Tilray Brands: The Wild Ride of Cannabis's First NASDAQ Pioneer

I. Introduction & Episode Roadmap

On a foggy morning in Nanaimo, British Columbia, in 2013, a small group of cannabis cultivation specialists and business strategists gathered at what would become one of the most consequential facilities in the history of the North American cannabis industry. The warehouse they were preparing to transform into a state-of-the-art growing operation didn't look like much—just another industrial building on Vancouver Island. But the people inside had a vision that would eventually captivate Wall Street, terrify short sellers, and fundamentally reshape how the world thought about the business of cannabis.

Tilray Brands, Inc. is an American pharmaceutical, cannabis-lifestyle, and consumer packaged goods company, incorporated in the United States and headquartered in New York City. But the path from that modest Canadian facility to becoming a NASDAQ-listed, multi-billion-dollar enterprise with operations spanning continents and product categories represents one of the most extraordinary corporate journeys of the past decade.

The central question of the Tilray story isn't simply how a small Canadian medical cannabis startup became the first pot company on NASDAQ. That's the easy part. The deeper mystery is how a company can experience one of the most insane stock bubbles of the decade—soaring from its $17 IPO price to an all-time high of $300 on September 19, 2018—and then reinvent itself entirely, pivoting from cannabis purity to becoming a diversified beverage and consumer goods giant.

With a diverse portfolio spanning cannabis, beverages, spirits, and wellness products, Tilray Brands achieved record net revenue of $788.9 million in fiscal year 2024, marking a 26% increase. The company now holds a commanding position: Tilray dominates the craft beer market in the Pacific Northwest and also holds a 5% market share of the US craft beer industry. In Canada, it reigns as the undisputed leader in legal cannabis sales.

Yet here's the paradox that makes Tilray a compelling study: despite record revenues, despite market-leading positions in multiple industries, despite a massive acquisition spree that transformed the company's DNA, Tilray has consistently struggled to achieve sustained profitability. The stock that once traded at $300 has spent years trading in the single digits. The company that promised to define the future of cannabis has instead become a case study in how nascent industries evolve—often in directions nobody anticipated.

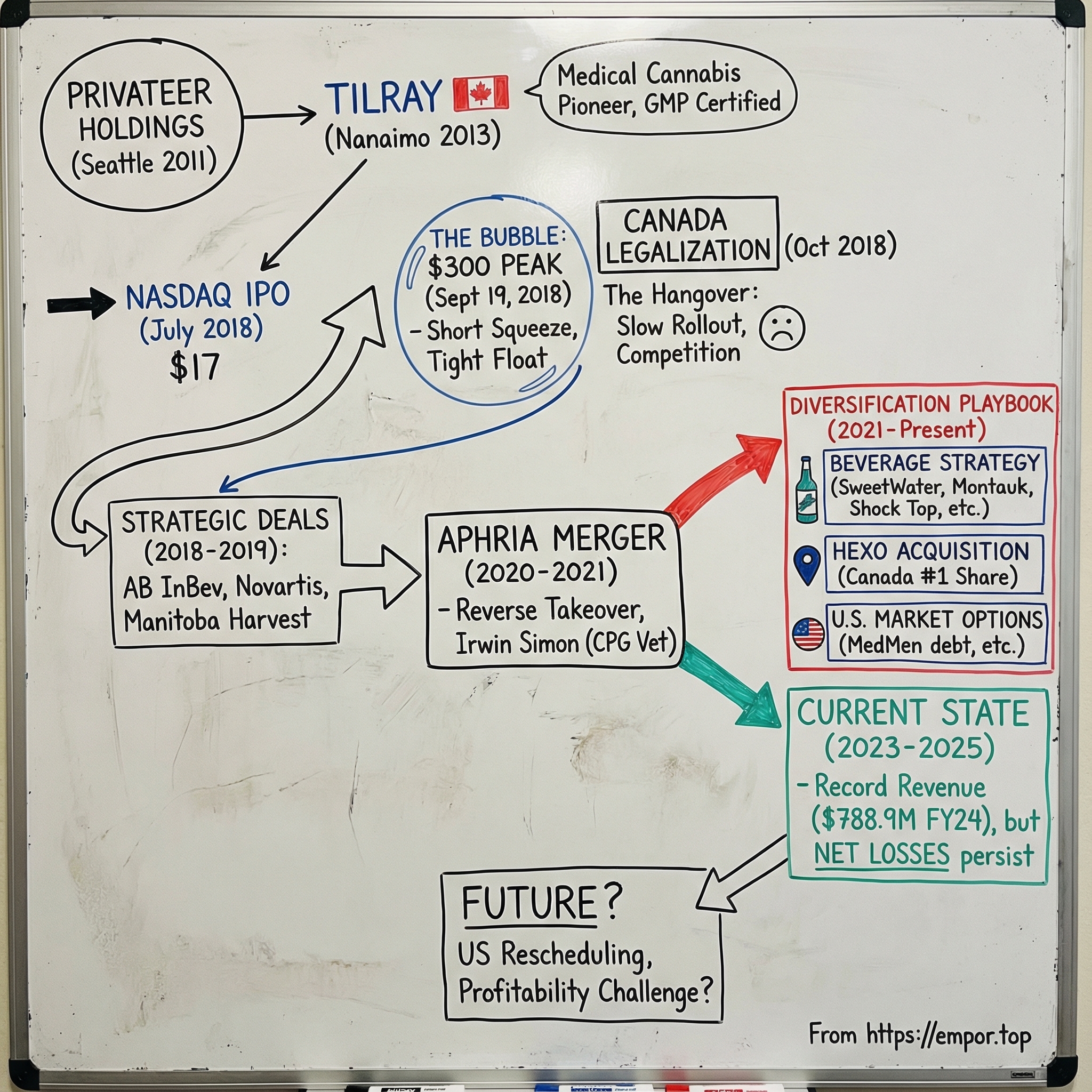

This story moves through distinct phases: from the audacious founding of Privateer Holdings, the first private equity firm betting solely on legal cannabis; through the NASDAQ IPO that opened the floodgates of institutional capital; into the September 2018 bubble that remains a landmark in market psychology; through the transformative Aphria merger that brought new leadership and strategic direction; and finally into the current era of diversification, where Tilray has become as much a craft beer company as a cannabis producer.

