IREN: From Aussie Bitcoin Miner to AI Infrastructure Titan

I. Introduction & Episode Roadmap

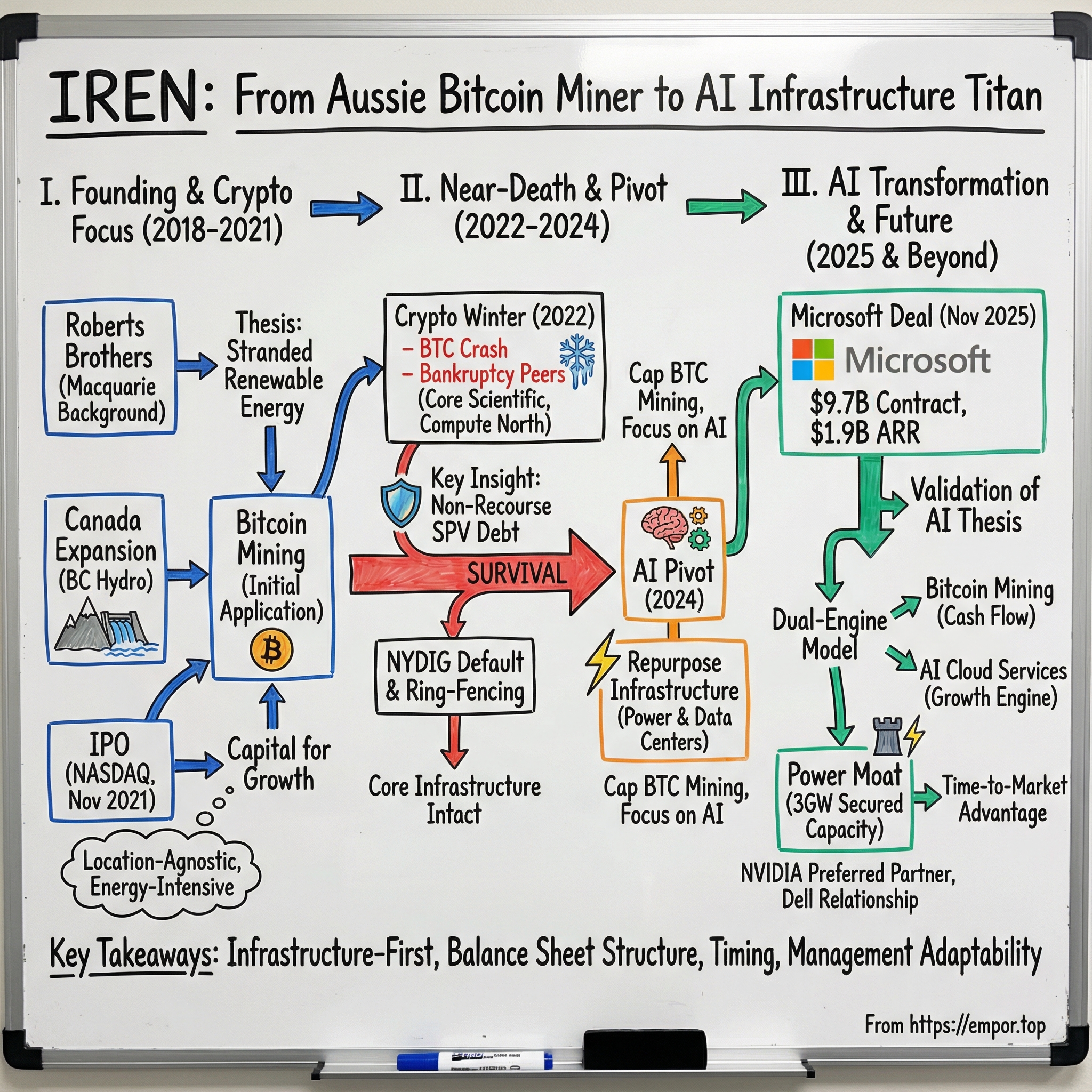

In late 2022, the cryptocurrency winter had turned into a massacre. Bitcoin had collapsed from nearly $69,000 to under $17,000. Crypto hedge fund Three Arrows Capital had imploded. Mining companies were dropping like dominoes—Compute North filed for Chapter 11, Core Scientific teetered on the edge, and Argo Blockchain's stock plummeted 50% in a single day.

Among the wreckage stood Iris Energy, a Sydney-based Bitcoin miner whose shares had fallen 96 percent. The business was bleeding cash and fighting off creditors who claimed they were owed more than $150 million. On December 28, 2022, the stock hit an intraday low of $1.06.

Fast forward to December 2025, and the story reads like fiction. That same stock hit an intraday high of $49.39 in late 2025. Microsoft Corp. has signed a roughly $9.7 billion deal to buy artificial intelligence computing capacity from IREN Ltd., becoming the Australian company's largest customer. The company was formerly known as Iris Energy Limited and changed its name to IREN Limited in November 2024.

This is not merely a comeback story. This is a masterclass in strategic pivoting—a case study in how two brothers from Sydney transformed a near-death cryptocurrency mining operation into one of the most consequential AI infrastructure companies on the planet. The company recorded fiscal year 2025 as a breakthrough year, generating total revenue of $501.0 million, a massive 168% increase over the prior year, and net income of $86.9 million.

In just 18 months, the company energized over 600MW of data centers and scaled from 5.6 to 50 EH/s of self-mining capacity, driven entirely by disciplined organic growth. By any measure, that represents roughly 9x growth in self-mining capacity within 18 months—a pace that would be remarkable in any industry, but borders on the surreal in capital-intensive infrastructure.

