Five9 Inc.: The Cloud Contact Center Revolution

I. Introduction & Episode Roadmap

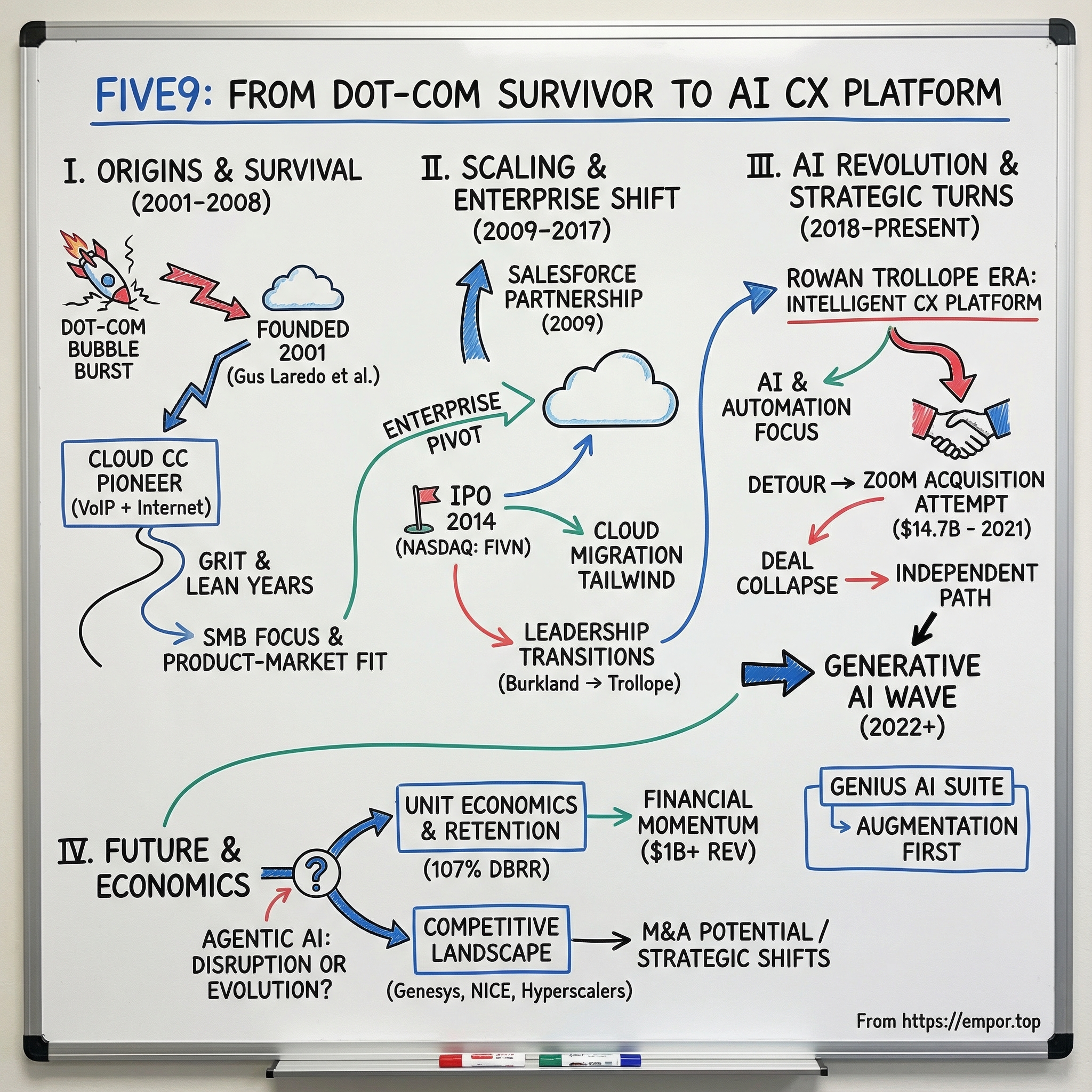

Picture a call center in the early 2000s: rows of cubicles, agents tethered to chunky desk phones, and a back room packed with expensive boxes from legacy vendors that determined whether customers got help—or heard a busy signal. If you wanted to upgrade, you didn’t push code. You ordered hardware. If you wanted to scale, you didn’t add seats in a dashboard. You signed a lease and ran more cables. And when something broke, it wasn’t a minor hiccup. It could mean hours of outages, dropped calls, and thousands of customer relationships quietly taking damage.

That’s the world Five9 set out to disrupt.

Five9 was founded in 2001 and became an early leader in bringing contact centers to the cloud—what we now call Contact Center as a Service, or CCaaS. Today, the company is based in San Ramon, California, and it’s one of the category’s dominant players. In 2024, it posted strong year-end results, with annual revenue exceeding $1 billion and fourth-quarter growth accelerating to 17%. Five9 is trusted by 2,500+ customers and works with 1,400+ partners globally, handling billions of customer interactions each year.

Here’s the question that makes Five9 worth a full episode: how did a startup born at the worst possible moment—right as the dot-com bubble collapsed—manage to survive, pivot its way into the enterprise, and become so strategically valuable that Zoom tried to buy it for $14.7 billion in an all-stock deal in July 2021, the second-biggest tech acquisition announced that year?

The answer is a mix of grit and timing—both bad and good. Five9 had to endure years when “cloud contact center” sounded like a niche idea. Then it caught the wave as enterprises finally moved mission-critical systems off-prem. And just as the category matured, AI arrived to change the rules again—forcing every company in the space to decide whether they’d bolt AI on, or rebuild around it.

This story has everything: near-death years after the dot-com crash, an inflection-point partnership that opened the enterprise door, leadership transitions, the Zoom deal that imploded in public, and a new arms race as generative AI reshapes what customer service can even be.

And for investors, Five9 is a clean case study in a particular kind of business: unglamorous on the surface, but deeply embedded once you win. Contact centers are where revenue is saved or lost, churn is prevented or created, and brands earn trust—or burn it. That makes Five9 both durable and exposed, because if AI can rewrite customer service, it can also rewrite the economics that made CCaaS so attractive in the first place.

