Profound AI: Marketing to Superintelligence

I. Introduction & Episode Thesis

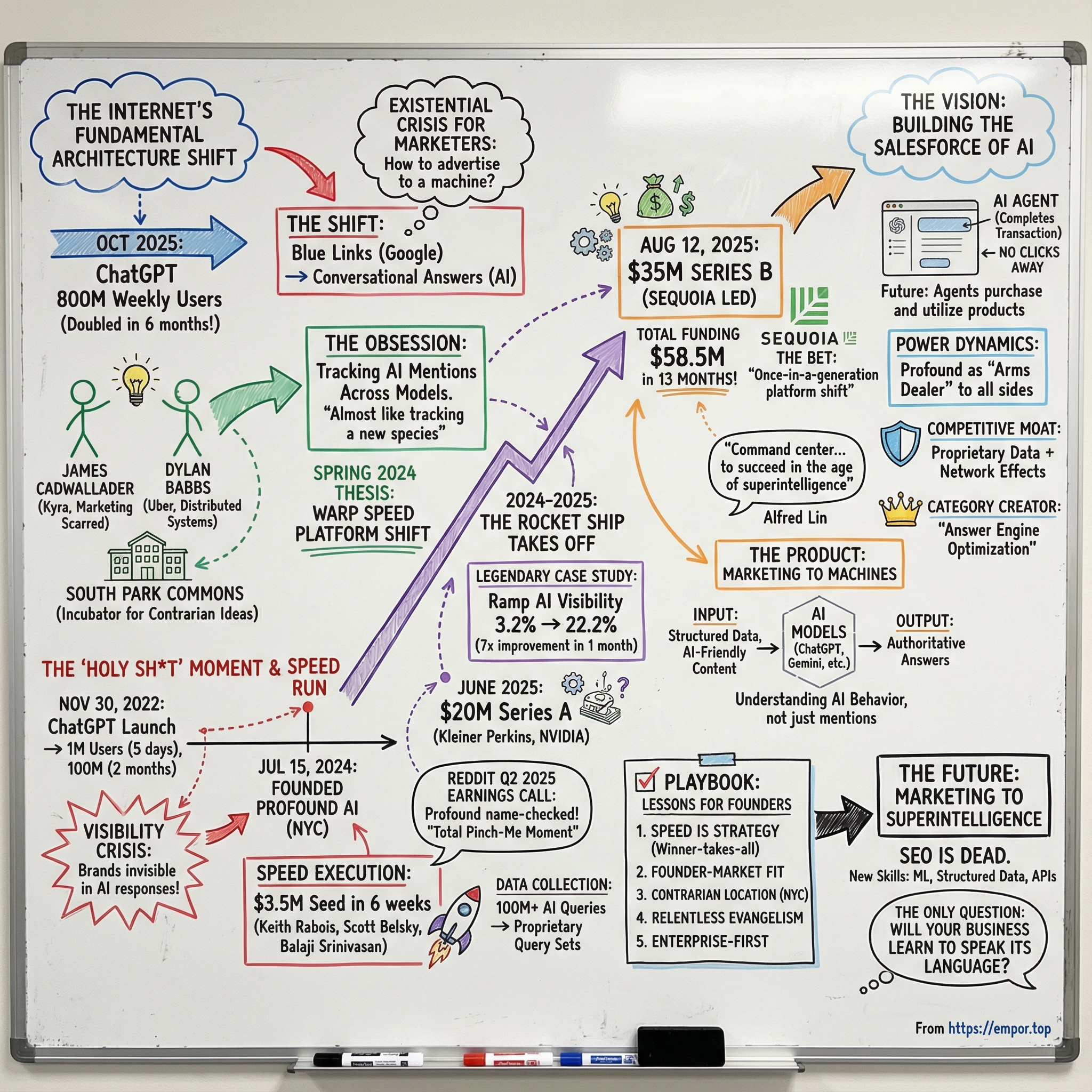

Picture this moment: Sam Altman announcing on Monday, October 6, 2025 that ChatGPT has reached 800 million weekly active users, marking a staggering doubling from just six months prior. This isn't just another tech milestone—it's the sound of the internet's fundamental architecture shifting beneath our feet.

