Coinbase: The Crypto Infrastructure Giant

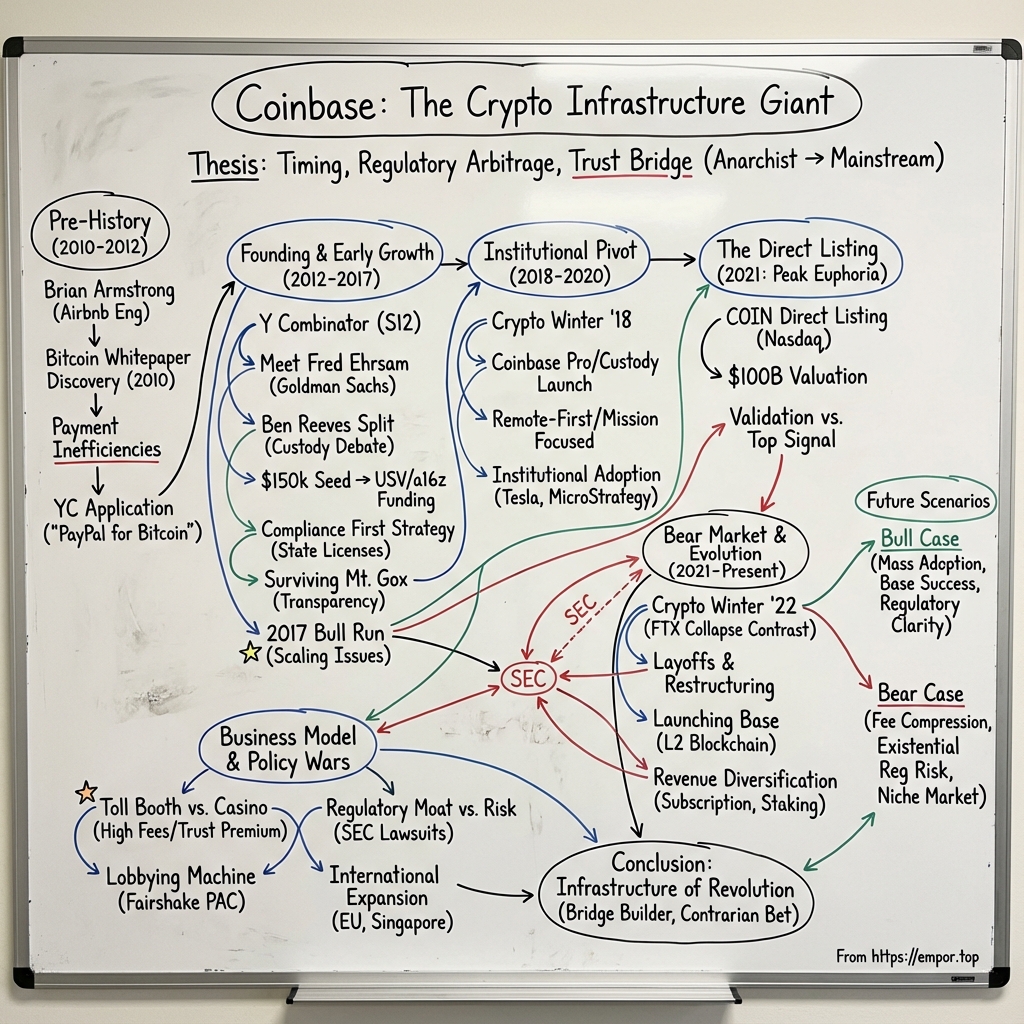

I. Introduction & Episode Thesis

Picture this: It's April 14, 2021, and the Nasdaq is buzzing with an energy typically reserved for Silicon Valley's most anticipated IPOs. But this isn't just any tech debut—it's Coinbase, and within hours of trading, the cryptocurrency exchange hits a market cap of $100 billion, making it more valuable than the New York Stock Exchange and Nasdaq combined. The former Airbnb engineer who founded it nine years earlier is now worth over $20 billion. How did we get here?

The story of Coinbase is fundamentally about timing, regulatory arbitrage, and the audacious bet that cryptocurrency would evolve from internet curiosity to financial infrastructure. Brian Armstrong didn't invent Bitcoin, didn't write the first crypto exchange, and wasn't even particularly early to the space. What he did was something perhaps more impressive: he built the bridge between the anarchist cryptography world and mainstream American finance, creating what would become the default on-ramp for millions into the crypto economy. Coinbase was founded in June 2012 by Brian Armstrong, a former Airbnb engineer. Armstrong enrolled in the Y Combinator startup incubator program and received a US$150,000 cash infusion. The journey from a tiny startup to a public company worth more than traditional stock exchanges represents one of the most dramatic arcs in modern finance—a story of perfect timing, regulatory navigation, and the audacious belief that digital money would reshape the global financial system.

This isn't just another Silicon Valley success story. It's the tale of how a software engineer saw inefficiencies in the global payment system, recognized Bitcoin's potential to solve them, and built the bridge that would bring millions of Americans into the crypto economy. It's about building trust in a trustless system, finding legitimacy in what many called a scam, and somehow thriving through multiple 80% drawdowns that would have killed most companies.

The themes we'll explore run deep: How does regulatory compliance become competitive advantage? Can you build a centralized business on decentralized technology? What happens when your revenue is fundamentally tied to asset price volatility? And perhaps most intriguingly—how did a Y Combinator startup become the quasi-official crypto gateway for America while offshore competitors dominated global volume?

As we unpack the Coinbase story, we'll see how Brian Armstrong and his team didn't just build an exchange—they built the infrastructure layer for an entirely new financial system, navigating between Silicon Valley innovation culture, Wall Street capital requirements, and Washington DC regulatory frameworks. This is the story of how crypto went mainstream, told through the lens of the company that made it possible.

II. Pre-History & The Bitcoin Discovery

The moment that changed everything came during Christmas 2010. Brian Armstrong, then 27 years old, was home visiting family in San Jose when he retreated to his room to escape the holiday chaos. Scrolling through Hacker News—that digital watering hole where Silicon Valley's technical elite gather—he stumbled upon something unusual: a nine-page PDF titled "Bitcoin: A Peer-to-Peer Electronic Cash System" by someone called Satoshi Nakamoto.

In 2010, he came across the Bitcoin white paper published under the alias Satoshi Nakamoto. Armstrong had the technical chops to understand it—dual bachelor's degrees in economics and computer science from Rice, plus a master's in CS—but even for him, the paper was dense. Yet as he parsed through the cryptographic proofs and game theory, something clicked. This wasn't just another internet protocol; it was a fundamental computer science breakthrough that made digital scarcity possible for the first time.

