessory design; and program management. With these new competencies, Cryoport was positioned as a market leader in temperature-controlled supply-chain solutions for the Life Sciences industry as opposed to being a "cryogenic logistics" company.

This evolution—from shipping containers to consulting services—represented a fundamental shift in how CryoPort created value. The company was no longer just moving packages; it was becoming embedded in its customers' regulatory and operational frameworks. Once a pharmaceutical company validated its supply chain with CryoPort's systems, switching costs became enormous.

VI. The Transformative Acquisitions: MVE & CRYOPDP (2020)

The year 2020 marked CryoPort's transformation from a pure logistics provider into an integrated platform company—and it did so with significant help from one of the world's largest private equity firms.

Cryoport announced it has completed the acquisitions of MVE Biological Solutions ("MVE"), a global leader in manufactured vacuum insulated products and cryogenic freezer systems and solutions, and CRYOPDP, a leading global provider of innovative temperature-controlled logistics solutions for the clinical research, pharmaceutical and cell and gene therapy markets. These two strategic acquisitions uniquely position Cryoport with a comprehensive and global platform supporting the growing need for fully integrated temperature controlled supply chain requirements of the life sciences industry. MVE and CRYOPDP add significant capabilities and competencies to Cryoport as well as markedly expand its client coverage of the global cell and gene therapy market. This newly formed end-to-end solutions platform significantly enhances Cryoport's market position.

Cryoport, Inc., a provider of temperature-controlled supply chain solutions for the life sciences, has signed an agreement to acquire MVE Biological Solutions, a manufacturer of vacuum insulated products and cryogenic freezer systems for the life sciences, in a cash transaction valued at $320 million.

The MVE acquisition was particularly significant. For more than half a century, MVE has been the preferred choice for cryogenic storage and shipper systems in the Life Sciences. With over 50 years of history, MVE brought CryoPort manufacturing capabilities, an established customer base, and expertise in cryogenic equipment design that would have taken years to build organically.

To fund these transformative acquisitions, CryoPort secured a major investment from The Blackstone Group—one of the world's largest alternative asset managers and a firm with deep expertise in healthcare and logistics.

In conjunction with the acquisition of MVE, the Company completed its previously announced private placement issuance of $25 million of common stock and $250 million of newly designated Series C Convertible Preferred Stock to funds affiliated with The Blackstone Group Inc. (NYSE: BX) ("Blackstone"). In conjunction with Blackstone's investment in Cryoport, Ram Jagannath, Senior Managing Director and Global Head of Healthcare for Blackstone Growth and Tactical Opportunities, joined the Board of Directors of Cryoport.

Blackstone's involvement was validating. Ram Jagannath, Senior Managing Director of Blackstone, said, "Life sciences and logistics are two of Blackstone's highest-conviction investment areas and we're excited to back an industry-leader at the cross-section of these fast-growing sectors. Together, Cryoport and MVE Biological Solutions offer a unique combination of industry knowledge, client coverage, engineering and innovation. Through Cryoport's acquisition, we believe MVE Biological Solutions will deliver strong growth as the demand for its solutions from cell and gene therapy customers continues to increase. This acquisition provides multiple value creation opportunities for Cryoport and MVE Biological Solutions that offer additional revenue growth upside, including the development of new product innovations, opportunities to grow with key distributors in the U.S., and the opportunity to increase direct customer sales and distributor relationships globally."

Ram Jagannath is the Global Head of Healthcare, responsible for investing across Blackstone's Private Equity, Tactical Opportunities and Growth businesses, based in New York. His presence on CryoPort's board brought not just capital but strategic expertise and access to Blackstone's healthcare network.

Following the acquisitions, CryoPort's scale increased dramatically. "We now support well over 500 of the preeminent companies in biopharma and are positioned to be the global leader in advanced temperature controlled supply chain solutions tailored to the life sciences industry."

VII. Riding the CGT Wave & Expansion (2020-2023)

The 2020 acquisitions positioned CryoPort to capture what would prove to be explosive growth in the cell and gene therapy market—growth that was paradoxically accelerated by the COVID-19 pandemic.

