Dave: The Fintech Phoenix That Rose From the SPAC Ashes

I. Introduction & Episode Roadmap

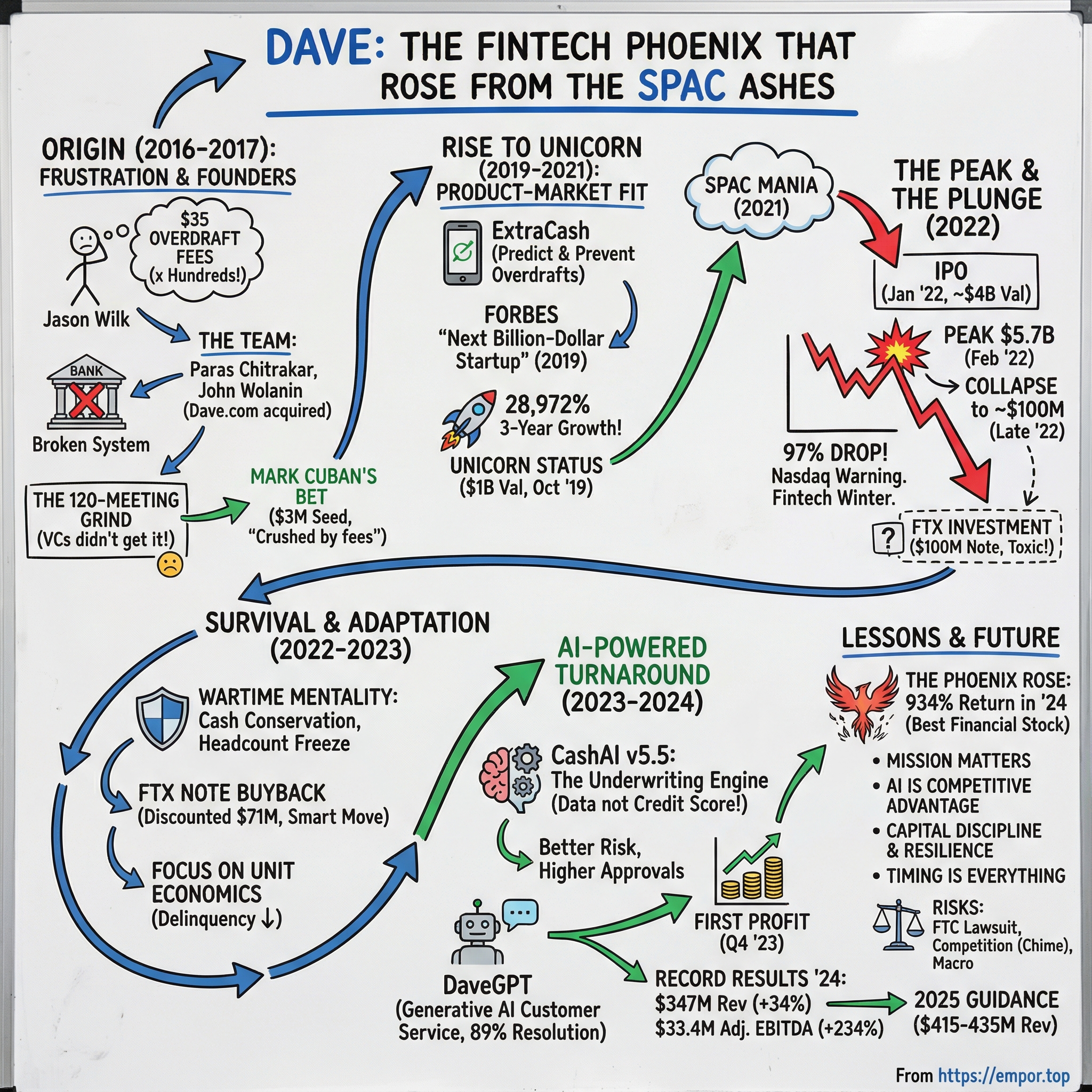

Picture this scene from late 2022: Jason Wilk sits in his West Hollywood office at the Pacific Design Center, staring at a stock chart that would make any founder's heart stop. His company, Dave, which had gone public mere months earlier at a valuation approaching $5.7 billion, now trades at roughly $100 million. A 97% collapse. The Nasdaq has sent warning letters about potential delisting. CNBC headlines scream of fintech winter. Skeptics openly question whether the company will survive.

Fast forward to late 2024, and the same company was crowned the best-performing financial stock in America, delivering a 934% return that year alone. According to CNBC, Dave was the best-performing financial stock in 2024. How does a company go from near-death to resurrection in barely two years?

Dave went public with a market cap of $4 billion; just months later, the company had a market cap of $50 million. The collapse was spectacular—and the recovery even more so. This is not merely a story of stock price gyrations; it's a masterclass in survival, adaptation, and the power of AI-driven transformation in financial services.

Dave Inc. operates as one of America's leading neobanks, best known for ExtraCash, a short-term credit product designed as an alternative to overdraft fees and payday loans. The name itself carries symbolic weight—Dave, as in David versus Goliath—chosen deliberately to invoke the biblical story of the underdog beating giants in combat, referring to how Dave sees itself compared to larger traditional banks.

