CleanSpark: From Energy Software to America's Bitcoin Miner®

I. Introduction: The Unlikely Metamorphosis

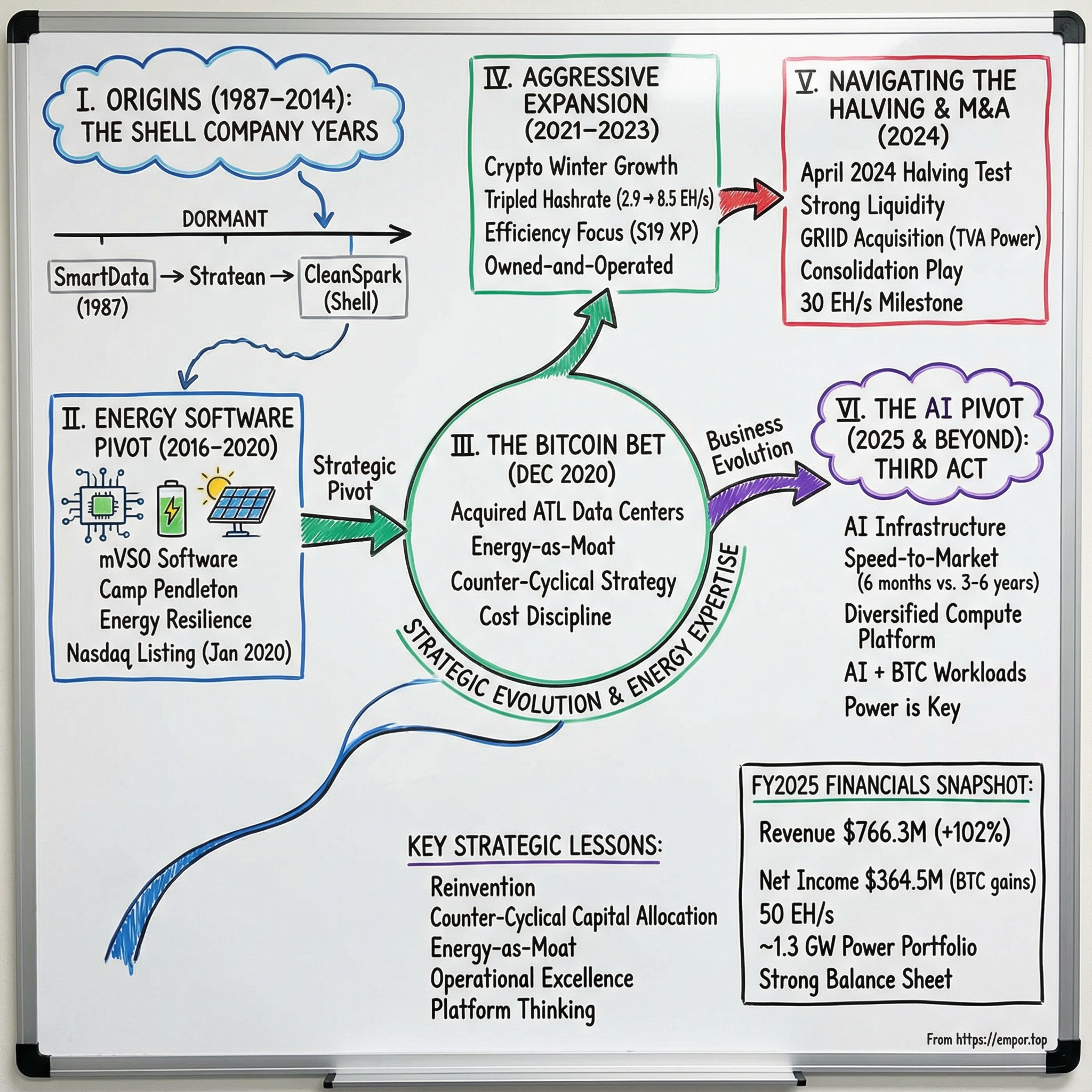

Picture a dusty filing cabinet in a Nevada corporate registry, circa 2018. Inside sits the paperwork for a dormant company that had been languishing for the better part of three decades—a shell of its former self, having cycled through alternative fuels research, software development, and the wilderness of corporate hibernation. Now fast forward to October 2024, when that same corporate entity—transformed, renamed, and radically reimagined—beat out Microsoft for a 100-megawatt data center contract in Wyoming.

The story of CleanSpark is one of the most audacious corporate reinventions in American business history. CleanSpark wasn't always a Bitcoin miner. It was founded in 1987 as SmartData, which focused on intellectual-property research and development for alternative fuels before it halted its business operations in 1992. Today, the company operates over 1.3 gigawatts of power infrastructure across the United States and stands as one of the largest Bitcoin miners in North America with ambitions to become a comprehensive compute infrastructure platform serving both Bitcoin and artificial intelligence workloads.

CleanSpark, a vertically integrated Bitcoin mining operator, concluded fiscal year 2025 with metrics reflecting aggressive operational scaling and a strategic shift funded by massive low-cost capital. Revenue doubled 102% year-over-year to $766.3 million, driven by operational execution that scaled the hashrate past 50 exahashes per second.

The central question this analysis seeks to answer: How did a dormant 1987 shell company become one of the largest Bitcoin miners in North America and now pivot toward AI infrastructure? The answer involves a peculiar alchemy of corporate reinvention, impeccable timing, counter-cyclical capital allocation, and the emerging realization that in the 21st-century economy, control of power infrastructure may prove more valuable than what you actually do with that power.

The journey spans five distinct chapters: the shell company years, the energy software pivot, the transformational December 2020 bet on Bitcoin mining, an aggressive expansion era that defied bear market conventions, navigation of Bitcoin's fourth halving, industry consolidation through M&A, and now a third act that positions CleanSpark at the intersection of the two most power-hungry computing demands of our era—Bitcoin and AI.

