Workiva: The Story of Enterprise Reporting's Unlikely Champion

I. Introduction: How Iowa Changed Financial Reporting Forever

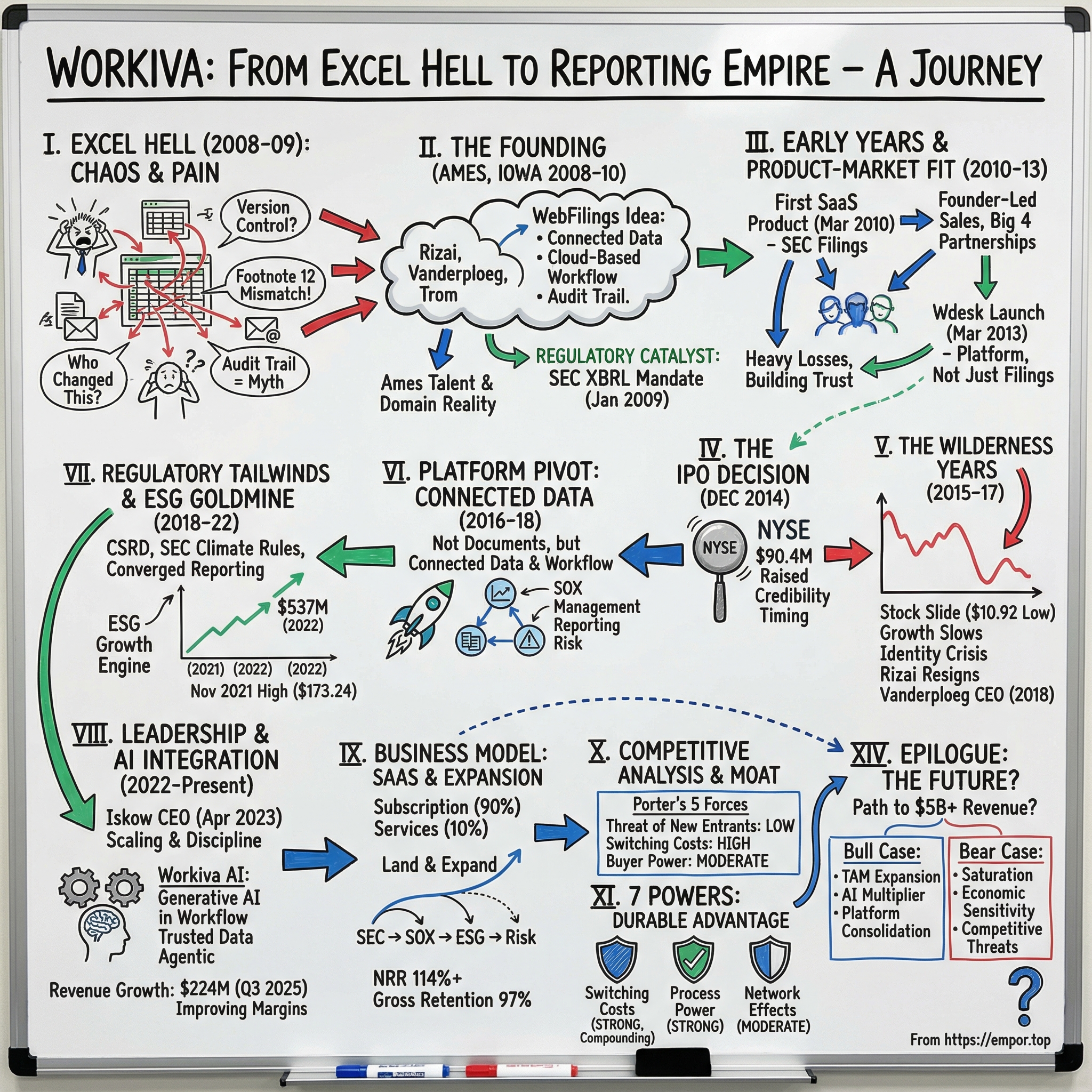

Picture a CFO at a Fortune 500 company in 2009. It’s midnight, the 10-K deadline is looming, and her team has been running on caffeine and adrenaline for weeks.

Spreadsheets are ricocheting around the company as email attachments, each one a fresh opportunity for a version-control catastrophe. Someone spots that the revenue figure in Footnote 12 doesn’t match the income statement. Another person swears they fixed it yesterday. Nobody can say which file is the real file, who changed what, or when. The audit trail is less a trail and more a myth.

That was normal. For essentially every public company in America, financial reporting meant stitching together Word docs, Excel models, PowerPoint decks, and last-minute changes from legal, finance, and auditors—all under extreme time pressure, with enormous consequences for getting it wrong. Practitioners had a name for it: “Excel Hell.”

And it was exactly this chaos that a small team of entrepreneurs in Ames, Iowa decided to take on.

Today, Workiva serves more than 5,600 organizations worldwide, including more than 85% of the Fortune 500. The company went public on December 12, 2014, and in 2024, Workiva’s revenue was $738.68 million. What started in the heartland during the Great Recession has become critical infrastructure for corporate reporting—the system behind the scenes that helps the world’s biggest companies produce filings that are accurate, auditable, and compliant.

Which raises the real question: how did a company from Iowa—not San Francisco, not Boston, not New York—end up owning one of the most specialized, most enterprise-critical corners of software?

Because Workiva didn’t just grow. It survived. It went public early. It got punished in the markets. It stared down existential doubt, then rewired its strategy while already on the field. And somehow, it came out the other side as the category leader.

The answer runs through regulatory tailwinds most people underestimated, switching costs that only get stronger with time, and a deceptively powerful product philosophy: build software that CFOs and auditors can actually trust. It’s a story about platform thinking in a “boring” domain that turns out to be anything but.

This is the story of Workiva: from Excel Hell to reporting empire.

II. The Founding Context: Iowa, Excel Hell, and a Better Way (2008–2010)

In August 2008, with the financial world beginning to crack and Lehman Brothers just weeks from collapse, three software veterans met in Ames, Iowa with a contrarian idea. Matthew Rizai, Martin Vanderploeg, and Jeff Trom founded a company they first called WebFilings—what we now know as Workiva.

They weren’t first-time founders, and they weren’t dabbling. Rizai would become Chairman and CEO, bringing years of enterprise software experience to a problem most people outside finance barely noticed. Vanderploeg helped lead the technology side as the company got off the ground. Together, they were aiming straight at the unglamorous but unavoidable machinery of public-company reporting.

So why Ames?

Because Ames had something Silicon Valley couldn’t manufacture on demand: a dense pocket of relevant talent. Iowa State University fed the area with strong engineering and business graduates, and the cost structure wasn’t distorted by coastal bidding wars. Just as important, the founders were building for accountants, finance teams, and auditors—people who live in precision, process, and proof. For that kind of product, proximity to domain reality mattered more than proximity to venture capitalists.

And the market pain was real. The Sarbanes-Oxley Act of 2002 had permanently reshaped what it meant to be a public company. Internal controls, documentation, review cycles, audit readiness—financial reporting stopped being a quarterly sprint and became a constant burden. The tools, however, didn’t keep up. Most companies still relied on a shaky stack of spreadsheets, Word documents, email threads, and last-minute patchwork.

