SiriusPoint Ltd.: The Story of Reinsurance, Reinvention, and Redemption

I. Introduction & Episode Roadmap

Picture an early 2022 evening in Hamilton, Bermuda. The rain comes in sideways, hammering the pastel storefronts along Front Street—the same few blocks that quietly house some of the most important balance sheets in global insurance.

Inside SiriusPoint, the mood was darker than the sky outside. The stock had collapsed. The company’s original champion was stepping back. And the founding thesis—use reinsurance float as fuel for hedge fund returns—was no longer a clever hybrid. It looked like a cautionary tale.

So how did a Bermuda-based insurer and reinsurer, writing more than $2.7 billion in gross premiums, manage to transform itself three separate times in barely a decade… and still be standing?

That’s the SiriusPoint story: financial engineering that met the hard physics of underwriting, activist pressure and boardroom drama, leadership churn, and then—against the odds—a real turnaround in one of the most unforgiving corners of financial services.

Today, SiriusPoint underwrites both insurance and reinsurance for clients and brokers around the world. It’s headquartered in Bermuda, with a footprint that includes New York, London, Stockholm, and more. And it trades on the New York Stock Exchange.

Before we get into the twists, we need one piece of grounding. Reinsurance is, quite literally, insurance for insurance companies. When a primary insurer writes homeowners’ policies in hurricane country, it rarely keeps all that risk on its own books. It passes a portion to reinsurers—specialists who get paid premiums to take on the tail risk, the kind that doesn’t show up for years… until it shows up all at once.

This is a business built on pricing discipline, deep capital, and a brutal respect for uncertainty. Get it right and you can compound steadily for decades. Get it wrong and one catastrophe season—or one set of bad assumptions hiding in the reserves—can erase years of progress.

SiriusPoint’s saga runs straight through the defining realities of modern reinsurance: opaque reserve accounting, boom-and-bust pricing cycles, the constant temptation to paper over underwriting mistakes with investment performance, and the unique cruelty of turnarounds in an industry where the bill for yesterday’s decisions often arrives years later.

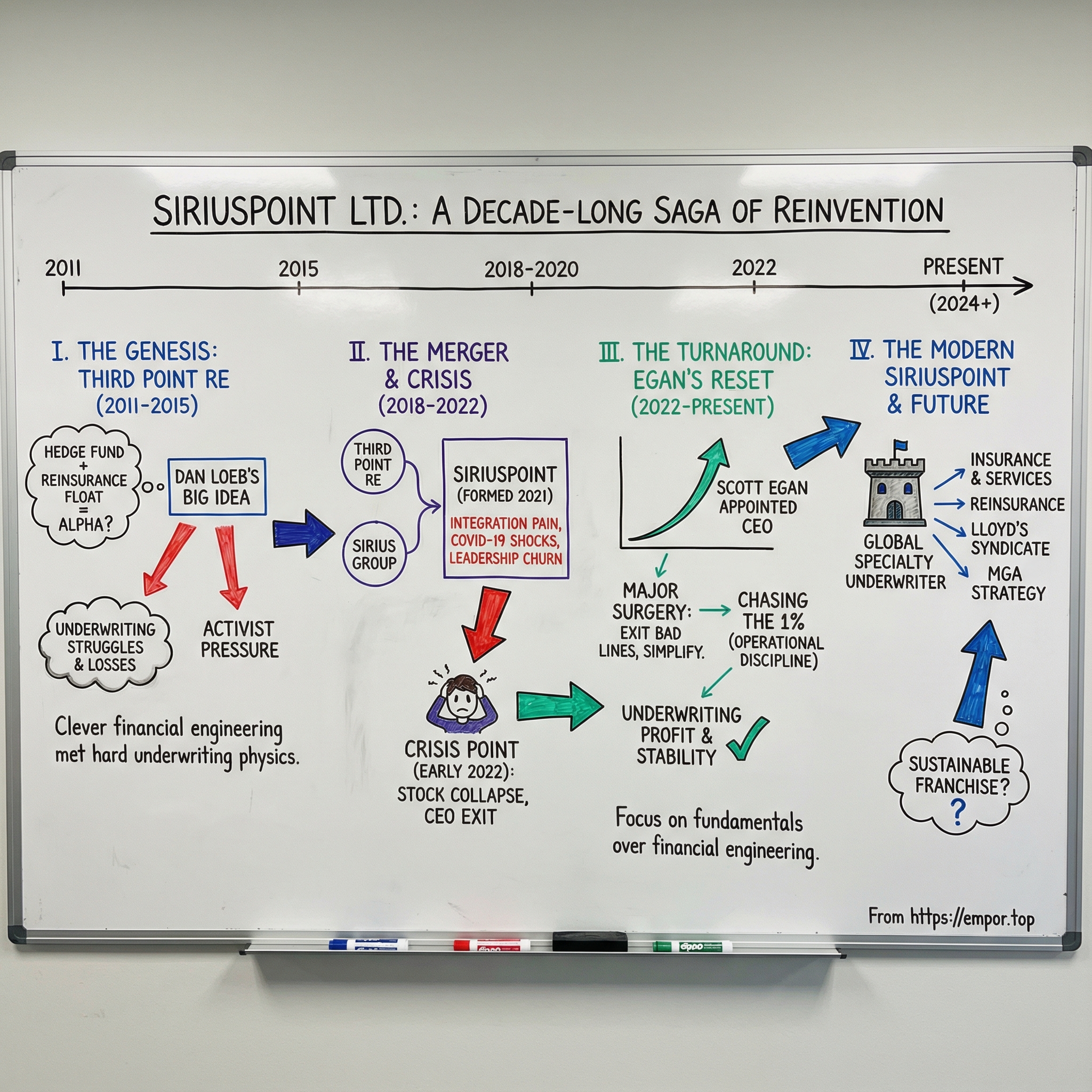

We’ll tell it through three reinventions.

First: Third Point Reinsurance in 2011—Dan Loeb’s bold experiment to pair hedge fund “alpha” with insurance float.

Second: the merger with Sirius Group that created SiriusPoint—a combination of a struggling hedge-fund-flavored reinsurer with a long-standing Scandinavian underwriting franchise.

Third: the reset under CEO Scott Egan, where the company finally confronted what was broken, shrank what it needed to shrink, and rebuilt the underwriting engine to produce real, repeatable profit.

Each chapter starts the same way: with an uncomfortable admission that the old model wasn’t working. And each one required some mix of new leadership, fresh capital, and the humility to clean up problems that couldn’t be wished away.

Let’s start at the beginning—when the idea sounded brilliant.

