10X Genomics: The Story Behind the Single-Cell Revolution

I. Introduction & Episode Roadmap

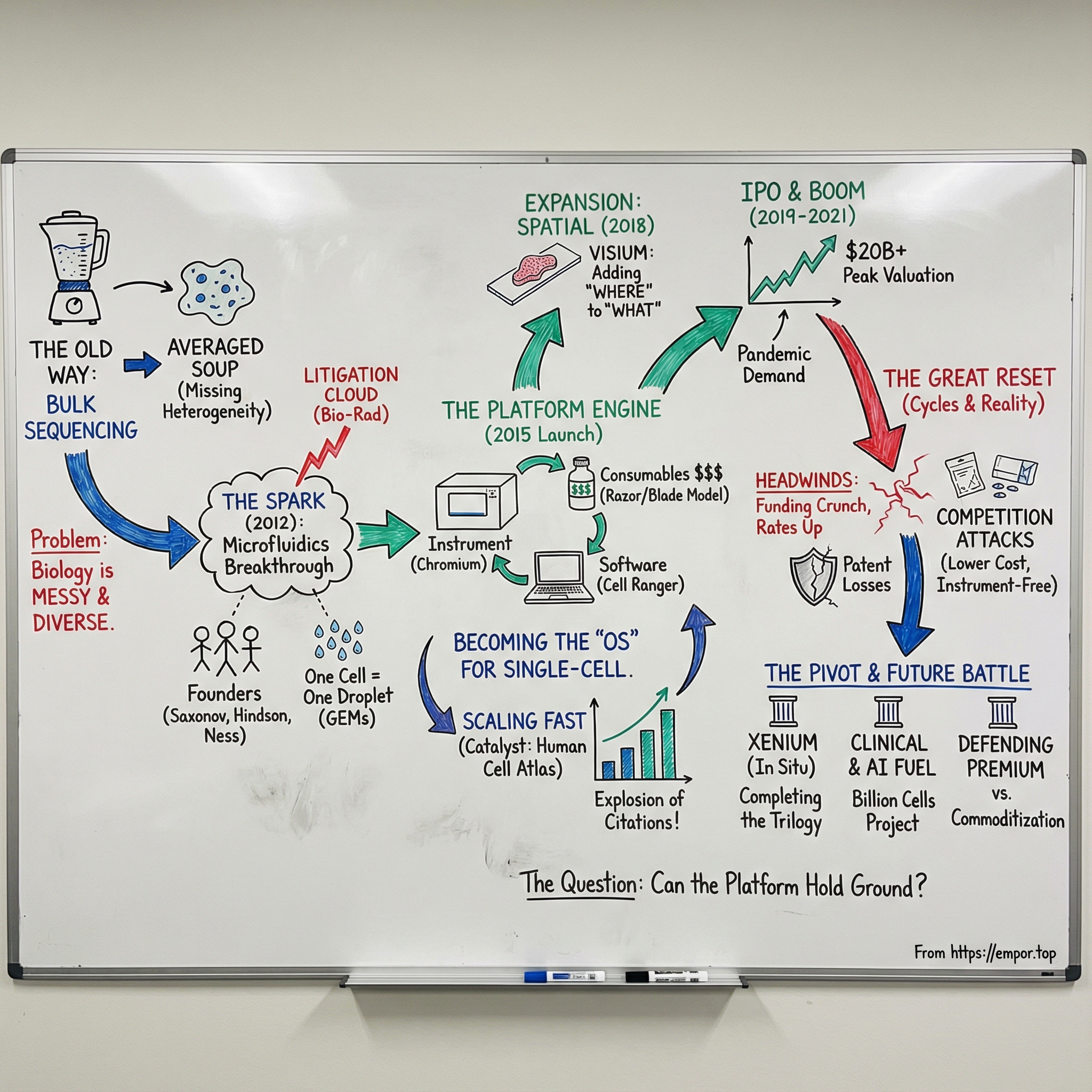

Picture a research lab in 2014. Scientists trying to understand cancer knew the real answers lived in the differences between cells. But their best tool was bulk sequencing, which mashed millions of cells together and returned one averaged signal—like trying to pick out a single violin by recording the whole orchestra and then listening to the mean. The nuance disappeared. And with it, the heterogeneity that actually drives disease.

Into that frustration stepped a company with an audacious name that telegraphed its ambition: 10X Genomics. The “10X” wasn’t just branding. It captured the founders’ intent to go after order-of-magnitude leaps in biology—to build something that could change what was even possible to measure.

Today, 10X Genomics is an American life sciences technology company headquartered in Pleasanton, California. It develops and commercializes instruments, consumables, and software that let researchers analyze biology at single-cell, spatial, and in situ resolution—and do it at scale. In a field where credibility is built paper by paper, 10X quickly became a default: at the 2019 IPO, around 500 academic papers cited the technology in their methods; by 2022, that number had grown to more than 4,100.

In 2024, the company generated $610.8 million in revenue, supporting work in thousands of labs worldwide. Its tools became nearly synonymous with single-cell analysis, powering breakthroughs across cancer biology, immunology, and neuroscience—and helping enable the Human Cell Atlas. As Aviv Regev of the Broad Institute put it, “The Human Cell Atlas is one of the most important scientific research undertakings since the Human Genome Project.”

This is the story of how three scientists spun out of an acquired company, endured years of bitter patent litigation, built the dominant platform for single-cell analysis—and now face an existential question: can a premium technology leader hold its ground as lower-cost competitors democratize the very market it helped create?

II. The Genomics Revolution & Founding Context

When the Human Genome Project declared victory in 2003, the headlines sounded like a finish line. We had the human genome: roughly three billion DNA base pairs, fully sequenced. Personalized medicine was around the corner. Cancer would be decoded. Genetic disease would be solved.

Then biology, as usual, reminded everyone that having the blueprint isn’t the same as understanding the building.

The genome turned out to be more like a parts list for a Boeing 747 without any of the assembly instructions. It told you what could be there, not what was actually happening inside a living system. It didn’t explain how genes switched on and off in different contexts, how tissues organized, or why two cells with identical DNA could behave like completely different species.

That gap had a name: heterogeneity. Biology isn’t uniform. It’s messy, varied, and wildly diverse at the level that matters most—cell by cell.

