Bloom Energy: From Mars to Main Street — The 24-Year Overnight Success

I. Introduction: When NASA Dreams Meet Silicon Valley Money

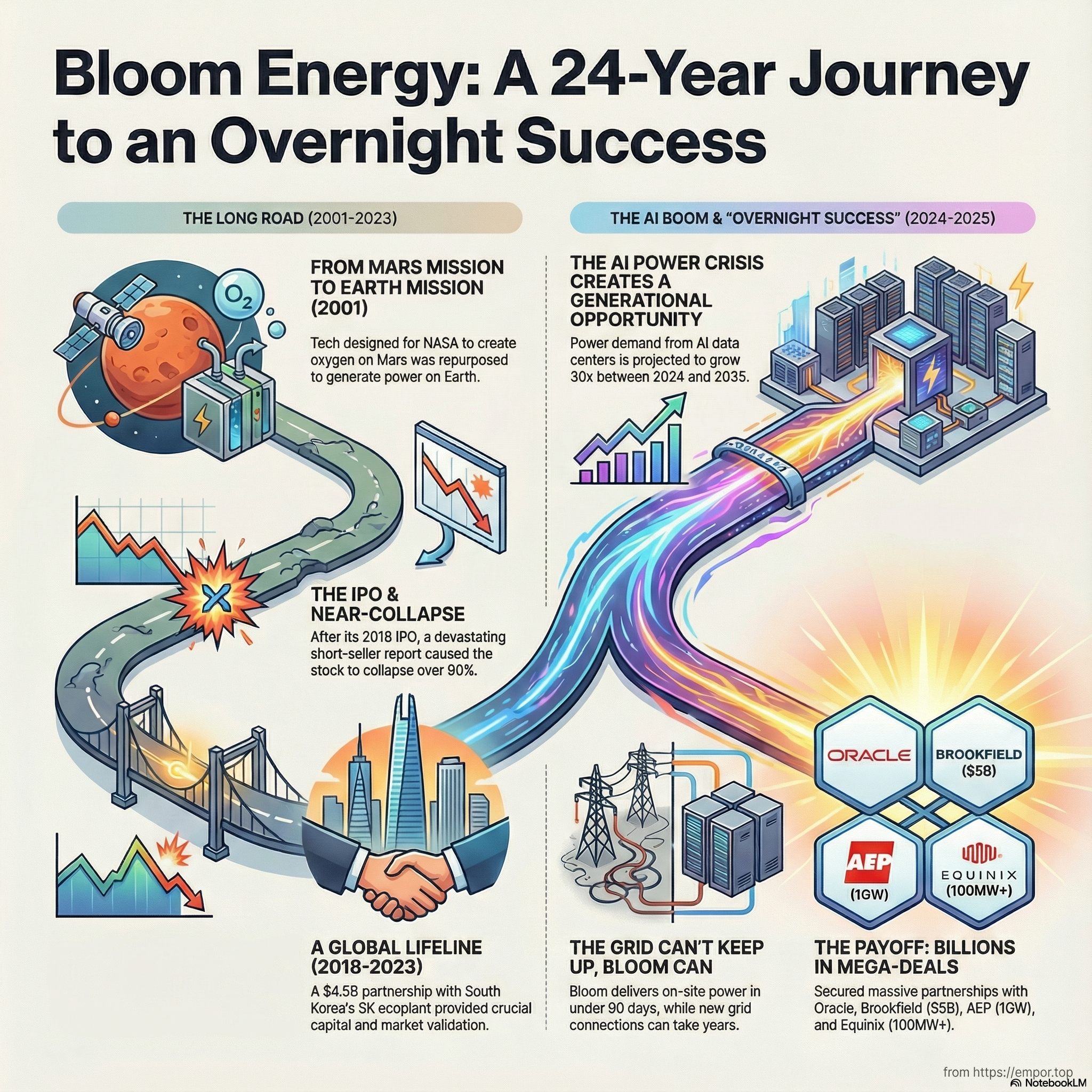

In the fall of 2024, something extraordinary happened on Wall Street. A company that Wall Street had nearly written off as "the next Theranos" just five years earlier saw its stock price rocket more than 1,000% in twelve months. One stock from the screen, Bloom Energy, has surged about 1,000% in the past year.

The company's founder, KR Sridhar, offered the perfect summation of this unlikely resurrection: "It's a 24-year journey for an overnight success."

Bloom Energy Corporation occupies a peculiar space in the American clean energy landscape. The company designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally. It offers Bloom Energy Server, a power generation platform to convert fuel, such as natural gas, biogas, hydrogen, or a blend of these fuels, into electricity through an electrochemical process without combustion.

That description, while technically accurate, fails to capture the drama of Bloom's journey. This is a company born from a cancelled NASA Mars mission, incubated in stealth for nearly a decade, unveiled with the fanfare of a Silicon Valley rocket launch, nearly destroyed by short sellers, and now resurrected by the most unexpected catalyst imaginable: the insatiable power demands of artificial intelligence.

The story of Bloom Energy is, at its core, a meditation on deep tech patience. It asks a fundamental question that haunts every technology investor: How long do you wait for a transformative technology to find its market? Two decades? Three? And what happens when that market finally arrives with more force than anyone imagined?

By 2025, the company had installed about 1.4 gigawatts of Bloom Energy Server systems at over 1,000 locations across nine countries, and developed low-emission, always-on, near zero-carbon green energy and carbon capture technologies for high-energy consumption industries. The goal is even more ambitious: Fuel cell manufacturer Bloom Energy said it is on track to double its annual production capacity to reach 2 GW by the end of 2026.