II. Reinsurance 101: The Business Model & Industry Context

To understand SiriusPoint’s journey, you have to understand the strange, unforgiving economics of reinsurance. This is a business that lives at the intersection of probability, capital markets, and catastrophe—and it only looks calm right up until it doesn’t.

At its core, reinsurers exist to keep the insurance system from snapping under pressure. Primary insurers write policies for homeowners, businesses, airlines, hospitals—everyone. But they rarely keep all that risk. They pass chunks of it to reinsurers, who take on the tail events: the rare, brutal losses that can wipe out years of “normal” profits in a single season.

When Hurricane Andrew tore through South Florida in 1992, it wasn’t just insurers paying claims. Reinsurers were the ones absorbing the upper layers of the loss. And the shockwaves did something else: they helped make Bermuda what it is today. In the aftermath, more than $4 billion of new capital flowed to the island to stand up seven new property catastrophe reinsurers—one of the clearest examples of how fast this industry can reconfigure when the math changes overnight.

The reinsurance model runs on three interlocking concepts: underwriting, investments, and float.

Underwriting is the straightforward part, at least in theory: premiums in, claims and expenses out. The key scoreboard here is the combined ratio. Below 100% means you made an underwriting profit; above 100% means you lost money on the insurance business itself. So if you collect $100 of premium and pay out $95 in claims and expenses, you’re at a 95 combined ratio—and you’re doing your job.

Float is what makes insurance uniquely powerful as a financial business. Premiums come in today; many claims get paid much later. That time gap creates a pool of money sitting on the balance sheet, available to invest. Warren Buffett built much of Berkshire Hathaway’s compounding machine around this dynamic: write disciplined insurance, generate reliable float, invest it patiently.

Put the pieces together and the “magic trick” becomes clear. A well-run reinsurer can earn money twice: once by underwriting profitably, and again by investing the float. But it cuts both ways. If underwriting is sloppy, investment returns don’t save you—they just slow the bleeding. And eventually, bad underwriting shows up where it always shows up in this business: in the reserves.

So why Bermuda? Taxes are part of it—Bermuda has no corporate income tax, and in years without major catastrophes, that can make profitable underwriting even more valuable. But the bigger story is ecosystem. Over decades, Bermuda built a fast, efficient market for reinsurance: deep pools of specialized talent, a tight broker and executive network, and a regulator with a reputation for being rigorous without being glacial.

The Bermuda Monetary Authority sits at the center of that credibility. And as Bermuda’s ties to the U.S. market strengthened, so did its strategic importance. The NAIC granted Bermuda Qualified Jurisdiction status in 2015, and in 2019 approved it as a Reciprocal Jurisdiction—meaning Bermuda-based reinsurers doing cross-border business with U.S. insurers could operate with a more streamlined set of requirements, without extra collateral or redundant capital rules.

The industry structure matters here, because it tells you what kind of arena SiriusPoint was trying to win in. At the top are giants like Swiss Re, Munich Re, and Hannover Re—massive, diversified institutions with pristine ratings and decades, even centuries, of credibility. Beneath them sits the modern Bermuda market: highly capable, often more specialized, and built to move quickly when opportunities appear. Alongside both are alternative capital providers—insurance-linked securities funds and other structures that can flood the market with capacity when returns look attractive.

By 2023, Bermuda’s role wasn’t niche at all. Member companies of the Association of Bermuda Insurers and Reinsurers reported collective gross written premiums of over $171 billion, up from $145 billion in 2022. And Bermuda was a meaningful contributor to the growth in global dedicated reinsurance capital, which reached $568 billion that year.

Then there’s the most important rule of the whole game: reinsurance is cyclical.

Markets swing between soft and hard conditions. In soft markets, capital is abundant, competition is intense, and pricing drifts down. Coverage is easy to find, terms get looser, and discipline becomes harder—not because underwriters forget math, but because saying “no” costs you business. In hard markets, the opposite happens: capacity tightens, prices rise, terms improve, and underwriting profits can finally reappear.

Hard markets usually arrive after a shock: a huge catastrophe loss, or a systemic event like the 9/11 attacks, when capacity pulls back and everyone reprices risk—fast.

This cycle is the backdrop for SiriusPoint’s entire saga. Many of its struggles happened in softer conditions, when excess capital compressed returns and punished anyone underwriting without perfect discipline. Its recovery began as the market hardened—helpful tailwinds, yes, but also a test of whether management could actually fix what was broken, or whether the environment was simply doing the heavy lifting.

For investors, a few metrics cut through almost everything else.

Combined ratio tells you if underwriting is working right now. Reserve development tells you whether the past was priced correctly—or whether the company is still paying for old mistakes. Book value per share growth shows whether capital is compounding or getting diluted and destroyed. Return on equity ties it all together: how effectively management turns risk-taking and capital into profit.

Keep those in your pocket. They’re the lens we’ll use to track SiriusPoint’s transformation—from the hedge-fund experiment, to the messy merger, to the hard reset that finally started restoring credibility.

III. The Third Point Re Genesis (2011–2015)

This story doesn’t start with actuarial tables or hurricane models. It starts with Dan Loeb—and with the kind of origin myth hedge funds love to tell.

In 1995, Loeb launched Third Point out of a weight room in a Chatham, New Jersey office building. He later moved the firm to New York and became exactly the kind of investor CEOs learn to fear: event-driven, value-oriented, and willing to go public with blistering letters when he thought management teams were asleep at the wheel. By 2011, he was widely seen as one of the most successful activists of his era.

And success created a familiar hedge fund problem: size. The bigger you get, the harder it is to put new money to work without diluting performance. Loeb needed capital that would stick around.

The answer he landed on was… insurance.

Reinsurance companies collect premiums up front and, in many cases, don’t pay claims until months or years later. That gap creates float—large pools of investable assets that can be deployed long before the bill comes due. Most reinsurers invest that float conservatively, largely in bonds, because their first job is to be there when losses hit.

Loeb looked at that tradition and saw an opportunity. What if you paired reinsurance float with a hedge fund that had already built its reputation generating outsized returns?

That’s the bet behind Third Point Re.

The company was incorporated on October 6, 2011. It set up in Bermuda, taking advantage of the island’s well-worn playbook: favorable tax treatment, a credible regulator, and a dense network of reinsurance talent and brokers. Third Point Re would underwrite a book of reinsurance business, and Third Point LLC would manage the investment portfolio. Loeb was a founding shareholder. Third Point Re directly owned its investments, but the investing brain trust sat at Third Point.

This wasn’t a lonely idea, either. David Einhorn had already done something similar with Greenlight Re, and other hedge fund luminaries explored comparable structures. For a moment, “hedge fund reinsurance” looked like a clever corner of financial innovation: underwriting as the machine that manufactures float, and the hedge fund as the engine that turns that float into “alpha.”