For long-term fundamental investors, CleanSpark represents a fascinating case study in platform evolution and the strategic value of energy-as-moat in an increasingly power-constrained digital economy.

II. Origins: The Shell Company Years (1987–2014)

The corporate history of what would become CleanSpark reads like an archaeological dig through the sediment of American corporate law. The company was formerly known as Stratean Inc. and changed its name to CleanSpark, Inc. in November 2016. CleanSpark, Inc. was incorporated in 1987 and is headquartered in Henderson, Nevada.

But the 1987 incorporation date tells only part of the story. CleanSpark was named SmartData Corporation until November 24, 2014. SmartData then changed its name to Stratean Inc., which later changed its name to CleanSpark, Inc. The entity that began as SmartData represented something common in the early days of the alternative energy boom: a company with big ideas about transforming how America powered itself, but insufficient capital, technology, or market conditions to make those dreams reality.

SmartData's original focus on intellectual-property research and development for alternative fuels placed it squarely in the post-oil-crisis zeitgeist of the late 1980s. But by 1992, with oil prices stabilized and the first Gulf War concluded, investor appetite for speculative energy plays evaporated. SmartData ceased meaningful operations, joining the ranks of thousands of small public companies that exist in a peculiar corporate purgatory—neither dead nor fully alive.

To understand why this matters for the CleanSpark story, one must understand the peculiar value of public shell companies in American capital markets. A dormant public company maintains its SEC registration, its stock ticker (however rarely traded), and most importantly, its ability to raise capital from public markets without the time-consuming and expensive process of an initial public offering. For ambitious entrepreneurs, acquiring such a shell represents a back door to public markets—a practice known as a reverse merger.

The transformation from SmartData to Stratean in 2014 marked the beginning of the entity's resurrection. Stratean represented an attempt to pivot toward software and technology, but the company remained thinly traded and largely unknown. Then came 2016, when Stratean merged with two entities—a company called CleanSpark and another called Specialized Energy Solutions—creating the foundation for what would eventually become America's Bitcoin Miner®.

The individuals who orchestrated this corporate resurrection understood something that many entrepreneurs miss: the value of an established corporate infrastructure. Schultz, who also served as executive chairman, co-founded CleanSpark in 2014 and previously served as CEO. S. Matthew Schultz, who later returned to the CEO role, had spent years working with small public companies and understood how to leverage the reverse merger structure to access capital markets quickly.

The 2016 10-K states on page 25, "S. Matthew Schultz, Chief Executive Officer, has been involved in many capacities with several publicly traded companies. Most recently, he served as the President and CEO of Amerigo Energy, Inc., creating multiple syndicated offerings of developmental oil production programs, as well as overseeing the operations from permitting through production..."

Schultz's background in energy, small-cap public companies, and capital formation would prove essential to CleanSpark's subsequent evolution. His experience navigating the complexities of SEC reporting, investor relations, and the unique challenges of microcap companies gave the reconstituted CleanSpark a managerial competence that many reverse-merger companies lack.

By late 2016, the company had completed its transformation. What had been SmartData, then Stratean, was now CleanSpark—a name chosen to reflect the company's focus on clean energy solutions. But the path from energy software company to Bitcoin mining giant was still several years and one crucial pivot away.

For investors analyzing CleanSpark today, the shell company heritage provides both context and caution. The company's management demonstrated early adaptability and an understanding of capital markets that would serve them well in the capital-intensive Bitcoin mining industry. However, the serial transformations also raise questions about long-term strategic vision versus opportunistic pivoting—a tension that continues to define investor debates about the company.

III. The Energy Software Chapter (2016–2020)

The CleanSpark that emerged from the 2016 corporate restructuring bore little resemblance to either SmartData or Stratean. The company positioned itself at the intersection of two mega-trends: the distributed energy revolution and the growing complexity of managing modern electrical grids.

The company underwent several transformations before emerging as CleanSpark, Inc. in 2019 when it began focusing on advanced energy software and control technology. CleanSpark initially specialized in microgrid solutions, developing software and hardware to optimize energy usage and integrate renewable energy sources into existing power systems.

The microgrid business model represented an intelligent strategic bet. As solar installations proliferated, battery storage costs plummeted, and grid reliability concerns mounted, the ability to manage distributed energy resources became increasingly valuable. CleanSpark developed what it called mVSO software—a platform for modeling and managing microgrids that could optimize power flows between solar panels, batteries, diesel generators, and grid connections.

The company found particular success with government and institutional clients. Its most notable early project involved Camp Pendleton, the Marine Corps base north of San Diego, where CleanSpark deployed its microgrid technology to improve energy resilience and reduce costs. S. Matthew Schultz led CleanSpark from its early days as an alternative energy generator focused on converting biomass into energy using CleanSpark's patented gasifier technology. He then transitioned CleanSpark into the renewable energy sector, helping to identify critical software that was used to deploy microgrids, most notably at Camp Pendleton.

The Camp Pendleton deployment provided CleanSpark with valuable credentials and, more importantly, deep operational experience in managing power-intensive facilities. The company learned how to negotiate with utilities, optimize power consumption, and build systems that could operate reliably under demanding conditions. These skills would prove prescient.

The company went public through a reverse merger in 2016 and was listed on the Nasdaq Capital Market in January 2020. The Nasdaq listing represented a crucial milestone. For a company that had spent years trading on the OTC markets, the upgrade to Nasdaq brought legitimacy, liquidity, and access to a broader investor base. The timing—January 2020, just before the COVID pandemic upended global markets—could have been catastrophic. Instead, it positioned CleanSpark perfectly for what came next.