The company's stock trades at approximately $89.99 as of November 24, 2025, with a 52-week range spanning from $15.15 to $147.86. That range tells its own story—a tenfold swing in valuation that reflects both the promise and the peril of investing in deep technology transformation.

This is the story of how a NASA researcher's dream of sustaining life on Mars became the unlikely answer to Silicon Valley's most pressing problem: how to power the artificial intelligence revolution when the grid simply cannot keep up.

II. The Founder: KR Sridhar — From Mars to Main Street

NASA Origins & The Mars Moment

In the arid landscapes of Tucson, Arizona, during the late 1990s, a young professor named KR Sridhar was working on one of humanity's most audacious engineering challenges: how to keep humans alive on Mars.

KR Sridhar (born c. 1960) is an Indian American engineer, inventor, professor, and entrepreneur. He is the founder, chairman, and chief executive officer (CEO) of Bloom Energy. Prior, Sridhar was a professor of Aerospace and Mechanical Engineering and the Director of the Space Technologies Laboratory (STL) at the University of Arizona.

Sridhar's academic journey had been characteristically methodical. He was awarded a bachelor's degree in mechanical engineering from the National Institute of Technology at Tiruchirappalli, Tamil Nadu, India in 1982. He moved to the United States and gained an M.S. in nuclear engineering and a Ph.D. in mechanical engineering from University of Illinois at Urbana-Champaign in 1989.

But it was his work at the Space Technologies Laboratory that would shape his destiny. Under his leadership, STL won several nationally competitive contracts to conduct research and development for the exploration of and flight experiments to Mars. Dr. Sridhar has served as an advisor to NASA and has led major consortia of industry, academia, and national labs. His work for the NASA Mars program to convert Martian atmospheric gases to oxygen for propulsion and life support was recognized by Fortune Magazine, where he was cited as "one of the top five futurists inventing tomorrow, today."

The technical challenge was elegant in its complexity. Sridhar led a project that built a Mars oxygen production cell using a yttria-stabilized zirconia solid-electrolyte ionic conductor to electrolyze carbon dioxide into oxygen and carbon monoxide. The oxygen production unit was to fly as part of the Mars ISPP Precursor (MIP) experiment package.

The science was beautiful: use electricity from solar panels to split Martian carbon dioxide into breathable oxygen for astronauts and carbon monoxide for fuel. If it worked, future Mars missions could travel lighter—manufacturing what they needed from the thin Martian atmosphere rather than hauling it from Earth.

The oxygen production unit was to fly as part of the MIP ("Mars ISPP Precursor") experiment package that was to be sent to Mars on the Mars Surveyor 2001 Lander mission. This would have been the first demonstration of in-situ resource utilization ("ISRU") for propellant production on another planet. However, the 2001 Surveyor Lander mission was cancelled after the failure of the Mars Polar Lander, which used an identical spacecraft.

The Pivot Point: When Space Dreams Meet Earth's Needs

The cancellation of Mars Surveyor 2001 could have ended Sridhar's story. Instead, it began a new chapter.

After NASA cancelled the Mars Surveyor 2001 mission, Sridhar started working on using oxygen and hydrogen to create power. He co-founded Ion America the same year, with a mission to "make clean, reliable energy affordable for everyone on earth". Sridhar became the chief executive officer. In 2002, the company moved to the NASA Ames Research Center in Silicon Valley.

The insight was characteristically brilliant: if you could electrolyze carbon dioxide into oxygen and fuel on Mars, you could run the same reaction in reverse on Earth. Feed in natural gas and air, and the electrochemical reaction would produce electricity—without combustion, without pollution, without the inefficiencies that plague traditional power generation.

With the cooling of space exploration activity, in the wake of the Cold War, Sridhar next co-founded Ion America, later Bloom Energy, to develop decentralized energy systems, in 2001. Sridhar was recognized in 2000 by Fortune as one of five young innovators practically advancing human progress.

The timing was propitious in ways Sridhar couldn't have anticipated. The 2000s would bring growing concerns about climate change, rising energy costs, and increasing frustration with the fragility of centralized power grids. California's rolling blackouts in 2001 had demonstrated what happens when demand outstrips supply. The market for distributed, reliable power was nascent but real.

The Name Change & Silicon Valley Move

The company was formerly known as Ion America Corp. and changed its name to Bloom Energy Corporation in 2006. Bloom Energy Corporation was incorporated in 2001 and is headquartered in San Jose, California.

The name change was more than cosmetic. "Bloom" suggested growth, life, organic development—a sharp contrast to the industrial coldness that typically surrounded power generation. It was a Silicon Valley company, born in the NASA Ames incubator, determined to bring the ethos of innovation to one of the world's oldest and most stagnant industries.

Sridhar's academic credentials continued to accumulate even as he built his company. He was named one of Time's "Tech Pioneers Who Will Change Your Life" in 2009, and received the University of Illinois Department of Mechanical Science Engineering Distinguished Alumnus award in 2011. In 2016, Sridhar was inducted into the National Academy of Engineering (NAE). He received an honorary degree from the University of Delaware in 2024.

But his greatest achievement was still eight years away, gestating in the secrecy that Silicon Valley startups consider holy. The Bloom Box was coming—and with it, a marketing moment that would capture America's imagination.

III. The Technology Deep Dive: Solid Oxide Fuel Cells

The Science Explained

Understanding Bloom Energy requires understanding what makes solid oxide fuel cells different from everything else in the energy marketplace.

