GigaCloud Technology: Building the "Alibaba for Big & Bulky" in Plain Sight

I. Introduction & Episode Roadmap

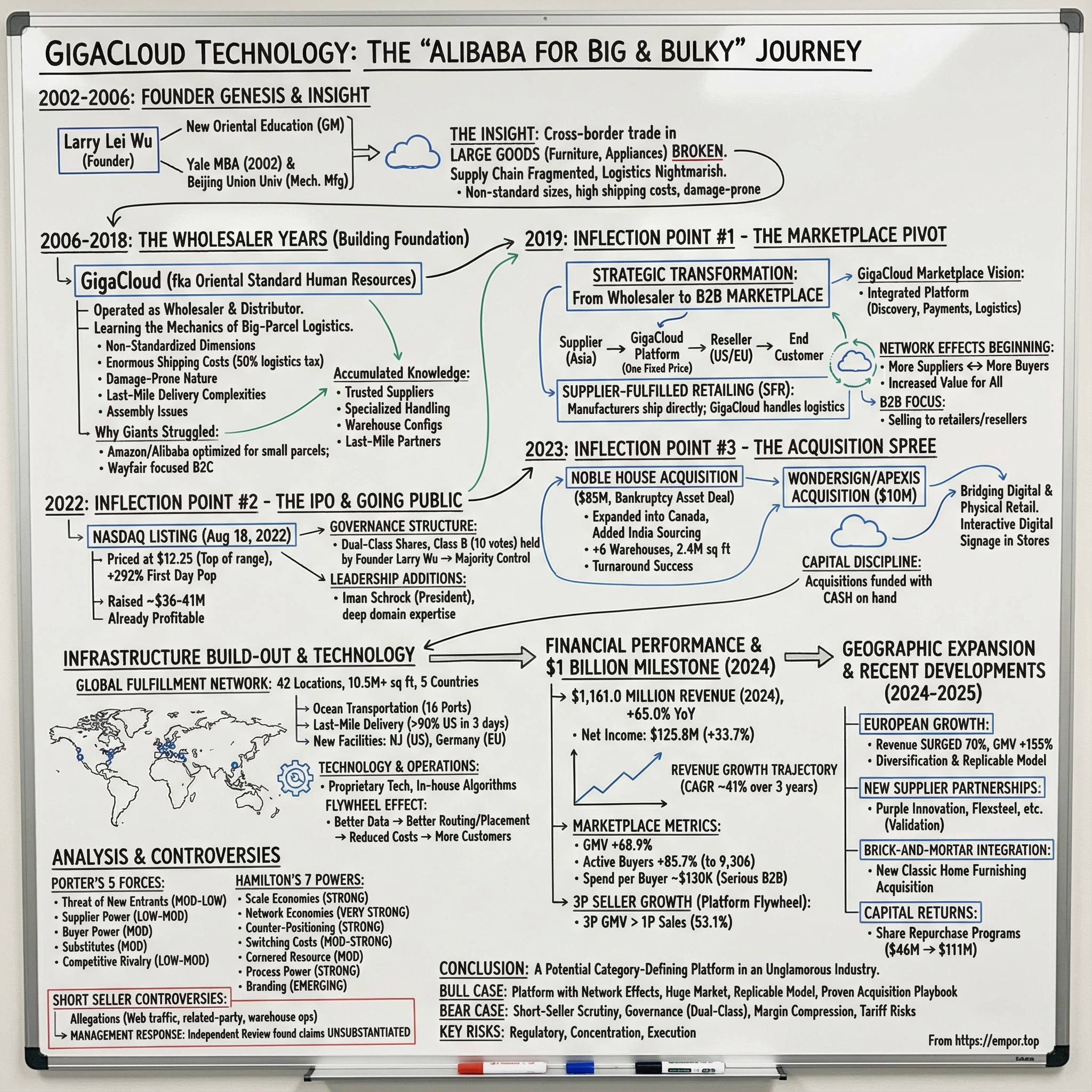

Picture a scene that plays out in warehouse districts from Los Angeles to Louisville every single day: A container ship docks at the Port of Long Beach, its belly stuffed with flat-packed sectional sofas, mattresses compressed to a fraction of their eventual size, and exercise bikes that weigh more than the people who will eventually pedal them. These aren't the small parcels that Amazon drones might someday deliver—these are the awkward, oversized items that have been the orphan children of e-commerce logistics for decades. Too big for standard shipping networks, too heavy for traditional parcel carriers, too complex for most marketplaces to bother figuring out.

GigaCloud Technology Inc. is an American e-commerce company that helps retailers buy and sell big and bulky, non-standardized items such as furniture, appliances, and fitness equipment. They own a business-to-business online marketplace and act as a middleman by handling sales, logistics and also delivery to end customers.