II. The Contact Center Industry & Founding Context (Late 1990s–2001)

Before we can understand Five9’s founding, we have to understand what a contact center really is—and why, by the late 1990s, the whole industry was begging to be reinvented.

A contact center is the nerve center for how a company talks to its customers. And even back then, it wasn’t just people on phones. As digital channels took off, “customer support” started showing up everywhere: voice calls, email, web chat, SMS, social media, and eventually video. Call your bank about a suspicious charge, message a retailer about a delayed shipment, or try to get an airline to rebook you after a cancellation—you’re talking to a contact center. For big enterprises, these are huge operations, with thousands of agents across multiple sites handling enormous volumes of customer interactions.

The problem was the technology stack running all of it.

In the late 1990s, contact centers were dominated by the legacy giants: Avaya, Genesys (then part of Alcatel), and Cisco. Their model was straightforward: you bought big, expensive on-premise systems—specialized hardware plus complex software—and you paid heavily up front. Deployments could run into the millions before the first call ever hit an agent. And once you were live, you were trapped in a world where scaling meant buying more boxes, new features meant waiting for vendor upgrades, and expanding to a new geography often meant duplicating the whole infrastructure footprint.

Then the internet started to suggest a different way. In the late 1990s, the Application Service Provider (ASP) model emerged—basically an early draft of what we’d later call cloud computing or Software as a Service. The pitch was simple and powerful: deliver software over the internet instead of installing it inside every customer’s building. Lower upfront cost. Faster deployment. And updates that could roll out to everyone at once.

Five9 was established in 2001, with Gus Laredo recognized as its primary founder. The founding team also included Wendell Black, David Van Everen, Brian Silverman, Andrew Veliath, James Southworth, and John Kim. Even the name was a statement: “five nines,” the 99.999% uptime standard. In contact centers, reliability isn’t a nice-to-have. If your system is down, your customers don’t just get annoyed—they can’t reach you at all.

In the early years, John Sung Kim played a central leadership role, serving as CEO until 2007. And the founding thesis was bold in its simplicity: pair VoIP (Voice over Internet Protocol) with widespread internet connectivity, and you could deliver contact center capabilities as a service. No hardware purchases. No server rooms. Subscribe instead of install. Go live in days or weeks, not months.

But there was one brutal catch: timing.

Five9 launched in 2001, right after the dot-com bubble had imploded. Venture capital dried up. Tech companies failed in waves. And the appetite for “trust us, it runs on the internet” basically vanished overnight. Technology budgets froze as enterprises focused on stability, not experimentation.

So Five9 entered the market selling a new and unfamiliar idea—put your customer communications on an internet-based service—at the exact moment customers were least willing to take that kind of risk. Enterprises weren’t looking for the next thing. They were clinging to the safest thing.

III. Survival Mode: The Dot-Com Crash & Finding Product-Market Fit (2001–2008)

From 2001 through 2008, Five9 didn’t “scale.” It endured.

This was the era when anything that smelled like an internet-delivered business system got lumped in with dot-com wreckage. Budgets tightened. Buyers wanted certainty. And plenty of other early cloud contact center bets simply disappeared. Five9 didn’t. It stayed alive by running lean and doing whatever it took to keep momentum—one customer, one renewal, one deployment at a time.

Money wasn’t abundant, but it did arrive in pieces. Over the company’s early life, Five9 raised capital across eight funding rounds, totaling $84.1 million. It wasn’t effortless fundraising; it was survival fundraising. The kind that teaches a company to watch costs, prioritize the roadmap ruthlessly, and build only what customers will actually pay for.

Those customers, at first, were not the enterprises Five9 would later become known for. In the early years, Five9 sold mostly to small and mid-sized businesses: teams that couldn’t justify the giant on-premise deployments from Avaya or Cisco, and were willing to take a chance on something delivered over the internet. They weren’t glamorous logos, but they were real. They brought in revenue, they stress-tested the product, and they gave Five9 the feedback loop it needed to iterate toward something sturdier.

Under the hood, Five9 was also quietly doing something ahead of its time: building a multi-tenant cloud architecture. That meant multiple customers running on shared underlying infrastructure, with their data and configurations kept separate. It’s a technical choice that sounds mundane until you realize what it enables: updates that roll out broadly, operations that get more efficient as you add customers, and a platform that improves as a whole instead of being endlessly customized one install at a time.

Still, none of this made the day-to-day easy. Five9 was building “cloud” before the market had a word for it, selling to skeptical buyers, and competing in the shadow of entrenched vendors with decades of relationships. Each quarter was a referendum on whether the business would exist next quarter.

Then, in January 2008, Five9 made a leadership move that signaled it wanted to be more than a survivor. Mike Burkland came in as CEO with a clear ambition: take what Five9 had proven in the SMB market and build a real enterprise cloud contact center company.

Burkland brought the kind of operating background that matters when you’re trying to go upmarket. Before Five9, he’d led several enterprise software and cloud companies across categories like systems management, content management, security, and CRM. Earlier, he held roles at Oracle and BMC. He understood how enterprise buyers think, how long sales cycles really take, and how much operational rigor it requires to run mission-critical software.

His tenure would span major chapters in Five9’s story—serving as CEO from 2008, later transitioning to Chairman in December 2017 after being diagnosed with cancer, and returning as CEO in November 2022. During that arc, Five9 grew from roughly 80 people to about 2,000, and the business expanded dramatically.

But at the moment Burkland arrived, the point wasn’t size. It was trajectory.

By 2008, Five9 had done the hardest part: it had lived through the worst timing imaginable, built real technology, and found paying customers. The company wasn’t thriving yet—but it had a foundation. And the market, slowly, was starting to loosen its grip on the old way of doing things.

To turn survival into a breakout, Five9 needed something else: credibility. A way into the enterprise. And, ideally, a partner already sitting at the center of customer workflows.