On 24 February 2010, Bloom Energy launched Sridhar's newest invention, the Bloom Energy Server, also known as the Bloom Box, an energy-efficient and environmentally-friendly fuel cell in which natural gas and atmospheric oxygen are pumped through a stack of cells, producing electricity. The energy is clean and inexpensive, but development and production of the solid oxide fuel cells require an initial investment of $100 million.

The basic principle is elegantly simple: fuel cells generate electricity through an electrochemical reaction rather than combustion. In a conventional power plant, you burn fuel to heat water, create steam, spin a turbine, and generate electricity. Each step introduces inefficiency—thermodynamic losses that mean a typical natural gas plant converts only 40-50% of its fuel energy into electricity.

Fuel cells skip most of those steps. They combine fuel with oxygen directly at the molecular level, generating electrons in the process. No flames, no turbines, no massive heat losses.

Why Solid Oxide is Different

Bloom Energy produces solid oxide fuel cells, which are frequently fueled by natural gas. They don't require an expensive catalyst and operate at very high temperatures. These cells are typically used in stationary and backup power generation. Notably, Bloom Energy's design allows its cells to use hydrogen as fuel, but the company believes that high costs and restricted availability limit hydrogen's usefulness.

The "solid oxide" designation refers to the electrolyte—the material that allows ions to pass between electrodes. Bloom's cells use a ceramic electrolyte made from yttria-stabilized zirconia, the same material Sridhar developed for Mars. This material becomes conductive to oxygen ions at high temperatures, typically above 800°C.

The high operating temperature is both blessing and curse. On the positive side, it enables exceptional electrical efficiency—Bloom claims its systems convert fuel to electricity at rates significantly higher than conventional power plants. The high temperature also allows "fuel flexibility"—the cells can use natural gas, biogas, hydrogen, or blends without modification.

The challenge is durability. Running any system at 800°C for years on end creates material stress. Early skeptics questioned whether Bloom's cells could maintain performance over the multi-decade service lives that customers expected. This concern would come back to haunt the company.

Bloom also developed electrolyzers for hydrogen production, and holds more than 1000 patents globally.

The electrolyzer technology represents Bloom's bet on the hydrogen economy. The same solid oxide cell that generates electricity from fuel can, when run in reverse, generate hydrogen from electricity. After generating hydrogen from its SOEC at NASA's Ames Research Center in Mountain View, California, to excellent results, generating hydrogen with 20–25% more efficiency than traditional methods; in November 2022, Bloom Energy's Delaware factory began manufacturing its high-volume commercial electrolyzer, the largest and most efficient in the world to date, producing 20-25% more hydrogen per MW than either proton exchange membrane (PEM) or alkaline electrolyzers.

The Cost Equation

The fuel cell industry has always struggled with a fundamental challenge: cost. Traditional fuel cells require expensive precious metals like platinum as catalysts. Bloom's solid oxide design eliminates this requirement, but the ceramic materials and complex manufacturing still made early units expensive.

Bloom Energy says hooking up one of its $700,000 to $800,000 Boxes is simple. That was the price point at launch in 2010—far too expensive for residential use, but potentially competitive for commercial and industrial customers, especially when factoring in government incentives.

The company promised costs would fall dramatically with scale. It has delivered on that promise, at least partially. "Every year, for over a decade, our fuel cells have seen double-digit, year-over-year cost reductions," Sridhar said. This learning curve has enabled expansion into "large, power-hungry markets" across the Midwest, Mid-Atlantic and Texas, not just in higher-priced electricity markets like California and the northeastern United States.

IV. The Long Stealth Era: Building in the Dark (2001–2010)

VC Backing & The Patient Capital Thesis

For eight years, Bloom Energy operated in near-total secrecy—an eternity in Silicon Valley's hyperventilating news cycle. The company was building something that required not just technological innovation but massive capital investment and the patience to wait for markets to develop.

Sridhar obtained funding for the project from investors, including Kleiner Perkins and New Enterprise Associates.

The involvement of Kleiner Perkins was significant. The firm, led by legendary investor John Doerr, had made its name with early bets on Amazon and Google. Doerr's willingness to commit to Bloom represented a bet on clean technology at a time when the sector was attracting enormous interest—and generating enormous skepticism.

Kleiner Perkins, the venture capital firm known for early bets on Google and Amazon, soon made its first-ever "clean tech" bet by investing in Bloom. John Doerr, the Kleiner Perkins partner known for backing Amazon and Google, joined Bloom's board of directors. By 2009 Bloom was valued at well over $1 billion by its venture capitalists. That was also the year that former Secretary of State Colin Powell, a strategic limited partner with Kleiner Perkins, was added to Bloom's board.

The addition of Colin Powell to the board signaled Bloom's ambitions beyond pure technology. Powell brought credibility with government, military, and Fortune 500 customers—exactly the constituencies that Bloom would need to convince.

The company raised more than $1 billion in venture capital funding before going public in 2018. This represented an extraordinary commitment to a technology that had yet to prove commercial viability at scale.

The "60 Minutes" Unveiling (2010)

The company worked in secret for eight years before coming out of stealth mode in February 2010, and introducing its Bloom Energy Server, or "Bloom Box", a fuel-cell technology that enables on-site carbon-neutral electricity generation. Bloom Energy was featured on 60 Minutes, supported by political figures and named one of 26 "2010 Tech Pioneers" by the World Economic Forum.