COVID-19 brought cold chain logistics into the public consciousness in unprecedented ways. The mRNA vaccines from Pfizer and Moderna required stringent temperature control—Pfizer's initially required -70°C storage. Suddenly, the specialized logistics that CryoPort had been building for years became front-page news. While CryoPort wasn't a primary vaccine logistics provider, the heightened awareness of cold chain importance benefited the entire sector.

More importantly, the pandemic accelerated investment in mRNA technology and gene therapy platforms. Researchers saw that mRNA could potentially address a wide range of diseases beyond COVID-19. Venture capital and pharmaceutical company R&D dollars flooded into the space.

CryoPort continued to build out its platform through additional acquisitions and partnerships. With 650+ clinical trials supported and more than half a million successful shipments of sensitive and often irreplaceable materials across the globe, you can count on our track record of success that spans decades.

We lead the way in temperature-controlled expertise for supply chain support. From our proprietary Veri-Clean® process to our requalification procedures, our consistent risk mitigation means we are the only provider to requalify our shippers – every shipment, every time. We stand at the forefront with unparalleled traceability thanks to our Chain of Compliance®. We offer scalability with an expanded depth of services, such as BioServices and biostorage, Consulting Services, and cryopreservation, that add certainty to your supply chain.

Revenue growth during this period was strong. The company was riding multiple tailwinds: the CGT market was expanding, commercial therapies were scaling, and the clinical trial pipeline was growing.

VIII. The Challenges & Strategic Reset (2024-2025)

The euphoria couldn't last forever. By 2024, CryoPort faced a more challenging environment—one that would ultimately lead to a significant strategic pivot.

"Cryoport ended 2024 with solid results across the company including total full year revenue of $228.4 million, which was in-line with our expectations."

The "solid" characterization masked underlying headwinds. Cost reduction initiatives anticipated to result in approximately $22 million of annualized cost savings and drive Cryoport towards its goal of profitable growth, as well as a return to positive Adjusted EBITDA in 2025. Company provides updated 2024 full-year revenue guidance of $225 to $235 million. Jerrell Shelton, CEO of Cryoport, commented, "During our second quarter, we saw continued progress across all businesses as all revenue lines improved sequentially. Our revenue from the support of commercial Cell & Gene Therapies stood out, with an increase of 51% year-over-year and 20% sequentially, reflecting a strong demand for these life-saving treatment therapies."

The biotech funding environment had cooled significantly from its 2021 peaks. Interest rate increases made capital more expensive. Some early-stage companies that had been CryoPort customers ran into funding difficulties or delayed clinical programs. The Life Sciences Products segment—cryogenic freezers and equipment—faced particular headwinds as customers delayed capital purchases.

In March 2025, CryoPort announced a strategic move that surprised many observers—the divestiture of CRYOPDP to DHL.

DHL to acquire 100% of CRYOPDP, a leading specialty courier providing logistics services for clinical trials, biopharma, and cell & gene therapies. The acquisition of CRYOPDP marks a significant step in DHL's commitment to enhancing its capabilities in specialized pharma logistics and expanding the breadth of its offering in the rapidly growing life science and healthcare sector. DHL to acquire 100% of CRYOPDP, a leading specialty courier providing logistics services for clinical trials, biopharma, and cell & gene therapies. This acquisition enhances DHL's capabilities in specialty pharma logistics and supports Group's 2030 strategy to become a leader in life science and healthcare logistics. DHL and Cryoport form strategic partnership to strengthen their respective supply chain services offerings for the global life sciences and healthcare sector.

Cryoport, Inc. today announced the completion of the previously disclosed divestiture of its specialty courier business, CRYOPDP, to DHL Group ("DHL"), one of the world's leading logistics providers, in a transaction that includes cash payments of approximately $200 million to Cryoport.

With operations in 15 countries, the company handles over 600,000 shipments per year, serving customers and patients in over 135 countries worldwide.

Jerrell Shelton, CEO of Cryoport, commented, "Our strategic partnership and this transaction mark a significant step that contributes to the continued evolution of our industry and aligns with Cryoport's long-term strategic vision. With this partnership, we are enhancing our core capabilities as we develop a strong global partner network. We believe this partnership with DHL will enhance our positioning in the Asia Pacific ("APAC") and Europe, Middle East and Africa ("EMEA") regions where it will reshape our competitive profile. It provides for greater opportunities to offer highly targeted, top-tier services in these regions in response to growing market demand. Most importantly, it allows us to intensify our focus on advancing our Life Science Services platform globally, particularly in the rapidly growing Regenerative Medicine market."

