Context Therapeutics: The Biotech Pivot Story

I. Introduction: A Philadelphia Biotech's Improbable Second Act

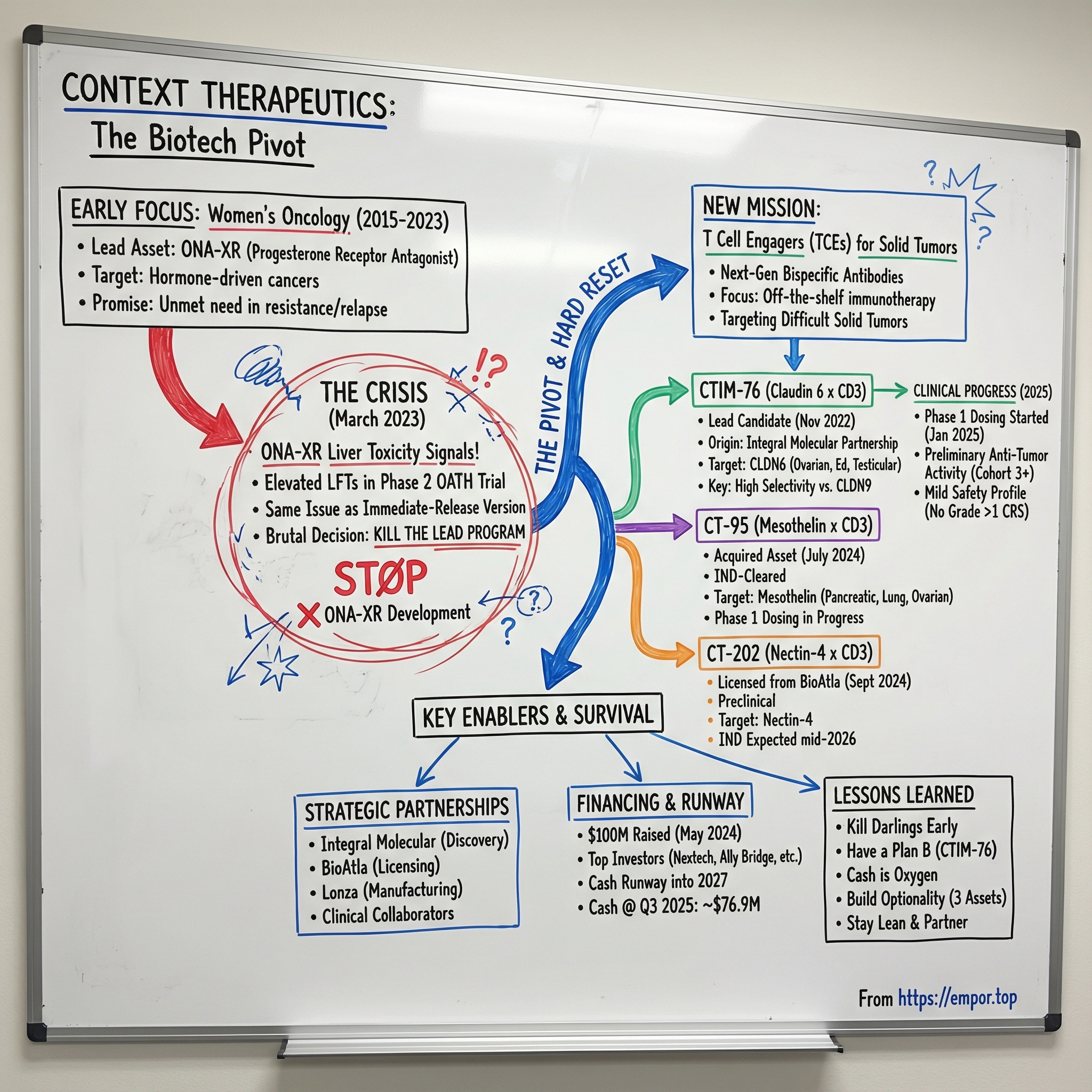

March 2023. Philadelphia. Context Therapeutics is operating with barely a dozen full-time employees, and CEO Martin Lehr is staring down a decision that will either redefine the company—or end it.

The problem isn’t subtle. In the clinic, the company’s lead program is throwing off elevated liver enzymes. Safety signals. And not just any safety signals: the same kind of liver toxicity that sank the immediate-release version of this drug years earlier. Context had built its identity around being a women’s oncology company, and this was the program carrying that flag.

In biotech, this is usually how the story turns tragic. The company determined that significant incremental program costs and delays were likely to be required to analyze and potentially mitigate future liver function test abnormalities. Layer on brutal market conditions for emerging companies, a rapidly crowding breast cancer landscape, and what the data was starting to say—and the decision became unavoidable.

Context would cease development.

But the astonishing part of this story is what happened next. Instead of a slow fade into irrelevance, Context treated the collapse of its lead program as a hard reset. It fundamentally redefined its mission, shifted its focus to next-generation T cell engaging bispecific antibody therapies for solid tumors, and later raised $100 million from major institutional investors. In the span of a remarkably short time, it went from a one-asset company in trouble to a company with a three-asset pipeline in one of the hottest corners of cancer immunotherapy.

That kind of pivot is rare on its own. Doing it with a team this small is almost unheard of.

