Credo Technology Group (CRDO): Breaking Bandwidth Barriers in the AI Era

I. Introduction & Episode Teaser

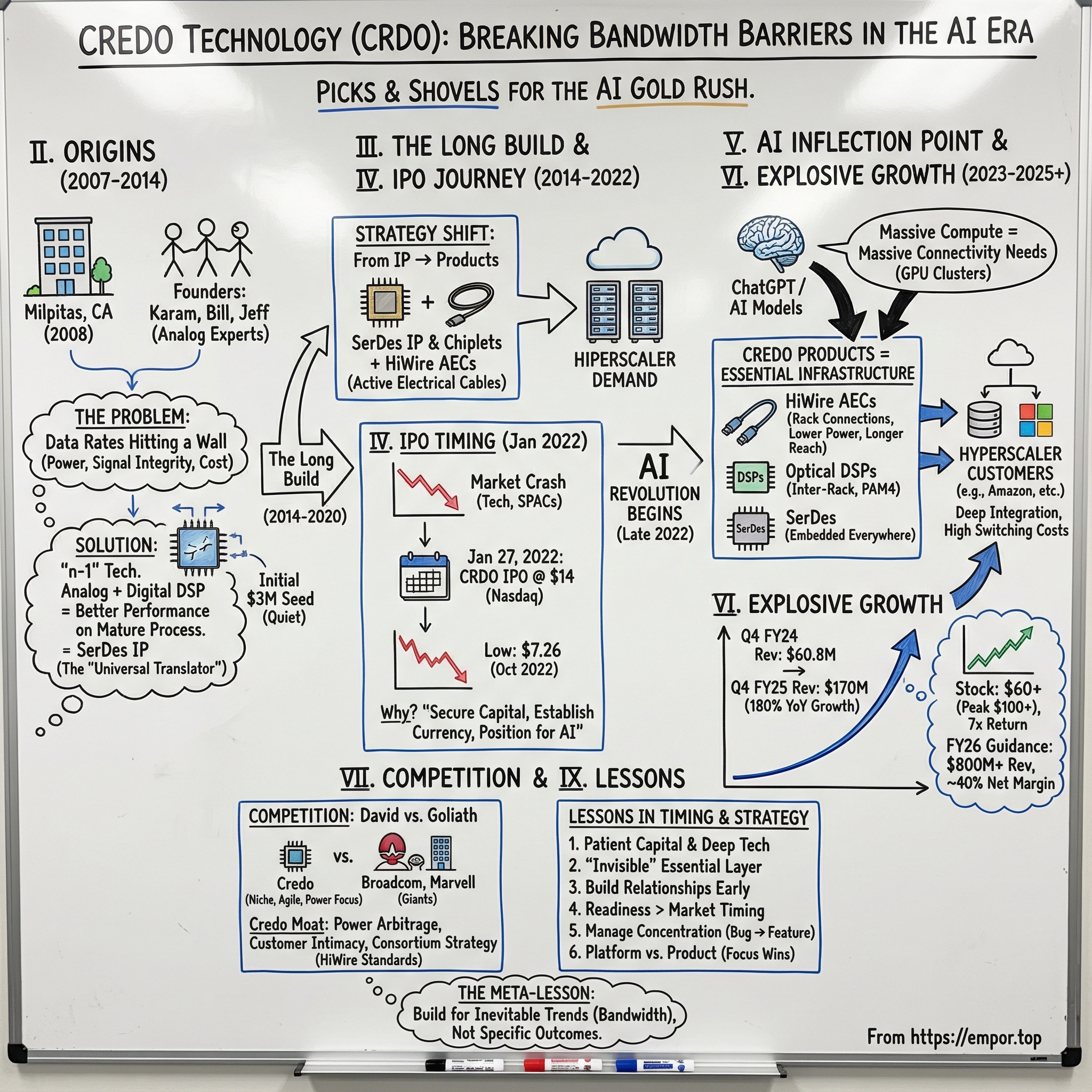

Picture this: It's late 2022, and the tech world is obsessed with ChatGPT's launch. While everyone's talking about AI models and NVIDIA's GPUs, there's a quieter revolution happening in the plumbing of the AI infrastructure—the cables and connectors that move unfathomable amounts of data between thousands of processors. At the center of this revolution sits a company most people have never heard of: Credo Technology.

On January 27, 2022, when Credo went public at $14 per share, the IPO market was in shambles. Tech valuations were crashing, SPACs were imploding, and investors were fleeing growth stocks. Yet here was this semiconductor company, founded 14 years earlier, choosing perhaps the worst possible moment to go public. The stock languished for months, trading as low as $7.26 by October 2022.

Fast forward to today: CRDO trades above $60, having touched $100+ at its peak—a more than 7x return from its lows. The company that barely anyone noticed during its IPO has become essential infrastructure for the AI boom, with revenue exploding from $236 million in fiscal 2024 to over $436 million in fiscal 2025.

Today's big question isn't just how a connectivity company became crucial to AI—it's how they stayed under the radar for so long, why they chose such terrible timing for their IPO, and what their meteoric rise tells us about picking winners in the infrastructure layer of technological revolutions.