IV. The Salesforce Partnership & Enterprise Pivot (2009–2012)

Five9’s first true breakout didn’t come from a flashy ad campaign or a massive enterprise contract. It came from a channel that, in 2009, was quietly becoming one of the most powerful distribution engines in software: the Salesforce AppExchange.

Salesforce had already done the hard part for every other cloud company—it proved that big, risk-averse enterprises would trust the internet with something mission-critical. Not a side tool. Their CRM system. And as Salesforce adoption spread, AppExchange became the place where complementary products could plug into the workflow and hitch a ride.

Five9 leaned into that opening. It integrated tightly with Salesforce so the agent experience finally made sense: the call arrives, the customer record appears, notes and outcomes get logged automatically, and reporting can connect what happened on the phone to what happened in the account. Instead of an agent juggling systems, the contact center became an extension of the CRM.

That fit turned into leverage. Five9 has now been a Salesforce partner for more than 15 years and has become a top global ISV AppExchange partner. Along the way, it built a large base of joint customers—more than a thousand—who adopted Five9 specifically because it worked so well inside Salesforce.

This partnership rewired Five9’s go-to-market. Selling a cloud contact center “cold” into the enterprise was a grind: long cycles, skeptical IT teams, and a constant credibility gap versus legacy vendors. But once a company was already running Salesforce, the conversation changed. The buyer was no longer being asked to take a leap of faith on cloud. They’d already jumped. Five9 just gave them the next logical piece.

It also pulled Five9 upmarket fast. SMBs had kept the lights on, but the real CCaaS economics show up with larger deployments: more seats, longer commitments, and the kind of expansion that compounds over time. Salesforce became the wedge into those bigger opportunities.

As the years went on, the integration story expanded too, including alignment with newer Salesforce capabilities like Data Cloud and Einstein 1—positioning Five9 as part of how companies supported not just today’s service operations, but the more automated, data-driven future they were trying to build.

Of course, Five9 wasn’t alone in seeing the prize. Competitors like inContact (later acquired by NICE and rebranded as NICE CXone) and NewVoice (which became Genesys Cloud) were charging at the same market. The space was getting crowded—but that was also the point. The cloud contact center category was moving from “weird experiment” to “inevitable migration.”

Through it, Burkland kept pushing a specific kind of operating discipline. Five9 wasn’t just trying to grow—it was trying to grow in a way that could stand up to public-market scrutiny. That meant showing a path to profitability, not just piling on revenue. In an era where many startups optimized for growth at any cost, Five9 was quietly building the financial profile of a company that planned to be here for the long haul.

V. Going Public & The Cloud Migration Tailwind (2013–2017)

By 2014, Five9 had spent more than a decade proving a simple idea: the contact center didn’t need to live in a server room. Now it was time to put that thesis in front of the public markets.

On April 3, 2014, Five9 priced its initial public offering: 10 million shares at $7.00 per share. The next day, April 4, the stock began trading on NASDAQ under the ticker FIVN. Five9 raised roughly $80.5 million in the IPO, and reports at the time pegged the company’s valuation at around $322 million. Mike Burkland marked the moment by ringing the Opening Bell at NASDAQ MarketSite.

Going public was a validation—but it wasn’t a victory lap. Five9 was still a relatively small player in a huge, entrenched market. Its pre-IPO cap table reflected the long grind it took to get there, with major stakes held by Hummer Winblad Venture Partners (23.2%), Adams Street Partners (19.8%), Partech International (17.4%), Mosaic Venture Partners (17.4%), and SAP Ventures.

What made the IPO especially well-timed wasn’t just Five9’s internal progress. It was the external tide finally turning.

In the mid-2010s, Fortune 500 companies started getting comfortable moving mission-critical systems to the cloud. Salesforce had normalized SaaS for core workflows. Amazon Web Services had made cloud infrastructure credible. Slowly, the old assumption—that “serious” systems had to be on-prem—began to crack. Cloud wasn’t an experiment anymore. For new deployments, it was becoming the default.

That shift played directly into Five9’s value proposition. Buyers were increasingly willing to move off legacy on-premise contact center stacks, drawn by the practical benefits: lower upfront costs, the ability to scale on demand, faster deployments, and simpler management and integration.

Meanwhile, the product itself was evolving along with customer expectations. Contact centers were no longer just phone systems. Customers wanted to reach companies through email, web chat, SMS, and social media—and they expected those channels to feel connected. Five9 responded by investing in omnichannel capabilities, aiming to give agents a single interface to manage all customer interactions, not a pile of disconnected tools.

The upmarket momentum continued, too. Over this period, Five9’s enterprise business accelerated, including 38% growth in enterprise subscription revenue and an average new enterprise deal size of about $450,000 in annual recurring revenue.

Then, at the end of 2017, the company hit a major transition point. In December, Mike Burkland stepped down as CEO and moved to Chairman after being diagnosed with cancer. Barry Zwarenstein, Five9’s CFO, served as Interim CEO during the transition while continuing as CFO.

Five9 had made it to the public markets. It had the cloud tailwind at its back. But the next phase would require a new kind of leadership—and the search for Burkland’s successor would set up one of the most consequential chapters in the company’s history.

VI. The Rowan Trollope Era: AI & Strategic Repositioning (2017–2021)

Five9 had the tailwinds of cloud adoption and a fresh IPO behind it. Then it hit the moment every scaling company eventually faces: the business needed a different kind of CEO for the next act.

On May 1, 2018, Five9’s Board appointed Rowan Trollope as CEO, effective May 3. Trollope came from Cisco, where he’d been SVP and General Manager of the Applications Group.

He wasn’t a “learn enterprise on the job” hire. Trollope brought more than 25 years of management experience, and at Cisco he’d been a key member of the CEO’s executive leadership team, running an Applications Group that was a $5 billion business. Before that, he joined Cisco in 2012 to lead the Collaboration Technology Group—where his team pushed Cisco’s collaboration business toward a SaaS model, emphasizing design, simplicity, and fast, compounding product improvement.

That background mattered because Five9’s next challenge wasn’t convincing the market the cloud was real. It was proving Five9 could become the system of record for customer experience—and then making that system smarter.