WebFilings formed around a simple observation: SEC reporting workflows were unnecessarily manual, unnecessarily risky, and full of avoidable errors. The company set out to automate and streamline the management of financial reporting data using cloud-based software—starting with the pain center: the filing process itself.

Then a regulatory accelerant hit.

On January 30, 2009, the SEC issued final rules requiring public companies to provide financial statements in an interactive data format called XBRL. Over the following years, companies would need to tag financial data so it could be read and analyzed by machines. In theory, XBRL made financial information easier to access, compare, and study. In practice, it added yet another layer of complexity to an already brittle process.

What the founders saw—and what many observers missed—was that XBRL wasn’t the whole problem. The real problem was everything upstream of XBRL: the chaos of building the numbers, copying them into documents, reconciling inconsistencies, chasing approvals, and hoping nothing broke at the end. The true enemy was the lack of connection between the numbers and the documents that carried them.

Their “aha moment” was deceptively radical: documents shouldn’t behave like files. They should behave like systems.

What if every number in a 10-K could be linked back to its source? What if a change in one place automatically flowed everywhere it appeared? What if you could see exactly who changed what, when they changed it, and why—with an audit trail that didn’t require detective work?

In March 2010, WebFilings released its first SaaS product, focused on automating SEC filings like 10-Ks and 10-Qs. The product emphasized linked data and collaborative workflows, designed to reduce errors and shrink the time it took to get a filing out the door. It was also a clear break from the legacy world of traditional financial printing.

That was the founding vision: connected data, collaboration, and auditability—delivered through the cloud.

It sounds straightforward now. But in 2008 and 2009, “cloud-based” and “compliance-critical” did not naturally belong in the same sentence for most CFOs. Workiva was betting that enterprise buyers would eventually trust the cloud with their most sensitive reporting work—and that the winners in this market wouldn’t just publish documents. They’d control the workflow behind them.

As we’ll see, that bet eventually paid off. But first, Workiva had to endure the messy middle: slow adoption, hard enterprise selling, and the kind of wilderness years that break most companies.

III. Early Years: Building the Product and Finding Product-Market Fit (2010–2013)

By 2010, WebFilings had something real to sell: a cloud platform for SEC reporting that promised to replace the duct-tape workflow of spreadsheets, Word docs, and frantic email chains. But building a product and finding product-market fit are two very different sports. The next few years would test whether this was a nice idea—or something companies would actually bet their filings on.

That first offering went straight at the most painful, highest-stakes use case in corporate reporting: the 10-K and 10-Q. If WebFilings could make those filings faster, more accurate, and less terrifying, it wouldn’t just win customers. It would embed itself into the most rigid, deadline-driven process in corporate America.

The company also made a technology choice that explains a lot about why it ultimately worked. WebFilings didn’t try to layer “compliance features” on top of Google Docs or Microsoft Office. It built its own editor and workflow system from the ground up.

That wasn’t ego. It was physics. The requirements of SEC reporting—chain-of-custody controls, true version history, granular audit trails, linked data that stays consistent across documents, and XBRL tagging—weren’t things you could reliably bolt onto consumer productivity software. In this world, “pretty good” isn’t good enough. If a tool can’t prove what changed, who changed it, and where that number appears everywhere else, it’s not an enterprise reporting system. It’s a liability.

Of course, that decision came with a brutal adoption hurdle. WebFilings wasn’t just competing with other vendors—it was competing with decades of muscle memory. Controllers and reporting teams knew Excel and Word like second languages. Asking them to move their most sensitive work into a new platform, in the cloud, required something that’s hard to manufacture: trust.

So the go-to-market had to be personal. The early motion was founder-led sales: the team sat with prospective customers, learned the exact shape of their reporting process, and walked them through how the platform reduced risk in the places that kept them up at night. Deals didn’t close quickly. Enterprise sales cycles often stretched from six months to a year, and they were built on relationships, not clever ad campaigns.

WebFilings also had a powerful distribution lever: the Big 4 accounting firms. EY, Deloitte, PwC, and KPMG touched an enormous share of SEC filings. If WebFilings could get those firms to recommend the platform to clients—or use it as part of the collaborative workflow between auditors and management teams—it would carry instant credibility inside the most conservative buyer base imaginable.

The financial results show a company finding traction fast. Revenue grew from $14.9 million in 2011 to $52.9 million in 2012 and $85.2 million in 2013, driven by subscriptions and support. But the growth came with heavy losses: net losses were $13.6 million in 2011, $30.4 million in 2012, and $28.0 million in later periods.

Those losses weren’t mysterious. They were the bill for building the platform, hiring the team, and paying for the long, relationship-driven enterprise sales motion.

In March 2013, the company took a meaningful step beyond “SEC filing software” and launched Wdesk, an expanded cloud platform that integrated compliance, risk management, and reporting tools. This mattered because it reframed the product: not a single-purpose filing machine, but a broader system for managing enterprise reporting work.

By late 2014, WebFilings served more than 2,100 enterprise customers, including more than 60% of the Fortune 500, and it had five issued patents and 13 pending, largely tied to the data-linking technology at the heart of the platform.

And that linking capability wasn’t just a neat trick. It was the feature that turned anxiety into confidence.

A single number—say, revenue—might appear a dozen times across a 10-K: in the financial statements, in the MD&A, in footnotes, and in supporting tables. In the old workflow, if that number changed late in the process, someone had to hunt down every instance and update it manually, then confirm nothing was missed. With WebFilings, you updated the source once, and every linked reference updated automatically.

That wasn’t convenience. That was compliance. That was auditability. That was fewer late-night fire drills. And once a team ran a reporting cycle that way, going back felt unthinkable—which is how switching costs start quietly compounding.

Investors saw the shape of the opportunity, and the company raised the capital it needed to keep pushing growth even while unprofitable—the same SaaS land-grab playbook playing out across enterprise software at the time.

Then, as 2014 approached, WebFilings hit the next fork in the road: stay private and keep building at its own pace, or go public and use the capital and credibility of a stock-market listing to accelerate. They chose the second path.

It would prove both a brilliant move—and the beginning of the hardest stretch of the company’s life.

IV. The IPO Decision: Going Public Early (2014)

December 12, 2014. WebFilings—newly rebranded as Workiva—walked onto the New York Stock Exchange and became a public company.

Workiva priced its IPO at $14.00 per share, selling 7.2 million shares and raising $90.4 million in net proceeds after underwriting and offering costs. It was a watershed moment, and the kind of validation that’s hard to buy in any other way.

The rebrand itself had been part of the runway to that day. In July 2014, the company changed its name to Workiva LLC as it prepared for a broader corporate restructuring ahead of the offering, while keeping its center of gravity in Ames, Iowa.

By any conventional measure, this was an early IPO. The company was only six years old. Revenue had just crossed into nine figures. And Workiva was still losing money. Even as the business grew—fourth-quarter revenue rose to $30.1 million, up from $23.6 million a year earlier—it was clear this wasn’t a mature, predictable cash machine. It was a growth company stepping into the public spotlight.

So why go public so soon? Three reasons.

