Blaize Holdings: The Edge AI Chip Startup That Bet Against NVIDIA

I. Introduction: A Contrarian Bet in the AI Arms Race

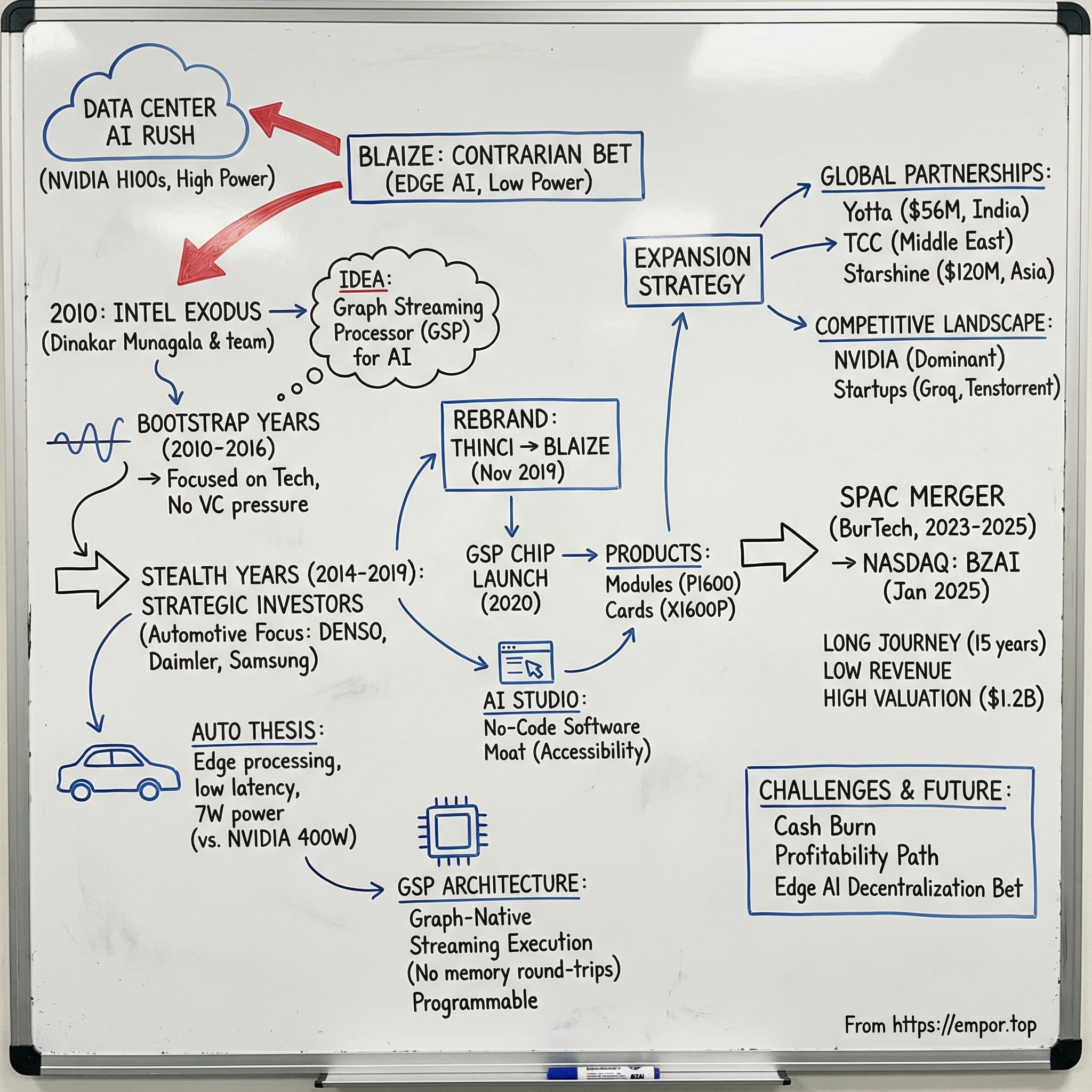

In the great AI chip gold rush of the 2020s, nearly every semiconductor startup and tech giant has focused their firepower on one battlefield: the data center. NVIDIA's H100s and now Blackwell chips sell faster than they can be manufactured, commanding astronomical prices and generating $25 billion in annual revenue. Cloud giants like Amazon, Microsoft, and Google pour billions into custom silicon for their sprawling server farms. It's a bloodbath where only the largest, best-capitalized players can survive.

And then there's Blaize—a company that has spent fifteen years deliberately running in the opposite direction.

"Blaize today emerged from stealth and unveiled a groundbreaking next-generation computing architecture that precisely meets the demands and complexity of new computational workloads found in artificial intelligence (AI) applications." That announcement came in November 2019, but the story began nearly a decade earlier, when a group of Intel engineers looked at the future of computing and made a contrarian bet: that the real opportunity wasn't in massive cloud data centers but at the edge—where data is created, where decisions must be made in milliseconds, and where power consumption matters.