The timing of Armstrong's discovery wasn't random. He'd spent the previous year living in Buenos Aires, where he witnessed firsthand how hyperinflation devastated ordinary people's savings. The poorest suffered most, holding their wealth in cash that lost value daily while the wealthy moved assets into real estate or offshore accounts. This wasn't theoretical economics anymore—it was human suffering caused by monetary policy failures.

In 2011, he joined Airbnb as a software engineer and was exposed to payment systems in the 190 countries Airbnb operated in at the time. While at Airbnb, he saw the difficulties of sending money to South America. As a software engineer working on fraud prevention and international payments, Armstrong had a front-row seat to the absurdity of the global financial system. Sending money between countries involved multiple intermediaries, took days, cost small fortunes in fees, and often simply failed for no clear reason. The contrast with how easily data moved across the internet was stark.

He began working weekends and nights to write code in Ruby and JavaScript to buy and store cryptocoins. While his Airbnb colleagues focused on optimizing conversion funnels and A/B testing homepage layouts, Armstrong spent his nights and weekends building prototypes for buying and storing Bitcoin. He wasn't trying to overthrow the financial system—he just wanted to make it easier for regular people to access this new technology.

The Silicon Valley context of 2010-2011 is crucial here. The financial crisis was fresh in everyone's memory. Occupy Wall Street was making headlines. Meanwhile, the tech world was experiencing its own revolution: APIs were making it possible to build financial products without being a bank, mobile was exploding, and "software eating the world" wasn't just a catchphrase—it was happening in real-time. The infrastructure for a digital money revolution was falling into place.

The early crypto landscape Armstrong surveyed was Wild West territory. Mt. Gox in Japan handled 70% of all Bitcoin transactions but required international wire transfers that took days and felt sketchy. LocalBitcoins involved meeting strangers in parking lots with cash. Mining required technical expertise most people didn't have. For a technology supposedly democratizing finance, Bitcoin was remarkably inaccessible to normal humans.

This accessibility gap became Armstrong's obsession. He saw Bitcoin not as a tool for libertarian ideologues or dark web transactions, but as infrastructure for a more open financial system. The same way the internet had democratized information, Bitcoin could democratize value transfer. But first, someone needed to build the bridge between the cryptographic complexity and everyday usability.

Why was 2012 the perfect timing to start Coinbase? Bitcoin had survived its initial proof-of-concept phase—it had been running for three years without major failures. The price had stabilized around $5-10 after the 2011 bubble and crash, shaking out the pure speculators. Regulatory agencies hadn't yet figured out how to classify it. And crucially, the infrastructure pieces were emerging: exchanges for price discovery, wallets for storage, and a growing developer community building tools.

Armstrong's insight wasn't that Bitcoin would replace the dollar or that blockchain would revolutionize everything. It was simpler and more profound: making it easy for Americans to buy Bitcoin with their bank accounts would unlock massive demand. While others debated Bitcoin's theoretical implications, Armstrong focused on the practical problem of user experience. This pragmatic approach—building the boring but essential infrastructure—would become Coinbase's defining characteristic and competitive moat.

The stage was set for a Stanford dropout moment, but Armstrong would take a different path: the Y Combinator accelerator.

III. The Y Combinator Sprint & Finding Fred

The Y Combinator application deadline was approaching, and Armstrong had a problem: Paul Graham's accelerator required co-founders. With just three days left, Armstrong did what any desperate founder would do—he posted on Hacker News. His post on Hacker News looking for a co-founder to get into the Y Combinator program later became a viral post in Hacker News. The headline was desperate but direct: "Looking for co-founder to build Coinbase (YC S12) - a PayPal for Bitcoin." The post exploded, generating hundreds of responses from developers, entrepreneurs, and crypto enthusiasts who sensed something big was brewing.

He eventually met his co-founder Fred Ehrsam on a Reddit subgroup and is quoted to have done over fifty meetings to find a perfect co-founder. Armstrong approached the search with the rigor of a technical hiring process, conducting what amounted to fifty first dates with potential partners. Most were brilliant technically but lacked business sense, or had business acumen but couldn't code, or worst of all, saw Bitcoin as a get-rich-quick scheme rather than foundational infrastructure.

Then came Fred Ehrsam. Fred Ehrsam, a former Goldman Sachs trader, later joined as a co-founder after noticing Armstrong's posts on Reddit. At just 24 years old, Ehrsam brought something crucial that Armstrong lacked: Wall Street credibility and an understanding of how traditional finance actually worked. After graduating from Duke with honors in computer science and economics, Ehrsam had become a foreign exchange trader at Goldman Sachs in New York. He'd discovered Bitcoin through an academic paper and began trading it in his spare time, fascinated by the parallels to his childhood spent trading digital currencies in World of Warcraft.

The chemistry was immediate. Where Armstrong was methodical and product-focused, Ehrsam was strategic and market-oriented. Armstrong built; Ehrsam sold. Armstrong thought in code; Ehrsam thought in market dynamics. Their complementary skills would become Coinbase's early superpower.

But there's a fascinating footnote to this founding story that rarely gets told. British programmer and Blockchain.info co-founder Ben Reeves was originally supposed to be part of the Coinbase founding team, but parted ways with Armstrong just before the Y Combinator funding event, due to their different stands on how the Coinbase wallet should operate.

The philosophical divide was fundamental: Reeves believed users should control their own private keys—staying true to Bitcoin's decentralized ethos. Armstrong wanted Coinbase to custody the keys, making the experience simpler but more centralized. This wasn't just a technical decision; it was about whether to prioritize ideological purity or user experience. Armstrong chose simplicity, Reeves walked away, and that choice would define everything Coinbase became.

In 2012, he entered the Y Combinator startup accelerator and received a $150,000 investment, which he used to fund Coinbase. The Y Combinator experience was transformative, but not in the way most people think. Paul Graham's advice was brutally simple: talk to users and build what they want. For Coinbase, this meant discovering that people didn't actually want a Bitcoin wallet—they wanted a way to buy Bitcoin with their bank account.

The initial product was embarrassingly simple: a basic interface to buy and sell Bitcoin. No fancy features, no complex trading tools, just a button that said "Buy Bitcoin" and another that said "Sell Bitcoin." The magic was in what happened behind that button—integrating with banks, handling compliance, preventing fraud. The boring stuff that no one else wanted to build.

Early traction came fast. In October 2012, the company launched the services to buy and sell bitcoins through bank transfers. Within months, they were processing $1 million in Bitcoin transactions monthly—not huge by today's standards, but enough to prove demand existed. The real validation came from an unexpected source: their bank shut them down. If traditional finance was scared enough to cut them off, they must be onto something big.

The Y Combinator demo day pitch was revealing. While other startups promised to change the world with social networks for dogs or Uber for laundry, Armstrong and Ehrsam stood up and essentially said: "We help people buy Bitcoin." The room was skeptical. One prominent investor later admitted he thought it was either a scam or would be shut down by regulators within months. Most passed.