And the standard sequencing workflow of the day made that problem worse. Most methods demanded bulk samples. Grind up a tumor, sequence the slurry, and you don’t get “the tumor.” You get an average of everything in the tube: cancer cells mixed with immune cells, blood vessels, connective tissue, and countless subtypes within each. The differences—the ones that decide whether a therapy works or fails—get washed out.

Next-generation sequencing, led by Illumina, changed the economics of reading DNA. Costs collapsed from the realm of the impossible to something that could be routine. But cheaper sequencing didn’t fix the averaging problem. It just made it faster and more affordable to produce beautifully precise… averages.

The real unlock would come from somewhere that didn’t look like genomics at first glance: microfluidics, the art of moving tiny volumes of liquid through microscopic channels. If you could flow cells in a controlled way and partition them into droplets, you could stop blending the orchestra. You could put each instrument in its own sound booth. One cell, one compartment, one experiment—repeated thousands of times in parallel.

This was the moment three scientists recognized as transformative.

Serge Saxonov and Ben Hindson had worked together at QuantaLife for about two years. Saxonov brought a computational biology background and a knack for translating messy biology into analyzable data. Kevin Ness—who would become the third co-founder of 10X Genomics—was even closer to Saxonov than most colleagues: he was his roommate.

At QuantaLife, Hindson was a co-founder and Chief Scientific Officer at a company that developed digital droplet PCR. Then, in 2011, QuantaLife was acquired by Bio-Rad. Suddenly the founders were inside a much bigger machine. Saxonov and Hindson stayed on for a few months, trying to imagine what their future looked like under a new roof. As Hindson would later put it, they wanted to make sure the technology succeeded—but “when you sell something, it’s not yours anymore.”

So the question in front of them wasn’t scientific. It was personal and entrepreneurial: stay comfortable inside Bio-Rad, or jump into single-cell analysis—an idea that, at the time, a huge portion of the field dismissed as niche.

They chose the leap.

III. The Fluidigm Years & Birth of GemCode

10X Genomics’ origin story is part deep tech, part courtroom drama.

The company began in July 2012 in Pleasanton, California, incorporated as Avante Biosystems, Inc. The name changed quickly—first to 10X Technologies, Inc. in September 2012, and then to 10x Genomics, Inc. in November 2014—as the founders narrowed in on a bigger idea: not just building a tool, but building an engine for biology at a new scale.

At the center was Serge Saxonov. Born in Russia when it was still the Soviet Union, he immigrated to the United States with his family in 1990 and grew up in New York. He studied applied math at Harvard, then moved to Silicon Valley and pursued a Ph.D. in bioinformatics at Stanford—training that made him unusually fluent in both computation and biology.

He was also early at 23andMe, joining as the company’s first employee and eventually becoming director of research and development. That experience—turning messy biological signals into something standardized, scalable, and product-like—would become a template for what 10X aimed to do in research genomics.

Ben Hindson brought single-cell and droplet expertise from QuantaLife, and Kevin Ness contributed engineering experience from Bio-Rad Laboratories. Together, they were building in a space where technical breakthroughs mattered—but so did who owned what.

Because in 2014, Bio-Rad brought an arbitration dispute against the three cofounders, alleging they had breached obligations they supposedly owed after Bio-Rad acquired QuantaLife. The accusations included misappropriating trade secrets and violating restrictive covenants. For an early-stage company, this is the kind of fight that can kill momentum—or kill the company outright.

In 2015, the arbitrator ruled in the founders’ favor. Bio-Rad’s claims were fully denied, with no damages awarded. It wasn’t just a legal win. It was permission to exist.

With that cloud lifting, 10X could focus on what it was actually trying to build: a way to break biology into tiny, trackable units so you could read out what each cell was doing—at industrial throughput.

By 2013, the team had an early prototype based on droplet microfluidics—using emulsions to partition genetic material so it could be processed in parallel. The breakthrough became what 10X called “GEM” technology: Gel Bead-in-Emulsion.

The idea was beautifully straightforward. You take cells (or genetic material), mix them with gel beads that carry molecular barcodes, and then use microfluidics to partition everything into microscopic oil droplets. Each droplet acts like its own reaction vessel. Each barcode acts like a return address. After sequencing, the computational step can sort the data back into separate droplets—and, critically, back to individual cells.

In the Chromium system, that looks like a lab workflow built around a microfluidic chip: cell suspension goes in, along with partitioning oil, reverse transcription reagents, and gel beads. The Chromium Controller creates an emulsion as everything flows through the channels. Only a fraction of droplets end up containing exactly one cell and one gel bead, but those are the droplets that matter: the gel bead releases primers carrying a unique barcode that tags the cell’s transcripts so they can be indexed later.

By the middle of the decade, the company had the story—and the technology—to start stepping onto bigger stages. 10x Genomics made its public debut at the JP Morgan Healthcare Conference in San Francisco in 2015, the industry’s premier gathering for introducing what’s next.

And investors leaned in. In 2015 and 2016, the company raised a total of $110 million in equity across two rounds—fuel for the next step: taking GEMs out of the prototype phase and into a platform that regular labs could run.

IV. Building the Platform: Chromium Launch (2015)

In 2015, 10X officially launched its first product: the Chromium System. This wasn’t a routine instrument release. It was the moment single-cell analysis started to look less like an artisanal craft and more like an industrial workflow—something a normal lab could run, repeatedly, at scale.

10X made an early, decisive bet on single-cell RNA sequencing as the lead application. And the market answered fast. The company sold 20 systems in just two weeks. “Other companies didn’t have the right technology to be able to scale in the way we did,” Ben Hindson said later. The velocity wasn’t just good sales execution. It was a signal that researchers had been waiting for a product that turned single-cell from “cool demo” into “core capability.”

Chromium was also the debut of 10X’s platform strategy: hardware plus consumables plus software, designed to work as one system. As the IPO filing would later put it, 10X sells “a line of instruments as well as related microfluidic chips, slides, reagents, and other consumables.” By June 2019, the company had sold 1,284 instruments globally—reaching 93 of the top 100 research institutions by publications, and 13 of the top 15 pharmaceutical companies by 2018 revenue.