Trollope arrived with enterprise DNA and a clear vision: AI wasn’t going to be a feature. It was going to be the platform. Across his Cisco portfolio, he’d used a blend of organic product development, strategic M&A, and major partnerships with companies like Apple and Salesforce. At Five9, that playbook translated into a repositioning: from “cloud contact center” to an “Intelligent CX Platform.”

It wasn’t just a new tagline. It was a shift in where the product dollars went.

AI is unusually well-suited to contact centers because the work is repetitive, measurable, and high-volume. Intelligent virtual agents can resolve routine issues without a human. Agent assist can surface answers and next-best actions while an agent is still on the call. Analytics can spot patterns across massive interaction volumes. Workforce optimization can forecast demand and schedule staffing accordingly. For enterprises, that’s the holy grail: better customer experience at lower cost, with more consistency.

To accelerate that build-out, Five9 leaned on acquisitions. In total, the company has made seven acquisitions spanning areas like customer service software, PaaS, and chatbots. Among the latest were Acqueon, Aceyus, and Inference Solutions—deals that expanded Five9’s capabilities in areas like intelligent virtual agents, analytics, and workforce optimization, and helped round out the platform into something broader than “just” routing calls.

Then the world changed.

COVID-19 turned contact centers from a back-office cost center into the primary lifeline between businesses and customers. As Trollope put it at the time, contact centers became the “only front door” for businesses forced to close offices and stores. And because Five9 was web-based, agents could log in from home—fast.

In April 2020, Five9 launched its FastTrack Program to help enterprises move to a work-from-home contact center model quickly. “Five9 is proud to launch our Five9 FastTrack program to deliver unwavering support to businesses, their customers and their employees,” said Dan Burkland, Five9 President. In some cases, Five9 could provision lines and have agents ready to answer in as little as 24 hours. “Now is the time that we are able to demonstrate the quick agility and scalability that the cloud offers,” Burkland said.

The pandemic didn’t create the cloud migration. It compressed it.

Companies with on-prem systems were suddenly trying to do the impossible: make office-bound infrastructure behave like a web app. Five9’s cloud-native model, built for remote access by design, became a competitive weapon. The company posted a record-breaking second quarter in 2020, with revenue of $99.8 million, up 29%. The momentum continued into the third quarter, with revenue rising 34% year over year to a record $112.1 million.

Underneath those numbers was the bigger shift: the contact center wasn’t just where problems got solved. It was where the brand showed up. Five9 believed the transition from on-prem to cloud—and the push toward digital transformation—would keep accelerating, and that demand for AI-driven automation would rise with it.

By 2021, Five9 had emerged as one of the clear leaders in cloud contact centers. Revenue grew to $550 million, up from $434.9 million in 2020. Investors noticed, and the stock soared—reaching an all-time high closing price of $209.70 on August 4, 2021.

In two decades, Five9 had gone from survival mode to market leader. And now, it had something else: the kind of strategic value that makes larger platforms start circling.

VII. The Zoom Deal That Wasn't: M&A Drama (2021)

In July 2021, Zoom dropped a bombshell: it planned to acquire Five9 in an all-stock deal valued at $14.7 billion. It would have been Zoom’s first acquisition over a billion dollars—and at the time, the second-largest tech deal announced that year.

Zoom Video Communications, Inc. announced on July 18, 2021 that it had reached an agreement to buy Five9 at a transaction equity value of $14.7 billion, representing a 13% premium.

On paper, the logic was hard to argue with. Zoom owned the modern video meeting. Five9 owned the modern cloud contact center. Put them together and you get an end-to-end communications stack: internal collaboration on one side, customer engagement on the other—moving customer service from traditional call centers to omnichannel, cloud-based experiences.

Zoom also had a very practical motive: it wanted to be less dependent on video and audio meetings. Executives told analysts that, with Five9’s contribution, Zoom saw a much larger total addressable market ahead—$91 billion by 2025, up from $34 billion in 2019.

And then the deal started to wobble.

The biggest problem was the same thing that made the headline number look so huge in the first place: it was all stock. Zoom’s shares had run up dramatically, but by the time shareholders were evaluating the merger, that stock was no longer soaring. On the day the deal was announced, Zoom traded around $360 per share. By September, it was closer to $260. As Zoom’s share price fell, the effective value Five9 shareholders would receive fell with it.

At the same time, scrutiny was rising. A branch of the U.S. Department of Justice reviewed the transaction over concerns about potential foreign participation, according to a letter dated August 27 that was sent to the Federal Communications Commission.

But the decisive force was shareholder confidence—or the lack of it. Many Five9 investors concluded the offer no longer reflected the company’s value, especially given that the consideration was Zoom stock. The situation tipped further when ISS, the influential proxy advisory firm, recommended that Five9 shareholders vote no and even consider other potential buyers. As Barron’s reported, ISS warned that the merger would expose Five9 holders to “a more volatile stock with a growth outlook that has become less compelling as the world begins to move past the pandemic.”

On September 30, 2021, Five9 announced the merger agreement had been terminated by mutual agreement after it failed to receive enough shareholder votes to pass. Five9 stayed independent and continued operating as a standalone public company.

The collapse was revealing. Five9 shareholders were effectively saying: we think this asset is worth more—and we don’t want to be paid in a currency that’s sliding. It also underscored something bigger about the category: contact centers had become mission-critical infrastructure with premium strategic value. And, hovering over everything, it showed how much more complicated large tech deals were becoming under increasing regulatory attention.

Notably, the relationship between the two companies didn’t vanish. Five9 continued its partnership with Zoom from before the acquisition attempt, including integration support between their UCaaS and CCaaS products and joint go-to-market efforts.

For Five9, the failed deal was arguably a gift. It got the validation—being “the company Zoom tried to buy”—without losing control of its roadmap. But the next wave was already forming, and it wasn’t about cloud migration anymore.

It was generative AI.