For investors and business observers, the Tilray saga offers lessons that extend far beyond the cannabis industry—insights into the dynamics of nascent markets, the perils and possibilities of stock float mechanics, the strategic logic of conglomerate building, and the persistence required to survive when early expectations prove wildly unrealistic.

II. Origins: Privateer Holdings & The Cannabis Private Equity Play (2011-2013)

The Tilray story begins not in Canada, but in a Seattle conference room in 2011, where three Yale School of Management graduates hatched a plan that most investors considered either brilliant or insane—and perhaps both.

Privateer Holdings was founded by Brendan Kennedy, Michael Blue, and Chris Groh on October 20, 2011. Their creation, Privateer Holdings, represented something genuinely unprecedented: Privateer Holdings was an American private equity company dedicated solely to the legal cannabis industry. Headquartered in Seattle, Washington, it employed more than 350 people in seven countries.

To understand how audacious this was, consider the context of 2011. Cannabis remained a Schedule I controlled substance under federal law, classified alongside heroin. Major banks wouldn't touch marijuana-related businesses. Institutional investors avoided the sector entirely. The very idea of a "professional" cannabis company seemed like an oxymoron.

Prior to founding Privateer Holdings, Brendan served as COO of SVB Analytics, a non-bank affiliate of Silicon Valley Bank. In 2006, Brendan joined SVB Analytics' founding team. He was responsible for executing over 350 client valuation assignments and issuing valuation opinions for private companies. Brendan managed a group of 45 people in the US and 75 in India that rendered valuation opinions for emerging growth technology, life science, and venture capital companies.

Kennedy wasn't some cannabis culture stereotype. He was an MBA-trained finance professional who had spent years valuing startups for Silicon Valley Bank. Brendan holds a BA from University of California, Berkeley, an MS in Engineering from University of Washington, and an MBA from Yale School of Management. He approached cannabis the same way he would approach any emerging market opportunity—with spreadsheets, due diligence, and a conviction that the existing operators were doing everything wrong.

Let's make one thing clear: Brendan Kennedy, co-founder of cannabis company Privateer Holdings, does not like images of pot leaves. Branding-wise, he believes the marijuana industry is its own worst enemy. "Everything is named 'canna-something' or 'mari-something,' with a green and black logo and pot leaves," he said. Cannabis would become a mainstream product, he insisted, but it had to lose the cheesy subculture clichés first.

This philosophy—that cannabis needed to be normalized, professionalized, and stripped of its counterculture baggage—would define everything Privateer built.

The early fundraising proved agonizing. When Privateer Holdings got its start in 2011, Kennedy pitched 500 investors over the course of two years. It was a struggle to scrape together a $7 million Series A round of funding from high net worth individuals and family offices.

The company raised an initial $7 million from high net worth individual investors and family offices, with a strategic plan to invest in companies in the cannabis space and build mainstream brands. "Our investors include ranchers in Texas, farmers in Kansas and finance professionals in New York" continued Kennedy. "They all are interested in ending the harms caused by prohibition and see the cannabis space as a once-in-a-lifetime opportunity to create an industry from the ground up."

Privateer's portfolio strategy was diversified from the start. Privateer Holdings portfolio companies include: Leafly, Tilray, and Marley Natural, a partnership with the Bob Marley estate launching a line of cannabis-focused goods.

Privateer Holdings acquired Leafly in 2011. In 2014, Leafly became the first cannabis company to place an advertisement in the New York Times. That advertisement represented a watershed moment—mainstream media acknowledging that cannabis companies could operate like any other business.

But the crown jewel of the Privateer empire would be Tilray itself. Founded in 2013, Tilray was originally incorporated under the umbrella of Seattle-based Privateer Holdings and was one of Canada's first licensed producers.

The company's original location was in Nanaimo, British Columbia, Canada. The decision to base operations in Canada was strategic—the regulatory environment for medical cannabis was more developed, and the path to licensing clearer than anything available in the United States.

Then came the moment that changed everything. At the end of 2014, it secured the first institutional investment in the cannabis industry from Founders Fund, a San Francisco-based venture capital fund.

Founders Fund, the investment firm created by Peter Thiel, has joined a Series B round of funding worth $75 million for Privateer Holdings. More than $50 million of the round has closed so far, including a $15 million convertible note from February of last year. Founders Fund, an early investor in Facebook, Airbnb, and SpaceX, became comfortable making a marijuana investment after a year and a half of diligence on Privateer, partner Geoff Lewis says. When he first became interested in the category, he realized how few real opportunities there were.

Peter Thiel's Founders Fund investing in cannabis sent a signal that echoed across Silicon Valley and Wall Street: this wasn't fringe speculation anymore. One of the most respected venture capital firms in technology was betting serious money on the future of legal cannabis.

The more than $100 million in new funding brings the firm's fundraising total to $200 million, the largest private capital raise closed in the legal cannabis industry to date. Privateer Holdings will use this new financing to expand its existing portfolio of brands to new markets, to make strategic acquisitions and to launch new ventures.