In January 2025, Blaize completed its business combination with BurTech Acquisition Corp., a publicly-traded special purpose acquisition company. The combined company began trading on Nasdaq under the ticker symbols "BZAI" and "BZAIW" on January 14, 2025.

The central question this article seeks to answer: How did a group of former Intel engineers spend fifteen years building a chip company in stealth, only to go public via SPAC with minimal commercial traction but billions in total addressable market opportunity ahead of them?

The answer reveals something important about the semiconductor industry, about the timeline required to build genuinely novel chip architectures, and about the emerging market for AI at the edge—a market that may ultimately dwarf the data center opportunity everyone else is chasing.

The total addressable market for AI accelerators silicon for edge applications is estimated at approximately $34.3 billion in 2024, and expected to grow to over $63.7 billion by 2030. Blaize's innovative AI hardware and software solutions are poised to capitalize on this explosive growth.

But getting there has been anything but easy.

II. Founding Story: The Intel Exodus (2010-2014)

The Architects Leave Intel

Picture Santa Clara in 2010. Intel remains the undisputed king of semiconductors, its processors powering virtually every PC and server on the planet. But inside the company's sprawling campuses, a small group of engineers sees something troubling on the horizon: the fundamental architecture that has dominated computing for decades is hitting its limits for emerging AI workloads.

Dinakar Munagala spent 12 years at Intel where he held pivotal roles in graphics processor micro-architecture and design and feature ownership in the mobile and graphics engineering group, as well as with the Intel Centrino platforms. Programs included Intel's next generation multi-core, multi-threaded graphics chips, and the architecture for Intel's first integrated CPU/GPU product family.

Munagala wasn't some junior engineer with a wild idea—he was an architect who had shaped Intel's graphics strategy through multiple generations of chips. Before Blaize, Dinakar spent over a decade at Intel, leading architecture and design for multi-core graphics chips including Sandy Bridge, Ivy Bridge, and Ironlake—products foundational to Intel's graphics strategy and developed across multinational teams.

The insight that drove Munagala to leave was deceptively simple but architecturally profound: traditional CPU and GPU architectures were designed for the computing problems of the past, not the AI-centric workloads of the future. Neural networks, he realized, had a fundamentally different computational structure—they could be represented as graphs, with data flowing from node to node. Munagala became drawn to the idea that intelligence—real, useful intelligence—needed to move closer to where data is created. He spent 12 years at Intel, where he helped design their next-generation multi-core graphics chips and worked on the first product line that combined CPU and GPU technologies into a single platform. In 2010, a few of us left Intel with a big idea: reimagine how AI could work in the real world, outside the walls of data centers.

The Bootstrap Years

Blaize was formerly known as ThinCI Semiconductor. It was founded in 2010 and is based in El Dorado Hills, California.

The name "ThinCI"—pronounced "Think-Eye"—captured the founding vision: a new kind of processor for machine vision and AI that would fundamentally rethink how neural networks are processed in hardware. But building a new chip architecture from scratch requires patience measured in years, not months.

Starting with a bootstrapped development effort to create a more energy efficient processor architecture for the needs of a new generation of computing, Dinakar has led Blaize in delivering a transformational compute solution that unites silicon and software to optimize AI at scale from the edge to the core.

For six years—from 2010 to 2016—Munagala and his co-founders worked without external funding. In an industry where chip startups typically raise tens of millions of dollars before even designing their first test chip, this was almost unheard of. The bootstrap approach served two purposes: it kept the team focused on technical development rather than investor management, and it allowed them to develop their core architectural innovations without the pressure of quarterly board meetings demanding evidence of commercial traction.

Dinakar holds a Bachelor of Engineering degree, Electrical and Computer Engineering, from Osmania University, India, and a Master of Science degree, Electrical and Computer Engineering, from Purdue University, USA. He is credited with 5 IP/Patent filings.

The technical work during these years would prove foundational. The team developed what they called the Graph Streaming Processor (GSP) architecture—a chip design built from the ground up to process neural networks in their native graph form, rather than forcing them through architectures designed for other types of computation.

III. The Stealth Years: Building the GSP Architecture (2014-2019)

Breaking Stealth for Capital

Six years of bootstrapping eventually gave way to the realities of chip development economics. The nine-year-old startup's claimed system-on-chip performance is impressive, to be fair, which is likely why it's raised nearly $100 million from investors including automotive component maker Denso. Blaize emerged from stealth with $87 million raised over several venture rounds from strategic and venture backers Denso, Daimler, SPARX Group, Magna, Samsung Catalyst Fund, Temasek, GGV Capital, SGInnovate, and Magna.

The investor list tells a story. Notice who's not there: typical Silicon Valley venture capitalists looking for quick returns. Instead, the cap table was dominated by strategic investors—automotive suppliers like DENSO and Magna, automakers like Daimler (Mercedes-Benz), and Samsung's venture arm. These weren't investors looking to flip their stake in two years. They were potential customers making early bets on technology they hoped would power the next generation of autonomous vehicles.