VIII. The Generative AI Revolution & Five9's Response (2022–Present)

Rowan Trollope announced his resignation from Five9 on October 10, 2022, effective November 28, 2022. He was leaving to become CEO of Redis, a privately held, pre-IPO company outside the CCaaS world.

That put the spotlight back on the leader who’d guided Five9 through its most important climb.

Mike Burkland explained the context for his return: “When I was diagnosed with cancer in 2017, I resigned from the CEO post to focus on my health while remaining very close to the business as Chairman. Now, following successful treatments, I am pleased to report that my doctors have given me a favorable long-term prognosis.”

Effective November 2022, Burkland stepped back into the CEO role—back on the field with the team.

His timing was almost poetic, because Five9 was about to face the biggest platform shift since cloud itself: generative AI. ChatGPT launched in November 2022 and instantly moved AI from “someday” to “right now.” For contact centers, it wasn’t just another feature wave. It raised an uncomfortable, existential question.

If AI can understand natural language, carry a conversation, and resolve real customer issues, what happens to the human agents who do that work today? And if agent headcount shrinks, what happens to the per-seat economics that have powered CCaaS for a decade?

Five9’s answer has been to lean in—but with a clear posture: augmentation first, automation second. In August 2024, Five9 announced the latest addition to the Five9 Genius AI Suite, including a four-step Five9 Genius AI process designed to help companies identify high-value AI use cases, implement and deploy them quickly, and realize ROI sooner, with support from Five9 experts.

The company positioned its growing “Genius AI” portfolio as the shift from “grunt technologies” to “generative technologies”—tools meant to reduce the time and cost it takes to improve customer experience, not just add a shiny new layer.

Underneath the branding, Five9 framed its AI strategy around four tenets: Embedded, Practical, Engine-Agnostic, and Responsible AI. “Embedded” is the core bet—AI capabilities integrated directly into the platform, not bolted on as a separate product.

In March 2024, Five9 launched GenAI Studio, which lets organizations take off-the-shelf generative models and customize them to the specific needs of their contact center.

In October 2024, Five9 announced it had again been positioned by Gartner as a Leader in the Magic Quadrant for Contact Center as a Service, recognized for both Completeness of Vision and Ability to Execute.

Operationally, the company pointed to results that matched the narrative. Five9 reported 2024 annual revenue exceeding $1 billion, with fourth-quarter revenue growth accelerating to 17%, driven by subscription revenue growth of 19%. It also reached an all-time record adjusted EBITDA margin of 23%. Five9 said AI traction continued to build, including enterprise AI revenue growth of 46% year over year in the fourth quarter.

But 2024 also made clear how unforgiving the public markets can be—even when the product story sounds right. Five9’s share price fell 47% year-to-date, despite continued double-digit revenue growth in a crowded market. Earlier in the summer, the company said it was aiming to drive “shareholder value” by laying off approximately 180 employees by the end of 2024.

And then came the activists.

On July 11, Reuters reported that Anson had acquired a position in Five9. The report noted Five9 as a cloud-based contact center software provider and a leader in the space, describing it as the only pure-play cloud contact center provider, with peers inContact and Genesys owned by NICE and Permira.

By December 2024, Five9 reached a settlement with Anson Funds Management after Anson and other activist investors pushed for changes to boost the share price. Under the terms being discussed, Anson portfolio manager Sagar Gupta would receive a board seat.

That became official in December 2024, when Sagar Gupta, a portfolio manager at Anson Funds, joined Five9’s Board of Directors. His appointment followed Anson’s increased investment and its advocacy for strategic considerations, including a potential sale.

Meanwhile, another leadership shift was set in motion. Mike Burkland, CEO and Chairman, is set to transition to Executive Chairman of the Board effective July 31, 2025, with Bryan Lee appointed as CFO on the same date. It’s the latest signal that Five9 is still adjusting its leadership and posture as the market, the technology, and investor expectations all shift at once.

IX. Business Model & Unit Economics Deep Dive

At its core, Five9 is a classic enterprise SaaS business: customers subscribe to the platform, typically priced per agent seat, and then pay additional consumption-based fees as they add higher-value capabilities. It’s a model built for predictability—recurring revenue, high retention, and a natural path to expansion once Five9 becomes embedded in day-to-day operations.

What’s changed over time isn’t the model. It’s the customer.

Five9 is now overwhelmingly an enterprise company. The enterprise segment represents about 90% of total revenue—up from roughly 60% at the time of the IPO. That’s the clearest signal that the upmarket migration worked. Five9 has also steadily deepened its footprint with very large customers, growing from just a handful of $1 million-plus ARR customers at IPO to 211 by Q4 2024.

In subscription businesses, retention is oxygen. For Five9, it has stayed solid: the Last Twelve Months Dollar-Based Retention Rate was 107% in Q1 2025. In plain terms, that means the average customer is spending more than they did a year ago—by adding seats, adopting new products, or expanding into new teams and geographies. And in a contact center, that “land and expand” motion is especially powerful: once a platform is working, companies tend to consolidate more interactions and more channels onto it.

The other engine here is operating leverage. Over the years, Five9’s adjusted gross margin expanded from 51.5% in Q2 2014 to 63.0% in Q2 2025. Over that same window, non-GAAP operating expenses as a percentage of revenue fell from 79.3% to 39.0%. Put together, that’s the story of a cloud platform getting more efficient as it scales—enough for Five9 to move from an adjusted EBITDA margin of -27.8% at IPO to 24.0% in Q2 2025.

A big driver is mix: as the platform adds more software-heavy capabilities—like AI and analytics—the economics improve. Infrastructure costs can be spread across a larger customer base, while the higher-margin parts of the product become a bigger share of what customers buy.

Looking forward, Five9 projected full-year 2025 revenue of $1.140 billion to $1.144 billion. Its medium-term operating model targets 10–15% annual revenue growth by 2027, with adjusted gross margins of 66–68%+ and adjusted EBITDA margins of 25–30%+.