And Context wasn’t pulling off this reinvention in a quiet corner of the market. It sat in an industry with thousands of active competitors—more than enough companies chasing the same scarce ingredients: capital, talent, patients, and time. With odds like that, how does a twelve-person operation not only survive, but come out the other side with real momentum?

To answer that, we have to go back to the beginning: the founding thesis, the ONA-XR journey, the 2023 crisis that forced the pivot, and the immunotherapy frontier Context decided to bet everything on. This is a case study in capital-constrained drug development—and the brutal realities of being a clinical-stage biotech when the market stops forgiving mistakes.

II. The Founding Vision: Women's Oncology Meets Unmet Need

When venture capitalist Martin Lehr realized he didn’t truly understand the companies he was backing until he’d had to run one himself, he decided to close that gap the hard way. In 2015, he co-founded Philadelphia-based Context Therapeutics to, quite literally, learn on the job.

He partnered with Felix Kim, Ph.D.—an Associate Professor of Cancer Biology at the Sidney Kimmel Cancer Center at Jefferson, whose preclinical research became the scientific starting point for the company and who later served as an advisor to Context.

Lehr’s route to the CEO seat wasn’t the standard biotech ladder. At Osage University Partners, he focused on very early-stage biopharma—companies just beginning to show signs of life in oncology. Before venture capital, he’d done research at places that shape the field: the Sloan Kettering Institute and the Children’s Hospital of Philadelphia.

That mix—science training plus an investor’s view of how fragile early biotech really is—shaped Context from day one. Lehr put it simply: “I sort of fell into it because my research focused on breast and ovarian cancers, and the drugs used to treat them. I very much like the interconnected network of biology and cancer is an area where you can do a lot of good.”

But there was also a personal itch he couldn’t ignore. “I had a great time in VC, but I wanted to learn about operating. I felt that to become the type of investor I respected, then I needed to learn how startups—the companies I was investing in—really worked.”

Philadelphia made the leap more realistic. For a young, cash-conscious biotech, the city offered what matters most early: talent and research density. As Lehr said, “Philly is a tremendous place to start a company. There's great research and great talent.”

The original thesis was focused and timely: build a women’s oncology company aimed at hormone-driven cancers—breast and gynecologic tumors where patients still relapse, still develop resistance, and still run out of options. Context set out to develop small molecule and immunotherapy treatments that could change that trajectory.

Their lead scientific bet centered on a target that was hiding in plain sight. ONA-XR—onapristone extended release—was designed as a potent and specific antagonist of the progesterone receptor, taken orally. And the gap was real: there were no approved therapies that selectively target PR+ cancers.

That mattered because progress in oncology doesn’t eliminate the core problem—it just moves it. Even as treatment options expanded, resistance and relapse kept limiting how long therapies worked, and for whom.

In 2018, Context made the move that effectively defined its early identity: it acquired a clinical-stage drug called Apristor (onapristone extended release). Apristor targeted the progesterone receptor, which is enriched in breast, ovarian, and endometrial cancers—and could also function as a biomarker to help identify patients most likely to respond.

The team also had credibility you could point to. Collectively, the founders and management team brought decades of experience studying what drives cancer initiation and relapse in women, and they’d been associated with major oncology products including Kisqali (ribociclib), Arimidex (anastrozole), and Afinitor (everolimus).

These weren’t footnotes in oncology history. Kisqali became a major advance in breast cancer care. Arimidex helped reshape hormone therapy for postmenopausal breast cancer patients. The message to the market was clear: this wasn’t a science project. This was a drug-development team that believed it knew the playbook.

Still, Lehr later admitted the early public narrative got ahead of the evidence. “I think what I'd have done differently is keep a lower profile post-acquisition of our Phase II drug. I would have waited until I had the full plan, everything was pressure tested, and had some new data in our hands before going forward. The questions we got from investors were, 'What's new? What are you going to do differently?' And all I really had was a plan, as opposed to any hard data showing what's different."

That instinct—pressure-test, don’t overpromise—would become more than a lesson. A few years later, it would be survival.

III. The Pre-IPO Struggle: Building a Clinical Pipeline

From 2015 to 2021, Context lived the unglamorous truth of early biotech: years of work, constant uncertainty, and a burn rate that never stops. The company was trying to run serious clinical development on a budget that, in any other universe, wouldn’t have been enough to get out of the starting blocks.

In 2019, Context took a real step forward. It initiated a Phase 2 trial of ONA-XR in women with ovarian cancer whose tumors expressed high levels of progesterone receptor. This was the moment where the thesis stopped being slides and started becoming patients.

And they didn’t do it halfway. The ONA-XR program spread across multiple shots on goal: three Phase 2 trials and one Phase 1b/2 trial in PR+ breast, ovarian, and endometrial cancers, plus two Phase 0 biomarker pharmacodynamic studies in breast cancer. For a small team, that’s an ambitious clinical footprint—more like what you’d expect from a better-capitalized company with a deeper bench.

To make that math work, Context had to get creative about what it owned outright and what it could partner for. Manufacturing was one of those pressure points. In August 2021, Context and Tyligand Bioscience announced they’d successfully completed manufacturing process optimization for ONA-XR under a collaboration agreement the two companies entered into in March 2020.