The instrument itself was engineered to fit into real labs, not just engineering benches. The Chromium Controller had “a small instrument footprint that easily integrates into existing laboratory infrastructure.” In practice, that meant fewer excuses and less friction: you didn’t need to rebuild your lab to start doing single-cell.

Under the hood, Chromium delivered the kind of throughput that made the platform feel inevitable. A typical workflow captured on the order of hundreds to tens of thousands of cells per sample, and could run far more per instrument run in about 20 minutes. It also kept error modes within tolerable bounds for researchers—recovering a meaningful fraction of cells while maintaining a low rate of “doublets,” where two cells get mistakenly read as one.

Just as important as the science was the business model. 10X priced instruments aggressively to get them placed, then made money on the steady drumbeat of consumables every time a lab ran an experiment. The company was explicit about the flywheel: as the installed base grew, it expected recurring consumables revenue to become an increasingly important driver of results.

And then there was the software. Chromium didn’t just spit out data; it came with the tools to make that data usable. 10X built Cell Ranger for processing and Loupe Cell Browser for visualization. By shipping powerful analysis software for free, 10X lowered one of the biggest barriers in the category: you didn’t need a full-time bioinformatics team to go from sequencing output to figures you could put in a paper.

That combination—an accessible instrument, a repeat-purchase consumables stream, and software that pulled the whole workflow together—made the land-and-expand motion work early. Academic labs bought one system, generated results, published, and then broadened usage: more runs, more experiments, and eventually more applications.

The revenue curve showed what that flywheel looked like in dollars: $3.32 million in 2015, then $27.48 million in 2016, $71.18 million in 2017, and $145 million in 2018. The pattern wasn’t subtle. Chromium wasn’t just a hit product. It was the foundation of a platform.

V. The Single-Cell Biology Explosion (2016-2018)

Between 2016 and 2018, single-cell biology hit something like a phase transition. What had been a specialist technique—hard, expensive, and fussy—started to feel like a standard way to do modern biology. And 10X wasn’t just riding the wave. In a very real sense, it was building the surfboard everyone else used.

A big catalyst was the Human Cell Atlas, an ambitious effort to catalog every cell type in the human body. As the project described it, “surprisingly little is known about the exact composition or number of cell types that exist,” even though the human body contains tens of trillions of cells and thousands of cell types. The HCA partnered with 10X Genomics, and consortium members could buy Chromium solutions at discounted prices.

That move mattered far beyond pricing. It effectively wired 10X into the most visible mapping project in cellular biology. When Human Cell Atlas teams published using 10X workflows, it didn’t just produce data—it produced legitimacy. Early HCA releases included single-cell RNA-seq profiles for about 530,000 human immune cells from adult bone marrow and newborn umbilical cord, plus roughly 200,000 human spleen cells—generated using the Chromium Single Cell Gene Expression Solution.

As demand grew, the product line widened with it. Researchers didn’t just want to measure gene expression. Immunologists wanted to read out the immune repertoire—the diversity of T-cell and B-cell receptors. Others wanted chromatin accessibility. 10X positioned Chromium as a system that could “capture molecular readouts of cell activity in multiple dimensions, including gene expression, cell surface proteins, immune clonotype, antigen specificity, and chromatin accessibility.”

Then the flywheel kicked into a higher gear. More users led to more papers, more papers led to more credibility, and more credibility pulled in more users. By the time of the 2019 IPO, about 500 academic papers cited 10X in their methods. By 2022, that had climbed to more than 4,100. In this market, a methods citation isn’t just a footnote—it’s marketing, trust, and standardization wrapped into one.

Industry leaned in, too. For pharma, single-cell analysis offered a sharper lens on mechanism: which specific cell types actually respond to a drug, which ones drive side effects, and what happens in rare populations that bulk sequencing simply washes out. That’s the kind of insight that can change how programs are prioritized and how trials are designed.

All of this reinforced 10X’s “picks and shovels” positioning. In a biological gold rush, the company didn’t have to bet on any single therapeutic hypothesis. It sold the tooling across academia and industry, and as labs kept running experiments, consumables kept flowing—exactly the kind of recurring engine the platform was designed to create.

But even as the science took off, the legal clouds didn’t fully clear. In November 2018, a Delaware jury found that 10x Genomics infringed several University of Chicago patents that were exclusively licensed to Bio-Rad. The verdict ordered 10x Genomics to pay $24 million in damages and a 15% royalty on sales. The company appealed, but the decision was upheld in August 2020.

That created a real overhang. Would the royalties compress the economics that made the model so powerful? Could the dispute escalate into business disruption? 10X kept growing through it, but the risk was hard for investors—and customers—to ignore.

VI. Going Spatial: Visium & The Next Frontier (2018-2020)

Single-cell analysis had given scientists a superpower: the ability to read out what individual cells were doing. But it came with a brutal tradeoff—dissociation. To run single-cell experiments, you had to break tissue apart into a cell suspension. And the moment you did that, you destroyed the map.

In biology, the “where” can matter as much as the “what.” Tumor margins versus tumor cores. One brain region versus another. Immune cells clustered near blood vessels versus scattered far away. With dissociation, all of that context gets erased.

Spatial transcriptomics was the fix: keep the tissue intact, and still measure gene expression. In December 2018, 10x Genomics acquired Stockholm-based Spatial Transcriptomics, one of the pioneers of this emerging field. As 10X described the promise, this new approach would let researchers see not only what’s in a cell, but how cells are organized in relation to one another—insight that could be invaluable for understanding disease.

The acquisition price was $38.1 million—small, relative to what it unlocked: a second major product category. Spatial Transcriptomics had grown out of work at Science for Life Laboratory, a joint project between two of Sweden’s leading universities, Karolinska Institutet and the Royal Institute of Technology (KTH).

The workflow was elegant in concept. You take frozen tissue sections and affix them to glass chips containing an array of sequencing capture probes laid out in a barcode-like grid. Pair microscopy imaging with RNA sequencing, and you can visualize different areas of the tissue and determine which genes are expressed in a specific location, and in what quantity.

Saxonov framed the acquisition as a missing piece in 10X’s bigger mission. “10x Genomics is on a quest to unlock a complete understanding of biology, and our recent growth and acquisition activities are accelerating our progress exponentially,” he said. “We are thrilled to have the Spatial Transcriptomics team join forces with us. Now, researchers will not only be able to understand what is happening within a cell but also understand where cellular activities are happening in relation to one another. It’s another integral piece of the puzzle that gets us closer to seeing the whole picture of biology.”