First: capital. The SaaS model is wonderful long-term, but punishing up front. You pay for sales commissions, implementation, and customer success now, then collect subscription revenue over time. The IPO gave Workiva the resources to keep investing in growth without taking its foot off the gas.

Second: credibility. If you’re asking a public-company finance team to run its most scrutinized process—SEC reporting—on your platform, the obvious question is: will you still be here in five years? Public-company status, with all the disclosure and scrutiny that comes with it, can feel like a stamp of permanence to CFOs and audit committees considering a multi-year commitment.

Third: timing. The SaaS land-grab era was in full swing. Workday and ServiceNow had already proven the public markets would reward subscription growth. Zendesk had gone out earlier in 2014. Workiva believed the window was open.

The company also leaned into the narrative. “We are pleased to report strong revenue growth for the fourth quarter and full year 2014 and to begin a new chapter as a publicly traded company,” Matthew Rizai said at the time. “Our results demonstrate increasing demand for our Wdesk platform, which is transforming the way companies collect, manage, report and analyze critical business data.”

Early signals looked like what SaaS investors love to see: stickiness. As of December 31, 2014, Workiva reported a revenue retention rate (excluding add-on revenue) of 97.0%, and 104.1% including add-ons—meaning customers largely stayed, and the base tended to expand over time.

But going public early has a hidden price tag. Every quarter becomes an exam: report results, explain what changed, and commit to what happens next. That pressure can warp decision-making, especially for a company still discovering which parts of its business are repeatable at scale and which parts require reinvention.

And then there was the Iowa factor—both advantage and liability. Ames meant lower costs and a stable employee base. It also meant less default visibility with the coastal investors and networks that shape public-market narratives. When the stock inevitably faced turbulence, Workiva wouldn’t have Silicon Valley hype to fall back on. It would have to earn attention the hard way.

The first full year as a public company brought continued growth. In 2015, Workiva’s revenue rose to $145.3 million, up 28.9% from 2014. But the questions were starting to sharpen. Growth was slowing from the early surge. Profitability still felt distant. And the market was beginning to scrutinize whether this was a platform with a long runway—or a niche product riding a regulatory wave.

The wilderness years were about to begin.

V. The Wilderness Years: Growth Pains and Existential Threats (2014–2017)

The honeymoon didn’t last.

By late 2015 and into 2016, Workiva ran into the stretch that breaks a lot of newly public software companies: growth expectations collided with the reality of long enterprise sales cycles, complex deployments, and a market that doesn’t forgive uncertainty. Revenue growth slowed. The stock slid. And inside the company, the most dangerous kind of debate started to take hold—what, exactly, was Workiva building?

The market’s verdict showed up in one brutal datapoint. Workiva had gone public at $14.00 per share. On February 12, 2016—barely fourteen months later—the stock hit an all-time low of $10.92. (For context, the stock’s all-time high would come much later, on November 4, 2021, at $173.24.)

That low wasn’t just a number. It was a signal flare.

When a young public company’s stock is in freefall, everything gets harder at once. Recruiting becomes a grind. Sales cycles get longer because procurement teams worry about vendor stability. Customers hesitate to standardize on a platform they fear might not be as independent—or as durable—as they assumed. And every board meeting gets sharper, because the questions stop being “how fast can we grow?” and start becoming “what happens if we don’t?”

Even when execution improved, the narrative didn’t. Workiva outperformed guidance in the first quarter of 2017, but its outlook for the second quarter called for slowing growth and a fairly large non-GAAP loss. At the midpoint, the company expected revenue to grow about 12.5% year over year. Management was working to win more enterprise-wide Wdesk contracts, and part of the slowdown reflected that deliberate shift: bigger, broader deals take longer to close than specialized, single-use deployments.

That set up the classic SaaS trap: “land and expand” looks great on a slide deck, and then you try to do it in the real world.

Workiva could land. Thousands of customers were already using the platform for SEC filings. But expanding those relationships beyond the initial use case—turning a filing tool into an enterprise standard—was harder than expected. The sales motion that worked for the first deal was narrow and deadline-driven. Expansion required something else entirely: strategic, consultative selling across legal, finance, risk, and audit, often with different budgets and different internal politics.

The product didn’t make this easier. Wdesk was powerful, but that power came with a learning curve. Customers needed training to unlock the full platform, and Workiva’s professional services teams often had to work intensely to get implementations right. The problem wasn’t effort. It was scale. A business can’t rely indefinitely on heroics to drive adoption.

And while Workiva was trying to broaden its footprint, competition was tightening around its core.

Donnelley Financial Solutions—often referred to as DFIN—was the second-largest SEC compliance software provider behind Workiva. Workiva had been taking share for years as customers transitioned from more traditional filing approaches to software-based solutions, and DFIN spent aggressively to catch up. From roughly 2010 to 2016, Workiva was able to snag approximately 50% market share away from Donnelley in compliance filings.

Then there was the shadow competition: the giants.

In theory, incumbents like Microsoft, Oracle, or SAP could build something similar—or at least decide they didn’t want Workiva sitting between them and the most important data a CFO produces. In practice, none of those companies had prioritized SEC filings. But “theoretically possible” is still enough to spook investors, and enough to make customers ask uncomfortable questions during a renewal.

So Workiva did what companies do when the outside pressure becomes impossible to ignore: it looked inward, and started asking the question that determines whether you survive.

What business are we really in?

One answer was “documents.” Wdesk was, on its surface, a collaborative document platform. If you accepted that framing, the competitive set became terrifying: Microsoft, Google, and every productivity tool with collaboration features. In that world, Workiva starts to look like a niche player with a nice compliance wrapper.

The other answer—the one that ultimately mattered—was “connected data.”

In that framing, Wdesk wasn’t a document tool at all. It was a data platform that happened to output documents. The value wasn’t the editor; it was the links between data elements, the workflow automation, the audit trails, and the single source of truth that eliminated spreadsheet chaos. It’s a subtle distinction, but strategically it changes everything. If you’re in documents, you’re fighting the biggest platforms on earth. If you’re in connected reporting, you can expand into any process where traceability and control matter.

This was also the period when leadership questions intensified. Matt Rizai had done the founder-CEO job brilliantly—taking Workiva from nothing to the public markets. But steering a public company through a growth crisis is a different kind of test, and the board began to evaluate what the next phase required.

In 2018, the transition became official. Following a mutual decision between the Workiva Board and Rizai, he resigned as an officer and director. The Board unanimously named co-founder Martin Vanderploeg as Chief Executive Officer.

Vanderploeg signaled both continuity and a reset: continuity with the product vision he’d helped build, and a reset in how the company would talk about itself and sell itself. “I am honored and energized to lead Workiva through our next chapter of innovation, platform expansion and revenue growth,” he said. He pointed to the company’s employees, customers, partnerships, and the recent launch of Wdata—positioning it as a key step in expanding access and usability for larger data volumes, and pushing toward a broader, enterprise-wide Wdesk platform.

Looking back, these wilderness years did more than bruise the stock chart. They forced strategic clarity. Workiva came out of this period with a sharper understanding of its advantage: not documents, but connected data. Not a single compliance workflow, but a platform.