The company's journey touches on nearly every major theme in modern fintech: the disruption of predatory banking fees, the SPAC mania of 2021, the FTX debacle, the brutal fintech winter of 2022, and the transformative potential of artificial intelligence in credit underwriting. Each chapter offers lessons for investors, entrepreneurs, and anyone seeking to understand how technology reshapes financial services.

What follows is the complete story of Dave—from its origins in frustration with overdraft fees, through a celebrity-backed rocket ship to a near-death experience, and finally to a profitable resurrection powered by machine learning and disciplined execution.

II. The Founders & Origin Story (2016-2017)

The Serial Entrepreneur Who Got Crushed by Fees

Long before Dave existed, Jason Wilk was accumulating both entrepreneurial experience and personal financial frustration. His educational background includes a degree in International Business with a focus on Technology from Loyola Marymount University's College of Business Administration, where he studied from 2003 to 2007. During his time at Loyola Marymount, Wilk also participated in a study abroad program at the University of International Business and Economics in Beijing, China, from 2005 to 2006.

Wilk's entrepreneurial career began early. He began his entrepreneurial journey by founding 1DaySports.com, a retail website for golf equipment, which was acquired in 2008. This early exit gave him credibility and capital to pursue bigger ambitions. In April 2010, Jason founded WriteyBoard, an international whiteboard and furniture solution for startup companies and small businesses, and prior to that, from January 2010 to July 2016, Jason founded and served as Chief Executive Officer of AllScreen.TV, a technology platform that enabled large media outlets to syndicate their digital content to over 500 publishers.

AllScreen.TV was ranked number twenty-nine on Inc. 5000's list of fastest-growing companies in 2015. After AllScreen was acquired for $85 million in 2015, the founders had money in their pockets—and Wilk still had his bone to pick with the U.S. banking system.

The frustration was deeply personal. Wilk continually found himself paying overdraft fees, hundreds of them dating back to his high school days. Eventually the experience helped form the idea for Dave, which aimed to help customers avoid similar difficulties. Even as a successful founder, Wilk remembered the sting of those $35 charges accumulating. "Shortly after college, Wilk started two companies in quick succession, including one that made a nifty peel-and-stick whiteboard called WriteyBoard. At times during that period he needed to cap his salary at $30,000. 'I was sleeping on people's couches and trying to make it work,' he says."

Assembling the Team

With the AllScreen exit complete, Wilk looked at his co-founder Paras Chitrakar and saw a shared mission. "He says he looked at his co-founder, Paras Chitrakar, and said: 'We don't have to be so mindful of every penny now. We can go bigger.'"

The two, along with co-founder John Wolanin, a former product lead at online-coupon startup Honey, went for banks. To create a friendly financial-analysis tool that would eventually evolve to include features of traditional banking for individuals, they sought a guy-next-door vibe, and named the venture accordingly: Dave.

The name selection was strategic. "Dave was the name we had originally discussed. It seems we all have a friend named Dave; it was also the easiest to remember and more importantly, spell." In a sea of fintech names with clever wordplay or corporate gravitas, "Dave" felt accessible—a friend who would help you through tough financial times.

Securing the Dave.com domain became a priority. "Dave.com was just a landing page for a design company owned by a nice man named Dave. I had reached out via their contact page a few times over 6 months with no luck. We settled on TryDave.com but as the launch became closer, we knew we could do better." Persistence paid off, and the team eventually acquired the coveted domain.

The 120-Meeting Grind

Despite Wilk's track record, fundraising proved surprisingly difficult. According to Wilk, he had more than 120 meetings with venture capitalists, attempting to get financial support for Dave from investors that do not themselves experience overdraft fees.

"Most VCs have never overdrafted," he says. Even his former backers took some convincing that it was a real problem. He says he and his co-founders had more than 120 meetings before finding a lead investor for its first major funding round.

The disconnect was revealing. Venture capitalists—typically wealthy individuals who had never faced the indignity of a $35 fee for being five dollars short—struggled to grasp the emotional and financial pain of Dave's target customer. This would become a recurring theme: Dave's mission resonated with people who lived the problem, not those who analyzed it from spreadsheets.

Mark Cuban's Bet

The breakthrough came from an unexpected ally who understood overdraft pain firsthand. Shark Tank star Mark Cuban led a $3 million seed investment round in the company, saying he was crushed by overdraft fees in his twenties. The CEO of Dave, Jason Wilk, was the former creator of AllScreen, a company which was also originally funded by Cuban, who put in a $300,000 investment.

When asked why he invested, Mark Cuban says "I got crushed by overdraft fees in my 20s. For anyone who wants to be successful, I always advise to cut down on useless expenses and save money. Overdraft fees are the definition of useless."

Cuban's involvement went beyond capital. His celebrity status and proven business acumen lent credibility to a startup challenging some of the most powerful financial institutions in America. Jason Wilk along with co-founders Dr. John Wolanin, Paras Chitrakar and Zack Martinsek raised $3 million by high profile investors including Mark Cuban, SV Angel, The Chernin Group, Jonathan Kraft, Skip Paul, Diplo and others.

The thesis was clear: banks had built a business model that punished their most vulnerable customers. "Banking is supposed to be free in this country!" Jason Wilk said. He set out to build a financial-analysis tool with a friend-next-door vibe. The revolution was underway.