This is the story of patient capital meeting perfect timing, of building picks and shovels for a gold rush that hadn't started yet, and of why sometimes the most valuable companies are the ones you can't see.

II. Origins & Founding Story (2007-2014)

The Milpitas, California office park where Credo Technology was born in 2008 was unremarkable—the kind of anonymous Silicon Valley building where hundreds of semiconductor startups have lived and died. But the timing was anything but ordinary. Lehman Brothers had just collapsed, the financial system was in freefall, and venture capital had essentially frozen.

Into this chaos stepped three industry veterans: Karam Awad, Bill Brennan, and Jeff Twombly. Each brought decades of experience from companies like Rambus, Applied Micro, and Broadcom. They weren't first-time founders chasing a trendy idea—they were analog and mixed-signal experts who saw a fundamental problem brewing in data centers.

"We saw that data rates were going to hit a wall," Brennan would later explain. The industry was pushing toward 10 Gigabit, then 25 Gigabit connections, but the traditional approaches—purely digital or purely analog—were running out of steam. Power consumption was exploding, signal integrity was degrading, and costs were skyrocketing.

Their insight was deceptively simple: combine analog and digital signal processing in new ways to achieve what they called "n-1" technology—delivering next-generation performance using previous-generation manufacturing processes. While competitors chased the latest 7nm or 5nm nodes at enormous cost, Credo would deliver comparable performance on mature, cheaper processes. The initial $3 million in seed funding from angel investors seemed almost quaint for a semiconductor company—an industry where a single chip design could cost millions. The founding team members included Karam Awad, Bill Brennan, and Jeff Twombly, and Credo Technology Group secured an initial $3 million in seed funding from angel investors. But the founders weren't trying to compete head-to-head with Intel or Broadcom. They were building something more subtle: intellectual property and design expertise that could be licensed or incorporated into products.

The SerDes (Serializer/Deserializer) technology they focused on was unglamorous but essential. Think of it as the universal translator for digital systems—taking parallel data streams and serializing them for transmission, then deserializing them at the destination. Every high-speed connection in a data center needs this technology, but most companies treated it as a necessary evil, not a source of competitive advantage.

Founded in 2008 by a seasoned team of analog, digital, and mixed-signal connectivity experts, Credo saw SerDes differently. They believed that by combining analog techniques (which handle real-world signals elegantly) with digital signal processing (which provides flexibility and programmability), they could achieve something remarkable: better performance at lower power consumption using cheaper manufacturing processes.

By 2014, after six years of heads-down development, Credo had built a portfolio of SerDes IP that was starting to gain traction. They weren't selling chips yet—they were licensing their designs to other companies. It was a capital-efficient model that let them prove their technology without the massive investments required for manufacturing.

The team had survived the financial crisis, built fundamental technology, and established credibility in the industry. But they were about to make a decision that would define the next decade: stay small and profitable as an IP company, or go big and build actual products. The choice they made would position them perfectly for a technological revolution they couldn't yet see coming.

III. The Long Build: Technology Development & IP Strategy (2014-2020)

By 2014, Credo faced a classic Silicon Valley dilemma: they had great technology that customers loved, but they were essentially a features company, not a product company. Their SerDes IP was being integrated into other companies' chips, generating steady licensing revenue but limiting their upside. The board meetings that year were heated—should they raise significant capital and build their own products, or stay lean and profitable?

At their core, they developed unique, patented mixed-signal IP, with an architectural approach that enabled them to leverage mature fabrication processes yet still deliver leading edge performance and power. This wasn't just marketing speak—it represented a fundamental bet against the industry's prevailing wisdom.

While competitors spent billions chasing Moore's Law to the latest process nodes, Credo's engineers were obsessing over something different: architecture. Their insight was that clever design could compensate for older manufacturing technology. A 16nm chip with superior architecture could outperform a poorly designed 7nm chip—and cost a fraction to produce.

The technical details mattered here. In traditional SerDes design, you had two camps: the analog purists who believed in handling signals in their natural form, and the digital zealots who wanted to digitize everything immediately. Credo's mixed-signal approach was heretical to both camps. They would use analog where it was most efficient (the front-end signal processing) and digital where it provided flexibility (adaptive equalization and error correction).The breakthrough moment came in March 2020, just as COVID-19 was shutting down the world. Credo closed a Series D Preferred financing round of $100M, with funds and accounts managed by BlackRock leading the round. The timing seemed insane—raising money during a global pandemic when no one knew if the economy would survive.

But CFO Dan Fleming, who'd joined in 2015, saw it differently. "The pandemic accelerated digital transformation by a decade," he'd later reflect. "We knew data center bandwidth demands were about to explode." The decision to approach BlackRock wasn't random—they wanted a public market investor who could guide them toward an eventual IPO.Between 2014 and 2020, Credo made several critical decisions that would prove prescient. First, they expanded from pure IP licensing into actual products—specifically, their HiWire Active Electrical Cables (AECs). These weren't sexy products; they were cables. But Credo's cables could do something special: they could transmit high-speed signals over longer distances with less power than traditional copper cables, and at a fraction of the cost of optical cables.

The company also became a founding member of the HiWire Consortium, establishing industry standards for their technology. This wasn't just about technical specifications—it was about creating an ecosystem where their products would become the default choice.