So how did two brothers from Sydney build a company now worth roughly $16 billion? The answer lies in three strategic pillars that will define our analysis: renewable energy arbitrage as a foundational competitive advantage, a deliberately structured balance sheet that allowed the company to survive the 2022 crypto winter when peers went bankrupt, and the prescient recognition that Bitcoin mining infrastructure could be redeployed for the AI compute gold rush.

What follows is the full story—the founding insight, the near-death experience, the pivot that changed everything, and the landmark Microsoft deal that validated the entire thesis. For long-term investors, this narrative offers something more valuable than stock tips: a framework for identifying companies capable of transforming existential crises into generational opportunities.

II. The Founding Vision: Dan and Will Roberts (2018)

To understand IREN, start with its founders. The founding team included brothers Daniel Roberts and William Roberts. They brought a background in infrastructure investment and development, having previously worked at Macquarie Group Ltd.

Macquarie is not just any bank. Known as "the Millionaire Factory," it pioneered infrastructure investing in Australia and globally. Before starting their own investment business, the brothers worked at investment bank Macquarie in Sydney, gaining experience across the capital market advisory, infrastructure, and renewable energy investment sectors, which their bitcoin and AI business now straddles.

The brothers grew up in Sydney and studied business at the University of Technology Sydney before working at Macquarie Group. Will was a vice president in the commodities and markets division, where he helped create the bank's crypto team. Daniel's former positions include Investment Director at Palisade Investment Partners Ltd. and Principal at PricewaterhouseCoopers Australia. His education includes an undergraduate degree from the University of Technology Sydney and a graduate degree from INSEAD Business School.

Daniel's Bitcoin journey began in 2013/14 when he bought high and sold low, and then went on to co-found IREN with his brother, Will Roberts, in 2018. That self-deprecating admission speaks to something important about the Roberts brothers: they are infrastructure operators who happen to be in crypto, not crypto true believers who stumbled into infrastructure. The distinction matters enormously.

The Bloomberg Billionaires Index listed Daniel, age 41, and Will, age 35, with a combined net worth of $846 million for the first time. The deal with Microsoft runs for five years and makes the tech giant the largest customer of IREN. Ex-Macquarie VPs Daniel and Will Roberts banked USD72 million apiece ($109 million) during the last financial year, according to documents filed with the SEC, making the IREN co-CEOs the best-paid executives leading any Australian company.

The Core Insight

The Roberts brothers saw something that most cryptocurrency enthusiasts missed. Iris Energy was established in 2018 by two brothers with a clear vision: to use stranded, low-cost renewable energy for high-performance computing.

The logic was elegant: renewable energy projects—particularly wind and solar—often produce power in locations far from population centers or during times when grid demand is low. This "stranded" energy gets curtailed (essentially wasted) because transmission infrastructure can't move it to where it's needed. What if you could bring the load to the power, rather than the power to the load?

The founders identified an opportunity in "stranded renewables"—abundant, low-cost green energy sources that were often difficult to monetize at scale.

Bitcoin mining, whatever one thinks of its economic utility, is the perfect application for stranded power. It's location-agnostic (miners only need internet connectivity), load-flexible (operations can ramp up or down instantly), and energy-intensive. A data center stuffed with Bitcoin mining machines is essentially a giant electrical load that can be deployed wherever cheap power exists.

The company sourced energy from 100% renewable sources, primarily hydroelectric power in British Columbia and wind/solar in Texas. It achieved industry-low net power costs, averaging approximately $0.033 per kWh. It manages the entire process from site development and securing power rights to data center construction and hardware operation, which cuts reliance on third parties.

This vertical integration philosophy came directly from the brothers' Macquarie training. When you control the entire stack—land acquisition, power procurement, electrical infrastructure, and data center operations—you eliminate counterparty risk and capture the full economic value of cheap power.

For Daniel, moving from Bitcoin to AI was not random. He explained that both require huge amounts of physical data center space and steady power. He said the shift followed the same logic that led them to start mining in the first place.

Why Bitcoin Mining?

The choice of Bitcoin mining as the initial application was strategic, not ideological. "Bitcoin mining was first pitched as the key focus to investors and the renewable energy cost of compute would be their edge to generate profits—and that's another factor as we now move into AI."

Mining operations, notorious for their high energy consumption, were coming under increased scrutiny for environmental impact. The Roberts brothers positioned Iris Energy's proposition—using renewable energy for large-scale Bitcoin mining—as both a profitability play and a public perception advantage.

The company differentiates itself in the cryptocurrency mining sector through its commitment to environmental sustainability, utilizing 100% renewable energy for its operations, and its vertically integrated business model.

The insight that would later prove transformative was already present at founding: the brothers weren't building a Bitcoin company. They were building a renewable-powered compute infrastructure company. Bitcoin was simply the first application.

III. Early Growth & Canadian Expansion (2019-2021)

In January 2020, the company acquired its first site in British Columbia, Canada. This site is connected to the British Columbia Hydro and Power Authority electricity transmission network (69 kV grid-connection) on which the electricity, as of 2021, was 98% sourced from clean or renewable sources.

British Columbia represented the ideal starting point for the Roberts brothers' thesis. The province generates vast quantities of hydroelectric power—clean, baseload energy that runs 24/7 regardless of weather conditions. More importantly, BC Hydro had excess capacity and the transmission infrastructure to support large industrial loads.

The company had a data center project in the Canadian Pacific coast province of British Columbia. This center has approximately 30 megawatts of capacity.