III. The Overdraft Fee Problem & Product-Market Fit (2017-2019)

Anatomy of a $35 Billion Heist

To understand Dave's opportunity, one must first understand the sheer scale of America's overdraft fee industry. In the 1990s and early 2000s, with the rise of debit cards, institutions began raising fees and using exemptions to churn high volumes of overdraft loans on debit card transactions. Annual overdraft fee revenue in 2019 was an estimated $12.6 billion.

Large financial institutions typically charge $35 for an overdraft loan, even though the majority of consumers' debit card overdrafts are for less than $26, and are repaid within three days. Approximately 23 million households pay overdraft fees in any given year.

The math is staggering. Most overdrafts are less than $26 and are repaid within three days. That means overdraft protection with a typical $35 fee amounts to a loan with a 16,000% APR. No credit card, no payday lender, no loan shark could legally charge such rates—yet America's largest banks collected billions doing exactly that.

The Wall Street Journal reported that consumers spent more than $33 billion on overdraft charges in 2016, citing data from research firm Moebs Services. That's the highest rate since 2009.

The burden fell disproportionately on those least able to bear it. "The CFPB found nearly twice as many consumers with incomes between $35,001 and $65,000 were charged overdraft and NSF fees (35%), versus consumers with incomes between $100,000 and $175,000 (18%)."

Dave's Initial Product

Dave's approach was elegantly simple: predict overdrafts before they happen and provide small advances to prevent them. For $1 a month, the app syncs with customers' checking accounts to monitor their spending habits and predict when they're at risk of overdrawing their accounts.

"Upon connecting any checking account, Dave instantly analyzes trends from an individual's bank history and displays their '7 Day Low', a number which represents the lowest Dave forecasts your account balance will get in the next week. 'We invented this new type of account balance because a current balance just doesn't mean anything if your Netflix bill is due tomorrow and your rent check is going to be cashed tonight.'"

When a predicted overdraft loomed, Dave offered advances of up to $250 at no interest. "If a user's '7 Day Low' is negative, Dave offers a unique borrowing capability. Users can advance up to $250 of their upcoming paycheck to get their balance back into a position that will keep them safe until they are paid next. Instead of charging interest, Dave lets its users decide what is fair to pay with an optional donation to the company."

The tip-based model was novel but not without critics. A watchdog group expressed concern over the tip system. National Consumer Law Center associate director Lauren Saunders says consumers may feel compelled to tip, even with the company offering assurances it's not necessary. "I suspect that it may not end up being so voluntary, or the tips could really add up."

Early Traction and the Apple Boost

The product resonated immediately. The Dave app was named Apple's App of the Day in April 2017, generating a surge of downloads and attention. The combination of a sympathetic problem, celebrity backing, and genuine utility created viral momentum.

Five years after launching, Dave had 10 million members—1.5 million of whom paid for banking through the company, which made most of its revenue through credit card interchange fees, as well as from referral fees through a gig-employment-finding tool called Side Hustle.

Banking Partnership & Expansion

In 2019, Dave expanded from an overdraft protection app into a full-fledged banking service. Dave launched banking services in 2019, through a partnership with Evolve Bank & Trust.

The partnership with Evolve Bank—a Memphis-based institution willing to work with fintech startups—gave Dave access to FDIC insurance and the ability to offer checking accounts. More critically, it opened a new revenue stream: interchange fees from debit card transactions. Every time a Dave member swiped their card, Dave earned a small percentage of the transaction.

It has a side job search service called SideHustle, and the company's "Sharing Economy Jobs Committee" is also committed to helping improve the financial situation of gig workers.

Dave was no longer just preventing problems—it was becoming the primary banking relationship for millions of Americans who felt poorly served by traditional institutions.

IV. Reaching Unicorn Status (2019-2021)

Forbes Recognition and Validation

By mid-2019, Dave had achieved what most fintech startups only dream about. The company's growth trajectory caught the attention of major business publications. In July 2019, Forbes named Dave one of the next billion-dollar startups, validating the thesis that helping underserved Americans manage their finances could build massive value.

Dave is taking on the banking Goliaths, with an astounding three-year growth rate of 28,972 percent. Growth rates of this magnitude are vanishingly rare—nearly 29,000% over three years meant Dave was doubling and redoubling at breakneck speed.

In October 2019, Dave officially achieved unicorn status with a $1 billion valuation and more than four million users. For a company that had launched just two years earlier with $3 million in seed funding, the acceleration was remarkable.

Victory Park Capital and the Financial Backing

The largest investor in Dave's growth story was Victory Park Capital, a Chicago-based global investment firm. Victory Park brought both capital and credibility to Dave's mission. The business had $122 million in revenue in 2020, and an astounding 28,972 percent three-year growth rate that earned it the No. 5 spot on the Inc. 5000.

The Product Evolution: ExtraCash Becomes the Engine

By 2021, Dave's flagship ExtraCash product had evolved from a simple overdraft-prevention tool into something more ambitious. ExtraCash offers members up to a $200 cash advance at no interest. Other products the app offers are a personal finance tool called Insights, which lets users track their monthly bills, and Side Hustle, which allows members to apply for various part-time jobs, such as working for Uber, Lyft, and Doordash.

In 2021, Dave was ranked the fifth fastest growing company in America on the Inc5000 list. The ranking placed Dave alongside the most explosive growth stories in American business—a remarkable achievement for a company disrupting one of the economy's most entrenched industries.

The numbers told a compelling story: millions of Americans needed affordable access to short-term credit, and Dave had built a machine to serve them. The question now was whether the company could scale that machine—and whether public markets would reward the effort.