The energy software business, while intellectually elegant, faced persistent challenges. Sales cycles were long. Government procurement processes moved at glacial speeds. Commercial and industrial customers required extensive customization. Revenue growth, while steady, remained modest. For fiscal year 2019, CleanSpark remained a small company with limited market impact.

Yet the company's marketing materials from this era contain a phrase that reads today like prophecy: "Since 2014, we've helped people achieve energy independence for their homes and businesses. In 2020, we transitioned that expertise to develop sustainable infrastructure for Bitcoin."

That transition didn't happen in a vacuum. In 2018, CleanSpark's energy professionals were tasked to design and engineer a microgrid solution for a 'stand-alone' mobile bitcoin mining system. The project gave CleanSpark its first exposure to the cryptocurrency mining industry and planted the seeds for a radical strategic pivot. The company's engineers discovered that Bitcoin mining operations faced exactly the kinds of energy management challenges CleanSpark had built its software to solve: variable power costs, the need for demand response, and the opportunity to arbitrage electricity pricing.

By early 2020, CleanSpark's leadership faced a strategic choice. The microgrid business was viable but slow-growing. Bitcoin, meanwhile, had just completed its third halving in May 2020 and was beginning to recover from its COVID crash. Institutional interest in cryptocurrency was awakening—MicroStrategy would announce its first Bitcoin purchase in August 2020, and Square followed in October.

The energy expertise CleanSpark had accumulated wasn't just relevant to Bitcoin mining; it was potentially transformational. In an industry where electricity represents the primary operating cost, a company that truly understood power markets could build sustainable competitive advantage. The question was whether CleanSpark's leadership had the conviction to make the leap.

For investors evaluating CleanSpark's energy software heritage, the key insight is that this chapter wasn't a false start—it was essential preparation. The company entered Bitcoin mining with capabilities that pure-play mining startups lacked: relationships with utilities, expertise in grid interconnection, software for optimizing power consumption, and credibility with regulators. This foundation would prove invaluable in the aggressive expansion that followed.

IV. The Bitcoin Mining Pivot: The Big Bet (December 2020)

The acquisition announcement landed on December 10, 2020, and changed everything. CleanSpark agreed to acquire ATL Data Centers, LLC for up to $19.4 million in shares of the Company's common stock. For a company that had been plodding along as an energy software provider, the decision to acquire a Bitcoin mining facility in Georgia represented the most consequential strategic pivot in its history.

In December 2020, CleanSpark made a strategic pivot toward bitcoin mining, acquiring ATL Data Centers, a bitcoin mining facility in Georgia, for up to $19.4 million in shares of the Company's common stock. ATL Data Centers was located in College Park, Georgia—just minutes from Hartsfield-Jackson International Airport—and operated both traditional data center services and Bitcoin mining operations. In addition to providing customers with rack space, power, and equipment, ATL Data Centers LLC also offered several "Cloud Services," including virtual services, virtual storage, and data backup services.

The timing was exquisite. One week after the acquisition was announced, CleanSpark said ATL had earned approximately 10 bitcoins. As of December 17, 2020, Bitcoin had traded as high as $23,775, increasing from $18,279 on the day the acquisition was completed. Bitcoin would surge to nearly $65,000 by April 2021, and CleanSpark rode that wave with an operational base that competitors scrambling to enter the space couldn't match.

CEO Zachary Bradford articulated the strategic logic in language that revealed the company's differentiated approach: "As part of our strategic acquisition initiative, we identified energy-intensive companies facing the greatest amount of exposure to high power costs and resiliency risk. Our prior experience in the digital currency mining industry provided insight into how proper energy management was crucial to successful and profitable mining operations."

This wasn't a naive company chasing cryptocurrency hype. CleanSpark had done its homework. The ATL acquisition included 23 mobile mining rigs alongside the main facility, which CleanSpark had previously helped design. This acquisition enabled CleanSpark to take its prior designs and expand upon them at a much greater scale.

The acquisition brought immediate operational capacity. Zachary Bradford, CleanSpark's CEO, said, "We are extremely pleased with the first week post acquisition, ATL has continued mining without significant interruption during integration of our teams and the ability to quickly procure additional miners immediately increased our capacity. With the latest S19s deployed we have now exceeded 200PH/s of mining capacity."

Executive Chairman Matthew Schultz captured the economic opportunity succinctly: "Doing the simple math, 10 bitcoins have added roughly $200,000 to CleanSpark's revenues in the week since closing."

Bradford's vision extended beyond mere Bitcoin accumulation. He emphasized that CleanSpark anticipated achieving among the lowest mining costs in the United States: "We are focused on successfully deploying renewable energy assets in digital currency mining, and CleanSpark anticipates upon implementation of its solutions that its total costs to mine at ATL will be among the lowest in the United States."

The first month of full operations validated the thesis. From December 10, 2020 the first full-day of mining following the acquisition, through the end of the calendar year, CleanSpark produced just over 31 Bitcoins from its mining activities.

This acquisition marked the beginning of CleanSpark's transformation into a bitcoin mining company that leveraged its energy expertise to create sustainable mining operations.

What made CleanSpark's approach distinctive in the 2020-2021 mining gold rush was its emphasis on cost structure rather than merely hashrate accumulation. Zach Bradford, CEO of CleanSpark, commented, "We believe in taking a big-picture approach in how we view Bitcoin values with a focus on profitability. Conservatively, based on our all-in costs including energy, rent, personnel and overhead the Company can realize a profit whenever Bitcoin values are above $6,000 per coin."

This cost discipline would prove prescient. When Bitcoin crashed from $69,000 in November 2021 to below $20,000 by late 2022, miners with high cost structures faced existential crises. CleanSpark's focus on operational efficiency positioned it to survive—and even thrive—through the crypto winter.

