Celsius Holdings: The Unlikely Rise of America's Hottest Energy Drink

I. Introduction & Episode Roadmap

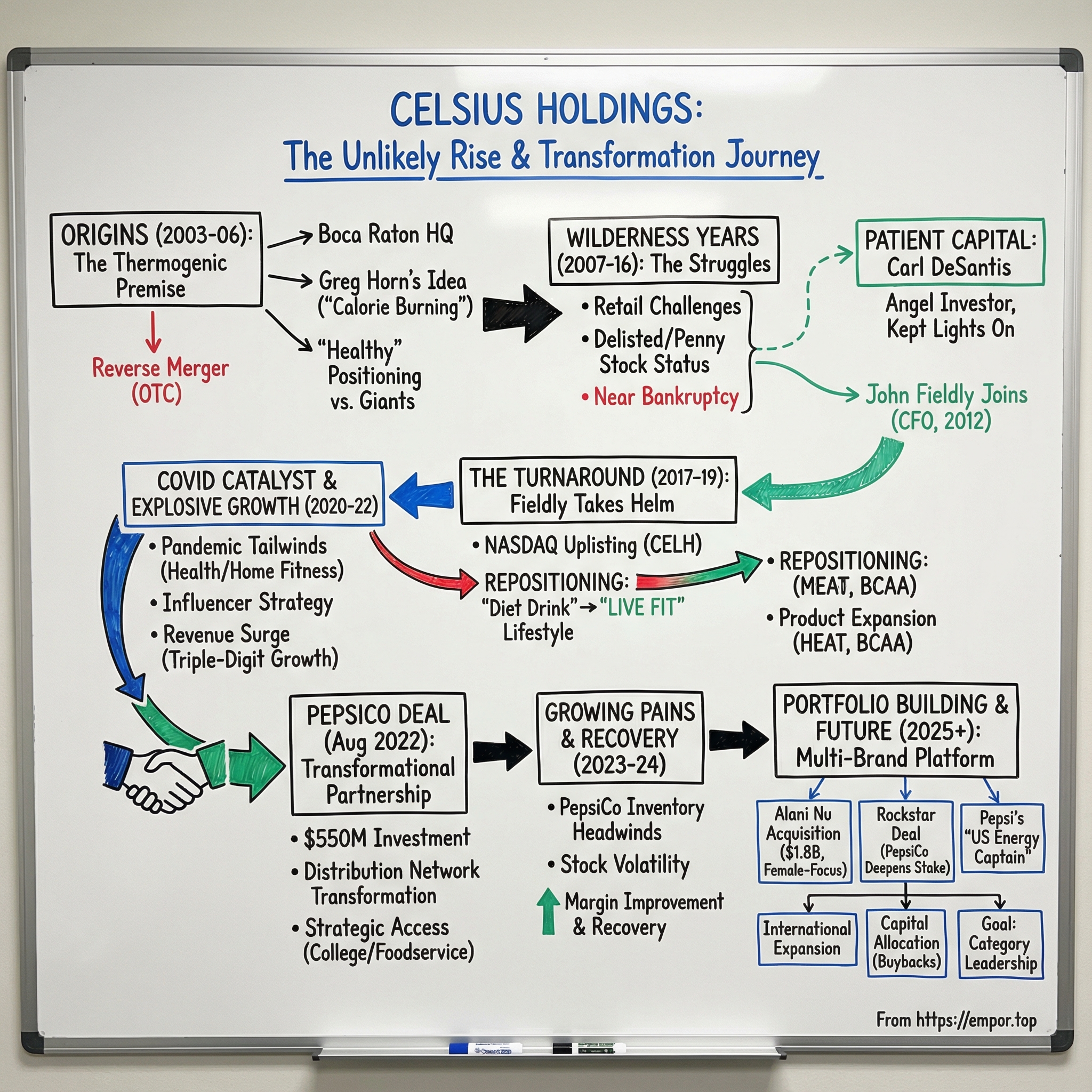

The story starts in a corner of South Florida that knows a thing or two about reinvention. Boca Raton—land of strip malls, golf courses, and plenty of second-act entrepreneurs—became the unlikely home base for one of the strangest, most improbable turnarounds in American consumer products.

As of August 2024, Celsius held about 11% of the roughly $19 billion energy drink market, with more than $1.3 billion in revenue and a market cap around $9 billion. But this wasn’t a clean, modern startup arc—no rocket-ship growth from zero to dominance in a few neat chapters. Celsius got written off, over and over again. It flirted with bankruptcy. It fell out of favor with retailers and investors. It lived as a penny stock. And somehow, it fought its way back to become the third-largest energy drink brand in America.

So the real question isn’t just “How did Celsius grow fast?” It’s: how did a near-dead company selling “thermogenic” energy drinks—positioned around calorie-burning claims—turn into a credible challenger to Red Bull and Monster, and land two transformational moves with PepsiCo?

“When I took over Celsius as the CEO, we did $36 million in total revenue for the year,” CEO John Fieldly told Fortune. “And just now in 2023, we did $1.3 billion.” In consumer packaged goods, where distribution is destiny and shelf space is war, that kind of leap is almost unheard of.

Most people know Celsius as a can they see everywhere now—gyms, convenience stores, college campuses. Far fewer know the turbulence underneath: the years when the company nearly went under, when revenue got cut in half overnight, when it was delisted, and when it seemed easier to shut the whole thing down than to save it. Fieldly didn’t just join a growth story. He walked into a rescue mission.

This is a story about patient capital and a long, bruising path to product-market fit. It’s about a strategic repositioning—from science-y “functional beverage” to fitness lifestyle brand—and what happens when a trend finally meets the right product at the right time. And it’s about distribution: first scraped together through a patchwork network, then supercharged by PepsiCo’s machine.

It’s also a story that’s still unfolding. Celsius didn’t stop at becoming a breakout brand. It moved to buy Alani Nu for $1.8 billion and take over PepsiCo’s Rockstar brand in North America—shifting from a single-brand upstart into something much bigger: a multi-brand energy platform aimed at owning the “better-for-you” future, while still playing in the traditional energy lane.