That relationship quickly became more than just a technical win. After the optimization work, Context and Tyligand signed a license agreement giving Tyligand the exclusive right—and the responsibility—to develop and commercialize ONA-XR in China, Hong Kong, and Macau. Context kept the rest-of-world rights and became eligible to receive royalties on net sales in that territory.

It was a classic capital-efficiency trade: offload a chunk of future development cost to a partner, keep your core markets, and buy yourself time.

The company also leaned on clinical collaborators. One Phase 2 effort was sponsored by Jefferson Health and run as a clinical collaboration between Context and Jefferson Health’s Sidney Kimmel Cancer Center. The study evaluated the progesterone receptor antagonist onapristone extended release in combination with the antiestrogen anastrozole for patients with metastatic endometrial cancer who had failed prior therapy.

The need was real and growing. Endometrial cancer is the most common gynecologic malignancy in the United States, and incidence has been rising. In 2018, more than 60,000 women were diagnosed, and the disease contributed to more than 10,000 deaths.

But the most important move of this era didn’t look like the most important move at the time. In 2021, Context entered a research collaboration with Integral Molecular. It read like sensible pipeline-building—one more early bet in the background.

Later, it would look like foresight.

Because while Context was busy trying to push ONA-XR across the finish line, the next question was already forming: if the market turned, if the data turned, if the lead asset stumbled—what else did the company have?

By 2021, there was one obvious answer. And the timing couldn’t have been more critical, because the next step for Context meant stepping into the public markets—during what was, for biotech, the most receptive IPO window in years.

IV. IPO and Early Public Life: Momentum and Promise

October 2021 was the kind of moment early-stage biotechs live for—the window opens, investors are listening, and you either step through it or you don’t.

Context did. It closed its initial public offering of 5,750,000 shares at $5.00 per share, raising $28.75 million in gross proceeds before fees and expenses. The stock began trading on the Nasdaq Capital Market on October 20, 2021 under the ticker “CNTX,” and the IPO officially closed two days later.

Demand showed up in a very public way: the underwriter exercised its over-allotment option in full. In other words, the IPO didn’t just clear—it expanded. The deal included 5,000,000 shares the underwriter initially agreed to purchase, plus an additional 750,000 shares through that option.

And Context wasn’t done raising.

In December 2021, the company announced a private placement with accredited investors: 5,000,000 shares of common stock, plus warrants to purchase another 5,000,000 shares, at a combined offering price of $6.25. That brought in approximately $31.25 million in gross proceeds.

CEO Martin Lehr framed it as a turning point: “This is a pivotal time for Context, as we debuted on Nasdaq and entered into a $31.25 million private placement agreement that extends our cash runway into 2024. We also strengthened our leadership team with the addition of Chief Financial Officer Jennifer Minai-Azary and Chief Legal Officer Alex Levit.”

The balance sheet shift was stark. Context had essentially been operating on fumes—cash and cash equivalents were $0.4 million at September 30, 2021, versus $0.3 million at December 31, 2020. After the IPO and private placement, by the end of 2021 the company had built a cash position of nearly $50 million.

The science was cooperating, too—at least on the surface. Data from a window-of-opportunity clinical trial in postmenopausal patients with progesterone receptor-positive early breast cancer showed that ONA-XR significantly increased suppression of tumor cell proliferation.

With cash in the bank, Context also kept layering in partnerships. In 2022, it entered a clinical trial collaboration with The Menarini Group for a Phase 1b/2 trial. “ONA-XR’s ability to restore hormone sensitivity and its tolerability profile positions it well for combination with elacestrant,” said Nassir Habboubi, M.D., Menarini’s Global Head of R&D.

But the most consequential work for Context’s future was happening a little more quietly. The earlier research collaboration with Integral Molecular—aimed at developing a CLDN6 bispecific monoclonal antibody—was still in the background.

Soon, it wouldn’t be background at all.

V. The Inflection Point: The ONA-XR Crisis

In the first half of 2023, Context finally had the kind of clinical momentum that early-stage biotechs live for. In the ongoing Phase 2 OATH trial—testing its oral progesterone receptor antagonist onapristone extended release (ONA-XR) in combination with anastrozole in hormone receptor positive metastatic endometrial cancer—two of the first 12 patients enrolled achieved confirmed partial responses.

CEO Martin Lehr leaned into the promise: “Data from the ongoing Phase 2 OATH clinical trial supports the potential for ONA-XR plus ANA combination therapy to serve as an effective therapeutic option in metastatic EC. We are encouraged by these findings and look forward to continued enrollment in the trial.”

And then the story took its turn.

In that same OATH trial, elevated liver function tests showed up in three patients. One patient discontinued treatment. None of the elevated LFTs were considered serious adverse events—but Context didn’t have the luxury of treating them as noise.

Because this wasn’t some brand-new, out-of-the-blue safety signal. It was the return of an old one. The immediate-release version of onapristone had been pulled from clinical trials years earlier for this exact reason: liver enzyme elevations. Context’s entire bet on the extended-release formulation was that it could keep efficacy while avoiding the peaks believed to stress the liver.

So when the liver signals appeared again, the calculus changed fast. Context determined that significant incremental program costs and delays were likely to be required to analyze and potentially mitigate future LFT abnormalities. Against a backdrop of challenging market conditions for emerging companies, an increasingly competitive breast cancer landscape, recent study findings, and other factors, the company made the call: it would cease development.