CleanSpark's energy-efficient approach to mining Bitcoin attracted interest for several reasons: inflation boosted electricity prices, and Riot and Marathon were criticized for their use of coal-fired and fossil fuel plants for mining Bitcoin.

The December 2020 pivot represents the defining moment in CleanSpark's corporate history. What followed was an aggressive expansion campaign that would transform a small energy software company into one of the largest Bitcoin mining operations in North America. But the success of that expansion rested on the foundation laid in College Park, Georgia—a foundation built on energy expertise, cost discipline, and the conviction to make a transformational bet at precisely the right moment.

V. The Aggressive Expansion Era (2021–2023)

If the ATL acquisition was CleanSpark's entrance to the Bitcoin mining industry, what followed was a master class in counter-cyclical capital allocation. While competitors celebrated paper profits during the 2021 bull run, CleanSpark's leadership was already planning for the inevitable bust—and positioning the company to emerge from it stronger than before.

Since October 2021, CleanSpark significantly increased its computing power year over year by quadrupling in 2022 and nearly doubling in 2023. This growth trajectory is remarkable not just for its magnitude but for its timing. CleanSpark's most aggressive expansion occurred during the darkest days of the crypto winter, when Bitcoin traded below $20,000 and mining companies faced existential questions about their viability.

Throughout 2021 and 2022, CleanSpark aggressively expanded its bitcoin mining capacity through both organic growth and strategic acquisitions of mining facilities and equipment. The company continued to emphasize its commitment to sustainable mining practices by seeking locations with access to renewable energy sources and by implementing energy-efficient technologies.

The Georgia strategy formed the cornerstone of this expansion. CleanSpark acquired the 36 MW campus along with existing infrastructure and machines for $25.1 million in August 2022, and has invested about $55 million on phase two – including construction, infrastructure, and machines – which is expected to increase the total power capacity to 86 MW.

This strategy allowed the company to increase its hashrate from 2.1 EH/s, in January 2022, to 6.2 EH/s, in December 2022, despite a downturn in the cryptocurrency markets. While competitors were retrenching, CleanSpark was tripling its operational capacity.

The company's equipment purchasing strategy demonstrated similar foresight. In April 2023, with Bitcoin still trading below $30,000 and mining stocks deeply out of favor, CleanSpark announced a blockbuster equipment deal: CleanSpark announced a purchase of 45,000 brand-new units of the Antminer S19 XP bitcoin mining machines for a total price of $144.9 million. All units are expected to be ready for delivery by the manufacturer before September end, adding, once deployed, over 6.3 exahashes per second of computing power to the company's current hashrate of 6.7 EH/s, a 95% increase.

By mid-2023, the strategy was bearing fruit. CleanSpark Inc. announced it had reached an all-time hashrate high of 8.5 exahashes per second (EH/s) as its Washington and Dalton, Georgia, campuses continued to come fully online. "We have nearly tripled our hashrate in just a year," said Zach Bradford, CEO.

"Last year at this time our operational hashrate was 2.9 EH/s and today it comes in at over 8.5 EH/s. Our owned-and-operated approach to mining has been essential to making this growth possible."

The numbers from this era tell a story of disciplined execution. From fiscal 2021 to fiscal 2023 (which ended last September), CleanSpark's revenue increased at a compound annual growth rate (CAGR) of 85%.

CleanSpark held the 44th spot on the Financial Times' 2022 List of the 500 Fastest Growing Companies in the Americas and ranked thirteenth on Deloitte's Fast 500.

The company's approach to expansion differed fundamentally from competitors like Marathon Digital and Riot Platforms. Rather than pursuing massive single-site developments or extensive hosting arrangements, CleanSpark built a portfolio of owned-and-operated facilities across Georgia. This strategy offered several advantages: diversification of regulatory and utility risk, operational flexibility, and the ability to quickly integrate acquisitions.

By 2023, CleanSpark had largely completed its transition from an energy technology company to a pure-play sustainable bitcoin mining enterprise, though it continues to apply its energy expertise to optimize its mining facilities.

The company's efficiency gains accompanied its growth. The focus on deploying the latest generation miners—particularly Bitmain's S19 XP and later S21 series—meant that CleanSpark could mine more Bitcoin while consuming less energy per terahash. This efficiency advantage would prove critical when Bitcoin's fourth halving arrived in April 2024.

By the end of fiscal year 2023, CleanSpark had established itself as the third-largest publicly traded Bitcoin miner in North America by hashrate, trailing only Marathon Digital and Riot Platforms. But unlike those competitors, CleanSpark had built its position primarily during the bear market, acquiring assets at depressed valuations while competitors faced financing constraints.

The aggressive expansion era demonstrated CleanSpark's most important competitive advantage: the ability to maintain conviction and deploy capital when others are paralyzed by fear. This counter-cyclical approach—buying equipment when prices are low, acquiring facilities when sellers are desperate—would define CleanSpark's playbook for the years ahead.

VI. The 2024 Halving: Test of the Business Model

Every Bitcoin miner's business model faces a recurring crucible: the halving. Approximately every four years, the Bitcoin network cuts mining rewards in half, instantly reducing the revenue miners earn for the same computational work. The fourth halving, which occurred on April 19, 2024, reduced block rewards from 6.25 BTC to 3.125 BTC—and represented the most significant test of CleanSpark's business model since its Bitcoin mining pivot.

For miners unprepared for this event, the halving can be catastrophic. Mining operations that were marginally profitable at pre-halving reward levels suddenly face operating losses. Equipment that was generating positive returns becomes economically stranded. The weakest operators exit the industry, while survivors capture their market share.