By 2020, when they raised that $100 million Series D, Credo had quietly built a comprehensive portfolio: SerDes IP that could be licensed, chiplets that could be integrated into other companies' designs, and complete cable solutions that hyperscalers could deploy immediately. They had also maintained their technological edge—their products delivered the performance of competitors' 7nm designs using 16nm processes, resulting in dramatically lower costs and power consumption.

The patient build phase was ending. With BlackRock and Capital Research as investors, Credo began preparing for the next chapter: going public and scaling dramatically. But first, they'd have to navigate one of the worst IPO markets in recent history.

IV. The IPO Journey: Timing, Strategy & Execution (2020-2022)

Dan O'Neil, vice president of corporate development and IR, explained that successful semiconductor firms tend to end up going public or being acquired, so Credo wanted to prepare for both eventualities. The IPO preparations that kicked off in earnest in spring 2021 weren't a sudden decision—they were the culmination of a three-year strategy that began with that BlackRock investment.

The semiconductor industry in 2021 was experiencing unprecedented demand. The chip shortage dominated headlines, data center buildouts were accelerating, and 5G deployments were ramping globally. It seemed like the perfect time to go public. Goldman Sachs was brought in as lead underwriter, and the company filed its S-1 in January 2022, targeting a $275 million raise.

Then the music stopped.

When Credo Semiconductor went public in January 2022, conditions in the US IPO market were starting to get ugly. The huge glut of listings over the previous two years, plus regulatory scrutiny of special purpose acquisition companies (Spacs) and falling tech valuations, had led many investors to step back.

The Fed was signaling aggressive rate hikes, tech stocks were cratering, and the IPO window was slamming shut. Companies were pulling their offerings left and right. Inside Credo, the debate was intense: wait for better conditions or push through?

CEO Bill Brennan made the call: they would proceed. His reasoning was counterintuitive but brilliant. "Everyone's focused on the macro," he told the board. "But our customers need our products now, not in two years. If we can get public in this market, we'll have proven our resilience."

The company set a price range of $10 to $12 per share, with new investors BlackRock, Capital Research, and GIC intending to purchase $120 million worth of shares in the offering (44% of the deal). Having these blue-chip investors as cornerstone buyers sent a powerful signal to the market.

The management team and its advisers settled on an IPO window of mid-January 2022. During the IPO roadshow, investor questions focused on the strength of the management team, the outlook for growing the business and why it made sense to go public now.

The roadshow was unusual. Instead of pitching AI or metaverse dreams (the hot topics of late 2021), Credo's team talked about power efficiency, signal integrity, and the unglamorous reality of data center infrastructure. They showed how their AECs could reduce power consumption by 50% compared to optical alternatives while taking up 75% less space than traditional copper cables.

But Credo's strong relationships with investors, bankers and other advisers, built over the previous three years, helped steer the company through a listing on Nasdaq, where it raised $230 mn. The IPO priced at $14, above the initial range—a minor miracle given market conditions.

On January 27, 2022, CRDO began trading on the Nasdaq. The stock opened flat and actually declined in the following months, hitting that October low of $7.26. To outsiders, it looked like another failed tech IPO. But inside Credo, something remarkable was happening: orders were accelerating, new hyperscale customers were signing up, and the AI revolution was about to begin.

The company had gone public at perhaps the worst possible time, but they'd done something crucial: they'd secured capital, established their currency for acquisitions, and positioned themselves as a public company just as their market was about to explode. Sometimes the worst timing becomes the best timing—if you survive long enough to see the turn.

V. Product Deep Dive: The Technology That Powers AI

To understand why Credo's stock would eventually explode, you need to understand what happens inside a modern AI data center. When ChatGPT generates a response, it's not happening on one chip or even one server. The computation is distributed across thousands of GPUs, each communicating with others billions of times per second. The bottleneck isn't the processors anymore—it's the connections between them.

This is where Credo's products become essential. Their core offerings break down into several categories, each solving a specific problem in the data center:

SerDes IP and Chiplets: These are the fundamental building blocks, the technology that converts parallel data into serial streams and back again. At their core, they develop unique, patented mixed-signal IP. Credo's architectural approach enables them to leverage mature fabrication processes yet still deliver leading edge performance and power. While competitors chase the latest process nodes, Credo's "n-1" approach delivers comparable performance at dramatically lower cost.

HiWire Active Electrical Cables (AECs): These are Credo's killer product. Traditional copper cables (DACs) can only transmit high-speed signals about 3 meters before degradation. Optical cables (AOCs) can go much further but consume significant power and cost 5-10x more. Credo's AECs use embedded signal processing to extend copper's reach to 7+ meters while consuming 50% less power than optical alternatives.

The technical moat here is profound. Building an AEC requires expertise in analog design (for the cable physics), digital signal processing (for error correction and equalization), and system integration (to make it all work seamlessly). Few companies have all three capabilities.

Optical DSPs: For connections that must use optical transmission, Credo provides the digital signal processors that sit at each end, handling the electrical-to-optical conversion. These DSPs use PAM4 modulation—a technique that doubles the data rate without doubling the frequency, crucial for managing power consumption.

The company sells its products to hyperscalers, original equipment manufacturers, original design manufacturers, and optical module manufacturers, as well as into the enterprise and HPC markets. But the real story isn't who they sell to—it's what problems they solve.