Spatial wasn’t the only frontier 10X was racing toward. Earlier that same year, in August 2018, the company acquired Epinomics, described as “the single-cell epigenetic sequencing startup founded by the developers of ATAC-seq technology”—a move that expanded 10X further into chromatin accessibility analysis.

Operationally, 10X planned to keep Spatial Transcriptomics running from its existing Stockholm offices and grow its presence there. The team stayed in place, and the Spatial Transcriptomics co-founders continued collaborating with 10x Genomics.

Out of that integration came Visium, and it landed with strong reception. “The Visium platform delivers unbiased, whole transcriptome spatial gene expression analysis at single cell scale with unmatched spatial data quality and offers a flexible assay portfolio to study a broad range of tissues.”

The platform logic now snapped into focus. Chromium handled dissociated single-cell samples. Visium handled tissue context. Together, they let researchers connect cell identities and gene expression profiles back to physical locations—more complete biological insight than either approach could deliver on its own.

The competitive landscape in spatial was also different from the early Chromium days. It was more crowded, with NanoString, Akoya Biosciences, and a long list of academic methods pushing alternative approaches. But 10X entered with real advantages: a trusted brand, a growing installed base, and a platform story that made spatial feel like the natural next module—something you added on, not something you switched to.

VII. IPO & Public Company Journey (2019-2021)

On September 12, 2019, 10x Genomics went public, raising $390 million. The timing was gutsy. Just months earlier, Bio-Rad had filed new patent infringement suits—exactly the kind of uncertainty that can spook public-market investors. Instead, the opposite happened: Wall Street leaned in.

The stock popped hard on day one, climbing as much as 49% in its market debut. It opened at $54, traded up to $58 midday, and closed at $53. The IPO had been priced at $39 per share, above the expected $31 to $35 range—a clear signal that demand was stronger than underwriters expected.

By the end of the day, 10x Genomics carried an implied valuation of about $3.66 billion. For a seven-year-old company that had done $145 million in revenue the year before, that was a statement: investors weren’t just buying a fast-growing instrument maker. They were buying the idea that 10X was becoming infrastructure.

The next morning, the story turned into a photo op. On September 13, 2019, at the Nasdaq MarketSite in Times Square, “Serge Saxonov, Chief Executive Officer, and Ben Hindson, Chief Scientific Officer, rang the Opening Bell.”

Saxonov framed the moment as more than a liquidity event. The IPO, he told reporters, was “a validation of the company's execution and scale over the years.” He called the coming era the “Century of Biology,” arguing that cures for cancer, Alzheimer’s, and other diseases were now plausible—and that going public would help 10X keep pushing toward “master[ing] biology and advanc[ing] human health.”

The investor pitch basically wrote itself: a platform company with razor-and-blade economics, recurring consumables revenue, a growing set of applications that expanded the total addressable market, and a moat built from technology, brand, and workflow lock-in. Analysts expected single-cell to become a standard method—and for 10X to be the default vendor as it happened.

Then COVID-19 arrived and scrambled the entire world.

In early 2020, research labs shut down, and that disruption hit the life-sciences tools industry at its core—fewer experiments meant fewer consumables runs, and uncertainty slowed instrument purchasing. But the pandemic also lit a fire under immunology. Understanding how the immune system responded to SARS-CoV-2 infection, and later vaccination, became an urgent global priority.

That played directly into 10X’s strengths. Researchers used Chromium’s immune profiling to see, at single-cell resolution, how vaccine candidates shifted immune cell populations—the kind of granular readout that’s hard to do any other way, especially at scale.

Public markets rewarded the category. 10x Genomics’ stock hit an all-time high closing price of $202.37 on April 26, 2021—more than five times the IPO price, and a market capitalization north of $20 billion. For a moment, 10X looked like one of the most valuable life sciences tools businesses on the planet.

It didn’t last. The same pandemic-era biotech bubble that lifted so many companies would soon deflate—and 10X would come down with it.

Still, 2021 delivered one major win that had nothing to do with market multiples: the legal cloud finally started to clear. In mid-2021, Bio-Rad and 10x Genomics reached what they called “a final settlement to resolve multiple long-running litigations in Massachusetts, Delaware, California, Germany, and before the International Trade Commission.” The deal included “a global patent cross-license for patents held by both Bio-Rad and 10x Genomics,” intended to resolve outstanding issues in single-cell genomics.

The scope tells you how consuming the fight had become. The settlement called for dismissal of 20 legal proceedings across federal courts, the U.S. International Trade Commission, and the U.S. Patent Office’s Patent Trial and Appeals Board—bringing “one of the bitterest legal battles in biotech” to a close.

Financially, the agreement required 10X to pay Bio-Rad $29.4 million in royalties and interest tied to GEM product sales between November 14, 2018 and March 31, 2021. That figure was lower than what 10X had previously accrued, allowing the company to reverse $15.4 million in its financial statements.

The company had gone public with a rocket ship of momentum—and finally, at least on patents, it could stop fighting a war on multiple fronts at once.

VIII. The Great Reset & Strategic Inflection (2021-2023)

The biotech winter hit fast. Interest rates rose, investors stopped rewarding “growth at any cost,” and the funding spigot that had powered a decade of aggressive biotech spending started to close. For 10X Genomics, a company built on labs running lots of experiments, the shift wasn’t abstract. It showed up in orders, budgets, and suddenly cautious customers.

The stock told the story in one brutal line. From an all-time high of about $209 in June 2021, 10X’s share price unraveled. By April 2025, it would hit a 52-week low of $6.78—down more than 96% from peak to trough. The market cap that had topped $20 billion shrank to roughly $1 billion.

The business began to feel the slowdown too. The hypergrowth years were over. After routinely growing more than 40% annually, revenue in 2024 was $610.79 million, down slightly from $618.73 million the year before. The headline wasn’t just “slower.” It was negative.

The reasons weren’t mysterious; they were everywhere at once. Academic labs faced tightening grant funding, especially from the National Institutes of Health. Biotech companies that had raised huge rounds during the pandemic boom were suddenly in cash-conservation mode, cutting research budgets and delaying purchases. Even pharma—usually the stable, high-budget customer—grew more conservative with capital spending.