CleanSpark had spent three years preparing for this moment. CleanSpark, Inc. reported financial results for the three months ended December 31, 2023. "We're well positioned for the halving, and we have the liquidity and balance sheet strength to enable us to continue to not only survive, but to thrive into the halving and beyond."

The company's first quarter fiscal 2024 results (the quarter immediately preceding the halving) demonstrated this preparation: The Company increased its quarterly revenues to $73.8 million, an increase of $46.0 million, or 165% from $27.8 million for the same prior year period. Net income for the three months ended December 31, 2023, was $25.9 million or $0.14 basic income per share compared to a loss of ($29.0) million or ($0.46) loss per share for the same prior year period.

CleanSpark entered the halving with significant firepower. "I'm also pleased to report that our bitcoin treasury has grown to over 5,000 bitcoin. Pair that with our current cash balance of over $300 million and we are well on our way to taking advantage of what we expect to be one of the most active merger and acquisition seasons ever experienced in our industry."

The immediate post-halving results validated the strategy. While competitors struggled with suddenly compressed margins, CleanSpark's efficiency-focused fleet continued generating positive returns. "CleanSpark weathered the challenges of the bitcoin halving with one of the most efficient mining portfolios as evidenced by our strong gross margins," said Gary A. Vecchiarelli, CFO. "During the third quarter, we saw block rewards get cut by 50%, yet we managed to recognize only 7% less revenue by mining 1,583 bitcoin in the period."

The full fiscal year 2024 results (ending September 30, 2024) demonstrated CleanSpark's success in navigating the halving: The company finished FY2024 with over 8,000 bitcoin in treasury, reaching 27.6 EH/s in hashrate and 552 MW of operational capacity at wholly-owned sites—increases of 258%, 187%, and 132% from FY2023, respectively.

The Company's annual revenues were $378.9 million, an increase of $210.5 million, or 125%, from $168.4 million for the prior fiscal year.

The post-halving growth reflected CleanSpark's aggressive fleet upgrade strategy. The Company's hashrate has surged 200% since October 2023 through significant organic growth paired with turn-key acquisitions and the execution of a fleet upgrade, improving efficiency during the same period by nearly 20% and boosting the number of operational machines by 112%.

"Our performance this year reflects a sustained growth trajectory, solidifying our position as one of the top Bitcoin miners in the world, as we move into an anticipated new bull market," said CleanSpark CEO Zach Bradford. "Reflecting on the past year, our results in FY 2024 and the positioning of the company going into 2025 demonstrated the wisdom of our counter-cyclical growth and capital allocation strategy."

The halving also triggered industry-wide consolidation that CleanSpark had anticipated and prepared to exploit. Smaller miners, facing unprofitable operations, became acquisition targets. Facilities that had been unavailable came to market. Equipment prices declined as distressed operators liquidated assets.

The 2024 halving ultimately validated CleanSpark's strategic approach: invest counter-cyclically during bear markets, prioritize efficiency over raw hashrate, maintain strong liquidity, and position for consolidation opportunities when competitors stumble. The company emerged from the halving stronger than it entered, with expanded market share and a clear path toward industry leadership.

VII. M&A Strategy: The Consolidation Play (2024)

If the halving stress-tested CleanSpark's operational model, 2024 became the year the company's M&A engine shifted into high gear. Management had telegraphed this strategy for months, building a war chest specifically to acquire distressed competitors and valuable power infrastructure when market conditions turned challenging.

CleanSpark bought three facilities in Mississippi in February 2024 for roughly $20 million and committed in May 2024 to spend about $19 million to acquire 75 MW worth of mining sites in Wyoming. More recently, the miner said it would buy five more bitcoin mining facilities in Georgia for nearly $26 million.

But the crown jewel of CleanSpark's 2024 acquisition strategy was GRIID Infrastructure—a deal that would reshape the company's geographic footprint and power supply diversity.

CleanSpark Inc. and GRIID Infrastructure Inc. announced that they had entered into a definitive merger agreement pursuant to which CleanSpark would acquire all the issued and outstanding common stock of GRIID in an all-stock transaction. The total enterprise value, including payment and assumption of debt, of the transaction was $155 million.

GRIID brought something CleanSpark didn't have: access to power from the Tennessee Valley Authority (TVA), one of the largest and most important public power companies in the United States. GRIID operates bitcoin mining data centers in various cities and towns throughout Tennessee that are serviced by Tennessee Valley Authority (TVA), the largest and one of the most important public power companies in the United States. Like CleanSpark, GRIID has taken a community-first approach to building its data centers.

CleanSpark, Inc. announced the completed acquisition of GRIID Infrastructure Inc. on October 30, 2024, following approval of the transaction by stockholders of GRIID at the special meeting of its stockholders on October 28, 2024. "I'm pleased to announce the completion of our acquisition of GRIID Infrastructure Inc., a strategic move that allows us to grow our Bitcoin mining capacity in the state of Tennessee, which we intend to build to over 400 MW in the coming years," said CleanSpark CEO Zach Bradford.

The strategic importance of securing TVA power access cannot be overstated in the Bitcoin mining industry. TVA is known for providing reliable and competitively priced power, which is important for maintaining profitable mining operations.

The GRIID acquisition also brought valuable human capital. Harry Sudock, who had been GRIID's chief strategy officer and its first employee in 2018, joined CleanSpark's leadership team. Harry Sudock is the chief business officer at CleanSpark, where he oversees investor relations and strategic communications, provides sector leadership, and plays a key role in the development and implementation of the broader corporate strategy. He previously served as CleanSpark's senior vice president and chief strategy officer for GRIID, where he joined in 2018 as the first employee.