The path from penny stock to Pepsi partner has lessons on turnarounds, brand building, and the brutal physics of the beverage business. Let’s crack it open.

II. Origins: The Thermogenic Premise (2003–2006)

The Founding Vision

In 2003, Greg Horn looked at the energy drink aisle and saw a gap. Red Bull and Monster were selling adrenaline. Horn wanted to sell something else entirely: energy that came with a second promise—heat. What if a drink could wake you up and help your body burn more calories while you went about your day?

That idea—thermogenic energy—leaned on research suggesting certain ingredients could increase metabolic rate and energy expenditure. Part energy drink, part weight-loss supplement, the concept would be called Celsius.

Horn created the Celsius beverage concept and trademark in 2003 and later licensed it to Elite FX, a company founded in 2004. Even the name did work. Celsius signaled temperature, intensity, and the “thermogenic” hook at the center of the pitch.

Celsius Holdings, Inc. was founded in 2004 and set up headquarters in Boca Raton, Florida—a home base it would keep. From day one, the company tried to sidestep the category’s dominant playbook. Instead of chasing Red Bull’s extreme-sports image or Monster’s loud, oversized-can swagger, Celsius positioned itself as a “healthy” energy drink backed by science.

The original formula centered on a proprietary blend that included green tea extract (with EGCG), guarana seed extract for extra caffeine, and ginger root for flavor and its purported benefits. Depending on the product line and can size, Celsius contained about 200 to 270 milligrams of caffeine. The company marketed the result as “clinically proven” energy, pointing to university studies published in peer-reviewed journals.

That science-first identity became both a tailwind and a trap. It set Celsius apart. But it also made the product feel less like a mainstream beverage and more like something you’d find on a supplement shelf—an important distinction when your business depends on impulse buys and broad appeal.

Early Product & Scientific Positioning

Celsius launched its first products in 2005, walking into a market already shaped—some would say owned—by two giants. Red Bull had basically written the category’s origin story. Monster was rapidly taking share with aggressive marketing and bigger cans that screamed value.

Celsius made a different bet: a “calorie-burning” energy drink for the diet-conscious consumer. The product claimed it could help burn up to 140 calories per bottle. Whether that read as rigorous science or savvy marketing, it did what every challenger brand needs early on: it gave people a reason to notice.

But it also created a positioning problem. An energy drink marketed like a diet product lives in an awkward middle. The student grabbing a can before an all-nighter isn’t counting calories. The fitness consumer counting macros isn’t always looking for carbonation and an energy-drink ritual. Celsius was aiming at two audiences with two different motivations—and it wasn’t yet clear which one would carry the brand.

Going Public via Reverse Merger

In 2006, Celsius went public through a reverse merger and began trading over the counter. Later, the company—then known as Vector Ventures, Inc.—changed its name to Celsius Holdings, Inc. in January 2007.

Reverse mergers were a well-worn shortcut for small companies: faster and cheaper than a traditional IPO, with the added benefit of public-market access. On paper, it meant liquidity for early backers and a new option for raising capital.

In practice, OTC trading was its own kind of purgatory. Liquidity was thin. Institutions stayed away. The stock lived in a world where perception can be as damaging as fundamentals. It’s often where ambitious stories go to fade out—and Celsius would spend years fighting that gravity.

Because the early 2000s were not kind to undercapitalized beverage startups. Red Bull was spending at a scale Celsius couldn’t dream of and had built a distribution machine to match. Monster had landed a transformational distribution deal with Anheuser-Busch. Celsius had an idea, a differentiated pitch, and a small team in Boca Raton.

What it didn’t have was the one thing the beverage business demands above all: a clear path to scale.

III. The Wilderness Years: Struggling to Find Product-Market Fit (2007–2016)

Early Retail Challenges

From 2007 through 2016, Celsius wandered in the wilderness. It was almost a full decade of near-misses and near-death experiences—years where the company repeatedly flirted with extinction.

And it wasn’t because the drink tasted bad. In fact, blind taste tests suggested consumers actually liked it. The problem was everything around the liquid: distribution, marketing, capital, and the simple fact that Celsius was trying to win shelf space from incumbents with billion-dollar playbooks.

Before John Fieldly arrived, Celsius had managed to get into major U.S. retailers. That sounds like success—until you remember the next rule of beverages: getting on the shelf is only the beginning. If your cans don’t move, you don’t get to stay. Celsius struggled to build consistent consumer pull, sales didn’t rotate, and the company burned cash trying to fix the gap. It slid into penny stock territory and, more than once, nearly ran out of money.

The industry’s feedback loop is ruthless. Slow sales lead to lost shelf space. Lost shelf space leads to fewer sales. Fewer sales mean less marketing. And without marketing, you don’t earn your way back onto shelves. Celsius got trapped in that spiral.

Carl DeSantis: The Patient Angel Investor

If Celsius has an unlikely hero before the comeback, it’s Carl DeSantis.

DeSantis wasn’t a typical venture capitalist hunting for the next hot thing. He was a Florida entrepreneur who’d already built and sold Rexall Sundown—one of the biggest vitamins and supplements businesses in the country—to Royal Numico for $1.8 billion in 2000. By the time Celsius crossed his radar, he’d built the kind of fortune that lets you operate on your own clock. Forbes pegged his net worth around $3.4 billion.

He also had a reputation for collecting businesses the way other people collect hobbies. As Fieldly once put it: “Some people collect cars. That’s not his M.O.—Carl collects businesses.”

DeSantis kept investing because the product line interested him, and in 2010 he extended a $3 million credit line to fund an advertising campaign around Celsius’s newer products. It didn’t work the way anyone hoped. Awareness didn’t break through. Sales didn’t suddenly snap into place. The company kept struggling.

That’s the unglamorous truth of turnarounds: sometimes you spend real money and nothing happens.