V. The SPAC Frenzy & Going Public (2021-Jan 2022)

The SPAC Announcement

The year 2021 represented the zenith of SPAC mania on Wall Street. Special purpose acquisition companies—blank check vehicles that allowed companies to go public without traditional IPO scrutiny—had become the favored exit route for venture-backed startups. The logic was seductive: guaranteed capital, faster timelines, and the ability to share forward-looking projections that would be prohibited in a traditional IPO.

On January 5, 2022, Dave Inc. and VPC Impact Acquisition Holdings III, Inc. announced they had completed their previously announced business combination. The Business Combination was approved by VPCC's stockholders on January 4, 2022. Upon completion, VPCC changed its name to "Dave Inc." and its Class A common stock began trading on The Nasdaq Global Market under the symbols "DAVE" and "DAVEW," commencing January 6, 2022.

The deal gave Dave a $4 billion valuation—extraordinary for a company with roughly $150 million in annual revenue. The implied enterprise value of the deal was $3.6 billion, well above VPC3's stated upper bound for its de-SPAC target, and Tiger alone accounted for $150 million (70+ percent) of the PIPE, representing a third of the overall cash ultimately raised in the transaction.

That investment was part of a larger $210 million private investment in public equity (PIPE) deal, led by New York-based investment firm Tiger Global Management, that would flow into Dave's coffers after its trading debut.

The Impressive Investor Roster

Dave had assembled a remarkable collection of backers. Beyond Mark Cuban's seed investment and Victory Park Capital's continuing support, the company attracted institutional heavyweights including Tiger Global Management, Wellington Management, and Corbin Capital Partners for the PIPE. Other notable investors included Norwest Venture Partners, Section 32, Capital One Financial Corp., the Kraft Group, SV Angel, and the Chernin Group.

The breadth of this investor base suggested widespread conviction in Dave's potential. These were not speculative retail investors but sophisticated institutions with extensive due diligence capabilities.

The Public Debut

The SPAC deal dragged on for months, with Dave eventually going public in January 2022 at a market cap of slightly more than $3 billion—a quarter less in value than it was signaling only weeks before.

There was a several-month-long delay that Dave had to endure for the operation to close. According to Wilk, this was due to increased scrutiny from the U.S. Securities and Exchange Commission, as such deals now often go through several rounds of comments. In a way, Dave paid a price for being lumped in together with 2021's many not-so-great SPAC deals.

Despite the delays, optimism remained high. Personal-finance startup Dave Inc. planned to use the roughly $450 million from its public listing for acquisitions, new products and possible investments in cryptocurrency.

"We do see ourselves over the next couple of years being a consolidator in the space," Dave's CFO said.

The Context: SPAC Mania

Dave entered public markets at precisely the wrong moment. The company was among the first SPACs to complete a merger in 2022, just as the entire asset class began collapsing under regulatory scrutiny and market skepticism.

"If I could have done it all over again, I guess it would have been the same price discovery and guaranteed capital without the name SPAC associated with it, just because it's been unfair," Wilk said, referring to the negative change in the reputation of SPACs.

The timing would prove catastrophic. As the Federal Reserve began signaling aggressive rate increases to combat inflation, the era of cheap money and growth-at-any-cost valuations ended abruptly. Dave was about to become a poster child for the carnage.

VI. The Spectacular Crash (Feb 2022 - Late 2022)

The Peak and the Plunge

What happened next defies easy description. Dave's market capitalization soared to $5.7 billion in February before collapsing as the Federal Reserve began its most aggressive series of rate increases in decades.

In February 2022, Dave, a U.S. challenger bank, was valued at $5.2 billion. By late 2022, Dave's valuation was roughly $100 million.

The scale of destruction was staggering. Dave shares plummeted over 97% since the company went public, mirroring the performance of the broader basket of SPACs. In July, the Nasdaq warned Dave that if its share price didn't improve, it was at risk of being delisted.

"If you told me that only a few months later, we'd be worth $100 million, I wouldn't have believed you," Wilk said.

The FTX Investment—A Double-Edged Sword

In March 2022, as Dave's stock was already cratering, an unlikely savior appeared. Through its FTX Ventures unit, the crypto firm in March invested $100 million in Dave, a fintech company that had gone public two months earlier through a special purpose acquisition company. At the time, the companies said they would "work together to expand the digital assets ecosystem."

With a shared goal of disrupting the U.S. financial system, the two firms formed a strategic partnership in March 2022, which included both the $100 million investment from FTX Ventures in the form of a promissory note as well as plans for Dave to build crypto-related products.

In August 2021, Alameda Research—a crypto trading firm founded by Sam Bankman-Fried—invested $15 million in Dave through a private placement funding deal in advance of the SPAC merger.

The FTX investment provided desperately needed capital at a moment when other funding sources had dried up. But it would soon become a liability of a different sort.

The Fintech Winter

The decline in fintech stock values eclipsed the fall in the Nasdaq after the dot-com crash. It was only marginally less severe than the crypto crash of 2021/22.

The F-Prime index tracking publicly listed fintech companies was down 63% from its peak in July 2021 to its trough in December 2022 vs the 61% fall in the Nasdaq during 14th month of the dot-com bubble. VC funding into fintech fell 80% between Q4 21 and Q2 23, according to CB Insights.