The company's trajectory reads like a Silicon Valley fantasy, except it happened in the decidedly unsexy world of furniture wholesaling. GigaCloud reported total revenues of $1,161.0 million in 2024, increased 65.0% year-over-year. Net income was $125.8 million, increased 33.7% year-over-year. The company crossed the billion-dollar revenue threshold for the first time in 2024—a milestone achieved just over two years after going public.

But the GigaCloud story isn't just about revenue growth. GigaCloud has been recognized on Forbes' prestigious list of America's Most Successful Small-Cap Companies 2026. This marks the second consecutive year that GigaCloud has been included in the annual ranking, following its No. 1 placement in 2025. The company went from complete obscurity to Forbes' top small-cap in America—then stayed on the list.

The journey, however, hasn't been without controversy. GigaCloud issued a statement in response to claims made in a report by Grizzly Research LLC, a short-seller, issued on May 22, 2024. The short-seller report lacks merit and contains numerous defamatory, selective, inaccurate, incomplete and misleading statements, speculation, and innuendo. Multiple short-seller attacks have questioned everything from the company's customer relationships to its warehouse operations—accusations the company has vigorously denied.

This raises the central question for any investor evaluating GigaCloud: Is this the next great platform business hiding in a boring industry—the "Alibaba for Big & Bulky" as some have called it—or is the skeptics' thesis correct? The answer lies in understanding the company's nineteen-year journey from Chinese wholesale trader to global B2B marketplace pioneer.

II. Founder Background & Early Genesis (2002–2006)

Larry Lei Wu's Journey

The GigaCloud story begins not in a Silicon Valley garage but in the classrooms of New Oriental Education & Technology Group, China's largest private education company. Prior to founding the company, Larry served as the general manager of a vocational education and online education company, New Oriental Education & Technology Group Inc. (NYSE: EDU and SEHK: 9901), from 2002 to 2006. Larry received his MBA degree from Yale University in 2002 and his bachelor's degree in mechanical manufacturing from Beijing Union University in 1994.

This background matters. New Oriental, founded by the legendary Michael Yu, was and remains one of China's most successful entrepreneurial stories—a company that built its empire on preparing Chinese students for the TOEFL and GRE exams they needed to study abroad. Working there in the early 2000s meant witnessing firsthand how a Chinese company could scale to serve millions of customers through a combination of operational excellence and technology-enabled services.

Larry Wu's educational trajectory tells its own story: a mechanical engineering degree from Beijing Union University in 1994, followed by a Yale MBA in 2002. That combination—deep technical understanding paired with world-class business training—would prove essential for what came next.

The Insight

By 2006, Wu was observing something that most Western observers missed entirely. The cross-border trade in large goods—furniture, appliances, fitness equipment—was exploding, but the infrastructure to support it was woefully inadequate. Factories in Guangdong and Zhejiang were churning out sofas, bed frames, and treadmills for American and European consumers, but getting those products from factory floor to consumer doorstep was a nightmare of complexity.

Many of the bulky products originate from Asia, where they are produced by factories there, while they are sold to end customers in the United States and Europe. GigaCloud combines product listings, payments, storage, shipping, and final delivery to the retailer's customer in one system. The company calls this model "supplier-fulfilled retailing," meaning manufacturers ship products straight to customers, while GigaCloud handles the logistics in between.

This was the insight that would eventually become GigaCloud: the furniture and large goods market wasn't just underserved by e-commerce—it was fundamentally broken. The supply chain was fragmented, the logistics were nightmarish, and no one had built the integrated platform that would make it all work.

GigaCloud was founded in 2006 by Larry Lei Wu, who has served as chairman and chief executive officer since inception. The company was formerly known as Oriental Standard Human Resources Holdings Limited and changed its name to GigaCloud Technology Inc. in February 2021.

The original company name reveals something important: this wasn't a venture capital-funded startup with a sexy pitch deck. It was a business built by a first-generation entrepreneur who was willing to do the unglamorous work of figuring out cross-border trade one shipment at a time.

III. The Wholesaler Years: Building the Foundation (2006–2018)

Understanding the Big & Bulky Problem

For thirteen years—a period longer than the entire existence of most tech startups—GigaCloud operated not as a marketplace but as a traditional wholesaler and distributor. This extended apprenticeship in the mechanics of large-parcel logistics would prove to be the company's greatest competitive advantage.

The challenges of big and bulky goods are numerous and interconnected. Unlike standardized packages that fit neatly on conveyor belts and into delivery vans, furniture and appliances come in non-standardized dimensions that make automated handling nearly impossible. A sectional sofa might require six separate boxes of varying sizes. A treadmill might weigh 300 pounds and require special handling equipment. A bedroom set might include pieces that can only be shipped standing upright.

Shipping costs for these items are enormous relative to their value. A $300 coffee table might cost $150 to ship cross-country—a 50% logistics tax that makes the economics of traditional e-commerce unworkable. Compare this to Amazon's small-parcel business, where shipping a $30 book might cost $5, or roughly 17% of the product value.