Distribution matters just as much as product in enterprise software, and Five9’s go-to-market blends direct sales with channel partners and strategic alliances. Salesforce remains the foundational relationship, but Five9 has also built partnerships with platforms like ServiceNow and Microsoft. These alliances don’t just create integration benefits—they open doors, reduce friction in procurement, and shorten sales cycles when a buyer can connect Five9 to systems they already run.

In 2024, Five9 achieved Summit status with Salesforce, becoming only the second CCaaS vendor to do so. That deepened the partnership into joint strategy sessions and roadmap planning—especially meaningful given a shared customer base of more than 1,200 with Salesforce.

Then there’s the newest variable in the model: AI.

AI brings both upside and uncertainty, because it can increase platform value even as it potentially reduces the number of human seats. Five9 said AI represented 9% of enterprise subscription revenue, and more than 20% of new-logo Annual Contract Value bookings included AI components. And in the deals that matter most—new customer wins exceeding $1 million in ARR—AI wasn’t optional; it was virtually always part of the package.

X. Strategic Analysis: Porter's 5 Forces & Hamilton's 7 Powers

Porter's 5 Forces Analysis

Threat of New Entrants (MODERATE-HIGH)

On the surface, the barriers to building a “contact center platform” have never been lower. Cloud infrastructure is cheaper and more accessible than it was even a few years ago, and AI has become table stakes: about 70% of organizations say AI integration is essential to improve customer interactions and operational efficiency. That demand signal pulls new builders into the market.

But getting a prototype running is not the same as winning enterprise trust. Real contact centers sit on sensitive data, live inside regulated environments, and can’t go down. Buyers expect compliance for regimes like HIPAA and PCI, and they want near-perfect uptime. And hovering over all of that are the hyperscalers—AWS, Google, Microsoft—showing up with native options like Amazon Connect and the resources to compete aggressively.

Bargaining Power of Suppliers (LOW-MODERATE)

Five9 relies on cloud infrastructure providers—primarily AWS—but it has maintained multi-cloud capability, which helps keep any single provider from having too much leverage.

The supplier landscape is shifting, though, because AI introduces a new dependency layer. Model providers like OpenAI, Anthropic, and Google can gain power if customers insist on specific engines or capabilities. Meanwhile, telecom carriers for voice remain largely commoditized.

Bargaining Power of Buyers (MODERATE-HIGH)

Enterprise buyers have plenty of options. Five9 competes against a deep bench: Genesys, Talkdesk, NICE, Avaya, RingCentral, Vonage, 8×8, 3CX, Verint, Twilio, UJET, and JustCall.

Switching isn’t painless, but it’s also not impossible. A migration can take 12 to 18 months, which creates real friction—yet it’s still a project many enterprises will undertake if they believe the next platform will save money or unlock better outcomes. And as AI promises to lower total cost of ownership, buyers get more confident pushing for price concessions.

Threat of Substitutes (HIGH)

This is the existential pressure in the entire category. If generative AI can handle customer interactions end-to-end, the “traditional” contact center starts to look like a transitional layer.

Five9’s strategy is to build these substitutes into its own platform—so the platform becomes the place where AI automation happens, not what AI replaces. But the risk remains: AI-native solutions could leapfrog legacy CCaaS patterns entirely, especially if they can deliver faster time-to-value with fewer moving parts.

Competitive Rivalry (HIGH)

Rivalry is intense, and the market is crowded with capable vendors. The top five providers control about 61% of the market, with Five9 at 16% and Genesys at 13%.

Perception and validation matter here, and Gartner has been a key arena for that. In August 2023, Genesys was recognized as a Leader in Gartner’s CCaaS Magic Quadrant for the ninth time, and Five9 was also named a Leader—reinforcing Genesys as the primary competitor and alternative in many enterprise evaluations.

Hamilton's 7 Powers Analysis

1. Scale Economies (MODERATE)

There are scale benefits in cloud contact centers: infrastructure costs improve with volume, and R&D gets amortized across a larger customer base. But this isn’t a business where scale becomes an unassailable moat. With enough capital, competitors can build similar scale.

2. Network Effects (WEAK-MODERATE)

Customers don’t directly create value for each other the way they do in a marketplace. The closest thing to a network effect is indirect: the partner ecosystem and integrations. More integrations makes the platform more useful, which attracts more customers, which attracts more partners.

There’s also a potential data flywheel: interaction data could improve AI performance. But that only becomes defensible if it turns into meaningfully better outcomes customers can measure.

3. Counter-Positioning (HISTORICALLY STRONG, NOW FADING)

Five9’s original advantage was textbook counter-positioning: it was cloud-only while legacy vendors were tied to on-premise hardware and couldn’t easily cannibalize their own businesses.

That gap has narrowed. The incumbents have cloud offerings now, and the old “pure-play cloud vs. legacy” framing doesn’t win by itself. The new counter-positioning is about being AI-first versus simply being cloud-based.

4. Switching Costs (MODERATE-HIGH)

Switching costs are real because contact centers are mission-critical. Migrations can’t disrupt operations, and the platform is deeply integrated with CRMs, workforce management, and analytics systems.

Still, these switching costs are not as absolute as core systems like ERP or databases. Enterprises will move if the ROI is compelling enough.

5. Branding (MODERATE)

Five9’s brand is strong where it matters: among enterprise buyers looking for reliability and a proven platform. It’s not consumer-facing, so “brand” here means trust, references, and track record.

At the same time, it competes against heavyweight brands like Genesys and NICE and against newer entrants like Talkdesk that push aggressive marketing and positioning.

6. Cornered Resource (WEAK-MODERATE)

Five9 doesn’t have a single patented secret that locks the market out. The most meaningful advantages are human: talent, domain expertise, and the accumulated know-how of building and operating complex contact centers.

Customer data could become a cornered resource if it’s used to build proprietary AI capabilities that translate into better models and better outcomes—but that advantage isn’t automatic.

7. Process Power (MODERATE)

Process power shows up in the unglamorous stuff: enterprise deployment experience, implementation playbooks, and the operational muscle to run reliable, compliant systems at scale. Compliance expertise across frameworks like HIPAA, PCI, and SOC 2 is also an accumulated advantage that’s hard to replicate quickly.