And that positioning—earned the hard way—set the company up for the next act, when regulatory demands would expand far beyond financial filings and make “connected, auditable reporting” a much bigger market than anyone expected.

VI. The Platform Pivot: From Documents to Connected Data (2016–2018)

The strategic repositioning that saved Workiva didn’t happen in a single all-hands meeting or a dramatic rebrand. It was a slow, sometimes painful realization that the company’s real advantage wasn’t a better place to type a 10-K.

It was the connective tissue underneath: the data links, the workflows, and the audit trail that made reporting dependable.

Even before the CEO transition, management could see the pattern in what customers were buying. “Non-SEC use cases contributed 25% of our subscription bookings in 2014 and 39% in 2015,” Rizai said. “In 2016, we expect that non-SEC use cases will contribute more than 50% of our subscription bookings.”

That booking mix mattered because it revealed what customers were actually doing with the platform. Companies came in for SEC filings, then looked around and realized they had the same problem everywhere else. SOX workbooks. Management and board reporting. Risk processes. Internal audit documentation. Different teams, different deliverables, same recurring nightmare: numbers and narratives moving across documents, systems, and people, with no clean way to keep everything consistent and provable.

Workiva’s product expansion during this period followed that thread. It didn’t try to be everything to everyone. It leaned into the use cases where connected data and an audit-ready trail weren’t nice-to-haves, but the whole job.

SOX compliance was a natural next step. If Sarbanes-Oxley had turned controls into a year-round discipline, then the work demanded the same core capabilities as SEC reporting: collaboration, permissions, evidence, and a defensible history of change. Management reporting fit, too, because board books and internal packages often reuse the same underlying figures as external filings—and finance teams needed those numbers to stay in sync without spending their lives reconciling versions.

Under the hood, the company invested in making the platform connect to the systems where the data actually lived. Accelerated by its acquisition of OneCloud, Workiva’s Data Prep worked with more than 70 pre-built connectors, providing out-of-the-box integration with systems like Anaplan, BlackLine, Google, Microsoft, Oracle, SAP, Workday, and others. The point wasn’t the connector count. The point was what it enabled: a more self-service, repeatable path for customers to pull data from mission-critical systems and use it inside Workiva’s controlled reporting environment.

Out of all of this came the vision Workiva would later describe as “assured integrated reporting”: the idea that financial, governance, and sustainability reporting should flow from one source of truth, through one set of controls, with one audit-ready trail. It wasn’t just a slogan. It was the organizing principle for how the product should evolve.

The go-to-market had to evolve, too. Selling SEC filing software is a straightforward, deadline-driven pitch: you either ship a compliant filing or you don’t. Selling a platform is different. Workiva’s sales teams increasingly led with an arc: start with SEC reporting, expand into SOX, then into adjacent reporting workflows—on the same infrastructure, with the same linking model, and the same controls.

That shift showed up in the retention numbers. As of December 31, 2015, Workiva reported revenue retention of 95.8% excluding add-on revenue, and 112.5% including add-ons. In other words: customers stayed, and many expanded.

That 112.5% figure was the most important proof point. It suggested Workiva wasn’t trapped as a one-use-case tool. The platform idea was translating into dollars, because expansion was happening in the exact way the strategy required.

But expansion doesn’t happen just because a product has more modules. It happens when customers successfully adopt what they bought. So customer success became a strategic lever, not a support function. Workiva invested in implementation playbooks, training, and teams focused on getting customers beyond “we filed once” to “this is how we run reporting now.”

The repositioning also changed the competitive frame. Point solutions could still fight Workiva deal-by-deal. Certent could show up for a specific SEC workflow. Donnelley Financial could win certain capital markets transactions. But Workiva was increasingly pitching something harder to copy: a unified system that connected reporting across teams and time, with auditability baked in.

And for the buyer—usually a CFO, controller, or compliance leader—that matters more than feature checklists. These are risk-averse customers. They don’t want to stitch together tools and hope the integrations hold at midnight on filing day. They want one vendor they trust, one platform their teams can standardize on, and one set of controls they can defend.

“‘Nobody got fired for choosing Workiva’ became the enterprise software version of the old IBM axiom. It wasn’t flashy, but it fit the psychology of the market perfectly.

By the end of this era, the story started to click. Workiva wasn’t building a better document editor. It was building the infrastructure layer for connected enterprise reporting.

And then the world handed it a tailwind that would make “connected, auditable reporting” feel a lot less like a niche—and a lot more like a land grab.

VII. Regulatory Tailwinds and the ESG Goldmine (2018–2022)

If Sarbanes-Oxley created Workiva’s first great opening, ESG reporting created the second—and it turned out to be even bigger.

For years, ESG, short for Environmental, Social, and Governance, lived off to the side of the core finance function. It was often a mix of voluntary reporting, investor relations messaging, and corporate responsibility initiatives. Then, starting around 2019—and accelerating hard through 2020 and 2021—ESG stopped being optional. It began to look, feel, and behave like compliance.

The push came from everywhere at once. In Europe, the Corporate Sustainability Reporting Directive (CSRD) was on a path to require detailed, audited sustainability disclosures from roughly 50,000 companies. The EU’s Sustainable Finance Disclosure Regulation (SFDR) added pressure on financial services firms. In the U.S., the SEC’s climate disclosure rules faced political uncertainty, but the direction of travel was still clear: California’s climate disclosure laws, plus investor expectations, meant most large American companies would be pulled into ESG reporting whether Washington moved quickly or not.

Erik Saito, General Manager for EMEA and APAC at Workiva, captured what this meant inside companies: “Data, narratives and the needs of once-disparate functions within your business have converged. We need to be honest about these changes and understand how we need to adapt.”

That convergence was the whole game. Because once ESG becomes a requirement, it creates the exact same kind of operational nightmare that SEC reporting always did—just spread across more departments, more systems, and more metrics.

ESG reporting meant pulling data from across an organization, tying that data to written disclosures, coordinating reviews between teams that didn’t traditionally work together (finance, sustainability, operations, legal), and producing outputs that could stand up to scrutiny. Not just “can we publish something?” but “can we prove it?”

For Workiva, this was a near-perfect tailwind. It was the same problem statement as financial reporting, just applied to a new domain. The company had spent a decade building software for controlled collaboration, linked data, and audit trails. Now the market was asking for that exact thing—at scale.

Marty Vanderploeg, Workiva’s Chief Executive Officer, underscored the impact in the company’s 2022 results: “Our strong performance resulted in a 2022 revenue growth rate of 23% in Subscription & Support and 21% in total revenue. We delivered strong growth in multiple solution areas, led by ESG. ESG was one of our fastest growing solutions in 2022.”

In other words, ESG wasn’t an experiment on the side. It was quickly becoming a core growth engine.

Workiva leaned in. In early 2022, the company announced it was strategically investing in people, technology, partners, and go-to-market strategy to capture what it saw as a significant ESG market opportunity.

The land grab dynamics were ideal for an incumbent platform. Large companies needed ESG infrastructure quickly, and the requirements were complex enough to overwhelm manual processes—tracking Scope 1 and 2 emissions, preparing for the growing demands around Scope 3, managing workforce and social metrics across geographies, and producing governance disclosures that touched boards and executive compensation. The moment ESG turned into something auditors and regulators might challenge, “good enough” reporting stopped being good enough.