For investors tracking nascent industries, the Privateer/Tilray origin story offers a crucial lesson: timing and positioning matter enormously. Kennedy and his co-founders weren't just early—they were positioned to capture the institutional legitimacy wave before most competitors even understood it was coming.

III. Building the Medical Cannabis Pioneer (2014-2017)

With Founders Fund's backing and Privateer's resources, Tilray moved with remarkable speed to establish itself as the quality leader in medical cannabis. The strategy was straightforward in concept but demanding in execution: build the most regulated, most compliant, most pharmaceutical-grade cannabis operation in the world.

Tilray was founded in 2013 by Brendan Kennedy, who served as the company's first CEO, with the vision of becoming a global leader in cannabis research, cultivation, production, and distribution. The company initially focused on medical cannabis production in Canada under the country's Marihuana for Medical Purposes Regulations (MMPR).

The MMPR framework required licensed producers to meet rigorous standards—cultivation had to occur in secure indoor facilities, products needed detailed testing and labeling, and distribution occurred only through mail order to registered patients. This created a natural moat: only well-capitalized, professionally managed operations could meet the requirements.

Tilray's breakthrough came in December 2016, when it achieved something no North American cannabis company had done before. Tilray became the first medical cannabis producer in North America to be GMP certified in December 2016. GMP certification is the most rigorous standard that manufacturers of medical products must meet in their production processes. GMP certification allows Tilray to create products for clinical research. As of 2016, Tilray supplies pharmaceutical-grade medical cannabis products for three different clinical trials in partnership with hospitals and universities in Canada and Australia.

GMP—Good Manufacturing Practice—certification represented the pharmaceutical industry gold standard. Achieving it required meticulous documentation, controlled environments, rigorous quality testing, and the kind of operational discipline more commonly associated with multinational drug companies than cannabis producers. The certification opened doors that had been firmly closed.

In 2016, it became the first cannabis company to conduct a clinical trial approved by Health Canada. The trial evaluated the therapeutic potential of medical cannabis.

The export achievements piled up. Tilray became the first company to legally export medical cannabis products from North America to Australia, Brazil, Chile, the European Union, and New Zealand. Each export required navigating a different country's regulatory framework, establishing relationships with health authorities, and demonstrating that product quality met international pharmaceutical standards.

By 2017, Tilray had positioned itself in a category of one: the cannabis company that looked, operated, and was regulated like a pharmaceutical manufacturer. This positioning would prove invaluable when the opportunity for public markets emerged.

Privateer owned 76 percent of Tilray Inc., a company federally licensed by the Government of Canada to produce, process, package and distribute medical cannabis. The company operated a 60,000 sq. ft medical cannabis research and production facility in Nanaimo, British Columbia. As of 2016, Tilray supplied pharmaceutical-grade medical cannabis products and had raised $122 million.

The revenue numbers remained modest—this was still a nascent industry—but the infrastructure, certifications, and regulatory relationships represented assets that would prove difficult for competitors to replicate.

For investors analyzing early-stage companies, Tilray's pre-IPO phase demonstrates the importance of regulatory moats. In industries shaped by government oversight, the company that achieves compliance first often maintains advantages that persist for years. Tilray's GMP certification and export licenses weren't just marketing achievements—they were structural advantages that competitors couldn't easily duplicate.

IV. The NASDAQ IPO & The 2018 Cannabis Bubble

The IPO That Changed Everything

By early 2018, the stars were aligning for cannabis in ways that even optimists hadn't anticipated. Canada's federal government had announced that recreational legalization would take effect in October. Medical cannabis programs were expanding globally. And investors, starved for growth stories after years of low interest rates, were increasingly willing to consider sectors they'd previously dismissed.

Tilray became the first cannabis company to complete an initial public offering on a major U.S. stock exchange when it went public on NASDAQ in July 2018 under the ticker symbol TLRY, raising approximately $153 million.

The timing was exquisite. By listing on NASDAQ rather than the Canadian exchanges where other cannabis companies traded, Tilray gained access to a vastly larger pool of institutional capital. Many U.S. funds couldn't or wouldn't buy stocks listed solely on foreign exchanges. Tilray eliminated that barrier.

But here's where the story takes a turn toward the extraordinary—and where the lessons about market dynamics become impossible to ignore.

The IPO structure created conditions that, in retrospect, made extreme volatility almost inevitable. Tilray was the first pure-play marijuana IPO in the U.S. and the third marijuana stock to list in the U.S. after Canopy Growth and Cronos Group. The novelty of a marijuana IPO on a U.S. exchange and a small float of just 9 million shares caused the offering to become several times oversubscribed. The small float helped push the stock higher, since there were only so many shares available to hungry investors, and a short squeeze followed as investors who bet against the stock were forced to cover their bets.

The float dynamics were critical. While Tilray had tens of millions of shares outstanding, the public markets had access to only 23 percent of the total equity, about 17.8 million shares. Privateer Holdings and other insiders held the rest, locked up per standard IPO restrictions.

The Bubble: From $17 to $300 in Two Months

What happened next remains one of the most studied episodes of market psychology in recent memory.

Nowhere has this been more obvious than in the sudden growth of Tilray, the Canadian pot grower, which surged more than 1,000% from its $17 IPO price on July 19 to an intraday peak of $300 two months later on Sept. 19.

On Wednesday, September 19, TLRY stock passed the $200 and $300 marks in the same day. On that same day, Tilray stock dropped to $150, then bounced back to close at $215.