The 60 Minutes appearance was a masterstroke of marketing. Bloom Energy generated buzz in 2010 after 60 Minutes correspondent Leslie Stahl became the first journalist to tour the Sunnyvale, California headquarters and look inside the top-secret "Bloom Box".

He says he knows it works because he originally invented a similar device for NASA. He really is a rocket scientist.

The segment positioned Bloom as exactly what Silicon Valley loves: a genius founder, space-age technology, and the promise of disrupting a stagnant industry. Asked if Bloom box is intended to get rid of the grid, John Doerr told Stahl, "The Bloom box is intended to replace the grid…for its customers. It's cheaper than the grid, it's cleaner than the grid."

At the launch event, Bloom Energy investor John Doerr, now chair of venture capital firm Kleiner Perkins Caufield & Byers, compared the unveiling of Bloom Energy's technology to Google's IPO.

The comparison was audacious. Google's IPO had transformed Kleiner Perkins's returns and cemented the firm's reputation. Doerr was betting that Bloom could deliver something similar.

Following its television debut on CBS News' "60 Minutes" last Sunday, the Bloom Box was formally introduced to the public at eBay's headquarters in San Jose, Calif. Founder and CEO K.R. Sridhar took the stage with Gov. Arnold Schwarzenegger, who touted his state's green jobs initiatives and noted, "160 years ago people flocked to California for the Gold Rush. The same spirit is still alive and can be seen as Bloom Energy."

The customer list was impressive: Executives from Google, Wal-Mart, FedEx, Staples, Coca-Cola and other blue-chip companies lauded the technology, saying it cuts both their carbon footprints and their energy costs.

The Bloom Box generator was also chosen among Time's "Best 50 Inventions of 2010". The company raised $400 million in funding that year, and had 300 employees.

But even at the moment of triumph, skeptics raised concerns. "In Silicon Valley, every time a company raises over $100 million, and they haven't come out with a product yet, everybody starts getting the heebie-jeebies," Michael Kanellos, editor-in-chief of the Web site GreenTech Media, told Stahl. Kanellos admitted he is skeptical. "I'm hopeful but I'm skeptical. 'Cause people have tried fuel cells since the 1830s," he explained.

V. The Subsidy Dependency Era & Road to IPO (2010–2018)

Government Incentives: Lifeline or Crutch?

From its earliest commercial deployments, Bloom Energy's business model was inextricably linked to government subsidies. This dependence would prove to be both essential to the company's survival and a persistent vulnerability.

Over the years, sales of Bloom Energy's fuel cells have benefited from the federal investment tax credit (or ITC), which provides customers a tax credit worth $3,000 per kilowatt, or 30 percent of the cost of the system. The ITC expired at the end of 2016. Accordingly, Bloom Energy lowered its prices for its customers.

California makes adopting green technologies like the Bloom Box attractive, with a 20 percent subsidy, in addition to a 30 percent federal tax break. Combined, these incentives could cut the effective price of a Bloom Box in half—making an expensive technology suddenly competitive.

Achieving profitability is difficult for Bloom because of the substantial upfront capital investment required from customers. Its business relies on government incentives, such as renewable energy rebates, tax credits, and other tax benefits, the company said. A federal tax credit for fuel cells in the US, which lapsed in 2015, was reinstated earlier this year, lowering the barrier for Bloom.

The lapse and reinstatement of the federal ITC created a roller-coaster for Bloom's business planning. When the credit expired, sales slowed. When it returned, customers who had been waiting rushed to buy. This volatility made forecasting difficult and highlighted a fundamental weakness: Bloom's technology was not yet competitive without government support.

The Customer Concentration Problem

Beyond subsidies, Bloom's early financial structure revealed another concern that would trouble analysts for years.

Bloom Energy's S-1 reveals a company with ballooning debt, dwindling cash and a historic dependence on both government subsidies and a handful of high-profile customers that have made substantial purchases of its fuel cells. In addition, the company is supporting a bunch of first-generation fuel cells, which are inefficient and in some cases are costing Bloom Energy money to maintain.

The customer list read like a Fortune 500 roll call—Google, Apple, Walmart, FedEx, AT&T, Coca-Cola. These were blue-chip names that lent credibility to the technology. But the concentration was extreme: a small number of large customers represented the vast majority of revenue. If any of them decided to switch technologies or simply stopped ordering, the impact on Bloom's financials would be devastating.

The 2018 IPO

After more than seventeen years as a private company, Bloom Energy finally went public in July 2018.

Bloom Energy Corp., the Kleiner Perkins Caufield & Byers-backed maker of fuel-cell power systems, climbed on its first day of trading after pricing a rare alternative-energy IPO. The shares rose 47 percent to $22.10 at 2:09 p.m. in New York, giving the company a market value of about $2.34 billion. Bloom Energy sold 18 million shares for $15 apiece Tuesday after marketing the stock at a range of $13 to $15 in the first alternative energy IPO in the U.S. since October 2016.

Bloom's largest stakeholder is venture capital firm Kleiner Perkins, which owns 16 percent of the company, according to filings. Kuwait Investment Authority—its second largest stakeholder—owns 11 percent.

In 2018, after nearly two decades as a private company, Bloom Energy made its long-anticipated debut on the New York Stock Exchange, trading under the symbol (NYSE: BE). The IPO raised over $270 million and provided Bloom with the capital to scale manufacturing, expand internationally, and accelerate product development.