But DeSantis didn’t bail. As a major stakeholder, he stayed involved—advising the team and pushing for leadership changes in 2012 when the business wasn’t meeting expectations. Through CDS Ventures, his family investment vehicle, he continued to provide capital and became Celsius’s financial backstop and dominant shareholder.

Years later, that patience looked genius. DeSantis ultimately earned about $1.2 billion from a 31% stake in Celsius—on a position that, in 2012, most investors would have considered a total write-off.

International Experiments

In 2009, Celsius launched in Sweden and finished the year with revenue of 5.86 million.

The move wasn’t random. Scandinavia had a reputation for health-conscious consumers, and the region offered a different environment for functional beverage positioning. Sweden became both a testing ground and, importantly, a source of revenue during a period when the U.S. business was wobbling.

But international expansion also came with a cost: attention and capital. Celsius was still fighting to survive at home, and every effort spent abroad was effort not spent fixing the core U.S. engine.

The Gerry David Era & John Fieldly's Entry

By the time John Fieldly entered the picture, Celsius was in rough shape. It had been listed, then delisted, from NASDAQ. Retailers had pulled it from shelves. Investors treated it like a penny stock curiosity rather than a real consumer brand.

Fieldly’s path to that moment was not glamorous either. He worked during the day and went to college at night, starting out at a drug manufacturer, becoming a CPA, and building a career the hard way. His most formative training, though, came earlier—during eight years at Eckerd Drugs, where he started in customer service and worked his way up to assistant manager.

“That experience really benefits me at Celsius,” he said, “as well really helping me understand the path to purchase with shoppers.” At Eckerd, he’d been part of turnaround efforts in underperforming stores while attending the University of South Florida. In other words: he didn’t just understand spreadsheets. He understood what actually happens inside a store—how shoppers behave, what shelves signal, and what it takes to change velocity.

The leadership shift that set Celsius up for its next phase began when Gerry David came in as the turnaround CEO. David recruited Fieldly to join him as CFO in 2012, a pairing that would end up mattering far more than anyone could have guessed at the time.

Fieldly has described that entry simply: “I joined Celsius over 13 years ago, back in 2012… I started off as their CFO, part of our original turnaround team.”

In 2012, the public market basically valued Celsius at about $5 million. Not five billion. Five million—roughly the price of a nice beach house in Boca Raton. On paper, the company was almost nothing.

But that was also the strange opportunity: when you’re already written off, you’re free to rebuild from fundamentals. And for Fieldly, with retail instincts and a finance background, Celsius wasn’t a broken growth story. It was a salvage job—one that would eventually become something much bigger.

IV. The Turnaround: John Fieldly Takes the Helm (2017–2019)

Leadership Transition

By 2017, Celsius had survived long enough to earn a new problem: it needed real leadership continuity. The turnaround wasn’t going to come from one big bet. It was going to come from doing a hundred small things right—tightening execution, rebuilding credibility, and keeping the business alive while it tried to grow.

Fieldly had joined in January 2012 as Chief Financial Officer. In March 2017, when Gerry David stepped back, Fieldly took on an uncomfortable but telling assignment: he became both Interim CEO and CFO, running the company while still managing the numbers. A year later, in April 2018, the “interim” label came off and he was formally appointed CEO. (He would later become Chairman in August 2021.)

What’s striking is that the CEO role wasn’t simply handed to him because he’d been there. As Fieldly tells it, the board ran a full search. “The company was looking for a CEO at the time,” he said. “They actually went through a variety of interviews. I was, I guess, younger than who they were looking for.” After watching attempt after attempt, he pushed for a shot: “I told Gerry I wanted in on the interview process, and I could run this company.”

His pitch wasn’t flashy. It was operational. “Performance, drive, passion, execution,” he said. “Look at what was accomplished over a year and a half—it was pretty much flawless execution.” In a business that had spent years lurching from crisis to crisis, that was exactly what the board needed to hear.

The NASDAQ Uplisting: A Critical Milestone

The biggest signal that Celsius was becoming something more than a penny-stock survival story came in 2017: the company uplisted to NASDAQ and began trading under the ticker CELH.

By the end of that year, Celsius was doing nearly $36 million in annual revenue—about 60% growth over 2016. It wasn’t a lot in absolute terms; against the giants of the category, it was still tiny. But the uplisting mattered far more than the number.

NASDAQ wasn’t just a new exchange. It was a new tier of legitimacy. It opened the door to institutional investors who couldn’t touch OTC stocks. It gave distributors and retailers a reason to take Celsius seriously again. And it forced the kind of corporate governance and financial discipline that helps a brand stop feeling like a long shot and start feeling like a real company.

The uplisting announcement came from Co-Chairman William H. Milmoe, with Fieldly—still wearing both the CEO and CFO hats—credited for driving the company’s growth trajectory. For Celsius, it was a rare kind of milestone: not a finish line, but proof it had earned the right to keep running.

Strategic Repositioning: From "Diet Drink" to "Fitness Lifestyle"

Once the company stabilized, the next question was existential: what, exactly, was Celsius in the consumer’s mind?

Under Fieldly, the answer moved decisively away from “diet drink with science claims” and toward something broader: a fitness lifestyle brand. That can sound like marketing-speak, but for Celsius it was a strategic reset. The team stopped treating the can like a list of ingredients and started treating it like a badge—something you’d choose because it said something about you.

Fieldly described the ambition plainly: Celsius needed to stand for something iconic. Not just “here’s what’s inside,” but “here’s what this brand means.” Because features can differentiate, but they don’t always create loyalty. Lifestyle does. Red Bull sells a feeling. Monster sells an identity. Celsius needed its own version—one that matched a consumer who cared about health, energy, and performance.

“Live Fit” became the organizing idea. Messaging shifted away from clinical weight-loss framing and toward an aspirational, everyday fitness identity. Packaging did work here too: slim cans, bright colors, and fruit-forward flavors that felt modern and premium—visually distinct from Monster’s aggressive, masculine aesthetic and Red Bull’s minimalist, European look.