Consider a typical AI training cluster: thousands of GPUs arranged in racks, each needing to communicate with every other GPU. The connections within a rack (up to 7 meters) are perfect for Credo's AECs. The connections between racks use their optical DSPs. The SerDes technology is embedded throughout. It's a complete ecosystem play.

The importance of the HiWire Consortium cannot be overstated. By establishing industry standards for AEC technology, Credo created a market where they're not just a supplier but the architect of the category. When hyperscalers specify "HiWire-compliant" cables in their designs, they're essentially specifying Credo technology.

But perhaps the most crucial aspect of Credo's technology is timing. Their products were designed for 400G and 800G networks—speeds that seemed almost theoretical when they started development. By 2023, these speeds weren't theoretical anymore. They were mandatory for AI workloads. And Credo was one of the only companies with proven, shipping products.

The stage was set for explosive growth. The question was: would the market recognize it?

VI. The AI Inflection Point: Explosive Growth (2023-2025)

The transformation began quietly. On May 30, 2024, when Credo reported its Q4 fiscal 2024 results, the numbers were solid but not spectacular: revenue of $60.8 million and non-GAAP gross margin of 66.1%. In fiscal '24, Credo achieved revenue of $193 million and non-GAAP gross margin of 62.5%. The stock jumped 27.1% that day—not because of the reported numbers, but because of what CEO Bill Brennan said on the earnings call.

"The workloads supported by our solutions changed significantly during the fiscal year, and our growth was primarily driven by AI deployments across our entire portfolio. In fiscal Q4, roughly three quarters of our revenue was driven by AI workloads."

This was the inflection point investors had been waiting for. The AI infrastructure buildout wasn't theoretical anymore—it was driving real revenue. But the real bombshell came on December 3, 2024. Credo reported a significant revenue increase of 21% sequentially and 64% year-over-year, reaching $72 million in Q2. More importantly, the company guided Q3 revenue to $115-125 million—a massive sequential jump that caught even bulls off guard.

The stock rocketed up 47.8% following the release. But this was just the beginning.CEO Bill Brennan confirmed what the market was beginning to realize: "For several quarters, we've anticipated an inflection point in our revenues during the second half of fiscal '25. I am pleased to share that this turning point has arrived, and we are seeing even greater momentum than initially projected."

Then came the Q4 2025 bombshell that sent the stock into the stratosphere. Credo Technology Group reported a significant revenue increase of 180% year over year for Q4, reaching $170 million. The company achieved a non-GAAP gross margin of 67.4% in Q4, indicating strong profitability. Credo's fiscal year 2025 revenue grew by 126% year over year, reaching $437 million, showcasing robust growth. The company has successfully diversified its customer base, with three hyperscalers each contributing over 10% of revenue. Credo's innovative connectivity solutions have positioned it well to capitalize on the expanding AI infrastructure market.

For Q4 2025, the company reported $170.0 million in revenue, marking a 25.9% quarter-over-quarter increase and a staggering 179.7% year-over-year surge. This performance was fueled by surging demand for Credo's 100G Active Electrical Cables (AECs), optical Digital Signal Processors (DSPs), and PCIe Gen6 solutions, which are critical for hyperscalers like Amazon, Microsoft, and Tesla.

The guidance for fiscal 2026 was even more stunning: Fiscal Year '26 Revenue Expectation: Exceed $800 million, growth over 85% year over year. Fiscal Year '26 Non-GAAP Net Margin Expectation: Approach 40%.

The company's financial discipline is equally impressive. GAAP gross margin hit 67.2%, while non-GAAP gross margin reached 67.4%, reflecting efficient cost management and a high-margin product mix. Operating expenses were tightly controlled at $52.0 million (non-GAAP), and Credo ended the quarter with $431.3 million in cash and short-term investments.

The transformation was complete. The company that went public at $14 during one of the worst IPO markets in history was now one of the fastest-growing semiconductor companies in the world. Revenue had exploded from $60 million per quarter to $170 million in less than two years. More importantly, they'd proven that being one step removed from the AI spotlight—the infrastructure behind the infrastructure—could be even more valuable than being in the spotlight itself.

VII. Competition, Market Position & Strategic Partnerships

In the semiconductor industry, David rarely beats Goliath. Yet here was Credo, with a market cap that Broadcom could acquire with pocket change, competing successfully against giants with 100x their resources. Understanding how they pulled this off reveals crucial lessons about finding competitive advantage in dominated markets.

The competitive landscape in high-speed connectivity is brutal. Broadcom commands the lion's share with its broad portfolio and deep customer relationships. Marvell leverages its scale and R&D budget to stay competitive. Smaller players like Alphawave and Rambus compete in specific niches. So how does Credo not just survive but thrive?

The answer lies in three strategic choices that define Credo's market position:

1. The Power Arbitrage Play: While competitors chase ultimate performance, Credo obsesses over performance per watt. Credo's success hinges on its ability to solve the most pressing challenges in AI infrastructure: power efficiency, scalability, and cost. Its HiWire AECs, for instance, combine retimer, gearbox, and forward error correction in a compact copper format, offering a compelling alternative to traditional optical solutions.