The Canal Flats facility, nestled in the mountains of southeastern BC, became the proving ground. At 30 megawatts, it was modest by data center standards but substantial enough to demonstrate the model worked. The company learned hard lessons about operating in remote locations: managing supply chains, recruiting technical staff, navigating Canadian regulatory requirements, and optimizing mining operations in the cold mountain climate.

Early Funding Rounds

Building data center infrastructure requires significant capital. The Roberts brothers leveraged their Macquarie networks to tap both equity and debt markets.

Daniel and Will attracted several high-profile pre-IPO backers including Regal Funds Management, Wilson Asset Management, Platinum Asset Management, and billionaire investor Alex Waislitz. Before listing on the Nasdaq, Iris had raised more than $175 million from investors alone during 2021.

Early investors included billionaire Atlassian co-founder and climate change activist Mike Cannon-Brookes via his Grok family office. Grok was attracted to Iris Energy's initial business plan as a renewable energy powered data centre operator in Canada where hydro power is abundant.

The Cannon-Brookes investment deserves attention. As co-founder of Atlassian and one of Australia's most prominent climate tech investors, his backing provided validation of the renewable energy thesis. This wasn't crypto speculation—sophisticated infrastructure investors saw a genuine business model.

A significant early capital injection occurred in March 2021, when the company secured $205 million in equity financing prior to its Initial Public Offering (IPO).

The ASX Rejection

Before conquering Wall Street, the Roberts brothers attempted to list on the Australian Securities Exchange. They were rejected.

The Australian regulators struggled to categorize a Bitcoin mining company. Was it a financial services firm? A technology company? A resources company? The lack of regulatory precedent made the ASX uncomfortable, and Iris Energy was effectively shown the door.

In hindsight, the rejection proved fortunate. The Nasdaq offered deeper capital markets, better analyst coverage for technology and digital infrastructure companies, and a more receptive investor base for the Bitcoin thesis. American institutional investors understood the energy economics of mining and the infrastructure value proposition in ways Australian generalist investors did not.

The share price of IREN skyrocketed after Sydney brothers Dan and Will Roberts moved it to the US.

IV. The NASDAQ IPO: Going Public (November 2021)

November 2021 was the peak of pandemic-era crypto mania. Bitcoin had surged to all-time highs above $68,000. Every crypto-adjacent company was rushing to public markets. Into this euphoria stepped Iris Energy.

Iris Energy Limited announced the pricing of its initial public offering of 8,269,231 ordinary shares, at a public offering price of US$28.00 per share. The underwriters of the offering also have a 30-day option to purchase up to an additional 1,240,384 Ordinary Shares from the Company at the initial public offering price.

Successful completion of a $232 million Nasdaq IPO. J.P. Morgan, Canaccord Genuity and Citigroup acted as lead book-running managers.

In its IPO paperwork, the company had planned to offer 8.27 million shares priced at $25 to $27 each. In the end, it sold 8.27 million shares at $28 each, with underwriters holding a 30-day option to buy an additional 1.2 million shares.

The IPO priced at the top of the range—always a sign of strong institutional demand. J.P. Morgan's willingness to lead the deal provided credibility, signaling that serious financial institutions viewed Iris Energy as more than a crypto play.

Iris Energy Limited commenced trading on the Nasdaq Global Select Market on November 17, 2021, at an initial public offering price of $28.00 per share.

Iris planned to use the roughly $215 million raised from its IPO to buy new bitcoin mining machines and data centers where it would install the machines. The bitcoin mining scene had exploded in the U.S. over the last year after China purged all its cryptocurrency miners.

The China ban provided a massive tailwind. When Beijing cracked down on cryptocurrency mining in 2021, approximately 50% of global Bitcoin hashrate went offline almost overnight. Miners scrambled to relocate to North America, creating intense competition for power capacity. Companies like Iris Energy, which had already secured grid connections and operating infrastructure, suddenly found themselves in privileged positions.

Initial Trading

The first day was rocky. The first trade for the stock was $28 a few minutes after the opening bell. But the stock quickly dropped by 14% to change hands at $24 apiece shortly after noon Eastern Time. Iris later fell as much as 22% before recouping some of the losses to end its first trading down 12.7% to $24.45.

The weakness was ominous. While broader markets celebrated crypto's ascent, sophisticated investors were already positioning for trouble. Within months, that caution would prove prescient.

V. KEY INFLECTION POINT #1: The 2022 Crypto Winter & Near-Death Experience

The 2022 crypto crash didn't arrive suddenly—it announced itself in stages, each more devastating than the last.

In May 2022, the stablecoin TerraUSD and its algorithmic sister token Luna collapsed, vaporizing $60 billion in market value essentially overnight. The implosion triggered a cascade of failures: cryptocurrency hedge fund Three Arrows Capital defaulted on its obligations, taking down multiple crypto lenders. Celsius Network, BlockFi, and Voyager Digital all filed for bankruptcy. Bitcoin plunged from $40,000 to under $20,000.

For Bitcoin miners, the economics became punishing. Revenue (denominated in Bitcoin) collapsed. Operating costs (denominated in dollars) remained fixed. Debt payments came due regardless of market conditions.

Iris Energy was one of several bitcoin mining firms struggling to repay their debt obligations during this bear market that had seen rewards dwindle alongside soaring energy costs. September saw the first Chapter 11 bankruptcy from a major player, Compute North, with other big firms including Core Scientific and Argo Blockchain seemingly teetering on the edge of solvency.

The SPV Debt Crisis

In November 2022, the situation at Iris Energy turned critical.

Bitcoin mining firm Iris Energy faced claims from its lender alleging that it had defaulted on $108 million of equipment loans held by two special-purpose vehicles (SPVs). The reason for the notice of default, which the lender sent to the miner on Nov. 4, was that the company had failed to engage in "good faith restructuring discussions" for the debt in question. As such, the lender looks to trigger an acceleration clause, meaning it is demanding immediate payment of the entire principal and accrued interest.