The pitch was clean. The reality was not.

Start with the basic mismatch in what different investors want. Hedge fund returns are volatile by nature—driven by market swings, concentrated positions, and event-driven outcomes that don’t cooperate on a quarterly schedule. Insurance investors, on the other hand, prize stability. They care about reserve adequacy, ratings, and not waking up to find capital vaporized in a downturn.

Meanwhile, the underwriting side had its own uphill climb. You don’t conjure a reinsurance franchise out of thin air. You need experienced underwriters, broker relationships, and the discipline to walk away from business that doesn’t pay—especially in competitive markets where pricing is thin and everyone is fighting for the same accounts. Third Point Re was building from scratch in exactly those conditions, while the broader market saw more competition as investors, including hedge funds, crowded into the business of providing backup coverage to primary carriers.

As the years rolled on, the tensions started to show up in the only place that really matters: the results. Combined ratios drifted above 100%, a sign the company was losing money on underwriting. And when Third Point’s hedge fund performance stumbled, there wasn’t enough underwriting profit to steady the ship.

By the middle of the decade, the mood had flipped. Optimism gave way to skepticism. The stock traded below book value—a blunt signal that the market thought the pieces might be worth more apart than together. Questions piled up about strategy, governance, and execution, and management turnover started to creep in.

The cleverness of the original thesis ran into the hard physics of the business. Financial engineering couldn’t replace underwriting discipline. And the diversification investors hoped for was shakier than advertised: when markets get stressed, hedge fund losses can arrive at the same time insurance risks reprice and capital matters most.

For Loeb, the message was getting harder to ignore. If Third Point Re was going to survive, it was going to need a different path forward.

IV. The Cracks Appear: Underwriting Struggles & Activist Pressure (2015–2019)

From 2015 through 2019, the weaknesses in Third Point Re’s model stopped being a worry and started being the story. The combined ratio stayed stubbornly above 100%, meaning the company was losing money on the insurance business itself. Reserves turned out to be too light, so they had to be strengthened—an accounting phrase that, in plain English, meant admitting prior years were underpriced and taking the hit through book value. And the “hedge fund alpha” that was supposed to make the whole structure sing couldn’t reliably outrun the underwriting drag.

Reinsurance punishes small mistakes. A combined ratio of 105% isn’t just a bad year—it’s five cents lost for every dollar of premium, and those losses stack up fast when your book is growing. Now layer on a volatile investment strategy. In down markets you can get hit twice—weak underwriting results and declining investments. In up markets, shareholders still had to live with the nagging question: are today’s profits real, or are they just borrowing from the future because the reserves aren’t right?

As performance sagged, leadership churn picked up. CEO changes signaled a board searching for a reset, but each new team walked into the same structural bind: an underwriting operation still trying to prove it had discipline and scale, an investment approach that made results swingy, and a stock price that increasingly traded like a vote of no confidence.

And it wasn’t just a Third Point Re problem. The broader “hedge fund reinsurer” idea was losing its shine. Greenlight Re wrestled with similar dynamics, and the category’s collective results poked holes in the elegant pitch that hedge fund skill could reliably turn insurance float into superior returns.

Because the customer for a public reinsurer is ultimately the equity market, and the equity market was sending a clear message: traditional insurance investors weren’t looking for correlated hedge fund risk. They wanted boring—in the best way. Conservative portfolios, stable underwriting profits, clean reserves, and a business model you didn’t have to explain twice. The hybrid structure ended up satisfying neither camp.

By 2018, Loeb and the board were boxed into a small set of options. Keep grinding it out as an undersized, underperforming specialty reinsurer. Find a buyer and call time on the experiment. Or do something big enough to change the company’s identity.

They chose the big swing: a transformative combination with Sirius Group, intended to create a larger, more diversified company with a real underwriting franchise and established broker relationships.

Sirius Group’s roots ran far deeper than Third Point Re’s. Its corporate history traced back to 1945, when a predecessor of Sirius International was founded in Stockholm. Over the decades, it expanded through acquisitions and built branch offices across Europe and Asia, writing insurance and reinsurance across multiple lines.

More importantly, Sirius brought what Third Point Re didn’t yet have: an established underwriting platform with global reach and an A- rating from major agencies. It was a multi-line insurer and reinsurer with a long operating history and a diversified book across risk types and geographies. As of December 31, 2019, Sirius Group had nearly 2,000 clients in roughly 150 countries, spread across more than 8,000 treaties and accounts.

On paper, the logic was clean: Third Point Re contributed capital and investment management expertise; Sirius contributed underwriting, distribution, and credibility. Together, they’d have the scale and breadth to compete more effectively against larger rivals.

But the fine print mattered. Integration would be hard. Sirius came with legacy issues of its own, including reserves that would later prove problematic. The cultural gap between a hedge-fund-flavored reinsurer and a more traditional Scandinavian franchise created friction. And instead of simplifying the story for investors, the merger risked multiplying complexity—two organizations, two histories, and now one balance sheet that had to work.

V. Key Inflection Point #1: The Sirius Merger & Name Change (2018–2020)

The deal itself was a clear admission: Third Point Re couldn’t underwrite its way into credibility fast enough on its own.

In 2018, it agreed to buy Sirius from its parent, China Minsheng Investment Group (CMIG), for $100 million in cash plus roughly 58 million shares of Third Point Re. The broader combination was framed as the birth of something new: a global insurance and reinsurance group that would eventually take the name SiriusPoint Ltd.

On announcement, the transaction was valued at $788 million. The pitch was scale: a combined company with about $3.3 billion of tangible capital and roughly $2.5 billion of pro-forma gross written premium. Bigger balance sheet, broader book, deeper broker relationships—enough heft to look like a real platform, not an experiment.

Strategically, it was a bet that diversification and a mature underwriting franchise could succeed where the hedge fund reinsurer model had struggled. Third Point Re needed underwriting legitimacy. Sirius Group needed capital and a clearer future after years under Chinese ownership. Together, they hoped to become more than a financial structure and start looking like an actual franchise.

To lead it, the board turned to Sid Sankaran—then Chairman of Third Point Re—who was slated to become CEO of the new company. Sankaran came in with a resume built for messy situations: most recently CFO at Oscar Health, and before that more than eight years at AIG, including serving as Group CFO starting in late 2015 and previously as Chief Risk Officer in the post-crisis era. If you’ve lived through AIG’s rebuild, you’ve seen what happens when risk, reserves, and reputation all break at once—and how hard it is to put them back together.

As SiriusPoint lined up its capital base, Sankaran emphasized stability and endorsement from the market. “Reaching an agreement with the Cornerstone Investors is an important milestone for SiriusPoint,” he said. “This agreement provides us with certainty regarding our capital position going forward, resolves amicably a potential litigation, and constitutes an important endorsement of SiriusPoint by sophisticated investors.”