COVID-19, paradoxically, pushed things further. Remote work broke the old operating model of finance and reporting teams crowding into war rooms and pushing documents around internally. Collaboration had to happen digitally, with controls intact. Workiva was built for exactly that: distributed work, with version history and accountability baked in.

During this period, Workiva positioned its platform as the connective layer between Financial Reporting, ESG, and Governance, Risk, and Compliance—one controlled, secure, audit-ready environment. The company also received an AAA rating in the 2022 MSCI ESG Ratings assessment, MSCI’s highest rating. According to MSCI, Workiva performed in the top 9% of all SaaS companies evaluated globally in 2022.

Customer behavior began to reflect the platform story Workiva had been trying to tell for years. Companies that started with SEC reporting expanded into ESG. Then risk reporting. Then internal audit. Each added workflow made Workiva more embedded—and harder to replace.

You can see the step-change in the financials. Workiva’s annual revenue grew to $443.29 million in 2021 (up 26.08% from 2020), then to $537.88 million in 2022 (up 21.34% from 2021). In plain terms, revenue climbed from about $352 million in 2020 to about $538 million in 2022, as growth re-accelerated on the back of ESG demand.

The stock market noticed too. Workiva’s all-time high stock closing price was 160.85 on November 09, 2021. From the lows of early 2016, that run-up reflected a change in perception: Workiva was no longer a niche compliance tool trying to convince the world it was a platform. It was starting to look like the platform.

Competition didn’t disappear, but the terrain shifted. Traditional financial printers struggled to keep pace with cloud-first workflows. ESG point solutions could help with specific frameworks, but they didn’t offer an integrated system that finance leaders could control end-to-end. And while large enterprise software vendors like SAP and Oracle had sustainability modules, those often lived as bolt-ons inside ERPs, not as purpose-built systems for connected, auditable reporting.

By the end of this era, Workiva had become the 800-pound gorilla in enterprise reporting—and the regulatory momentum behind ESG suggested this wasn’t a temporary spike. It was a new permanent layer of corporate compliance.

VIII. Leadership Evolution and AI Integration (2022–Present)

By the time ESG demand had pushed Workiva into a new growth gear, the company faced a very different challenge than it had in the early Ames days. It wasn’t just about building the right product anymore. It was about running a scaled enterprise business—predictably, efficiently, and with the kind of operational discipline public markets expect—while still chasing an ambitious north star: $1 billion in revenue.

That backdrop helps explain the leadership moves that followed.

Workiva announced the promotion of Julie Iskow to president and chief operating officer, effective March 1, 2022. She had joined in 2019 as EVP and Chief Operating Officer, bringing experience from Medidata Solutions, a SaaS and data platform for life sciences, where she served as Chief Technology Officer. At Medidata, she led technology and product strategy through a period of rapid scaling that contributed to a strategic sale in 2019.

Then came the bigger transition. Iskow was appointed to succeed Marty Vanderploeg as Chief Executive Officer, effective April 1, 2023.

Her fit for the moment was straightforward: Workiva had become a platform company selling into the most conservative buyers in enterprise software. Scaling that kind of business takes both product instincts and process rigor. Workiva framed it similarly, noting that Iskow had spent the prior three years shaping the leadership team and operational strategy as the company progressed toward its long-term revenue goal.

And almost immediately, the market forced the next question: what does Workiva look like in the AI era?

The launch of ChatGPT in late 2022 created both opportunity and pressure. Every enterprise software company suddenly needed a credible AI story. But for Workiva’s customers—CFOs, controllers, audit leaders—AI couldn’t be a gimmick. It had to work inside compliance-grade workflows, with security and auditability intact.

Workiva announced that generative AI would be available on its cloud platform, positioning it as a way to boost productivity, improve efficiency, and surface insights faster for business reporting teams. In practice, Workiva AI was designed to feel native to the platform: a global chat tool available in the toolbar, plus a growing set of embedded “companion” tools that could operate directly inside documents, spreadsheets, and presentations.

But the more important point was where Workiva aimed the capability. Instead of generic AI features, it emphasized reporting-specific workflows—tools to generate content grounded in trusted data, like narratives built from tables, controls based on existing documentation, or draft disclosures aligned to a company’s specifications. The company also described its innovations as embedding agentic AI into workflows, automating steps that slow teams down, and delivering continuous, connected insights within a secure, auditable environment.

Security and privacy were non-negotiable. Workiva’s buyers have zero tolerance for “we’ll figure it out later” when it comes to sensitive financial data. Workiva stated that Workiva AI is encrypted, session-limited, and never trained on Workiva content or customer data.

It also took an LLM-agnostic approach. Workiva AI allows users to choose their preferred LLM for response generation, with available models including options from Google, AWS/Anthropic, and Microsoft/OpenAI (subject to change over time). That flexibility matched how large enterprises actually buy: different vendor standards, different risk postures, and different internal politics. Giving customers choice removed friction without giving up the productivity upside.

The business results during this period suggested the strategy was working: keep expanding the platform, move upmarket, and make Workiva harder to displace.

In the fourth quarter of 2024, Workiva’s total revenue reached $200 million, up from $167 million in the fourth quarter of 2023.

As of December 31, 2024, Workiva reported a gross retention rate of 97% and a net retention rate of 112%. It also reported a growing base of large customers: 2,055 customers with annual contract value above $100,000, and continued growth in larger cohorts above $300,000 and $500,000 in ACV.

The trend continued into 2025. As of September 30, 2025, Workiva again reported gross retention of 97%, with net retention rising to 114%, and further growth in customers above $100,000, $300,000, and $500,000 in ACV.

That mix shift mattered. More big contracts meant Workiva was doing what great enterprise platforms do: starting in one high-stakes workflow, then expanding until the platform becomes the operating system for reporting across the organization.

Profitability was improving too. In the third quarter of 2025, GAAP operating margin improved to (1.5)% from (11.8)% in the prior year’s third quarter. Non-GAAP operating margin rose to 12.7% from 4.1% in the third quarter of 2024.

That’s the SaaS endgame Workiva had been building toward for years: strong retention, expanding deal sizes, and operating leverage—without letting go of the core promise that got it here in the first place: reporting you can trust.

IX. Business Model Deep Dive: What Makes Workiva Tick

To understand Workiva, you have to understand the mechanics underneath the story: how it makes money, why customers rarely leave, and why the platform tends to grow inside an organization once it gets a foothold.

At its core, Workiva sells multi-tenant cloud software built for one job: take critical business data, keep it connected, and produce reporting you can defend. The platform’s foundation is data linking, audit trails, and administrative controls—plus the ability to connect to and transform data from major systems of record, including ERP, HCM, and CRM platforms, along with other third-party cloud and on-premise applications.

The revenue model is classic enterprise SaaS. Customers pay subscription fees based on platform capabilities and user counts, typically under annual or multi-year contracts. In 2024, revenue reached $739 million, up 17% from $630 million in 2023. Subscription and support revenue was $668 million, up 20% year over year.