The Automotive Thesis

Why automotive? Because the car is perhaps the ultimate edge computing challenge. A self-driving vehicle generates terabytes of sensor data every hour—from cameras, lidar, radar, and ultrasonic sensors. Processing that data in the cloud isn't just impractical; it's dangerous. The latency involved in sending data to a server farm and waiting for a response could mean the difference between avoiding an obstacle and catastrophic collision.

Lead investor and partner Denso has helped Blaize advance its GSP architecture in the automotive field. Given that many customers have been playing with Blaize's hardware and software for a year, Blaize is confident that its GSP will be designed into industrial, automotive, retail stories and factory floors on the edge.

The automotive focus shaped Blaize's entire development philosophy. Unlike chips designed for data centers—where you can afford to use massive amounts of power and generate significant heat—automotive chips must operate within tight thermal and power envelopes. A chip running inside a hot engine bay can't draw hundreds of watts of power like an NVIDIA H100. This constraint became a feature, not a bug, driving Blaize toward an architecture optimized for efficiency.

The Test Chip: El Cano

Blaize developed a graph streaming processor (GSP), codenamed El Cano, for AI edge applications as well as real time video processing and sensor fusion. The fully programmable engine consists of 16 cores and can handle up to 16TOPS of 8bit integer operations and has been used for a range of boards costing from $300 to $1000.

The chip is built on Samsung's 14nm process technology and has a power consumption of 7W.

Seven watts. That number is crucial for understanding Blaize's positioning. An NVIDIA A100 GPU—a workhouse of data center AI—draws up to 400 watts. Even NVIDIA's Jetson modules designed for edge applications consume 10-30 watts. Blaize was targeting power consumption that would allow their chip to run inside cameras, embedded systems, and autonomous vehicles without requiring elaborate cooling solutions.

The architectural approach was radical: rather than compile neural network models into sequences of traditional instructions, Blaize's chip would receive the neural network as a graph structure and execute it natively. When Blaize's hardware, using OpenVX to accelerate computer vision applications presents graphs completely. In contrast, Val Cook, Blaize's director of products, noted he's skeptical that Graphcore's processor can represent graphs natively throughout its entire process.

IV. Emerging from Stealth: The Blaize Rebrand (November 2019)

The Big Reveal

November 12, 2019 marked the end of nearly a decade of stealth development. Blaize today emerged from stealth and unveiled a groundbreaking next-generation computing architecture that precisely meets the demands and complexity of new computational workloads found in artificial intelligence (AI) applications. Driven by advances in energy efficiency, flexibility, and usability, Blaize products enable a range of existing and new AI use cases in the automotive, smart vision, and enterprise computing segments, where the company is engaged with early access customers.

The rebranding from ThinCI to Blaize was both practical and strategic. "ThinCI" had caused confusion—people didn't know how to pronounce it, and it didn't immediately convey the company's AI focus. "Blaize" (a play on "blaze") suggested speed, energy, and the fiery processing power at the heart of their technology.

"Blaize was founded on a vision of a better way to compute the workloads of the future by rethinking the fundamental software and processor architecture," said Dinakar Munagala, Co-founder and CEO.

Industry Reaction: Skeptical Curiosity

The semiconductor analyst community greeted Blaize's emergence with a mixture of intrigue and frustration. The company claimed dramatic efficiency improvements—10-100x better system efficiency compared to traditional architectures—but provided limited technical details to validate those claims.

"Yes, Blaize does look strong and ahead of others such as Groq and Intel (Habana). It is a low-power solution, targeting areas below Nvidia Xavier and Jetson." Karl Freund, senior analyst at Moor Insights & Strategy added, "It will take some time before we will have in-depth comparisons." Pressed to compare Blaize's solution with Nvidia's Xavier, Freund said, "Well, the Xavier is higher cost and power, but with many different types of processors, including CPU, GPU, DLA, etc. Blaize is lower on all three."

The strategic positioning was becoming clearer: Blaize wasn't trying to compete with NVIDIA in the data center. "The proliferation of AI across multiple industries and application areas is dependent upon robust, programmable, efficient, scalable, high-performance hardware, that extends AI processing from cloud datacenters through to the end device, server or appliance," noted Aditya Kaul, Research Director at Tractica. "It's becoming clear that traditional processing architectures will not be enough to meet the demands of this new emerging market, with new techniques like graph-based computing showing promise."

V. The GSP Chip Launch & Product Development (2020-2022)

First Silicon Ships

The launch of the first-generation graph streaming processor (GSP) chip in 2020 marked a pivotal moment, bringing the technology to market and validating the vision.

Getting functional silicon out of a fabrication plant is one thing; turning it into products customers can actually buy is another. Blaize took a deliberate approach to product strategy: rather than trying to sell bare chips (which would require customers to design their own boards and systems), they would offer complete platforms.

