BigBear.ai: From Cold War Defense Roots to AI Decision Intelligence

I. Introduction & Episode Roadmap

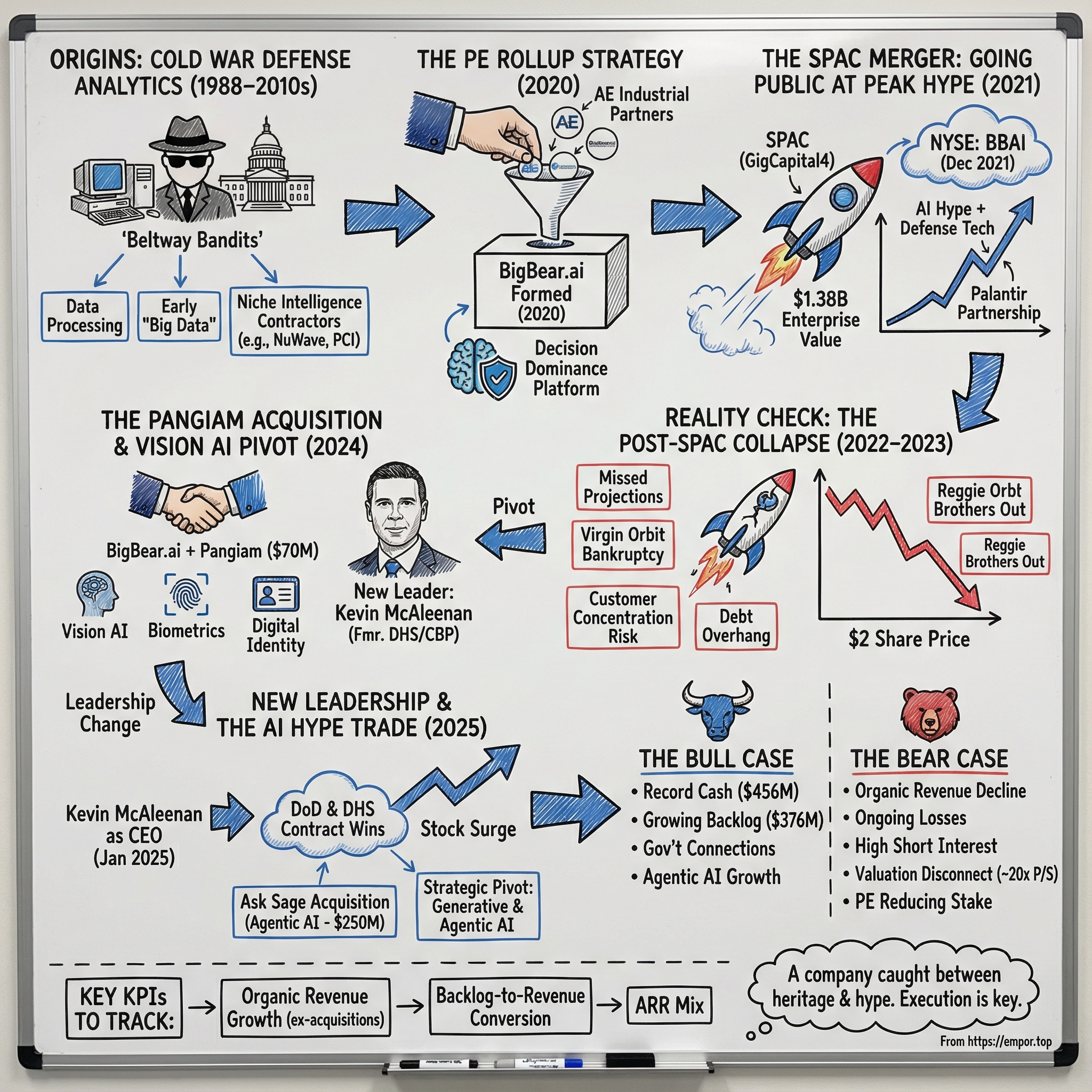

On a crisp December morning in 2021, something remarkable happened on the floor of the New York Stock Exchange. A company most Americans had never heard of—BigBear.ai Holdings—began trading under the ticker symbol BBAI, completing its merger with a blank-check company called GigCapital4. BigBear.ai, a leading provider of artificial intelligence, machine learning, cloud-based big data analytics, and cyber engineering solutions, completed its business combination with GigCapital4. The Business Combination was approved at a Special Meeting of GigCapital4's stockholders on December 3, 2021. Upon completion of the Business Combination, the combined company changed its name to BigBear.ai Holdings, Inc.

The timing could hardly have been better—or worse, depending on your perspective. SPAC mania was at its zenith, defense tech was the flavor of the month, and the AI hype cycle was just beginning its vertical ascent. The combined business would operate as BigBear.ai Holdings and the transaction gave it a pro forma enterprise value of nearly $1.38 billion.

Fast forward to December 2025, and BigBear.ai presents one of the more puzzling case studies in the public markets. The current BigBear.ai stock price is $6.04, with a market capitalization of $2.66 billion. That's a market cap approaching $2.7 billion for a company that, in the third quarter of 2025, saw revenue decrease 20% to $33.1 million compared to $41.5 million for the third quarter of 2024.

The math doesn't immediately add up. How did a PE-backed rollup of niche defense contractors become a multi-billion-dollar AI meme stock? Is there substance behind the hype, or is BigBear.ai simply riding the same speculative wave that has lifted quantum computing stocks and AI chatbot companies into the stratosphere?