Then came the repositioning statement—less hedge fund flash, more insurance fundamentals. “We are excited to create a powerful new entity that focuses on underwriting first but strives for excellence in its investment results,” Sankaran said. The idea was that the combined company would keep investment capability, but put it back in its proper place: underwriting discipline first, steady book value growth over time, and a broader platform that could pursue better risk-adjusted business.

By late 2020, the merger got its formal green light. Shareholders of both Third Point Re and Sirius Group approved the required proposals at special meetings held on November 23, 2020. Dan Malloy, Third Point Re’s CEO at the time, said, “We are very pleased that shareholders have approved the merger.”

But the real world didn’t wait for integration plans.

The combination closed right as COVID-19 was injecting uncertainty into every corner of insurance. Pandemic-related losses, questions about reserve adequacy, and market volatility all arrived at once—exactly the kind of environment where a newly merged balance sheet gets stress-tested before it’s fully bolted together.

Meanwhile, the mechanics of integration were heavy: merging systems, aligning underwriting approaches, and knitting together teams across Bermuda, Sweden, and the U.S. It demanded enormous management attention at the same moment the business needed clear, confident execution.

And one more complication lingered from the old era. Even with the “underwriting first” messaging, Third Point LLC still managed significant portions of the investment portfolio. The correlation and volatility issues that had defined Third Point Re didn’t magically disappear just because the letterhead changed.

The merger was supposed to be the clean pivot. Instead, it became the runway into the next, sharper chapter—because within eighteen months, the promise of SiriusPoint would give way to crisis.

VI. Key Inflection Point #2: The Dan Loeb Exit & Strategic Reset (2020–2022)

By early 2022, SiriusPoint was in real trouble. Losses kept coming. Reserve charges kept surfacing. The strategy felt muddled. Investor confidence evaporated, and the stock followed it down. The original promise—hedge fund returns supercharged by reinsurance float—didn’t look like innovation anymore. It looked broken.

Then came the leadership rupture.

SiriusPoint announced that Siddhartha (Sid) Sankaran, its Chairman and CEO, had resigned to pursue other opportunities. The board named Daniel Malloy interim CEO while it began searching for a permanent successor, and director Sharon Ludlow stepped in as interim chair.

Dan Loeb didn’t mince words about what needed to happen next. “SiriusPoint has significant strategic assets and a strong financial and operating model,” he said. “The company now needs to recruit an experienced CEO to focus on disciplined expense management, profitable underwriting and growth strategies, and supporting a prudent investment program.”

Sankaran’s exit—after barely a year in the role—wasn’t just another executive shuffle. It was a flare shot into the sky. Whatever the merger was supposed to fix, it hadn’t. Now the board had to confront the core question: should SiriusPoint try to sell itself, pursue yet another combination, or attempt a standalone turnaround?

The rating agencies noticed the instability immediately. S&P Global Ratings placed SiriusPoint and its core subsidiaries on CreditWatch with negative implications, pointing directly to the senior management departures and warning that it would be monitoring whether the company could still execute its strategy.

In the end, SiriusPoint chose to fight on as a standalone company—and it went out and hired an operator.

In September 2022, Scott Egan was appointed CEO. He came from Royal Sun Alliance, where he had most recently been CEO of RSA UK & International and had served as a FTSE 100 board director. He brought more than 25 years in insurance, including senior roles at Aviva, Zurich Financial Services, Brit Insurance, and Towergate Broking. He’d been CFO at RSA Group PLC before moving into the CEO seat for its UK and International business. His profile wasn’t “financial engineering.” It was underwriting, risk, finance, and execution.

That distinction mattered. Egan’s pitch—implicitly and then explicitly—was that SiriusPoint didn’t need another clever structure. It needed to do the unglamorous work: tighten underwriting, cut costs, reduce volatility, and rebuild credibility one renewal season at a time.

While SiriusPoint was trying to reset, Loeb’s relationship with the company kept evolving too—and not quietly.

At one point, Loeb explored taking SiriusPoint private. But the talks fell apart over valuation. Shares dropped sharply on the news, and SiriusPoint said that while discussions had ended, it had made progress over the prior seven months improving underwriting performance, reducing volatility, and shifting the investment portfolio toward high-quality fixed-income assets.

Not long after, Loeb entered into a standstill agreement with SiriusPoint. Under the deal, he agreed—subject to limited exceptions—not to make a takeover proposal or acquire more than 9.5% of the outstanding shares until at least July 2025. He had floated the take-private idea earlier in the year; the potential deal was scrapped the following month when the two sides couldn’t agree on price.

The episode exposed the tension at the center of SiriusPoint’s predicament. Loeb believed the turnaround might be easier outside the glare of quarterly reporting. The company’s special committee concluded the opposite: that remaining public offered shareholders better value. Either way, the standstill bought the new leadership team something priceless—time and focus.

For investors, 2022 was the bottom. But it also set up the snap-back. In 2023, SiriusPoint swung to an annual profit of $339 million from a loss of $403 million in 2022—a reversal of nearly three-quarters of a billion dollars that captured both how deep the hole had been and how much operational leverage the business still had if it could be stabilized.

Egan described what he inherited in blunt terms. Performance had been “below average,” he said, and what the company needed was “major surgery” and “tougher underwriting decisions” after the 2022 underwriting losses. The cleanup meant real exits, including stepping away from the international property catastrophe market.

One of the most consequential moves was getting legacy risk off the books. SiriusPoint executed a significant ground-up Loss Portfolio Transfer with Compre covering a diversified portfolio of primarily reinsurance business. Compre assumed approximately $1.3 billion of reserves through its Class 3B Bermudian reinsurer, Pallas Reinsurance Company Ltd., for a portfolio largely from 2021 and prior underwriting years.

“This is a transformational deal for SiriusPoint,” Egan said. “It demonstrates decisive and continuing execution against our strategic priorities of simplifying our business, reducing future volatility, and improving the profitability of our Company. By transferring these reserves, we are aligning our balance sheet to our go-forward strategy. The expected substantial capital release should further increase our balance sheet strength.”

The message was clear: no more hoping the past would behave. SiriusPoint was paying to draw a line under it—and trying, finally, to rebuild from clean ground.

VII. Key Inflection Point #3: The Turnaround Begins (2022–2024)

Under Scott Egan, the turnaround came in phases. First was the “major surgery”: pull out of unprofitable lines, shove legacy liabilities off the balance sheet, and make the organization simpler and easier to run. Then came the harder, less cinematic part—operational improvement, day after day. Egan’s phrase for it was “chasing the 1%.”