Munagala emphasized that his company isn't in the business of selling chips. It offers modules and plug-in cards. The first product on the Pathfinder platform is the P1600 embedded system-on-module, priced at $399 in volume. The credit card-size module, integrated with Arm CPU and Blaize GSP, is a standalone system—without a host processor—that can go inside cameras, for example.

The product lineup evolved to address different segments: - Pathfinder P1600: A system-on-module for embedded applications - Xplorer X1600P: A PCIe accelerator card for industrial PCs and servers - Xplorer X1600P-Q: A higher-performance variant for edge data center applications

With 16 TOPS AI inference performance at 7W power, 50x less memory bandwidth, and 10x lower latency, GSP-based platforms deliver up to 60% greater systems efficiency.

The Software Strategy: AI Studio

Perhaps Blaize's most underappreciated strategic decision was their emphasis on software. In the chip industry, hardware companies typically treat software as an afterthought—necessary for customers to use the chip, but not a core competitive advantage. Blaize took the opposite approach.

In December 2020, Blaize fully unveiled the Blaize AI Studio offering, the industry's first open and code-free software platform to span the complete edge AI operational workflow from idea to development, deployment and management. AI Studio dramatically reduces edge AI application deployment complexity, time, and cost by breaking the barriers within existing application development and machine learning operations (MLOps) infrastructure that hinder edge AI deployments. Eliminating the complexities of integrating disparate tools and workflows, along with the introduction of multiple ease-of-use and intelligence features, AI Studio reduces from months to days the time required to go from models to deployed production applications.

The no-code approach was a strategic choice aimed at expanding the potential customer base. Traditional AI chip deployment requires specialized machine learning engineers who understand both the underlying hardware and complex software frameworks like TensorFlow or PyTorch. These engineers are scarce and expensive. By offering a visual, drag-and-drop interface, Blaize hoped to make AI deployment accessible to "domain experts"—the factory floor managers, retail operations teams, and security professionals who understood their business problems but lacked coding expertise.

AI Studio is the first open and code-free software platform to span the complete edge AI operational workflow, dramatically reducing deployment time, complexity, cost and efficiency. AI Studio is built as an accessible platform for all non-developers – domain experts, AI teams, devops teams – to put AI ideas into production quickly and easily. With a code-free, visual interface, AI apps are built with drag-and-drop operations, and conversational interface assists and guides users throughout the AI development workflow.

VI. Strategic Funding & Automotive Partnerships (2021-2023)

The Strategic Investor Model

Blaize previously raised $224 million from strategic investors such as DENSO, Mercedes-Benz AG, Magna, and Samsung and financial investors such as Franklin Templeton, Temasek, GGV, and Bess Ventures.

What's notable about Blaize's funding history is who invested and why. Unlike many AI chip startups that raised from traditional venture capital firms seeking financial returns, Blaize's largest investors were potential customers—automotive suppliers and automakers who would eventually need to deploy AI chips in millions of vehicles.

This created a unique dynamic: strategic investors were paying Blaize engineering fees to develop automotive-grade versions of their chips, generating revenue while simultaneously validating the technology. The relationships with DENSO (Japan's largest automotive parts supplier) and Mercedes-Benz represented potentially massive future chip sales—if Blaize could deliver automotive-grade silicon.

But "automotive-grade" is where the timeline challenge becomes apparent. Automotive chips must meet stringent reliability requirements—they need to function reliably for the 15-20 year lifespan of a vehicle, across extreme temperature ranges, while meeting rigorous safety certification standards (ISO 26262). This qualification process takes years.

The Series D and Growing Momentum

In April 2024, Blaize announced it had raised $106 million from existing investors, including Bess Ventures, Franklin Templeton, DENSO, Mercedes-Benz AG, and Temasek and new investors Rizvi Traverse, Ava Investors and BurTech LP LLC.

The April 2024 round—one of the final private financings before the SPAC merger—brought total funding to over $330 million. Blaize has raised over $330 million from strategic investors such as DENSO, Mercedes-Benz AG, Magna, and Samsung and financial investors such as Franklin Templeton, Temasek, GGV, Bess Ventures, BurTech LP LLC, Rizvi Traverse, and Ava Investors.

The investor base revealed the challenge of Blaize's positioning: sophisticated investors with long time horizons (sovereign wealth funds like Temasek, long-term asset managers like Franklin Templeton) understood the semiconductor industry's extended development cycles. But the years of development with limited commercial revenue was starting to test even patient investors' resolve.

VII. The SPAC Deal: Going Public via BurTech (2023-2025)

Why SPAC?

By late 2023, Blaize faced a strategic decision familiar to many deep-tech startups: how to access the public markets to fund continued development without having the commercial traction that traditional IPO investors typically demand.

Blaize, a provider of AI-enabled edge computing solutions, announced that it has entered into a definitive agreement to combine with BurTech Acquisition. The proposed transaction values Blaize at a pro forma enterprise value of $894 million.