We're witnessing something unprecedented. ChatGPT's impressive growth as a consumer app continues as the chatbot is on track to hit 700 million weekly active users this week, making it perhaps the stickiest consumer application ever created. More critically, consumer behavior has already crossed the Rubicon: over half of all product research now begins with AI chatbots instead of Google's familiar search box. The blue links that defined the internet for a generation are being replaced by conversational interfaces that generate singular, authoritative answers.

This shift has created an existential crisis for marketers. How do you advertise to a machine? How do you ensure your brand appears when an AI assistant recommends products? How do you optimize for algorithms that change their reasoning patterns weekly?

Enter James Cadwallader and Dylan Babbs, two founders who built something remarkable: a company that went from zero to $58.5 million in funding in just over twelve months, addressing a market that literally didn't exist eighteen months ago. Their company, Profound AI, represents perhaps the fastest category creation we've seen in enterprise software—and they did it by recognizing a simple truth: every company on the planet needs to understand and control how AI interprets, talks about, and eventually uses their products.

This is the story of how two engineers from wildly different backgrounds met at an incubator, became obsessed with a problem no one else saw coming, and built what Sequoia Capital calls the platform for marketing's "once-in-a-generation shift." It's about speed, timing, and most importantly, understanding that the next great platform shift isn't coming—it's already here.

II. The Founders' Journey & South Park Commons

The story begins not in a garage or dorm room, but in an unassuming building in San Francisco's South of Market district. South Park Commons, a San Francisco community and early-stage fund founded in 2016 by Ruchi Sanghvi, Facebook's first female engineer, and Aditya Agarwal, former Dropbox CTO, had become a breeding ground for contrarian ideas. Unlike traditional incubators that push founders toward rapid product-market fit, South Park Commons encourages exploration—sometimes for months—before committing to a direction.

It was here that James Cadwallader and Dylan Babbs first crossed paths in early 2024, though their backgrounds couldn't have been more different.

Cadwallader, who previously founded influencer marketing firm Kyra, arrived at South Park Commons carrying the battle scars of building and scaling a data-driven marketing agency. He'd spent years helping Fortune 500 brands navigate the shift from traditional advertising to influencer-powered campaigns, watching firsthand as each new platform—Instagram, TikTok, BeReal—rewrote the rules of customer acquisition. But by late 2023, something new was nagging at him. His clients were asking questions he couldn't answer: "Why aren't we showing up when people ask ChatGPT about our products?"

Dylan Babbs brought an entirely different perspective. As a former Uber engineer who'd worked on maps and location services, he understood distributed systems and real-time data processing at scale. While Cadwallader saw the business problem, Babbs immediately grasped the technical challenge: tracking mentions across dozens of AI models, each with different architectures, update cycles, and response patterns, would require infrastructure unlike anything built for traditional SEO or social media monitoring.

Cadwallader said he became "obsessed" with Perplexity in early 2024, spending hours daily querying the AI search engine about different products and brands. He'd screenshot results, create spreadsheets tracking which companies appeared and which didn't, trying to reverse-engineer the patterns. "Once you've used AI to search," he would later tell investors, "you quickly understand why our children won't be using blue links."

The obsession became infectious. Babbs started building scrapers to automate Cadwallader's manual tracking. They'd meet at South Park Commons at 7 AM, comparing notes on overnight findings. "We see huge differences across models, and that changes week over week or month over month," Cadwallader said. "It's almost like tracking a new species."

By spring 2024, they had a thesis: the entire marketing industry was about to be blindsided by a platform shift as significant as the rise of search engines themselves. And unlike the gradual adoption of Google in the late 1990s, this transition was happening at warp speed. They had to move fast.

III. The "Holy Sh*t" Moment: ChatGPT Changes Everything

November 30, 2022. That date will likely be remembered as the internet's second Big Bang. ChatGPT launched to the public and saw unprecedented user growth almost immediately, becoming both the preeminent consumer AI product and one of the fastest-growing online services ever. Within five days, it had a million users. Within two months, 100 million. Nothing in consumer technology history compared.

But the real shock wasn't the growth rate—it was the behavior change. Users weren't just playing with a novelty; they were replacing Google for an increasing number of queries. Need a recipe? Ask ChatGPT. Comparing insurance providers? ChatGPT. Planning a vacation? ChatGPT would create a full itinerary in seconds.