One of the top five publicly traded mining companies by monthly production, IREN borrowed about $105 million from NYDIG between 2021 and 2022 to purchase around 37,800 units of the AntMiner S19 series from Bitmain. IREN set up two special purpose vehicles (SPVs) – IE CA 3 and IE CA 4 – to ink the lending deals. According to IREN, the nature of this setup means the SPVs have "no parent company guarantee or recourse."

In November 2022, IREN said the two SPVs were generating "an indicative $2 million of bitcoin mining monthly gross profit" and were not able to pay NYDIG the required monthly principal and interest payment obligations of $7 million. It soon defaulted on the loans and unplugged the financed equipment. Amid bitcoin's price slump throughout 2022, the market value of the 37,800 miners declined to a steep discount compared to the $108 million that NYDIG said it was owed.

The Brilliant Non-Recourse Structure

Here is where the Roberts brothers' Macquarie training proved invaluable. The loans were structured through non-recourse special purpose vehicles—legal entities specifically designed to contain risk.

The two loans in question – which as of Sept. 30 had principal amounts of $32 million and $71 million – are secured by 1.6 exahash/second (EH/s) and 2.0 EH/s of mining machines, respectively. The debt is held by two wholly-owned, non-recourse SPVs, meaning in the event of default the lender will not be able to seize any Iris Energy assets other than the collateral. The loans appear to be from troubled lender NYDIG.

This structure was not accidental. The company's SEC filings explicitly noted that "these financing arrangements were intentionally structured for prudent risk management to protect the underlying business and data center infrastructure the Group has built." When the SPVs defaulted, NYDIG could seize the mining machines but could not touch the data centers, the power contracts, the land, or the healthy portions of the mining fleet.

Fortunately for Iris Energy, the machines purchased with the loan were also written down as collateral – meaning the debt will be cleared simply by turning them over to NYDIG. Iris Energy – a company headed by Daniel and Will Roberts – recently suffered a wipeout of $220 million in market value due to a 94.5% drop in their stock prices. Nevertheless, the brothers stated that they are still optimistic about the cryptocurrency sector.

Surviving While Competitors Failed

The contrast with peers was stark. Core Scientific, once the largest publicly traded Bitcoin miner, filed for Chapter 11 bankruptcy in December 2022. Core Scientific revealed last month that it might file for bankruptcy, and could possibly run out of funds by the end of the year. It has only 24 Bitcoin left on its balance sheet compared to over 7000 before June, and only $26 million in cash.

On Monday, Argo Blockchain's stock plummeted 50% after revealing negative cash flow, and may be forced to cease operations if it can't secure more financing.

Iris Energy survived because of three factors: the non-recourse structure limited contagion, the company maintained substantial unencumbered assets, and the core data center infrastructure remained intact. The Roberts brothers had built the corporate equivalent of firebreaks—when one part of the business caught fire, the flames couldn't spread.

The NYDIG Settlement (2025)

The legal dispute with NYDIG dragged on for nearly three years before resolution.

IREN Limited has finally resolved its multi-year legal dispute with NYDIG over $107.8 million in defaulted loans linked to about 35,000 Antminer S19 Bitcoin mining equipment. According to IREN Limited's annual report, the company has agreed to pay $20 million to NYDIG to settle the years-long dispute. The loans, which were arranged in 2021, financed two of IREN's special-purpose vehicles, IE CA3 and IE CA4. But unfortunately, they defaulted in late 2022 due to unprofitable fixed-rate hosting and hashrate lease agreements amid a Bitcoin market downturn.

IREN's debt settlement stands out in the cryptocurrency industry as similar disputes typically end in reorganizations or asset liquidation.

Settling for $20 million on a $108 million claim represents an approximately 82% haircut for the lender. The resolution removed a significant legal overhang and allowed management to focus entirely on executing the AI pivot.

VI. The Recovery: Building the Foundation (2023-2024)

The 2022 crisis, paradoxically, strengthened IREN's strategic position. By surviving with its infrastructure intact while competitors either went bankrupt or were forced into distressed asset sales, the company emerged from the crypto winter with key advantages: unencumbered data center capacity, established power contracts, and operational expertise that couldn't be easily replicated.

The company remained well capitalized with approximately $64 million of cash, no debt, operating cash flows from its existing 5.6 EH/s, as well as additional optionality from its committed equity facility. The Company also advises that its previous HPC data center strategy is now a parallel focus.

Scaling Bitcoin Mining Operations

Rather than retreating, IREN doubled down on capacity expansion. The strategy was counterintuitive: build aggressively during the downturn when equipment costs were depressed and competitors were distracted or distressed.

IREN reached the 50 EH/s milestone organically by the development of its Childress site in Texas, where 650 megawatts are now energized.

The company now operates 810MW of operating data centers underpinning three verticals: Bitcoin Mining, AI Cloud Services and AI Data Centers. For Bitcoin Mining, it is one of the world's largest and lowest-cost Bitcoin producers with 50 EH/s of installed self-mining capacity.

The Childress facility in West Texas became the crown jewel. The connection has the capacity to deliver 750MW of electricity to the site. The Childress operations comprise 350MW of operating data centers, with an additional 400MW of data centers planned for 2025.