In modern data centers, power is becoming more precious than space. A hyperscaler might have the physical room for more servers, but they've hit their power ceiling. Credo's products that deliver equivalent performance at 50% less power aren't just nice to have—they're essential for expansion.

2. Strategic Customer Intimacy: The company has successfully diversified its customer base, with three hyperscalers each contributing over 10% of revenue. But this understates the depth of these relationships. Credo doesn't just sell products; they co-develop solutions. Engineers are embedded with customers, understanding their roadmaps 18-24 months out.

This approach creates switching costs that go beyond technology. When a hyperscaler's entire rack design is optimized around Credo's AECs, changing suppliers means redesigning the entire system—a multi-year, multi-million dollar proposition that no one wants to undertake.

3. The Consortium Strategy: Credo's role as a founding member of the HiWire Consortium is masterful strategic positioning. By helping establish industry standards for AEC technology, they've essentially written the rules of the game they're playing. When customers specify "HiWire-compliant" solutions, they're implicitly choosing Credo's technology paradigm.

But the real genius is in how Credo manages competitive dynamics. The company faces competitive pressure in the AEC market, with customers expressing a desire for multiple suppliers. Rather than fight this, Credo embraces it. They license certain technologies to create a ecosystem of suppliers, ensuring the market adopts their standards while maintaining their position as the technology leader.

The partnership strategy extends beyond customers. Credo works closely with TSMC on advanced packaging, with optical module manufacturers on integration, and with system vendors on reference designs. Each partnership reinforces their position in the ecosystem.

Mizuho also highlighted Credo's potential to add two new hyperscale customers by fiscal 2026, which could further diversify its revenue base and accelerate growth. This upgrade is part of a broader industry-wide optimism, with Mizuho simultaneously raising targets for Nvidia and AMD, signaling a coordinated bullish stance on the AI sector.

Yet customer concentration remains the achilles heel. The largest customer accounted for 61% of revenue, with two others at 12% and 11%. This concentration is both a testament to Credo's importance to these customers and a risk that keeps investors awake at night.

The competitive moat isn't just technical—it's systemic. Credo has positioned itself where the pain is highest (power consumption), the switching costs are significant (system-level integration), and the alternatives are limited (few companies have their mixed-signal expertise). They're not trying to be everything to everyone; they're trying to be essential to the companies that matter most.

VIII. Financial Analysis & Unit Economics

The numbers tell a story of one of the most dramatic transformations in semiconductor history. But beneath the headline growth figures lies a more nuanced tale of operational leverage, margin expansion, and the economics of selling into the most demanding customers on earth.

Let's start with the revenue trajectory—it's not just growing, it's accelerating. Fiscal 2024: $193 million. Fiscal 2025: $437 million. Fiscal 2026 guidance: over $800 million. This isn't the typical semiconductor cycle of boom and bust. This is structural growth driven by architectural shifts in computing.

But revenue is vanity; profit is sanity. Here's where Credo's model gets interesting. The company achieved a non-GAAP gross margin of 67.4% in Q4, indicating strong profitability. For a company selling physical products—cables and chips—these are software-like margins. How?

The secret lies in Credo's "n-1" technology strategy. By achieving cutting-edge performance on mature process nodes, they avoid the astronomical costs of bleeding-edge manufacturing. A 7nm chip might cost $100 million to develop; Credo achieves similar results on 16nm for a fraction of that cost. The savings flow directly to gross margins.

The operating leverage is even more impressive. Non-GAAP operating expenses are expected to grow at less than half the revenue growth rate, driving non-GAAP net margin to nearly 40%. This is the beauty of the semiconductor model at scale—the first chip costs millions to develop, but the millionth chip costs pennies to produce.

Our operating margin improved by 2,500 basis points as we continue to generate considerable top-line leverage, driven by growth in our products while growing operating expenses considerably slower than revenue.

R&D spending tells another story. At $47.6 million in Q4 (28% of revenue), Credo invests heavily in staying ahead. But here's the key: they're not spreading R&D across dozens of products. They're focused on a narrow set of technologies where they can dominate. Every dollar of R&D strengthens their core moat rather than chasing new markets.

The cash position—$431.3 million with no debt—provides both offensive and defensive flexibility. They can weather downturns, invest in new technologies, or make strategic acquisitions without diluting shareholders or taking on leverage.

The unit economics reveal why hyperscalers love Credo. A single high-end GPU might cost $30,000. The Credo connectivity products that enable that GPU to function in a cluster might cost $500-1000. But without those connections, the GPU is useless. It's a classic razor-and-blade model, except Credo is selling the blades to the most price-insensitive customers in the world.

Working capital dynamics are fascinating. The company generated a fourth-quarter fiscal 2025 cash flow from operating activities of $57.8 million, up $53.6 million sequentially, driven by strong cash collections from the product ramp. Credo's customers—hyperscalers—pay quickly and reliably. There's no chasing invoices from small customers or managing bad debt. When Amazon or Microsoft is your customer, payment terms are excellent.

The capital allocation strategy is evolving. CapEx Expectation: Projected to double in the coming fiscal year, primarily from production mask set tape-outs and three-nanometer chip development. This isn't maintenance capex—it's growth investment in next-generation products that will drive revenue in 2027 and beyond.