The moves forced an abrupt shift in investor preference to profits over the previous growth-at-any cost mandate and has rivals, including bigger fintech Chime, staying private for longer to avoid Dave's fate.

FTX Collapse and the Scramble for Distance

Then came November 2022 and the spectacular implosion of FTX. Sam Bankman-Fried's crypto empire collapsed in a matter of days, revealing billions in misappropriated customer funds. The FTX Ventures investment in Dave was suddenly toxic.

Dave moved quickly to distance itself from the debacle. The company emphasized that it had not launched any crypto products and that no customer funds were at risk through FTX. But the association with one of the most spectacular frauds in financial history added yet another cloud over the company.

Neither Mysten nor Dave have been linked to any alleged wrongdoing within Bankman-Fried's empire. But the investments appear to be the first identified examples of customer money being used by FTX and Bankman-Fried for venture funding.

By year-end 2022, Dave was trading below $1 per share, its future uncertain, and its once-heralded public market debut looking like a cautionary tale about SPAC excess and unfortunate timing.

VII. The Survival Playbook (2022-2023)

Cash Management and Survival Mode

In November 2022, with Dave's stock trading at pennies on the dollar, Jason Wilk delivered a simple message to investors: the company would survive. "We're trying to dispel the myth of, 'Hey, this company does not have enough money to make it through'," Wilk said. "We think that couldn't be further from the truth."

Dave had $225 million in cash and short-term holdings as of September 30, which Wilk said was enough to fund operations until they were generating profits.

The company adopted a wartime mentality. Expenses were scrutinized. Headcount growth stopped. Every initiative was evaluated through the lens of path to profitability rather than market share gains.

"We have to respect what the market values and we have to respect the need for conserving our cash right now, given that investors are looking for companies that can survive on their own without the need to raise more capital."

"We expect one more year of burn and we should be able to become run-rate profitable probably at the end of next year," Wilk said.

The FTX Note Buyback

One of Dave's smartest survival moves came in early 2024 when it repurchased the FTX promissory note at a significant discount. The U.S. neobank Dave reached an agreement with FTX Ventures to buy back a $100 million promissory note that it had issued in 2022. Friday's announcement reflects Dave's full retreat from the deal in the wake of FTX's catastrophic collapse in November 2022. In a statement, Dave founder and CEO Jason Wilk said the neobank could afford the repurchase of the promissory note at a discounted price of $71 million while continuing to expand.

Dave repurchased the note for a discounted price of $71 million, reflecting a $35 million discount and 67% of the outstanding balance.

The buyback accomplished multiple goals: it removed the FTX association from Dave's cap table, eliminated a future liability, and demonstrated financial strength at a moment when many questioned the company's viability.

Focus on Unit Economics

Throughout the survival period, Dave obsessed over improving the economics of each transaction. The company's CashAI underwriting system—which had been quietly improving since launch—became central to this effort.

In the fourth quarter of 2023, Dave improved its 28-day delinquency rate on cash advances to 2.19%, which is its lowest to date and an improvement from 3.58% in the fourth quarter of 2022.

A 140 basis point improvement in delinquency rates might seem incremental, but in a lending business operating at high volumes, it represented millions of dollars in reduced losses. Every percentage point improvement in credit performance flowed directly to profitability.

VIII. The AI-Powered Turnaround (2023-2024)

CashAI: The Underwriting Engine

The secret weapon in Dave's turnaround was CashAI, a proprietary machine learning system that analyzes cash flow patterns rather than traditional credit scores to make lending decisions. Dave Inc.'s proprietary underwriting engine, CashAI, is an AI-backed tool utilized to assess credit risk and eligibility. This technology is instrumental in improving ExtraCash originations' size and delinquency rates.

CashAI assesses credit risk in real-time through fully automated analysis of cash flow data from Dave members' primary bank accounts.

Wilk said Dave gets between three to 12 months of checking account history from members every time they apply for a cash advance, which is a rich source of data on which to make decisions and train its CashAI model.

The approach represented a fundamental rethinking of consumer credit. Traditional credit scores capture historical patterns of formal debt repayment—mortgages, car loans, credit cards. But Dave's target customers often had thin credit files or poor scores precisely because they had been excluded from traditional credit products. CashAI could see what FICO couldn't: the steady rhythm of paychecks arriving, rent being paid, bills being managed—the daily cash flows of working Americans.

This data scale, combined with the rapid training feedback from ExtraCash, enables Dave to build a competitive moat in consumer credit underwriting.

By September 2025, Dave announced CashAI v5.5, the latest iteration of its underwriting engine. v5.5 nearly doubles CashAI's feature set versus prior models and optimizes around Dave's new fee structure. Given the rapid payback cycle of ExtraCash, v5.5 was refreshed and trained on more than 7 million recent ExtraCash originations that have reached full maturity.

Early results of v5.5 demonstrate more accurate risk ranking, leading to higher average approval amounts, stronger conversion, and lower delinquency and loss rates.

DaveGPT: Customer Service Revolution

In December 2023, Dave unveiled another AI innovation: DaveGPT, a generative AI assistant for customer service. The neobank launched DaveGPT, a gen AI-driven chatbot that can respond to customer inquiries in real-time. The tool, which replaces its DaveBot, is generating an 89% resolution rate.