The SPAC route offered several advantages. Unlike a traditional IPO, which requires extensive roadshows and relies on institutional investor appetite, a SPAC merger provides a more predictable path to public markets. BurTech Acquisition Corp., owned by Burkhan World Investments, specialized in technology investments and understood the long-term nature of Blaize's opportunity.

Shahal Khan, CEO and Chairman of BurTech, commented, "Today marks the beginning of an extraordinary journey as BurTech agrees to combine with Blaize. The potential in the field of edge AI is immense, and this partnership positions the combined company for success. We are honored to have garnered strong backing from visionary investors, a testament to the revenue and growth potential in our journey. Our confidence in Blaize's management team is unwavering."

Pre-Merger Funding and Convertible Notes

$116 million convertible notes issued from August 2023 through February 2024, together with additional funding that is expected to be received by the combined company upon closing of the business combination, reflects the importance BurTech placed on securing funding for the combined company to position the combined company for sustained growth.

The SPAC transaction was structured to ensure Blaize would have adequate runway post-merger. The SPAC that merged with Blaize is called BurTech Acquisition Corp. The deal valued Blaize at $1.2 billion and gives the chipmaker access to a $116 million convertible note, with $36 million in additional funding planned once the transaction closes.

The Nasdaq Debut

The Business Combination, approved at a special meeting of BurTech shareholders on December 23, 2024, begins a new period in Blaize's growth in bringing artificial intelligence to the edge. The Business Combination marks a major milestone for Blaize as it continues building its transformative new compute solution that unites silicon and software to optimize AI from the edge to the core.

When trading began on January 14, 2025, Blaize entered public markets with something rare among tech IPOs: a 15-year history and a chip architecture proven in production, even if commercial traction remained limited.

Blaize has strong traction with over $400 million in a qualified pipeline of prospective customers it expects to engage in 2025 and a global footprint with Tier 1 supply chain relationships.

VIII. Technology Deep Dive: The Graph Streaming Processor

Why Graph-Native Matters

To understand Blaize's competitive position, you need to understand the fundamental insight behind the Graph Streaming Processor architecture.

Neural networks—the mathematical structures underlying modern AI—are inherently graphs. A neural network consists of nodes (neurons) connected by edges (weights), with data flowing from input layers through hidden layers to output layers. This is fundamentally different from traditional sequential computation, where a processor executes instructions one after another.

The Blaize Graph Streaming Processor (GSP) architecture is powerful, energy efficient and adaptable to overcome the limits on computing that keep AI, machine learning and deep learning from doing all it can do.

Traditional processors—including GPUs—were designed for different problems. GPUs excel at graphics rendering because they can perform the same operation on many data points simultaneously (parallel processing). This capability makes them useful for AI, but they weren't designed for AI from the ground up. Blaize's Graph Streaming Processor introduces a shift away from traditional hardware architectures. Instead of saving and loading a lot of data all the time like a graphics processing unit (GPU) does, it sends the data from one part to another only when it's needed. This saves energy and works faster, directly aligning with the real-time requirements of edge AI applications.

The Technical Approach

The fully programmable GSP architecture leverages task level parallelism and streaming execution processing in an intuitive manner, enabling developers to take advantage of extremely low energy consumption, high performance and superior scalability.

The key innovation is "streaming execution." Traditional processors load data from memory, perform operations, save results back to memory, then load the next piece of data. Each memory access consumes energy and takes time. In a neural network, these memory operations can dominate the computational cost.

Blaize's approach streams data through the chip, passing intermediate results directly from one processing unit to the next without unnecessary memory round trips. Blaize's GSP architecture stands out for its low power, low latency, and high scalability, achieved through a unique streaming execution model and task-level parallelism.

Programmability vs. Efficiency Trade-off

One strategic choice deserves attention: programmability. Blaize could have built a custom chip optimized for specific neural network architectures—the approach taken by some competitors. Instead, they built a fully programmable processor that could run different neural network architectures.

Blaize GSP is the first fully programmable processor architecture and software platform that is built from the ground up to be 100% graph-native.

This choice has implications. A programmable chip is more flexible—it can run new AI models as they're developed. But programmability typically comes at an efficiency cost compared to custom ASICs designed for specific workloads. Blaize bet that the rapidly evolving AI landscape would reward flexibility over pure performance.

IX. The Global Expansion Strategy (2024-2025)

The Regional Partnership Model

Post-IPO, Blaize has pursued an aggressive international expansion strategy, partnering with regional players rather than trying to build direct sales channels in every market.

Blaize Holdings announced that Yotta Data Services, India's leading sovereign AI, sovereign cloud infrastructure, and platform services provider, is Blaize's end customer under its $56 million edge AI initiative. Through this partnership, the Blaize AI Platform is powering Yotta's Hybrid AI infrastructure, transforming more than 250,000 cameras to deliver real-time insights at scale across India. The rollout began earlier this year, and deployments are planned through 2026.