But perhaps the most impressive metric is capital efficiency. Credo has generated over $400 million in revenue on roughly $100 million in total funding (pre-IPO). Compare that to other semiconductor companies that require billions in investment to reach similar scale. This efficiency comes from their IP-first strategy—they leveraged their designs before building products, generating cash flow to fund growth.

The financial model is approaching a tipping point. With gross margins expanding, operating leverage kicking in, and revenue scale building, Credo is transitioning from growth-at-any-cost to profitable growth. The projected 40% net margins would put them in rare company—more profitable than most software companies despite being a hardware business.

IX. Playbook: Lessons in Timing, Technology & Market Entry

Every successful company teaches lessons, but Credo's journey offers a masterclass in strategic patience, technical focus, and the art of being perfectly positioned when the market explodes. These aren't just lessons for semiconductor companies—they're principles for any business trying to compete in dominated markets.

Lesson 1: The Power of Patient Capital and Technical Depth

Credo stayed private for 14 years. In Silicon Valley, where the average time to IPO has shrunk to 5-7 years, this seems almost archaic. But those 14 years weren't spent in hibernation—they were spent building fundamental technology that competitors couldn't easily replicate.

The patience paid off in multiple ways. First, they avoided the quarterly earnings pressure that forces public companies to optimize for short-term results. Second, they built deep technical moats that require years of expertise to replicate. Third, when they finally did go public, they had real products, real customers, and real revenue—not just promises.

Lesson 2: Why Being "One Step Removed" From the Spotlight Can Be Advantageous

Everyone knows NVIDIA. Few know Credo. Yet Credo's products are essential for NVIDIA's GPUs to function at scale. This positioning—critical but invisible—offers unique advantages.

First, you avoid the hype cycles that create and destroy valuations. While AI stocks gyrate wildly based on sentiment, Credo steadily ships products that everyone needs regardless of which AI company wins.

Second, you face less direct competition. Everyone wants to build the next GPU; few want to build the cables that connect them. The unsexy markets often offer the best risk-adjusted returns.

Third, customer relationships are stickier. When you're embedded in the infrastructure layer, switching costs are enormous. It's easier to switch AI models than to rewire your entire data center.

Lesson 3: The Importance of Building Relationships Before You Need Them

Credo's decision to raise from BlackRock and Capital Research in 2020—two years before their IPO—was strategic genius. These weren't just investors; they were tutors in public market dynamics.

When the IPO window briefly opened in January 2022, Credo was ready. They had cornerstone investors lined up, a story that resonated with public market investors, and the operational metrics to back it up. Companies that scramble to go public rarely succeed; companies that prepare methodically often thrive.

Lesson 4: When to Go Public - Market Timing vs. Company Readiness

Conventional wisdom says wait for perfect market conditions to go public. Credo did the opposite—they went public in one of the worst markets in recent history. Why did it work?

Because company readiness matters more than market timing. Credo had product-market fit, scaling revenue, and path to profitability. They didn't need the IPO market to be hot; they needed access to capital and currency for acquisitions. By going public when others couldn't, they eliminated IPO competition and got full investor attention.

Moreover, going public in a bad market set low expectations. Every subsequent quarter of growth surprised to the upside, creating momentum that fed on itself.

Lesson 5: Managing Customer Concentration While Scaling

Credo's customer concentration—61% of revenue from one customer—would terrify most investors. But Credo has turned this bug into a feature through three strategies:

First, they've made themselves indispensable to that customer through technical integration and co-development. The switching costs aren't just financial; they're architectural.

Second, they're using the concentration as a bridgehead to expand. Success with one hyperscaler becomes the reference that wins the next one.

Third, they're transparent about the risk and the mitigation strategy. By acknowledging concentration and showing concrete progress on diversification, they maintain investor trust.

Lesson 6: The Platform vs. Product Decision

Many semiconductor companies try to be platforms—offering broad solutions across multiple markets. Credo chose to be a product company focused on a narrow but critical problem: high-speed connectivity.

This focus enabled them to be world-class in their niche rather than mediocre across many areas. It also made the value proposition crystal clear to customers: "We solve your connectivity problems better than anyone else."

The lesson: in dominated markets, depth beats breadth. It's better to be essential to a few customers than nice-to-have for many.

The Meta-Lesson: Timing Isn't Everything, But It's a Lot

Credo's greatest strategic insight wasn't technical—it was temporal. They bet that data center bandwidth requirements would explode, that power efficiency would become paramount, and that copper could be extended further than anyone believed. They were right on all three.

But being right isn't enough—you have to be right at the right time. Too early and you run out of money waiting for the market. Too late and entrenched competitors lock you out. Credo threaded the needle perfectly, going public just as AI infrastructure spending was about to explode.

The playbook isn't about predicting the future—it's about positioning yourself to benefit from multiple possible futures. Credo's technology works whether AI, traditional cloud, or 5G drives demand. They bet on bandwidth growth, not specific applications. That's the ultimate lesson: build for inevitable trends, not specific outcomes.

X. Bear vs. Bull Case & Future Outlook

The stock market is a voting machine in the short term and a weighing machine in the long term. With Credo trading at a $10+ billion valuation—up from $2 billion at IPO—investors are voting with their feet. But what does the weighing machine say? Let's examine both sides of the argument with the rigor they deserve.