The September 19, 2018 trading session deserves careful examination as a case study in market mechanics gone haywire.

Shares in marijuana company Tilray Inc. went on a roller-coaster ride yesterday that likely left many investors with whiplash. In the final hour of trading on Wednesday, Tilray's shares went from nearly doubling to a loss before settling in with a 38% gain. The crazy volatility during the final hour resulted in trading in Tilray's shares being halted five times.

On Sept. 19, 2018, more than 31 million Tilray shares changed hands, nearly double its float at the time. Tilray had become heavily shorted as the stock rose and a short squeeze helped drive its volatility. However, the limited number of shares made the swings in the stock bigger than they would have been with a greater supply and helped fuel a trader-driven bubble as day traders looked to capitalize on the wild movements in the stock.

The first five-minute pause in trading happened when shares dropped from $300 to about $230 in a 10-minute span between about 2:50 p.m. EDT and 3 p.m. EDT. Then, as shares continued falling toward their intraday low of $151.40, trading was paused four more times between 3:20 p.m. EDT and 3:45 p.m. EDT. When all was said and done, Tilray's stock finished the day up 38% at $214.06 with over 31 million Tilray shares changing hands.

With its market cap approaching $8 billion, Tilray was now considered a "no brainer" short. By September 19th Tilray had tripled again, from $100 to as high $300. This was nearly 18x vs. its IPO price from just two months earlier, and Tilray was now valued at over $20 billion.

The fundamentals-to-valuation disconnect was staggering. At its peak, Tilray commanded a market capitalization exceeding $20 billion. The underlying business? Tilray's multibillion-dollar valuation is untenable given its annualized sales total of less than $40 million.

Why the Bubble Popped

There were almost no fundamentals driving the surge in Tilray. News on Sept. 13 that the company had secured permits to sell cannabis oil and cannabis flower in Germany may have helped boost the stock, but mostly shares were driven higher by irrational exuberance, the short float, and the greater fool theory. A pattern with bubbles, as we've seen with bitcoin and other assets, is that growth turning parabolic usually heralds the bubble's bursting.

As the squeeze entered its final stages, the cost to borrow shares spiked to between 200-650%. Tilray was already absurdly overvalued at $50, and even more so as it hit $100, $200 and then $300. But when someone makes the decision to pay 650% to short any stock, regardless of how absurdly valued, it means that this person clearly does not understand the economics of what he is doing.

On Sept. 19, 2018, Tilray stock jumped from the prior day's closing price of $154.98 to an intraday high of $300 before closing at $214.06.

The aftermath unfolded predictably. What was also noteworthy about Tilray's sudden explosion is that other Canadian pot producers didn't experience the same burst. That might have made sense if Tilray had been the biggest Canadian pot producer and seemed to have the market cornered once legalization happened, but that wasn't the case. At the time, Tilray was the fifth-largest marijuana producer in Canada, but it still had the highest market cap. Something clearly didn't add up there. Today, the market has corrected that error.

For investors, the Tilray bubble offers essential lessons about market structure. A tight float, combined with institutional restrictions (many funds couldn't short cannabis stocks), created conditions where price discovery failed spectacularly. The 2018 episode foreshadowed similar dynamics that would later appear in GameStop and other meme stocks—the mechanics of constrained supply meeting enthusiasm-driven demand.

V. Canada Legalization & The Hangover (October 2018-2020)

The Big Day That Didn't Deliver

Less than a month after Tilray's stock peaked at $300, Canada made history. Ultimately, these changing tides culminated in the Cannabis Act, which came into effect on October 17th, 2018. This date marked the beginning of dried cannabis flower and cannabis oil sale in retail stores, followed by cannabis edible products and concentrates exactly one year later.

The Cannabis Act took effect on 17 October 2018 and made Canada the second country in the world, after Uruguay, to formally legalize the cultivation, possession, acquisition, and consumption of cannabis and its by-products. Canada is the first G7 and G20 nation to do so.

For Tilray and the broader industry, this should have been the moment of validation—the culmination of years of positioning. Instead, it marked the beginning of a brutal reckoning.

The market reality proved far harsher than projections suggested. Cannabis companies had built massive cultivation capacity anticipating explosive demand. What they got instead was a market constrained by slow retail rollout, pricing pressure, and persistent competition from the illicit market.

When Canada legalized recreational cannabis in October 2018, one of the federal government's most pressing goals was clear: eliminate the illicit market. The reasoning was straightforward.

When RCL was passed, medical cannabis represented 11.8% of the market and illegal cannabis 88.2%. At five years post-RCL implementation, medical cannabis decreased to 3.7%, illegal cannabis decreased to 24.3%, and licensed cannabis took over 72.0% of the market.

The transition from illicit to legal market took years, not months. Licensed producers had built capacity for a market that wouldn't materialize at the expected pace. The result: oversupply, price compression, and brutal margin pressure.

The province of Ontario took steps in 2020 to increase the number of retail licenses issued per month to increase the availability of legal cannabis, in order to combat the illicit market. The market share of legal cannabis products has since risen rapidly, with a Statistics Canada analysis suggesting that Canadians were spending more on legal than illegal cannabis products by the third quarter of 2020, with the amount spent in the black market having dropped by nearly half since immediately prior to legalization. In response to Statistics Canada's 2021 Canadian Cannabis Survey, 64% of cannabis users reported that they usually purchased cannabis from a legal storefront or online store, up from 54% in 2020 and 37% in 2019.

Strategic Deals & Partnerships (2018-2019)

Despite the difficult market conditions, Tilray under Brendan Kennedy pursued an aggressive partnership strategy designed to position the company for the next phase of industry evolution.