BigBear.ai provides artificial intelligence-powered decision intelligence solutions. The company offers national security, supply chain management, and digital identity and biometrics solutions. It also provides data ingestion, data enrichment, data processing, artificial intelligence, machine learning, predictive analytics, and predictive visualization solutions and services. The company serves U.S. defense and intelligence agencies, border protection, transportation security, manufacturing, distribution and logistics, travel, entertainment, and tourism sectors.

The central question isn't whether BigBear.ai is a "real" company—it clearly is, with decades of government contracting heritage, meaningful contract wins, and technology that does actual work for actual customers. The more interesting question is whether its current valuation reflects realistic growth expectations, or whether investors are paying a premium for the ticker symbol BBAI in an era when anything touching "AI" gets bid up indiscriminately.

What follows is an attempt to answer that question by tracing BigBear.ai's journey from its Cold War origins through its private equity rollup, its SPAC debut, its subsequent struggles, and its recent transformation under new leadership. Along the way, we'll examine the business model, the competitive landscape, and the fundamental metrics that matter for tracking this company's progress—or lack thereof.

II. Origins: Cold War Defense Analytics (1988–2010s)

Before there was BigBear.ai, before there was a ticker symbol or a SPAC merger or quarterly earnings calls, there were a handful of small contractors clustered around the Washington Beltway, doing unglamorous but essential work for the U.S. intelligence community.

The company was founded in 1988 and is headquartered in McLean, Virginia. That founding year places BigBear.ai's origins squarely in the Reagan era, when the Cold War was approaching its final act and the U.S. government was pouring resources into digital intelligence capabilities. The Berlin Wall wouldn't fall for another year. The Soviet Union still existed. And the nascent field of data analytics was beginning to prove its worth in the shadowy world of national security.

The company's initial focus was on providing cloud-based big data analytics solutions to government and commercial clients, leveraging data to enhance decision-making and operational efficiency. In those early years, this wasn't called "artificial intelligence"—the term carried different connotations in the late 1980s, conjuring images of expert systems and symbolic reasoning rather than machine learning. But the underlying mission was recognizable: take vast amounts of information, process it, and turn it into actionable intelligence.

To understand BigBear.ai's heritage, you have to understand the ecosystem from which it emerged. The "Beltway Bandits"—the affectionate (and sometimes not-so-affectionate) term for defense contractors clustered around Washington, D.C.—represent a distinctive species in the corporate jungle. These firms live and die by their relationships with government customers. They navigate byzantine procurement processes that would make most Silicon Valley founders weep. They employ security-cleared workforces that can take years to assemble. And they develop deep institutional knowledge about specific agencies and missions that is nearly impossible for outsiders to replicate.

Founded in 2008, BigBear specializes in big data computing and analytics, cloud computing, artificial intelligence, machine learning, geospatial information systems, biotech and life sciences, data mining and systems engineering to customers in the United States defense and intelligence communities. The Company combines comprehensive technology solutions with its BigBear Platform to create entirely private, secure cloud environments in a unique manner that helps organizations enable big data computing, machine learning and improved decision-making while better managing risk. BigBear specializes in helping customers make sense of their data by delivering the most advanced customized data analytics solutions available today.

The evolution from "big data analytics" to "artificial intelligence" wasn't sudden—it was a gradual rebranding that tracked the broader technology industry's linguistic shift. The underlying capabilities didn't change overnight; rather, the vocabulary used to describe them evolved as "AI" became the preferred terminology for what had previously been called "machine learning," "predictive analytics," or simply "advanced computing."

By the 2010s, the companies that would eventually form BigBear.ai had emerged as an umbrella entity for multiple specialized firms bringing expertise in machine learning, predictive analytics, cloud-based data integration, and cyber operations. The company positioned itself as a full-stack solutions provider—not just selling software, but providing the people, processes, and cleared facilities necessary to deploy that software in mission-critical environments.

The implications for investors: this heritage matters. BigBear.ai isn't a startup that emerged from a garage in Palo Alto with a clever algorithm and dreams of disruption. It's an assemblage of mature government contractors with decades of relationships, past performance records, and institutional knowledge. That heritage is both an asset and a constraint—it provides stability but can limit growth potential compared to pure-play technology companies.

III. The Private Equity Rollup Strategy (2020)

The story of modern BigBear.ai begins not with a founder's vision or a technological breakthrough, but with a PowerPoint presentation in a private equity firm's conference room. AE Industrial Partners—a private equity shop specializing in aerospace, defense, and government services—had a thesis: the fragmented landscape of defense AI contractors was ripe for consolidation.

AE Industrial Partners is a private equity firm specializing in Aerospace, Defense & Government Services, Space, Power Generation, and Specialty Industrial markets. AE Industrial Partners invests in market-leading companies that can benefit from its deep industry knowledge, operating experience, and relationships throughout its target markets. AE Industrial Partners is a signatory to the United Nations Principles for Responsible Investing.

The playbook was classic PE: buy fragmented niche players, combine them for scale, cross-sell capabilities across the combined customer base, and prepare for exit. It's a strategy that has worked in countless industries, from dental practices to car washes. The question was whether it could work in defense AI, where the product is intangible, the customers are demanding government agencies, and success depends on maintaining specialized technical capabilities.

BigBear.ai was established in 2020 through the merger of several companies, including NuWave Solutions and PCI Strategic Management. This consolidation was orchestrated by AE Industrial Partners. The company's early structure was heavily influenced by private equity, with AE Industrial Partners leading the acquisition and integration of its constituent entities.

The rollup assembled several established government contractors, each bringing distinct capabilities:

NuWave Solutions brought data management, advanced analytics, artificial intelligence, machine learning, and cloud solutions. Its sweet spot was "anticipatory intelligence"—using AI to help government customers predict what might happen next, rather than simply analyzing what had already occurred.