By late 2024, Saxonov acknowledged that reality publicly: “Our results this quarter fell short of our expectations given greater-than-anticipated disruption from the sales restructuring we implemented in the quarter and cautious customer spending. As these dynamics persist, especially under a difficult macro backdrop, our revenue growth this year will be lower than our previous expectations.”

Inside the company, the response was restructuring and operational tightening. Kevin Ness had left back in December 2016, but the leadership bench kept evolving. In 2018, 10X brought in Justin McAnear—formerly Tesla’s finance chief—as CFO, adding a leader with experience scaling manufacturing-heavy businesses under intense operational pressure.

Financial results showed a company trying to regain its footing. The full-year operating loss in 2024 was $194.6 million, improved from a $265.3 million loss in 2023. Gross margin rose to 68% in 2024 from 66% in 2023—cost discipline starting to show through even as revenue stalled.

And the messaging shifted accordingly. Profitability and efficiency moved from “eventual benefits of scale” to immediate priorities. Management emphasized, “As we move through 2025, we will continue our focus on managing costs, taking a disciplined approach to spending, so we can maintain the strength of our balance sheet.”

Then came the worst timing of all: competition got louder precisely when 10X was least insulated.

A wave of newer entrants—Parse Biosciences, Singleron Biotechnologies, Fluent BioSciences, Scale Biosciences, and CS Genetics—backed by more than $250 million in collective funding, went straight at the core of 10X’s model. The pitch was simple and sharp: instrument-free, modular, scalable offerings that could lower the barrier to entry and reduce the pain of buying into a premium platform.

Parse, in particular, also made progress in the arena 10X knew all too well: patents. As the company described it, “The Patent Trial and Appeal Board (PTAB) of the United States Patent and Trademark Office (USPTO) issued Final Written Decisions invalidating all claims in 10x Genomics' 10,697,013 and 10,240,197 patents. Parse has now invalidated all claims that 10x Genomics asserts against Parse products.”

Parse framed the moment as both vindication and a market-opening event: “Parse offers a fundamentally differentiated solution that makes single cell sequencing more scalable without the need for expensive microfluidics. The recent decisions reward innovation and promote accessibility to cutting edge new tools.”

So by the end of this period, 10X was staring at the question that defines every great platform company once the first wave crests: is this just a cyclical downturn that eventually passes—or the start of a structural shift that rewrites the rules under its feet?

IX. The Clinical & AI Pivot (2023-Present)

The way out of a cyclical squeeze and an intensifying price war wasn’t to argue harder for the old world. It was to expand the playing field. If research budgets were getting pinched, 10X needed use cases with bigger stakes, more durable funding, and workflows that could eventually live closer to the clinic.

That’s where in situ came in.

In December 2022, 10x Genomics announced the first commercial shipments of Xenium, its platform for in situ analysis. The promise was straightforward and ambitious: “Xenium is the next generation of targeted spatial profiling of genes and proteins at subcellular resolution.”

More importantly, Xenium completed the trilogy. “With the Xenium launch, 10x Genomics is the only company to offer researchers all three technological approaches for interrogating biology—single cell analysis, spatial transcriptomics and in situ analysis. The company's Chromium, Visium and Xenium platforms can be used independently or as an integrated suite for higher resolution and scale.” In other words, 10X wasn’t just selling another box. It was trying to become the default toolkit for how modern biology gets measured—whether you dissociate cells, keep tissue architecture, or interrogate molecules directly in place.

And early on, Xenium showed real commercial pull. It “emerged as a significant driver of new revenue in 2023,” helped by what was described as a seven-fold year-over-year revenue jump in the company’s “spatial” segment over the first three quarters of that year.

Xenium also wasn’t built in a vacuum. It was the product of internal development stitched together with targeted M&A: “10x Genomics developed the Xenium platform by uniting its internal development with its 2020 acquisitions of CartaNa and ReadCoor, which provided intellectual property, key technology advances, and deep talent and expertise in the emerging in situ field.”

The clinical logic behind all of this is easy to see. Traditional pathology has long been about morphology—what tissue looks like under a microscope, how cells are shaped, and how they’re arranged. Spatial and in situ methods layer on molecular truth: which genes and proteins are present, and exactly where. In cancer diagnosis and treatment selection, that combination has the potential to push precision medicine beyond educated guessing toward higher-confidence decisions.

At the same time, 10X kept leaning into big, mission-driven biology. The company announced collaborations with the NIH Intramural Center for Alzheimer's and Related Dementias (NIH CARD) to build “a more comprehensive single cell atlas of the human brain to further neuroscience research.” Ben Hindson put the motivation plainly: “So much of neurodegeneration is a black box, but once you start opening up that black box, you have many new avenues for progress. That's what single cell analysis does; it brings to light the ground truth of the underlying biology at massive scale and high resolution.”

Then there’s the next wave: AI.

In February 2025, the Chan Zuckerberg Initiative launched the Billion Cells Project, “an effort to generate an unprecedented one billion cell dataset to fuel rapid progress in AI model development in biology.” CZI partnered with 10x Genomics and Ultima Genomics, and the plan was to generate the dataset using “10x Genomics' Chromium GEM-X technology for single-cell analysis.” GEM-X, launched in 2024, was positioned as a meaningful step forward: “the GEM-X technology architecture delivers superior sensitivity, throughput, data quality, and cell recovery to improve robustness and enable single-cell analysis at larger scale and lower cost.”

CTO Michael Schnall-Levin captured just how fast “impossible” turns into “baseline” in this field: “Back in 2017, we made a million-cell dataset to showcase how scalable the technologies were, and people were like 'Oh my God, a million cells, that's crazy.' Now a billion cells is not just theoretical; it's feasible and not outlandishly expensive.”

And if that sounds like a direct response to the new, lower-cost competitors circling the core single-cell market—it was. At the Human Cell Atlas General Meeting in October 2024, “10x Genomics announced an imminent plan to deliver 'single cell for a single cent.' Through a series of new products and configurations expected to launch this quarter, 10x Genomics intends to deliver mega-scale single cell analysis at a cost as low as $0.01 per cell.”