The site is strategically placed in the West Texas Load Zone with access to low-cost excess renewable energy. The region has approximately 37GW of renewable energy installed, however only approximately 18.5GW of nameplate transmission line capacity to export this renewable power to major load centers (such as Dallas and Houston). This constraint currently results in wind and solar farms often being curtailed (or temporarily turned-off) at times of high renewable energy generation due to a lack of local load. IREN's Childress operation will support existing renewable energy generation and further build out of renewable generation by establishing a flexible load in the West Texas Load Zone.

This is the renewable energy arbitrage thesis in action. IREN locates in transmission-constrained regions where renewable generation exceeds local demand, effectively becoming the "buyer of last resort" for otherwise stranded power.

Cost Efficiency as Competitive Advantage

The company achieves industry-low net power costs, averaging approximately $0.033 per kWh.

At 3.3 cents per kilowatt-hour, IREN operates at roughly half the power cost of many competitors. When Bitcoin mining margins compress—as they inevitably do after halving events—this cost advantage translates directly into survival.

In terms of operational and energy efficiency, Bernstein claims CleanSpark and IREN "are in the sweet spots of energy efficiency and realized hash rate/uptime."

The 2024 Bitcoin Halving Challenge

The 2024 Bitcoin halving reduced block rewards to 3.125 BTC, cutting miners' income in half. This change, combined with higher electricity costs, expensive equipment maintenance and increased competition, made traditional mining less profitable.

The halving, occurring in April 2024, presented an existential question: could IREN remain profitable with block rewards cut by 50%? The answer required a fundamental strategic shift.

"The halving", which took place April 20, meant the amount of new Bitcoin created each day had been cut by 50%. The theory goes that the inevitable supply crunch this creates will spike the cryptocurrency's price, making up for the smaller number of Bitcoin collected. But if that will actually happen is anyone's guess.

Rather than betting the company on Bitcoin's price appreciation, the Roberts brothers had already begun executing Plan B.

VII. KEY INFLECTION POINT #2: The AI Pivot (2024-2025)

The AI pivot wasn't a desperate scramble—it was a calculated recognition that IREN's core asset (cheap, abundant power at scale) had become exponentially more valuable for a different application.

Sydney-based IREN, formerly Iris Energy, is in a better position than most of its fellow miners to ride the Bitcoin wave. The company, which listed on the NASDAQ in 2021, has this year spent about $40 million on 800 Nvidia H100 GPUs specifically targeting AI developers, creating a revenue stream discrete from crypto. Its data centres now double as Bitcoin miners and AI development accelerators.

Recognizing the Opportunity

The AI boom created unprecedented demand for GPU compute. Significant time was invested in exploring the strategy approximately 3-4 years ago, including signing a strategic memorandum of understanding with Dell Technologies in March 2020 to test and develop potential data center solutions for energy intensive compute applications, including leveraging Dell Technologies' HPC and artificial intelligence expertise. Developments continue to accelerate in the sector, including the growth of computing power and clean energy requirements. Recent discussions with market participants have further validated this previous work.

The Dell MOU from 2020 is crucial context. IREN wasn't pivoting opportunistically—the company had been exploring AI/HPC applications for years, building relationships and technical capabilities while the Bitcoin mining business generated cash flow. When the AI boom accelerated in 2023-2024, IREN was positioned to move faster than competitors who were starting from scratch.

Infrastructure Flexibility: Data centers are designed to be modular and liquid-cooled, enabling a seamless, efficient swap between Bitcoin ASIC miners and high-density NVIDIA GPUs for AI workloads.

The Strategic Decision to Cap Bitcoin Mining

In a move that surprised some observers, IREN announced it would halt Bitcoin mining expansion at 50 EH/s to focus resources on AI infrastructure.

IREN likely won't join any further arms race as it previously noted that it would halt hashrate expansion to focus on AI infrastructure once it hits the 50 EH/s mark.

This decision reflected cold economic logic. Compass Point recently raised its target to a moderate $50 while emphasizing the revenue intensity of over $10 million per megawatt for AI compared with $2 million for colocation.

AI compute generates 5x the revenue per megawatt compared to Bitcoin mining or generic colocation. The same power infrastructure that made IREN a competitive miner could generate dramatically higher returns serving AI customers.

NVIDIA Partnership

IREN Limited today announced it has secured NVIDIA Preferred Partner status and procured an additional 1.2k air-cooled NVIDIA B300s and 1.2k liquid-cooled NVIDIA GB300s for approximately $168m, expanding its total GPU fleet to 10.9k NVIDIA GPUs.

"They've also been appointed as an Nvidia preferred partner and that places them in a good position to access chips and build out capacity."

NVIDIA Preferred Partner status is not merely a marketing designation—it provides priority access to GPUs during periods of constrained supply. When every AI company in the world is fighting for Blackwell chips, having a direct relationship with NVIDIA confers meaningful competitive advantage.

Massive GPU Expansion

The company recently announced the purchase of 4,200 Blackwell B200 GPUs, again to be installed at the Prince George site. The B300 and GB300 NVL72 Systems add to IREN's fleet of GPUs, which now consists of 800 H100s, 1,100 H200s, 5,400 B200s, 2,400 B300s, and 1,200 GB300s. IREN currently boasts six data centers across North America, with a total capacity of 2,910MW.

The GPU buildout has been aggressive.

First AI Customer: Poolside

Iris Energy announces commencement of GPU cloud service with leading AI company, Poolside AI SAS ("poolside"). Iris Energy has executed a cloud service agreement with poolside for 248 NVIDIA H100 GPUs. The contract is for an initial 3-month term, with an extension option for an additional 3 months at the customer's election. Poolside closed a $126m seed funding round in mid-2023 and is building the world's most capable AI for software development.

Poolside represented proof of concept. When a well-funded AI startup led by GitHub's former CTO chose IREN over established cloud providers, it validated the company's technical capabilities and service quality.