But a few saw what Armstrong and Ehrsam saw: the beginning of a parallel financial system. The internet had democratized information; Bitcoin could democratize value. And Coinbase would be the bridge between the old world and the new, speaking both languages fluently.

The founding team was now complete, the product had early traction, and the Y Combinator network was activated. What came next would test whether two twenty-somethings could navigate the treacherous waters between Silicon Valley disruption culture and financial services regulation. The answer would make them billionaires—or land them in federal prison.

IV. Building the On-Ramp: Product Evolution & Early Growth (2012–2017)

The turning point came in May 2013. In May 2013, Coinbase received a US$5 million Series A investment led by Fred Wilson from the venture capital firm Union Square Ventures. For Wilson, who had backed Twitter, Tumblr, and Etsy, this was his first crypto investment—a bet that would eventually be worth over $4 billion.

Wilson's blog post announcing the investment was revealing: "We have been thinking about and looking to make an investment in the Bitcoin ecosystem for several years. Today, we are happy to be able to talk about our" first investment in the sector. He wasn't investing in Bitcoin itself but in the infrastructure that would make Bitcoin accessible. "Coinbase is where I have purchased my Bitcoin and keep it," Wilson wrote, signaling that even sophisticated investors needed simpler tools.

But the real validation came six months later. In December, the company received a US$25 million investment from the venture capital firm Andreessen Horowitz, Union Square Ventures (USV), and Ribbit Capital. Marc Andreessen, who had declared software was eating the world, now believed Bitcoin would eat money. His involvement brought instant credibility—this wasn't just crypto enthusiasts anymore; Silicon Valley royalty was betting on Coinbase.

The regulatory moat strategy emerged early and would define everything. While competitors rushed to list every new cryptocurrency and chase volume at any cost, Coinbase took a different path: compliance first, growth second. State by state, they pursued money transmitter licenses—expensive, time-consuming, and monumentally boring work that no other crypto startup wanted to do.

By 2014, they had licenses in 20 states. Each license required millions in surety bonds, detailed financial reporting, and regular examinations. Competitors mocked them for being slow and conservative. But when regulators eventually came knocking—and everyone knew they would—Coinbase would be the only exchange they could work with rather than shut down.

The product evolution reflected this compliance-first approach. Three core offerings emerged: a simple retail exchange for buying and selling, a wallet for storage, and crucially, merchant services that allowed businesses to accept Bitcoin. This last piece was key—if Bitcoin was going to be more than speculation, it needed real-world utility. The 2013 bubble and crash tested everything. Bitcoin surged from about $100 in October 2013 to more than $1,100 two months later, driven by speculation and the infamous Willy bot on Mt. Gox. When the exchange collapsed in February 2014, taking 850,000 bitcoins with it, the entire crypto ecosystem faced an existential crisis. Bitcoin crashed to under $200. Competitors vanished. Investors fled.

Coinbase survived because they had built differently. While Mt. Gox had operated like a black box—no one knew if customer funds actually existed—Coinbase pioneered radical transparency. They were the first exchange to implement segregated customer accounts, regular financial audits, and even secured insurance for customer funds stored online. When Mt. Gox imploded, Coinbase could prove they actually had the Bitcoin they claimed.

The survival strategies during the 2014-2016 crypto winter revealed Armstrong's long-term thinking. Instead of chasing quick profits through leverage or exotic products, Coinbase focused on boring infrastructure: better bank partnerships, more regulatory licenses, improved security. They launched Coinbase Vault for secure storage, GDAX (later Coinbase Pro) for professional traders, and merchant services that powered Bitcoin payments for Dell, Expedia, and Wikipedia. Then came 2017—the year everything changed. Bitcoin's price jumped from under $1,000 in January to more than $19,000 in December. The cryptocurrency had gone mainstream, and Coinbase was the gateway. Traffic exploded. The app topped the App Store charts. Customer support tickets numbered in the hundreds of thousands. The infrastructure, built for thousands of users, suddenly needed to handle millions.

The scaling challenges were brutal. During peak periods, the site crashed repeatedly. Wire transfers took weeks. Customer funds got stuck in limbo. The subreddit r/Coinbase became a wall of complaints. Competitors mocked them for poor execution. But while Coinbase struggled operationally, they never lost customer funds, never got hacked, and never had a major security breach. The boring compliance work had paid off.

Competition intensified from every direction. Kraken offered more coins. Bitstamp had lower fees. Binance, launching in 2017, would quickly become the global volume leader by ignoring regulations entirely and operating from jurisdiction to jurisdiction. But Coinbase stuck to their strategy: US-focused, compliant, simple. They were building for the next decade, not the next quarter.

By the end of 2017, Coinbase had over 13 million users and had facilitated over $150 billion in cryptocurrency trades. They'd raised over $200 million in funding at a valuation approaching $2 billion. More importantly, they'd survived multiple boom-bust cycles, regulatory challenges, and competition from both Silicon Valley startups and offshore exchanges. The foundation was set for the next phase: institutional adoption.

V. The Institutional Pivot & Professionalization (2018–2020)

The 2018 crypto winter arrived with brutal efficiency. Bitcoin crashed from nearly $20,000 to below $4,000. ICO projects evaporated. Retail traders fled. The euphoria of 2017 transformed into despair. For most crypto companies, this meant layoffs, pivots, or bankruptcy. For Coinbase, it meant opportunity.

Armstrong had studied the playbook of financial exchanges through history. The pattern was consistent: retail traders drive initial adoption, but institutional money drives long-term value. The Chicago Mercantile Exchange didn't become a trillion-dollar business by serving day traders—it succeeded by becoming critical infrastructure for banks, hedge funds, and corporations. Coinbase needed to follow the same path.

The launch of Coinbase Pro (rebranded from GDAX) signaled this shift. While the retail app remained simple—buy Bitcoin with one click—Coinbase Pro offered sophisticated trading tools, advanced order types, and API access that institutional traders required. The fee structure reflected this segmentation: retail users paid 1.5-4% per trade, while high-volume institutional traders paid as little as 0.1%.

But the real prize was custody. In May 2020, during the COVID-19 pandemic, Coinbase announced it was shifting completely to remote work and would no longer recognize a formal headquarters. But before that transformation, in 2018, they launched Coinbase Custody, targeting the $7 trillion sitting in institutional investment accounts. The challenge was enormous: convincing Harvard's endowment or Fidelity to store Bitcoin required military-grade security, insurance, regulatory clarity, and most importantly, trust.

The technical infrastructure for institutional custody was complex. Cold storage wasn't just keeping private keys offline—it meant geographically distributed vaults, multi-signature requirements, and hardware security modules that met banking standards. Coinbase hired executives from traditional finance, people who spoke the language of compliance officers and risk committees. They secured a BitLicense in New York, one of the hardest regulatory approvals to obtain.