Of course, repositioning a brand doesn’t automatically fix your distribution problems. Celsius still had baggage. Distributors remembered it as a brand that had stalled out, and some dismissed it as a “fitness gym rat” product that didn’t belong in mainstream beverage. So Celsius leaned into the one place it could win first: the fitness community. Build awareness there, generate real pull, and let demand do what pitches can’t.

That “gym rat” label wasn’t purely an insult. It was also proof of authenticity. The plan was to own the niche, then expand outward—rather than trying to be everything to everyone again.

Product Line Expansion

With the brand strategy clearer, Celsius began building a lineup that could stretch across different use cases without losing the core identity.

CELSIUS HEAT was positioned as a higher-caffeine, pre-workout offering for more serious athletes. CELSIUS Originals stayed as the core, everyday product. CELSIUS Essentials leaned more functional, adding aminos for consumers who wanted that extra performance cue.

It was a familiar playbook in energy—one Monster had used effectively with sub-brands and extensions. Different variants, different occasions, one consistent umbrella. The goal wasn’t complexity for its own sake. It was reach: more reasons to pick Celsius, more moments in the day when it made sense, and more doors into the category—all without abandoning what made the brand feel distinct in the first place.

V. The COVID Catalyst & Explosive Growth (2020–2022)

Pandemic Tailwinds

By 2020, Celsius had finally found a clearer identity and a sharper playbook. Then the world changed—and the change tilted directly into Celsius’s strengths.

The pandemic created a strange set of conditions that supercharged “better-for-you” brands. People weren’t just buying drinks. They were buying reassurance. Labels mattered. Ingredients mattered. “Zero sugar” and “functional” stopped sounding like niche fitness jargon and started sounding like responsible choices.

At the same time, fitness culture didn’t disappear when gyms closed—it relocated. Living rooms turned into spin studios. Garages turned into weight rooms. Workouts moved onto screens, and pre-workout rituals came with them. Celsius didn’t need to convince consumers to try energy; it just needed to be the can that matched the new at-home, wellness-forward vibe.

Distribution helped too. With fewer commutes and more local errands, convenience stores and quick trips became even more important. Celsius had been building momentum in those channels, and it benefited as shopping patterns shifted.

And then the growth numbers started looking unreal.

Celsius entered its PepsiCo era on the back of more than a year of triple-digit retail growth. In 2021, domestic revenue jumped 186% to $273 million, while international revenue grew 17% to $41.2 million. Gross profit rose 111% to $128.2 million. By Q1 2022, the company reported revenue up 167% year-over-year to $133.4 million, including $123.5 million from North America. Even more striking: distributor revenues in the quarter were up 395% over the prior year.

That kind of acceleration is almost unheard of in consumer staples. Celsius wasn’t just growing—it was hitting an inflection point.

Brand Ambassador & Influencer Strategy

Celsius didn’t try to win this moment with traditional advertising. It went where attention had already moved.

The brand leaned into influencers and social media personalities who fit the “Live Fit” image, partnering with creators like Jake Paul and David Dobrik. The pitch was simple: Celsius wasn’t the loud, edgy energy drink. It was the one you could hold in a selfie without breaking character—health-conscious, fitness-forward, and native to Instagram and TikTok.

That strategy helped Celsius reach younger consumers who were increasingly skeptical of polished commercials but highly responsive to creators they followed every day.

But the company also carried baggage from earlier celebrity marketing. In 2021, Celsius faced a lawsuit from rapper Flo Rida over breach of contract claims related to an ambassador deal from 2014 to 2018. The case ended with a Florida court ruling in Flo Rida’s favor, and in January 2023 he was awarded $82.6 million.

It was a painful reminder that when a brand is small, sponsorship deals feel like scrappy growth hacks. When the brand becomes big, those same contracts can turn into very expensive liabilities.

Distribution Network Building

If branding is what gets consumers to care, distribution is what turns that care into revenue. In beverages, you can’t win from the sidelines. You have to be cold, visible, and everywhere.

Before PepsiCo entered the picture, Celsius stitched together a patchwork of independent distributors—many of them Anheuser-Busch houses. And here’s where timing got weirdly lucky.

In 2020 and 2021, as PepsiCo’s relationship with Bang Energy deteriorated, many distributors suddenly had a hole in their energy portfolios. Celsius stepped into that vacuum. AB houses that needed a fast-growing energy brand increasingly embraced Celsius—and that broader DSD footprint helped the brand show up in more fridges, more often, with less friction.

This mattered because Celsius wasn’t just building demand online. It was converting that demand in the real world—one cooler door at a time.

Revenue Explosion

The results from this period read less like a beverage company and more like a breakout tech story.

In the first quarter of 2022, Celsius’s U.S. revenue surged 217% to $123.5 million. And that wasn’t a one-off spike—it was part of a sustained run:

- 2020: Revenue approximately $130 million

- 2021: Revenue approximately $314 million

- 2022: Revenue approximately $654 million

- 2023: Revenue approximately $1.32 billion

Three straight years of triple-digit growth is rare in any consumer category. In energy drinks—where the incumbents have massive budgets, entrenched distribution, and decades of brand equity—it’s almost surreal.

Celsius had spent years trying to earn the right to matter. And suddenly, it did.

VI. The PepsiCo Deal: A Transformational Partnership (August 2022)

The Deal Structure

Celsius had spent years clawing for distribution one independent truck route at a time. Then, on August 1, 2022, it landed the kind of partnership that changes a company’s trajectory overnight.

PepsiCo and Celsius announced a long-term strategic distribution arrangement, paired with a $550 million investment. PepsiCo agreed to invest in Celsius in exchange for roughly 7.33 million shares of convertible preferred stock, giving the beverage giant an 8.5% ownership stake. PepsiCo also gained the right to nominate a director to Celsius’s board.

The distribution agreement, effective August 1, 2022, transitioned Celsius’s U.S. distribution into PepsiCo’s system across retail and food service channels, subject to certain exceptions.