That mix is exactly what you want to see in a SaaS business: roughly 90% subscription revenue and roughly 10% professional services. Services—implementation help, training, and consulting—are often necessary when you’re selling to large enterprises with complex processes, but they’re usually lower margin than subscriptions.

The more interesting signal is how those pieces move over time. In the first quarter of 2025, revenue was $206 million, up 17% from $176 million in the first quarter of 2024. Subscription and support revenue was $186 million, up 20%, while professional services revenue was $21 million, flat year over year.

That “flat services, growing subscriptions” dynamic is a quiet win. It suggests customers are getting more value from the platform without Workiva needing to scale services in lockstep—less hand-holding, more repeatability.

From there, the story becomes very enterprise. Workiva’s growth isn’t just about winning new logos; it’s about expanding inside accounts. You can see it in the rising number of large contracts. As of December 31, 2023, Workiva had 1,631 customers with annual contract value above $100,000, up 21% from 1,345 a year earlier. It also had 915 customers above $150,000 in ACV, up 27% from 718, and 311 customers above $300,000, up 32% from 236.

That’s “land and expand” in the real world. A company often starts with one high-stakes use case—frequently SEC reporting, because the pain is immediate and the deadline is immovable. Then the platform earns the right to spread: SOX compliance, ESG reporting, internal audit, risk management. Each additional workflow raises the contract value and, more importantly, deepens Workiva’s integration into how the company actually operates.

As Workiva put it in the quarter, 64% of subscription revenue came from customers with multiple solutions. That’s the platform thesis showing up in one clean metric: most subscription dollars are coming from customers who are already using Workiva for more than one job.

Retention is where the moat becomes visible in financial terms. Workiva reported gross retention of 97% and net retention of 114%, with net retention reflecting changes in solutions and pricing among existing customers.

A 97% gross retention rate means customers almost never leave. And in compliance-heavy workflows, that makes intuitive sense: once your reporting process depends on linked data, permissions, workflows, and a defensible audit trail, switching isn’t just a procurement decision. It’s a risk decision.

Net retention of 114% adds the second half of the story. Even after accounting for churn, the existing customer base spent more year over year. That combination—low churn plus steady expansion—is what a sticky enterprise platform looks like when you translate it into numbers.

The unit economics support the picture. GAAP gross margin was 79.3% versus 76.5% in the third quarter of 2024, and non-GAAP gross margin was 81.4% compared to 78.6%. Those are software margins: once the platform exists, the marginal cost of serving additional customers is relatively small, which is what creates the foundation for long-term profitability as scale kicks in.

Finally, Workiva has two multipliers that are hard to replicate.

One is distribution through partners. The Big 4—EY, Deloitte, PwC, and KPMG—maintain relationships with Workiva, recommend it to clients, and use it for collaborative work. In a category built on trust, that kind of endorsement isn’t just lead flow. It’s credibility.

The other is positioning. This is “boring but essential” software, and that’s exactly the point. CFOs don’t want to experiment with compliance infrastructure. They want something stable, proven, and likely to be around for the long haul. Workiva’s public-company profile, its Fortune 500 penetration, and its track record in audit-sensitive workflows all reduce perceived risk—which, in this market, is often what wins the deal.

X. Competitive Analysis: Porter's Five Forces

To see why Workiva has held its ground—and why it’s so hard to unseat—we can zoom out and look at the industry structure around it.

Threat of New Entrants: LOW

On paper, “reporting software” sounds buildable. In reality, a credible Workiva competitor needs years of product development, deep regulatory knowledge, and trust with the exact people who hate risk: finance leaders and their auditors. You also need distribution into that world—relationships with enterprise customers and audit firms that aren’t won with clever marketing.

And then there’s the biggest barrier of all: switching costs. Even if a new entrant shipped a technically better product, it would still face the painful truth of compliance workflows—customers don’t rip out the system that holds their linked data, audit trails, and filing processes unless the alternative is overwhelmingly better and the transition risk is near zero. The regulatory surface area—SEC requirements, XBRL, SOX controls, CSRD disclosures—only reinforces that inertia.

Bargaining Power of Suppliers: LOW

Workiva largely controls its own technology stack, and it isn’t dependent on a handful of niche suppliers to deliver the product. Cloud infrastructure is effectively a commodity at this level—AWS, Azure, and Google Cloud can all support comparable capabilities.

The real “supplier” constraint is talent. Here, Workiva benefits from being headquartered in Ames, Iowa, and operating with approximately 2,828 employees globally. Iowa gives the company a more favorable cost and retention profile than many coastal tech hubs, which matters over decades of steady R&D and customer support.

Bargaining Power of Buyers: MODERATE

Workiva sells to big enterprises, and big enterprises negotiate hard. Procurement teams have leverage, and compliance budgets—while protected—aren’t infinite.

But buyer power changes after adoption. Once Workiva is embedded, the renewal conversation isn’t just about price. It’s about risk. Leaving would mean exporting years of linked and audited data, retraining teams, rebuilding workflows, and running a high-stakes migration where mistakes can have real regulatory consequences. That reality creates a kind of practical lock-in, which limits how far buyers can push—especially if they’re mid-cycle on reporting and audits.

Threat of Substitutes: MODERATE TO LOW

The “substitute” for almost any enterprise tool is the same one: Excel and Word. They’re still there, still familiar, and still used. But modern compliance has made manual processes increasingly brittle and expensive. As requirements expand, the old duct-tape workflow becomes harder to defend.

There are also point solutions—tools for XBRL tagging, carbon accounting, or internal controls—but they can’t replicate what Workiva offers as an integrated platform. In theory, giants like Microsoft, Oracle, or SAP could build something similar. Large customers might even try to develop parts of it in-house to keep full ownership of their processes and data. In practice, none of those paths have become a true replacement at scale, largely because the work is complex, constantly changing with regulation, and difficult to maintain reliably over time.

Industry Rivalry: MODERATE

Workiva competes most directly with DFIN’s ActiveDisclosure business, as well as offerings from Certent and Toppan Merrill’s Bridge. Donnelley Financial is the largest SEC filer in the United States, with more than 80,000 submissions in 2020, and it is the second-largest SEC compliance software provider behind Workiva.

But this isn’t a commodity knife fight. The competitive landscape is made up of differentiated players with different histories and strengths. Donnelley Financial Solutions is strong in capital markets transactions and comes from a legacy world of financial printing. Certent and other vendors focus on specific slices of the workflow.

Workiva’s advantage is that it’s increasingly selling a unified, platform-based approach to enterprise reporting—one that spans multiple workflows and teams. As that platform footprint expands inside customers, rivalry still exists, but the battlefield shifts from individual features to something harder to copy: the whole connected system.

XI. Hamilton's 7 Powers Analysis

Porter tells you what the industry looks like from 30,000 feet. Hamilton Helmer’s 7 Powers gets more personal: what specific advantages does Workiva have that can actually endure?

Scale Economies: MODERATE

Software wants to scale. Once the platform is built, serving the next customer is relatively cheap. But Workiva doesn’t get to coast. Regulations change, customers add use cases, and the bar for security and reliability keeps rising—so the company has to keep investing in R&D and support. The result is real scale leverage, just not the “set it and forget it” kind.