For Cadwallader, watching from his perch in the marketing world, this represented an extinction-level event for traditional digital advertising. Gartner predicts that 90% of B2B purchases in 2028 will be mediated by AI agents, representing over $15 trillion in spending. The implications were staggering: no more bidding on keywords, no more SEO optimization, no more display ads. Just AI assistants making recommendations based on their training data and real-time information retrieval.

The fundamental shift was architectural. Cadwallader has called the change a "Game of Thrones power shift" from decades of search engine optimization tactics to a new world of AI search. Where Google presented ten blue links and let users choose, AI assistants generated single, authoritative responses. Where Google sold ads against searches, AI assistants had no native advertising model. Where Google's algorithm was somewhat predictable and game-able, AI models exhibited emergent behaviors that changed with each update.

Consider the economics: Google's trillion-dollar valuation rests primarily on search advertising revenue. Every query that moves from Google to ChatGPT represents not just a loss of ad impression, but a fundamental break in the chain between intent and transaction. Early data shows a 15–25% drop in organic clicks when AI answers appear in search results.

By early 2024, the platform shift was accelerating beyond anyone's predictions. ChatGPT had reached another milestone of 100 million weekly active users by November 2023, which grew to 300 million by December 2024, then 400 million in February 2025. The growth wasn't just in casual users—enterprises were integrating AI assistants into their workflows, governments were adopting them for citizen services, and perhaps most importantly, younger generations were treating them as their default information source.

This created what Cadwallader would later describe to investors as a "visibility crisis" for brands. Companies that had spent decades and billions of dollars optimizing for Google suddenly found themselves invisible in AI responses. Worse, they had no idea if they were being mentioned, how they were being described, or whether competitors were gaining an advantage.

IV. Speed Run: Building in Public (July 2024 - August 2024)

Founded Jul 15, 2024, Profound AI officially came into existence in a cramped conference room in New York City. The choice of NYC over San Francisco was deliberate—Cadwallader and Babbs believed they could build a different engineering culture away from the Bay Area echo chamber. "In NYC, top engineers are too often funneled into fintech or hedge funds. Profound is offering a different path – building a world-class engineering team in the heart of Manhattan working on a problem that is both fun and challenging." - Dylan Babbs, Co-Founder CTO

The speed of execution that followed was breathtaking. Within six weeks of incorporation, they'd closed a $3.5 million seed round. The investor roster read like a who's who of contrarian tech investing: Keith Rabois from Khosla Ventures, who'd backed companies like Square and Affirm before they were obvious; Saga Ventures; South Park Commons; Scott Belsky, the Chief Product Officer at Adobe; and Balaji Srinivasan, the former CTO of Coinbase.

But it was a meeting with Ben Braverman at Flexport that really captured the energy of those early days. Braverman would later recall: "The energy is dripping off this guy"—referring to Cadwallader's infectious enthusiasm about the market opportunity. Within that first meeting, Cadwallader had pulled up live examples of Flexport's competitors appearing in ChatGPT responses while Flexport was nowhere to be found.

The product vision was ambitious from day one: build a dynamic platform that could track brand mentions across ChatGPT, Claude, Perplexity, and every other AI assistant, analyze the sentiment and context of those mentions, identify which sources the AI systems were citing, and most importantly, provide actionable recommendations for improving visibility.

What made Profound different from traditional brand monitoring tools was its focus on understanding AI behavior rather than human behavior. "But what used to take a team of 10, you can now do entirely within Profound." The platform needed to track not just mentions, but understand why certain brands appeared in certain contexts, how different models weighted different sources, and how responses changed based on prompt variations.

By August 2024, while still technically in stealth, they'd already signed their first enterprise customer—a large branding agency that immediately saw the platform's value for their Fortune 500 clients. Two more contracts were in final negotiations. The feedback was consistent: this solved a problem companies didn't even know how to articulate yet.

The early product had rough edges, but it worked. It could show a CMO exactly how often their brand appeared in AI responses versus competitors, which web sources were being cited, and whether the sentiment was positive or negative. More importantly, it could suggest specific actions: create content addressing these topics, update these pages with structured data, ensure your robots.txt allows these AI crawlers.