On March 22, 2023, Context put it plainly. The company announced a portfolio prioritization and capital allocation strategy expected to extend its cash runway into late 2024. The resulting changes included discontinuing ONA-XR and shifting focus to CTIM-76, its Claudin 6 bispecific antibody clinical candidate.

Lehr’s quote carried the weight of a decision no biotech CEO wants to make: “Given the challenging market conditions for emerging companies, the increasingly competitive landscape for breast cancer treatments, and recent study findings, we have decided to discontinue the development of ONA-XR.”

Then came the line that made clear this wasn’t just a program update—it was an identity change: “As a result, the Company will no longer primarily focus on female cancers.”

Context had been built around women’s oncology. Now, the company was walking away from the very category it was founded to serve.

But the decision wasn’t emotional. It was survival math. Continuing ONA-XR meant spending more money, waiting longer, and carrying a safety question that would only get harder to answer—at the exact moment biotech financing had tightened and competition had ramped up.

Investors didn’t reward the bravery. Around the announcement, Context traded at a steep discount to its cash value—a public signal that the market had largely written off the original plan.

Still, inside that wreckage was the one thing a clinical-stage biotech always needs: time. By stopping the cash-intensive ONA-XR trials, Context expected its cash and cash equivalents to fund operations into late 2024. The lead program was gone—but the company had bought itself a runway to attempt something else.

VI. The Pivot: Betting Everything on CTIM-76

That runway Context bought by killing ONA-XR only mattered if there was something real to run toward. CTIM-76 wasn’t a last-minute scramble. The company had been quietly building it for years.

In November 2022—months before the ONA-XR decision—Context announced it had selected CTIM-76, a T cell-engaging bispecific antibody, as its lead clinical development candidate. The program came out of its research collaboration and licensing agreement with Integral Molecular, and it aimed squarely at Claudin 6-positive cancers.

That timing ended up being everything. Without CTIM-76 already in motion, the ONA-XR crisis would have left Context with the worst possible problem: a public company without a credible next act.

To understand why this pivot made sense, you have to understand the target. CLDN6 is one of the more compelling solid-tumor targets to emerge in recent years because it sits at the intersection of two truths: cancer needs growth programs, and some tumors revive embryonic genes—genes that are active in fetal development, then largely shut off after birth. In the 1990s, BioNTech co-founders Özlem Türeci and Uğur Şahin were thinking through exactly this kind of target: something largely absent in healthy adult tissue, but switched on in cancer. As Türeci put it, “We knew cancer cells like to activate embryonic genes because they make use of proliferation.”

Claudin 6 is a tight junction protein and a therapeutic target across multiple solid tumor types, including ovarian, endometrial, testicular, and gastric cancers. It’s differentially expressed on cancer cells, with no or limited expression in normal, healthy tissue. Context estimated there were roughly 70,000 patients in the United States with CLDN6-positive metastatic solid tumors—and no approved targeted treatment options.

But CLDN6 comes with a trap. The claudin family is big—27 human family members—and many are broadly expressed and highly conserved. Worse, the extracellular region of CLDN6 is extremely similar to CLDN9, differing by just three amino acids. That similarity is why the category has been so hard: several CLDN6 monoclonal antibodies in clinical development showed significant binding to other claudins, and most of those programs were ultimately halted.

Context’s claim to differentiation started with selectivity. Using Integral Molecular’s MPS antibody discovery platform, the company said it was able to isolate and optimize rare antibodies against CLDN6 that did not cross-react with other CLDN family members in protein binding assays.

Then came the head-to-head comparisons. Context generated clones of other clinical-stage CLDN6 molecules—TORL-1-23 and AMG-794—for benchmarking. In those studies, TORL-1-23 activity appeared dependent on high CLDN6 expression, while CTIM-76 maintained activity across a range of cell lines expressing low through high CLDN6. CTIM-76 also showed ten-fold higher potency than AMG-794 in in vitro cytotoxicity and cytokine activation.

Lehr framed the bet plainly: “It is estimated that there are 70,000 patients with CLDN6-positive metastatic solid tumors in the United States, and no approved targeted treatment options exist. We're encouraged by the promise CTIM-76 has shown with these first in vivo data, which reinforce the selectivity and potency seen in earlier in vitro data and demonstrate CTIM-76's ability to induce complete tumor regressions across multiple dose levels.”

The rest of the story, at least on paper, followed the standard biotech march: preclinical data, IND-enabling work, then an FDA filing to earn the right to test in humans. Context said CTIM-76 showed high potency and target selectivity in binding and cytotoxicity assays. In in vivo xenograft experiments, it induced dose-proportional tumor regressions and was well tolerated.

On March 28, 2024, Context submitted an Investigational New Drug application to the FDA to begin a first-in-human study of CTIM-76. The IND supported a Phase 1 dose escalation and expansion trial in patients with CLDN6-positive gynecologic and testicular cancers.

But INDs don’t get filed on grit. They get filed on cash. And even with a smaller footprint, Context didn’t have the kind of balance sheet that makes the leap from preclinical promise to human trials feel safe.

That set up the next move—the one that would change the company’s trajectory overnight.

VII. The Transformative Year: 2024 and the $100M Lifeline

In May 2024, Context pulled off the kind of financing that turns a precarious pivot into a real plan. The company announced it had entered into a securities purchase agreement with new and existing investors in a private placement expected to raise about $100.0 million in gross proceeds, before fees and expenses.