Canadian cannabis company Tilray entered a $100 million joint venture with beer brewer AB InBev to study non-alcoholic THC and CBD beverages, the companies announced Wednesday. The partnership is limited to Canada, and the companies will make decisions about commercializing the products in the future. Shares of Tilray jumped as much as 19 percent after hours. The joint venture, in which both companies will invest $50 million each, will study non-alcoholic beverages containing THC, the psychoactive chemical compound in marijuana, as well as CBD, the non-active chemical.

In 2018, Tilray announced it had entered into global alliance with Sandoz, a division of Novartis to co-brand and distribute non-combustible medical cannabis products in global markets where it is legally authorized. The Globe and Mail dubbed this partnership as 'big-pharma's first foray into cannabis'. Also in 2018, Tilray announced a $100-million joint venture with the world's largest brewer, AB InBev to research non-alcohol tetrahydrocannabinol (THC) and cannabidiol (CBD)-infused beverages.

The Novartis partnership represented another milestone: Big Pharma was acknowledging cannabis as a legitimate therapeutic category worth investing in.

In 2019, Tilray signed a $250 million revenue-sharing deal with U.S. based brand company, Authentic Brands Group, to leverage ABG brand names, such as Juicy Couture, Greg Norman, and Nine West to create cannabis products. ABG has a portfolio of over 50 brands. In February 2019, Tilray acquired Manitoba Harvest, a hemp foods manufacturer, for $317 million. The acquisition allowed Tilray to use Manitoba Harvest's retail distribution network to enter the U.S. CBD market. Manitoba Harvest's products are available in approximately 13,000 U.S. stores and 3,600 in Canada.

The Manitoba Harvest acquisition proved strategically significant beyond its immediate revenue contribution. It gave Tilray a legal foothold in U.S. retail through hemp-based products—a category that didn't face the federal restrictions limiting THC cannabis.

For long-term investors watching the cannabis sector, the 2018-2020 period offered a sobering lesson: being right about industry direction doesn't guarantee being right about timing or magnitude. Every cannabis company had projected exponential growth from Canadian legalization. The reality proved far more gradual—and far more punishing to companies that had scaled capacity in anticipation of demand that took years longer to materialize.

VI. The Aphria Merger: A Reverse Takeover That Changed Everything (2020-2021)

The Deal Structure

By late 2020, the cannabis industry's consolidation phase had begun in earnest. Companies that had scaled aggressively were running low on cash. Stock prices had collapsed from their 2018 peaks. The market demanded rationalization.

Against this backdrop, Tilray and Aphria announced a transaction that would reshape both companies—and provide a template for cannabis industry consolidation.

Tilray's shareholders voted in favor of the proposed merger with Aphria. The two cannabis companies completed the transaction, forming the world's largest cannabis company under the Tilray name, with a market capitalization of approximately $8.2 billion.

But here's what made the deal genuinely unusual: Since this was a reverse merger, the legacy Aphria's management holds the decision-making powers. In fact, Aphria's shareholders now own 62% of the new company, with Irwin Simon (Aphria's CEO and chairman) leading the combined entity.

In reality, this is Aphria taking over Tilray. In an all-stock deal agreed to last December, each Aphria share held as of April 30 was swapped for 0.8381 of a Tilray share. Aphria's CEO Irwin Simon is taking over that role with the reconstituted Tilray, and has also become the chairman of the new company's board of directors. To mark the new phase of its existence, Tilray has also changed its corporate logo.

The structure was clever. Tilray had the more valuable brand name and the NASDAQ listing. Aphria had the stronger operations and the leadership team with deeper CPG (consumer packaged goods) experience. By structuring the deal as Tilray acquiring Aphria—while giving Aphria shareholders majority ownership—both sides got what they needed most.

Meet Irwin Simon: The CPG Veteran

The leadership transition brought a dramatically different executive profile to Tilray's helm.

He started his career at Haagen Daaz, until he was told in 1993 that he was unemployable. That was the year he founded the Hain Celestial Group in the Hamptons. He built it into a leading global organic and natural products company with more than $3 billion in net sales. He remained with the company until 2018, when he decided it was time for a change. He currently serves as chairman and chief executive officer of Tilray Brands, Inc.

Irwin Simon was ready for something new. For 25 years, Simon had worked to build Hain Celestial Group into one of the largest and most successful organic and natural foods companies in the world, with a wide-ranging portfolio of category leading brands including Celestial Seasonings, Terra Chips, Arrowhead Mills, Earth's Best and Garden of Eatin'. But in 2016, an accounting issue threatened to undermine everything he'd built. The issue forced the company to delay its fourth-quarter earnings report, sending its stock plummeting and unleashing a flurry of shareholder lawsuits Simon successfully led Hain Celestial through an independent audit and Securities and Exchange Commission investigation.

All of which is to say Simon's post-Hain plate was already full when, in December 2018, he got a call from a friend asking if he'd consider joining another board. The company was Aphria Inc., Canada's third-largest producer of cannabis, which had come under fire following the release of a short-seller report. The company's shares plunged 60% in the wake of the report, leading the board to seek an experienced outside executive to help steer the sinking ship. Almost instantly, Simon was appointed chairman, where he was faced with guiding the company through the short-seller controversy, fending off a hostile takeover bid and solving an impending cash crunch. Simon embraced the challenge. "I love going into the fire," he said. "I love going in to fix things and then turning them around." In March 2019, following the resignation of Aphria's CEO, Simon took on the additional title of interim CEO, which thrust him into an executive leadership role in the $150 billion cannabis industry.