When Egan took over in 2022, SiriusPoint was still reeling from the old era’s baggage. By 2025, the change was visible not just in the stock, but in the company’s posture: tighter, calmer, more deliberate. Egan has been candid about what that first stretch felt like. “The toughest decisions are always the ones that impact people,” he said. “You can strategize on a page, but in real life it affects people… those are always the ones that give me the sleepless nights, and they absolutely should.”

He also emphasized how much speed and clarity mattered early on. “For different stages of the journey, you need different capabilities and precision,” he said. “At the beginning, the company was in a tight spot. We could have spent six months agonising over the perfect strategy, but in truth, good enough was good enough. We set our direction, and the most important part was that we communicated well with our employees. Even with the tough decisions, we stood up and talked to them about what we were doing and why.”

That’s where the “1%” mindset came in. Not as a slogan, but as a replacement for the company’s old habit of reaching for a clever fix. “Strategy is important,” Egan said, “but actually, getting people to march behind you and having a mindset… is really what the 1% is all about. It’s the accumulation of lots of little things that make a difference rather than always trying to find the silver bullet.”

Or, as he put it more directly: “Chasing the 1% is a mindset. First, we had to get ourselves out of the tight spot the company was in. Then our ambition turned towards being a best-in-class underwriter. We certainly weren’t there then, and we’re not there yet, but ultimately, you have to have an ambition.”

In 2023, the numbers finally started to tell the same story management was telling. SiriusPoint reported record underwriting profits, net services fee income, and net income, while growing book value per share by 18%. The company said its cost program was completed a year early, and that it over-delivered on its 2023 guidance for net investment income. It posted a 16.2% ROE for 2023 and said it was now targeting 12–15% ROE over the medium term.

Zoom out, and the swing was dramatic: a $339 million profit in 2023 versus a $403 million loss in 2022—roughly a $700 million turnaround. The combined ratio improved to 84.5% from 96.4%.

And crucially, Egan didn’t treat that as a victory lap. He framed it as a phase change. “I have been very clear to the market that our turnaround is over,” he said. “We have moved to refinement now. But refinement means we chase the 1%.”

A quieter but equally important shift happened on the investment side. SiriusPoint moved away from Third Point LLC’s hedge fund-style approach and toward a more traditional, fixed-income-oriented portfolio. That trade-off was the point: less headline-grabbing upside, but far less volatility, and far more alignment with what insurance investors and rating agencies expect. In a business where confidence is a form of capital, predictability was a feature.

On the underwriting mix, Egan was explicit that this wasn’t a retreat from property catastrophe risk so much as a narrowing of where and how SiriusPoint wanted to play. “We haven’t moved away from property cat risk,” he said. “We actually took ourselves out of one part of the market… but we are a very big property cat reinsurer in the US. What we don’t do is much outside the US now.”

The goal, in his telling, was a portfolio that could take risk without becoming hostage to it. “Lower volatility portfolios tend to create the best value for shareholders,” Egan said. “We’re not afraid to take risk, but we manage our risk, individual risk, very carefully and we manage our portfolio very carefully. We try and make sure that we don’t have too many correlated risks and we diversify by geography, by product, by risk, etc. If we can do that well, we can create a lower volatility portfolio, and that drives the best shareholder value.”

By 2024, SiriusPoint wasn’t just posting a good quarter here and there—it was stacking them. The company reported its ninth consecutive quarter of underwriting profits in its fourth quarter and full-year 2024 results. It delivered a Core combined ratio of 90.2% in Q4, improving 3.2 points from the prior year, and a full-year Core combined ratio of 91.0%, with Core underwriting income of $200 million. It also reported growth in gross premiums written for continuing lines business—up 21% in Q4 and up 10% for the full year.

Egan summed up the year like a CEO trying to cement a new identity. “2024 has been a remarkable year of delivery for SiriusPoint,” he said. Despite increased catastrophe activity, the company’s Core combined ratio improved to 91.0%. He pointed to a 4.2-point improvement in the attritional loss ratio as evidence of better underwriting quality, and noted the reported premium growth in continuing lines. SiriusPoint said its underlying return on equity was 14.6%, at the upper end of its 12–15% target range, and that it returned over $1 billion to investors during 2024 while maintaining robust capital ratios.

And the progress didn’t stop at the calendar year boundary. In its third quarter 2025 results, SiriusPoint reported a Core combined ratio of 89.1%, with Core underwriting income up 11% to $70 million. It reported a third-quarter return on equity of 17.7%, with operating return on equity of 17.9% for the quarter and year-to-date operating return on equity of 16.1%—all above the company’s 12–15% “across the cycle” target range.

VIII. The Modern SiriusPoint: Strategy, Operations & Competitive Position (2024–Present)

The SiriusPoint you see today looks nothing like the anxious, unraveling company of 2022. It now presents itself as what reinsurers are supposed to be: a global underwriter built around two engines—Reinsurance, and Insurance & Services.

Egan has described the mix as roughly two-thirds insurance and one-third reinsurance, with more room to grow on the insurance side. But he’s also careful not to make that sound like a fixed identity. “Agility” matters, he’s suggested—because in this market, customer demand and pricing can flip what’s attractive from one year to the next.

Operationally, SiriusPoint underwrites through hubs in North America, Bermuda, and Europe, with a meaningful presence in London via Lloyd’s Syndicate 1945.

Lloyd’s matters because it’s still one of the world’s great distribution machines for specialty risk. SiriusPoint has been explicit that it isn’t treating Lloyd’s as a side project. “SiriusPoint will retain Syndicate 1945 and its UK Branch operations,” the company said, and Egan added, “The Lloyd’s market is an important and integral part.” The syndicate wrote Accident and Health, Marine, Energy, and Casualty business in 2023. SiriusPoint has framed its Lloyd’s businesses—Sirius International Managing Agency and Syndicate 1945—as “vital elements” of the overall strategy to be “a high-performing underwriter,” calling Lloyd’s “core” to the business and pointing to opportunity in the London Market.

Another pillar is its MGA strategy. This is the modern specialty-insurance playbook: partner with Managing General Agents that source and underwrite business, while SiriusPoint supplies the capital and capacity behind them.

But even here, the company’s recent story is less “expand everywhere” and more “simplify and focus.” “When I first came, we had lots of investments in MGAs—36, I think,” Egan said. “The reason why we didn’t want to have that is because it takes an awful lot of energy and effort to manage 36 different investments.” Since then, SiriusPoint has rationalized the portfolio, leaning into fewer, higher-quality relationships and cutting complexity. In that spirit, it announced the sale of Arcadian MGA for $139 million, alongside a long-term capacity deal running through 2031.