The damage-prone nature of furniture in transit creates another layer of complexity. A scratched table or torn sofa cushion represents a complete loss—the item can't be resold, and returns are prohibitively expensive. Managing damage rates requires expertise in packing, handling, and carrier selection that takes years to develop.

Last-mile delivery presents perhaps the greatest challenge. Delivering a mattress to a third-floor apartment in San Francisco requires a two-person team, scheduling coordination with the customer, and specialized equipment. This is a fundamentally different operation from dropping a package at a doorstep.

Finally, many furniture items require assembly—which means either shipping pre-assembled goods (expensive and damage-prone) or providing clear assembly instructions and dealing with customer service issues when pieces don't fit together correctly.

Why the Giants Struggled

Amazon, despite its logistics prowess, has never cracked the big and bulky category. The company's entire infrastructure—from its fulfillment centers to its delivery fleet—is optimized for packages that fit in standard-sized bins. Alibaba, despite its dominance of cross-border trade from China, focuses primarily on connecting buyers and sellers; it has never built the logistics infrastructure needed for oversized goods.

Wayfair, the most direct analog to what GigaCloud does, chose a different model entirely—focusing on B2C sales directly to consumers rather than B2B sales to resellers. This means Wayfair bears the full burden of marketing, customer acquisition, and customer service costs that GigaCloud's business model avoids.

During the 2006-2018 period, Wu and his team were accumulating what would later prove to be irreplaceable knowledge: Which manufacturers in Asia could be trusted to deliver consistent quality? Which freight forwarders could handle oversized cargo without damaging it? Which warehouse configurations worked best for furniture storage? Which last-mile delivery partners could actually get a sofa up three flights of stairs without destroying it?

This wasn't technology innovation—it was operational excellence, built one container shipment at a time. But it would become the foundation for everything that followed.

IV. Inflection Point #1: The Marketplace Pivot (2019)

The Strategic Transformation

In January 2019, after thirteen years as a wholesaler, GigaCloud made the strategic decision that would transform the company. The Company first launched its marketplace in January 2019 by focusing on the global furniture market and has since expanded into additional categories, including home appliances and fitness equipment.

The shift from wholesaler to marketplace is more profound than it might appear. As a wholesaler, GigaCloud bought inventory, stored it, and sold it to customers—bearing all the capital risk of inventory and the operational risk of warehouse management. As a marketplace, the company could instead act as a platform connecting suppliers with buyers, taking a commission on transactions while offloading inventory risk to the suppliers themselves.

But unlike typical marketplace pivots, GigaCloud didn't abandon its operational capabilities. Instead, it turned those capabilities into a service layer that would differentiate it from any potential competitor.

The GigaCloud Marketplace Vision

The Company's B2B ecommerce platform, the "GigaCloud Marketplace," integrates everything from discovery, payments and logistics tools into one easy-to-use platform. The Company's global marketplace seamlessly connects manufacturers, primarily in Asia, with resellers, primarily in the U.S., Asia and Europe, to execute cross-border transactions with confidence, speed and efficiency. GigaCloud offers a comprehensive solution that transports products from the manufacturer's warehouse to the end customer's doorstep, all at one fixed price.

The phrase "all at one fixed price" is key to understanding GigaCloud's value proposition. Traditional cross-border furniture trade involves multiple parties: the manufacturer, an export agent, a freight forwarder, a customs broker, a domestic warehouse operator, and a last-mile delivery company. Each of these parties quotes separately, creating complexity and unpredictability for the buyer.

GigaCloud's innovation was to collapse all of this into a single transaction. A reseller on the platform could see a sofa listed by a manufacturer in Guangdong, see a single all-in price that included shipping to their customer's door in Ohio, and complete the transaction with a single click. The complexity that had previously required specialists to navigate was hidden behind a simple interface.

The Company's marketplace is a business-to-business (B2B) platform, not a consumer-direct business. As previously disclosed, buyers in the Company's marketplace are typically resellers (rather than end consumers) and this level of website traffic is fully consistent with the Company's disclosures that it had approximately 5,010 active buyers on its marketplace during 2023.

This B2B focus is strategically important. Rather than competing with Wayfair and Amazon for consumer attention—an expensive proposition requiring massive marketing spend—GigaCloud sells to furniture retailers, online resellers, and other B2B customers who place large, recurring orders. These customers don't need to be convinced to try online furniture shopping; they need a reliable, cost-effective supply chain.

Network Effects Beginning

The marketplace model created the potential for powerful network effects. More suppliers meant more selection, which attracted more buyers. More buyers meant more demand, which attracted more suppliers. Each new participant on either side of the marketplace made the platform more valuable for everyone else.

Retailers and resellers can efficiently source quality products from a diverse network of global sellers, leveraging our streamlined Marketplace to reduce inventory risk, optimize costs, and simplify supply chain management.

By providing end-to-end logistics alongside its marketplace, GigaCloud created switching costs that pure-play marketplaces couldn't match. A reseller who integrated their inventory management and fulfillment operations with GigaCloud's platform would find it increasingly costly to move to a competitor.