Simon brought something Tilray's original leadership lacked: decades of experience building and scaling consumer brands. His playbook wasn't cannabis-specific—it was about understanding retail distribution, brand positioning, and margin optimization.

Strategic Rationale

The combination of Aphria and Tilray brings together two highly complementary businesses to create the leading cannabis-focused CPG company with the largest global geographic footprint in the industry.

The combination of Aphria and Tilray is expected to generate roughly $81 million in annual pre-tax cost savings within 18 months of the transaction's completion.

As CEO, Irwin successfully founded and led consumer goods company Hain Celestial Group to success before doing the same for Aphria. Aphria survived and thrived amid a global crisis because of Simon and his leadership team's smart growth strategies of focusing on their core operations and strengthening their brands and balance sheet, rather than spending cash haphazardly on acquisitions.

The merger also brought an important asset: SweetWater Brewing Company. Aphria recently paid $300 million to acquire Atlanta-based craft brewing company SweetWater Brewing, known for its flagship 420 themed line of beers.

This acquisition, completed shortly before the Tilray merger closed, would prove far more significant than it initially appeared. SweetWater gave the combined company a legal, profitable U.S. business—something most Canadian cannabis companies lacked entirely.

For investors evaluating mergers, the Aphria-Tilray deal offers a textbook example of reverse merger logic. Sometimes the acquired company's management and strategy deserve to lead the combined entity. The key is whether the structures can be designed to make that happen while preserving the brand equity and market access that made the acquisition attractive in the first place.

VII. The Diversification Playbook: From Cannabis to Consumer Goods (2021-Present)

The Beverage Strategy

Under Irwin Simon's leadership, Tilray embarked on a transformation that would have seemed unthinkable in the Brendan Kennedy era: it became primarily a beverage company.

The logic was brutally pragmatic. U.S. federal cannabis legalization—which the industry had expected imminently in 2018—remained stubbornly out of reach. Canadian cannabis markets had matured into intensely competitive, margin-compressed businesses. The growth story that had justified astronomical valuations simply wasn't materializing.

Simon's answer: build a diversified consumer goods company that could eventually layer cannabis capabilities onto existing distribution and brand infrastructure—if and when U.S. regulations allowed.

With this EBITDA accretive transaction, Tilray has acquired a stellar lineup of eight craft beer and beverage brands that both solidify our leadership in the craft beer industry and strengthen our business in the expansive beverage sector in which we see tremendous opportunity to reinvigorate innovation across many categories including non-alcoholic beverages, energy, and nutritional drinks. Tilray Brands, Inc. today announced that the Company has closed its all-cash previously-announced acquisition of eight beer and beverage brands from Anheuser-Busch, including the breweries and brewpubs associated with them.

In August 2023, Tilray acquired eight beverage brands in addition to the breweries of the brands from Anheuser-Busch for $85 million. Citing financial shortfall in part due to the 2023 Bud Light boycott, Anheuser-Busch sold the brand to Tilray in August 2023.

The Bud Light boycott created an unexpected opportunity. Anheuser-Busch, facing pressure across its portfolio, decided to divest craft brands that no longer fit its strategic priorities. Tilray swooped in at what industry observers considered attractive prices.

This acquisition further strengthens Tilray's leadership position in the U.S. craft beer market as the 5th largest craft brewer in the country and the top craft brewer in the Pacific Northwest and Georgia. It also anchors Tilray in Texas, the second largest beer consumption state, and expands Tilray's craft beer portfolio across key beer markets, adding 30% new beer buying accounts.

The portfolio expanded dramatically. Tilray Brands' impressive beverage portfolio now includes some of the leading craft beer, spirits, and non-alcohol beverage brands such as SweetWater Brewing Company, Montauk Brewing Company, Alpine Beer Company, Green Flash Brewing Company, Shock Top, Breckenridge Brewery, Breckenridge Distillery, Blue Point Brewing Company, 10 Barrel Brewing Company, Redhook Brewing Company, Widmer Brothers Brewing, Square Mile Cider Company, HiBall Energy, Happy Flower CBD, along with Canada's top recreational cannabis and THC beverage brands, Mollo and XMG.

The HEXO Acquisition (2022-2023)

While building the U.S. beverage platform, Simon also moved aggressively to consolidate Tilray's position in Canadian cannabis.

Tilray Brands, Inc., a leading global cannabis-lifestyle and consumer packaged goods company, today announced the completion of its previously announced acquisition of HEXO Corp. by way of plan of arrangement. The HEXO acquisition provides several key strategic benefits, including: Creates Largest Canadian Cannabis LP by Revenue, Strengthening Tilray's #1 Market Share Position. Tilray expands its leading cannabis market share position in Canada with pro-forma cannabis market share increasing by 467 basis points to ~13% for the quarter ended May 31, 2023, including the #1 position in almost all markets.

Enables Accelerated Cost Savings and Earnings Growth. With this acquisition, Tilray expects to achieve additional cost savings in excess of US$27M on an annualized pre-tax basis, driven by synergies across production, sales, marketing, distribution, and corporate savings, with potential incremental upside resulting from consolidating packaging, procurement, freight, and logistics.

Tilray amplifies its market-leading offering and substantially expands its base of consumers and patients with a portfolio consisting of the highest growth consumer and medical brands in the Canadian cannabis market across the premium, mainstream, and value segments. Tilray's newly combined brand portfolio now includes Canada's top-selling brands such as Good Supply, RIFF, Broken Coast, Solei, Canaca, HEXO, Redecan, Original Stash, and Bake Sale, among others.

U.S. Market Strategy Without Touching THC

With federal legalization remaining elusive, Tilray developed creative approaches to position for eventual U.S. market entry.