"It's pretty impressive, based on what we used to have with our DaveBot, which was significantly lower," said Wilk. DaveBot's "rules-based model" would generate canned responses compared to DaveGPT's "more human, large language model approach."

DaveGPT is equipped to answer customer inquiries, set up direct deposits, advance account management, and solve customer issues end-to-end without human assistance. By using Generative AI models, DaveGPT has demonstrated its ability to resolve upwards of 89% of member inquiries.

AI helps fintechs like Dave serve more customers without staffing up. The technology allows Dave to serve its 9 million customers with only 300 employees, Wilk said.

First Profitable Quarter

The turnaround crystallized in Q4 2023 when Dave reported its first profitable quarter as a public company. "2023 was an extraordinary year for Dave, and our results are a testament to the dedication and hard work of our exceptional team. Focused execution of our growth strategy enabled us to surpass our operational and financial objectives, exceeding our updated annual guidance across all metrics, and achieving profitability much earlier than anticipated," stated Jason Wilk.

"Once we're at 2.2 million to 2.4 million members, the company is now profitable," Wilk told investors in June 2023. Later that year, the company hit those targets slightly ahead of schedule, with Dave eking out a small profit for the first time in Q4 2023.

Record Results in 2024

The profitability continued through 2024 with accelerating momentum. Dave Inc. reported strong Q3 2024 results with record revenue of $92.5 million, up 41% year-over-year, marking the fourth consecutive quarter of accelerating growth. The company achieved net income of $0.5 million, a $12.5 million improvement from last year, and Adjusted EBITDA of $24.7 million. Monthly Transacting Members grew 23% to 2.4 million.

For Q4 2024, Dave reported record revenue up 38% year-over-year to $100.9 million, with full year 2024 revenue up 34% to $347.1 million. Q4 Net Income increased $16.6 million year-over-year to $16.8 million, and Adjusted EBITDA increased 234% year-over-year to $33.4 million.

Wall Street's Best Performer

The company's shares, once relegated to the dustbin of SPAC-related disasters, sprang to life. In 2024, Dave Inc.'s shares rose 934%, making it the third-best performer in the Russell 2000 index, behind buy-now, pay-later company Sezzle and just ahead of quantum computing stock D-Wave Quantum.

The turnaround story captured attention across financial media. A company that had lost 97% of its value had returned to deliver nearly 10x returns in a single year. "It was never a business problem. We always had good fundamentals. We just had a really, really unfavorable situation with respect to our cap table; all of our PIPE investors sold out of their position immediately when the market turned."

IX. The Business Model Deep Dive

How Dave Makes Money

Dave's business model combines several revenue streams that together create a differentiated approach to serving underbanked Americans. Unlike traditional banks that rely heavily on net interest margin and fee income, Dave generates revenue through ExtraCash advances, subscription fees, interchange from debit card transactions, and optional tips.

The standout feature of Dave's platform is its cash advance service, which provides short-term payday loans without interest, origination fees, or other traditional charges. Instead, the company generates revenue through expedited service fees, a monthly subscription, and an optional tipping model.

The absence of traditional loan fees requires explanation. Dave structures ExtraCash as a cash advance against future income rather than a traditional loan. This distinction allows the company to avoid certain lending regulations while also differentiating from payday lenders whose triple-digit APRs have drawn regulatory scrutiny.

When members request ExtraCash, they can receive funds instantly for a fee ranging from $3 to $25, or wait 2-3 business days for free standard transfer. The company also offers a $1 monthly subscription for its budgeting tools and financial insights.

Dave's app draws on analysis of past spending patterns and actually prompts the account holder to request an advance. There is no charge for the actual short-term advance. Users are given the option to tip Dave for use of the funds, with a fee being applied for instant transfers. Wilk says that even with the optional tips, customers' cost for the funds is far below $35 overdraft fees. Most customers tip Dave something, reflecting that the relationship saves them, on average, $400 a year in bank overdraft fees.

The ExtraCash Product Economics

The economics of ExtraCash depend critically on credit performance. Every dollar lent carries risk; every delinquent advance reduces profitability. This is why CashAI has become so central to Dave's success.

Dave reported a 33-basis-point or 18% year-over-year improvement in its 28-day delinquency rate, over which a 46% expansion was observed in ExtraCash originations. The underwriting engine leveraged insights and performance data to reduce the percentage of provision for credit losses to originations to 0.69% from the year-ago quarter's 0.94%.

The efficacy of the CashAI underwriting engine is reflected in the strong engagement with ExtraCash originations, which rose 46% year over year to more than $1.5 billion. Despite a seasonally soft quarter, CashAI was able to profitably underwrite larger numbers of Dave members for higher ExtraCash approval amounts.

Key Metrics and User Behavior

Monthly Transacting Members increased 18% to 2.3 million. This is the third consecutive quarter of accelerating revenue growth, fueled by ARPU expansion.

In Q2 2024, new members totaled 716,000 while customer acquisition costs decreased 26% to $15. ExtraCash originations increased 37% to $1.2 billion, while the average 28-Day delinquency rate improved 80 basis points to 2.03%.

The high-frequency usage patterns among Dave's most engaged members create a flywheel effect. Each advance generates data that improves CashAI. Better underwriting enables higher approval amounts. Higher approvals drive member satisfaction and retention. Retention reduces customer acquisition costs. Lower costs improve profitability. Profitability enables investment in better AI. And the cycle continues.

