Astrana Health: Building America's Physician-Powered Healthcare Constellation

I. Introduction & Episode Roadmap

Picture a hospitalist making rounds at Glendale Memorial Hospital in 2001. The hallways echo with the familiar chaos of American healthcare—beeping monitors, hurried nurses, patients shuffled between specialists who rarely communicate. This physician sees something broken in the system, something fundamental. Patients arrive sicker than they should be because preventive care failed. Costs spiral because nobody coordinates the journey. The incentives are backwards—hospitals profit from filled beds, not empty ones.

Now fast-forward more than two decades. That small hospitalist operation has transformed into something almost unrecognizable: a publicly-traded healthcare constellation spanning multiple states, managing the care of millions of Americans through a vast network of physicians. The company anticipated multibillion-dollar revenue for 2025. The transformation from ApolloMed Hospitalists—a scrappy California startup—to Astrana Health, one of the nation's largest population health management platforms, represents one of healthcare's most compelling growth stories.

But this isn't simply a tale of corporate expansion. It's the story of how physician-founders, frustrated with medicine's misaligned incentives, built something designed to fix healthcare from the inside out. They didn't wait for Washington to solve the fee-for-service problem. They didn't bet on a single technological breakthrough. Instead, they constructed a platform—piece by piece, acquisition by acquisition—that aligns physicians, payers, and patients around a revolutionary concept: getting paid for keeping people healthy rather than treating them when they're sick.

The company's own mission statement captures this ethos: "A physician-centric, technology-enabled healthcare company empowering providers to deliver accessible, high-quality, and high-value care to all." Those words matter because they explain everything Astrana does and why it does it. The physician-centric piece means doctors aren't employees stripped of autonomy—they're partners empowered by technology and shared risk. The value-based care model means success is measured in outcomes, not volume.