The initial euphoria was real: the stock popped 47% on its first day. But going public also brought new scrutiny. Investors questioned the path to profitability and the company's ability to compete with falling costs for solar, wind, and battery storage. At times, (NYSE: BE) shares were volatile, reflecting both market sentiment and the broader volatility of the clean tech sector.

As of the end of March, the company has accumulated a deficit of $2.3 billion. The message was clear: this was a company that had consumed enormous amounts of capital over nearly two decades without generating profits. Investors were betting on the future, not the past.

VI. INFLECTION POINT #1: The Hindenburg Attack (2019)

The Short Seller's Thesis

On September 17, 2019, Hindenburg Research—an investment firm specializing in activist short-selling—published a devastating report that would threaten Bloom Energy's very survival.

The market appears to be slowly waking up to the same unfortunate conclusion about Bloom Energy that we have arrived at after several months of rigorous deep dive research. Instead of being a great clean energy success, we expect Bloom's "too good to be true" story will find its place in history along the likes of defunct companies such as Solyndra and Theranos.

The comparison to Theranos—the blood-testing company whose fraudulent claims had recently been exposed—was deliberately inflammatory. Hindenburg was accusing Bloom of fundamental deception about its technology and finances.

The Hindenburg analysts attacked Bloom on several fronts, saying their research "indicates that Bloom's technology is not sustainable, clean, green, or remotely profitable."

Making matters worse for investors, according to Hindenburg, are $2.2 billion in "undisclosed servicing liabilities" that the firm expects to "sink" Bloom. The short seller claims that Bloom's contracts with its customers place "nearly 100%" of the performance risk of the fuel cells on Bloom.

The servicing liability argument struck at the heart of Bloom's business model. The company guaranteed customers that its fuel cells would perform at specified efficiency levels for years. If the cells degraded faster than expected, Bloom would have to replace them—at enormous cost.

In short, Bloom's expected server life is untested at best, and its history has demonstrated a 4-7 year lifespan. Even if we assume just 1 server replacement on an average outstanding contract life of 13 years, we estimate this to result in a nearly $1.5 billion unrecorded service liability.

Hindenburg also attacked Bloom's environmental claims. As shown in the earlier chart, Bloom's systems are about 59% DIRTIER than the grid in California when you don't slip the word "marginal" into the sentence.

The Stock Collapse

A scathing report issued Tuesday by short-seller Hindenburg Research shaved nearly a quarter off the shares of fuel-cell maker Bloom Energy Corp. Bloom came public in July of last year and its share price rose to a post-IPO high of $38 in late September of 2018. As of August 30 this year, 18.7% of the company's total float was short, and shares were down more than 90% from the high.

The 18-year-old company—which makes on-site generators for retailers, hospitals and other large power consumers—plunged as much as 26% Tuesday after short seller Hindenburg Research said mounting servicing costs could help push the company into "the history books alongside failed companies like Theranos or Solyndra."

Bloom's Defense

Bloom pushed back aggressively. Today, a report about Bloom Energy published by a known short seller, Hindenburg Research, presented factual inaccuracies, misleading allegations, and drew erroneous conclusions, including about the future viability of Bloom.

Of the $701 million of debt reflected on Bloom's June 30, 2019 balance sheet, $269.5 million is PPA debt that is non-recourse to Bloom. For calendar years 2016 - 2018, Bloom fuel cells have an average life of 4.8 to 5.2 years.

Bloom Energy also has a proven track record of providing power resiliency and reliability for our customer facilities through our microgrid solutions. These solutions are becoming increasingly important at a time when grid outages are escalating due to aging infrastructure and a higher frequency of natural disasters. We have deployed 85 microgrids globally and powered customer facilities through more than 550 outages in 2018.

The Hindenburg attack raised legitimate questions about accounting practices, fuel cell durability, and environmental claims. But it also came at a moment of maximum vulnerability for Bloom—when the company was struggling to demonstrate profitability and facing headwinds from shifting subsidy regimes.

By 2020, shares had lost nearly 50% in value. Though not profitable in its first 19 years of operation, the company had raised over $1.7 billion in capital for its technology.

The company that had been compared to Google at its launch was now being compared to Theranos. The dream seemed to be dying.

VII. INFLECTION POINT #2: The SK ecoplant Partnership & International Expansion (2018–2023)

The Korea Bet

While Bloom was fighting for survival in the U.S., a lifeline emerged from an unexpected direction: South Korea.

Launched in 2018, the strategic partnership between Bloom Energy and SK ecoplant has strengthened their respective market leadership positions in power generation and the global hydrogen economy.

SK ecoplant, an affiliate of South Korean conglomerate SK Group, saw in Bloom what many U.S. investors had begun to doubt: a technology platform with genuine differentiation and long-term potential.

The partnership includes purchasing a minimum of 500 megawatts (MW) from Bloom Energy, representing a $4.5 billion revenue commitment; co-creating two hydrogen innovation centers; and targeting an equity investment of approximately $500 million. Since the start of their strategic partnership three years ago, Bloom Energy and SK ecoplant have transacted nearly 200 MW of projects together totaling more than $1.8 billion of equipment and expected service revenue. Over the next three years the companies will expand this existing business with contracts for at least an additional 500 MW of power between 2022 and 2025, representing approximately $4.5 billion in equipment and future service revenue.

SK's Strategic Investment

The SK partnership went beyond product purchases. SK ecoplant continues to build upon its investment in Bloom Energy, having made a roughly $566 million equity investment in the company and owning about 10% of the company's shares.