Canadian pot producer Tilray Inc on Tuesday said it will buy convertible debt of struggling U.S. rival MedMen Enterprises Inc's for about $166 million in a deal with partners, giving it a pathway to enter the United States. Due to U.S. federal laws classifying marijuana as an illegal drug, companies not based in the country can not directly own a U.S. weed business. By buying convertible debt and warrants - which can be changed into shares later - Tilray gets the option to take a "significant equity position in MedMen... following U.S. cannabis legalization", it said in a statement.

Despite its "challenges and tribulations", MedMen remains an "iconic brand, known by everybody, the 'Apple' of cannabis," Tilray Chief Executive Irwin Simon said in an interview. Simon, who earlier this year reverse merged his former company Aphria with Tilray, is still looking at more deals to get the new company to $4 billion in revenue by 2024.

The MedMen investment ultimately proved unsuccessful—The company acquired a majority position in MedMen Enterprises' amended convertible notes for $165.8 million in 2021. MedMen has now filed for bankruptcy in Canada.—but it illustrated Simon's willingness to find unconventional pathways into the U.S. market.

For investors tracking Tilray's transformation, the diversification strategy represents a significant pivot away from pure-play cannabis exposure. The bet is that beverage distribution infrastructure, brand-building expertise, and retail relationships will prove valuable whenever U.S. cannabis markets finally open. Whether that bet pays off depends heavily on timing—and on whether Tilray can achieve profitability in its current businesses while waiting.

VIII. Current State: The Numbers (2023-2025)

The most recent financial results tell a story of progress and persistent challenges operating in tension.

Tilray Brands, Inc., a global lifestyle and consumer packaged goods company at the forefront of the cannabis, beverage, and wellness industries, today reported financial results for its first fiscal quarter ended August 31, 2025. Net revenue increased 5% to $209.5 million in the first quarter compared to $200.0 million. Gross profit was $57.5 million in the first quarter compared to $59.7 million. Gross margin was 27% in the first quarter compared to 30%. Cannabis net revenue increased 5% to $64.5 million in the first quarter compared to $61.2 million.

Tilray shares are up 14% after posted record Q1 FY2026 revenue of $209.5 million, up 5% YoY and above consensus of $205.75M Adjusted EPS came in at $0.00, in line with expectations, while net income reached $1.5 million, marking a turnaround from a $(34.7)M loss a year ago. Adjusted EBITDA rose 9% YoY to $10.2 million, also exceeding forecasts, with cash used in operations improving by $34 million.

The profitability picture has improved, though challenges remain. Balance Sheet Update: In the first quarter, Tilray reduced its total outstanding debt by $7.7 million, further strengthening the balance sheet. As a result, the ratio of net debt to trailing twelve months adjusted EBITDA was reduced to 0.07x. Our $264.8 million cash balance provides Tilray with great flexibility for strategic opportunities.

Tilray reaffirmed its FY2026 adjusted EBITDA guidance of $62-72 million, signaling confidence in its ongoing strategic initiatives. The company is focused on expanding its international cannabis markets and exploring opportunities in the U.S. medical cannabis sector.

Fiscal year 2024 showed the scale Tilray has achieved through acquisitions. Tilray noted that nearly all of its losses were "a result of non-cash expenses" and highlighted a 26% growth in net revenue to $788.9 million for the fiscal year, up from $627 million. That diversification – particularly in the beverage sector – has paid off thus far, Tilray reported, with alcoholic beverage revenue surpassing cannabis revenue, $76.7 million and $71.9 million, respectively, in the fourth quarter. Alcohol sales were up 137%, while cannabis sales increased just 12%. For the full fiscal year, alcoholic beverage sales were up 113% to $202.1 million, compared with 24% growth in cannabis revenue for the year and a total of $272.8 million.

However, the net income picture remains concerning for investors focused on GAAP profitability. Net income (loss) was ($2,181.4) million in fiscal 2025, compared to a net loss of ($222.4) million in the previous fiscal year. This change is mainly due to non-cash impairment of goodwill and intangible assets, as stated in Q4 financial highlights, of ($2,096.1) million. Net income (loss) per share was ($2.46), compared to a net income (loss) of ($0.33) per share in the prior fiscal year.

The shareholder value destruction has been severe. The latest closing stock price for Tilray Brands as of December 11, 2025 was 8.43. The all-time high Tilray Brands stock closing price was $214.06 on September 19, 2018.

The stark contrast between that peak and today's single-digit prices represents one of the most dramatic value evaporations in recent market history. Yet recent developments have provided optimism: Shares of cannabis company Tilray Brands jumped 40.8% in the afternoon session after reports suggested the Trump administration planned to ease federal restrictions on marijuana by reclassifying it as a less dangerous substance. This potential move would shift cannabis from a Schedule I drug, a category that includes substances like heroin, to a Schedule III drug, which is similar to some common prescription painkillers. Such a change, while not legalizing marijuana outright, would significantly reduce federal oversight. The reclassification was expected to expand research access and improve profitability for cannabis companies.

Reports indicate the President will instruct federal agencies to make marijuana a Schedule III drug soon.

For investors evaluating Tilray today, the key question is whether the operational improvements and regulatory tailwinds can translate into sustained profitability before the company needs additional capital. The balance sheet has improved significantly, but years of losses have left their mark.

IX. Playbook: Business & Investing Lessons

First-Mover in Nascent Industries

Tilray's journey illustrates the double-edged sword of pioneering. Being first to achieve GMP certification, first to export to multiple continents, first pure-play cannabis IPO on NASDAQ—these achievements created brand recognition and institutional relationships that proved durable. Yet being first also meant absorbing all the regulatory uncertainty, market development costs, and valuation volatility that later entrants could avoid.