And crucially, it wasn’t a buyout. The deal was designed as a partnership: Pepsi would bring the muscle—distribution, execution, channel access—while Celsius kept control of the brand. That mattered, because the scrappy, fitness-forward identity Celsius had built was the whole reason Pepsi wanted in. The goal was to scale it, not dilute it.

Why PepsiCo Needed Celsius

For PepsiCo, the timing wasn’t subtle. Energy was one of the fastest-growing beverage categories outside of alcohol, and soda wasn’t exactly a growth engine anymore. Pepsi had been trying to build a real position in energy—and it had the scars to prove it.

In early 2020, Pepsi bought Rockstar for $3.85 billion, hoping to reignite a legacy brand. It also bet on another insurgent, Bang Energy, through an exclusive distribution deal. That relationship fell apart, ending in a legal fight that Pepsi won, and the two companies split earlier than expected in June 2022.

So Pepsi found itself in an awkward place: it needed a winner in energy, and its recent moves weren’t delivering. Meanwhile, Celsius—an upstart that had once looked like a penny-stock footnote—was ripping up the category and had even overtaken Rockstar in U.S. popularity.

Celsius was the fastest-growing brand in the fastest-growing segment. It had momentum and loyalty. What it didn’t have was Pepsi-scale reach. PepsiCo did. The partnership fit both sides’ needs almost too neatly.

Distribution Transformation

Celsius had built its rise with a network of more than 250 independent distributors, many of them instrumental in getting the brand onto shelves. But that patchwork system came with real friction: inconsistent execution, uneven inventory, and the sheer overhead of managing so many partners.

Under PepsiCo, Celsius could trade fragmentation for a single, highly disciplined direct store distribution machine. The company expected the deal to expand distribution by about 40% over the next year, opening doors in places that are notoriously hard to penetrate without a giant behind you: independent convenience stores, college campuses, military bases, vending, and foodservice. Just as importantly, it reduced the operational cost of juggling hundreds of distributor relationships.

By 2022, Fieldly told GQ that roughly 95% of stores around the country were stocked with Celsius—a level of availability that’s incredibly hard to achieve without a partner like Pepsi pushing cases, managing resets, and fighting for cooler space.

This is the unsexy truth of beverages: distribution doesn’t just help you sell more. It can turn a great brand into a default choice, because the best product in the world can’t win if it isn’t cold and within arm’s reach.

Strategic Value Beyond Distribution

The partnership wasn’t just about getting into more stores. It was about getting into the right places—where habits form.

Fieldly explained it this way: “PepsiCo has access to 61% of the college population where they have exclusive contracts, so that’s going to bring us to college campuses, and we know we’re resonating extremely well with 18 to 24-year-olds, the next generation in the energy category. We align really well with their health and wellness goals for their lifestyle. Food service is another big opportunity. We’re more than just an energy drink. You’re seeing a lot of consumers drink Celsius with their lunch, which expands the usage occasion. PepsiCo has a massive food service department that really opens us up to fast-casual restaurants, cafeterias and office buildings. It really is a transformational partnership for the company.”

That college-campus piece is especially powerful. Energy drink loyalty gets set early. If you become the can that’s always available in the dining hall, the student union, the campus store—if you’re the brand someone grabs at 18—you don’t just win a quarter. You can win a decade.

VII. Growing Pains & Recent Challenges (2023–2025)

The PepsiCo Inventory Headwinds

If the PepsiCo deal was the rocket booster, 2024 was the reminder that rocket boosters also kick up a lot of exhaust.

After years of eye-popping growth, Celsius ran into a very unglamorous problem: inventory. PepsiCo had built up significant product as it ramped Celsius onto its system, and then—inevitably—that inventory had to normalize. On paper, it looked like the story was suddenly slowing.

For the 12 months ended December 31, 2024, revenue rose just 3% to $1,355.6 million, up from $1,318.0 million the year before. Management pointed to the timing of orders from its largest distributor, along with heavier promotional activity and incentive programs.

After three straight years of triple-digit growth, 3% felt like slamming the brakes. Investors didn’t just see a slowdown; they worried Celsius had finally hit the ceiling.

The pain was most visible in Q3 2024, when revenue came in at $265.7 million—down versus the same quarter the prior year. The company framed the decline as inventory normalization rather than a collapse in consumer demand, but the market doesn’t love nuance in the middle of a growth scare.

Stock Price Volatility

The stock reacted the way high-expectation growth stocks tend to react: violently.

Celsius hit an all-time high of about $96 in March 2024. By late 2025, it was trading in the high $30s—down more than 60% from peak levels. As of November 23, 2025, shares last closed at $38.99, implying a market capitalization of roughly $10.05 billion, more than 40% below its 52-week high of $66.74.

For anyone who bought near the top, that drawdown was brutal.

But for long-term holders, the more important question wasn’t the chart. It was whether the business had actually broken—or whether it was just digesting the biggest distribution change in company history.

2024-2025 Recovery

The key to reading Celsius in 2024 was separating shipments from sell-through.

Yes, reported revenue was up only 3%. But retail sales—the consumer demand measured at the register—grew 22% year-over-year, and category share climbed 160 basis points to 11.8% in 2024. That gap is the story: PepsiCo’s inventory moves muted reported revenue even while consumers kept buying more Celsius.

Profitability also moved in the right direction. Gross profit increased 7% to $680.2 million, and gross margin improved to 50.2% from 48.0% the prior year.

In other words, behind the inventory noise, Celsius still looked like a scaled brand: gaining share, expanding margins, and benefiting from the “better-for-you” tailwind that helped create the breakout in the first place.

VIII. The Alani Nu Acquisition & Rockstar Deal: Building a Portfolio (2025)

Acquiring Alani Nu

By early 2025, Celsius wasn’t thinking like a one-brand challenger anymore. It was thinking like a platform.

In February 2025, the company announced its most ambitious move yet: a definitive agreement to acquire Alani Nutrition LLC (Alani Nu) for $1.8 billion, including $150 million in tax assets—for a net purchase price of $1.65 billion—paid through a mix of cash and stock.