V. Inflection Point #2: The IPO & Going Public (2022)

The NASDAQ Listing

The company went public in the U.S. on August 18, 2022, raising about $36–41 million. GigaCloud is headquartered in El Monte, California, and has been listed on the Nasdaq stock exchange since August 2022.

The GigaCloud IPO was notable for what it wasn't: a high-flying tech debut with investment banks tripping over themselves to participate. Its IPO price of $12.25 was more than twice the prevalent range of $4.00 to $5.00. The deal was priced at the top of its range—a pivot away from several recent deals priced at the low end or the mid-point.

GigaCloud Technology has set a blistering pace after joining the US tech-heavy Nasdaq index in August 2022. Having priced its IPO at $12.25, the stock closed at $48.01 on the first Friday of trading, 292% higher.

The spectacular first-day pop suggested that the market had severely underpriced the offering—or alternatively, that speculation had gotten ahead of fundamentals. The IPO raised approximately $36–41 million, a modest sum by tech IPO standards but sufficient to fund the company's growth plans.

The company's profitability appealed to IPO investors. GigaCloud Technology reported net income of $29.3 million on revenue of $414.2 million for the year ended Dec. 31, 2021, according to the prospectus.

Unlike many IPO companies that promise profits in some distant future, GigaCloud came to market already profitable—a rarity in the 2022 vintage of public offerings and a reflection of Wu's disciplined approach to building the business.

Governance Structure

The company uses a dual-class share structure. Class A shares have one vote per share, while Class B shares have ten votes per share and are held by founder Larry Lei Wu, giving him majority voting control following the IPO.

The dual-class structure is common among founder-led companies, particularly those with roots in Asia. It allows Wu to maintain control over strategic decisions regardless of his economic ownership percentage. For long-term investors who believe in management's vision, this can be a positive—it prevents activist shareholders from forcing short-term thinking. For those who prefer traditional corporate governance, the concentrated control presents a risk.

Leadership Additions

The IPO also brought new leadership to complement Wu's founder-CEO role. Iman Schrock has served as president since August 2022. Prior to joining, Iman held the position as the Vice President of Retail Sales of Abbyson Living from 2006 to 2022. He received a PhD in Organizational Psychology at University of Phoenix in 2014 and has completed Disruptive Strategy at Harvard Business School in 2023.

Schrock's background is notable: sixteen years at Abbyson Living, a furniture manufacturer and distributor, gave him deep domain expertise in exactly the industry GigaCloud serves. His addition signaled that the company was serious about building a professional management team capable of executing at scale.

VI. Inflection Point #3: The Acquisition Spree (2023)

Noble House Acquisition

With cash from the IPO and growing operating cash flows, GigaCloud embarked on an acquisition strategy that would dramatically accelerate its growth. GigaCloud completed the previously announced asset acquisition of Noble House Home Furnishings LLC, a leading B2B distributor of indoor and outdoor home furnishings, for approximately $85 million, subject to customary purchase price adjustments.

Noble House filed for Chapter 11 bankruptcy protection in early September and GigaCloud was identified as a stalking horse bidder early on, placing a bid of $85 million for the company and its assets.

The bankruptcy context is important. Noble House wasn't a failing business in the sense that customers didn't want its products—it was a business that had mismanaged its inventory and operations. Its 2023 purchase of Noble House Home Furnishings, once losing $40 million annually, has now become profitable.

The acquisition of Noble House is a pivotal moment for GigaCloud, expanding its operations into Canada and adding a new sourcing origin in India. In addition to providing more geographical diversity within the supply chain and enhancing fulfillment and logistics capabilities, Noble House adds scale and product diversity to further expand GigaCloud's B2B marketplace. With over one million five-star reviews online, Noble House exemplifies significant brand value, reinforcing its strong market standing with the inclusion of iconic brands Christopher Knight and OkiOki.

The acquisition of Noble House added six warehouses with approximately 2.4 million square feet to the warehousing network in the U.S., and one warehouse with approximately 0.1 million square feet in Canada.

The turnaround of Noble House would become one of GigaCloud's most impressive operational achievements. Since taking ownership, the company has added 2,300 new SKUs, retired 1,100 underperformers, and restored growth while maintaining profitability.

Wondersign/Apexis Acquisition

Just weeks after closing Noble House, GigaCloud made another acquisition. GigaCloud completed the acquisition of a 100% equity interest of Apexis, Inc., a Florida corporation dba Wondersign, for a total cash consideration of $10.0 million, subject to customary purchase price adjustments.

Wondersign is a cloud-based interactive digital signage and e-catalog management SaaS company headquartered in Tampa, Florida with access to thousands of storefronts across the United States through its customers.

"With access points to approximately 2,500 storefronts through its customers, Wondersign significantly broadens our reach to the physical retail stores nationwide," said Iman Schrock, President of GigaCloud.