Net income for 9M 2025 was primarily driven by the sale of our CRYOPDP specialty courier business during Q2 2025, which contributed $115.4 million, net of taxes, to income from discontinued operations.

This divestiture represented a strategic retreat from the courier business—an acknowledgment that competing with logistics giants like DHL, FedEx, and UPS in pure transportation wasn't where CryoPort's competitive advantage lay. Instead, the company would focus on the higher-value, more specialized aspects of the supply chain: equipment, software platforms, biostorage, and consulting services.

IX. Current State & Business Model Deep Dive

Following the CRYOPDP divestiture and the strategic reset, CryoPort operates as a more focused company.

Total revenue from continuing operations for Q3 2025 was $44.2 million compared to $38.3 million for Q3 2024, a year-over-year increase of 15%. Third quarter revenue increased 15% year-over-year to $44.2 million. Commercial Cell & Gene Therapy revenue increased 36% year-over-year to $8.3 million. Our Q3 Life Sciences Services revenue increased 16% year-over-year, representing 55% of total revenue from continuing operations. This included a 21% rise in BioStorage/BioServices revenue, reflecting continued strong demand for our integrated platform. We also saw encouraging signs of stability in our Life Sciences Products segment, where revenue grew 15% year-over-year, supported by sustained demand for our market-leading cryogenic systems. Cryoport continues to demonstrate a visible pathway to profitability with improvements in adjusted EBITDA and a solid gross margin of 48% in Q3, while continuing to invest in our priority growth initiatives to drive long-term value.

The company continues to strengthen its position as a cell and gene therapy (CGT) supply chain leader, now supporting 19 commercial therapies and 745 active clinical trials.

Cryoport held $421.3 million in cash, cash equivalents, and short-term investments as of September 30, 2025.

The Company now expects total revenue from continuing operations for fiscal year 2025 to be in the range of $170.0 million to $174.0 million.

Business Segments:

The company's Life Sciences Services segment provides temperature-controlled logistics and cryogenic biostorage within the life science industry. Its Life Sciences Products segment offers cryogenic freezers, cryogenic dewars, and accessories within the life science industry through direct sales or a distribution network. The company's products include Cryoport Express Shippers; Cryoport ELITE Shippers; Cryoport Express Cryogenic HV3 Shipping System; Smartpak II Condition Monitoring System and Tec4Med; and Cryoport accessories.

In addition, the company offers IntegriCell services that comprise apheresis/leukapheresis collection, cryoshuttle transportation, cryo-process optimization, and cryopreservation services.

Financial Position:

Cryoport's commercial Cell & Gene Therapy revenue rose to $26 million in FY 2024, marking a 20% year-over-year increase. The company supported a record total of 701 global clinical trials as of December 31, 2024, with 81 trials in Phase 3.

Total gross margin was 45.8% for Q4 2024 compared to 40.6% for Q4 2023. Total gross margin was 43.6% for FY 2024 compared to 42.6% for FY 2023.

Gross margins improved to 48%, with a target of 55%. Adjusted EBITDA loss narrowed to $600,000.

The company's substantial cash position—over $420 million—provides significant strategic flexibility. This war chest, built through the CRYOPDP sale proceeds and previous capital raises, allows CryoPort to weather industry headwinds, invest in organic growth, and potentially pursue acquisitions if attractive opportunities emerge.

X. Why Cell & Gene Therapy Changes Everything

To understand CryoPort's value proposition, one must appreciate what makes cell and gene therapy logistics fundamentally different from traditional pharmaceutical distribution.

A bottle of aspirin can sit in a warehouse for months. It can survive temperature fluctuations. If a shipment is damaged, the manufacturer simply produces more. The logistics are commoditized; FedEx, UPS, and countless others can handle the task.

Cell and gene therapies are different in every respect.