V. The Rocket Ship Takes Off (2024-2025)

Nine months. That's all it took from launch to having thousands of marketers at Fortune 100 brands using the platform daily. The inflection point came in early 2025 when several high-profile case studies emerged, validating Profound's approach and catalyzing enterprise adoption.

The Ramp case study became legendary in B2B marketing circles. Ramp's AI visibility surged from 3.2% to 22.2% within a month, a 7x improvement that translated directly to pipeline. Ramp moved from 19th to 8th place among fintech brands in the Accounts Payable sector, surpassing 11 competitors. The key? Profound's platform identified that AI engines frequently cited content related to automation and software comparisons—content traditionally overlooked in SEO strategies. Ramp created targeted pages specifically designed for AI consumption, and the results were immediate.

In June 2025, today we announce a $20M Series A led by Kleiner Perkins with Khosla Ventures, NVIDIA NVentures, Saga Ventures, South Park Commons and SV Angel. The inclusion of NVIDIA's venture arm was particularly strategic—it signaled that the companies building AI infrastructure saw Profound as essential to the ecosystem's development.

The roster of enterprise customers read like a Fortune 500 index: Ramp, US Bank, Indeed, MongoDB, DocuSign, and Chime. Each had similar stories: they'd discovered they were either invisible or misrepresented in AI responses, implemented Profound's recommendations, and saw immediate improvements in both AI visibility and downstream metrics like website traffic and lead generation.

But perhaps the most surreal validation came during Reddit's Q2 2025 earnings call. Reddit is the number one most cited domain for AI across all models per data collected by ProFound, CEO Steve Huffman told analysts. For a startup less than a year old to be name-checked during a public company's earnings call was, as Cadwallader later said, "a total pinch-me moment."

The data Profound was collecting revealed stunning insights about the AI economy. Early customers report dramatic improvements in AI visibility, with some seeing hundreds of thousands of dollars of revenue coming directly from AI assistants mentioning their products and services. This wasn't theoretical—companies could now trace actual revenue to AI recommendations, justifying significant investments in AI optimization.

By mid-2025, Profound had processed over 100 million AI search queries, building what became the industry's most comprehensive dataset on AI behavior. The platform then uses advanced reasoning models, such as OpenAI's o3 (and now GPT-5), to analyze those insights and generate recommendations. The company wasn't just tracking mentions; it was building a deep understanding of how AI systems made decisions about which brands to recommend.

The platform's sophistication grew rapidly. Features like Shopping Insights showed exactly how products appeared in ChatGPT Shopping recommendations. Agent Analytics revealed how AI crawlers accessed and interpreted websites. The Conversation Explorer helped brands understand the full context of AI discussions about their products.

VI. Sequoia Doubles Down: The Platform Shift Thesis

August 12, 2025, marked a watershed moment. Profound, the platform that helps businesses control how they appear in AI responses, today announces a $35 million Series B round led by Sequoia. In just thirteen months, the company had raised $58.5 million—a pace of funding that recalled the early days of companies like Uber or Airbnb.

But this wasn't just about the money. Sequoia Capital, the firm that had backed Apple, Google, and countless category-defining companies, was making a strategic bet. Sequoia views the rise of AI search as a once-in-a-generation platform shift for marketers—one it believes Profound is poised to lead.

More than 2,000 marketers from over 500 organizations now rely on the platform daily. The growth metrics were staggering, but what really impressed Sequoia was the execution velocity. "Their speed of execution was truly remarkable—in both the product they built and the customers they landed," said Biad.

Anas Biad, the Sequoia partner who led the deal, had seen hundreds of enterprise software companies. What struck him about Profound was the urgency of the problem they were solving. This wasn't a nice-to-have tool that would provide incremental improvements. For many companies, being invisible in AI responses was becoming an existential threat.

"Profound has established itself as the definitive platform for AI visibility and content optimization. Their growth to date has been nothing short of remarkable," said Anas Biad, Partner at Sequoia and Profound board member. "As AI agents become the primary interface between consumers and brands, Profound provides the critical infrastructure every company will need to remain competitive."

The board composition after the Series B told its own story. You had operators who'd scaled billion-dollar companies, investors who'd backed category-defining platforms, and advisors who understood both the technical challenges of AI and the go-to-market complexities of enterprise software.