PCI Strategic Management specialized in strategic consulting for national security agencies, translating high-level government guidance into actionable initiatives. This was the "services" side of the house—less product-focused, more people-intensive, but deeply embedded in key customer relationships.

The combination was announced with appropriate fanfare. Jeffrey Hart, Principal at AEI, articulated the vision: the merger would instantly create "a formidable player of scale" positioned to address "the growing threats of hybrid warfare" through a "decision dominance platform."

The language is worth parsing. "Decision dominance" is a Pentagon buzzword referring to the ability to make better decisions faster than adversaries—exactly the kind of capability that AI promises to deliver. The implication was clear: BigBear.ai wasn't just a defense contractor; it was a platform company that could help the U.S. military and intelligence community maintain their decision-making edge against peer adversaries like China and Russia.

The leadership team reflected this ambition. Dr. Reggie Brothers, formerly CEO of NuWave, became CEO of the combined entity. Brothers had served as Under Secretary for Science and Technology at the Department of Homeland Security—the kind of credential that opens doors in Washington. Sean Battle, co-founder and CEO of PCI, became Vice Chairman and Chief Strategy Officer, ensuring continuity on the consulting side.

The decision by AE Industrial Partners to merge several established government contractors in 2020 was a bet that a unified platform could win larger, more complex contracts than the individual entities. This created a single, full-spectrum AI and analytics provider for the U.S. defense and intelligence community.

NuWave's acquisition of BigBear illustrates the following buyer priorities in Government & Defense M&A: strategic positioning in the defense and intelligence communities with enduring mission support, differentiation through proprietary technology solutions applied to data intensive environments, an elite cadre of technical thought leaders and subject matter experts, and private equity-backed companies executing an inorganic growth strategy. NuWave Solutions is a leading provider of data management, advanced analytics, artificial intelligence, machine learning, and cloud solutions that delivers anticipatory intelligence and advanced decision support solutions and technologies to the federal government. NuWave provides innovative, customized solutions through development, selection, and integration of leading technologies. NuWave has unmatched expertise in advanced technologies across the analytics and data management lifecycle.

For investors, the PE rollup origin has important implications. First, it means the company was built for exit—AE Industrial Partners didn't acquire these companies to hold forever. Second, it means the corporate culture is a blend of different organizations with different histories, which can create integration challenges. Third, it means the financial structure from day one was oriented toward maximizing returns for private equity investors, which sometimes creates tension with the interests of public shareholders.

IV. The SPAC Merger: Going Public at Peak Hype (2021)

If you wanted to design a laboratory experiment to test investor enthusiasm for defense AI during a speculative bubble, you couldn't do better than BigBear.ai's December 2021 public offering.

Combined Company Expected to Begin Trading on NYSE Under Ticker Symbols "BBAI" and "BBAI.WS," Respectively, on December 8, 2021. GigCapital4's shareholders voted to approve the previously announced proposed business combination between GigCapital4 and BigBear.ai, as well as all other proposals related to the Business Combination. Following the consummation of the Business Combination, the combined company will operate as BigBear.ai Holdings, Inc. and its shares of common stock and warrants are expected to trade on the New York Stock Exchange beginning on December 8, 2021 under the symbols "BBAI" and "BBAI.WS," respectively.

The SPAC merger came with the usual array of projections that would later prove wildly optimistic. Revenue was projected to grow from $182 million in 2021 to $764 million in 2025, implying a 43% compound annual growth rate. Adjusted EBITDA was projected to grow from $23 million in 2021 to $159 million in 2025, a 63% CAGR. Free cash flow was projected to grow from $18 million in 2021 to $120 million in 2025.

These weren't crazy numbers by tech standards—plenty of software companies achieve 40%+ growth rates. But they represented a massive acceleration from BigBear.ai's historical performance, premised on assumptions about commercial market penetration and contract wins that would prove difficult to achieve.

"We are in the early innings of unprecedented growth in the AI/ML landscape, and we believe our recent contract wins, which bring our total backlog to $485 million, are the tip of the iceberg." With well-established roots in the national security and defense space, BigBear.ai's platform is battle-tested to perform in complex, real time environments, and its highly flexible solutions are highly applicable to the rapidly growing commercial market and state and local government sector. The Company is well positioned to leverage the significant growth opportunities in the global AI and machine learning market, which is projected to grow at a compound annual growth rate of approximately 40% to $310 billion by 2026. Dr. Reggie Brothers, Chief Executive Officer of BigBear.ai, said, "The completion of our business combination with GigCapital4 and emergence as a publicly-traded company is a landmark achievement for BigBear.ai."

The transaction included a $200 million convertible senior unsecured note private placement with institutional investors including Fortress, Marathon, and Highbridge. The 5-year unsecured convertible notes, which shall bear interest at a rate of 6% per annum, are convertible into common shares of the combined company at a conversion price of $11.50. This debt would later become a significant overhang on the stock, requiring restructuring as the share price collapsed.

Timing matters in public offerings, and BigBear.ai's timing was exquisite—from the perspective of the sellers, at least. December 2021 was essentially the peak of SPAC mania. Retail investors were pouring money into de-SPACs across virtually every sector. Defense tech was having a moment, with Palantir's stock having more than tripled from its direct listing price. And the AI hype cycle, while not yet at its ChatGPT-induced crescendo, was building steam.