Also in May, the company announced the acquisition of New York-based digital asset trading firm Tagomi for a price between US$75 and US$100 million. Tagomi was crucial—it provided sophisticated trading algorithms that could execute large orders across multiple exchanges without moving the market. For a pension fund wanting to buy $100 million of Bitcoin, this infrastructure was essential.

The remote work announcement in May 2020 was more than pandemic adaptation—it was strategic positioning. By going fully remote, Coinbase could hire the best talent globally, reduce costs, and more importantly, avoid being tied to any single regulatory jurisdiction. As countries competed to attract crypto businesses, Coinbase could be everywhere and nowhere simultaneously.

Armstrong wrote a blog post in September 2020 calling Coinbase a "Mission Focused Company", discouraging employee activism and discussion of political and social issues at work. He offered severance packages for Coinbase employees uncomfortable with this policy; as a result, sixty employees (amounting to 5% of the company) left Coinbase.

The "mission-focused" controversy revealed the tensions of rapid growth. As Coinbase expanded from startup to major corporation, internal culture wars emerged. Some employees wanted the company to take stands on social issues; Armstrong believed that would distract from building financial infrastructure. His blog post was polarizing—some praised the clarity, others called it tone-deaf. But from a business perspective, it worked: the employees who stayed were aligned on the mission, and recruiting became easier as candidates self-selected.

Behind the scenes, the professionalization was comprehensive. They hired a CFO from Twitter, a chief legal officer from Facebook, and compliance executives from major banks. The scrappy Y Combinator startup was transforming into something that looked increasingly like a traditional financial institution—with one key difference: it was native to crypto.

The institutional adoption started slowly, then suddenly. Hedge funds needed a secure place to custody assets. Family offices wanted exposure to Bitcoin without managing private keys. Corporations exploring Bitcoin for their treasuries needed a trusted partner. By late 2020, Coinbase Institutional was managing billions in assets, and names like Tesla, MicroStrategy, and Paul Tudor Jones were driving a new narrative: Bitcoin as digital gold.

The numbers told the story: while retail trading volume fluctuated wildly with Bitcoin's price, institutional volume grew steadily. By the end of 2020, institutions represented over 60% of assets on the platform. The pivot was complete—Coinbase was no longer just a consumer app but critical infrastructure for the emerging crypto economy. The stage was set for the most audacious move yet: going public.

VI. The Direct Listing: Peak Euphoria (2021)

The numbers were staggering. Revenue in the period surged ninefold from a year ago to $1.8 billion, and net income climbed from $32 million to between $730 million and $800 million. The number of monthly transacting users (MTUs) climbed from 2.8 million three months earlier to 6.1 million. For full-year 2020, revenue more than doubled to $1.28 billion, and the company swung from a loss in 2019 to a profit of $322.3 million.

These weren't tech company numbers—they were lottery ticket numbers. Coinbase was printing money faster than the Federal Reserve, with profit margins that would make Apple jealous. The first quarter of 2021 alone generated more profit than most fintech unicorns had ever seen in revenue. The crypto boom had transformed Coinbase from a startup into a money-printing machine.

The decision to pursue a direct listing rather than a traditional IPO was vintage Armstrong: unconventional but strategically sound. No roadshow, no investment banker fees, no lockup periods. Existing shareholders could sell immediately at market prices. It was the crypto-native approach to going public—decentralized, transparent, and cutting out the middlemen.

Coinbase shares closed at $328.28 in their Nasdaq debut on Wednesday, giving the cryptocurrency exchange an initial market cap of $85.8 billion on a fully diluted basis. The shares opened at $381 and quickly shot up as high as $429.54, before dropping back below the debut price and reaching a low of around $310.

The valuation math was extraordinary. At the peak intraday price, Coinbase was worth over $100 billion—more than Goldman Sachs, more than the Intercontinental Exchange (which owns the NYSE), more than almost every traditional financial institution except the mega-banks. A nine-year-old crypto company was suddenly worth more than centuries-old pillars of finance.

What did this mean for crypto legitimacy? Everything. Coinbase's public listing wasn't just a liquidity event—it was validation. Pension funds that couldn't touch crypto could now buy COIN stock. Financial advisors who dismissed Bitcoin as speculation had to explain why a crypto exchange was worth more than Charles Schwab. The SEC, which had spent years warning about crypto risks, had just approved a crypto company for public trading.

But timing, as they say, is everything. The April 2021 listing coincided almost perfectly with the peak of the crypto bubble. Bitcoin hit its all-time high around $64,000 that same month. Dogecoin, a literal joke cryptocurrency, was worth $80 billion. NFTs of pixelated punks sold for millions. The euphoria was absolute.

Looking back, the signs were obvious. Retail trading apps showed COIN as the most bought stock. Taxi drivers offered crypto tips. Saturday Night Live did skits about Dogecoin. When mainstream culture fully embraces a financial trend, the smart money is usually heading for the exits.

For Armstrong and early investors, the timing was perfect. They'd built through the 2014 bear market, the 2018 crash, the pandemic uncertainty. Now, at the absolute peak of market euphoria, they were cashing out at a $100 billion valuation. Fred Wilson's Union Square Ventures saw their $5 million investment worth over $4 billion. Andreessen Horowitz's stake exceeded $3 billion.

But for public market investors buying at $380? They were about to learn what crypto winter really meant. The Coinbase public listing marked both the legitimization of crypto and, in retrospect, the top of the market. What followed would test whether Coinbase had built a real business or just rode a speculative wave.

VII. Bear Market Navigation & Strategic Evolution (2021–Present)

The reversal was swift and brutal. From its April 2021 peak above $430, Coinbase stock began a relentless descent that would eventually see it trading below $40 by late 2022—a 90% drawdown that wiped out over $80 billion in market value. The crypto winter of 2022 made previous bear markets look like gentle corrections.

The macro environment had shifted completely. The Federal Reserve, after years of zero interest rates and money printing, began aggressively hiking rates to combat inflation. Liquidity dried up. Risk assets crashed. And crypto, the ultimate risk asset, got destroyed. Bitcoin fell from $69,000 to below $16,000. The total crypto market cap dropped from $3 trillion to under $800 billion. But the November 2022 collapse of FTX changed everything. Sam Bankman-Fried's empire went from $32 billion to bankruptcy in 72 hours, taking customer deposits with it. The contagion fears were immediate and visceral. If FTX—with its stadium naming rights, celebrity endorsements, and Washington connections—could vaporize overnight, what about Coinbase?

On January 10, 2023, Coinbase announced it would be laying off around 950 employees, incurring restructuring expenses of up to US$163 million. Citing the possibility of "further contagion" following the collapse of the FTX exchange, Brian Armstrong said Coinbase would be "shutting down several projects where we have a lower probability of success".