The investor lineup signaled this wasn’t a “keep the lights on” round. The deal was led by new investor Nextech1, with participation from new and existing investors including Ally Bridge Group, Avidity Partners, Blackstone Multi-Asset Investing, Blue Owl Healthcare Opportunities, Deep Track Capital, Driehaus Capital Management, Great Point Partners, LLC, and other healthcare-focused investors.

Just as important: this wasn’t priced like a rescue. The price per share of common stock and per pre-funded warrant came at a premium to the company’s closing price on May 1, 2024.

The structure still meant meaningful dilution. Under the agreement, Context sold roughly 64.5 million shares of common stock (or pre-funded warrants in lieu thereof) at $1.55 per share.

But that was the trade: give up a big slice of ownership to buy years of survival. Context said the net proceeds, combined with existing cash and cash equivalents, were expected to extend runway through the planned CTIM-76 Phase 1 clinical trial and into 2028.

The scale of the shift showed up clearly in the year-end balance sheet. Cash and cash equivalents were $94.4 million at December 31, 2024, up from $14.4 million a year earlier.

Then came the regulatory green light that made the fundraising even more meaningful. In May 2024, Context announced that the FDA cleared its IND for CTIM-76, supporting the start of a Phase 1 dose escalation and expansion trial in patients with CLDN6-positive gynecologic and testicular cancers.

And with capital in hand, Context stopped acting like a one-asset pivot story and started building a portfolio.

In July 2024, the company entered into an asset purchase agreement to acquire CT-95 (formerly owned by Link Immunotherapeutics), a mesothelin x CD3 T cell engaging bispecific antibody with first-in-class potential that had already received IND clearance from the FDA.

Context made the strategy explicit: “CT-95 is an IND-cleared asset that we plan to rapidly progress into clinical trials. We intend to fund the acquisition of CT-95 and its advancement through the dose escalation portion of a Phase 1 clinical trial with Context's existing cash.”

The biology here matters. Mesothelin is a membrane protein overexpressed in many cancers, with limited expression in normal tissues. But one historical challenge for mesothelin-targeted drugs has been the “sink”—shed mesothelin floating in blood and within the tumor microenvironment that can soak up therapies before they reach tumor cells. CT-95 was designed with that problem in mind: it’s a fully humanized bispecific TCE using an IgG-scFv architecture with an effector-silenced IgG1 backbone, and it pairs relatively low affinity with high avidity for membrane-bound mesothelin to help minimize the impact of that shed sink.

Then Context added a third swing.

In September 2024, BioAtla and Context announced that Context had obtained an exclusive, worldwide license to develop, manufacture, and commercialize BA3362, BioAtla’s Nectin-4 x CD3 T cell engaging bispecific antibody.

Context positioned Nectin-4 as both prevalent and strategically urgent: “Nectin-4 is a priority target for Context given the target's high prevalence in solid tumors and the unmet need to address potential resistance to Nectin-4 antibody-drug conjugates. We identified BioAtla's Nectin-4 TCE antibody as a potentially best-in-class asset. BA3362 is built from BioAtla's compelling CAB platform technology that uses pH-dependency to drive selective Nectin-4 binding and T cell activation within the tumor microenvironment."

The economics were structured to protect near-term cash. Under the agreement, BioAtla was eligible to receive up to $133.5 million in aggregate payments, including $15.0 million in upfront and near-term milestones, plus additional potential clinical, development, and commercial milestones totaling $118.5 million, along with tiered royalties on net sales.

To match the expanded ambition, Context also strengthened its operating team. In August 2024, the company announced the appointments of Dr. Claudio Dansky Ullmann as Chief Medical Officer and Ms. Karen Andreas as VP, Clinical Operations.

Martin Lehr summed up what had happened over the course of a year: “We believe 2024 was a transformative year for Context, marked by strategic acquisitions, a strengthened financial position, and enhancements to our leadership team, all aligning with our mission to develop innovative T cell-engaging bispecific antibodies for solid tumors.”

VIII. The Current Pipeline and Clinical Progress

By late 2025, Context had moved into a very different reality than the company that nearly ran out of road in early 2023. Instead of living and dying on a single program, it was now building a three-asset portfolio of T cell engaging (TCE) bispecifics: CTIM-76 (Claudin 6 x CD3), CT-95 (Mesothelin x CD3), and CT-202 (Nectin-4 x CD3).

The lead program, CTIM-76, crossed the line that matters most in biotech: into humans. In January 2025, Context announced that it had dosed the first patient in its Phase 1 clinical trial evaluating CTIM-76, a Claudin 6 x CD3 T cell engaging bispecific antibody.

The trial is an open-label dose escalation and expansion study designed to evaluate safety and efficacy in patients with CLDN6-positive advanced or metastatic ovarian, endometrial, and testicular cancers. Across escalation and expansion, the study is intended to assess safety, tolerability, pharmacokinetics, and early signals of anti-tumor activity, including overall response rate, duration of response, and disease control rate. Context expects the study to enroll up to 70 patients.