On November 15, 2021, BigBear.ai and Palantir Technologies announced that they have entered into a commercial partnership under which BigBear.ai's and Palantir's products will be integrated to extend the operating system for the modern enterprise with data and AI that provide advice and other actionable insights for complex business decisions. Brian Frutchey, BigBear.ai Chief Technology Officer, said, "We are thrilled to partner with Palantir to deliver a more robust range of capabilities to our respective customer bases at a time in which demand for AI and ML solutions is growing rapidly. We are confident that this partnership will accelerate BigBear.ai's penetration into high growth markets, including commercial markets and the Federal government, and help us expand our existing customer relationships as well as attract new customers at this critical stage of expansion for BigBear.ai." Akash Jain, President of Palantir USG, said, "We see immense opportunities to deliver more, faster for customers by partnering with cutting edge companies who can leverage Foundry as Infrastructure in their offerings."

The Palantir partnership was particularly well-timed from a marketing perspective. In November 2021, BigBear.ai partnered with Palantir to integrate Foundry's services into its own Observe, Orient, and Dominate modules. That headline-grabbing partnership, along with ambitious growth targets, generated significant buzz for its SPAC-backed debut.

The data mining company's shares started trading at $9.84 and climbed to an all-time high of $16.12 on April 6, 2022. For brief, giddy moments, the BigBear.ai story seemed to be working exactly as planned.

Then reality intervened.

V. Reality Check: The Post-SPAC Collapse (2022–2023)

The honeymoon didn't last. By the second half of 2022, it was becoming clear that BigBear.ai's ambitious projections were not going to be achieved. The company blamed macroeconomic headwinds, slower government spending, and the bankruptcy of its major customer Virgin Orbit in early 2023.

CEO Reggie Brothers stepped down in October 2022 amid that slowdown and was succeeded by Mandy Long, a former IBM executive who brought experience in commercial technology sales and operations. The leadership change signaled a pivot from the company's original defense-centric vision toward a broader commercial strategy.

Revenue decreased 21.4% to $33.1 million for the first quarter of 2024, compared to $42.2 million for the first quarter of 2023. The year-over-year decrease was primarily driven by the planned wind-down of the Air Force EPASS program in mid-2023 ($6.8 million) and the elimination of revenue from Virgin Orbit due to their bankruptcy announcement in April 2023 ($1.5 million). We also experienced delays in contract awards due to the continuing resolutions. Gross margin of 21.1% in the first quarter of 2024, a decrease from 24.2% in the first quarter of 2023, primarily driven by an increase in equity-based compensation expense of $1.8 million and the elimination of revenue and gross margin from Virgin Orbit.

The revenue trajectory told the story of missed promises. From 2020 to 2023, BigBear.ai's revenue only increased at a CAGR of 3.5% to $155 million—far short of its original target of $388 million. Its gross margin shriveled to 26% while adjusted EBITDA margin turned negative.

Customer concentration emerged as a significant vulnerability. In 2023, BigBear.ai generated 49% of its revenue from just three customers. It's already supported those top customers for more than five years, but each of them can "unilaterally elect" to terminate their existing contracts. This is the Achilles' heel of government contracting: relationships that took years to build can be severed with minimal notice.

The Virgin Orbit bankruptcy was particularly painful, illustrating the risks of customer concentration. Virgin Orbit had been a meaningful commercial customer, part of BigBear.ai's strategy to diversify beyond government work. When Virgin Orbit filed for bankruptcy in April 2023, BigBear.ai lost both the revenue and had to write off receivables, creating a one-two punch to the income statement.

The balance sheet told an equally concerning story. The company ended 2023 with a whopping $194.3 million in long-term debt and just $32.6 million in cash. Most of that debt came from the $200 million convertible notes offering in December 2021, which were issued when the stock was trading above $10 and would become increasingly problematic as the share price collapsed.

The stock price told the final verdict. From its April 2022 peak above $16, BBAI collapsed to under $2 by late 2023. Investors who had bought into the SPAC story had lost 85%+ of their investment. AE Industrial Partners, which had rolled up these companies with dreams of a lucrative exit, watched its paper gains evaporate.

Myth vs. Reality Box: | Pre-SPAC Projection | Actual Result | |---------------------|---------------| | 2022 Revenue: $269M | ~$155M | | 2023 Revenue: $388M | ~$155M | | 43% Revenue CAGR | 3.5% Revenue CAGR | | Positive EBITDA | Negative EBITDA |

The pattern was familiar to anyone who followed the SPAC wave: ambitious projections, enthusiastic initial trading, reality check, stock collapse. BigBear.ai wasn't unique in missing its targets—the majority of SPAC de-spacs disappointed. But the magnitude of the miss raised questions about whether the business model was fundamentally flawed or whether management had simply been too optimistic about execution.

VI. The Pangiam Acquisition & Vision AI Pivot (2024)

Rather than retrench, BigBear.ai doubled down on its acquisition strategy. In November 2023, the company announced a definitive merger agreement to acquire Pangiam Intermediate Holdings, LLC—a leader in Vision AI for the global trade, travel, and digital identity industries—for approximately $70 million in an all-stock transaction.

BigBear.ai announced the completion of its acquisition of Pangiam Intermediate Holdings, LLC (Pangiam), a leader in Vision AI for the global trade, travel, and digital identity industries. This strategic move accelerates and evolves BigBear.ai's mission to create clarity for the world's most complex decisions in three markets: national security, supply chain management, and digital identity. The combined entity will create one of the industry's most comprehensive Vision AI portfolios, combining facial recognition, image-based anomaly detection and advanced biometrics with BigBear.ai's computer vision and predictive analytics capabilities.