The Cell and Gene Therapy Cold Chain Logistics Market refers to the specialized supply chain infrastructure and services required for transporting, storing, and distributing temperature-sensitive CGT products. These therapies, including autologous and allogeneic treatments, require stringent conditions ranging from controlled refrigerated (+2°C to +8°C) to ultra-low and cryogenic temperatures (−80°C to −196°C).

Many cell therapies are autologous—meaning they're made from the patient's own cells. A CAR-T therapy, for example, begins when cells are extracted from a specific patient. Those cells are sent to a manufacturing facility, genetically modified, expanded, and then shipped back to treat that patient. The entire batch is irreplaceable. There's no inventory to pull from.

Each shipment can represent years of research, millions of dollars in manufacturing costs, and—most critically—a patient who may have no other treatment options.

The highly personalized nature of many cell therapies, such as CAR-T treatments, require complex supply chain logistics, including strict cold chain management, real-time tracking, and just-in-time delivery.

The Market Opportunity:

The global cell and gene therapy cold chain logistics market size is calculated at US$ 1.89 billion in 2024, grew to US$ 2.19 billion in 2025, and is projected to reach around US$ 8.06 billion by 2034. The market is expanding at a CAGR of 15.64% between 2025 and 2034.

This represents one of the fastest-growing segments within healthcare logistics. The growth is driven by several factors:

The clinical segment accounted for the highest market share of 83.33% in the cell & gene therapy third-party logistics industry in 2024. The growth of the segment is due to the growing number of cell and gene therapy clinical trials worldwide. For instance, over 1,975 ongoing clinical trials for cell and gene therapy as of Q4 2024. The increasing complexity of early-stage research and stringent regulatory requirements have driven demand for specialized logistics solutions to support trial site distribution, sample collection, and real-time temperature monitoring.

XI. Playbook: Business & Investing Lessons

CryoPort's journey from near-death to category leadership offers several lessons for investors and business operators:

1. Timing the Technology Wave

Shelton's arrival in 2012 coincided with the cell and gene therapy market's transition from experimental to clinical reality. The first CAR-T therapy wasn't approved until 2017, but CryoPort was building infrastructure years earlier. The "picks and shovels" strategy works best when you can position before the rush but survive long enough for the market to arrive.

2. The Pivot That Saved the Company

Mr. Shelton's initial strategy was to reposition Cryoport as a solutions-oriented Life Sciences company focused on cryogenic (-150°C) logistics. Over the next years he developed the infrastructure to be modular and agile to support the anticipated growth, enabling Cryoport to create a "first-to-market" advantage.

The shift from manufacturing dewars to providing end-to-end solutions transformed CryoPort's value proposition. Commoditized products became differentiated services.

3. Platform Through Acquisition

The 2020 acquisitions of MVE and CRYOPDP weren't just growth plays—they were strategic moves to create a vertically integrated platform. By controlling equipment manufacturing, logistics, and software, CryoPort created switching costs and cross-selling opportunities that a pure-play logistics provider couldn't match.

4. Strategic Portfolio Management

The CRYOPDP divestiture demonstrated willingness to shed assets that didn't fit the long-term strategy. Rather than competing against logistics giants in pure transportation, CryoPort sharpened focus on areas where it has genuine competitive advantage.

5. Patient Capital

Driven by a belief that Cryoport has significant unfulfilled potential, a few key shareholders asked Mr. Shelton to become a member of the Board of Directors.

CryoPort's survival through the wilderness years required shareholders willing to hold through extended periods of disappointment. This patience was eventually rewarded with the company's transformation.

6. Regulatory Moats

CryoPort's involvement in developing industry standards creates barriers to entry. Cryoport Systems' ISO 21973-compliant shipping systems support expanded temperature ranges. Competitors must not only match the technology but also achieve the regulatory certifications and validation that took years to develop.

XII. Competitive Analysis: Porter's 5 Forces & Hamilton's 7 Powers

Understanding CryoPort's competitive position requires examining both the industry structure and the company's specific sources of durable advantage.