The message was clear: 10X wasn’t just defending a premium platform. It was trying to make its platform unavoidable—by pushing into clinical-grade modalities on the high end and driving costs down on the low end, all while positioning its datasets as fuel for the next generation of biology-first AI.

X. The Business Model Deep-Dive

To really understand 10X Genomics, you have to understand the economics of life science tools. This isn’t a therapeutics company betting on a handful of drug shots on goal, and it isn’t software where gross margins come “for free” once the code is written. It’s a platform business built on instruments, recurring consumables, and the workflows that glue them together.

The 2024 revenue mix makes that structure obvious. Instruments brought in about $92.7 million (down 25% year over year), split between roughly $35.2 million from Chromium instruments and $57.5 million from Spatial instruments. Consumables were the engine: about $493.4 million (up 3% year over year), including roughly $372.3 million from Chromium consumables and $121.1 million from Spatial consumables.

Services were smaller but growing quickly: about $24.6 million in 2024, up 57% from the prior year.

That’s the razor-and-blade model in plain sight. Consumables generated about five times the revenue of instruments, and they held up even as instrument sales fell. Once a lab installs a 10X instrument, it’s not just buying a box—it’s adopting a workflow. The switching costs are real: retraining staff, revalidating protocols, rewriting analysis pipelines, and even managing reagents and inventory. All of that friction helps keep the consumables stream resilient.

You can also see the model in margins. Gross margin improved to 67% in Q4 2024 and 68% for the full year. Part of that is the basic value proposition—labs will pay premium prices for tools that unlock experiments they couldn’t reliably do otherwise. Part of it is mix: consumables tend to be higher-margin than instruments, so the more the business leans into recurring chemistry, the more margin naturally improves.

The company was also clearly trying to buy itself time. Operating expenses fell 6% to $160.8 million in Q4 2024, and 10X ended the year with $393.4 million in cash and marketable securities. In a downturn, that kind of balance sheet matters: it’s runway to keep investing while customers slow down.

Then there’s the customer mix, which is both the opportunity and the vulnerability. Roughly 40% to 50% of revenue was tied to academic and government research funding—meaning NIH budgets and grant cycles aren’t background noise; they’re a demand driver. Pharma and biotech can be higher-value customers, but the last few years proved they can be cyclical too when venture funding tightens and burn rates suddenly matter.

Management has talked about shifting that mix over time, with pharma and biotech potentially growing to about half of revenue. But even in the way analysts framed it—“If you’re at 15% to 20% revenue mix now”—you can hear how long that road could be.

What hasn’t changed is the playbook: land and expand. A lab might start with Chromium for gene expression, then add immune profiling, then move into spatial with Visium, and eventually step up to Xenium for in situ, higher-resolution work. Each add-on raises the value of the account, broadens what the lab can publish, and makes the platform harder to rip out.

XI. Porter's Five Forces Analysis

Threat of New Entrants: Medium-High

The bar to enter single-cell has come down. It still takes real science and real execution, but it no longer requires building a full instrument platform from scratch. Newer entrants have raised more than $250 million collectively to take on 10X, and approaches like Parse Biosciences’ instrument-free workflow lower the hurdle even further: no complex hardware manufacturing, just consumable kits that run on standard lab equipment.

The technical challenge is significant, but it’s not a lock. And the patent shield that once looked like a fortress has shown cracks. Parse has said it has “invalidated all claims that 10x Genomics asserts against Parse products.”

10X’s brand and installed base still matter—a lot—but the direction of travel is clear: credible new entrants can show up faster than they could a few years ago.

Bargaining Power of Suppliers: Low-Medium

10X ultimately depends on sequencing, and Illumina remains the critical downstream platform for most experiments. That creates dependency, although Illumina has little reason to squeeze a company that helps drive sequencing volume.

On the rest of the bill of materials, supplier power is limited. Enzymes and reagents come from a broad supplier ecosystem, and microfluidics manufacturing can be done in-house. In aggregate, suppliers aren’t the center of gravity in this industry’s power dynamics.

Bargaining Power of Buyers: Medium-High

Customers feel the pinch, and they know they have options. Academic labs live on fixed grant budgets, which makes them acutely price-sensitive—especially in a tighter funding environment. When alternatives like Parse offer similar workflows for less, the negotiating leverage shifts toward the buyer.

Pharma customers usually have more flexibility, but they still want proof: clear ROI, cleaner data, faster answers. 10X can point to quality advantages. In head-to-head comparisons, “10x data [was shown] to have lower technical variability and more precise annotation of biological states in the thymus compared to Parse.” But the uncomfortable truth is that “better” doesn’t always mean “worth the premium” for every experiment.

Threat of Substitutes: Medium

Single-cell isn’t the only way to answer biological questions. Alternative single-cell methods keep improving, and bulk sequencing paired with computational deconvolution gets better every year. Over time, some questions that currently require single-cell workflows could become “good enough” with cheaper substitutes.

Still, for many applications, 10X’s combination of throughput and data quality remains hard to replace. Substitutes are real, but not yet universally equivalent.

Competitive Rivalry: High

This is where the heat is. Competition is rising quickly: “Several newer entrants are aiming to challenge 10x's dominance,” and “have released new offerings in the past 3 months, a clear indicator that competition is heating up.”

And as overall market growth slows, the game shifts. In a high-growth market, multiple winners can coexist. In a slower market, share gets taken, not just created. That’s when price pressure and feature competition intensify—and when even a category-defining leader has to fight to keep the ground it already owns.

Overall Assessment: The industry looks less forgiving than it did during the boom years. Power has shifted toward buyers and entrants, and 10X has to defend its position deliberately—not just with technology, but with pricing, positioning, and where it chooses to play.

XII. Hamilton's Seven Powers Analysis

1. Scale Economies (Moderate)

Scale helps, but it doesn’t make 10X untouchable. On consumables, higher manufacturing volumes can drive down unit costs. And on the R&D side, once you’ve built the chemistry and the software, every additional customer helps amortize the investment.

The catch is that “enough scale” in this market is achievable. Competitors like Parse have shown they can get product into the world and manufacture at meaningful volume without building a full instrument footprint.