The September 2024 acquisition of seven additional Bitcoin mining facilities in the Knoxville, Tennessee area further expanded CleanSpark's footprint: CleanSpark Inc. announced it had entered into definitive agreements to acquire seven bitcoin mining facilities and certain associated land in the Knoxville, Tennessee, area for total cash payments of $27.5 million, or approximately $324,000 per megawatt. This acquisition builds on the Company's strategy of securing high-quality infrastructure opportunities at market-leading valuations.

"With the energization of our Dalton 4 campus last week, we've already surpassed 23 EH/s and expect more hashrate to come online this week from the energization of 50 MW of S21 pros in Sandersville. With this additional 5 EH/s expected to begin hashing over the coming weeks, we now expect to achieve 37 EH/s before the end of 2024."

The consolidation strategy rested on a clear thesis: "Reaching 30 EH/s positions us as one of the largest bitcoin miners in the world. We have added more operational hashrate than any other miner in 2024. The results we continue to deliver demonstrate our commitment and ability to scale rapidly and with capital efficiency," said Zach Bradford, CEO.

"Our efforts to time the market and lock in industry-best pricing on rigs and sites positioned us to take advantage of the opportunities in the market."

By October 2024, CleanSpark had achieved 30 EH/s—a remarkable milestone that positioned it among the largest Bitcoin miners globally. The announcement, made on August 21, 2024, follows a period of consolidation among North American publicly traded miners, with CleanSpark acquiring GRIID Infrastructure Inc. in June and Riot Platforms purchasing Block Mining in July.

The M&A strategy transformed CleanSpark's geographic profile. What had been a Georgia-centric operation now spanned Georgia, Mississippi, Wyoming, and Tennessee—providing diversification across power markets, regulatory jurisdictions, and climate zones. This diversification reduced single-point-of-failure risk and positioned CleanSpark for continued expansion.

VIII. The AI Pivot: Third Act Begins (2025)

In October 2025, CleanSpark announced what management described as a "business evolution"—an expansion beyond pure-play bitcoin mining into AI data center infrastructure. The move represented both a natural extension of CleanSpark's core competencies and an acknowledgment that the company's most valuable assets might not be its mining equipment but rather its power infrastructure and site development expertise.

CleanSpark, Inc. announced the appointment of Jeffrey Thomas as Senior Vice President of AI Data Centers. Thomas brings over four decades of global experience in emerging technologies and data center infrastructure development as CleanSpark positions itself for its next phase of growth.

As Senior Vice President of AI Data Centers, Mr. Thomas will lead CleanSpark's strategy to expand beyond bitcoin mining by developing and operating advanced AI data center infrastructure. This strategic evolution will diversify the Company's revenue streams, strengthen long-term cash flow potential, and enhance its ability to serve the world's leading technology companies.

The logic behind the pivot crystallizes when examining the broader technology landscape. Hyperscale cloud providers and AI companies face an unprecedented constraint: access to power. Data centers require reliable, abundant, low-cost electricity—the same requirements that define successful Bitcoin mining operations.

One key example of why bitcoin miners can win in the booming data center market: CleanSpark recently won a 100-megawatt site in Cheyenne, Wyoming, and beat out the tech giant Microsoft for the contract, according to its CEO. How did a company with a market cap under $6 billion best a $4 trillion company?

Speed to market. "We were able to scale up and deploy 100 megawatt bitcoin mining facility in about six months, where to build a proper AI data center is going to take three to six years," CleanSpark CEO Matt Schultz said on CNBC.

The shift comes as competition for power intensifies, and in a sense, brings CleanSpark full circle, with Schultz noting that it started as an energy company before shifting to bitcoin mining five years ago and becoming one of the largest mining operations.

The Texas acquisition in October 2025 signaled serious commitment to the AI strategy: CleanSpark announced it had acquired the rights to approximately 271 acres of land in Austin County, Texas, and executed long-term power supply agreements totaling 285 megawatts to support the development of a next-generation data center campus.

"The Houston market is emerging as a premier destination for next-generation data center development," said Jeffrey Thomas, senior vice president of AI data centers. "This acquisition provides CleanSpark with the footprint and power capacity needed to deliver large-scale, high-density compute solutions to global technology partners."

The capital to fund this expansion came from CleanSpark's largest-ever financing: CleanSpark, Inc. announced the upsize and pricing of its offering of $1.15 billion aggregate principal amount of 0.00% Convertible Senior Notes due 2032.

CleanSpark said it will use about $460 million of the proceeds to buy back common stock and dedicate the balance to growing its power and land holdings, building new AI-focused data centers, and repaying debt lines.

"This transformative $1.15 billion offering marks a defining moment in CleanSpark's growth as a leading energy and infrastructure compute platform," said Matt Schultz, CleanSpark Chairman and Chief Executive Officer.

The AI pivot doesn't abandon Bitcoin mining—rather, it positions CleanSpark to optimize across multiple compute workloads. During its earnings call, CleanSpark management relayed a conversation with a Georgia utility executive who effectively said, "We need about 120 hours a year where someone can give power back." Bitcoin has historically filled that role; now, the solution seems to be a blend of AI and mining at the same campuses so a portion of the load remains interruptible. CleanSpark's plan is to use AI campuses for stable, premium-priced long-term tenants but keep a slice of Bitcoin mining at or near those sites to preserve flexible load for the utility and earn better power rates.

The industry-wide trend validates CleanSpark's timing. Across the US, an identical pattern is playing out at bitcoin mining facilities owned by a variety of operators. In the last 18 months, at least eight other publicly traded bitcoin mining companies—Bitfarms, Core Scientific, Riot, IREN, TeraWulf, CleanSpark, Bit Digital, MARA Holdings, and Cipher Mining—have announced AI pivots.