The Bull Case: AI Infrastructure Is Still Day One

The bulls start with a simple observation: we're in the first inning of AI infrastructure buildout. Every major technology company is racing to build AI capabilities, and they all need the same thing—massive computational power connected with high-bandwidth, low-latency networks.

Consider the math. OpenAI's GPT-4 reportedly required 25,000 NVIDIA A100 GPUs for training. GPT-5 might require 10x that. Google, Meta, Amazon, Microsoft, Tesla, and dozens of others are building similar capabilities. Each cluster requires thousands of Credo's connections. The demand pipeline isn't quarters; it's years.

The technology differentiation is real and growing. Credo's success hinges on its ability to solve the most pressing challenges in AI infrastructure: power efficiency, scalability, and cost. Its HiWire AECs, for instance, combine retimer, gearbox, and forward error correction in a compact copper format, offering a compelling alternative to traditional optical solutions.

Power efficiency isn't just a nice-to-have anymore—it's existential. Data centers are hitting power limits before space limits. Credo's 50% power reduction versus alternatives doesn't just save money; it enables expansion that wouldn't otherwise be possible.

The customer diversification story is compelling. Mizuho also highlighted Credo's potential to add two new hyperscale customers by fiscal 2026, which could further diversify its revenue base and accelerate growth. Moving from one to three to five hyperscale customers doesn't just reduce concentration risk—it validates the technology and creates competitive dynamics that benefit Credo.

Margin expansion has room to run. Software companies with 40% net margins trade at 10-15x revenue. Credo is approaching those margins while growing faster than most software companies. The valuation framework might need to shift from hardware multiples to software multiples.

The innovation pipeline is robust. PCIe Gen 6, 3nm chiplets, and 1.6T solutions are all in development. Each generation strengthens Credo's moat and expands their addressable market. They're not just riding the current wave; they're positioned for the next one.

The Bear Case: Concentration, Competition, and Cyclicality

The bears have legitimate concerns, starting with customer concentration. Its revenue is heavily concentrated among a few hyperscalers, with each of its top three customers contributing over 10% of total revenue in Q4 2025. While the addition of two new clients by 2026 is expected to mitigate this risk, any disruption in these relationships could impact growth.

What happens if that 61% customer decides to build their own solutions? Or if they simply slow spending? The impact would be catastrophic. History is littered with suppliers who became too dependent on single customers.

Competition from larger players remains a threat. Broadcom has unlimited resources and deep customer relationships. If they decided to seriously compete in Credo's niche, could Credo survive? Marvell is already making aggressive moves in connectivity. The giants are awakening.

Valuation concerns are real. The stock has risen 7x from its lows. At current prices, Credo trades at over 12x forward revenue—rich even for a high-growth semiconductor company. The easy money has been made; future returns require flawless execution.

The cyclical nature of semiconductors hasn't disappeared. Yes, AI spending seems structural, but every semiconductor cycle looks permanent at the peak. When cloud capex eventually slows—and it will—Credo's growth will decelerate dramatically.

Technical transitions create risk. The industry is debating Ethernet versus PCIe, copper versus optical, and various competing standards. If Credo bets wrong on any of these transitions, their technology advantage could evaporate.

Insider selling is worth noting. Additionally, insider stock sales and a July 2025 downgrade from Wall Street Zen to "Hold" highlight lingering skepticism about valuation. When insiders are selling into strength, it raises questions about their confidence in sustained growth.

Future Catalysts: What Could Move the Stock

Several catalysts could drive the next leg of Credo's journey:

PCIe Gen 6 Adoption: Credo's entry into PCIe retimers and DSPs could open a massive new market. If they can replicate their Ethernet success in PCIe, revenue could double again.

3nm Product Cycle: The transition to 3nm technology could extend their technical lead and enable new products that aren't possible today.

New Hyperscaler Wins: Adding Google or Apple as customers would dramatically reduce concentration risk and validate the technology platform.

Optical Technology Breakthrough: If Credo can extend their power efficiency advantage to optical connections, they could capture a much larger market.

M&A Activity: With $431 million in cash and a high-value stock, Credo could acquire complementary technologies or companies to accelerate growth.

The Verdict: Exceptional Company, Full Valuation

The truth lies between the extremes. Credo is an exceptional company with real technology advantages, riding a powerful secular trend. The AI infrastructure buildout is real and has years to run. Their products are becoming industry standards, and customer relationships are deepening.

But the stock has already priced in much of this success. At 12x revenue, investors are betting on flawless execution and sustained hypergrowth. Any disappointment—a quarter of weak guidance, a customer loss, a competitive threat—could trigger a significant correction.

For long-term investors, Credo represents a way to invest in AI infrastructure without betting on specific AI winners. For traders, the volatility offers opportunities but requires strong risk management.

The future outlook depends on your time horizon. Over the next quarter or two, the stock could go anywhere—momentum could drive it higher or valuation concerns could trigger a pullback. Over the next five years, if AI infrastructure spending continues and Credo maintains its competitive position, the company could be multiples of its current size.