Network Effects: MODERATE TO STRONG

Workiva’s network effects don’t look like a social network, but they’re there.

As more companies run reporting on the platform, standard ways of working spread. Partners build repeatable implementations. Taxonomies and best practices mature. And the Big 4 and other advisors have more reason to train teams, hire specialists, and build methodologies around Workiva. That partner investment then makes Workiva easier to buy, easier to deploy, and harder to avoid.

There’s also a collaboration dynamic: companies and their auditors can work in the same environment, with shared visibility and controls. In a process where “prove it” matters as much as “do it,” that shared workflow becomes a quiet, compounding advantage.

Counter-Positioning: STRONG (Historically)

Workiva’s early edge was classic counter-positioning: it was built for the future that incumbents couldn’t fully embrace without hurting themselves.

Donnelley Financial, despite being a dominant player, saw revenue decline for several years after being spun off from R. R. Donnelley & Sons Company in 2016, partly due to the secular decline of its print business. Legacy players were tied to print-based, service-heavy, high-touch models. Moving customers to cloud-native SaaS would have cannibalized the very revenue streams those businesses were built on.

Workiva didn’t have that baggage. It started cloud-native, and as customers shifted away from legacy filing and printing workflows, Workiva was able to take significant share in compliance filings from about 2010 to 2016.

Switching Costs: VERY STRONG

This is the main event—the moat that really explains the durability.

To switch away from Workiva, a customer isn’t just changing vendors. They’re trying to transplant a living system:

- Data migration: years of linked, audited data have to be exported, restructured, and imported somewhere else

- Training costs: teams that built muscle memory in Workiva need to relearn workflows under deadline pressure

- Process integration: approvals, permissions, controls, and cross-team handoffs have to be rebuilt

- Regulatory risk: nobody wants to change the engine while the plane is in the air—especially mid-reporting cycle

- Audit trail continuity: historical audit trails get messy, and “messy” is a dangerous word in compliance

And the most important part: these switching costs compound. Every new reporting cycle run in Workiva, every new workflow added, every additional team brought onto the platform makes the idea of leaving more painful—and less likely.

Branding: MODERATE

Workiva isn’t a household name, but it doesn’t need to be. In the circles that matter—CFOs, controllers, compliance leaders, audit committees—it’s associated with reliability and credibility. In a risk-averse category, that reputation reduces friction and helps close deals.

Cornered Resource: WEAK TO MODERATE

Workiva’s XBRL and regulatory expertise is valuable, but not entirely unique. Its Iowa talent base is an advantage, but not an exclusive one.

What becomes more interesting over time is the data and usage patterns Workiva has accumulated across years of reporting workflows. That history can translate into an advantage—especially as AI features become more central—because the platform sits on structured, contextual, compliance-grade work.

Process Power: STRONG

Workiva has baked a lot of hard-earned knowledge into how the product is implemented and used. Thousands of deployments have turned into repeatable playbooks. Years of customer feedback have embedded practical details—how reviews happen, how evidence gets tracked, how deadlines compress, how auditors actually work—directly into the platform.

Competitors can copy features. It’s much harder to copy institutional know-how at scale.

Summary: Workiva’s moat is primarily Switching Costs + Process Power, with growing Network Effects. In enterprise software—especially compliance-grade workflows—that combination is about as durable as it gets.

XII. Bull vs. Bear Case: What's at Stake

The Bull Case

TAM expansion continues: ESG reporting is still early globally. CSRD will push thousands of European companies—and many of their U.S. subsidiaries—into producing detailed, auditable sustainability disclosures. California’s climate disclosure laws pull in hundreds more large companies. As more jurisdictions turn “nice-to-have” sustainability reporting into “prove-it” compliance, the market for platforms that can produce defensible reporting keeps getting bigger.

Platform consolidation wins: Every new reporting requirement—SEC filings, ESG, SOX, internal audit, risk management—has the same underlying problem: data has to be collected, reconciled, narrated, reviewed, and signed off, with an audit trail that holds up later. Workiva’s bet is that once a customer trusts one system for that, they’d rather expand it than stitch together a pile of point solutions. If that preference holds, Workiva’s advantage compounds over time.

AI multiplier: Workiva’s data is structured, validated, and contextual—the kind AI can actually use without hallucinating its way into trouble. If Workiva can deliver AI that’s grounded in customer-specific reporting data while staying secure and auditable, it can be more than a novelty feature. It can become a real productivity edge inside compliance workflows.

Market consolidation opportunity: As the category leader, Workiva has the option to keep buying smaller competitors or adjacent capabilities—expanding the platform while narrowing the field at the same time.

Durable moat: Switching costs don’t just exist; they grow. A customer that’s run a decade of filings, controls, and reporting cycles on linked data and locked-down workflows isn’t comparing features anymore. They’re comparing risk—and the risk of switching only increases with every year of history stored in the platform.

Rule of 40 potential: If Workiva can keep growth in the high teens while margins continue to expand, it has a path toward Rule of 40 performance as it matures—the kind of profile public markets tend to reward in durable SaaS businesses.

The Bear Case

Market saturation: Workiva already serves more than 85% of the Fortune 500. That’s a flex, but it also raises the obvious question: where do new logos come from? Over time, more of the growth has to come from expanding inside accounts instead of landing fresh ones.

Economic sensitivity: Compliance is hard to cut, but selling new platform footprints still depends on budgets and timing. With long enterprise sales cycles, any recession or spending freeze can show up as delayed deals and slower expansion.

Competitive threat from giants: Microsoft or Salesforce could decide enterprise reporting is strategically important and bring distribution and bundling power to the fight. It hasn’t happened yet, but the possibility hangs over the category and can create persistent uncertainty.

Execution risk: Getting to $1 billion in revenue while improving margins is a balancing act. Slip-ups in product velocity, customer success, or go-to-market focus could slow the flywheel—especially when customers are betting their most sensitive reporting processes on the platform.

Valuation premium: Premium SaaS multiples don’t leave much room for a bad quarter. Any growth wobble—or a credible new competitive threat—can lead to sharp multiple compression.

Disruption possibility: If AI agents eventually can gather data, draft narratives, and handle tagging and compliance checks with minimal human involvement, the question becomes uncomfortable: does that reduce the need for collaborative reporting platforms—or does it make the controlled, auditable system of record even more important?

Key Metrics to Track

For investors monitoring Workiva’s trajectory, two metrics tell you the most about whether the platform flywheel is still spinning:

Net Revenue Retention (currently 114%): This is the clearest read on expansion versus churn. If net retention stays above 110%, the installed base is compounding. If it drifts toward 105% or below, the expansion engine is losing force.

Large Contract Growth (customers with ACV > $300K): This shows whether Workiva is moving upmarket and deepening relationships. Strong growth signals that customers are standardizing on the platform across more workflows; deceleration can be an early warning sign of saturation or a tougher buying environment.

XIII. Lessons for Founders, Operators, and Investors

Workiva’s path—from an Iowa startup to the default system behind enterprise reporting—offers lessons that have nothing to do with SEC filings and everything to do with building durable companies.