The lesson: first-mover advantages in regulated industries require patient capital and realistic expectations about how long market development takes.

Stock Float Dynamics

The September 2018 bubble stands as a case study in how market structure can overwhelm fundamentals. The combination of: - Extremely tight public float (most shares locked up) - High short interest with expensive borrow costs - Retail enthusiasm for a novel sector - Institutional restrictions limiting short selling

...created conditions where price discovery broke down entirely. For sophisticated investors, understanding float dynamics and short squeeze mechanics has become essential—not to participate in such events, but to recognize and avoid them.

The Pivot Play

Simon's diversification strategy represents a classic corporate reinvention: when the original thesis proves slower to materialize than expected, adapt the business model while preserving optionality on the original bet.

The beverage acquisitions weren't abandonment of cannabis—they were acknowledgment that waiting for U.S. legalization required a business that could generate cash and capabilities in the interim.

Competitive Analysis: Porter's Five Forces

Threat of New Entrants: Medium In Canadian cannabis, regulatory barriers limit new entry. In craft beer, barriers are lower but Tilray's scale provides advantages.

Supplier Power: Low to Medium For cannabis, Tilray is vertically integrated. For beverages, commodity inputs keep supplier power manageable.

Buyer Power: Medium to High Both retail cannabis and beer face concentrated retail channels with significant bargaining power.

Threat of Substitutes: High Cannabis faces competition from the illicit market. Craft beer faces pressure from spirits, seltzers, and non-alcoholic alternatives.

Industry Rivalry: High Both industries feature intense competition. Cannabis has seen margin compression since legalization; craft beer faces saturated distribution.

Hamilton Helmer's 7 Powers Assessment

Scale Economies: Tilray has achieved meaningful scale in Canadian cannabis, but not yet in U.S. beverages.

Network Effects: Limited. Neither cannabis nor beer benefits from strong network effects.

Counter-Positioning: The diversification strategy may position Tilray differently from pure-play cannabis competitors, though it's unclear this constitutes true counter-positioning.

Switching Costs: Low for consumers in both categories.

Brand: Tilray has accumulated numerous brands across categories. Building brand equity that commands pricing power remains work in progress.

Cornered Resource: GMP certification and regulatory relationships represent modest cornered resources. International licenses have value.

Process Power: Unclear whether Tilray has developed processes that competitors cannot replicate.

Assessment: Tilray lacks the durable competitive advantages typically associated with strong returns on capital. The investment thesis depends more on industry dynamics (U.S. legalization, craft beer market shifts) than on company-specific moats.

Key Performance Indicators to Monitor

For investors tracking Tilray's ongoing performance, two KPIs deserve primary attention:

-

Adjusted EBITDA Margin by Segment: This reveals whether the company can achieve profitability in its core businesses independent of one-time items. The cannabis segment should show margin improvement as the Canadian market matures; the beverage segment margins will indicate whether acquisition integration is succeeding.

-

Canadian Cannabis Market Share: As the undisputed leader in Canada's federally legal cannabis market, Tilray's market share trajectory indicates competitive position. Gains suggest brand strength and operational excellence; losses would signal deeper problems.

Regulatory Overhang

Investors must recognize that U.S. federal cannabis policy represents the single largest factor in Tilray's long-term value. Rescheduling to Schedule III—if it occurs—would provide meaningful benefits but would not constitute full legalization. The ultimate bull case requires federal legalization that allows interstate commerce and removes 280E tax burdens.

The December 2025 news regarding potential executive action on rescheduling has already moved the stock dramatically, demonstrating both the opportunity and the binary risk embedded in regulatory dependence.

Myth vs. Reality

Myth: Tilray is primarily a cannabis company. Reality: Beverage alcohol revenue now exceeds cannabis revenue. The company is better understood as a diversified consumer goods company with significant cannabis exposure.

Myth: Canadian legalization was a failure. Reality: "Canada's legal cannabis market has displaced approximately three-quarters of domestic expenditures on the illegal cannabis market four years after federal legalization of non-medical cannabis." The transition simply took longer than early projections suggested.

Myth: The 2018 stock bubble was caused by fundamentals. Reality: Market structure (tight float, high short interest, expensive borrow) created the technical conditions for the squeeze. The bubble had almost nothing to do with business performance.

Conclusion

Tilray Brands represents one of the most remarkable corporate evolutions of the past decade. From a small Canadian medical cannabis facility backed by a Seattle private equity firm, through the first-ever cannabis IPO on a major U.S. exchange, into one of the most spectacular stock bubbles in modern market history, through transformative mergers and strategic pivots, Tilray has survived challenges that destroyed many competitors.

The company that exists today bears limited resemblance to the 2018 version that briefly commanded a $20+ billion market capitalization. Under Irwin Simon's leadership, Tilray has become a diversified consumer goods company that happens to lead in Canadian cannabis while also ranking among America's largest craft brewers. Whether this diversification represents strategic brilliance or dilution of focus depends on one's view of U.S. cannabis legalization timing.

For long-term fundamental investors, the Tilray story offers essential lessons about nascent industries, market structure, and corporate adaptation. The company demonstrates both the extraordinary returns possible when timing aligns with market enthusiasm—and the patience required when that enthusiasm proves premature.

The most recent chapter remains unwritten. With potential U.S. rescheduling on the horizon, Tilray's years of positioning may finally face their ultimate test. The infrastructure is built. The brands are assembled. The question is whether the market—and the regulators—finally arrive.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music