As of the October 30, 2025 cutoff, Context had enrolled 12 patients and was enrolling Cohort 5, using a priming dose of 140 micrograms and a full dose of 560 micrograms. Importantly, Context reported preliminary signs of anti-tumor activity beginning in Cohort 3, including an ongoing RECIST response. On the safety side—often where T cell engagers live or die—no cytokine release syndrome greater than Grade 1 had been observed in any cohort.

That last point matters because CRS is one of the defining risks of the entire TCE category. Seeing only mild CRS, at least early on, suggested CTIM-76 could have a more manageable tolerability profile than some competing approaches.

As Martin Lehr put it: "We believe the early clinical data for CTIM-76 provides encouraging early signs of antitumor activity for Context's T cell engagers in solid tumors where many other approaches have failed due to material safety issues or lack of efficacy."

Behind CTIM-76, CT-95 was also moving through the clinic. As of the October 30, 2025 cutoff, Context had enrolled 6 patients in its Phase 1 trial. CT-95 is in Phase 1 dose escalation in patients with pancreatic, non-small cell lung, ovarian, mesothelioma, and colorectal cancers. Mesothelin—the tumor target here—is a membrane protein that is overexpressed in approximately 30% of cancers.

The third asset, CT-202, remained preclinical. Context licensed it from BioAtla as an exclusive worldwide program: a Nectin-4 x CD3 T cell engaging bispecific antibody. Context said it expected to file an IND application for CT-202 in mid-2026.

Near-term catalysts were also coming into view. Context had said: "Looking ahead, we anticipate dosing the first patient in our Phase 1 clinical trial of CT-95, targeting mesothelin-expressing cancers, in Q2 2025. Additionally, we expect to share initial clinical data from the CTIM-76 Phase 1 trial in the first half of 2026 and from the CT-95 Phase 1 trial in mid-2026."

And unlike the pre-pivot era, the company wasn’t running this plan on fumes. Context reported $76.9 million in cash as of September 30, 2025, which it expected would fund operations into 2027.

IX. Playbook: Biotech Survival and Pivot Lessons

Context Therapeutics’ story reads like a case study in what it actually takes to survive clinical-stage biotech—when the science gets messy, the market gets tighter, and you don’t have the luxury of waiting for perfect answers.

Lesson 1: Know When to Kill Your Darlings

Context’s leadership didn’t sugarcoat the decision: “Given the challenging market conditions for emerging companies, the increasingly competitive landscape for breast cancer treatments, and recent study findings, we have decided to discontinue the development of ONA-XR.”

That’s a brutal sentence for any company to write about its lead program. Especially because ONA-XR wasn’t failing on efficacy. In the endometrial cancer trial, two of the first 12 patients had confirmed partial responses—exactly the kind of signal that usually buys you more time and more capital.

But the liver safety signals changed the risk profile. Pushing forward meant more time, more money, and more uncertainty—plus the ethical reality that patient safety isn’t negotiable. Context chose to preserve both patients and runway, rather than fall victim to sunk-cost thinking.

Lesson 2: Always Have a Plan B Developing in the Background

The pivot only worked because it wasn’t invented on the spot.

The 2021 Integral Molecular partnership—work that initially looked like “nice pipeline optionality”—became the lifeline when ONA-XR hit the wall. When Context named CTIM-76 as its lead candidate in November 2022, Lehr framed it as momentum: “This year has been marked by several exciting and significant milestones for Context, culminating in naming our lead CLDN6 clinical development candidate, CTIM-76, a bispecific antibody showing high selectivity for CLDN6.”

In hindsight, that wasn’t just progress. It was insurance. Without CTIM-76 already selected and moving, discontinuing ONA-XR could have been the end of the company’s story.

Lesson 3: Cash Runway Is Survival

Everything at Context—strategy, pacing, even identity—has been dictated by runway.

Throughout 2023 and into early 2024, the company consistently guided that cash and cash equivalents would fund operations into late 2024. The March 2023 decision to discontinue ONA-XR bought time. The May 2024 financing bought years.

In clinical-stage biotech, cash isn’t just a resource. It’s oxygen. And running out doesn’t mean you “pause the plan.” It means the plan is over.

Lesson 4: The Asset Acquisition Playbook

Context didn’t just fund CTIM-76. It used its recapitalized balance sheet to buy speed.

CT-95 arrived with IND clearance already in hand. That matters because IND-enabling work can take years and burn a lot of cash before you ever dose a patient. By acquiring a de-risked, IND-cleared asset, Context shortened the distance between “we like this biology” and “we’re in the clinic.”

Lesson 5: Building Optionality in Clinical-Stage Biotech

For years, Context lived the single-asset life: one lead program, one thesis, one set of clinical outcomes that could make—or break—the company.

Post-pivot, it deliberately moved away from that binary setup. As the company put it: “Context executed on its strategy to build a pipeline of T cell engaging bispecific antibodies through its acquisitions of CT-95, a Mesothelin x CD3 bispecific antibody, and CT-202, a Nectin-4 x CD3 bispecific antibody.”

That’s what optionality looks like in biotech: fewer “all-or-nothing” moments, and more ways for the company to be right over time. If CTIM-76 disappoints, Context still has CT-95 and CT-202. That doesn’t eliminate risk—but it changes the shape of it.

Lesson 6: Right-Sizing the Organization

Context kept the company lean and leaned hard on partners. It operated with a very small employee base, while outsourcing what didn’t need to be built internally: manufacturing through Lonza, discovery through Integral Molecular, and clinical execution through collaborators.