2. Network Effects (Moderate-Strong)

10X benefits from a kind of scientific network effect. By 2022, more than 4,100 papers cited 10X technology, and that creates momentum: methods get standardized, protocols spread, and new labs often default to what the community already trusts.

The ecosystem deepens that pull. Analysis pipelines are built around 10X formats. Cell Ranger and Loupe Browser became common starting points. Labs hire people already trained on 10X workflows. None of this is a classic “the product gets better with every new user” network effect, but it creates real inertia—and real friction for alternatives.

3. Counter-Positioning (Vulnerable)

This is where the ground has shifted. 10X originally won by disrupting older, lower-throughput approaches. Now it’s the incumbent being attacked from below by companies pitching simpler, cheaper workflows. Parse put the contrast plainly: “Parse offers a fundamentally differentiated solution that makes single cell sequencing more scalable without the need for expensive microfluidics.”

That puts 10X in a classic bind. If it moves downmarket aggressively, it risks undercutting its premium products. If it doesn’t, it risks letting competitors redefine “good enough” as the default. The “single cell for a single cent” push is 10X trying to thread that needle—matching the cost narrative without giving up the high-end platform story.

4. Switching Costs (Strong)

This is 10X’s strongest power, and it’s very real. Labs don’t just buy an instrument; they build their workflows around it. Over time, they invest in:

- Training staff on 10X protocols

- Building bioinformatics pipelines around 10X data formats

- Optimizing sample prep and experimental design for Chromium

- Setting up purchasing habits, inventory, and supply relationships for consumables

10X has been explicit that the installed base drives recurring consumables demand. Each instrument placed is more than a sale—it’s a workflow embedded into the lab.

5. Branding (Strong)

In many research settings, “single-cell” and “10X” have become closely linked. The brand stands for quality, reliability, and credibility, reinforced by thousands of peer-reviewed publications.

That premium reputation is an asset—until the market becomes more price-sensitive. In a downturn, or when new entrants offer cheaper alternatives, a premium brand can also become an easy target: great, but is it worth it?

6. Cornered Resource (Moderate)

Historically, patents around gel bead barcoding and microfluidics helped protect the business. But as the competitive landscape shows, workarounds and legal challenges can erode that advantage.

Beyond IP, 10X’s real resources are its accumulated expertise and its customer relationships. Valuable, yes—but not impossible for competitors to chip away at over time, especially if they can recruit talent and win accounts with price or workflow simplicity.

7. Process Power (Moderate)

Years of shipping products, improving manufacturing yields, building software, and supporting customers have created organizational know-how that’s hard to copy quickly. That kind of process power matters in life sciences tools, where reliability and support often decide what becomes a lab standard.

But it’s not permanent. Well-funded competitors, given time, can build strong processes too.

Overall Power Assessment: 10X’s primary strengths are Switching Costs and Branding, reinforced by Network Effects and Process Power. The biggest vulnerability is counter-positioning from lower-cost entrants—an attack that can’t be solved by defending the past alone, and forces 10X to keep innovating on both performance and price.

XIII. Strategic Crossroads & The Path Forward

10X Genomics now sits in a place that should feel familiar to anyone who’s watched platform companies mature: can a premium leader keep owning the high end while the market pulls pricing down and alternatives get “good enough”? Tech history is littered with incumbents that tried to do both and got squeezed anyway—IBM in computing, Kodak in photography, Nokia in mobile phones.

Management’s answer is to change the terrain. The clinical strategy is a bet that the next leg of growth won’t be won in the most price-sensitive corners of academic research, but in diagnostics and therapeutic workflows where: - Regulatory barriers create natural moats - Quality and reproducibility command premium pricing - Clinical reimbursement supports higher price points - Switching costs are enhanced by validation requirements

But even with that thesis, execution is the tell. Analysts watching the transition noted that “all eyes will be on Visium HD’s success and Xenium’s placement trends to determine if Spatial’s market is focused more on niche applications or if it can scale into what Chromium did for single cell.”

Then there’s AI—an opportunity that could either be an accelerant or a mirage. The Billion Cells Project aims to deliver “data with greater consistency than past efforts to better enable researchers to train AI models and make transformative discoveries across precision medicine and functional genomics.” If models trained on single-cell and spatial data start producing real clinical value, demand for the underlying data generation could rise sharply. In that world, data quality stops being a nice-to-have and starts being the product.

Geography adds another layer. China accounts for approximately 10% of revenues. As the company put it: “But given our ability to manufacture many of our products in Singapore and other mitigation strategies, we believe the impact from currently proposed tariffs is likely to be minimal.”

And, as with most category leaders in a downturn, consolidation always hangs in the air. 10X could buy its way into complementary capabilities that deepen the platform. Or a larger life sciences company could decide that owning the single-cell and spatial “operating system” is strategically worth it—though that kind of deal usually requires a healthier valuation environment than the post-reset reality.

Comparable life sciences tools companies point to multiple viable playbooks. Illumina built a near-monopoly in sequencing through relentless innovation and aggressive pricing. Thermo Fisher became a giant by assembling a diversified portfolio through acquisition. Bio-Rad carved out profitable niches where it could sustain premium positioning.

Bull Case: Clinical adoption accelerates, research funding recovers, the integrated suite (Chromium + Visium + Xenium) wins against point solutions, and AI creates new demand that rewards data quality more than lowest cost.

Bear Case: Single-cell and spatial keep sliding toward commoditization, Parse and other lower-cost competitors erode pricing power and share, and what looks like cyclical pressure in research funding turns out to be more structural than temporary.

XIV. Playbook: Lessons for Founders & Investors

Deep Tech Commercialization: 10X proves that deep tech doesn’t win on a single breakthrough—it wins when you ship the whole system. Hardware plus consumables plus software (and the support to make it all actually work in real labs) is what turns a clever demo into a defensible platform. That “whole product” approach creates switching costs that point solutions struggle to match.

Platform Thinking: 10X didn’t just sell instruments; it helped standardize a workflow. Over time, that becomes an ecosystem: researchers, publications, shared protocols, and data pipelines that quietly reinforce the default choice. The free software layer—Cell Ranger and Loupe Browser—helped make adoption easier, and once labs built analysis habits around it, that convenience turned into real dependency.