The key question isn't whether Credo is a good company—it clearly is. The question is whether it's a good stock at current prices. That depends on your belief in the duration and magnitude of the AI infrastructure boom. If you believe we're in year one of a ten-year buildout, Credo could still be early. If you believe we're closer to peak spending, caution is warranted.

XI. Epilogue & Key Takeaways

As we close this deep dive into Credo Technology, it's worth stepping back to consider what this company represents in the broader landscape of technology and investment. Credo isn't just another semiconductor company riding the AI wave—it's a new archetype for how specialized companies can thrive in an era of platform giants.

Why Credo Represents a New Archetype: The Specialized Enabler

In the technology stack of the future, there are three layers: the platform layer (dominated by giants like NVIDIA, Google, Microsoft), the application layer (where thousands of startups compete), and the enabling layer (where Credo lives). This enabling layer—unglamorous, technical, essential—might be the best risk-adjusted place to invest.

Credo has proven that you don't need to build the whole platform to capture value. By solving one critical problem exceptionally well—high-speed, power-efficient connectivity—they've become indispensable to the platform players. They're the specialized surgeon in a world of general practitioners.

This model—the specialized enabler—is repeatable across industries. Find a critical bottleneck in a growing market, develop deep technical expertise to solve it, and embed yourself so deeply in customer workflows that switching becomes unthinkable. It's not as sexy as building the next AI model, but it's far more defensible.

Lessons for Founders on Timing, Patience, and Picking Your Battles

For founders studying Credo's journey, several lessons stand out:

First, patience isn't just a virtue—it's a strategy. Credo spent 14 years building before going public. They resisted the pressure to grow fast and break things, instead choosing to grow steadily and build something lasting. In an era of overnight unicorns, Credo reminds us that some moats take time to dig.

Second, pick battles you can win. Credo didn't try to compete with Broadcom across the board. They picked a specific problem (SerDes for high-speed connectivity), a specific approach (mixed-signal architecture), and a specific market (hyperscale data centers). By narrowing their focus, they could outmaneuver larger competitors.

Third, timing isn't about predicting the future—it's about positioning for multiple futures. Credo's technology works whether AI, 5G, or traditional cloud computing drives demand. They bet on bandwidth growth, not specific applications. This optionality is invaluable in uncertain markets.

The Importance of Being Essential but Not Visible

Credo has mastered the art of being essential but not visible. They don't have consumer brand recognition. They don't keynote at major conferences. They don't get profiled in mainstream media. Yet their products are in every major data center, enabling the AI revolution that everyone talks about.

This invisibility is a strategic advantage. It keeps competitors focused elsewhere. It reduces customer pressure on pricing (no one knows what cables cost). It allows technical merit rather than marketing to drive sales.

For investors, finding these essential but invisible companies before they become visible is where outsized returns live. The best investments are often hiding in plain sight, one layer removed from the spotlight.

What This Means for the Broader Semiconductor and AI Infrastructure Landscape

Credo's success signals several important trends in semiconductors and AI infrastructure:

The return of systems thinking. Success increasingly comes not from individual components but from system-level optimization. Credo doesn't just sell cables; they solve system-level connectivity challenges.

Power efficiency as the new performance. Moore's Law drove performance for decades. But in a power-constrained world, performance per watt matters more than absolute performance. Companies that optimize for efficiency will win.

The democratization of advanced manufacturing. Credo proves you don't need bleeding-edge process nodes to build leading-edge products. Smart architecture can compensate for older manufacturing technology.

The importance of ecosystems. Credo's role in the HiWire Consortium shows that creating standards and ecosystems might be more valuable than protecting proprietary technology.

Final Thoughts on Valuation and Investment Implications

At current valuations, Credo is priced for perfection. The stock market has recognized the company's potential and bid it up accordingly. For new investors, this creates a dilemma: pay up for quality or wait for a better entry point?

The answer depends on your investment philosophy and time horizon. If you believe in the long-term AI infrastructure buildout and can stomach volatility, Credo offers exposure to a secular trend through a best-in-class operator. If you're value-conscious and patient, waiting for a correction might offer better risk-reward.

But perhaps the real lesson from Credo isn't about this specific investment—it's about the pattern. In every technology revolution, there are companies like Credo: specialized, technical, essential. Finding them early, understanding their importance, and having the patience to hold them through volatility—that's how outsized returns are generated.

The Credo Story Continues

This analysis captures Credo at a specific moment—flush with success, growing rapidly, valued richly. But companies aren't snapshots; they're movies. Credo's story is still being written.

Will they successfully diversify their customer base? Can they maintain their technical edge as competitors invest heavily? Will new technologies obsolete their solutions? Can they manage the transition from growth to scale?

These questions will determine whether Credo becomes a permanent fixture in the technology landscape or a brilliant but brief success story. Based on their track record—14 years of patient building, successful navigation of a terrible IPO market, explosive growth in AI infrastructure—betting against them seems unwise.

But investing isn't about cheering for companies; it's about generating returns. At current prices, Credo stock requires belief not just in the company but in the duration and magnitude of AI infrastructure spending. That's a bet on humanity's continued digitization, on AI becoming as essential as electricity, on data growth continuing its exponential trajectory.

It's a big bet. But then again, selling picks and shovels to gold miners has always been a good business—especially when the gold rush is just beginning.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music