Alfred Lin, another Sequoia partner, captured the broader vision: "Profound's vision extends well beyond AI-powered SEO. The Profound platform has the potential to become the command center that empowers businesses to stand out and succeed in the age of superintelligence".

The Sequoia investment also validated Profound's pricing strategy. Rather than racing to the bottom with freemium offerings, they'd maintained premium enterprise pricing from day one. The platform wasn't cheap—enterprise contracts typically started in the six figures—but for companies seeing millions in revenue at risk from AI invisibility, it was a bargain.

VII. The Product: Marketing to Machines, Not Humans

"This is the first time ever you are creating content for bots," Cadwallader explained to a room full of CMOs at a marketing conference in late 2025. The statement hung in the air, its implications slowly sinking in. For decades, all content creation—every blog post, product description, and landing page—had been designed for human consumption. Now, the primary audience was artificial.

Profound tracks how major AI models—from ChatGPT, Grok, and Meta's Llama to Google's Gemini and Microsoft Copilot—surface brand mentions. The company also supports DeepSeek, the Chinese model that had recently disrupted Silicon Valley's assumptions about AI development costs.

The technical challenge was immense. Each model had different training data, different retrieval mechanisms, and different ways of weighing information. ChatGPT might favor Reddit discussions and Wikipedia entries. Perplexity might lean heavily on recent news articles. Google's Gemini might prioritize content from authoritative domains. And these preferences changed—sometimes dramatically—with each model update.

"We see huge differences across models, and that changes week over week or month over month". The volatility made traditional SEO look static by comparison. Profound's AI search volatility research shows that roughly 40-60% of the domains cited in AI responses will be completely different just one month later, even for identical questions.

The platform's architecture reflected this complexity. At its core, Profound maintained what they called a "query engine"—a system that continuously prompted various AI models with millions of commercially relevant questions, tracking responses, citations, and changes over time. This wasn't simple screen scraping; it required sophisticated natural language processing to understand context, sentiment, and relevance.

Under the hood, our engineers utilize the state of the art reasoning models to leverage billions of unique signals flowing through our database. These signals included everything from which sources were cited, to how responses changed based on prompt variations, to patterns in how different models described products and services.

The insights Profound generated were revelatory. Brands discovered that their carefully crafted marketing messages were being completely reinterpreted by AI systems. A software company might position itself as "enterprise-grade and secure," but AI assistants might describe it as "complex and expensive." A consumer brand might emphasize sustainability, but AI responses might focus on price comparisons.

The platform's recommendations went far beyond traditional SEO tactics. Instead of keyword density and backlinks, Profound advised on structured data formats that AI systems could easily parse. Instead of meta descriptions, they recommended creating what they called "AI-friendly content"—highly structured, factual content designed for machine consumption.

VIII. The Vision: Building the Salesforce of AI

"We're building a marketing platform for the age of superintelligence", Cadwallader told investors during the Series B fundraise. The ambition was breathtaking—not just to help brands appear in AI responses, but to build the infrastructure for a future where AI agents conducted most commercial transactions.

The Salesforce analogy was carefully chosen. "I'm inspired by Salesforce," he said, pointing to the company's early-2000s cloud software disruption. Just as Salesforce recognized that customer relationships would move to the cloud before most companies even understood what cloud computing was, Profound was betting that marketing would fundamentally shift to AI optimization before most marketers even recognized the threat.

Cadwallader envisions a future where transactions happen directly inside AI assistants—without a single click away—posing competitive threats even to giants like Amazon. Imagine asking ChatGPT to order office supplies, and it completes the entire transaction without you ever visiting a website. Or telling Claude to book your business travel, and it handles everything from flights to hotels to ground transportation.

This wasn't science fiction. Eventually agents won't just talk about your products but will purchase and even utilize them. The technical capabilities already existed; what was missing was the business infrastructure—payment processing, identity verification, fraud prevention. But those were solvable problems.

Eventually, it seems obvious that thousands of businesses of all sizes will rely on Profound to create marketing aimed at superintelligence instead of humans. The platform was already expanding beyond pure marketing use cases. PR teams used it to monitor how AI systems described their companies during crises. Customer support teams used it to understand what information AI assistants provided about their products. Product teams used it to identify feature gaps highlighted in AI responses.