The $56 million Yotta deal represents Blaize's largest commercial contract to date and validates their technology in one of the world's fastest-growing markets for AI infrastructure. India's combination of massive population, rapidly expanding surveillance infrastructure, and emphasis on "digital India" initiatives creates natural demand for edge AI solutions.

Middle East Expansion

Blaize has formed a strategic partnership with Technology Control Company (TCC) to advance AI infrastructure in Saudi Arabia, focusing on energy-efficient solutions for the Gulf Cooperation Council industries. This collaboration includes joint training workshops and the co-development of AI applications for public safety and smart infrastructure.

The Middle East expansion aligns with Gulf states' Vision 2030-type initiatives that emphasize economic diversification and smart city development. These regions have capital to deploy, ambitious infrastructure plans, and increasing focus on "AI sovereignty"—the desire to process sensitive data locally rather than sending it to foreign cloud providers.

The Starshine Partnership

A $120 million multi-phase contract with Starshine to deploy hybrid AI platform infrastructure across various industries in Asia represents another major deal. This strategic alliance aims to deliver TCO (Total Cost of Ownership) advantages through Blaize's hybrid computing approach combining its Graph Streaming Processor (GSP) with GPUs.

X. Playbook: Business & Strategy Lessons

Lesson 1: The Contrarian Market Position

Blaize's most important strategic decision was choosing not to compete where everyone else was fighting. The data center AI chip market is dominated by NVIDIA, with AMD, Intel, and well-funded startups like Groq and Tenstorrent all vying for position. It's a market measured in tens of billions of dollars annually, but the competition is brutal.

This partnership introduces significant competitive implications, particularly for companies heavily invested in cloud-centric AI processing. Blaize's focus on "physical AI" and decentralized processing directly challenges the traditional model of relying on massive data centers for all AI workloads, potentially compelling larger tech companies to invest more heavily in their own specialized edge AI accelerators or seek similar partnerships.

By focusing on edge computing—where power efficiency, compact form factors, and real-time processing matter more than raw performance—Blaize carved out a position where their architectural advantages shine and NVIDIA's brute-force approach is less applicable.

Lesson 2: Strategic Investors as Development Partners

Using strategic investors (DENSO, Mercedes-Benz, Magna) as both funding sources and development partners created a virtuous cycle. These investors provided capital while simultaneously providing engineering fees and design specifications that helped shape Blaize's product roadmap. The downside: dependence on a small number of large customers for both funding and future revenue.

Lesson 3: Software as Competitive Moat

The investment in AI Studio differentiates Blaize from pure-hardware competitors. In enterprise markets, the ability to deploy AI without extensive coding expertise addresses a genuine market pain point—the shortage of ML engineers. AI Studio delivers AI-driven, application end-to-end data operations, development operations, and Machine Learning operations tools. The AI Software Platform reduces dependency on critical resources like Data Scientists and Machine Learning engineers, reduces the time from development to deployment, and makes it easier to manage edge AI systems over the product's lifetime.

Lesson 4: The Semiconductor Timeline Reality

Blaize's journey—15 years from founding to IPO—illustrates the extended timelines inherent in building novel semiconductor architectures. Unlike software companies that can iterate rapidly, chip development requires multi-year design cycles, expensive fabrication runs, and extensive testing before products reach customers. Patient capital and patient management are prerequisites for success.

XI. Competitive Landscape & Porter's Five Forces Analysis

Understanding the Battlefield

Blaize's top competitors include Groq, Tenstorrent, and Foundry. But the competitive landscape varies significantly depending on which market segment you examine.

Threat of New Entrants: MODERATE-HIGH

The AI chip boom has attracted billions in venture funding to new semiconductor startups. New entrants, such as Cerebras Systems, Graphcore, Groq, Blaize, NeuReality, and Ampere, are all vying for mind share and more AI ecosystem influence as AI chip buyers investigate their best alternatives to NVIDIA's proposition.

However, the barriers to entry remain formidable. Designing a new chip architecture requires deep technical expertise and years of development time. Tenstorrent has secured $693 million in funding as part of an investment round valuing the company at $2.6 billion. Tenstorrent is intent on storming the AI chipset market and posing a long-term challenge to dominant market leader NVIDIA. The capital requirements—often $50-100+ million just to tape out a single chip design—limit the field to well-funded competitors.

Bargaining Power of Suppliers: HIGH

As a fabless semiconductor company, Blaize depends on foundries (primarily Samsung for its 14nm process) to manufacture its chips. Global fab capacity constraints have created challenges for smaller chip companies competing for manufacturing slots against larger customers. Headquartered in El Dorado Hills (CA), Blaize has more than 220 employees worldwide.

Bargaining Power of Buyers: HIGH

Large enterprise customers and automotive OEMs have significant leverage. Long qualification cycles—especially in automotive—give buyers ample time to evaluate alternatives. The concentration of revenue among a small number of strategic customers increases their bargaining power.