This investment came at a crucial moment. When U.S. investors were fleeing, SK was doubling down. The vote of confidence from a sophisticated global energy company helped stabilize Bloom's position and provided credibility that pure financial investors couldn't match.

SK ecoplant has committed to purchase 500 megawatts (MW) of Energy Servers from Bloom Energy through 2027. The transaction is expected to generate approximately $1.5 billion in product revenue and $3 billion of service revenue over 20 years for Bloom Energy.

Hydrogen Expansion & Innovation Centers

SK ecoplant and Bloom Energy Establish Two Hydrogen Innovation Centers. Bloom Energy and SK ecoplant agreed to create Hydrogen Innovation Centers in the United States and South Korea. The intent is to significantly accelerate the global market expansion for Bloom Energy's hydrogen fuel cell and hydrogen electrolyzer products. The agreement also reflects both Bloom Energy and SK ecoplant's enhanced commitment to a zero-carbon future.

The hydrogen focus was prescient. While Bloom's current business runs primarily on natural gas, the same solid oxide technology can operate on hydrogen when supplies and economics become favorable. SK's investment positioned both companies for the hydrogen economy that governments worldwide were beginning to subsidize.

The first-of-its-kind demonstration for South Korea, which will commence in late 2025, includes 1.8 megawatts (MW) of Bloom's industry-leading Solid Oxide Electrolyzer (SOEC) technology to develop green hydrogen at scale.

The SK partnership transformed Bloom from a struggling U.S. cleantech company into a genuine global player with a diversified customer base and a strategic investor committed to its success.

VIII. INFLECTION POINT #3: The AI Data Center Boom (2024–2025)

ChatGPT Changes Everything

When OpenAI launched ChatGPT in November 2022, few observers recognized the implications for the power industry. But KR Sridhar did.

KR Sridhar: Good afternoon, and thank you for joining us today. I am delighted that Bloom Energy Corporation had its fourth consecutive quarter of record revenue. This seminal year for Bloom positions us for an even stronger 2026 and beyond, with higher growth and more profitability. Three major tailwinds benefiting Bloom today have created a once-in-a-generation opportunity for us to become the global standard for on-site power generation.

The AI revolution has created an unprecedented power crisis. Training large language models requires enormous computational resources, and those resources require enormous amounts of electricity. Demand from these power-hungry facilities is expected to grow to more than 120 GW by 2035. By comparison, power demand from AI data centers was just 4 GW in 2024.

The growth is staggering: 30x in eleven years. And the grid simply cannot keep up.

Utilities report significantly longer timelines to deliver power in key U.S. markets, typically 1 to 2 years beyond what hyperscalers and colocation developers expect, the survey found.

This is Bloom's moment. The company that had struggled to find its market for two decades suddenly found itself at the center of the most important infrastructure challenge of the AI era.

The Power Grid Crisis & Bloom's Solution

"Behind-the-meter power solutions are essential to closing the grid gap for AI factories," said Sikander Rashid, global head of AI infrastructure at Brookfield.

The math is simple: if you need power in six months and the grid says three years, you need another solution. Bloom offers exactly that.

Bloom Energy's Mid-Year 2025 Data Center Power Report points to a seismic shift in data center energy strategy: by 2030, 27% of facilities expect to be fully powered by on-site generation. That's a sharp increase from just 1% in 2024, underscoring growing concerns with grid power, including limited availability, reliability issues, and a lack of operator control over their energy sources.

The shift is historic. For decades, data centers relied almost entirely on grid power. Now, according to a survey by Bloom, in 2024 just 1% of data centers planned to run entirely on onsite power by 2030; this year, the share has soared to 27%.

The Mega-Deals of 2024–2025

The commercial momentum in 2024-2025 has been extraordinary.

American Electric Power (November 2024): Bloom Energy (NYSE:BE), the world leader in stationary fuel cell power generation, announced that it has signed a supply agreement with American Electric Power (AEP) for up to 1 gigawatt (GW) of its products, the largest commercial procurement of fuel cells in the world to date.

AEP has an agreement in place to secure up to 1 gigawatt (GW) of Bloom Energy solid oxide fuel cells for data centers and other large energy users who need to quickly power their operations while the grid is built out to accommodate demand.

Bloom Energy Corp. shares soared the most ever in intraday trading Friday after American Electric Power Co. said it would use the company's fuel cells to supply data centers. Bloom shares were up 49% to $19.74 at 10:13 a.m. in New York, after initially surging as much as 69%.

Oracle (July 2025): Bloom and Oracle collaborate to deliver onsite power to Oracle AI data centers within 90 days. Fuel cells will support Oracle Cloud Infrastructure's growth strategy with clean, reliable, and cost-efficient power for large-scale AI workloads.

The 90-day deployment promise is transformative. Bloom's fuel cells can be deployed in less than three months, offering a faster path to reliable energy for growing data center campuses. For hyperscalers racing to build AI capacity, this speed is worth paying a premium.

Brookfield (October 2025): US fuel cell developer Bloom Energy has signed a $5 billion AI infrastructure partnership with global investment firm Brookfield. The partnership will see Brookfield invest up to $5bn to support the deployment of Bloom's Solid Oxide Fuel Cell (SOFC) technology in AI data centers worldwide.

Bloom Energy (NYSE: BE), a global leader in power solutions, and Brookfield today announced a $5 billion strategic partnership to implement a reimagined future for AI infrastructure. This partnership marks the first phase of a joint vision to build AI factories capable of meeting the growing compute and power demands of artificial intelligence.