The contrast with FTX couldn't have been starker. While Bankman-Fried had allegedly commingled customer funds with his trading firm Alameda Research, Coinbase had always segregated customer assets. While FTX operated from the Bahamas with minimal oversight, Coinbase was regulated in every US state. While FTX's books were allegedly fraudulent, Coinbase was a public company with audited financials.

But in a panic, nuance doesn't matter. Coinbase stock crashed to $31.55 in December 2022. The market cap fell below $7 billion—less than a tenth of its peak value. Revenue collapsed as trading volumes evaporated. The company that had printed money in 2021 was now burning cash. The strategic evolution during this period revealed Armstrong's long-term thinking. In February 2023, Coinbase launched its own layer 2 blockchain on Ethereum, based on MIT-licensed OP Stack of layer-2 blockchain Optimism. Base wasn't just another blockchain—it was Coinbase's bet on becoming the infrastructure layer for all of crypto, not just an exchange.

The logic was compelling. If crypto's future was thousands of applications running on blockchains, Coinbase couldn't just be a place to trade tokens—it needed to be where those applications lived. Base would provide fast, cheap transactions while inheriting Ethereum's security. More importantly, it would give Coinbase a direct stake in the success of decentralized finance, NFTs, and whatever came next.

Revenue diversification became existential. Coinbase makes most of its money from transaction fees for services on its platform. In fact, transaction fees made up 90% of Coinbase's revenue in 2020. This dependency on trading volume made the company essentially a leveraged bet on crypto prices—great in bull markets, devastating in bear markets.

The pivot toward subscription and services accelerated. Coinbase One, a subscription service offering zero trading fees for a monthly payment, targeted retail users who wanted predictable costs. Staking services, where Coinbase took a 25% cut of rewards for managing the technical complexity, generated recurring revenue regardless of trading volumes. Custody fees from institutions provided steady income even when markets were dead.

International expansion offered another escape route from US regulatory uncertainty. While the SEC sued Coinbase and questioned whether most cryptocurrencies were unregistered securities, other countries rolled out red carpets. Singapore, Dubai, and European nations competed to attract crypto businesses. Coinbase obtained licenses in Germany, Ireland, and the Netherlands, building optionality for a future where the US might not be crypto's center.

The numbers by late 2024 told a story of survival and adaptation. While the stock remained well below its 2021 highs, it had recovered from the darkest days of 2022. Revenue had stabilized even as trading volumes remained depressed. The company had weathered the storm that destroyed many competitors. But the question remained: was Coinbase a crypto company that happened to be public, or a public company that happened to do crypto?

VIII. Power & Business Model Analysis

The fundamental question about Coinbase's business model is deceptively simple: Is it a toll booth or a casino? The answer determines everything about how to value the company and understand its future.

The exchange business model appears straightforward—charge fees on trades, custody assets, provide liquidity. But the economics are more complex than traditional exchanges. The NYSE makes money from listing fees, market data, and technology services—recurring revenue streams largely independent of trading volumes. Coinbase's revenue remains overwhelmingly transaction-based, making it more like a brokerage than an exchange.

Coinbase makes money from the spread on crypto trades made on its platform, transaction fees on the Coinbase debit card, spread when converting to fiat currency, and staking. Coinbase charges traders a spread on the buying and selling of cryptocurrencies. The spread is equal to 0.5% for all crypto purchases and sales through the Coinbase platform. But the real money comes from retail fees—often 1.5-4% per trade for smaller transactions. This is extraordinary pricing power by financial services standards.

Why do users tolerate such high fees? Trust. In a world of anonymous exchanges, exit scams, and frozen withdrawals, Coinbase offers something priceless: the confidence that your money is actually there. This trust premium manifests in pricing power that would be impossible in traditional finance. It's the same reason people pay more at Whole Foods—perceived quality and safety justify the markup.

The regulatory moat deserves special attention. Each money transmitter license, BitLicense, and regulatory approval represents years of work and millions in compliance costs. New entrants face a Kafkaesque maze of state-by-state requirements, federal uncertainty, and international complexity. By the time a competitor navigates this labyrinth, Coinbase has moved on to the next regulatory frontier.

But moats in crypto are peculiar things. Network effects exist but are weaker than in traditional platforms. Users multi-home across exchanges, chasing the best prices or newest tokens. Liquidity is fragmented globally. And the very nature of blockchain—open, permissionless, interoperable—makes lock-in difficult. Your Bitcoin on Coinbase can move to Binance in minutes.

The platform economics reveal the tension. Retail revenue is high-margin but volatile, surging in bull markets and evaporating in bear markets. Institutional revenue is more stable but lower margin—sophisticated traders won't pay 2% fees. The mix matters enormously: in Q1 2021, retail trading generated most of the profit despite institutions holding most of the assets.

The volatility problem is existential. Coinbase's revenue correlation with Bitcoin price exceeds 0.8 in most quarters. When crypto booms, Coinbase prints money. When crypto busts, losses mount. This isn't just operational leverage—it's fundamental to the business model. Traditional exchanges see higher volumes in volatile markets regardless of direction. Coinbase sees volumes collapse when prices fall, as retail traders simply stop trading.

Trust emerges as the core value proposition, but trust in what? Not just security of funds, though that's table stakes. It's trust in compliance—that the SEC won't shut them down tomorrow. Trust in availability—that the site won't crash during the next rally. Trust in legitimacy—that this isn't another crypto scam. Coinbase sells regulatory clarity in a murky world.

Competition dynamics are fascinating. Globally, Binance dominates with 10x Coinbase's volume, but operates in regulatory grey zones. Domestically, Coinbase faces limited direct competition—Kraken is smaller, Gemini is niche, Robinhood offers fewer coins. The real competition might be traditional finance: Fidelity, Schwab, and PayPal all offer crypto now. If crypto truly goes mainstream, why wouldn't existing financial giants dominate?

The answer lies in native crypto DNA. Coinbase understands concepts like self-custody, DeFi integration, and layer-2 scaling that traditional finance struggles to grasp. They can move fast in a rapidly evolving space. When NFTs exploded, Coinbase launched a marketplace. When DeFi surged, they integrated wallet connections. When institutions arrived, they built custody. This agility in crypto-native products provides an edge—for now.

But the bear case is compelling. If crypto remains niche, Coinbase is a volatile, high-cost operator in a small market. If crypto goes mainstream, margins compress as competition intensifies. The company is caught between being too crypto for traditional investors and too traditional for crypto natives. DeFi threatens to disintermediate exchanges entirely. Regulatory risk remains existential.

The bull case requires believing in a specific future: crypto becomes essential financial infrastructure, regulation provides clarity without crushing innovation, Coinbase maintains its trust premium while diversifying revenue, and Base becomes the AWS of blockchain applications. It's not impossible, but it requires a lot to go right. For investors, Coinbase isn't just a bet on crypto—it's a bet on a particular path for crypto's evolution.