Threat of Substitutes: HIGH

NVIDIA GPUs remain the default choice for most AI workloads, even at the edge. NVIDIA's Jetson product line specifically targets edge applications, offering a comprehensive hardware and software ecosystem. Tenstorrent and other AI chipset vendors have their work cut out as NVIDIA offers a comprehensive AI platform designed for enterprise-level generative AI applications. The company's full-stack AI solutions encompass both hardware and software components. This includes NVIDIA's specialization in GPUs, which are particularly well suited for AI tasks due to their ability to perform parallel computations efficiently.

Industry Rivalry: VERY HIGH

The global edge AI market size was estimated at USD 20.78 billion in 2024 and is projected to reach USD 66.47 billion by 2030, growing at a CAGR of 21.7% from 2025 to 2030.

The market is large and growing rapidly, but competition is intense. Well-funded competitors like Groq, Tenstorrent, and Hailo are all pursuing AI chip opportunities, while established players (Intel, Qualcomm, AMD) bring massive resources to bear.

XII. Hamilton's 7 Powers Analysis

1. Scale Economies: WEAK

In 2024, Blaize Holdings's revenue was $1.55 million, a decrease of -59.70% compared to the previous year's $3.86 million. Losses were -$61.20 million.

With minimal revenue, Blaize lacks the manufacturing scale that would drive cost advantages. Competitors like NVIDIA ship millions of GPUs annually, driving down per-unit costs through volume.

2. Network Effects: MODERATE

Blaize's software ecosystem—particularly AI Studio—could create network effects as more developers adopt the platform and share models, workflows, and applications. With AI Studio, users can deploy models with one click to plug into any workflow across multiple open standards including ONNX, OpenVX, containers, Python, or GStreamer. No other solution offers this degree of open standard deployment support. The challenge is achieving critical mass in a market where NVIDIA's CUDA ecosystem has decades of developer investment.

3. Counter-Positioning: STRONG (Potential)

This is perhaps Blaize's most powerful strategic advantage. Blaize's focus on "physical AI" and decentralized processing directly challenges the traditional model of relying on massive data centers for all AI workloads, potentially compelling larger tech companies to invest more heavily in their own specialized edge AI accelerators or seek similar partnerships.

NVIDIA's business model centers on high-performance, high-power, high-price chips for data centers. Responding to Blaize's positioning would require NVIDIA to compete in low-power, low-cost edge applications—potentially cannibalizing their higher-margin business.

4. Switching Costs: MODERATE-HIGH

Long automotive qualification cycles create significant switching costs once a chip is designed into a vehicle platform. Software ecosystem investments similarly create lock-in. However, until customers have made significant design-in investments, switching costs remain low.

5. Branding: WEAK

Blaize lacks consumer awareness and competes against NVIDIA's formidable brand in AI computing. In enterprise sales, this matters less than performance, price, and support, but brand recognition influences R&D and procurement decisions.

6. Cornered Resource: MODERATE

Blaize has filed 49 patents. The company's unique GSP architecture represents genuine technical IP. Whether this constitutes a truly "cornered resource" depends on how effectively patents protect against competitors developing alternative approaches.

7. Process Power: MODERATE

Blaize's positioning around data sovereignty and air-gapped deployments resonates in defense and government markets where data cannot leave national borders. Given the growth of the digital economy and the boom of the AI industry, there has also been increasing interest in the concept of AI sovereignty. As countries continue to integrate AI into sensitive sectors such as government agencies, healthcare and defence, guarantees around data storage and infrastructure continuity have taken on greater importance.

XIII. Bear vs. Bull Case

The Bear Case

Minimal Commercial Traction: After 15 years of development and over $330 million in funding, Net revenue for fiscal year 2024 decreased to $1.6 million from $3.9 million in the prior year. The gap between potential and actual revenue remains vast.

Extended Path to Profitability: The company's Q1 2025 earnings showed substantial net loss of $147.6 million, compared to $16.7 million in the same quarter last year. The company's cash position stood at $45 million as of the end of Q1, down from $50.2 million at the end of 2024, with $13.1 million used for operations during the quarter.

Competitive Intensity: In addition to NVIDIA, Tenstorrent faces a growing field of AI chipset rivals. AMD and Intel already offer AI chipsets. New entrants, such as Cerebras Systems, Graphcore, Groq, Blaize, NeuReality, and Ampere, are all vying for mind share.

Single Generation Chip: The first-generation GSP chip launched in 2020. Five years without a second-generation chip raises questions about product roadmap execution.

Stock Volatility: The security has experienced substantial declines in the lead-up to the earnings release, with shares down over 23% in the past week and more than 51% over the last month.