Underneath all of this is the prerequisite for credibility in insurance: capital and ratings. SiriusPoint’s capital base has strengthened, and its operating companies carry A- (Excellent) financial strength ratings from AM Best, S&P, and Fitch. The direction of travel has improved, too. SiriusPoint said, “We are pleased to see our outlook move to Positive from Stable this year for both AM Best and Fitch. These are important proof points of our progress.”

The underwriting philosophy is the connective tissue across the whole platform: disciplined, diversified, and intentionally not trying to be everything to everyone. “That means we can’t be all things to all people,” Egan said. “On one level, our strategy is to be ruthlessly focused on the areas where we think we’ll get expertise that we can bring to our customers. That marriage between our areas of expertise and our customers’ needs is where the magic happens.” He pointed to SiriusPoint winning Program Insurer of the Year as evidence that the strategy is resonating with customers.

And then there’s the promise SiriusPoint is trying hardest to make believable: consistency. “Our half year results delivered a 15.4% return despite having California wildfires and two airline crashes in the first half of the year,” Egan said. “We’re beginning to show that our portfolio is diversified and can still deliver returns. Our message for shareholders and investors is we will deliver a 12% to 15% return across the cycle, and that means we don’t do boom, bust, boom, bust. We work to operate within that range.”

That “across the cycle” target—12% to 15% return on equity—is the company’s attempt to draw the clearest possible line between the old SiriusPoint and the new one: less drama, fewer lurches, and a business built to hold up when the market stops being friendly.

IX. The Reinsurance Industry Today & SiriusPoint's Moat (or Lack Thereof)

To understand SiriusPoint’s competitive position, you have to zoom out and look at the arena it’s fighting in. And then ask the uncomfortable question every reinsurer eventually faces: what, exactly, makes this company meaningfully different?

SiriusPoint is not Swiss Re or Munich Re. It doesn’t have their scale, their brand gravity, or the kind of reputation that comes from centuries of paying claims through wars, crashes, and catastrophe seasons. It plays in a market where the ultimate weapon is capital—and in modern reinsurance, capital is no longer scarce.

That’s the structural shift that’s been reshaping the industry for more than a decade. When pricing looks attractive, money rushes in. Not just from traditional reinsurers, but from alternative capital: insurance-linked securities, collateralized reinsurance, and other offshore vehicles designed to deploy third-party money into risk. Start-ups pop up too, often in familiar domiciles like Bermuda. The practical effect is simple: barriers to entry come down, capacity rises, and pricing power gets competed away. Alternative capital was a major driver of the post-2012 softening for exactly that reason.

Layer on the industry’s growing list of hard problems. Climate change is altering catastrophe frequency and severity. Social inflation is pushing liability costs higher than models used to assume. Cyber is a fast-growing category with loss patterns that are still hard to pin down. These aren’t just risks; they’re moving targets—creating opportunity for disciplined underwriters, and real danger for anyone pricing yesterday’s world.

Now add the cycle. Heading into 2025, there were signs the market could be transitioning from the hard conditions that helped drive recent underwriting profitability toward something softer. Not every line would ease at the same pace, but the direction mattered. Easing inflation reduced some claims-cost pressure. Capacity began to loosen. And improved insurer profitability in 2024 created room for more competitive pricing.

That brings us to the key question hanging over SiriusPoint’s comeback: how much of the turnaround was execution, and how much was the tide?

Hard markets make everyone look smarter. When prices rise and terms tighten, margins improve across the board—even for average underwriters. SiriusPoint’s recovery arrived during some of the strongest pricing conditions in decades, which is both a tailwind and a warning label.

Complicating things further, the cycle itself hasn’t behaved the way it used to. Underwriting cycles have stretched out. New capital has shortened hard markets and prolonged soft ones. Rate swings have become less dramatic, and the old pattern—earn a lot in hard years to offset thin soft years—has become harder to count on.

So the real test for SiriusPoint isn’t what it did in a favorable market. It’s what it does when the market stops being friendly.

Can the company keep underwriting discipline when competitors start buying top-line growth? Can management resist the temptation to chase volume into thinner pricing? SiriusPoint’s own history argues for skepticism here: in prior eras, leadership repeatedly made poor underwriting decisions when conditions got competitive. If this version of SiriusPoint is truly different, it’ll be proven the next time “no” becomes the hardest word to say.

X. Porter's 5 Forces & Hamilton's 7 Powers Analysis

If you step back from the turnaround narrative and run SiriusPoint through classic strategy frameworks, you land in a sobering place. This is a tough industry. And even a well-run SiriusPoint doesn’t get to cheat the structure of the game.

Porter’s Five Forces is a good way to see why.

Threat of new entrants is moderate. Reinsurance still demands real capital and regulatory approvals. But the modern twist is that you don’t always need to build a traditional reinsurer to compete. Alternative capital—from pension funds, hedge funds, and insurance-linked vehicles—can show up through sidecars and fully collateralized structures and start taking share without building a decades-long franchise.

Bargaining power of suppliers is low, but it shifts with the cycle. Reinsurers are, in effect, buying risk from primary insurers. In soft markets, cedants can shop around and play carriers against each other. In hard markets, capacity tightens and the balance of power swings back toward reinsurers.

Bargaining power of buyers is moderate to high. The biggest insurers have leverage, especially when there’s plenty of capacity in the market. And brokers matter here more than most industries: a small number of global reinsurance brokers control a huge share of the premium flow, which gives them meaningful influence over pricing and placement.

Threat of substitutes is also moderate to high. Catastrophe bonds, insurance-linked securities, captives, and other workarounds can replace traditional reinsurance. Even simple retention—keeping more risk on the primary balance sheet—can be a substitute when pricing doesn’t make sense. These options have become far more material over the last couple of decades, and they cap how much pricing power traditional reinsurers can sustain.

Industry rivalry is high. There are dozens of well-capitalized competitors chasing a finite pool of business. Differentiation is limited—capacity is often treated as a commodity—and in soft markets, that turns into a race to the bottom. That’s when you see combined ratios creep above 100% across the industry, not because everyone forgot how to underwrite, but because competitive pressure makes discipline expensive.

Now run Hamilton’s 7 Powers and the picture gets even clearer: SiriusPoint’s strategic advantage, if it exists, is mostly operational—not structural.

Scale economies are weak. SiriusPoint is mid-sized. It doesn’t have the cost absorption, diversification, or sheer negotiating gravity that the global giants can bring to bear.

Network effects are none. Reinsurance isn’t a platform business. One more customer doesn’t inherently make the product more valuable to the next customer.

Counter-positioning is minimal. SiriusPoint’s current playbook—specialty focus, MGA partnerships, disciplined underwriting—is not something the big players are structurally unable to copy.