IX. The Crypto Policy Wars

The regulatory battlefield where Coinbase operates isn't just complex—it's existential. Every SEC filing, every congressional hearing, every regulatory guidance letter could fundamentally alter the company's ability to operate. The stakes couldn't be higher: regulatory clarity could unlock trillions in institutional capital, while hostile regulation could destroy the entire US crypto industry.

The SEC's approach to crypto has been, charitably, inconsistent. Gary Gensler, appointed SEC Chair in 2021, brought impressive crypto credentials—he'd taught blockchain at MIT. But his tenure became defined by enforcement actions rather than clear rules. The SEC's position seemed to be that every cryptocurrency except Bitcoin was potentially an unregistered security, subject to securities laws written in 1933.

In June 2023, the SEC sued Coinbase, alleging the exchange operated as an unregistered securities exchange, broker, and clearing agency. The irony was rich: the SEC had reviewed and approved Coinbase's business model for the public listing just two years earlier. Now they claimed that same business was illegal. Coinbase's response was aggressive—they sued the SEC for clarity, demanding the agency actually write rules rather than regulate by enforcement.

The political theater extended beyond courtrooms. In July 2023 he met with House Democrats, specifically the New Democrat Coalition, in a closed-door session that reportedly focused on digital-asset legislation. Armstrong according to Bloomberg had "led a campaign in Washington to create clearer rules around digital assets". This wasn't just lobbying—it was an education campaign, teaching legislators about blockchain technology, explaining the difference between proof-of-work and proof-of-stake, demonstrating why crypto needed new frameworks rather than forcing it into 90-year-old securities laws.

Armstrong's political evolution was remarkable. The engineer who'd wanted to build products was now testifying before Congress, writing op-eds in major newspapers, and building one of crypto's most powerful lobbying machines. In 2024, Armstrong rallied bitcoin supporters behind Ohio Republican Bernie Moreno in his bid to unseat three-term Democrat Sherrod Brown in Ohio's senate race. Brown, chairman of the Senate Banking Committee, was a critic of bitcoin. Armstrong's super PAC Fairshake spent some $40 million to elect Moreno.

The crypto lobbying machine Coinbase helped build was unprecedented in both scale and sophistication. Fairshake and affiliated PACs raised over $200 million for the 2024 election cycle, making crypto one of the largest political donors. The strategy was bipartisan but tactical—support crypto-friendly candidates regardless of party, oppose crypto skeptics with overwhelming force. When Elizabeth Warren criticized crypto, attack ads flooded Massachusetts. When pro-crypto candidates ran, donations poured in.

The regulatory clarity versus regulatory capture debate split the crypto community. Purists argued Coinbase was betraying crypto's anarchist roots by inviting government oversight. They saw Armstrong's Washington engagement as capture—using regulation to cement Coinbase's position while crushing smaller competitors who couldn't afford compliance. Why should crypto need permission from the same broken system it was designed to replace?

Armstrong's counterargument was pragmatic: crypto couldn't achieve mainstream adoption while existing in legal grey zones. Institutional investors needed regulatory clarity before deploying capital. Regular users needed protection from scams and fraud. The choice wasn't between regulation and no regulation—it was between thoughtful rules that enabled innovation and hostile enforcement that killed it.

The international dimension added urgency. While the US debated, other nations acted. The European Union passed comprehensive crypto legislation. Hong Kong courted crypto businesses fleeing China's ban. Dubai positioned itself as the crypto hub for the Middle East. Every month of US regulatory uncertainty meant talent, capital, and companies flowing overseas. Coinbase's international licenses weren't just growth strategy—they were insurance against US regulatory failure.

By late 2024, the policy wars had reached a stalemate. Courts pushed back against SEC overreach, ruling the agency couldn't unilaterally declare cryptocurrencies securities without congressional action. Congress remained gridlocked, with competing bills offering different visions for crypto regulation. Meanwhile, Coinbase continued operating in legal limbo—profitable but precarious, growing but constrained, essential but potentially illegal.

The resolution of these policy wars would determine not just Coinbase's fate but the entire trajectory of crypto in America. Would the US lead the next financial revolution or watch from the sidelines as innovation happened elsewhere? For Coinbase, having spent over a decade building compliant infrastructure, the answer would determine whether their regulatory bet was prescient or naive.

X. Playbook: Lessons for Founders & Investors

The Coinbase story offers a masterclass in contrarian thinking, but not in the way most people assume. The contrarian bet wasn't on crypto—plenty of people were bullish on Bitcoin in 2012. The contrarian bet was building a centralized, compliant, boring infrastructure company in a space defined by decentralization, anarchism, and speculation.

Timing markets versus building through cycles presents the fundamental tension every crypto entrepreneur faces. Armstrong's genius wasn't timing—Coinbase launched after the 2011 bubble burst and went public at the 2021 peak by coincidence, not design. The genius was building regardless of timing. Through three major crypto winters, Coinbase kept shipping products, hiring engineers, and acquiring licenses. They built for the next cycle during the current crash.

The power of regulatory compliance as strategy seems obvious in retrospect but was revolutionary at the time. While competitors chased volume by listing every token and offering 100x leverage, Coinbase chose the harder path: geographic expansion through proper licensing, not regulatory arbitrage. This created a compounding advantage—each license took years to obtain, creating time-based moats competitors couldn't quickly replicate.

Platform transitions reveal how technology businesses evolve. Coinbase's journey from product (simple Bitcoin buying) to platform (exchange, wallet, custody) to protocol (Base blockchain) mirrors the classic progression of successful tech companies. Each transition required different skills—product needed user experience, platform needed partnerships, protocol needed developer ecosystems. Most companies fail these transitions; Coinbase navigated all three.

Managing stakeholder complexity in volatile markets tested every leadership skill. When Bitcoin crashed 80%, employees questioned the mission. When profits soared, investors demanded dividends. When regulations threatened, lawyers counseled caution. Armstrong's solution was radical simplicity: focus on the mission of creating an open financial system. Everything else—politics, social causes, short-term profits—was secondary.

The remote-first experiment at scale proved prescient. By going fully remote before it was forced by COVID, Coinbase could hire globally, reduce costs, and most importantly, avoid geographic regulatory capture. If the US became hostile to crypto, the company wasn't tied to San Francisco. If Singapore offered better terms, key functions could shift overnight. Geographic flexibility became regulatory optionality.

When to be political versus apolitical as a CEO emerged as Armstrong's defining challenge. His "mission-focused" stance alienated some employees and activists but clarified the company's purpose. Yet when regulatory threats emerged, he became intensely political—funding PACs, lobbying Congress, fighting the SEC. The lesson: be apolitical on issues irrelevant to your mission, be intensely political when your mission is threatened.