For CleanSpark, the AI pivot represents the third major transformation in the company's history—from energy software to Bitcoin mining to diversified compute infrastructure. Each transformation has built on the capabilities developed in the prior phase, creating what management hopes will be a durable platform for long-term value creation.

IX. Current State & Financials (2025)

CleanSpark's fiscal year 2025 results (ending September 30, 2025) demonstrated the payoff from years of aggressive expansion and counter-cyclical capital allocation.

Fiscal year revenues were $766.3 million, an increase of $387.3 million, or 102.2%, from $379 million for the same prior year period.

Net income reached $364.5 million ($1.25 per share), compared to a $145.8 million net loss in FY2024, while adjusted EBITDA jumped to $823.4 million.

Net Income Reversal: The company swung from a $(145.8) million net loss in fiscal year 2024 to a $364.5 million net income in fiscal year 2025, highlighting a substantial shift in statutory profitability.

However, investors should understand what drives these numbers: The $364.5 million net income was entirely sustained by a $425.6 million non-cash gain on the fair value of Bitcoin holdings. This disparity suggests that, absent market appreciation of Bitcoin, core operational activities potentially generated a net loss.

The balance sheet reflects CleanSpark's transformed scale: CleanSpark reported cash of $43 million, $1.2 billion in bitcoin, and $1 billion in working capital as of Sept. 30.

The company reported current liabilities of $315.8 million and long-term debt of $644.6 million. Total liabilities were listed at $1.0 billion, with stockholders' equity at $2.2 billion.

Operational metrics demonstrate the scale achieved: During the 2025 fiscal year ended September 30, CleanSpark mined 7,873 BTC for $766 million in revenue and $364.5 million net profit.

By fiscal year 2025, CleanSpark operated 50 EH/s, which represented 4.5% of Bitcoin's total hashrate.

The company's power portfolio had grown substantially: it owned a portfolio of more than 1.3 GW of power, land, and data centers across the United States powered by globally competitive energy prices.

Leadership transitioned in August 2025: Bitcoin mining company CleanSpark said Monday that founder Matthew Schultz will assume the CEO position effective immediately following the resignation of Zachary Bradford. Bradford had served as the company's chief executive since October 2019.

Bradford, who led the company since 2019, said he is stepping down to focus on family. The current management team will remain in place, and the company said its strategic plans are unchanged.

The convertible notes financing strengthened CleanSpark's capital position while avoiding equity dilution: The company has repurchased 30.6 million shares of its common stock from the offering participants. This share repurchase represents approximately 10.9% of CleanSpark's outstanding shares and cost around $460 million.

"Fiscal 2025 was the year CleanSpark achieved operating leverage," said Matt Schultz, Chairman and CEO of CleanSpark in the statement. "We are evolving into a comprehensive compute platform that is prepared to optimize value from both AI and bitcoin workloads."

X. Playbook: Business & Strategy Lessons

CleanSpark's journey from dormant shell company to industry leader offers valuable lessons for students of business strategy:

1. Corporate Reinvention is Possible The reverse merger structure that brought CleanSpark to life remains a viable path for entrepreneurs seeking public market access. However, success requires more than just the corporate shell—it demands management teams with genuine operational capabilities and a clear strategic vision.

2. Timing the Cycle Matters CleanSpark's December 2020 Bitcoin mining pivot caught the market at a near-perfect moment. But timing alone doesn't explain the company's success—preparation did. The company's energy expertise, acquired over years of microgrid work, enabled rapid execution when the opportunity emerged.

3. Counter-Cyclical Capital Allocation Creates Durable Advantage "Reflecting on the past year, our results in FY 2024 and the positioning of the company going into 2025 demonstrated the wisdom of our counter-cyclical growth and capital allocation strategy. We produce durable, high performing growth and have been since our earliest days in Bitcoin mining," Bradford said.

CleanSpark's most aggressive expansion occurred during the 2022 crypto winter, when competitors were retrenching and asset prices were depressed. This required both financial capacity (strong balance sheet) and psychological fortitude (willingness to invest when others are fearful).

4. Energy-as-Moat Creates Strategic Options CleanSpark's energy expertise proved valuable not once but twice—first as the foundation for Bitcoin mining success, and now as the springboard for AI infrastructure expansion. In a power-constrained world, control of energy infrastructure creates options that pure technology companies lack.

5. Operational Excellence Enables Survival "Our team's agility, effectiveness and relentless grit has been paramount to the success of CleanSpark. Our efforts to time the market and lock in industry-best pricing on rigs and sites positioned us to take advantage of the opportunities in the market."

The focus on efficiency—maintaining the newest, most power-efficient mining fleet—enabled CleanSpark to remain profitable through the halving while competitors struggled.

6. Platform Thinking Enables Multiple Revenue Streams CleanSpark's evolution from energy software to Bitcoin mining to AI infrastructure reflects platform thinking: building capabilities that can serve multiple use cases rather than optimizing for a single product or customer.

7. Treasury Strategy as Competitive Advantage CleanSpark's approach to Bitcoin holdings—maintaining a substantial treasury while using derivatives strategies to generate additional yield—represents sophisticated financial management that creates shareholder value beyond pure mining operations.

XI. Strategic Analysis: Competitive Position and Investment Considerations

Porter's Five Forces Analysis

Threat of New Entrants: MODERATE-HIGH Bitcoin mining requires significant capital for equipment and facilities, creating meaningful entry barriers. However, the industry has attracted substantial new investment, particularly from traditional finance and technology sectors seeking AI infrastructure plays. The strategic value of power assets has drawn interest from well-capitalized competitors.

Bargaining Power of Suppliers: HIGH Bitmain and a small number of other manufacturers dominate ASIC production, giving them significant pricing power. Power utilities also hold leverage through rate structures and interconnection agreements.