BigBear.ai completed its purchase of fellow artificial intelligence company Pangiam Intermediate Holdings for an estimated $70 million in stock. Pangiam CEO Kevin McAleenan and two-time Wash100 inductee will become president of the combined company.

The deal closed on March 1, 2024, and brought two critical assets: technology and people. On the technology side, Pangiam's facial recognition and advanced biometrics capabilities complemented BigBear.ai's existing computer vision and predictive analytics. On the people side, Pangiam's leadership—particularly CEO Kevin McAleenan—would prove transformative.

McAleenan currently serves as BigBear.ai's President and has deep government and business experience working with U.S. national security agencies, including serving as Acting Secretary of the U.S. Department of Homeland Security (DHS) during the first Trump administration before founding Pangiam, which was subsequently bought by BigBear.ai in 2024. Prior to Pangiam, McAleenan was Commissioner of U.S. Customs and Border Protection, where he focused on counterterrorism, border security and immigration enforcement, following almost two decades as a career official.

McAleenan's background deserves particular attention. Kevin brings experience from almost two decades of leadership in the U.S. Government to his role. He was the first career civil servant to be appointed and confirmed as Commissioner of U.S. Customs and Border Protection (CBP) in 2018, and he served most recently as Acting Secretary of the U.S. Department of Homeland Security (DHS) under President Donald Trump, where he led over 240,000 employees and oversaw operations at CBP, the Transportation Security Administration (TSA), the U.S.

His past experiences include implementing innovations to the U.S. international arrival and departure process, developing comprehensive counterterrorism and risk management strategies, and overseeing the implementation of the U.S. government's single window for international trade, a project that spanned over 4-dozen agencies. Kevin received several awards for his service and leadership including a Presidential Rank Award—the nation's highest civil service award, a Service to America Medal, and multiple awards from travel and trade industry groups.

This wasn't just a technology acquisition—it was a bet that McAleenan's Rolodex and reputation could open doors that had previously been closed to BigBear.ai, particularly at the Department of Homeland Security and Customs and Border Protection.

BigBear.ai is currently providing predictive analytics capabilities to over 20 U.S. government defense and intelligence customers and 160 commercial enterprises. Merging with Pangiam will enable BigBear.ai to also serve customers at the Department of Homeland Security and Customs and Border Protection.

The strategic logic was straightforward: BigBear.ai's strength was in defense and intelligence agencies; Pangiam's strength was in border security and travel. Together, they could offer a more comprehensive suite of solutions across national security missions.

But the organic business continued to struggle even as the acquisition integration proceeded. The company's total sales were up just 2% in 2024, propped up by the acquisition of Pangiam. Without that acquisition, the core business declined, with sales plunging 21.2% YoY due to the wind-down of legacy programs and contract timing issues.

For investors, the Pangiam acquisition represented both opportunity and risk. The opportunity: expanded capabilities and a star executive with exceptional government connections. The risk: paying for acquisitions when the core business isn't growing raises questions about whether M&A is a growth strategy or a distraction from fundamental problems.

VII. New Leadership & The AI Hype Trade (2025)

On January 15, 2025, BigBear.ai announced the appointment that had seemed inevitable since the Pangiam acquisition: BigBear.ai announced that the Board of Directors has appointed Kevin McAleenan as Chief Executive Officer and member of the Board of Directors, effective January 15, 2025, succeeding Mandy Long. Mandy Long will step down as Chief Executive Officer and from the Board of Directors, transitioning to serve as a Company advisor.

The board's statement was effusive: "Having served at the highest levels of government, Kevin brings an intimate understanding of current national security priorities and the challenges faced by our mission partners, providing BigBear.ai with a deep understanding of how artificial intelligence can be most effectively leveraged to maximize impact. We are thrilled to welcome Kevin as CEO and confident in his ability to drive the company's next phase of growth."

The timing of McAleenan's ascension to CEO coincided with renewed investor enthusiasm for defense and border security themes. Under the incoming Trump administration, defense spending increases and border security investments seemed likely. McAleenan's relationships at DHS and CBP—agencies he had led—positioned BigBear.ai to benefit from these tailwinds.

The contract wins began to accumulate. BigBear.ai has been awarded a contract by the Department of Defense CDAO to advance its Virtual Anticipation Network (VANE) prototype. This initiative will support the CDAO and Office of the Secretary of Defense by leveraging custom AI models to better assess news media originating in countries that are potential foreign adversaries.

VANE received "awardable" status on the CDAO Tradewinds Solutions Marketplace in April 2024. Advancing to CDAO marks a successful transition from a research prototype to an operational prototype, providing critical insights to decision-makers.

BigBear.ai announced that the U.S. Army has awarded the company a five-year, $165.15 million sole source prime contract for Global Force Information Management (GFIM) Production Services. "This contract exemplifies our unwavering commitment to the Army's digital transformation efforts through our deep mission expertise and use of cutting-edge technology," said BigBear.ai's CEO, Mandy Long.

BigBear.ai has been awarded a position on the U.S. General Services Administration's (GSA) OASIS+ (One Acquisition Solution for Integrated Services Plus) Unrestricted Multiple Agency Contract (MAC). OASIS+ is a best-in-class, government-wide suite of contracts designed to streamline the procurement of complex professional services across all federal agencies. This multiple-award IDIQ (Indefinite Delivery Indefinite Quantity) contract has no maximum dollar ceiling and offers a 10-year ordering period with an unlimited number of task orders at any dollar value, providing government customers with flexible and efficient access to BigBear.ai solutions.

BigBear.ai stock went parabolic in early 2025—trading at around $4 at the start of the year and surging as high as $10, more than doubling. The DoD contract announcement alone sent shares soaring more than 45% in a single day.