X. Competitive Landscape Analysis

The Cash Advance App Ecosystem

Dave operates in a crowded and rapidly evolving market for earned wage access and short-term credit products. Competitors range from other fintech startups to features embedded within larger platforms.

Major players in the space include Earnin, Brigit, MoneyLion, Albert, Empower Finance, and others. Many of these companies offer similar value propositions: access to wages before payday, budgeting tools, and attempts to help users avoid overdraft fees at traditional banks.

However, the most formidable competition comes not from direct cash advance rivals but from larger neobanks offering comprehensive banking alternatives.

Chime: The Gorilla in the Room

Chime has about 25 million customers, 8.7 million of which are considered active. Chime made $1.6 billion in revenue in 2024, a 30.6% increase on the previous year.

Chime serves 8.6 million active customers (Q1 2025), 67% of whom use it as their primary bank.

The scale differential was significant. Chime's revenue of $1.6 billion dwarfed Dave's roughly $350 million. Chime made about $251 per active member, with an 88% gross margin.

Alongside fee-free mobile banking, Chime also offers a $200 overdraft for free and access to over 60,000 ATMs for free. Other features include receiving a paycheck two days early and a credit builder service.

Chime's SpotMe feature directly competes with Dave's ExtraCash, offering fee-free overdrafts of up to $200. The battle for the underbanked American wallet is intensifying.

Competitive Positioning

Dave differentiates on several dimensions:

AI Underwriting: "CashAI is a powerful differentiator for Dave, and this latest model underscores our leadership in AI for financial services," said Jason Wilk. "By combining our massive cash flow dataset with advanced machine learning, we are driving more consistent, profitable credit outcomes."

Higher Advance Limits: While Chime caps SpotMe at $200, Dave offers advances up to $500, appealing to users with larger short-term needs.

Lean Operations: AI allows Dave to serve its 9 million customers with only 300 employees. This operational efficiency translates to profitability at scale.

XI. Regulatory Landscape and Risks

The FTC Lawsuit

In November 2024, Dave faced a significant regulatory challenge. The Federal Trade Commission announced it would be taking action against the online cash app and neobank Dave, which it says used "misleading marketing to deceive consumers." At issue is how Dave marketed $500 cash advances to consumers that it rarely offered, and the "Express Fee" it charged if customers wanted their money immediately.

The FTC claimed the service was misleading because Dave's marketing implied that its cash advances would be "instant," using terminology like "on the spot" to describe them, without disclosing the fees involved until after the consumer completed the sign-up process. The fees ranged anywhere from $3 to $25. If the user chose not to pay the fee, they'd have to wait two to three business days.

The FTC says that only 10 cents of each "tip" is donated and the company keeps the remaining amount. Also, when consumers tried to lower their tip, they would see an image of the food being taken away from the child until they were left with an empty plate.

Dave responded forcefully. "Following months of good-faith negotiations, we are disappointed the FTC has chosen to file suit against Dave, a company on a mission to level the financial playing field. The FTC asserts many incorrect claims regarding Dave's disclosures and how the Company acquires consent for the fees associated with our products. For the avoidance of doubt, Dave's ability to charge subscription fees and optional tips and express fees is not in question. We believe this case is another example of regulatory overreach by the FTC."

The company set aside a $7 million legal reserve related to the matter but maintained its guidance, arguing the lawsuit related to disclosure practices rather than its fundamental business model.

Business Model Adaptation

In response to the regulatory environment, Dave has made changes to its fee structure. As discussed on Dave's third quarter 2024 earnings call, this new fee structure was the next step in the evolution of the company's business model, taken in the ordinary course. Following positive customer feedback and adoption, all new Dave members onboarded on or after December 4, 2024 have been transitioned to this new fee structure and the transition of existing members is underway.

This upgrade aligns with Dave's new fee structure, which eliminates optional tips and express fees for its ExtraCash product, enhancing monetization while maintaining strong member retention.

XII. Bull Case and Bear Case

Bull Case

AI Moat Deepens: Dave's CashAI system improves with every transaction. With more training data, Dave will be able to identify and indulge in good risk, maximizing approval, offering amounts for members and acting as a moat. Competitors without comparable data sets may struggle to match Dave's credit performance.

Underserved Market Remains Vast: Over 130 million Americans live paycheck to paycheck. Traditional banks have shown little appetite for serving this demographic profitably. Dave's combination of technology and mission positions it to capture meaningful share of this underserved market.

Operational Leverage: Dave has demonstrated the ability to grow revenue without proportional increases in headcount or operating expenses. "We've not needed to add operational expenses or head count to achieve those numbers. The company is now achieving just significant operating leverage, which is really showing its teeth in terms of profitability."

New Bank Partnership: Dave has announced a partnership with a publicly-traded fintech sponsor bank to diversify its banking relationships beyond Evolve Bank & Trust. The announced strategic partnership with a publicly-traded fintech sponsor bank represents a significant strategic move. This diversification of banking relationships strengthens Dave's operational foundation and regulatory compliance framework.

2025 Guidance: Looking ahead, Dave has set a robust financial outlook for 2025, projecting GAAP operating revenues between $415 million and $435 million, with expected year-over-year growth of 20% to 25%. The company anticipates adjusted EBITDA to range from $110 million to $120 million.