That approach won’t work for every biotech. But in Context’s case, it did something critical: it kept burn low while still letting the company play in high-end science. When your entire future can hinge on whether you have six extra months of runway, operating discipline isn’t a nice-to-have. It’s strategy.

X. Porter's Five Forces and Hamilton's Seven Powers Analysis

Porter's Five Forces:

1. Threat of New Entrants: MODERATE-HIGH

Biotech has enormous capital and regulatory barriers. Just getting to a Phase 1-ready program can take years and tens of millions of dollars. But the scientific barrier to entry is lower than people assume—smart teams can form quickly around a new target, license in tools, and start generating compelling preclinical data.

You can see that dynamic in CLDN6. Even after Amgen discontinued AMG 794, the field kept moving. According to OncologyPipeline, there were 15 CLDN6-targeting projects in clinical and preclinical development.

2. Supplier Power: HIGH

For a company like Context, suppliers aren’t office vendors—they’re specialized partners that control the hardest parts of the value chain. Complex biologics like bispecific antibodies require high-end manufacturing capabilities, and contract manufacturing organizations can have real leverage on timelines, cost, and capacity.

On top of that, Context’s relationship with Integral Molecular isn’t just a services relationship. It’s a dependency on licensed discovery technology and the intellectual property that came with it. That kind of reliance can be strategically valuable, but it also concentrates supplier power.

3. Buyer Power: MODERATE

In oncology, the “buyers” are really a chain: physicians deciding what to prescribe, payers deciding what to cover, and health systems managing budgets. When a drug is meaningfully better—real efficacy, acceptable safety—pricing power can be substantial.

The hard part is earning that position. FDA approval creates protected market access, and in practice, payers generally cover approved cancer drugs even when costs are high. But the bar for differentiation has risen, and payers can still push back around labels, sequencing, and prior authorization if the benefit looks incremental.

4. Threat of Substitutes: HIGH

Context isn’t competing with “nothing.” It’s competing with an entire ecosystem of modalities that can target similar patients: CAR-T, other bispecifics, antibody-drug conjugates, and checkpoint inhibitors.

CLDN6 also has credible competitors. BioNTech has long been a category leader in Claudin 6, though it had not yet begun a pivotal Phase 2 trial with its CAR-T contender, BNT211. And Torl Therapeutics has been advancing its own approach, saying it would start a pivotal study of its ADC in the second half of 2024.

Different modalities will likely carve out different niches—some patients may be better suited for a cell therapy, others for an off-the-shelf bispecific—but from Context’s perspective, substitutes are everywhere.

5. Competitive Rivalry: HIGH

Oncology is the most crowded arena in biotech, and rivalry is relentless. Context had 3,125 active competitors, including 1,061 funded and 723 that had exited. Its top competitors included companies like Moderna, Jazz Pharmaceuticals, and BeiGene.

In a market like this, “good” isn’t enough. First-mover advantage helps, but differentiated data is what actually creates staying power.

Hamilton's Seven Powers:

1. Counter-Positioning: MODERATE

Context’s bet on T cell engaging bispecifics carries a built-in contrast with CAR-T: potentially easier administration, no need to manufacture patient-specific cells, and a path that could be more scalable if the data holds up. Preclinical research suggested the potential for convenient dosing, low immunogenicity risk, and manufacturing scalability—features that matter if you’re trying to reach large solid-tumor populations.

That said, the counter-positioning is only as strong as the clinical outcomes. In oncology, the market doesn’t award points for elegance; it awards them for response rates and safety profiles.

2. Scale Economies: LOW (Currently)

Context is still clinical-stage. It doesn’t have scale advantages today. If one of its assets reaches approval, manufacturing scale and commercial infrastructure could matter—but that’s still ahead.

3. Switching Costs: LOW-MODERATE

Oncologists switch therapies as evidence evolves. If a new drug shows better efficacy or safety, adoption can move quickly. Still, there’s some stickiness created by regulatory labels, clinical guidelines, and treatment pathways—once a therapy becomes standard in a line of treatment, it can be hard to dislodge.

4. Network Effects: NONE

This isn’t a network-effect business. Drug development doesn’t get easier because more people use your product—at least not in the way software does.

5. Cornered Resource: MODERATE-HIGH

Context does have something defensible: its collaboration and licensing agreement with Integral Molecular for a CLDN6 bispecific monoclonal antibody program.

Using the MPS Antibody Discovery platform, Integral Molecular isolated a lead molecule targeting a unique CLDN6 epitope, positioned as offering potentially best-in-class specificity versus other molecules in clinical development. Exclusive licenses and proprietary relationships like that can function as a real moat—especially in a target class where cross-reactivity has derailed prior programs.

6. Process Power: DEVELOPING

The team’s oncology drug development experience is an advantage, but process power usually takes many cycles—multiple programs, multiple clinical learnings, and years of iteration. Context is building toward that, not benefiting from it in full yet.

7. Branding: LOW

In biotech, branding is a rounding error. Clinical data is king. What ultimately matters is the evidence package that convinces regulators, physicians, and patients that a drug works—and is safe enough to use.