Porter's Five Forces Analysis:

| Force | Assessment | Analysis |

|---|---|---|

| Threat of New Entrants | LOW-MODERATE | From our proprietary Veri-Clean® process to our requalification procedures, our consistent risk mitigation means we are the only provider to requalify our shippers – every shipment, every time. High capital requirements, regulatory expertise needed, and validation processes create significant barriers. However, large logistics players (FedEx, UPS, DHL) have resources to enter. |

| Bargaining Power of Suppliers | MODERATE | Liquid nitrogen suppliers and component manufacturers have alternatives, but specialized cryogenic equipment suppliers are limited. MVE acquisition reduced supplier dependence. |

| Bargaining Power of Buyers | LOW-MODERATE | When therapies cost $400K-$2M per patient, logistics cost is immaterial; buyers prioritize reliability over price. However, large pharmaceutical companies have negotiating leverage. |

| Threat of Substitutes | VERY LOW | No substitute exists for cryogenic shipping of temperature-sensitive biologics; dry ice is insufficient for many therapies. Room-temperature stable alternatives are years away. |

| Competitive Rivalry | MODERATE-HIGH | The list of top companies in cell and gene therapy cold chain logistics market are Cryoport, Inc., World Courier, Marken, Catalent Cell & Gene Therapy Logistics, Lonza Bioscience Logistics, Thermo Fisher Scientific, BioLife Solutions. |

Hamilton's 7 Powers Analysis:

| Power | Applicability | Evidence |

|---|---|---|

| Scale Economies | MODERATE | Network density improves economics; geographic coverage creates efficiency advantages. However, CGT logistics isn't as scale-driven as traditional logistics. |

| Network Effects | LOW-MODERATE | Limited direct network effects; more validated lanes = more reliability data. Each successful shipment adds to track record that attracts new customers. |

| Counter-Positioning | HIGH | Focused pure-play on CGT vs. logistics giants (FedEx, UPS, DHL) who treat it as ancillary business. Large players struggle to match specialization without cannibalizing existing businesses. |

| Switching Costs | HIGH | Revalidation costs are enormous; regulatory submissions are tied to specific logistics providers. Once embedded in a customer's validated supply chain, switching requires significant investment. |

| Branding | MODERATE | Trusted reputation in CGT space matters when stakes are irreplaceable therapies. The CryoPort brand carries weight with regulatory-conscious pharmaceutical companies. |

| Cornered Resource | LOW-MODERATE | Proprietary technology (Cryoportal, SmartPak) provides some advantage, but no single cornered resource is decisive. |

| Process Power | MODERATE-HIGH | Accumulated know-how from 650+ clinical trials and 500,000+ shipments creates operational excellence that's difficult to replicate quickly. |

Key Competitors:

Here are some of the key competitors of Cryoport in the frozen shipping solution space: World Courier is a global specialty logistics company that provides customized transportation solutions for the biopharmaceutical industry. They offer temperature-controlled shipping services for biological materials, pharmaceuticals, and clinical trial supplies. Marken is a leading global provider of supply chain solutions for the life sciences industry. They specialize in the transportation of clinical trial materials, biological samples, and pharmaceuticals, offering a range of temperature-controlled shipping options. CSafe Global is a provider of temperature-controlled packaging solutions for the pharmaceutical and life sciences industries. They offer a range of active and passive shipping containers designed to maintain the integrity of temperature-sensitive products during transit.

The DHL partnership is particularly notable as it transformed a potential competitor into a channel partner. The strategic partnership with Cryoport will bring together DHL's global health logistics capabilities with Cryoport's industry-leading expertise in providing specialized solutions in a fast growing life science and healthcare market segment.

XIII. Key Performance Indicators & Investment Considerations

For investors tracking CryoPort, three key performance indicators stand out as the most important to monitor:

1. Commercial Cell & Gene Therapy Revenue Growth

This metric directly measures CryoPort's success in the highest-value segment of its business. Commercial cell & gene therapy revenue grew 36% YoY to $8.3M in Q3 2025. As more CGT therapies receive regulatory approval and scale commercially, this revenue stream should accelerate. Year-over-year growth rates in this segment are the clearest indicator of whether CryoPort is capturing the CGT market opportunity.

2. Number of Clinical Trials Supported (and Phase 3 Trials)

Cryoport supported 745 global clinical trials as of September 30, 2025, a net increase of 54 trials from the previous year. Clinical trials are leading indicators of future commercial revenue. Phase 3 trials are particularly important—these are the trials most likely to lead to regulatory approval and commercial launch. Each Phase 3 trial represents a potential future commercial customer.