Jason Warner, CEO & Co-Founder of poolside and ex-CTO of GitHub, commented: "We're excited to select Iris Energy as a cloud services partner. Our business, like many others, has a substantial growing demand for GPU compute and we have been impressed with the professionalism and quality shown by Iris Energy during our testing and selection process."

The Rebrand

The rebranding from "Iris Energy" to "IREN" symbolized the broader transformation. The new name de-emphasized "energy" (which connoted the mining heritage) and created a tech-forward identity appropriate for an AI infrastructure company.

VIII. KEY INFLECTION POINT #3: The Microsoft Deal (November 2025)

Microsoft Corp. has signed a roughly $9.7 billion deal to buy artificial intelligence computing capacity from IREN Ltd., becoming the Australian company's largest customer. The five-year agreement gives Microsoft access to Nvidia Corp. systems in Texas built for AI workloads and includes a 20% prepayment.

This single contract transformed IREN's investment thesis overnight. A $9.7 billion, five-year commitment from Microsoft—one of the world's most sophisticated technology buyers—validated everything the Roberts brothers had built.

"This deal is really transformational for our business," IREN chief commercial officer Kent Draper told Yahoo Finance. "It absolutely catapults us into the kind of top echelon of the neoclouds."

The Deal Structure

Under the agreement, IREN will provide Microsoft with access to NVIDIA GB300 GPUs over a five-year term, with a total contract value of approximately $9.7 billion, including a 20% prepayment. IREN has also entered into an agreement with Dell Technologies to purchase the GPUs and ancillary equipment for approximately $5.8 billion. The GPUs are expected to be deployed in phases through 2026 at IREN's 750MW Childress, Texas campus, in conjunction with the delivery of new liquid-cooled data centers that will collectively support 200MW of critical IT load (Horizon 1–4).

The 20% prepayment is critical. Microsoft will make a 20% prepayment as part of the contract, while IREN will purchase about US $5.8 billion in GPUs and hardware from Dell Technologies to meet deployment needs.

At $9.7 billion contract value, a 20% prepayment implies nearly $2 billion in upfront capital—enough to fund a significant portion of the hardware purchases required to fulfill the contract.

The Dell Partnership

Sydney-based IREN has agreed to buy the necessary advanced chips known as graphics processing units and related equipment for $5.8 billion from Dell Technologies Inc.

Dell's involvement as hardware supplier simplifies execution. Rather than managing multiple vendor relationships and complex procurement logistics, IREN has a single counterparty responsible for delivering complete systems—GPUs, servers, networking, and deployment services.

Why Microsoft Chose IREN

The five-year Microsoft deal shows the AI industry's growing hunger for computing power to run applications such as ChatGPT. It follows earnings from major tech companies last week that underscored capacity shortages were limiting their ability to fully benefit from the boom.

Microsoft has struck a $9.7 billion deal with data-center operator IREN that includes access to Nvidia's advanced chips, aiming to ease the computing crunch that has kept the tech giant from fully cashing in on the artificial intelligence boom. Under the agreement, Microsoft will use IREN's data-center capacity—primarily located at its 750-megawatt Childress, Texas campus—to expand its AI cloud services without having to build all new facilities.

Partnering with IREN would allow Microsoft to expand computing capacity without building new data centers or securing additional power—two of the biggest hurdles slowing its ability to meet demand.

Microsoft's motivation was straightforward: speed. Building greenfield data centers takes 3-5 years. IREN has power, land, and operational infrastructure available now. In the AI arms race, time is the most precious commodity.

Daniel Roberts, Co-Founder & Co-CEO of IREN, commented: "We're proud to announce this milestone partnership with Microsoft, highlighting the strength and scalability of our vertically integrated AI Cloud platform. This agreement not only validates IREN's position as a trusted provider of AI Cloud services, but also opens access to a new customer segment among global hyperscalers."

Market Reaction

The news sent shares of IREN up as much as 24.7% to a record high on Monday.

IREN shares jumped as much as 24.7% to a record high on Monday. Shares were up about 580% so far that year.

The stock reaction reflected the transformational nature of the announcement. With a single contract, IREN secured visibility into nearly $2 billion in annual revenue, de-risked its AI pivot, and established credibility with the most demanding customer segment in enterprise technology.

Daniel said about completing the agreement, "It's been a big weekend and it's fantastic to knock it off. But the reality here is, it's back into the office, we've still got a big job to do."

IX. The Business Model: A Deep Dive

The Dual-Engine Model

This dual-engine model—combining a 50 EH/s Bitcoin mining capacity with a rapid expansion into AI Cloud services targeting up to $250 million in annualized revenue by December 2025—is why this story matters.

IREN operates two distinct but complementary business segments: Bitcoin mining provides steady (if volatile) cash flow from an established operation, while AI Cloud Services represents the high-growth future. The Bitcoin business funds AI expansion; the AI business will eventually dwarf Bitcoin in revenue contribution.

IREN's core business revolves around two primary areas: sustainable Bitcoin mining, utilizing 100% renewable energy sources, predominantly hydroelectric power, in locations across British Columbia (Canada) and Texas (USA); and High-Performance Computing (HPC) and AI Cloud Services, leveraging its data center infrastructure and high-performance NVIDIA GPUs to offer computing power for machine learning and training large language models. The company's vertically integrated model, encompassing site development, electrical infrastructure, and data center operations, provides significant control over costs and scalability.