This acquisition signaled GigaCloud's ambition to bridge the digital and physical retail worlds. Wondersign's kiosk technology allows brick-and-mortar furniture stores to display their entire catalog digitally, even if they only have floor space for a fraction of their inventory. Integrating this technology with the GigaCloud marketplace meant that a customer in a physical furniture store could order from the full GigaCloud catalog and have the item delivered directly to their home.

Ashley Furniture Industries is the first supplier to adopt the Wonder App across its retailer network.

Capital Discipline

Despite the aggressive acquisition pace, management maintained a disciplined approach to capital allocation. The acquisition is funded entirely with cash on hand.

The company avoided taking on debt to fund acquisitions, preferring to use the cash it was generating from operations. This approach limited how fast the company could grow through M&A but preserved balance sheet strength and signaled confidence in organic growth prospects.

VII. The Infrastructure Build-Out

Global Fulfillment Network

The physical infrastructure that GigaCloud has built represents perhaps its most durable competitive advantage. The company now operates 37 fulfillment facilities across five countries with over 10.9 million square feet of space under unified management. Its logistics network includes ocean transportation through 16 ports of destination, handling over 30,000 containers annually, and last-mile delivery capabilities that reach over 90% of customers in the continental United States within three days.

The pace of expansion has been remarkable. GigaCloud's global fulfillment network, comprising strategically positioned fulfillment centers and other facilities designed for efficient inventory management and order fulfillment, expanded to 42 locations with over 10.5 million square feet—an increase of 169% from approximately 3.9 million square feet.

Recent expansion has focused on both U.S. capacity and European presence. GigaCloud entered into a new lease for a fulfillment center in Jackson Township, New Jersey. The class A new construction facility, leased from Brookfield Properties, spans approximately 617,000 square feet and is expected to commence operations in January 2026.

GigaCloud has expanded its European fulfillment network with a new 409,300 square foot facility in Werne, Germany. This marks the company's sixth fulfillment center in Germany, strengthening its regional infrastructure.

Technology & Operations

The physical network is supported by proprietary technology that optimizes every step of the supply chain. "Our Supplier Fulfilled Retailing model revolutionizes the traditional B2B ecommerce by streamlining every step of the supply chain. The Company's in-house algorithms continuously optimize infrastructure and operations efficiency, delivering end-to-end fulfillment solutions for marketplace participants."

Streamlined transactions between suppliers and resellers, enabled by tech-driven logistics, facilitate direct delivery to the end customer. From first mile to last mile, GigaCloud provides end-to-end logistics to help streamline fulfillment for suppliers and resellers.

The integration of software and physical infrastructure creates a flywheel: better data from more transactions enables better routing and inventory placement, which reduces costs and delivery times, which attracts more customers, which generates more data.

VIII. Financial Performance & The $1 Billion Milestone

Revenue Growth Trajectory

GigaCloud reported its Q4 and full-year 2024 financial results, achieving a milestone of over $1 billion in annual revenues. Full-year 2024 highlights include: revenues of $1,161.0M (+65.0% YoY), gross profit of $285.2M (+51.2% YoY), and net income of $125.8M (+33.7% YoY).

To put the growth trajectory in context: GigaCloud generated revenue of approximately $414 million in 2021, $490 million in 2022 (its IPO year), $704 million in 2023, and $1.16 billion in 2024. That's a compound annual growth rate of roughly 41% over three years—exceptional for any company, particularly one operating in what most would consider a mature industry.

Importantly, this growth has been accompanied by profitability. Net income of $125.8 million, increased 33.7% year-over-year. Net income margin was 10.8%, compared to 13.4% in 2023. Diluted EPS increased 32.6% year-over-year to $3.05.

The margin compression—from 13.4% in 2023 to 10.8% in 2024—reflects the dilutive impact of acquisitions and investments in capacity expansion. Management has signaled that margins should stabilize as acquired businesses are fully integrated.

Marketplace Metrics

The underlying marketplace metrics tell an even more compelling story. The company's GigaCloud Marketplace showed strong growth with GMV increasing 68.9% YoY to $1,341.4M, while active buyers grew 85.7% to 9,306.

Active 3P sellers increased 17.2% year-over-year to 1,232 for the 12 months ended September 30, 2025. Active buyers increased 33.8% year-over-year to 11,419 for the 12 months ended September 30, 2025. Spend per active buyer was $130,349 for the 12 months ended September 30, 2025.

The spend per active buyer metric—approximately $130,000 annually—highlights that GigaCloud's customers are serious B2B operations, not casual shoppers. This concentration means that each customer relationship represents significant recurring revenue potential.

3P Seller Growth (The Platform Flywheel)

The growth of third-party sellers on the platform is particularly important for understanding GigaCloud's evolution. 3P seller GigaCloud Marketplace GMV increased 24.4% year-over-year to $790.4 million for the 12 months ended September 30, 2025. 3P seller GigaCloud Marketplace GMV represented 53.1% of total GigaCloud Marketplace GMV for the 12 months ended September 30, 2025.