XI. Bear versus Bull Case

The Bull Case:

Validated target with differentiated molecule: CLDN6 is gaining traction as an oncology target. Context has argued that CTIM-76 is among the most selective CLDN6 binders in the field, and its preclinical benchmarking suggested the potential for a best-in-class profile versus molecules like TORL-1-23 and AMG-794.

De-risked financials: With roughly $76–94 million in cash disclosed across recent reporting periods, Context expected to have runway into 2027. That kind of cushion matters in biotech because it buys focus—time to run trials and generate data without immediately turning back to the market.

Multi-asset optionality: Post-pivot, Context isn’t a one-shot story anymore. It’s advancing three T cell engaging bispecifics—CTIM-76, CT-95, and CT-202—each aimed at a different tumor antigen (CLDN6, mesothelin, and Nectin-4). That doesn’t remove risk, but it does change the shape of it: fewer all-or-nothing outcomes tied to a single asset.

Early clinical signals positive: The earliest CTIM-76 clinical readouts included preliminary RECIST responses starting in Cohort 3, and no cytokine release syndrome above Grade 1 reported. In TCE land, where safety can derail programs quickly, “mild CRS so far” is a meaningful early signal.

Competitive dynamics improving: One high-profile competitor appears to have stepped back. Amgen’s AMG 794 Phase 1 listing on clinicaltrials.gov notes that development was discontinued following a business decision—clearing at least one name from an already crowded scoreboard.

M&A target potential: If Context can translate its early promise into credible human data across multiple assets, it could become interesting to larger pharma players looking for an entry point—or more depth—in off-the-shelf T cell engagers for solid tumors.

The Bear Case:

Clinical-stage binary risk: The company is still in Phase 1, and oncology is littered with drugs that looked exciting early and then failed when patient numbers grew and endpoints got harder. Context has no approved products and no operating revenue beyond interest income.

Intensifying CLDN6 competition: CLDN6 is “hot” for a reason—and that cuts both ways. BioNTech’s BNT211 reported strong activity at its recommended dose level, including an ORR of 59% and a DCR of 95%. TORL’s CLDN6 ADC has been moving toward pivotal development. Context is earlier in clinical execution, which raises the bar for differentiation.

Manufacturing complexity: Bispecific antibodies are not easy to make at scale. If manufacturing or quality issues emerge, timelines can slip and costs can climb—exactly the kind of hidden risk that doesn’t show up in preclinical slide decks.

Dependence on external partnerships: CTIM-76 originated from Context’s collaboration and licensing relationship with Integral Molecular. That’s a strength when it’s working—and a concentration risk if anything about the partnership, IP, or ongoing support becomes complicated.

Small team execution risk: Running multiple trials with a very small full-time team is capital-efficient, but it’s also fragile. When you’re lean, any operational miss—trial activation delays, vendor problems, recruitment slowdowns—hits harder.

Dilution pressure: Even after raising $100 million, later-stage oncology trials are expensive. If the programs advance, Context may still need additional capital—and the share count has already grown meaningfully during the pivot.

XII. Key Performance Indicators to Track

If you’re following Context as an investor, there are really three things that matter day to day: how fast the trials move, how clean the safety profile stays, and how long the company can fund the work before it has to go back to the market.

1. Clinical trial enrollment and safety data

In the near term, nothing is more important than enrollment pace and safety across the CTIM-76 and CT-95 Phase 1 trials. As of the October 2025 cutoff, Context had enrolled 12 patients in CTIM-76 and 6 patients in CT-95, and it reported no cytokine release syndrome above Grade 1 and no dose-limiting toxicities.

Watch for: whether that safety picture holds as dosing escalates and more patients are treated. Any emergence of higher-grade CRS or other serious adverse events would quickly change the narrative.

2. Cash runway and burn rate

In clinical-stage biotech, cash isn’t a “finance metric.” It’s the clock.

Context reported about $76.9 million in cash as of Q3 2025 and expected that to fund operations into 2027. The question underneath that guidance is burn: net losses were running roughly $9–10 million per quarter.

Watch for: burn creeping up faster than expected as trials expand and the portfolio advances. If runway starts compressing before the company has meaningful clinical data in hand, the odds of a dilutive raise go up.

3. Preliminary efficacy signals (RECIST responses)

Safety keeps you alive. Efficacy is what makes you matter.

Context has already pointed to preliminary RECIST responses beginning in Cohort 3 of the CTIM-76 trial, including an ongoing RECIST response. As more patients become evaluable, the durability of those responses—and whether they broaden beyond a handful of early signals—will be the first real test of whether CTIM-76 can compete in a crowded, unforgiving category.

Watch for: updated interim Phase 1a data expected in Q2 2026, which should start to turn “interesting early hints” into something closer to a real read.

At the end of the day, this is a story about optionality—and survival.

Context made the kind of decision that ends most companies: it shut down the program it was built around. But by having CTIM-76 in the wings, and by raising enough capital to turn a pivot into a portfolio, it bought itself a second act in one of the most competitive frontiers in cancer immunotherapy.

The outcome is still uncertain. Most clinical-stage biotechs don’t make it. But Context has already proven something rare: when the plan broke, the company didn’t. Whether CTIM-76, CT-95, or CT-202 ultimately becomes a real medicine remains to be seen. For now, Context has what it didn’t have in early 2023—time, shots on goal, and a reason to believe it can keep going.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music