The Bull Case

Strong Pipeline: Roth/MKM noted that cost- and power-efficient AI accelerators like those from Blaize have been optimized for edge inference applications and are increasingly being used in data center hybridization, which is expected to create a $30 billion total addressable market by 2030. The firm highlighted Blaize's $176 million in design wins as of the second quarter of 2025 and a $725 million opportunity pipeline.

Major Contract Wins: Blaize Holdings revealed that Yotta Data Services is the end customer for its previously announced $56 million edge AI initiative. The partnership will deploy Blaize's AI platform across more than 250,000 cameras throughout India, transforming them into real-time analytics endpoints for public safety and security applications.

Growing Market: Blaize is strategically poised to capture a significant share of the rapidly expanding global market for edge AI solutions, which is projected to be valued at $71.3B by 2028. Blaize's market strategy targets opportunities across three core sectors: the security and monitoring market, valued at $20 billion in 2024 and forecasted to grow to over $42 billion by 2028.

Strategic Investor Validation: The continued participation of sophisticated investors like DENSO, Mercedes-Benz, Temasek, and Franklin Templeton suggests informed parties believe in the long-term opportunity.

Revenue Acceleration: Blaize Holdings reported a substantial increase in revenue for the third quarter of 2025, with a sequential rise of 499%, reaching $11.9 million.

XIV. KPIs to Watch

For investors tracking Blaize's progress, three metrics warrant close attention:

1. Design Win Conversion Rate

Blaize reports "design wins"—customer commitments to use Blaize technology in their products—before those designs translate into chip sales. The firm highlighted Blaize's $176 million in design wins as of the second quarter of 2025. The critical question is how quickly design wins convert to revenue, and at what margin.

Watch for: Quarterly disclosure of design win pipeline, and more importantly, the lag time between design win announcements and actual revenue recognition. In automotive, this lag can extend years. In smart infrastructure projects like the Yotta deal, conversion should be faster.

2. Gross Margin Evolution

Gross margin decreased from 59% to 15% in Q3 2025.

Gross margin reveals the unit economics of Blaize's business as it scales. The dramatic decline in Q3 2025 reflects revenue mix—high-volume hardware sales at lower margins versus higher-margin software and engineering services. As Blaize scales, investors should track whether hardware margins improve with volume, and whether software revenue (targeted at 20-30% of total revenue) achieves higher margins.

3. Cash Runway and Burn Rate

The company's cash position stood at $45 million as of the end of Q1, with $13.1 million used for operations during the quarter. This burn rate raises questions about the company's runway despite management's assertion that it has extended its cash runway to the first half of 2026.

With significant ongoing R&D expenses and the extended timeline to profitability, Blaize will likely need additional capital. The company raised approximately $30 million via PIPE, selling 9,375,000 shares at $3.20 and issuing 5-year $5.00 warrants. Investment fuels growth and reinforces confidence in Blaize's edge AI strategy to power global AI infrastructure.

Watch for: Quarterly cash burn trends, any capital raises and their terms, and progress toward management's guidance of reaching break-even financial results by late 2027.

Conclusion: The Long Road from Stealth to Scale

Blaize's story captures both the promise and the peril of deep-tech semiconductor investing. Here is a company that identified a genuine architectural opportunity—edge AI computing—nearly a decade before the market recognized its importance. The founding team's technical pedigree is impeccable, the strategic investor base suggests sophisticated validation, and the market opportunity is vast.

Yet fifteen years of development, $330+ million in funding, and multiple generations of semiconductor design cycles have produced revenue still measured in single-digit millions. The gap between Blaize's technological achievements and commercial scale remains wide.

"Today is an exciting milestone on Blaize's journey of powering the next generation of computing," said Dinakar Munagala, CEO of Blaize. "AI-powered edge computing is the future due to its low power consumption, low latency, cost-effectiveness and data privacy advantages."

The question for investors isn't whether edge AI will be important—it clearly will be—but whether Blaize can capture meaningful share of that opportunity before well-funded competitors or incumbent giants close the gap. The recent contract wins with Yotta and Starshine suggest commercial momentum is finally building. Whether that momentum translates into sustainable, profitable growth remains to be seen.

For those with the patience to wait, Blaize represents a bet on the decentralization of AI—the thesis that intelligence will ultimately move from centralized data centers to the billions of devices where data is actually generated. It's a fifteen-year bet that's only now beginning to pay off.

Material Regulatory Considerations:

-

Export Controls: As an AI chip company, Blaize operates in a regulatory environment shaped by U.S. export restrictions on advanced semiconductors. CEO Munagala has noted that current restrictions primarily target high-end AI training systems rather than edge inference products, but regulatory evolution could impact market access.

-

Automotive Certification: The extended timeline to automotive-grade certification (ISO 26262) represents both an opportunity and a risk. Until Blaize achieves full automotive qualification, its largest strategic investors cannot convert engineering partnerships into volume chip purchases.

-

Going Concern: The combination of minimal revenue, ongoing losses, and cash burn warrants continued attention to liquidity and the company's ability to access capital markets on favorable terms.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music