Timing Markets: 10X arrived when three things lined up at once: scientists knew why single-cell mattered, the underlying tech (microfluidics and sequencing) was ready, and customers finally felt the pain strongly enough to pay for a solution. Too early, and 10X would have spent years evangelizing. Too late, and it would have had to pry customers away from established alternatives.

The Installed Base Advantage: The company internalized a simple truth early: “the installed base of instruments” is the annuity. Every instrument placement isn’t just revenue today—it’s future consumables pull-through and a workflow that gets harder to replace over time.

When to Go Public: The 2019 IPO gave 10X capital and momentum at a moment when markets loved platform growth stories. The drawdown that followed is the counter-lesson: public markets are a different game, and when sentiment turns, even category leaders can get repriced fast.

Cyclicality Management: Life science tools are chained to research budgets. When 40% to 50% of revenue is tied to academic and government funding, NIH cycles stop being “macro” and become an operating variable. Moving toward pharma and clinical applications can smooth the ride, but it doesn’t eliminate the industry’s inherent boom-and-bust dynamics.

Innovation Dilemma: This is the Christensen problem in real time: defend a premium position while the market gets pulled downmarket. 10X’s attempt to thread the needle—offering lower-cost options while keeping premium products at the top end—is a bid to serve multiple segments without collapsing its own pricing umbrella.

Patent Strategy: The Bio-Rad fight, and later the Parse patent invalidations, underline a harsh reality: patents are valuable, but rarely permanent protection. 10X has said it invested “nearly $1 billion in research and development, which has led to more than 1,100 issued and pending patents,” and still the market found paths around the walls. Over the long run, execution, process, and ecosystem pull can matter more than legal exclusivity.

KPIs to Track:

1. Consumables revenue growth: The clearest signal of installed-base utilization and how engaged customers really are

2. Spatial revenue as percentage of total: A read on whether the platform is expanding beyond Chromium into a second durable engine

3. Gross margin: The real-time pressure gauge for pricing power, mix, and competitive intensity

XV. Epilogue & Current State

In May 2025, 10x Genomics announced an 8% headcount reduction—about 100 employees—aimed at cutting $50 million in costs. As of December 31, 2024, the company had 1,306 full-time employees across its global operations.

Management tied the move to what it called “the rapidly evolving macro environment” in the U.S., pointing in particular to worsening research funding conditions across academic and government labs—“where the environment kept getting worse as we proceeded through the quarter.”

And that instability was spilling directly into buying behavior. “The uncertainty for our customers is driving increasingly unpredictable purchasing behavior and reducing visibility on our outlook for the year,” Saxonov said. “As a result, the company is withdrawing its previously issued full-year guidance.”

The numbers in Q1 2025 showed why. Total instrument revenue fell 42% year over year, to $14.815 million from $25.453 million in Q1 2024. Chromium instrument sales declined 25%, and spatial instrument sales fell 49%.

But the business wasn’t collapsing across the board. The consumables engine—the heartbeat of the model—kept turning. Consumables revenue in Q1 2025 was $115.4 million, up 5% from $110.3 million a year earlier, and spatial consumables grew 18%.

On the legal front, 10X also got a tangible boost from the Vizgen settlement: $26 million upfront plus royalties on covered products. The company said it reduced its net loss by 43% compared to Q1 2024.

Zoom out, and you can see the paradox of 10X’s moment. The company helped ignite the single-cell and spatial revolution—and demand for the science is still there. As Saxonov put it, “When you take a step back, it is clear just how vast and powerful the opportunity is for single cell and spatial truly are. It seems not a week goes by but another new exciting revelation being made using our technologies.”

Now comes the harder question: can the platform that democratized single-cell analysis stay on top as democratization continues—this time pushed forward by competitors offering lower-cost alternatives designed to pry away 10X’s own customers?

XVI. Key Takeaways & Reflection

The arc of 10X Genomics runs like a classic platform story: a real technical breakthrough, shipped as a product that normal labs could actually use, scaled into a workflow that became a default—and then, inevitably, a fight to defend that default as the market matured. Over the years, there have been “many advances in single cell technologies thanks to 10x Genomics.”

What Made 10X Special: First, execution. 10X took something that lived at the edge of academic ingenuity and turned it into an industrial-scale, repeatable capability. Second, timing. It arrived right as sequencing costs fell and the heterogeneity problem became impossible to ignore. Third, platform thinking. Hardware, consumables, and software weren’t separate products; they were one integrated loop that created real switching costs. And finally, brand built the hard way—through publications and method citations that delivered credibility no marketing budget could buy.

The Ongoing Challenge: The market 10X helped create is no longer a wide-open frontier. As single-cell and spatial tools mature, price pressure rises, “good enough” alternatives multiply, and the burden shifts from proving what’s possible to proving what’s worth paying for. At the same time, 10X has had to shift from growth-at-all-costs to a more disciplined operating posture—without starving the R&D engine that kept it ahead in the first place. And while switching costs are still a strength, competitors are explicitly trying to remove them.

For Founders: Deep tech can scale—but it rarely moves on startup timelines. The seven years from founding to IPO, and the decade from founding to market maturity, demand patience, capital, and a willingness to keep building while the world catches up. Installed base creates moats, but only if you keep moving fast enough that the walls don’t become the strategy.

For Investors: Life science tools don’t behave like therapeutics. You don’t get binary clinical readouts, but you also don’t get guaranteed defensibility. The risk shows up differently: gradual competitive erosion, customer spending cycles, and the constant need for the platform to earn its premium. The most important signals are often operational—installed base utilization, consumables pull-through, and whether new products actually expand the platform or just protect it.

The Meta-Lesson: Infrastructure for biology is still being built. Just as computing infrastructure moved from mainframes to PCs to cloud over decades, the measurement layer of biology is evolving in stages. 10X built essential infrastructure for one era of the genomics revolution. The open question is whether Chromium, Visium, and Xenium—and whatever comes next—remain essential infrastructure for the era that follows.

The Human Cell Atlas initiative “aims to create comprehensive reference maps of all human cells—the fundamental units of life—as a basis for both understanding human health and diagnosing, monitoring, and treating disease.” That vision is still unfolding. The tools that enable it will keep changing. And 10X—the company that made single-cell analysis accessible at scale—now has to do the hard, unglamorous work of staying indispensable after the revolution.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music