The fact that third-party seller GMV now exceeds GigaCloud's own first-party sales (1P) is a critical milestone. It demonstrates that the platform has achieved sufficient scale and liquidity to attract independent sellers who could theoretically sell through other channels. These third-party sellers bring their own products and customers to the platform, reducing GigaCloud's capital requirements while increasing the platform's value to buyers through expanded selection.

IX. Geographic Expansion & Recent Developments (2024–2025)

European Growth

GigaCloud Technology demonstrated resilience in Q3 2025, achieving a 10% year-over-year increase in revenue. This growth was driven by a diversified business model and strong international presence, particularly in Europe, where revenue surged by 70%.

Global diversification has been a key strength, with standout progress in Europe, which has experienced 155% GMV growth year over year, further validating the broad appeal for the company's solutions across diverse markets.

That strength helped offset a 5% decline in U.S. product revenue, which fell from $202.0 million to $192.0 million amid a cooling housing market and rising tariffs.

The European expansion is strategically important for several reasons. First, it diversifies GigaCloud's geographic exposure, reducing dependence on the U.S. housing and furniture markets. Second, it expands the addressable market for suppliers on the platform—a Chinese furniture manufacturer can now reach customers across both North America and Europe through a single platform. Third, it demonstrates that the GigaCloud model is replicable beyond its original U.S. focus.

New Supplier Partnerships

New suppliers to the GigaCloud Marketplace include Purple Innovation Inc. (Nasdaq: PRPL), Homestyles, a brand of Flexsteel Industries Inc. (Nasdaq: FLXS), Corsicana Mattress Company, Restonic, Walker Edison, GhostBed, Simpli Home and others.

"Partnering with GigaCloud has opened up exciting new avenues for Purple to extend our market presence," said Mason Stephens, Vice President, Head of Wholesale at Purple Innovation Inc.

The addition of publicly traded companies like Purple Innovation and Flexsteel to the platform represents a meaningful validation of GigaCloud's model. These companies have sophisticated supply chain operations and numerous distribution options; their choice to partner with GigaCloud suggests the platform offers genuine value.

Brick-and-Mortar Integration

Wu called the deal a "perfect strategic fit" that will help diversify GigaCloud's revenue mix beyond ecommerce. "We've proven the viability of our digital marketplace. The next step is bridging the digital and physical worlds."

GigaCloud announced its entry into a binding term sheet for the acquisition of 100% of outstanding equity interest of New Classic Home Furnishing, Inc. for $18 million. Headquartered in Fontana, California, New Classic is a profitable U.S.-based furniture distributor with 25 years of history, primarily servicing brick-and-mortar retailers across North America. New Classic generates approximately $70 million in annual revenues by offering a diverse portfolio of over 2,000 active SKUs and servicing over 1,000 retailer customers.

The company sources predominantly from Southeast Asia and the United States, with less than 3% coming from China, providing GigaCloud with greater supply-chain diversification.

Capital Returns

In September 2024 the board authorized a $46 million share repurchase program, which was later increased by $16 million in April 2025, and in August 2025 the company announced a new three-year $111 million buyback program replacing the prior plan.

As of that point, the company had repurchased approximately 3.7 million shares for $61.8 million—close to 150% of the gross proceeds raised in its IPO—at a weighted average price well above the IPO offering price.

The share repurchase activity sends a clear signal: management believes the shares are undervalued relative to intrinsic value, and they're willing to put the company's cash behind that conviction.

X. Porter's 5 Forces Analysis

Threat of New Entrants: MODERATE-LOW

Building a competitor to GigaCloud would require replicating both its technology platform and its physical infrastructure. The company now operates 37 fulfillment facilities across five countries with over 10.9 million square feet of space under unified management. Replicating this footprint would require billions of dollars in capital expenditure and years of operational learning.

The supplier relationships compound this challenge. GigaCloud has spent nearly two decades building relationships with Asian manufacturers, understanding their production capabilities, and establishing trust. A new entrant would need to convince these suppliers to work with an unproven platform while GigaCloud already offers access to thousands of buyers.

However, the threat isn't zero. Well-funded competitors—Amazon Business, Alibaba B2B—could theoretically enter this market. The technology itself is replicable; what's difficult to replicate is the accumulated operational expertise and network effects.

Bargaining Power of Suppliers: LOW-MODERATE

Active 3P sellers increased 17.2% year-over-year to 1,232. This diversified supplier base means no single supplier has significant leverage over the platform. Suppliers benefit from access to GigaCloud's buyer network—access they couldn't achieve independently.

That said, the largest suppliers do have alternatives. They could sell through Amazon, work with traditional distributors, or invest in their own direct-to-consumer capabilities. GigaCloud's value proposition must remain compelling to retain these important partners.

Bargaining Power of Buyers: MODERATE

GigaCloud's buyers are B2B customers—resellers, retailers, and other businesses. Spend per active buyer was $130,349 for the 12 months ended September 30, 2025. These are significant commercial relationships, and the buyers have some negotiating leverage.