The most significant announcement came in November 2025. BigBear.ai announced a definitive agreement to acquire Ask Sage, a fast-growing Generative AI platform for secure distribution of AI models and agentic AI capabilities, built specifically for defense and national security agencies and other highly-regulated sectors. AskSage is expected to deliver annual recurring revenues (ARR) of approximately $25 million in 2025 (non-GAAP), demonstrating a year-on-year increase of approximately six times AskSage's 2024 ARR. BigBear.ai will pay a total of $250 million for the whole business, subject to customary adjustments for indebtedness, cash and working capital.

"Ask Sage already supports more than 100,000 users on 16,000 government teams and across hundreds of commercial companies. It is a turnkey platform that's in production today, at scale, in the environments that matter most," said Kevin McAleenan, CEO of BigBear.ai.

The Ask Sage acquisition represented a strategic pivot toward generative AI and "agentic AI"—systems capable of taking autonomous action rather than simply providing analysis. Founded in 2023, Ask Sage designed its platform to help organizations that work with classified and sensitive information use AI systems that can take independent action to achieve a goal. This is what observers refer to as agentic AI, where systems act as virtual assistants to users while completing tasks without constant intervention. During BigBear's third quarter earnings call Monday, chief executive Kevin McAleenan said the company is prioritizing "disruptive AI mission solutions for national security" in the current iteration of its strategy. For BigBear, this also means a focus on scalable AI deployments with information security at the center of them.

The acquisition price—$250 million for a company with $25 million in ARR—implies a 10x revenue multiple, which is reasonable for a fast-growing SaaS company in the defense sector. More importantly, it adds high-margin recurring revenue to a business that has historically been weighted toward lower-margin services.

VIII. The Business Model Deep Dive

Understanding why BigBear.ai trades at a premium to its fundamentals requires understanding what the company actually does and how it makes money. The Company operates through two segments: Cyber & Engineering, Analytics. It combines subject-matter expertise with technology to connect the enterprise, provide insights on process performance and recommendations for managing risk. It offers computer vision, anomaly/event detection, and descriptive and predictive analytics to support operations and break down silos between vendors and systems. The Company's customers span the public and private sector, including the United States, as well as allied nations' defense and intelligence agencies, border protection, transportation security, manufacturing, distribution and logistics, as well as travel, entertainment and tourism.

The Cyber & Engineering Segment offers high-end technology and management consulting services focusing on cloud engineering, cybersecurity, computer network operations, and systems engineering. This is fundamentally a services business—headcount-intensive, relationship-driven, and dependent on maintaining security-cleared personnel.

The Analytics Segment provides big data computing and analytical solutions, including predictive and prescriptive analytics. This is where the proprietary technology lives—the AI/ML capabilities, the data platforms, the visualization tools that differentiate BigBear.ai from commodity IT services providers.

Understanding this history of acquisition explains why the business model is a blend of high-margin software and traditional government services. The company didn't start as a pure software company—it acquired software capabilities through its rollup strategy while maintaining the services businesses that came with the acquired companies.

Revenue Mix Breakdown:

Most of their revenue comes from long-term government contracts or professional services tied to running and supporting their tech. This creates predictable revenue streams but limits the operating leverage that pure software companies enjoy. When Palantir adds a new customer, marginal contribution margins are extremely high because the software already exists. When BigBear.ai wins a new contract, they often need to hire additional cleared personnel to staff it.

Backlog of $376 million as of September 30, 2025. This backlog figure—representing contracted future work—provides some visibility into near-term revenue. But backlog doesn't automatically convert to recognized revenue; contracts can be modified, delayed, or terminated. Government continuing resolutions and budget uncertainty create persistent risk to backlog conversion.

Sequential improvement to the balance sheet and record cash balance of $456.6 million, as of September 30, 2025, positioning the Company to accelerate growth. BigBear.ai continues to project full-year 2025 revenue between $125 million and $140 million.

The balance sheet transformation is striking. From $32.6 million in cash at the end of 2023 to $456.6 million by September 2025, BigBear.ai has completely repositioned its financial foundation. This came through a combination of warrant exercises, convertible note restructuring, and equity issuances that diluted existing shareholders but provided the capital to pursue acquisitions like Ask Sage.

IX. Competitive Landscape & Market Positioning

BigBear.ai operates in one of the most intensely competitive markets in enterprise technology: AI-powered analytics for government and enterprise customers. The competitive landscape includes well-funded giants, hungry startups, and traditional defense primes all racing to capture a piece of the burgeoning AI market.

Palantir Technologies represents the most obvious comparison and the most formidable competitor. Palantir is a heavyweight in enterprise analytics and AI platforms, significantly larger than C3.ai by scale. Its Gotham platform became a critical tool for agencies like the DoD and CIA, creating a deep moat in government contracting. In recent years, Palantir has expanded aggressively into commercial markets with its Foundry platform and new Artificial Intelligence Platform (AIP), aiming to become a central provider of AI-powered decision support for large enterprises. Palantir's key strength lies in its entrenched customer relationships and product breadth. The company enjoys long-term contracts with government agencies, providing a stable revenue base. Palantir's push into commercial AI is gaining traction, with its new AIP helping organizations deploy large language models and automation.

The scale differential is stark: Palantir's revenue in one quarter exceeds C3.ai's revenue in an entire year. In FY2025, C3.ai's revenue was around $310M, growing ~16% YoY, much slower than Palantir, and C3 remains unprofitable with ongoing losses. BigBear.ai is even smaller than C3.ai, with trailing twelve-month revenue around $140-150 million.