Alani Nu, founded in 2018, had built a fast-growing, female-focused business spanning functional beverages and wellness products. The brand’s tone was aspirational but accessible, and it resonated with a community of Gen Z and millennial consumers. Strategically, it gave Celsius something energy drinks rarely come with: deeper access to female consumers driving incremental category growth.

The combination also fit a pattern Celsius had already started to prove out. Unlike traditional energy brands that skew heavily male, Celsius had reached a roughly even gender split among consumers. Alani Nu leaned even harder in that direction—92% of its social following was female—making the two brands feel complementary rather than redundant.

In announcing the deal, Celsius pointed to Alani Nu’s scale and economics: 2024 sales of $595 million and EBITDA of $87 million, plus an expectation of $50 million in cost synergies within two years of closing. Celsius also noted the brand’s growth trajectory—Nielsen data showing nearly 60% consumption growth in 2024 within energy drinks and a 4.4% market share—and said the acquisition was expected to be accretive to cash EPS in year one, with closing targeted for the second quarter of 2025.

Celsius ultimately completed the Alani Nu acquisition for $1.8 billion, creating a combined CELSIUS and Alani Nu portfolio designed to compete as a broader “better-for-you” functional beverage player, not just a single breakout can.

PepsiCo Deepens Its Stake: The Rockstar Deal

Then came the sequel—this time with PepsiCo.

Just months after the Alani Nu acquisition closed, Celsius announced an expanded partnership with PepsiCo that reshaped both companies’ energy strategy. PepsiCo bought $585 million of newly issued convertible 5% preferred stock in Celsius, increasing its ownership stake to about 11%. In return, Celsius acquired PepsiCo’s Rockstar Energy Drink brand in the U.S. and Canada.

The structure was telling. Pepsi wasn’t just distributing Celsius anymore—it was doubling down, adding another board seat, and consolidating its energy ambitions under Celsius’s umbrella. Celsius, meanwhile, wasn’t just buying a brand. It was absorbing a legacy energy franchise that Pepsi had paid $3.85 billion for in 2020—then handing it to a company that had recently shown it could still grow energy drinks in a crowded category.

Going forward, Celsius Holdings became PepsiCo’s strategic energy lead in the U.S., managing CELSIUS, Alani Nu, and Rockstar, while PepsiCo continued to lead distribution for the portfolio across the U.S. and Canada. The pitch was a unified commercial strategy: fewer seams, more coordination, and a cleaner story for retailers.

“This will now allow us to put the fastest cars on the track, as they say,” CEO John Fieldly explained, describing how the portfolio now covered distinct parts of the market: Celsius as “healthy, better for you,” Alani Nu as “female-focused,” and Rockstar as “traditional energy.”

The Combined Portfolio

“Now we’ve got the Rockstar brand that is more on the core energy side. We’ve got Celsius and Alani Nu, which are more modern energy and more female forward.”

Put simply, Celsius built a three-brand lineup that could play across the entire category: - Celsius: health-conscious consumers and a fitness lifestyle identity, with a roughly 50/50 male-female split - Alani Nu: female-focused energy and wellness, built around Gen Z and millennial community - Rockstar: classic, traditional energy, with more conventional flavors and a more male-skewing audience

If the PepsiCo deal in 2022 solved distribution, these 2025 moves aimed to solve something bigger: category coverage. Celsius was no longer just trying to be the third major brand in energy. It was trying to become the house that could hold multiple winners at once.

And the scale shift was dramatic. Celsius said that in 2020 it had about $150 million in retail sales—and by 2025, that figure had grown to $5 billion, with a projected $6 billion the following year.

IX. The Competitive Landscape: Energy Drink Wars

The Big Three Becomes Four

Once Celsius stitched together Celsius, Alani Nu, and Rockstar, the story stopped being “a scrappy challenger catches fire” and became something more threatening to the incumbents: a portfolio with real momentum.

On recent year-over-year sales growth, Celsius’s combined portfolio posted the biggest dollar gain—about $337 million—outpacing Red Bull (about $275 million) and Monster (about $237 million). That’s the key dynamic: Red Bull and Monster are still bigger, but Celsius has been the one changing the scoreboard fastest.

At the top of U.S. energy, the hierarchy is now pretty clear:

- Red Bull (~35% share): the category’s creator, premium positioning, Austrian heritage, and a marketing machine built on extreme sports and events

- Monster (~27% share): big cans, aggressive branding, and Coca-Cola’s distribution muscle

- Celsius portfolio (~21% share including Alani Nu and Rockstar): the fastest-growing “better-for-you” platform, scaled through PepsiCo

- Everyone else: Ghost, C4, Prime, and a long tail of smaller brands fighting for what’s left

Together, the top five brands account for nearly 85% of the market. In other words: this category may look chaotic on Instagram, but at the shelf it’s consolidating. Red Bull and Monster still win on legacy and footprint. Celsius is winning on velocity—especially in mass retail and convenience, where repeat purchases turn into share.

Market Dynamics

Zoom out and the tailwind is obvious. The U.S. energy drink market is projected to grow from about $20.7 billion in 2024 to about $41.4 billion by 2033—roughly 8% annual growth.

That’s fast for beverages. And when the category is expanding that quickly, you can grow even if you’re not stealing share. But Celsius has done both: it’s ridden the “energy everywhere” wave, and it’s taken share from incumbents by offering something that feels aligned with modern consumer taste—especially zero- or low-sugar options with a wellness halo.

That broader shift has also boosted “performance energy” as a segment, which has grown to about a fifth of the category. Celsius’s fitness-and-wellness positioning has been a major driver of that mix shift.

Strategic Positioning Analysis

One way to understand why this has been so hard for competitors to stop is to strip away the brand hype and look at the underlying forces.

Porter’s Five Forces paints a pretty clear picture:

- Threat of New Entrants (Moderate): It’s easy to make a caffeinated drink. It’s brutally hard to get it everywhere. Distribution and shelf space are the gatekeepers, and the big networks—PepsiCo, Coca-Cola bottlers, and AB InBev houses—act like toll roads to national scale.