Overall Assessment:

Five9’s strongest powers are switching costs and the residue of its historical counter-positioning. Its weakest are network effects and cornered resource. AI is the swing factor: it can help Five9 create new defensibility through data and model quality, or it can open the door for AI-native competitors to redefine what the category even is.

XI. The Competitive Landscape & Bear vs. Bull Case

Key Competitors

Genesys Cloud: The heavyweight rival in most enterprise bake-offs. Genesys positions itself around “experience orchestration,” offering Genesys Cloud CX, an API-first platform that blends conversational, predictive, and generative AI. As of August 2023, Genesys Cloud CX served more than 5,000 clients across 100+ countries.

NICE CXone: NICE brings scale and breadth, with a full contact center suite spanning self-service and agent-assisted CX. As of September 2023, NICE served more than 25,000 organizations in 150+ countries, including 85 of the Fortune 100.

Talkdesk: One of the best-known independent cloud challengers, positioned as an AI-powered CCaaS provider for enterprises of all sizes, with customers in 100+ countries.

Hyperscalers: Amazon Connect, Google CCAI, and Microsoft (through partnerships) are the “good enough, already bundled” threat. For enterprises standardizing on a cloud stack, the appeal is straightforward: tighter integration, simpler procurement, and often a lower effective price.

AI-Native Startups: New entrants like Sierra and PolyAI are built around the idea that the interface to customer service is shifting from menus and queues to natural conversation—systems designed AI-first, not retrofitted.

Bull Case

The bull case starts with the size of the prize. The global CCaaS market was valued at $6.02 billion in 2024 and is projected to grow to $23.33 billion by 2032, implying an 18.40% CAGR over that period.

That kind of growth supports a very plausible “everything goes right” story for Five9:

-

Long runway for cloud migration: Even after years of adoption, plenty of contact centers still run on-prem. The migration isn’t over; it’s just moved from early adopters to the next wave of large, complex enterprises.

-

Mission-critical staying power: Contact centers aren’t going away. Companies may change channels and automate more, but the need to serve customers doesn’t disappear. The battle is over who owns the platform.

-

AI transformation partner: Five9’s bet is that enterprises don’t want a point solution for AI; they want a trusted vendor to weave AI into the messy reality of customer operations. Five9 pointed to enterprise AI revenue increasing 32% year-over-year in Q1 2025 as evidence that customers are buying into that roadmap.

-

Strong customer base: In 2024, Five9 secured what it described as its “largest deal ever”: an agreement with a Fortune 50 U.S. bank serving 70 million customers globally. Five9 said the deal is expected to contribute more than $50 million in ARR over the coming years.

-

Financial momentum: The model has become more profitable as the company scales, with improving margins supporting the argument that Five9 can grow without permanently living on “next year’s profitability story.”

-

M&A potential: As a remaining pure-play cloud contact center provider, Five9 still fits as a strategic asset for potential acquirers like ServiceNow, Salesforce, and Zoom.

Bear Case

The bear case is simpler, sharper, and harder to ignore:

-

AI disruption risk: If generative AI agents take over a meaningful share of customer interactions, the entire per-seat pricing foundation of CCaaS gets pressured. Even if Five9 “wins” technologically, the unit of monetization could shrink.

-

Intense competition: Five9 is fighting on two fronts—hyperscalers pushing bundled, lower-price options, and large suites like Genesys and NICE pushing scale, features, and enterprise relationships.

-

Commoditization: As vendors converge on similar “feature-complete” checklists, differentiation becomes harder, and price pressure rises.

-

Macro sensitivity: In downturns, customer service budgets get scrutinized. Enterprises may delay migrations, reduce expansion, or push vendors to do more for less.

-

Technology transitions: AI-native platforms are being built without the architectural baggage of traditional CCaaS. If that approach delivers faster outcomes with fewer moving parts, incumbents can get leapfrogged.

-

Valuation pressure: Public markets have already punished the stock. As of December 24, 2025, Five9 closed at $19.71, down more than 90% from its all-time high close of $209.70 on August 4, 2021.

Key KPIs to Monitor

For investors tracking Five9, three metrics tell you whether the story is compounding—or quietly breaking:

-

Dollar-Based Retention Rate (DBRR): The clearest read on expansion versus contraction inside the installed base. At 107%, it indicates customers, on average, are still growing their spend. A sustained drop below 100% would be a red alert.

-

Enterprise AI Revenue Growth: A direct signal of whether Five9 is monetizing the AI shift. Enterprise AI revenue growth of 42% year-over-year in Q2 2025 suggests adoption is real, not just marketing.

-

Adjusted EBITDA Margin: The proof that this is a durable SaaS business, not a treadmill. Five9’s adjusted EBITDA margin improved from -27.8% at IPO to 24.0% in Q2 2025. If margins keep expanding while growth holds, the model works. If not, the market will keep demanding a different ending.

XII. Lessons & Reflections: The Playbook

For Founders

Timing isn't everything: Five9 was born into the wreckage of the dot-com implosion—about as bad a launch window as you can imagine. It survived anyway by staying lean, staying close to customers, and outlasting better-funded peers. Timing can hurt you. It doesn’t have to kill you.

Platform thinking matters: The Salesforce partnership wasn’t just a nice integration. It was a distribution engine and a credibility bridge into the enterprise. Five9 didn’t win only by building features—it won by showing up exactly where customer workflows already lived.

Mission-critical wedge creates durability: Contact centers aren’t “nice to have.” They are the front line where revenue is saved, churn is prevented, and brands either earn trust or lose it. Once you’re embedded in that workflow, you’re not easy to rip out.

Ride secular waves: Five9 didn’t try to drag the market forward by sheer will. It stayed pointed at the big waves—first cloud adoption, then AI—and made sure the company would still be standing when those waves finally arrived.