Direct listing as a liquidity event strategy offered unique advantages. No lockup periods meant early employees could sell immediately, reducing retention risk from golden handcuffs. No banker roadshow meant the market, not investment banks, set the price. No dilution from new shares meant existing shareholders captured full value. For a company built on disintermediation, going public without intermediaries was philosophically consistent.

The talent strategy deserves examination. Coinbase hired differently than typical startups—fewer crypto evangelists, more traditional finance veterans. The head of engineering from Google, the CFO from Twitter, compliance officers from major banks. This hybrid talent model—Silicon Valley execution with Wall Street rigor—created unique capabilities. They could build consumer apps and navigate SEC examinations, ship code quickly and manage billions in custody.

Risk management philosophy separated survivors from casualties. While FTX allegedly gambled customer funds, Coinbase segregated assets. While Celsius offered unsustainable yields, Coinbase kept services simple. While BlockFi made risky loans, Coinbase avoided credit exposure. Boring risk management isn't sexy, but it's why Coinbase survived while flashier competitors imploded.

The capital allocation strategy was notably conservative. Despite generating billions in profit during bull markets, Coinbase never paid dividends, bought back minimal stock, or made flashy acquisitions. Capital went to licenses, security, and product development. This frustrated investors during boom times but proved wise during busts—Coinbase had cash to survive winters that killed leveraged competitors.

For founders, the Coinbase playbook offers clear lessons: Pick massive markets with regulatory complexity—it creates moats. Build boring infrastructure, not sexy products—utilities capture more value than apps. Embrace compliance early—it's expensive but becomes a competitive advantage. Think in decades, not quarters—crypto has multi-year cycles. Hire experience, not just enthusiasm—scaling requires professionals.

For investors, Coinbase demonstrates the power and peril of platform businesses in volatile markets. The revenue multiple expansion during bull markets can generate 10x returns. But the correlation with underlying asset prices means you're making a leveraged bet on crypto, not just a business bet. Understanding this dynamic—and sizing positions accordingly—is crucial for portfolio construction.

XI. Bull vs. Bear Case & Future Scenarios

The bull case for Coinbase rests on a simple premise: crypto represents the largest financial innovation since the joint-stock company, and Coinbase owns the toll booth to this new economy. If you believe crypto will grow from $2 trillion to $20 trillion in total market cap, Coinbase's current $50 billion valuation looks quaint.

Crypto adoption inevitability drives the optimistic scenario. Every financial innovation in history—from paper money to credit cards to online banking—faced initial skepticism before becoming essential infrastructure. Bitcoin has survived fifteen years, multiple 80% drawdowns, China bans, and regulatory assault. Each crisis that doesn't kill crypto makes it stronger. If this pattern continues, adoption isn't a question of if but when.

Base L2 as the next revenue driver offers explosive potential. If Base becomes the dominant layer-2 for consumer crypto applications—the iOS of blockchain—Coinbase captures value from every transaction, every token launch, every DeFi interaction. The numbers could dwarf exchange revenue. Ethereum processes over $5 trillion annually in transactions; if Base captures even 10% of similar volume, the fee opportunity is massive.

International expansion opportunity remains largely untapped. Coinbase generates most revenue from the US, but 96% of the world's population lives elsewhere. As emerging markets leapfrog traditional banking through crypto—like they did with mobile phones—Coinbase's brand and infrastructure position them to capture global growth. A billion people using crypto for daily transactions isn't fantasy; it's already happening with stablecoins in Argentina, Nigeria, and Turkey.

Regulatory clarity finally arriving could unleash institutional tsunamis. If Congress passes comprehensive crypto legislation, or the SEC provides clear guidelines, trillions in sidelined institutional capital could flow into crypto. Coinbase, as the only major US exchange with institutional-grade infrastructure, would capture outsized share. The Blackrock Bitcoin ETF choosing Coinbase as custodian validates this thesis.

Platform expansion into DeFi, NFTs, and Web3 multiplies the opportunity. Coinbase isn't just an exchange—it's becoming the AWS of crypto. Their wallet connects to thousands of DeFi applications. Their NFT marketplace, while struggling initially, could capture value as digital ownership expands beyond JPEGs. Their developer tools power the next generation of crypto applications. Each expansion creates new revenue streams independent of trading.

But the bear case is equally compelling. Structural revenue volatility might be unfixable. No matter how Coinbase diversifies, crypto trading drives profits. When Bitcoin crashes, revenue collapses. This isn't a bug—it's a feature of the business model. Public market investors hate unpredictability, which explains why Coinbase trades at lower multiples than stable SaaS companies despite higher growth.

Race to zero on fees seems inevitable. Competition drives fees lower in every financial market. Stock trading went from dollars to pennies to free. Why should crypto be different? Robinhood offers free crypto trading. International exchanges offer sub-0.1% fees. If Coinbase's 2% retail fees compress to 0.2%, the business model breaks.

Regulatory existential risk remains real. The SEC could declare most cryptocurrencies securities, making Coinbase's current business illegal. Congress could pass hostile legislation taxing crypto transactions prohibitively. The Federal Reserve could launch a digital dollar that obsoletes stablecoins. Any of these scenarios would devastate Coinbase's business overnight.

Competition from both CeFi and DeFi presents a two-front war. Traditional finance giants like Fidelity and Schwab are entering crypto with massive customer bases and trusted brands. Meanwhile, decentralized exchanges like Uniswap eliminate intermediaries entirely. Coinbase sits awkwardly in the middle—too centralized for crypto natives, too crypto for traditional investors.

Crypto winter permanence scenario, while unlikely, deserves consideration. Perhaps crypto was a pandemic-era aberration, fueled by stimulus checks and zero interest rates. As monetary conditions normalize, crypto might shrink to a niche curiosity for libertarians and criminals. The industry wouldn't die, but it wouldn't grow either, leaving Coinbase as a subscale financial services company with unsustainable costs.

The realistic scenario probably lies between extremes. Crypto becomes important but not dominant, like forex or commodities markets. Coinbase survives as a profitable but volatile business, generating strong returns in bull markets and losing money in bear markets. The stock becomes a portfolio diversifier for risk-tolerant investors, not a core holding for pension funds.

Multiple futures remain possible. In one, Coinbase becomes the JPMorgan of crypto—too big to fail, boringly profitable, systemically important. In another, they're displaced by traditional finance or decentralized protocols, becoming the AOL of crypto—a pioneer that couldn't adapt. The next few years will determine which future materializes.

XII. Epilogue: What Would We Do?

If we were running Coinbase today, the strategic choices would be agonizing but clear. The company sits at an inflection point where every decision shapes not just quarterly earnings but the next decade of financial infrastructure.

The Web3 super app opportunity screams for attention. Coinbase has the users, brand, and trust to become the WeChat of crypto—one app for trading, payments, messaging, identity, and social. But super apps require focus, and Coinbase is already fighting battles on multiple fronts. The question isn't capability but prioritization. Do you go broad or deep?