- Bargaining Power of Suppliers (Low): The inputs are mostly commodity ingredients, and co-manufacturing is widely available.

- Bargaining Power of Buyers (Moderate): The Walmarts and Costcos of the world control space and promotions, and they use that leverage. But energy drinks also drive traffic and carry strong margins, which gives the big brands real negotiating power too.

- Threat of Substitutes (Moderate): Coffee and tea compete for the same “I need energy” moment. But energy drinks have carved out a distinct, portable, socially coded ritual—especially for younger consumers.

- Competitive Rivalry (High): This is a knife fight. Red Bull and Monster have enormous budgets and decades of shelf advantage. New brands keep showing up. Everyone battles for cold-box placement, endcaps, and the right to be the grab-and-go default.

Hamilton Helmer’s 7 Powers helps explain Celsius’s specific edge:

- Brand (Strong): “Live Fit” isn’t just a slogan—it’s a coherent identity for a health-conscious energy consumer.

- Scale Economies (Emerging): As Celsius has grown, its costs and capabilities have improved—and PepsiCo accelerates that curve.

- Network Effects (Weak): This isn’t social media; people don’t drink Celsius because their friends drink Celsius.

- Counter-Positioning (Strong): Celsius’s better-for-you posture is difficult for Red Bull and Monster to copy without confusing what they stand for.

- Switching Costs (Weak): Consumers can switch instantly. Loyalty exists, but it isn’t structural.

- Cornered Resource (Moderate): The PepsiCo relationship functions like a strategic asset—exclusive access to a world-class distribution system and commercial resources.

- Process Power (Moderate): Celsius has built repeatable muscle in influencer-driven, digital-native marketing that’s harder to replicate than it looks.

The takeaway is simple: energy is consolidating into a few giants, but it’s also evolving. Celsius didn’t just grow into the category—it grew into the category’s next chapter, and then bought the pieces to play every part of it.

X. Investment Considerations & Key Performance Indicators

Financial Profile

By November 2025, Celsius sat in a strange, familiar place for a company that’s spent its whole life defying expectations: the brand looked bigger and more strategically important than ever, but the public market was still trying to figure out what the “real” earnings power of the business actually was.

As of November 2025, Celsius had an enterprise value of $11.59 billion, with a trailing P/E of 316.00 and a forward P/E of 24.45.

That gap is doing a lot of storytelling. The trailing P/E is distorted by one-time charges and integration costs from a year of major portfolio moves. The forward P/E—around 24x—matters more, because it reflects what analysts think Celsius can earn once Alani Nu and Rockstar are fully integrated and the financials look more “normal.”

Those expectations were fueled by a very loud quarter. In the third quarter of 2025, revenue jumped 173% year over year, driven by the additions of Alani Nu and Rockstar, alongside continued growth in the core Celsius brand. CELH ended the quarter with nearly $806 million in cash, supported by strong operating cash flow and solid liquidity despite an acquisition-heavy year. Gross margin expanded by 530 basis points to 51.3%.

And Celsius didn’t just grow; it also started cleaning up the balance sheet. After quarter-end, the company reduced debt by $200 million, bringing total debt down to about $700 million. It also cut its term loan rate by 75 basis points, a move expected to reduce annual interest expense by roughly $20 million starting in 2026.

Key Performance Indicators to Track

If you’re trying to track whether Celsius is actually winning—beyond the headlines and the quarterly noise—three metrics matter most:

-

Retail Dollar Sales Growth (reported by Circana/Nielsen): This is the cleanest read on true consumer demand, because it isn’t distorted by distributor inventory swings. If retail sales are rising, the brand is healthy even if reported revenue gets choppy.

-

Market Share in the RTD Energy Category: This is the scoreboard. Share gains mean Celsius is taking ground from Red Bull, Monster, and the rest. Share losses are the earliest warning that the brand is losing its edge.

-

Gross Margin: This is the signal for pricing power and operational discipline. Celsius has expanded gross margin from roughly the mid-40s to the low-50s in recent years. If margins keep widening, that suggests brand strength and improving execution. If they compress, it can point to heavier promotions, rising costs, or both.

Myth vs. Reality

| Myth | Reality |

|---|---|

| Celsius is just another fad energy drink | Celsius has been compounding for more than a decade, survived multiple near-death moments, and now operates with major CPG-grade distribution infrastructure. |

| PepsiCo will eventually acquire Celsius outright | It’s possible, but the current structure already gives PepsiCo many of the benefits of owning the energy business without making a full acquisition. As Fieldly put it when asked about the speculation: “This is an established model in the industry.” |

| The 2024 revenue slowdown signals growth is over | The slowdown was largely inventory normalization at PepsiCo, not a collapse in demand. In 2024, Celsius contributed 30% of all category growth, gained 160 basis points of share to 11.8%, and total distribution points increased 37%. |

| The Alani Nu and Rockstar acquisitions are too risky | The core CELSIUS brand’s retail sales were up 13% year over year, while Alani Nu grew 114%. The acquisitions broaden the portfolio across different consumer segments and reduce reliance on a single brand. |

Risk Factors

Integration Risk: Celsius is integrating two major acquisitions while also moving Alani Nu onto PepsiCo’s distribution system. That’s a lot of operational change at once, and execution missteps could slow momentum.

Competition: Red Bull and Monster are deeply entrenched, extremely well-funded, and unlikely to sit still. More marketing and more promotional pressure are the obvious counterpunches.

Category Deceleration: If energy drink growth slows materially, Celsius’s valuation becomes harder to support, especially after the portfolio expansion.

Regulatory Risk: Energy drinks face ongoing scrutiny around caffeine levels and marketing to younger consumers. Changes in regulation could reshape how the category is sold and advertised.

Consumer Preference Shifts: “Better-for-you” is a powerful tailwind—until it isn’t. Consumers could swing back toward traditional offerings or migrate to substitutes like coffee and other functional beverages.