Switching costs are low to moderate. Relationships matter, and a good underwriting partnership can be sticky. But most contracts renew annually, and capital moves quickly to wherever returns look best. That makes it easy for competitors to show up and take a swing.

Branding is weak. An A- rating gives credibility, but it’s not the same thing as the blue-chip reputation of the category leaders. And SiriusPoint’s own history still hangs around as a question mark for some buyers and investors.

Cornered resource: none obvious. The company can have strong underwriters and better analytics, but those aren’t exclusive assets. Talent can be hired away, and capabilities can be built.

Process power is emerging. This is the one place SiriusPoint can plausibly build something durable: if Egan’s discipline and the “chasing the 1%” culture translate into consistently better risk selection, tighter operations, and fewer nasty surprises. But by definition, that only becomes credible over time—and ideally through a full market cycle.

Put it all together and the takeaway is blunt: SiriusPoint doesn’t have a moat. It has a chance. The business is cyclical, capital-intensive, and crowded. The turnaround appears real—but it’s fragile, because it depends on sustained execution and the ability to stay disciplined when the market gets easier and competitors start trading margin for growth.

XI. Playbook: Business & Investing Lessons

SiriusPoint’s arc is a useful case study in what does—and doesn’t—work in financial services turnarounds. The details are uniquely reinsurance, but the lessons travel.

The hedge fund reinsurance lesson is simple: financial engineering doesn’t replace underwriting discipline. Dan Loeb’s original thesis was elegant on paper—pair reinsurance float with hedge fund “alpha.” In practice, the structure imported volatility that insurance investors don’t want and created correlation at exactly the wrong moments. The cleverness never mattered as much as the basics: price risk correctly, keep reserves honest, and don’t confuse investment gains with underwriting skill.

Turnarounds in financial services require three things at once: capital, credibility, and consistency. SiriusPoint needed capital strength (helped by improved earnings and balance-sheet actions), leadership credibility (Egan’s operator profile mattered here), and then year-after-year execution. And unlike most industries, you don’t get to leave the past behind quickly. Old underwriting decisions keep resurfacing through reserve development long after the premium is booked, which is why these turnarounds tend to take longer than investors want.

Culture is not a soft factor in underwriting—it’s the product. Underwriting is judgment plus incentives, repeated thousands of times. If the culture rewards growth for growth’s sake, a company will eventually buy bad business in a soft market. Egan’s “chasing the 1%” framing is really a culture reset: fewer hero bets, more discipline, and a refusal to trade long-term stability for short-term top-line wins.

Market timing matters more than people like to admit. Hard markets forgive a lot; soft markets expose everything. SiriusPoint’s improvement arrived during one of the toughest pricing environments in years, when margins expanded across the industry. That tailwind doesn’t invalidate the progress—but it does raise the question that ultimately decides whether this is a real franchise or a temporary rebound: can the company keep its footing when capacity loosens and competitors start buying growth again?

Activist pressure can be a catalyst, even when it’s messy. Loeb’s role in this story evolved from founder to frustrated shareholder to would-be buyer. His involvement, alongside the discipline of the public markets, helped force clarity after years of drift. In financial services, where inertia is easy and problems can be papered over for a while, that kind of pressure can accelerate changes that otherwise never happen.

Capital allocation is the hidden skill in reinsurance. Knowing when to grow, when to shrink, and when to hand capital back is often the difference between a great reinsurer and an average one. SiriusPoint’s decision to return substantial capital to shareholders in 2024 sent a clear signal: management was prioritizing returns over empire-building. In this business, shrinking in unattractive pricing is often the most shareholder-friendly move.

The Bermuda advantage is real—but it’s not a cheat code. Bermuda’s tax and regulatory setup, plus the ecosystem of brokers and talent, is a genuine competitive asset. But smaller Bermuda-based players can still struggle with governance depth and talent density compared to the biggest global reinsurers. Location helps; it doesn’t substitute for operational excellence.

And for investors, the takeaway is a checklist as much as a thesis: beware complexity, understand reserves, and treat certain patterns as smoke. SiriusPoint’s worst years featured the classic red flags—management turnover, reserve charges, capital raises, and shifting strategy. The more recent results are encouraging, but the bar for true confidence in reinsurance is high: prove it through a full cycle, not just during the good part of one.

XII. Bear vs. Bull Case

Bull Case:

The turnaround is real—and it sticks. Under Scott Egan, SiriusPoint has put underwriting back at the center of the company, and the results have followed: nine consecutive quarters of underwriting profit. The combined ratio has tightened from the mid-90s into the low 90s, with management aiming to hold the business in the mid-90s range across the cycle.

The market is still helping. Even as conditions begin to ease from the peak, pricing in many lines remains meaningfully better than it was during the long soft-market grind. After years of underpriced risk, the system-wide reset in terms and rates has given disciplined underwriters more room to earn their return.

Valuation still leaves room for upside. The stock rebounded to around $19 from roughly $4 in September 2022, a visible vote that the market believes the crisis is behind it. If SiriusPoint keeps compounding book value and proving the new model is durable, investors could still decide the business deserves a higher multiple than it did as a distressed turnaround.

Capital returns can do a lot of the work. SiriusPoint returned more than $1 billion to investors in 2024. If earnings and capital generation remain steady, ongoing buybacks and dividends can become a second engine of shareholder returns—especially in a business that still carries “prove it” skepticism in its valuation.

Specialty focus can support better margins. SiriusPoint isn’t trying to win by being the biggest. It’s trying to win by being selective—leaning into specialty insurance and reinsurance lines like accident and health, marine, energy, and programs, where expertise and distribution matter more and pricing can be less purely commoditized.

Management credibility is compounding. Egan’s story isn’t built on a new financial structure. It’s built on execution. If he keeps delivering quarter after quarter, the company’s most valuable asset may become the simplest one: a reputation for doing what it says it will do.

Bear Case:

There’s still no moat. Reinsurance is brutally competitive, and SiriusPoint sells capacity into markets crowded with larger traditional players and deep pools of alternative capital, including cat bonds and other structures. Without a structural advantage, margins can get competed away the moment the market loosens.

The cycle will turn—and that’s the real test. Hard markets make everybody look better. The bear case is that SiriusPoint’s profitability has not yet been proven through a full soft-market stretch, when competitors start chasing top line and discipline becomes expensive. The company’s own history includes periods where it didn’t hold the line when conditions got competitive.

Legacy issues can reappear at the worst times. In this business, the past doesn’t stay buried. If reserves from prior underwriting years turn out to be light, adverse development can show up suddenly, hitting earnings and book value and reopening old credibility wounds.