C3.ai differentiates itself through a broad enterprise AI application suite targeting both government and commercial sectors, delivering AI solutions for predictive maintenance, supply-chain optimization, and operational decision-making. C3.ai faces its own challenges—recent revenue misses and CEO departure—but remains a significant competitor in enterprise AI.

Traditional Defense Primes represent another competitive threat. Unlike Palantir and ServiceNow, which serve both government and private clients, Booz Allen earns virtually all of its revenue from Washington. Booz has its own Pentagon-only AI software and also integrates platforms like Palantir's. Revenue dipped 8.1% year over year to $2.9 billion in its fiscal second quarter.

Companies like Lockheed, Raytheon, Northrop Grumman, and Leidos are all building AI capabilities, either organically or through acquisition. They have advantages in existing contract relationships, security clearances, and financial resources. The risk for BigBear.ai is that these giants decide to internalize capabilities that were previously outsourced to niche contractors.

BigBear.ai's Strategic Partnerships provide some competitive differentiation. The company maintains relationships with heavyweights like Amazon, Palantir, and Autodesk. The Palantir partnership, in particular, allows BigBear.ai to leverage Foundry's infrastructure while adding its own predictive analytics and mission-specific capabilities.

While both rivals have larger scale and market visibility, BigBear.ai's niche mission expertise and tailored solutions may help it carve out market share despite the crowded, high-stakes federal AI landscape. The question is whether "niche expertise" is enough to compete against Palantir's horizontal platform approach and the defense primes' massive installed bases.

X. Porter's Five Forces Analysis

1. Threat of New Entrants: LOW-MEDIUM

The barriers to entry in defense AI are substantial. A major differentiator for BigBear.ai is its unique heritage: unlike pure-play commercial AI startups, its technology has been stress-tested in national security environments. Security clearances, FedRAMP certifications, and years of past performance create significant barriers that take years to build.

However, well-funded AI startups with government connections continue entering the market. Anduril has demonstrated that a well-connected startup can break into defense markets quickly. Scale AI has built significant government business from a standing start. The barriers are real but not impenetrable for sufficiently capitalized and connected entrants.

2. Bargaining Power of Suppliers: LOW

AI/ML talent is the key input—widely available but competitive. Cloud infrastructure from AWS/Azure is commoditized. Minimal physical supply chain dependencies exist. BigBear.ai isn't beholden to any single supplier in the way that hardware companies might be. The main constraint is security-cleared talent, which is scarce but not controlled by any single supplier.

3. Bargaining Power of Buyers: HIGH

BigBear.ai relies heavily on U.S. federal dollars. In 2023, 49% of revenue came from just three customers. Government procurement processes favor buyers; contract terminations are possible with minimal notice. Any contract delays, budget cuts, or government shutdown might derail cash flows and slow backlog conversion.

The government is the ultimate demanding customer. Procurement offices are staffed by professionals whose job is to extract maximum value for taxpayer dollars. Multi-year contract cycles create predictability but also lock in pricing that may become unfavorable as costs evolve.

4. Threat of Substitutes: MEDIUM-HIGH

In-house government AI development is increasing through the CDAO and individual service branches. Large defense primes (Lockheed, Raytheon, Northrop) are building AI capabilities that could substitute for BigBear.ai's offerings. Commercial AI tools are becoming more accessible, potentially enabling government agencies to build solutions themselves.

The generative AI revolution cuts both ways: it creates new opportunities for specialized providers like BigBear.ai, but it also makes AI capabilities more accessible to non-specialists who might previously have relied on contractors.

5. Industry Rivalry: HIGH

Competitors like Palantir and C3.ai are better-funded and just as hungry. The defense AI/analytics market is increasingly crowded with both traditional primes and new entrants. Winner-take-all dynamics on major platform contracts mean that losing a competition can have outsized consequences.

XI. Hamilton's 7 Powers Analysis

1. Scale Economies: WEAK

At approximately $140M revenue, BigBear.ai doesn't provide meaningful scale advantages. R&D and S&M costs don't decline materially with size at current scale. Larger competitors (Palantir at $2.5B+) have genuine scale benefits that allow them to spread fixed costs across a larger revenue base.

2. Network Effects: WEAK

Decision intelligence tools don't inherently benefit from more users in the way that social networks or marketplaces do. Some data network effects are theoretically possible if aggregating intelligence across agencies, but there's limited evidence of this occurring at BigBear.ai.

3. Counter-Positioning: MODERATE

BigBear.ai's niche mission expertise and tailored solutions may help it carve out market share by serving specific government missions that larger horizontal players don't optimize for. The question is whether this counter-positioning is genuine strategic differentiation or simply being smaller and hoping the giants don't notice.

4. Switching Costs: MODERATE-STRONG

They've built a modest moat because switching out government software isn't easy. Multi-year contracts with training, integration, and clearance requirements create real friction. Customers have trusted them for decades because solutions are built for the domains and missions they serve.

This is perhaps BigBear.ai's strongest power. Once embedded in a government program, contractors tend to stay embedded unless they fail dramatically. The institutional knowledge, security clearances, and integration work create meaningful switching costs.

5. Branding: WEAK

Limited brand recognition outside the defense/intel community. Not a household name; overshadowed by Palantir in public consciousness. Kevin McAleenan's government credentials add credibility but don't translate into consumer-style brand value.

6. Cornered Resource: MODERATE

Kevin brings experience from almost two decades of leadership in the U.S. Government to his role. He was the first career civil servant to be appointed and confirmed as Commissioner of U.S. Customs and Border Protection (CBP) in 2018, and he served most recently as Acting Secretary of the U.S. Department of Homeland Security (DHS) under President Donald Trump, where he led over 240,000 employees and oversaw operations at CBP, the Transportation Security Administration (TSA), the U.S.