Bargaining Power of Buyers: LOW to MODERATE For Bitcoin mining, the company sells into a global liquid market with no individual buyer negotiating power. However, AI infrastructure customers (hyperscalers) are sophisticated and have alternatives, giving them more leverage in the emerging AI business.

Threat of Substitutes: MODERATE Bitcoin mining has no substitutes within the Bitcoin ecosystem—proof-of-work validation cannot be replaced without changing Bitcoin's fundamental design. However, the broader question is whether investors view Bitcoin mining as a compelling way to gain Bitcoin exposure versus alternatives like direct ownership or ETFs.

Industry Rivalry: VERY HIGH CleanSpark operates in the highly competitive bitcoin mining industry, where companies compete primarily on hash rate capacity, energy efficiency, and access to low-cost electricity. Its main publicly-traded competitors include Marathon Digital Holdings (MARA), Riot Platforms (RIOT), Core Scientific (CORZ), Bitfarms (BITF), and Hut 8 (HUT).

Miners with the largest market capitalizations – MARA Holdings (MARA), Riot Platforms (RIOT) and CleanSpark (CLSK) – all increased their share of the total amount of bitcoin mined last month versus August.

Hamilton's 7 Powers Analysis

Scale Economies: DEVELOPING Larger operations can negotiate better equipment pricing and power rates, but CleanSpark hasn't yet achieved scale where competitors can't match its cost structure.

Network Effects: NONE Bitcoin mining has no network effects—one miner's success doesn't enhance another miner's value proposition.

Counter-Positioning: STRONG CleanSpark's ability to deploy power infrastructure rapidly for Bitcoin mining, then potentially convert to AI workloads, represents a capability that traditional data center developers and hyperscalers struggle to match. The speed advantage—six months versus three to six years—creates meaningful competitive differentiation.

Switching Costs: LOW to MODERATE Bitcoin mining has minimal switching costs. AI customers may have higher switching costs due to data locality, contract commitments, and the friction of relocating workloads.

Branding: MODERATE "America's Bitcoin Miner®" positioning and emphasis on sustainable operations differentiates CleanSpark from competitors criticized for environmental practices. However, branding creates limited economic moat in a commodity business.

Cornered Resource: STRONG (Potentially Key Power) Long-term power contracts, TVA access through GRIID, and sites with completed grid interconnections represent assets that are difficult and time-consuming to replicate. In a power-constrained environment, these resources may prove the company's most valuable assets.

Process Power: DEVELOPING CleanSpark's operational capabilities—rapid site development, efficient fleet management, counter-cyclical capital allocation—suggest emerging process advantages, but these haven't yet been proven durable against well-capitalized competitors.

Key Performance Indicators to Monitor

1. Hashrate and Operational Capacity Growth The most direct measure of CleanSpark's core business expansion. Watch for continued growth toward 50+ EH/s and monitoring of utilization rates across facilities.

2. Cost Per Bitcoin Mined Efficiency drives profitability through halvings and Bitcoin price cycles. CleanSpark's all-in cost to mine Bitcoin relative to spot prices determines margin sustainability.

3. Power Pipeline Development and AI Revenue As CleanSpark pursues its AI strategy, track progress on converting power capacity to AI workloads and the emergence of contracted AI revenue streams.

Investment Considerations

Bulls would emphasize: - Counter-cyclical execution track record - Strong balance sheet with $1.2 billion in Bitcoin holdings - Optionality from AI infrastructure pivot - Experienced management team - Diversified power portfolio across multiple states

Bears would highlight: - The $364.5 million net income was entirely sustained by a $425.6 million non-cash gain on the fair value of Bitcoin holdings—suggesting core operations may be marginally profitable - Bitcoin price dependency creates earnings volatility - Mining profitability has hit structural lows that experts say represent more than just a temporary downturn. Hashprice, which measures how much miners earn per unit of computing power, crashed from $55 per petahash per second in the third quarter to roughly $35 PH/s by late 2024. - AI pivot execution risk—converting Bitcoin mining infrastructure to AI-ready data centers involves significant technical and commercial challenges - "A bitcoin mining data center is the simplest type there is," said Fred Thiel, CEO of MARA. "It's very hard for bitcoin miners to pivot to be hosts for large-scale enterprises." AI clients require near perfect uptime to train their models.

Material Risks and Regulatory Considerations

CleanSpark faces several material risks that investors should monitor:

- Bitcoin Price Volatility: The company's revenue and profitability remain highly correlated with Bitcoin prices

- Regulatory Risk: Energy-intensive operations face potential regulatory scrutiny and changing utility rate structures

- Competition for Power: AI demand may increase competition for the power assets that form CleanSpark's moat

- Halving Cycle Risk: Future halvings will continue to pressure mining economics

- Technology Obsolescence: Mining equipment requires continuous upgrade cycles

The company's accounting treatment for Bitcoin holdings—now at fair value under updated accounting standards—introduces mark-to-market volatility that can significantly impact reported earnings independent of operational performance.

CleanSpark's journey from dormant shell company to Bitcoin mining leader to emerging AI infrastructure platform represents one of the most dramatic corporate reinventions in recent American business history. The company's success rests on genuine competitive advantages: energy expertise, counter-cyclical capital allocation discipline, and operational excellence in power-intensive computing environments.

Whether CleanSpark can successfully execute its AI pivot while maintaining Bitcoin mining leadership remains the central question for investors evaluating the company's long-term prospects. The assets are real, the management is experienced, and the strategic logic is sound. Execution across multiple complex initiatives will determine whether CleanSpark becomes a durable platform company or remains primarily a leveraged play on Bitcoin prices.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music