International strategy priorities would focus on regulatory arbitrage and market selection. The UK's pragmatic approach to crypto regulation makes London attractive for European headquarters. Singapore's clear frameworks and access to Asian markets demand presence. But the real opportunity might be emerging markets where crypto solves real problems—remittances in the Philippines, inflation hedging in Turkey, financial inclusion in Nigeria. These aren't nice-to-haves; they're necessities.

The stablecoin question looms largest. USDC, through the Centre Consortium partnership with Circle, gives Coinbase exposure to the fastest-growing crypto segment. But why share economics when you could own the whole stack? Launching a Coinbase-native stablecoin would capture massive value—every transaction, every holding, every yield opportunity. The regulatory complexity is enormous, but so is the prize. Tether generates billions in profit essentially risk-free. That could be Coinbase.

Building versus buying in crypto infrastructure presents constant choices. Should Coinbase build its own blockchain analytics like Chainalysis? Acquire a wallet company like MetaMask? Create a venture arm like Binance Labs? The balance sheet supports acquisitions, but integration challenges in crypto are unique. Acquiring decentralized teams, open-source projects, and token communities isn't like buying traditional companies.

Managing the next cycle requires fighting the last war's instincts. The 2021 boom caught Coinbase unprepared—customer service collapsed, scaling failed, hiring lagged. The temptation is to prepare for that exact scenario again. But the next cycle might be different—institutional rather than retail, international rather than domestic, DeFi rather than centralized. Preparing for the wrong future wastes resources.

The decentralization paradox deserves resolution. Coinbase profits from centralization while promoting decentralization. They custody assets while preaching self-sovereignty. They're publicly traded while building permissionless protocols. This contradiction isn't sustainable. Either embrace being a traditional financial company with crypto assets, or truly commit to decentralization even if it means disrupting your own business.

If we had to make the hard calls: First, go all-in on Base. Make it the default layer-2 for everything Coinbase does. Every trade, every transaction, every new product should strengthen the Base ecosystem. Second, launch a stablecoin. The regulatory risk is worth the reward—stablecoins are becoming the rails for global money movement. Third, expand aggressively internationally while the US dithers on regulation. Build liquidity and brand in markets where crypto solves real problems.

Fourth, create a developer ecosystem fund. Invest $1 billion in teams building on Base. The next Uniswap or Aave could generate more value than Coinbase itself—own pieces of everything. Fifth, embrace the super app strategy internationally first. US regulations constrain functionality, but emerging markets allow experimentation. Build the everything app where it's possible, then bring lessons back to developed markets.

The hardest decision would be cultural. Coinbase succeeded by being conservative in a wild industry. But the next phase might require wildness—shipping faster, taking bigger risks, embracing chaos. The company that got here won't get there. Transform or be transformed.

XIII. Conclusion: The Infrastructure of Revolution

Coinbase's story isn't finished—it's barely started. After twelve years, multiple cycles, and a public listing, the company remains fundamentally a bet on crypto's future. But it's a specific bet: that the revolution needs infrastructure, that compliance creates competitive advantages, and that centralized bridges to decentralized systems capture enormous value.

The company Armstrong and Ehrsam built defied every crypto orthodoxy. In a space that celebrated anarchism, they embraced regulation. Where others chased quick profits, they built long-term infrastructure. While competitors offered everything to everyone, they focused on doing a few things exceptionally well. This contrarian approach created a $50 billion business and made crypto accessible to millions.

But success in technology is temporary. The moats that protected Coinbase—regulatory licenses, brand trust, technical infrastructure—face constant erosion. Traditional finance is coming with massive balance sheets. DeFi promises to eliminate intermediaries entirely. International competitors operate with fewer constraints. The next decade will test whether Coinbase's advantages are durable or transitory.

The broader implications extend beyond one company. Coinbase represents a template for bridging old and new systems. Every technological revolution needs translators—companies that speak both languages, that make the future accessible to the present. Netscape did this for the internet. PayPal did it for online payments. Coinbase is doing it for crypto.

Whether crypto ultimately transforms finance or remains a speculative sideshow, Coinbase has already won in one sense: they proved it was possible to build a compliant, profitable, public crypto company. They showed that working with regulators, however frustrating, beats working against them. They demonstrated that boring infrastructure, not sexy products, captures value in new markets.

For investors, Coinbase offers a liquid, regulated way to bet on crypto's future. The volatility is extreme, the correlation with Bitcoin is high, but the optionality is enormous. If crypto reaches escape velocity, Coinbase could become one of the world's most valuable financial companies. If crypto stagnates, it becomes a profitable niche business. If crypto collapses, well, that's why position sizing matters.

For the industry, Coinbase serves as both inspiration and warning. Inspiration that crypto companies can achieve massive scale and public market validation. Warning that the path requires compromises that many crypto natives find unacceptable. Coinbase chose legitimacy over ideological purity—a trade-off that enabled success but alienated purists.

The next chapters remain unwritten. Will Base become the dominant layer-2 platform? Can Coinbase maintain pricing power as competition intensifies? Will regulatory clarity unleash institutional adoption? Does the company have another act beyond exchange and custody? These questions will determine whether Coinbase's public market debut was the beginning or the peak.

What's certain is that Coinbase has earned its place in financial history. They took an anarchist technology and made it accessible to grandmothers. They built bridges between incompatible worlds. They survived multiple near-death experiences that killed seemingly stronger competitors. They proved that crypto companies could be both revolutionary and responsible.

The ultimate judgment depends on your view of crypto's future. If you believe we're witnessing the birth of a new financial system—programmable money, permissionless innovation, global accessibility—then Coinbase is building critical infrastructure for the next century. If you think crypto is a speculative bubble dressed in revolutionary rhetoric, then Coinbase is a well-run casino benefiting from temporary madness.

Time will render its verdict. But whatever crypto becomes, Coinbase will have played a defining role in its evolution. They didn't create the revolution, but they built the infrastructure that made it possible. In technology history, that's often the position that captures the most value. The question now is whether they can maintain that position as the revolution they enabled potentially makes them obsolete.

For Brian Armstrong, the mission remains unchanged: create an open financial system that increases economic freedom globally. Whether that happens through Coinbase, because of Coinbase, or despite Coinbase remains to be seen. But twelve years in, with millions of users, billions in revenue, and survival through multiple crypto winters, they've earned the right to keep building toward that vision.

The crypto infrastructure giant isn't done growing. The next decade will determine whether Coinbase becomes the JPMorgan of crypto or the Friendster of finance. Either way, they've already changed how the world thinks about money. For a Y Combinator startup that started with a simple Bitcoin buying button, that's not a bad legacy. But for Armstrong and team, it's just the beginning.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music