Scale is still a constraint. SiriusPoint sits in an awkward middle: not big enough to enjoy the diversification and cost absorption of the global giants, but not small enough to pivot without friction. Fixed costs, catastrophe exposure management, and the need to maintain strong ratings all weigh heavier when you’re mid-sized.

Execution risk never goes away. Turnarounds can reverse, and SiriusPoint has a long record of leadership churn before Egan. If key leaders depart or discipline slips, the market’s trust could evaporate quickly—especially given how fast confidence moves in insurance.

Catastrophe risk is real and getting harder to model. SiriusPoint still writes property catastrophe reinsurance, and extreme weather is a moving target. Even a well-managed book can have a bad year, and the industry’s models are constantly playing catch-up to new climate and loss patterns.

The balance sheet is stronger, but not invulnerable. Capital has improved, but it’s not infinite. A major loss event—or a couple of them close together—could pressure ratings and constrain the company just when the market is least forgiving.

Key KPIs to Watch:

Combined Ratio: The fastest read on underwriting quality. Can SiriusPoint keep the combined ratio in the low-to-mid 90s? Any slide toward 100% is a warning that discipline is fading or losses are rising.

Reserve Development: The truth serum for prior years. Favorable development suggests conservative reserving and good past pricing. Adverse development usually means yesterday’s business was underpriced—and the bill is coming due.

Book Value Per Share Growth: The long-term scoreboard. Is the company steadily compounding capital per share, or giving it back through losses, reserve hits, or dilution? Over time, this is what separates a real franchise from a temporary rebound.

XIII. Epilogue & Recent Developments

As 2025 drew to a close, SiriusPoint sat at a familiar place in this story: another inflection point. The “major surgery” Egan talked about had been done, and the business looked steadier. But reinsurance doesn’t hand out medals for recovery. The real exam is always the same—can you keep making money when conditions change?

In its results for the third quarter ended September 30, 2025, SiriusPoint reported a Core combined ratio of 89.1%, with Core underwriting income up 11% to $70 million. Book value per diluted common share, excluding AOCI, rose by $0.83 per share, or 5.3%, from June 30, 2025 to $16.47.

Egan framed it as another quarter of proof. “The third quarter marked another successful quarter of delivery for SiriusPoint,” he said, pointing to strong underwriting performance, targeted growth, the announcement of two MGA disposals, and a positive outlook upgrade by S&P. “We achieved a strong operating return on equity of 17.9% in the quarter, significantly ahead of our ‘across the cycle’ 12–15% target range.”

Meanwhile, Dan Loeb kept chasing the same big idea—permanent capital through insurance—just through a different door. He won a vote to transform his UK investment trust into a life and annuity reinsurance company, despite vocal opposition from some shareholders. Investors backed a plan for London-listed Third Point Investors to acquire Cayman Islands-based Malibu Life Reinsurance, shifting the trust away from its prior role as a vehicle investing in Loeb’s hedge fund, Third Point LLC. Loeb described the deal as bringing a “high-quality reinsurance platform to the London market.”

Looking ahead, the wildcards haven’t gotten smaller. AI and climate risk are poised to reshape reinsurance over the coming decades. Better modeling could sharpen risk selection and pricing. At the same time, climate change keeps rewriting the loss landscape, creating new exposures and new uncertainty. SiriusPoint’s long-term relevance will hinge on whether it can keep adapting—through technology investments, portfolio construction, and the kind of underwriting discipline that holds when the market gets competitive again.

There are potential catalysts, too: further ratings upgrades, strategic partnerships, and the ever-present possibility of M&A. SiriusPoint could play offense as a buyer of smaller specialty platforms, or end up on someone else’s shopping list as a Bermuda-based franchise with a rebuilt engine.

But the core question remains the one investors have been asking for years: is SiriusPoint a sustainable franchise—or a cigar butt trade that happened to catch a good part of the cycle? The evidence from the turnaround is real. The skepticism is, too, because the company’s history was written in reserve surprises and strategic pivots, and reinsurance is a business that loves to humble anyone who declares victory early.

If you wanted an Acquired-style verdict, it would sound like cautious optimism with eyes wide open. Under Egan, SiriusPoint made genuine progress and started to look like the kind of underwriter the market can trust. But the best operators in this industry stay disciplined precisely when everything feels easiest—because they know the next soft market, the next catastrophe, and the next uncomfortable reserve review are never that far away.

SiriusPoint’s story, in the end, is transformation through pain. Each reinvention—from Third Point Re, to the Sirius merger, to Egan’s reset—started with the same hard moment: admitting the old plan wasn’t working. That willingness to confront reality is what kept the company alive when many expected it to fade out.

And for anyone studying financial services turnarounds, it’s a case study that travels: financial engineering can’t substitute for operational discipline, underwriting mistakes don’t stay in the past, and real redemption in insurance is earned the slow way—one renewal season at a time.

XIV. Further Reading

Top Resources:

Books: - Against the Gods: The Remarkable Story of Risk by Peter Bernstein — A great, readable tour of how probability, uncertainty, and risk management evolved into a discipline. - The Outsiders by William Thorndike — A reminder that in capital-intensive businesses like insurance, allocation decisions can matter as much as operating decisions. - Reinsurance: Principles and Practice by Robert L. Carter — A more technical grounding in how reinsurance is structured, priced, and managed.

Industry Reports: - A.M. Best reinsurance market reports — Useful for understanding market conditions, rating considerations, and how carriers are positioned. - Guy Carpenter rate-on-line indices — A window into how pricing moves through the cycle. - Swiss Re sigma research publications — Clear, high-quality research on industry economics, risk trends, and emerging exposures.

Company Filings: - SiriusPoint 10-Ks (2019–2024) — Spend time in the MD&A, reserve development, and risk disclosures; that’s where the real story lives. - Proxy statements for governance insights — Helpful for seeing incentives, board structure, and how priorities are reflected in compensation.

Articles & Analysis: - Reinsurance News archives on SiriusPoint — A running timeline of key events, restructuring actions, and market reactions. - Insurance Journal coverage of the Bermuda market — Solid context on the Bermuda ecosystem and the broader industry backdrop. - Rating agency research reports — A credit lens on balance sheet strength, risk appetite, and what the agencies are watching.

Academic/Industry: - Lloyd's of London market reports — Good context for how syndicates operate and how performance is evaluated in the London Market. - NAIC regulatory filings — Helpful for understanding the U.S. regulatory framework and how it intersects with reinsurance.

Podcasts/Interviews: - Industry interviews with Scott Egan and other SiriusPoint executives — Great for hearing strategy and underwriting philosophy in their own words. - Monte Carlo and Baden-Baden reinsurance conference presentations — Where the market often tells you what it’s worried about, and what it’s pricing for next.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music