3. Gross Margin Trajectory

Gross margins improved to 48%, with a target of 55%. As CryoPort shifts toward higher-value services and away from lower-margin logistics, gross margins should expand. Progress toward the 55% target indicates successful execution of the strategic repositioning.

XIV. Bull vs. Bear Case

The Bull Case:

CryoPort occupies a privileged position in one of healthcare's most transformative trends. The cell and gene therapy market is projected to grow at double-digit rates for the next decade. The global cell and gene therapy cold chain logistics market is projected to reach around US$ 8.06 billion by 2034, expanding at a CAGR of 15.64%.

The company's first-mover advantage in CGT logistics has created substantial switching costs. Pharmaceutical companies that have validated their supply chains with CryoPort's systems face significant regulatory and operational costs to switch. The DHL partnership extends CryoPort's global reach without the capital investment of building international logistics infrastructure.

With over $420 million in cash and improving profitability metrics, CryoPort has the financial flexibility to weather industry headwinds and capitalize on growth opportunities. The company's path to profitability is becoming visible.

The Bear Case:

CryoPort remains unprofitable, and the timeline to sustained profitability remains uncertain. The company's revenue guidance for 2025 ($170-174 million from continuing operations) represents a significant step down from prior years due to the CRYOPDP divestiture.

Competition is intensifying. Large logistics players (DHL, UPS, FedEx) are investing heavily in healthcare logistics. Well-capitalized competitors like Thermo Fisher and Catalent have broader offerings and deeper pharmaceutical relationships.

The CGT market's growth depends on clinical trial success and regulatory approvals that are inherently unpredictable. A slowdown in CGT funding—whether from interest rate pressures, regulatory setbacks, or clinical failures—would directly impact CryoPort's growth trajectory.

Myth vs. Reality:

| Myth | Reality |

|---|---|

| CryoPort dominates CGT logistics | CryoPort is a leader but faces significant competition from established players |

| CGT market growth is guaranteed | Clinical trial failures and funding cycles create meaningful uncertainty |

| The CRYOPDP sale was a sign of weakness | Strategic refocusing on higher-value segments may prove prescient |

| Profitability is imminent | Path to profitability is visible but not yet achieved |

XV. Looking Forward

CryoPort stands at an interesting inflection point. The company has transformed from a near-death penny stock into a focused leader in CGT logistics. The CRYOPDP divestiture sharpened strategic focus and provided substantial capital. Recent quarters show improving margins and strong growth in the highest-value segments.

Regenerative medicine has been advancing steadily, largely driven by the expanding pipeline of regenerative therapeutics entering clinical development and commercialization. Despite any short-term headwinds, cell and gene therapies have continued to enter and move through the clinical pipeline, which should ultimately result in growing revenue from commercially supported therapies. Cryoport's temperature-controlled supply chain solutions are supporting the largest portfolio of clinical and commercial gene therapies in the world.

The fundamental thesis remains intact: cell and gene therapies represent a revolution in medicine, and these therapies require specialized logistics that CryoPort is uniquely positioned to provide. But execution remains critical. The company must continue improving margins while investing in growth. It must maintain its first-mover advantages as competitors increase investment. And it must demonstrate that the focused strategy post-CRYOPDP divestiture produces superior returns.

Cryoport is maintaining and growing its competitive differentiators as the only pure-play end-to-end temperature-controlled supply chain platform that supports the largest portfolio of clinical and commercial cell and gene therapies globally.

For long-term investors, CryoPort represents a bet on the continued growth of the CGT market and the company's ability to maintain its market-leading position. The "picks and shovels" strategy that nearly failed in the 2000s has evolved into a defensible platform positioned at the center of one of healthcare's most important trends.

The six doctors who founded CryoPort in 1999 to replace dry ice could hardly have imagined their company would one day enable billion-dollar cancer therapies. But their core insight—that life sciences needed better logistics—proved prescient. The question for investors is whether that prescience translates into sustained competitive advantage and, eventually, profitability in the decades ahead.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music