However, switching costs limit buyer power. A reseller who has integrated their inventory management and fulfillment operations with GigaCloud's platform would face significant disruption in moving to an alternative supplier network.

Threat of Substitutes: MODERATE

Traditional alternatives to GigaCloud exist: trade shows, direct manufacturer relationships, traditional wholesalers. But these alternatives generally lack the integration, efficiency, and technology that GigaCloud provides.

General B2B marketplaces like Alibaba and Amazon Business exist but don't specialize in big and bulky goods. The logistics complexity of these items means that general-purpose platforms can't match GigaCloud's service level for this category.

Competitive Rivalry: LOW-MODERATE

Perhaps the most striking aspect of GigaCloud's competitive position is the absence of direct competitors. GigaCloud Technology Inc specializes in global end-to-end business to business (B2B) technology solutions for large parcel merchandise. The Company's B2B e-commerce platform, the GigaCloud Marketplace, integrates everything from discovery, payments and logistics tools into one easy-to-use platform.

Wayfair and Overstock focus on B2C; Amazon and Alibaba are generalists without specialized large-parcel infrastructure. Traditional wholesalers lack the technology platform. The result is that GigaCloud competes primarily with industry fragmentation rather than with specific competitors—a favorable position.

XI. Hamilton's 7 Powers Analysis

Scale Economies: STRONG ✓

GigaCloud's fulfillment network creates meaningful scale advantages. Fixed costs of warehouses and technology platforms spread across growing GMV. Each additional shipment reduces per-unit costs. GigaCloud's global fulfillment network expands to 42 locations with over 10.5 million square feet.

A new entrant attempting to match this network would face unit costs significantly higher than GigaCloud's, making price competition difficult.

Network Economies: VERY STRONG ✓✓

The marketplace model creates classic two-sided network effects. One of the most impressive metrics in GigaCloud's presentation was the 34% year-over-year growth in active buyers, which reached 11,419 for the trailing twelve months ended September 30, 2025. The company also reported 17% growth in active third-party sellers, now numbering 1,232.

More suppliers attract more buyers; more buyers attract more suppliers. Each new participant makes the platform more valuable for everyone else, creating a self-reinforcing growth dynamic.

Counter-Positioning: STRONG ✓

Traditional wholesalers cannot easily adopt the marketplace model without cannibalizing their existing business. Their sales forces would resist a shift to a platform that might disintermediate them. Their existing inventory investments would become stranded assets.

B2C players like Wayfair face a different counter-positioning challenge: pivoting to B2B wholesale would confuse their consumer brand and require fundamentally different operations.

Switching Costs: MODERATE-STRONG

Suppliers integrate inventory systems with GigaCloud. Buyers build purchasing workflows and supplier relationships through the platform. The launch of the Wonder App represents a natural evolution, moving beyond its beginnings as a kiosk app provider to a network that empowers every stage of the retail transaction.

Product integrations like the Wonder app deepen customer relationships and increase switching costs further.

Cornered Resource: MODERATE

GigaCloud's nearly two-decade accumulation of operational knowledge represents a cornered resource of sorts. The relationships with Asian manufacturers, the understanding of complex logistics operations, and the institutional knowledge of how to move large goods efficiently cannot be easily replicated.

Process Power: STRONG ✓

The company's Supplier Fulfilled Retailing (SFR) model represents genuine process innovation. "That is a testament to the efficiency and value created by our Supplier Fulfilled Retailing (SFR) model," said Larry Wu, Founder, Chairman, and Chief Executive Officer.

This end-to-end process—from manufacturer to end customer—is difficult to replicate because it requires coordination across multiple functions and geographies.

Branding: EMERGING

GigaCloud's brand recognition among its target B2B audience appears strong, as evidenced by the willingness of publicly traded companies like Purple Innovation to partner with the platform. However, brand power is still emerging rather than fully established.

XII. Short Seller Controversies & Management Response

The Allegations

GigaCloud has faced two significant short-seller attacks, from Culper Research in September 2023 and Grizzly Research in May 2024. The short-seller report lacks merit and contains numerous defamatory, selective, inaccurate, incomplete and misleading statements, speculation, and innuendo. The report demonstrates a fundamental lack of understanding of the Company's business particularly with respect to the types of buyers who use our marketplace and the services we provide them.

The allegations focused on several areas: web traffic that allegedly didn't match revenue claims, purported undisclosed related-party transactions, and questions about warehouse operations.

Management Response

The report omits this data, which shows significant web traffic measured by visits to the Company's website of roughly 130,000 total visits and 11,000 unique visitors during April 2024, according to this third-party's estimates. The Company's marketplace is a business-to-business (B2B) platform, not a consumer-direct business. As previously disclosed, buyers in the Company's marketplace are typically resellers (rather than end consumers) and this level of website traffic is fully consistent with the Company's disclosures that it had approximately 5,010 active buyers on its marketplace during 2023.