Financial Performance

Q4 FY25 revenue of $187.3m, net income of $176.9m, Adj. EBITDA of $121.9m, and EBITDA of $241.4m. The company is approaching $1.25bn total annualized revenue with scope for further growth ahead. There is more than $1bn annualized revenue from Bitcoin mining under current mining economics, and $200-250m annualized revenue from AI Cloud at 10.9k NVIDIA GPUs by December 2025.

The company just posted its best quarterly earnings to date, in which it raked in $187.3 million in revenue last quarter, which contributed to a record $501 million revenue for the fiscal year.

Quarterly revenue for the period ended June 30 was up 226% year-on-year, which has put the company back into profitability with $176.9 million in net income.

Infrastructure Portfolio

Power & Land Portfolio: 2,910MW of grid-connected power secured across more than 2,000 acres in the U.S. and Canada, with an additional multi-gigawatt development pipeline. Next-Generation Data Centers: 810MW of operating data centers underpinning three verticals: Bitcoin Mining, AI Cloud Services and AI Data Centers.

The power portfolio is the moat. In an industry where securing grid connections can take years, IREN's 2,910MW of secured capacity represents a barrier to entry that new competitors cannot easily replicate.

The Power Moat

IREN secured 3 GW of power capacity, giving it a structural advantage amid nationwide interconnect delays and hyperscaler grid constraints.

"Bitcoin miners enjoy a lead in the 'large load' power interconnect queue vs. approval queue of more than 4 years for greenfield buildouts, thus saving 'time to market,'" the Bernstein analysts said, with a pipeline of power access projected to double by the end of 2027.

When hyperscalers like Microsoft, Google, and Amazon attempt to build new AI data centers, they face multi-year timelines just to secure grid connections. IREN's head start in the power queue—accumulated through years of Bitcoin mining operations—translates into years of competitive advantage.

X. Competitive Landscape & Strategic Analysis

Bitcoin Mining Peers

In a bitcoin mining report card, Bernstein has rated Riot Platforms, CleanSpark, IREN and Core Scientific as "outperform" while rating Marathon Digital as "market perform." The assessments are based on five key metrics: production and hash rate, operational and energy efficiency, power, hash costs, and each company's artificial intelligence strategy.

According to Bernstein, the three largest bitcoin producers are Marathon, Core Scientific and CleanSpark, with the latter two standing out on realized hash rate.

Three of the industry's largest players—CleanSpark, Cango, and IREN—each announced they have surpassed 50 EH/s of installed hashrate. Not far behind, MARA, currently the largest mining operation, declared an ambitious new target to hit 75 EH/s by the end of this year. Taken together, the four firms now control over 200 EH/s, equivalent to more than 20% of the current Bitcoin network.

AI Infrastructure Competition

IREN competes in the "neocloud" category—infrastructure companies selling GPU compute capacity to AI customers. Founded during the bitcoin mining wave, IREN joins peers like CoreWeave and Crusoe in redeploying energy-intensive infrastructure toward AI workloads. The deal is indicative of how miners' once-volatile hardware fleets are increasingly viewed as strategic compute assets, bridging the gap between blockchain and AI.

Such demand has propelled so called "neocloud" companies such as CoreWeave and Nebius Group - which sell cloud computing services built on Nvidia's processors - ahead in the AI race. Microsoft recently also signed a deal worth $17.4 billion with Nebius for infrastructure capacity.

Porter's Five Forces Analysis

Threat of New Entrants: LOW Power interconnection queues of 4+ years create substantial barriers. Capital requirements exceed $10 billion for meaningful scale. NVIDIA chip allocation favors established partners.

Bargaining Power of Suppliers: MODERATE-HIGH NVIDIA maintains dominant GPU market share. However, IREN's Preferred Partner status and Dell procurement relationship mitigate supply risk.

Bargaining Power of Buyers: MODERATE Major hyperscalers like Microsoft have significant negotiating leverage, but AI compute demand far exceeds supply, limiting their alternatives.

Threat of Substitutes: LOW No substitute exists for GPU compute in AI training and inference workloads. Quantum computing remains years from commercial viability.

Industry Rivalry: HIGH Competition among neoclouds (CoreWeave, Nebius, Crusoe) and hyperscalers (AWS, Azure, GCP) is intense, but the market is growing faster than capacity expansion.

Hamilton Helmer's 7 Powers Analysis

Scale Economies: MODERATE Operating leverage exists in data center operations, but beyond certain thresholds, additional capacity doesn't dramatically reduce per-unit costs.

Network Effects: WEAK Unlike platform businesses, infrastructure doesn't inherently benefit from more users.

Counter-Positioning: STRONG IREN's renewable energy positioning is difficult for hyperscalers to replicate quickly. Their traditional data center economics and ESG commitments make them reluctant to match IREN's model.

Switching Costs: MODERATE Once AI workloads are deployed on IREN infrastructure, migration costs create customer stickiness.

Branding: WEAK Infrastructure is largely commoditized; brand matters less than reliability and cost.

Cornered Resource: STRONG The 2,910MW power portfolio represents a scarce, non-replicable asset. Power interconnection positions cannot be easily purchased or quickly developed.

Process Power: MODERATE IREN's vertical integration enables faster execution, but the processes aren't dramatically superior to well-capitalized competitors.

The most defensible competitive advantage is the cornered resource—the power portfolio. In an industry constrained by power availability, IREN's secured capacity represents a genuine moat.

XI. Bull Case, Bear Case, and Key KPIs

The Bull Case

IREN has positioned itself at the intersection of two secular trends: renewable energy transition and AI compute demand. The Microsoft contract provides $1.9 billion in annual run-rate revenue with minimal execution risk (Dell handles hardware delivery). Total AI Cloud ARR is guided to $3.4B by year-end 2026.