Equinix (February 2025): Bloom Energy, a global leader in power solutions, announced today an expansion of its longstanding relationship with Equinix, the world's digital infrastructure company®. The collaboration now exceeds 100MW of electricity capacity to support Equinix's International Business Exchange™ (IBX®) data centers across the United States. With approximately 75MW already operational and another 30MW under construction, this latest expansion marks a significant milestone in the companies' decade-long collaboration. What began as a pilot program in 2015 with just 1MW of fuel cells at a single IBX data center in Silicon Valley has scaled one hundredfold.

The Equinix relationship is particularly instructive. The expansion of Bloom's deal with Equinix to over 100 MW across 19 data centers demonstrates that fuel cells are now being deployed as a primary, baseload power source, solving a critical business continuity problem and unlocking billions in data center investment that would otherwise be stalled.

IX. The Financial Transformation

Record Results

The commercial momentum has translated into financial performance that would have seemed impossible five years ago.

The company reported revenue of $519.0 million for the third quarter of 2025. Third Quarter Highlights: Revenue of $519.0 million in the third quarter of 2025, an increase of 57.1% compared to $330.4 million in the third quarter of 2024.

Product and service revenue of $442.9 million in the third quarter of 2025, an increase of 55.7% compared to $284.5 million in the third quarter of 2024. Gross margin of 29.2% in the third quarter of 2025, an increase of 5.4 percentage points compared to 23.8% in the third quarter of 2024.

The last four quarters have been a record operational and financial performance, and Q3 was no exception. While our commercial success has been most visible, the work our engineering, manufacturing, and support teams have done behind the scenes to drive product cost reduction is evident in our financial results. Highlights include record third quarter revenue, positive cash flows from operating activities, and our seventh consecutive quarter of profitability in our service business.

In 2024, Bloom Energy's revenue was $1.47 billion, an increase of 10.53% compared to the previous year's $1.33 billion. Losses were -$29.23 million, -90.33% less than in 2023.

The improvement in losses is as important as the revenue growth. After decades of burning cash, Bloom is demonstrating operating leverage as it scales.

Capacity Expansion

Annual production capacity expected by December 2026, double 2025 levels. Fuel cell manufacturer Bloom Energy said it is on track to double its annual production capacity to reach 2 GW by the end of 2026.

The company announced they're expanding their capacity to 2 gigawatts by next December. That level of scale should allow Bloom to 4X their 2025 revenue.

X. Bull & Bear Case: Strategic Analysis

The Bull Case

1. First-Mover Advantage in AI Power Infrastructure

Bloom Energy has established itself as the go-to solution for data center operators facing grid constraints. The high-profile agreements with Oracle and Equinix serve as powerful market validation, effectively creating a blueprint for other hyperscalers, colocation providers, and AI-focused companies facing crippling grid-related delays. The most critical signal to watch is deployment velocity.

2. Technological Differentiation

The company says the fuel cells use 15%-20% less fuel to produce the same amount of energy compared with combustion turbines. This efficiency advantage compounds over time, and the solid oxide platform's fuel flexibility positions Bloom for the hydrogen transition when economics permit.

3. Customer Quality & Stickiness

The company's customer base reads like a Fortune 100 roll call. These relationships, built over years, create switching costs and provide visibility into future demand. The Equinix partnership—spanning a decade and now exceeding 100 MW—demonstrates the durability of these relationships.

4. Manufacturing Scale

"With our proven track record of more than 1.3 GW deployed, and a fully functional factory that can deliver GWs of products per year, we are ready and able to meet this rapid electricity demand growth."

The Bear Case

1. Valuation Premium

Would you pay 18 times revenues for shares of a 24-year-old fuel cell maker that has never turned a profit? The stock's extraordinary run has priced in substantial execution on the AI power opportunity.

2. Natural Gas Dependence

Despite this, there have been some concerns over the sustainability of the solution, with the cells predominantly being powered via natural gas due to the cost of hydrogen and the lack of a reliable supply chain. This fact scuppered a deal with Amazon last year, as the hyperscaler canceled a contract to power three of its data centers in Oregon with Bloom fuel cells.

In June, Amazon canceled a contract with the firm to provide gas-powered fuel cells to its data center operations in Oregon. In 2023, the two companies signed an agreement that would have seen Bloom provide fuel cells with a capacity of 24MW to three of Amazon's data center sites. At the time, Amazon was promoting the technology as a low-carbon alternative to using energy from the grid. However, Morrow County gets most of its electricity via hydropower, and the state regulator, the Oregon Department of Environment Quality, said that using fuel cells would lead to facilities emitting the equivalent of 250,000 tons of carbon dioxide annually.

3. Competition

However, competition is fierce. Companies like Plug Power and FuelCell Energy are also targeting data centers with hydrogen and fuel cell solutions. Bloom's edge lies in its execution speed and Oracle's endorsement, which could open doors to other hyperscalers like Microsoft or Google.

Beyond fuel cells, Bloom faces competition from small modular nuclear reactors, battery storage, and eventually grid expansion. The question is whether Bloom can capture enough market share during the current window of grid constraint before alternatives become viable.

4. Execution Risk

Scaling from 1 GW to 2 GW of annual production in a year is ambitious. Supply chain constraints, quality control issues, or delays in raw material sourcing could impact delivery schedules and margins.

Porter's Five Forces Analysis

Threat of New Entrants: MODERATE Solid oxide fuel cell technology requires decades of R&D and substantial capital. However, competitors like Plug Power and FuelCell Energy exist, and well-funded tech companies could potentially develop alternatives.