Bear Case

Regulatory Risk: The FTC lawsuit represents existential risk if the agency succeeds in fundamentally changing how Dave can charge for its services. With hundreds of individual claims, Dave potentially faces millions in arbitration fees alone, regardless of case outcomes. The parallel government actions amplify this threat, as FTC/DOJ findings could strengthen consumer claims.

Competition Intensifies: Chime's impending IPO may bring additional resources and attention to the neobank space. Traditional banks have begun offering early paycheck access and reduced overdraft fees, narrowing Dave's competitive advantage.

Customer Acquisition Costs: While Dave has reduced CAC significantly, the pool of easy-to-acquire customers may become exhausted. Reaching the next tier of users could prove more expensive.

Economic Sensitivity: Dave's customers are precisely the population most vulnerable to economic downturns. A recession could simultaneously increase demand for cash advances while reducing repayment capacity, stressing the CashAI model under conditions it hasn't experienced.

Partner Bank Dependency: A key risk includes the reliance by Dave on a single bank partner. While the new bank partnership addresses this, any disruption in the Evolve relationship during transition could impact operations.

Porter's Five Forces Analysis

Threat of New Entrants (Moderate): Building a cash advance platform requires relatively modest capital, but developing competitive AI underwriting and achieving profitable unit economics takes years of data accumulation.

Bargaining Power of Suppliers (Low to Moderate): Dave depends on bank partners (Evolve, now adding Coastal Community Bank) for FDIC insurance and banking infrastructure. Partner banks have leverage, though Dave's scale provides some countervailing power.

Bargaining Power of Buyers (Moderate): Users can switch to competitors with low friction, but established cash flow patterns and familiarity create moderate switching costs.

Threat of Substitutes (High): Traditional bank overdraft protection, credit cards, family loans, and other fintechs all serve similar needs. The substitute threat is significant.

Industry Rivalry (High): Numerous well-funded competitors pursue the same customer segment with similar value propositions.

Hamilton Helmer's 7 Powers Framework

Scale Economies: Dave's CashAI benefits from data scale—more loans generate more training data, improving underwriting. This creates a virtuous cycle competitors struggle to match.

Network Effects: Limited direct network effects, though referral programs create some viral loops.

Counter-Positioning: Dave's willingness to serve high-risk customers at low margins represents counter-positioning against traditional banks that avoid this segment.

Switching Costs: Moderate—users who have established direct deposit patterns and spending habits with Dave face friction in switching.

Branding: The friendly "Dave" brand and mission resonance create emotional connection, though not yet at the level of enduring brand power.

Cornered Resource: CashAI training data represents a cornered resource that took years and billions of transactions to accumulate.

Process Power: Dave's AI-driven underwriting and customer service represent process power that competitors cannot easily replicate.

XIII. Key Performance Indicators

For investors tracking Dave's ongoing performance, three metrics matter most:

1. Monthly Transacting Members (MTMs): This measures engaged users who generate revenue through ExtraCash advances, debit card usage, or subscriptions. MTM growth indicates product-market fit and acquisition efficiency. Target trend: 15-25% year-over-year growth.

2. 28-Day Delinquency Rate: This measures credit performance on ExtraCash advances. Lower rates indicate CashAI effectiveness and enable higher approval amounts. Target: below 2.5%, with quarterly improvement.

3. Non-GAAP Variable Margin: This measures revenue minus directly variable costs (processing, provision for losses), indicating unit economics. Expanding margins signal operating leverage. Target: continued improvement toward 80%+.

XIV. Conclusion: Lessons from the Phoenix

Dave's journey from $4 billion valuation to $50 million market cap to best-performing financial stock offers several enduring lessons.

Mission Matters: Companies solving real problems for real people can survive market conditions that destroy purely speculative ventures. Dave's mission—helping Americans avoid predatory overdraft fees—created customer loyalty that sustained the business through dark days.

AI as Competitive Advantage: CashAI transformed Dave from a marketing company that happened to offer loans into a technology company with genuine underwriting capabilities. The continuous improvement of machine learning models creates compounding advantages over time.

Capital Discipline: The decision to buy back the FTX note, control expenses, and reach profitability without additional equity raises demonstrated financial sophistication that restored investor confidence.

Founder Resilience: Jason Wilk remained at the helm through a 97% stock collapse, delisting warnings, regulatory challenges, and association with the FTX scandal. That persistence proved essential to the turnaround.

Timing Is Everything: Dave went public at exactly the wrong moment—the peak of SPAC mania and the eve of the Fed tightening cycle. Better timing might have preserved billions in market value.

The company's future depends on several unresolved questions: Can Dave continue improving CashAI performance as the model matures? Will the FTC lawsuit result in material changes to the business model? Can the company expand profitably beyond its current customer base? How will traditional bank fee reductions affect demand for Dave's services?

It is also worth noting that the stock price was still considerably below its all-time high of $490, which it reached in 2022. The comeback, remarkable as it is, remains incomplete.

For long-term investors, Dave represents a unique asset: a profitable, AI-powered fintech serving an underserved market of over 130 million Americans, trading at valuations well below peak levels. The risks are real—regulatory, competitive, and macroeconomic. But the company has demonstrated an ability to adapt and survive that few SPAC-era fintechs can match.

The fintech phoenix has risen. Whether it soars or falls again will depend on execution in a market that has proven unforgiving to companies that promise more than they deliver.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music