The international opportunity was massive. While Profound had started with English-language models, AI assistants were rapidly launching in other languages. Each market would need localized optimization strategies. A brand might be highly visible in ChatGPT's English responses but completely absent from its Chinese or Spanish equivalents.

The company's engineering culture in New York was proving to be a strategic advantage. "In NYC, top engineers are too often funneled into fintech or hedge funds". Profound offered something different—technically challenging problems with clear real-world impact. They were building systems that needed to process billions of queries, understand natural language at scale, and provide real-time insights, all while maintaining enterprise-grade security and reliability.

IX. Power Dynamics & Competition

The race for AI visibility had become a "Game of Thrones power shift," as Cadwallader colorfully described it. Traditional SEO empires built over two decades were crumbling. New kingdoms were rising. And Profound had positioned itself as the arms dealer to all sides.

Being first mattered enormously in this market. Profound had effectively created and defined the "Answer Engine Optimization" category before competitors even recognized it existed. By the time traditional SEO tools started adding AI monitoring features, Profound had already processed hundreds of millions of queries and built deep relationships with enterprise customers.

The network effects were powerful. Built by alumni of AMD, Microsoft, Datadog, Uber, Bridgewater, and OpenAI, the team brought together rare expertise in distributed systems, machine learning, and enterprise software. Each customer that joined provided more data about AI behavior, making the platform's recommendations more accurate, which attracted more customers, creating a virtuous cycle.

The competitive moat went beyond data. Profound had built what they called "proprietary query sets"—collections of commercially relevant questions that thoroughly tested AI systems' knowledge about brands and products. These weren't random queries; they were carefully crafted to surface the kinds of questions real customers asked when making purchasing decisions.

Media positioning amplified their advantage. Publications from Fortune to TechCrunch had crowned them the leader in AI visibility, often quoting Cadwallader as the authoritative voice on how AI was reshaping marketing. Even last week, Profound was referenced by the CEO of Reddit during their Q2 earnings call—the kind of third-party validation money couldn't buy.

The platform dependency risk was real but manageable. Yes, Profound relied on access to AI models from OpenAI, Anthropic, and others. But these companies needed Profound too. As AI systems became commercial platforms, they needed ways for businesses to optimize for their systems—just as Google eventually embraced the SEO industry as essential to its ecosystem.

Competition was emerging from predictable quarters. Traditional SEO platforms like Semrush and Ahrefs were adding AI monitoring features, but they were retrofitting old architectures for a fundamentally different problem. Marketing clouds like Adobe and Salesforce were making noise about AI optimization, but they moved at enterprise speed while the market evolved at startup velocity.

X. Bear & Bull Case Analysis

The Bear Case:

The skeptics had legitimate concerns. Platform dependency topped the list—if OpenAI or Anthropic decided to restrict API access or dramatically raise prices, Profound's entire business model could be at risk. The company was essentially building on rented land, with no guarantee the landlords wouldn't change the terms.

The market evolution uncertainty was real. Would AI search fully replace traditional search, or would they coexist? Google's AI Overviews showed the search giant wasn't going down without a fight. If traditional search maintained significant market share, the TAM for AI optimization might be smaller than projected.

Enterprise sales cycles posed another challenge. While Profound had signed impressive logos quickly, scaling to thousands of enterprises would require a massive sales organization. The education component alone—teaching marketers why they needed to optimize for AI—added months to typical sales cycles.

There was also the risk that AI platforms might resist optimization tactics. Just as Google had spent years fighting SEO manipulation, AI companies might implement measures to prevent brands from gaming their systems. If AI responses became pay-to-play like traditional search ads, Profound's value proposition would evaporate.

The Bull Case:

But the optimists had history on their side. By 2026, every company, not just the Fortune 500, will need to control how AI interfaces with their brand. This wasn't a discretionary purchase—it was becoming essential infrastructure for digital commerce.

The TAM expansion opportunity was staggering. 90% of B2B purchases in 2028 will be mediated by AI agents, representing over $15 trillion in spending. Even capturing a tiny fraction of the value in optimizing for these transactions would make Profound a multi-billion dollar company.