Based on such Independent Review, the Audit Committee has concluded that the reviewed claims in the Short Seller Report were not substantiated. The Independent Review was conducted by the audit committee of Company's board of directors with the assistance of independent professional advisors, including White & Case LLP, an international law firm as its legal advisor and FTI Consulting (China) Limited, a forensic accounting expert that is not related to the Company's auditor.

The company engaged independent advisors to review the allegations—a step that carries costs and risks if the review were to uncover problems. The fact that they took this step, and that the review found the claims unsubstantiated, provides some reassurance about the legitimacy of the business.

XIII. Bull Case, Bear Case, and Key Risks

The Bull Case

The bull thesis on GigaCloud rests on several pillars. First, the company has built a genuine platform business with network effects in a market where no comparable platform exists. Second, the addressable market is enormous—the U.S. B2B e-commerce market alone is measured in trillions of dollars. Third, geographic expansion into Europe demonstrates that the model is replicable internationally. Fourth, the acquisition playbook—buying distressed assets and turning them around—has been proven with Noble House. Fifth, management has a long track record and significant equity ownership, aligning their interests with shareholders.

The Bear Case

The bear thesis focuses on different concerns. First, the short-seller allegations, while officially refuted, raise questions that some investors cannot fully dismiss. Second, the dual-class share structure concentrates control in founder Larry Wu's hands, limiting outside shareholder influence. Third, margin compression has accompanied the rapid growth, and it's unclear when (or if) margins will return to prior levels. Fourth, tariff risks and U.S.-China trade tensions could disrupt the supply chain that underlies the business. Fifth, the lack of direct competitors might reflect not a sustainable moat but rather a market that isn't attractive enough to draw them.

Key Risks

Regulatory risk looms large. As a company facilitating cross-border trade from Asia to Western markets, GigaCloud is exposed to changes in tariffs, trade policy, and customs enforcement. The company faces challenges from recent tariffs and global trade uncertainties, which have introduced complexities into the supply chain.

Concentration risk exists in the customer base. While the company has over 11,000 active buyers, large customers likely represent a disproportionate share of GMV.

Execution risk accompanies any rapid growth strategy. Integrating acquisitions, expanding into new geographies, and building new product capabilities all require disciplined execution.

XIV. Key Performance Indicators to Monitor

For investors tracking GigaCloud's ongoing performance, three metrics stand out as particularly important:

1. Third-Party Seller GMV as a Percentage of Total GMV

This ratio indicates the health of GigaCloud's platform business. As 3P GMV grows relative to 1P (first-party) sales, it signals that the marketplace is attracting independent sellers who bring their own products and customers. Currently at approximately 53%, continued growth in this percentage would validate the platform thesis. A decline would suggest the company is relying more heavily on its own inventory—a less capital-efficient business model.

2. Active Buyer Growth and Spend Per Buyer

Active buyers reached 11,419 for the trailing twelve months ended September 30, 2025. Both the absolute number of buyers and their average spend indicate marketplace health. Ideally, buyer count grows while spend per buyer remains stable or increases, indicating that new buyers are achieving scale and that existing buyers aren't churning.

3. European Revenue Growth

Europe represents GigaCloud's geographic diversification strategy and its ability to replicate success in new markets. Europe, where revenue surged by 70%. Continued strong growth in Europe would validate the international expansion thesis; deceleration would raise questions about the model's portability.

XV. Conclusion

GigaCloud Technology represents a fascinating case study in platform building within an unglamorous industry. Founded in 2006, operating in obscurity for over a decade, the company has emerged as a potential category-defining platform for the enormous big-and-bulky goods market.

The thesis is straightforward: no one else has built what GigaCloud has built. The combination of a B2B marketplace, integrated logistics infrastructure, and technology platform creates a value proposition that neither traditional wholesalers nor general-purpose e-commerce platforms can match.

"Being named to Forbes' list for the second consecutive year signifies broad recognition of the strength and durability of the GigaCloud Marketplace ecosystem," said Larry Wu, Founder and Chief Executive Officer. "In an era of rapid technological advancement across sectors, we are leveraging innovation to enhance the efficiency of how big and bulky goods trade and move."

The risks are real: short-seller scrutiny, governance concerns, macro headwinds in the furniture industry, and tariff uncertainty all deserve serious consideration. But the opportunity is equally real: a trillion-dollar market with no clear category leader, serving a customer need that isn't going away.

For long-term investors, GigaCloud offers the potential for continued platform scaling, geographic expansion, and operating leverage as the business reaches greater scale. For skeptics, the concerns raised by short sellers and the compressed margins warrant continued monitoring.

Either way, GigaCloud deserves attention. In a world obsessed with the next AI breakthrough or social media phenomenon, a company building infrastructure for moving sofas might seem boring. But boring businesses that solve real problems and generate real profits have a way of creating substantial long-term value. Whether GigaCloud ultimately realizes that potential—or succumbs to the concerns that have dogged it—will make for a compelling story to follow.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music