The power moat compounds over time. As data center demand accelerates and interconnection queues lengthen, IREN's secured capacity becomes more valuable. The company can expand AI infrastructure without competing in the 4+ year queue.

Bitcoin provides optionality. If cryptocurrency prices appreciate significantly, the mining business generates substantial free cash flow. If Bitcoin stagnates, the AI business carries the company.

Management has demonstrated the ability to execute through crisis. Surviving the 2022 crypto winter while competitors went bankrupt suggests operational resilience and financial discipline.

The Bear Case

Execution risk looms large. The Microsoft contract can be terminated if delivery timelines aren't met. Its Microsoft contract could be terminated if it fails to meet the delivery timelines.

Capital intensity is extreme. For investors focused on catalysts, this financing package helps support the Microsoft contract build out but also heightens dilution and leverage sensitivities if AI demand or Bitcoin driven cash flows do not keep pace with spending. IREN's heavy, debt funded data center and GPU build could rapidly outstrip operating cash flows.

Key items: $2.3 billion aggregate convertible senior notes issued (two series: 0.25% due 2032 and 1.00% due 2033, including a $300 million greenshoe), a $1,632.4 million concurrent registered direct equity placement of 39,699,102 ordinary shares at $41.12 per share.

The company is aggressively raising capital through convertible notes and equity issuance. While necessary to fund growth, these financings create dilution risk.

The company has faced scrutiny, including a short seller report (July 2024) questioning its HPC pivot and alleging a "stock promotion." JPMorgan downgraded IREN to "Underweight" in September 2025, citing concerns that the current price overestimates HPC potential.

Competition is intensifying. GPU shortages, stricter energy regulations, and competition from giants like Equinix could slow growth.

Myth vs. Reality

Myth: IREN is just another crypto company. Reality: Bitcoin mining represents legacy revenue; AI infrastructure is now the growth engine. The Microsoft deal represents a fundamental business transformation.

Myth: The 2022 debt crisis showed poor risk management. Reality: The non-recourse SPV structure worked exactly as designed—protecting core assets during a crisis that bankrupted competitors.

Myth: Renewable energy is just ESG marketing. Reality: Low-cost power is the competitive moat. Operating at $0.033/kWh enables profitability at price points competitors can't match.

Key Performance Indicators to Track

1. AI Cloud Annualized Run-Rate Revenue (ARR) This is the single most important metric. Management has guided to $3.4 billion ARR by end of 2026. Hitting or missing this target will determine whether the AI pivot thesis holds.

2. Microsoft Contract Delivery Milestones The Horizon data centers (1-4) must be energized and operational on schedule. Any delays risk contract termination and would signal execution problems.

3. Power Portfolio Utilization Rate With 2,910MW secured, the percentage of capacity actually generating revenue indicates how effectively management is monetizing its cornered resource.

XII. Regulatory and Legal Considerations

The company has faced scrutiny, including a short seller report (July 2024) questioning its HPC pivot and alleging a "stock promotion."

Co-CEOs Daniel and Will Roberts reportedly sold 1 million shares each in September 2025, totaling approximately $US66.4 million, which, while legal, can sometimes be viewed critically by investors. Creditors in the US sued Iris Energy in Australian courts, seeking $107.3 million for Bitcoin computers.

Investors should note the NYDIG settlement, securities class action exposure, and insider selling. While none of these issues appears existential, they warrant monitoring.

The regulatory environment for cryptocurrency mining and AI data centers continues evolving. Texas's favorable regulatory framework has attracted significant data center investment, but political winds could shift. British Columbia's temporary suspension of new crypto mining connections demonstrated how quickly regulatory postures can change.

XIII. Conclusion

IREN's journey from near-bankruptcy to Microsoft's newest AI infrastructure partner represents one of the most remarkable corporate pivots in recent memory. The story validates several investment principles worth noting:

Infrastructure-first thinking creates optionality. The Roberts brothers didn't build a Bitcoin company—they built a renewable-powered compute infrastructure company. When market conditions changed, the infrastructure remained valuable for new applications.

Balance sheet structure matters. The non-recourse SPV financing that seemed like arcane financial engineering in 2021 proved to be the firebreak that saved the company in 2022.

Timing beats perfection. IREN wasn't the most efficient miner, the most profitable, or the most technologically advanced. But by securing power capacity years before the AI boom, they created time-to-market advantages that more capable competitors couldn't match.

Management adaptability trumps rigid strategy. The decision to cap Bitcoin mining at 52 EH/s and redirect resources to AI required abandoning a profitable business model for an uncertain future. Most management teams lack the courage.

Daniel and Will share management of IREN and continue reviewing decisions together. Daniel said, "We challenge each other, we analyze things to the nth degree, and we're not afraid to say that if we're wrong, we're wrong. Let's change what we're doing."

For long-term investors evaluating IREN, the fundamental question is execution. The Microsoft contract provides visibility and validation. The power portfolio provides a defensible competitive position. The balance sheet, while leveraged, appears manageable given contracted cash flows.

What remains uncertain is whether IREN can deliver $3.4 billion in AI Cloud ARR by end of 2026 while managing rapid scaling, complex construction projects, and the inherent volatility of a Bitcoin mining business. The next 18 months will determine whether IREN becomes a dominant AI infrastructure platform or a cautionary tale about overreaching ambition.

The Roberts brothers bet everything—twice. First on Bitcoin mining as a way to monetize stranded renewable energy. Then on AI infrastructure as the next evolution of compute demand. Both bets required courage, capital, and execution. The first bet paid off. The second bet, worth nearly $10 billion in contracted revenue, is now being decided.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music