Bargaining Power of Suppliers: LOW TO MODERATE "We have multiple suppliers in several countries, including the U.S.," Sridhar said. The diversified supply base limits supplier power.

Bargaining Power of Buyers: MODERATE Hyperscalers have significant negotiating leverage, but Bloom's rapid deployment capability and proven reliability create switching costs. The grid constraint crisis gives Bloom unusual pricing power in the current environment.

Threat of Substitutes: HIGH Nuclear small modular reactors, battery storage with renewable generation, and eventually grid expansion all represent alternatives. Bloom's advantage is speed and proven reliability; its vulnerability is the perception of natural gas dependence.

Industry Rivalry: MODERATE TO HIGH Plug Power Inc. PLUG and Bloom Energy Corporation BE are both familiar names operating in the fuel cell technology market. As rivals, both companies are engaged in manufacturing innovative fuel cell product solutions and electrolyzers in the United States and internationally.

Hamilton Helmer's 7 Powers Framework

Counter-Positioning: Bloom's solid oxide technology operates at fundamentally different parameters than competitors' PEM fuel cells. This creates a situation where copying Bloom would require competitors to cannibalize their existing technology bases.

Scale Economies: Manufacturing learning curves are delivering "double-digit, year-over-year cost reductions" that will be difficult for smaller competitors to match.

Switching Costs: Long-term service contracts and site-specific installations create meaningful switching costs for customers like Equinix that have invested heavily in Bloom infrastructure.

Network Economies: Limited—fuel cells are essentially standalone installations.

Cornered Resource: Bloom's 1,000+ patents create meaningful intellectual property barriers.

Process Power: Two decades of manufacturing refinement have created operational knowledge that is difficult to replicate.

Branding: The partnerships with Oracle, Equinix, and Brookfield serve as powerful endorsements that create brand equity in the enterprise market.

XI. Key Metrics for Investors to Monitor

For investors tracking Bloom Energy, three KPIs warrant particular attention:

1. Megawatt Acceptances (Product Deployments)

The core operating metric for the business. This measures actual fuel cell systems deployed and accepted by customers—a leading indicator of both revenue recognition and market penetration. Management targets and actual deployments against those targets reveal execution capability.

2. Gross Margin Progression

Gross margin of 29.2% in the third quarter of 2025, an increase of 5.4 percentage points compared to 23.8% in the third quarter of 2024. The trajectory of gross margin reveals whether manufacturing scale is translating into improved unit economics—the prerequisite for sustainable profitability.

3. Backlog and Pipeline

Given the long sales cycles for large infrastructure projects, announced deals and contracted backlog provide visibility into future revenue. The pace of new announcements indicates whether commercial momentum is accelerating, plateauing, or declining.

XII. Regulatory and Accounting Considerations

Several regulatory and accounting issues warrant investor attention:

Tax Credit Dependence: While less critical than historically, U.S. tax credits, like the 48E and 45V incentives, may reduce deployment costs by up to 30%, making the technology more affordable and scalable. Changes to these incentives could impact customer economics.

Related Party Revenue: Related party revenue—$288 million disclosed in fiscal Q3 2025, specifically tied to joint ventures with Brookfield resulting from small equity investments. The growing share of revenue from related parties warrants monitoring for proper arm's-length pricing.

Service Liability Accounting: The Hindenburg report raised legitimate questions about how Bloom accounts for long-term service obligations. While the company's accounting has been audited and validated, the complexity of multi-decade service contracts requires ongoing scrutiny.

Environmental Claims: Bloom markets its technology as cleaner than grid power, but this claim depends on geography, fuel source, and the specific grid mix being displaced. Regulators in some jurisdictions (like Oregon) have challenged these claims.

XIII. Conclusion: A 24-Year Journey to the Right Place at the Right Time

The Bloom Energy story is, ultimately, a story about timing and patience.

KR Sridhar built technology for Mars that found no market. He pivoted to Earth and built a company that was ahead of its time for nearly two decades. He survived the clean-tech boom and bust, weathered a devastating short-seller attack, and kept his company alive long enough to see the AI revolution create exactly the market his technology was designed to serve.

"AI infrastructure must be built like a factory—with purpose, speed, and scale," said KR Sridhar, Founder, Chairman and CEO of Bloom Energy. "Unlike traditional factories, AI factories demand massive power, rapid deployment and real-time load responsiveness that legacy grids cannot support. The lean AI factory is achieved with power, infrastructure, and compute designed in sync from day one. That principle guides our collaboration with Brookfield to reimagine the data center of the future."

The question for investors is whether the current valuation adequately reflects both the genuine opportunity and the execution risks ahead. Bloom has commercial momentum, technological differentiation, and partnerships with some of the world's most sophisticated infrastructure investors. But it also trades at premium multiples after a 1,000% run, depends on continued AI infrastructure buildout, and faces legitimate questions about its natural gas dependence in a world increasingly focused on zero-carbon energy.

What is clear is that Bloom Energy represents a remarkable story of persistence—of a founder who kept believing in his technology through years of skepticism, a board that kept funding development through years of losses, and a market that finally arrived.

The Bloom Box that Sridhar once showed Lesley Stahl on 60 Minutes, promising it would power American homes, is now powering the artificial intelligence revolution. The market was wrong—just not in the way anyone expected.

Whether the next chapter brings profitability, scaled growth, and shareholder returns commensurate with the current valuation remains to be written. But after 24 years, Bloom Energy has finally found its moment.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music