The investor validation was undeniable. Sequoia, Kleiner Perkins, and Khosla Ventures didn't just bring capital—they brought pattern recognition from decades of successful platform investments. When these firms all bet on the same company, they were usually right.

Early customers report dramatic improvements in AI visibility, with some seeing hundreds of thousands of dollars of revenue coming directly from AI assistants. The ROI was clear and measurable, making renewal and expansion decisions easy for customers.

The platform expansion opportunities were endless. Today, Profound focused on marketing optimization. Tomorrow, it could expand into customer service optimization, sales enablement, competitive intelligence, and even AI-powered market research. The core technology—understanding and optimizing for AI behavior—had applications across every business function.

XI. Playbook: Lessons for Founders

The Profound story offers a masterclass in platform shift entrepreneurship. First, speed is strategy. Founded Jul 15, 2024, and thirteen months later they'd raised $58.5 million. This wasn't recklessness—it was recognition that platform shifts create winner-take-all dynamics where first movers capture outsized value.

Riding platform shifts requires different muscles than building incremental improvements. You're not competing with existing solutions; you're creating a new category. This means traditional metrics—like competitor analysis or market sizing—are less useful than customer desperation. When Fortune 500 CMOs are calling you in panic because they're invisible in ChatGPT, you know you've found a real problem.

Founder-market fit proved crucial. Cadwallader brought marketing domain expertise and understood viscerally how brands thought about visibility. Babbs brought technical depth and could build systems that actually solved the problem at scale. Neither could have built Profound alone.

The decision to build in New York rather than San Francisco was contrarian but strategic. "Profound is offering a different path – building a world-class engineering team in the heart of Manhattan". By fishing in a different talent pool, they could hire engineers who might have been priced out of Bay Area startups.

Category creation requires relentless evangelism. Cadwallader spent as much time educating the market about the problem as selling the solution. Every conference keynote, podcast appearance, and customer meeting included education about why AI visibility mattered. You can't sell aspirin if customers don't know they have a headache.

The enterprise-first approach, while requiring longer sales cycles initially, built a defensible moat. Consumer products might have scaled users faster, but enterprise contracts created predictable revenue, deep customer relationships, and rich data about AI optimization needs.

XII. Epilogue: What This Means for the Future

We stand at an inflection point. Profound will be the platform teams rely on to connect with one new customer, Superintelligence. That sentence, which might have sounded like science fiction two years ago, now feels inevitable.

The implications ripple far beyond marketing. If AI agents become the primary interface between businesses and customers, then every company needs to fundamentally rethink how they present information. Product descriptions written for humans won't work for machines. Brand stories crafted for emotional resonance won't register with algorithms. The entire language of commerce needs translation.

Traditional advertising and marketing agencies face an existential crisis. The Mad Men era celebrated creativity and emotional manipulation. The Google era rewarded technical optimization and data analysis. The AI era demands something entirely new—professionals who can think like machines while advocating for human businesses.

SEO as we know it is already dead. The cottage industry of link builders, keyword researchers, and content farms that grew around Google's algorithm is scrambling to remain relevant. Some will successfully transition to AI optimization. Most won't. The skills required—understanding machine learning, structured data, and API integrations—are fundamentally different from traditional SEO.

The winners in this new world will be companies that recognize the shift early and invest accordingly. Just as companies that ignored the internet in the 1990s or mobile in the 2010s fell behind, companies that ignore AI interfaces risk invisibility. The difference this time is speed—the transition from early adopter to mainstream is happening in months, not years.

Is Profound building the next $100 billion marketing platform? The ingredients are there: a massive market shift, proven customer value, exceptional execution speed, and elite investor backing. But the biggest factor might be timing. They recognized the platform shift just as it began, built the right solution just as customers felt the pain, and scaled just as the market reached its tipping point.

The story of Profound AI isn't just about one company's rapid rise. It's about recognizing that the fundamental architecture of commerce is changing. Every transaction, every customer interaction, every business decision will increasingly be mediated by artificial intelligence. The companies that learn to market to machines—not just humans—will thrive. Those that don't will become invisible, lost in the vast silence of AI's unanswered queries.

The superintelligence customer has arrived. The only question is: will your business learn to speak its language?

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music