McAleenan's relationships and reputation represent a cornered resource that competitors cannot easily replicate. The security-cleared workforce and past performance records are similarly difficult to duplicate. But these resources are human—they can leave—and past performance, while valuable, doesn't guarantee future wins.

7. Process Power: DEVELOPING

BigBear.ai has demonstrated innovation through its Virtual Anticipation Network (VANE) prototype for geopolitical risk analysis and its ConductorOS platform for AI orchestration. The Ask Sage acquisition adds agentic AI capabilities. Still proving whether technology differentiation is sustainable versus competitors with larger R&D budgets.

XII. Bear vs. Bull Case

The Bull Case

The optimists can point to genuine improvements in BigBear.ai's strategic position:

Record cash balance of $456.6 million as of September 30, 2025, positioning the Company to accelerate growth. The balance sheet transformation provides firepower for acquisitions and investment without the distressed-debt overhang that plagued the company in 2023.

Backlog of $376 million as of September 30, 2025. A growing backlog signals strong customer confidence and provides revenue visibility.

This multiple-award IDIQ contract has no maximum dollar ceiling and offers a 10-year ordering period with an unlimited number of task orders at any dollar value, providing government customers with flexible and efficient access to BigBear.ai solutions. The GSA OASIS+ contract vehicle provides a streamlined path to win additional government work across multiple agencies.

Kevin McAleenan's connections could drive border security and DHS wins at a time when the incoming administration has prioritized these areas. His relationships are real, recent, and relevant.

The Ask Sage acquisition adds high-margin SaaS revenue ($25M ARR) and positions BigBear.ai in the hot "agentic AI" market. Defense and border security spending likely increases under the new administration, providing tailwinds for BigBear.ai's core markets.

The Bear Case

The skeptics have plenty of ammunition:

Revenue decreased 20% to $33.1 million for the third quarter of 2025, compared to $41.5 million for the third quarter of 2024 primarily due to lower volume on certain Army programs. The core business continues to shrink despite acquisitions and contract announcements.

The valuation disconnect is extreme. A company with trailing revenue around $140 million is trading at nearly $2.7 billion market cap—a price-to-sales multiple approaching 20x for a business that isn't growing organically.

The latest short interest is 76.75 million, so 17.58% of the outstanding shares have been sold short. In the last 12 months, BBAI had revenue of $152.56 million and -$443.92 million in losses.

BigBear.ai reported 39.13 million shares sold short, which is 36.88% of all regular shares that are available for trading. Based on its trading volume, it would take traders 1.13 days to cover their short positions on average. The high short interest suggests significant skepticism about the current valuation.

AE Industrial Partners has systematically reduced its stake since the SPAC merger, a potentially concerning signal about the company's largest original shareholder's confidence in future appreciation.

Contract announcements may be designed to create short-term market excitement rather than reflect significant wins. The disconnect between headline wins and actual revenue growth raises questions about whether the business is fundamentally improving or just generating better press releases.

Key Performance Indicators to Track

For investors monitoring BigBear.ai's progress, three metrics deserve particular attention:

1. Organic Revenue Growth (ex-acquisitions): The most important metric for assessing whether the core business is improving. Strip out the contribution from Pangiam and Ask Sage to understand whether the historical BigBear.ai is growing, shrinking, or stagnating. Until organic growth turns positive, acquisitions are masking—not solving—fundamental challenges.

2. Backlog-to-Revenue Conversion Rate: With $376 million in backlog and ~$140 million in annual revenue, BigBear.ai theoretically has 2.5+ years of work under contract. But backlog doesn't always convert to revenue on schedule. Tracking how much backlog converts to recognized revenue each quarter indicates whether contract wins are translating into actual business.

3. Annual Recurring Revenue (ARR) Mix: As BigBear.ai acquires more software businesses like Ask Sage, the mix between recurring software revenue and project-based services revenue should shift. Higher ARR mix indicates a more scalable, higher-margin business model. If the ARR percentage isn't increasing, the acquisition strategy isn't transforming the fundamental business economics.

Conclusion

BigBear.ai presents one of the more intriguing—and perplexing—case studies in the current market. The company has legitimate heritage, real technology, meaningful contracts, and exceptional leadership in Kevin McAleenan. The balance sheet transformation from distressed to fortress has been remarkable. The strategic positioning in defense AI, border security, and agentic AI addresses genuine market opportunities.

Yet the stock trades at a valuation that seems to discount a future far brighter than recent results would suggest. Organic revenue is declining, losses continue, and the company's path to profitability remains unclear. The market appears to be pricing BigBear.ai as a growth company when the recent data suggests a company struggling to maintain its revenue base.

The central question for investors isn't whether BigBear.ai is a "real" company—it clearly is. The question is whether the current market price appropriately reflects the probability distribution of outcomes. At lower prices, the bull case becomes more compelling. At current prices, a lot has to go right for investors to earn attractive returns.

What happens next depends on execution. Can McAleenan convert his relationships into contract wins? Can the Ask Sage acquisition transform the revenue mix toward higher-margin SaaS? Can the Army, DHS, and other customers provide the growth that commercial markets have failed to deliver? The next few quarters will provide crucial data points.

Until then, BigBear.ai remains a company caught between its Cold War heritage and its AI-hype-fueled valuation—a fascinating case study in the intersection of government contracting, private equity financial engineering, and retail investor enthusiasm for anything attached to artificial intelligence.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music