Boring is beautiful. Compliance software isn’t glamorous, and that’s the point. When a product sits underneath mission-critical work, it doesn’t need to be trendy to be valuable. Enterprise infrastructure can quietly turn into the kind of revenue stream that lasts for decades.

Timing + tailwinds matter. Sarbanes-Oxley created the initial pressure. XBRL added technical complexity that pushed companies toward specialized tools. ESG reporting then arrived as a second wave that looked a lot like compliance. Workiva benefited because it paid attention to where regulation was headed—and built for that world early.

Switching costs beat features. A slick UI is nice; a system that becomes painful to remove is better. Every reporting cycle customers run in Workiva creates more linked data, more workflows, more training, and more reliance on the audit trail. Over time, the decision to leave stops being about software preference and becomes a question of risk tolerance.

Platform thinking requires patience. Workiva started with a narrow wedge—SEC filings—but built the core infrastructure for expansion from the start. The same data-linking foundation that made a 10-K safer also made SOX work, ESG disclosures, and internal audit documentation easier. That architectural choice is what made the later platform pivot possible.

Surviving the wilderness matters. Many companies don’t make it through the messy middle, and Workiva’s was real. From 2015 to 2017, growth expectations tightened, the stock fell to $10.92, and the company risked losing talent, confidence, and narrative. Getting through that stretch required holding conviction in the core idea while being willing to change how the company framed and sold it.

Geographic arbitrage is real. Building in Iowa created compounding advantages: lower costs, longer employee tenure, and less distraction from constant recruiting battles. Over years of steady R&D and customer support, those edges can add up.

Going public early has trade-offs. The 2014 IPO brought capital and credibility—both valuable when you sell into conservative enterprises. But it also brought the tax of public scrutiny. Every quarter became a referendum, and the margin for experimentation shrank. For earlier-stage companies, that trade-off is existential, not cosmetic.

In enterprise software, winners buy their competitors. Consolidation isn’t an accident; it’s how categories mature. As a leader emerges, acquisitions can expand the platform, fill product gaps, and remove competitive pressure—all while increasing the gravitational pull of the ecosystem.

Understand your buyer. Workiva sells to CFOs, controllers, and audit committees—people trained to avoid unnecessary risk. They don’t want to “try something new.” They want something defensible, stable, and likely to be around for the rest of their careers. Companies that win these buyers build differently, market differently, and prioritize trust over novelty.

XIV. Epilogue: Where Does Workiva Go From Here?

By the third quarter of 2025, Workiva’s momentum was still building. Subscription and support revenue grew 23% year over year, and total revenue reached $224 million for the quarter—up 21%. As 2025 drew to a close, Workiva stood at a familiar kind of moment for great enterprise companies: the fundamentals looked strong, but the next leg required a new level of ambition and execution.

The base business was doing what you want a platform business to do. Revenue was approaching $850 million annually. Cash, cash equivalents, and marketable securities totaled $857 million, giving the company plenty of runway to keep investing. Margins were expanding. The cohort of large customers kept growing, which is another way of saying the platform was still spreading inside the accounts it already had.

Now the questions get bigger.

The AI era: Workiva, which trades on the NYSE as WK, has positioned itself as an AI-powered platform for transparency, accountability, and trust. At Amplify, the company announced a major expansion of its intelligent platform, introducing agentic AI, unified data automation, and a modernized controls experience aimed at the Office of the CFO. The strategic bet is clear: can Workiva turn its core advantage—structured, validated, contextual reporting data—into an AI advantage that generic tools can’t replicate? The opportunity is there, but it won’t be won by press releases. It will be won by shipping real product, proving reliability in compliance workflows, and getting customers to adopt it at scale.

International expansion: Workiva has meaningful traction outside the U.S., particularly in Europe where CSRD requirements are pushing companies to professionalize sustainability reporting. But most revenue still comes from the United States. Replicating its U.S. success globally means navigating different regulatory regimes, different buyer expectations, and different competitive landscapes—exactly the kind of complexity that can create a moat, but also slow you down if you underestimate it.

Adjacent markets: Board management software, internal audit, regulatory change management—there’s a long list of categories next to Workiva’s core where the same promise applies: connected data, controlled workflows, and reporting you can defend. Each adjacency expands the platform’s scope. Each also adds product and go-to-market complexity, which is the tax every platform company pays as it tries to become a system of record for more of the enterprise.

The ultimate question: Can Workiva become a $5B+ revenue platform company—an enterprise category king alongside Salesforce, Workday, and ServiceNow? Going from roughly $850 million to $5 billion isn’t a straight line. It demands sustained innovation, smart expansion into new markets, and continued retention and growth inside the existing base.

And, of course, the risks are real. A serious push from Microsoft or Salesforce into enterprise reporting. A regulatory reversal that meaningfully reduces ESG disclosure requirements. A failure to adapt if AI changes how reporting work is done. Macro conditions that stretch already-long enterprise buying cycles even further.

But the more interesting takeaway is what Workiva proves.

Category-defining companies can come from anywhere—not just coastal tech hubs. Regulatory complexity, which most people treat as dead weight, can become an enduring advantage if you build the right product around it. And “boring” enterprise infrastructure, built patiently, can create enormous value precisely because it sits underneath work that can’t fail.

From Excel Hell to a reporting empire. From near-death moments as a young public company to category dominance. From Ames, Iowa to near-ubiquity in the Fortune 500—Workiva’s story is still being written. But the chapters so far point to a company that earned its position the hard way, and built foundations strong enough to keep compounding.

For CFOs preparing the next 10-K, sustainability leaders staring down CSRD, and internal audit teams living inside SOX controls, Workiva remains the platform trusted with the most critical work. And in enterprise software, trust isn’t just a feature. It’s the ultimate moat.

XV. Further Reading and Resources

Key Primary Sources

Workiva SEC Filings: Workiva’s 10-K and 10-Q filings are the cleanest way to see the business as it really is—revenue mix, retention and customer metrics, and the risk factors management has to disclose when the stakes are highest.

SEC XBRL Documentation: If you want to understand the regulatory spark that helped create Workiva’s first market, start with the SEC’s Interactive Data rules adopted in 2009 and the practical implications of XBRL tagging.

CSRD and ESRS Documentation: For the current wave, go straight to the source. The EU’s CSRD requirements and the ESRS standards explain why ESG reporting is rapidly turning into audit-ready compliance work—and why the market is expanding.

Workiva Investor Presentations: Workiva’s investor deck history is useful not just for metrics, but for narrative. You can watch the company’s strategy shift over time from “SEC reporting tool” to “connected reporting platform,” and see what it chooses to emphasize as the market changes.

Strategic Frameworks Referenced

7 Powers by Hamilton Helmer: The framework used here to explain why Workiva’s advantages endure—especially switching costs and process power, the two forces that tend to compound quietly in compliance-heavy enterprise software.

The Innovator's Solution by Clayton Christensen: Helpful for interpreting how Workiva took share from legacy incumbents like Donnelley Financial by building a cloud-first model that traditional, service-heavy businesses struggled to match without cannibalizing themselves.

Crossing the Chasm by Geoffrey Moore: The right lens for the messy middle of Workiva’s story: long enterprise sales cycles, conservative buyers, and the challenge of turning early traction into mainstream adoption.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music