Leadership matters at different stages: Five9’s story is also a story of CEO-fit. Mike Burkland joined in January 2008 and led the company through its enterprise push and IPO in 2014, then transitioned to Chairman in December 2017 before returning as CEO in November 2022. Rowan Trollope brought enterprise-scale instincts and an AI-centered vision for the 2018–2022 chapter. Different phases demanded different strengths—and Five9 treated leadership as a strategic lever, not a title.

For Investors

Long-term orientation required: Five9’s initial funding commenced April 28, 2004, and the company took roughly 13 years from founding to IPO. Category shifts like “move the contact center to the cloud” don’t resolve on startup timelines. They resolve on enterprise timelines.

Follow the workload: The biggest wins often come from watching where mission-critical work is migrating. Enterprise workloads moving to the cloud was slow—but it was massive and directionally clear. If you’re right about the workload, you don’t need to be right about every quarter.

Network effects aren't everything: Five9 didn’t build a consumer network. It built a sticky system. Switching costs, integrations, reliability, and execution can be just as powerful as viral loops.

Category leadership provides durability: In enterprise software, being in the top tier changes your odds. You get more deals, more references, and more “safe choice” momentum than the long tail ever will.

Technology risk is real: AI isn’t just another module you upsell. It could reprice the whole market if automation reduces the need for human seats. The contact center of 2030 may not resemble the one that built Five9’s economics in the first place.

Valuation matters: Five9’s multiple expanded and contracted dramatically—at times trading around 3x, then 30x, then 10x revenue. The business can execute and still produce wildly different investor outcomes depending on what you paid.

Surprises

The Zoom deal collapsing may have been the best outcome for Five9 shareholders. It validated Five9’s strategic value without taking away the company’s independence—or its ability to benefit from future optionality.

The cloud migration took far longer than most people expected. Enterprises didn’t move contact centers to the cloud in a few years. It took more than a decade, and the lag was the story.

Contact centers turning into an AI battleground wasn’t obvious until generative AI arrived. Before ChatGPT, “AI in the contact center” meant IVR trees and basic chatbots. After it, the question became whether human agents are the permanent center of the model—or a transitional phase.

And finally, the resilience: even in a market packed with competitors, enterprises kept paying for reliability, integrations, and execution. In contact centers, “works every day” is still a feature customers will pay a premium for.

XIII. Epilogue: What's Next for Five9?

Agentic AI forces the question that hangs over the whole category: ten years from now, will there still be human agents in contact centers at all?

Five9 argues the opportunity is bigger than “moving call centers to the cloud.” In its framing, AI expands the total addressable market from roughly $24 billion for cloud contact center software to $234 billion once you include the labor spend inside contact centers—the part AI can potentially optimize, automate, or replace.

That framing is revealing, because it defines the win condition for Five9’s next decade. The company has to capture value from the AI transformation—either by becoming the platform enterprises trust to deploy AI agents at scale, or by getting leapfrogged by AI-native competitors that do it faster and cleaner.

The strategic menu is the classic one: build, buy, or partner. Five9 launched Five9 Fusion, a new native integration with Salesforce, and expanded collaborations with ServiceNow, Google Cloud, and IBM. The intent is straightforward: embed deeper into the systems enterprises already run, and make AI-powered customer experience feel like a platform upgrade, not a risky science project.

But another question sits just beneath the product roadmap: integration at the company level. Does Five9 eventually get acquired by Salesforce, Microsoft, or private equity? The company already proved it can attract huge strategic interest. It turned down an acquisition offer from Zoom Video Communications in late 2023, and the logic that made Five9 valuable in 2021 hasn’t disappeared—if anything, AI has made “own the customer conversation” even more important.

Growth, meanwhile, won’t come only from bigger U.S. enterprise deployments. International expansion remains a meaningful opportunity, but management reported resistance among some international customers to U.S. vendors, driven largely by geopolitical factors. They indicated this was more pronounced with new logo opportunities than within the existing customer base.

Differentiation could also come from going vertical. Industry-specific solutions for healthcare, financial services, and other regulated environments can be a way to win where horizontal platforms struggle—because in contact centers, compliance and workflow nuance aren’t edge cases. They’re the product.

All of that leads back to the ultimate question: is Five9 a platform that enables the future of customer service, or a transitional technology that gets disrupted by AI? The answer is what determines whether the stock’s 90%+ decline from its peak is an opportunity—or the market pricing in a business model that’s being repriced.

For long-term fundamental investors, Five9 is a clean case study in secular transitions. It rode the cloud migration wave successfully, turning an “internet contact center” idea into an enterprise-standard category. Now it faces the next wave, one that could be even bigger—and even more unforgiving.

Two decades after its founding, Five9 proved cloud contact centers were viable. The next decade decides whether that hard-earned expertise carries into an AI-dominated future—or whether Five9 becomes the kind of company that did everything right for the last transition, and still got outrun by the next one.

XIV. Epilogue & Further Learning

Top Resources for Further Research

-

Five9 Investor Relations — Annual reports, 10-Ks, and earnings transcripts for the clearest view into strategy, financials, and what management thinks matters next.

-

Gartner Magic Quadrant for CCaaS — A yearly snapshot of how the major vendors stack up, and how the category’s definition keeps shifting.

-

Five9 Engineering Blog — A window into how the platform is built, how reliability gets delivered at scale, and how AI features actually get implemented.

-

Industry Analyst Coverage — McGee-Smith Analytics and other contact center specialists offer grounded perspective on vendor positioning, customer adoption, and what’s real versus hype.

-

Salesforce AppExchange — Reviews and documentation that show how contact center software wins in practice: in integrations, workflow fit, and day-to-day usability.

Key Books for Context

- "Crossing the Chasm" by Geoffrey Moore — A useful lens for how Five9 crossed from early adopters into enterprise reality.

- "The Innovator's Dilemma" by Clayton Christensen — The classic playbook for why cloud upstarts can unseat incumbents built around on-prem economics.

- "Zero to One" by Peter Thiel — A framework for thinking about differentiation when the market starts to converge on similar feature sets.

- "7 Powers" by Hamilton Helmer — The strategy toolkit for understanding what advantages actually endure—and which ones fade when the platform shift arrives.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music