Legal Overhang: Celsius has faced class action lawsuits. While it has settled previous litigation, ongoing legal costs—and the risk of future settlements—remain a real overhang.

XI. Looking Ahead: The Road to Category Leadership

The 2025 Portfolio Transformation

If 2022 was the year Celsius found its rocket booster in PepsiCo’s distribution machine, 2025 was the year it stopped being a one-brand phenomenon and started acting like an energy platform.

Celsius entered 2025 as essentially a single-brand company doing about $1.36 billion in revenue. It was on track to exit the year with a multi-brand lineup—and pro-forma revenue approaching $2.5 billion—thanks to the additions of Alani Nu and Rockstar.

Wall Street adjusted quickly. Over the past 90 days, full-year revenue estimates rose from about $2.16 billion to $2.46 billion for 2025, and from about $2.72 billion to $3.23 billion for 2026. Earnings estimates also moved up: from $0.78 to $0.81 per share for 2025, and from $1.10 to $1.33 for 2026. The Zacks Consensus Estimate implies earnings growth of roughly 80% in 2025 and about 21% in 2026.

The point isn’t the precision of any one forecast. It’s the direction: the market started pricing Celsius less like a single hit product—and more like a scaled portfolio with multiple ways to grow.

International Expansion

The next frontier is outside the U.S.

International markets like Canada, the UK, and Australia offer a familiar setup: rising demand for premium, functional beverages and consumers increasingly drawn to “better-for-you” positioning. Celsius already has a foothold—especially in Scandinavia, where it’s maintained a presence for more than a decade—and it has expanded into additional European markets more recently.

The opportunity is meaningful, but it won’t be free. International growth in energy can outpace the U.S. in many regions, yet it still requires the hard work Celsius knows well: building brand relevance and earning distribution market by market.

“We’ve got some momentum we’re building with the Celsius brand internationally,” Fieldly said. “Alani Nu is largely not outside the US, but I think over time, we’ll look at opportunities for Alani internationally.”

The PepsiCo Relationship

If Celsius has a single strategic advantage that’s hard to replicate, it’s this: its deepening partnership with PepsiCo.

Fieldly framed the new dynamic plainly: “Stepping into the role of PepsiCo’s strategic energy drink captain in the U.S. is expected to be a pivotal milestone in our journey to shape the future of modern energy and grow our brands within a leading beverage distribution system. With a proven functional beverage portfolio and a stronger long-term partnership with PepsiCo, we believe that Celsius Holdings is well-positioned to deliver greater innovation, sharper execution and sustained brand growth.”

“Energy drink captain” is corporate language, but the practical meaning is straightforward: Celsius now helps steer the strategy for three energy brands inside PepsiCo’s system. That brings real leverage—on shelf placement, promotions, execution standards, and how new products get prioritized.

In a category where distribution is destiny, being the strategic lead inside one of the world’s most powerful beverage networks is about as close to high ground as it gets.

Capital Allocation

Celsius also started acting like a more mature public company. It announced a new $300 million share repurchase authorization, pointing to strong cash generation and a healthy balance sheet—and emphasizing that it can buy back stock while still investing behind its now multi-brand portfolio.

A buyback like this sends a clear message: management believes the stock is undervalued at current levels, and it wants the option to offset dilution from stock-based compensation and acquisition-related share issuance.

After two decades of fighting for survival, Celsius is now making a different kind of decision—how to deploy excess capital while still pushing for category leadership.

XII. Conclusion: From Penny Stock to Category Challenger

If you zoom out, Celsius reads like the kind of turnaround that shouldn’t happen in consumer products—because the beverage business usually doesn’t hand out second chances.

In 2012, the market was valuing Celsius at roughly $5 million. A little more than a decade later, it had grown into an energy platform with an enterprise value north of $11 billion. The brand that once got delisted and squeezed off shelves now sits near the center of the category conversation—with a combined portfolio that has become a real challenger in U.S. energy.

That transformation wasn’t magic. It was a chain of hard-to-replicate advantages stacking on top of each other:

Patient capital: Carl DeSantis provided the runway Celsius needed to survive the years when survival was the only goal. Most investors would have walked away. He stayed—and ultimately earned about $1.2 billion from a 31% stake.

The right operator at the right moment: John Fieldly brought a rare mix of financial discipline and retail instincts. He understood what the numbers meant, but he also understood how velocity gets built—what needs to happen in a store, a cooler, and a distributor relationship for a brand to actually move. And he had the conviction to fight for the CEO seat when others weren’t sure he fit the profile.

A positioning reset that matched the culture: Celsius stopped trying to win as a science-forward “diet” product and started building an identity—a fitness lifestyle brand that could ride the wellness megatrend without feeling like a supplement in a can.

Distribution as the force multiplier: the PepsiCo partnership didn’t just add doors. It added execution. It gave Celsius access to places where habits get formed—college campuses, food service, national retail—at a speed that would’ve been almost impossible to achieve independently.

Timing: the pandemic didn’t create Celsius, but it accelerated the consumer shift toward “better-for-you” choices and at-home fitness rituals—exactly where Celsius already had credibility.

Taken together, those ingredients produced something rare: a brand that didn’t just grow—it escaped gravity.

For investors, that makes Celsius both compelling and complicated. The company has proven it can build a brand, run a turnaround, and leverage a strategic partnership with one of the world’s biggest beverage companies. The energy drink category still has strong underlying growth. And with Celsius, Alani Nu, and Rockstar now under one roof, the competitive positioning may be the strongest it’s ever been.

But the risks are real too. Integrating acquisitions, managing a multi-brand portfolio at scale, and defending share against Red Bull and Monster is the kind of challenge that breaks plenty of “next big things.”

Still, Celsius has already demonstrated the hardest part: it can survive long enough to be right. A company that nearly died multiple times now has a credible shot at shaping where the category goes next.

The story isn’t finished. But the arc so far—penny stock to PepsiCo partner, niche product to platform—offers a clean lesson in consumer products: persistence matters, patience matters, and distribution is destiny.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music