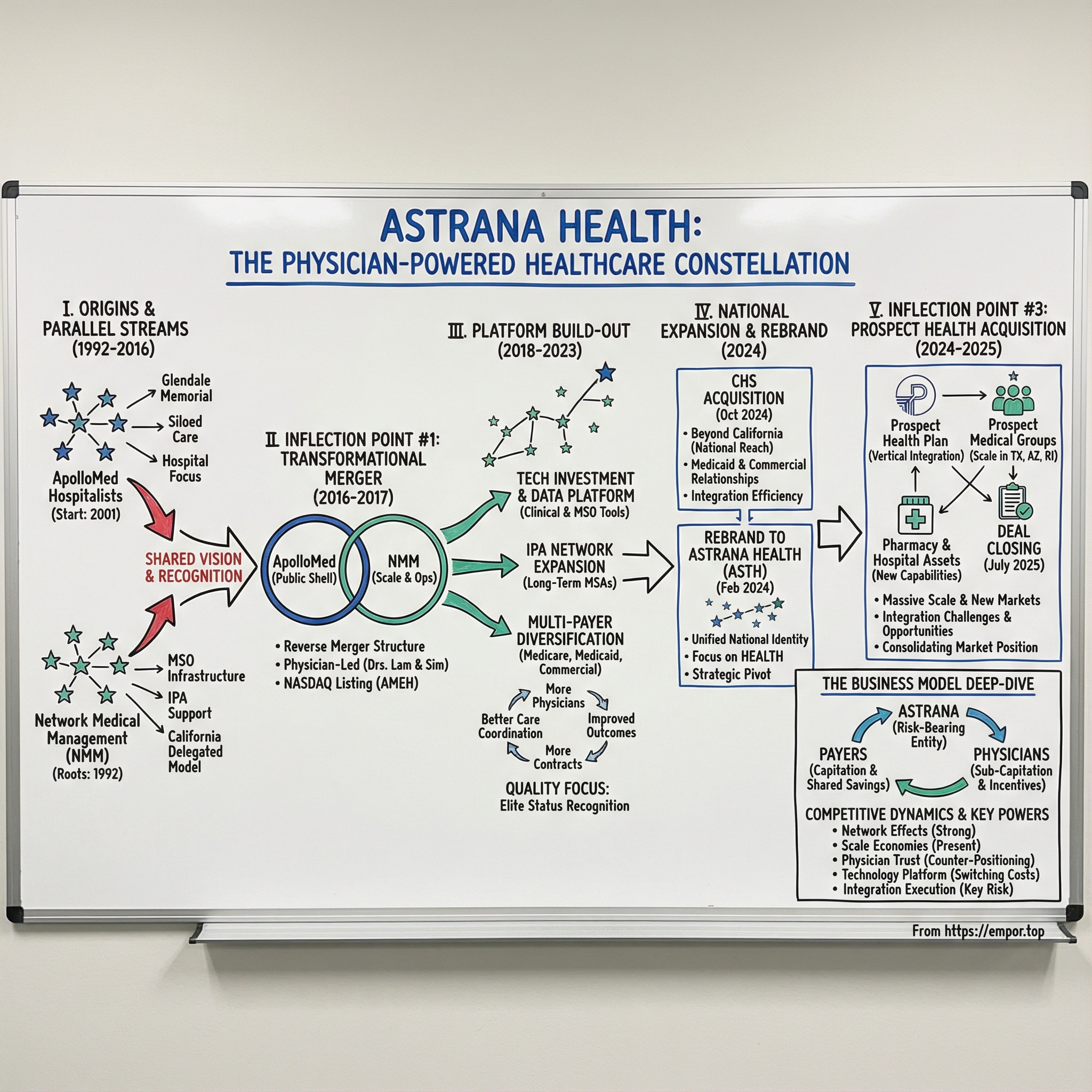

This episode explores how Astrana achieved what many thought impossible: scaling the California delegated model—a unique arrangement where physician groups accept financial responsibility for patient populations—into a national platform. We'll trace the origins from physician-founders in the 1990s through the transformational merger with Network Medical Management in 2017, the strategic rebrand in 2024, and the massive Prospect Health acquisition that closed in July 2025. Along the way, we'll decode the business model, analyze competitive dynamics, and examine whether Astrana's constellation of care can continue expanding across American healthcare's fractured landscape.

The themes that emerge tell us something profound about where medicine is heading: physician-founder DNA shapes culture in ways that matter for decades; value-based care represents a structural shift, not a passing trend; acquisitions can build durable platforms when integration is executed properly; and California's unique IPA ecosystem created a blueprint that's finally going national. For investors trying to understand healthcare's future, Astrana offers a case study in how disruption sometimes comes not from Silicon Valley newcomers, but from practitioners who understand the system's failures intimately enough to fix them.

II. The Healthcare Context: Why Value-Based Care Matters

To understand Astrana, you first need to understand the disease it's trying to cure—and that disease is fee-for-service medicine itself.

For most of the twentieth century, American healthcare operated on a simple transactional model: doctors perform procedures, hospitals fill beds, insurers pay bills. Do more, bill more, earn more. The incentives seem obvious in hindsight, yet the consequences took decades to fully manifest. A physician who prevents a heart attack through lifestyle counseling earns a fraction of what a cardiologist makes performing a bypass surgery. A hospital that sends patients home quickly with excellent care coordination generates less revenue than one that sees readmissions. The system literally pays for failure and penalizes success.

The numbers grew staggering. The United States now spends nearly $4.5 trillion annually on healthcare—roughly 17% of GDP—yet ranks poorly among developed nations on outcomes like life expectancy and infant mortality. Something was fundamentally broken. The misalignment between payment and value created a healthcare industrial complex optimized for volume, complexity, and intervention rather than health, prevention, and coordination.

Enter value-based care: the revolutionary concept that providers should be rewarded for outcomes rather than activities. The shift from fee-for-service to value-based contracts has been accelerating nationally, driven by government programs like Medicare Advantage and commercial payers seeking to control costs. The premise is elegant—pay physicians and health systems a fixed amount per patient (capitation) or share savings when costs come in below benchmarks. Suddenly, keeping people healthy becomes profitable. Preventing hospitalizations adds to the bottom line. Care coordination transforms from a cost center into a value driver.

But here's where geography matters enormously. California became the laboratory for capitated care models decades before the rest of the country caught on. The Golden State's unique combination of HMO penetration, regulatory frameworks, and physician entrepreneurship created an ecosystem where Independent Physician Associations—IPAs—could accept financial risk from insurers and manage patient populations directly. This collaboration between HMOs and medical groups represents a well-established model designed to motivate physicians to practice preventive medicine and reduce unnecessary procedures.

Understanding the alphabet soup of healthcare organizations is essential for following Astrana's story. IPAs are networks of independent physicians who band together to contract with insurers while maintaining their autonomy. Management Services Organizations—MSOs—provide the administrative backbone: claims processing, credentialing, data analytics, contracting support. Accountable Care Organizations—ACOs—represent Medicare's version of the model, where provider groups share savings (and sometimes losses) based on quality and cost performance. Astrana operates across all three structures simultaneously.

The California delegated model works differently than healthcare elsewhere in America. When a health plan contracts with an IPA in California, it often delegates both the clinical and financial responsibility for a patient population. The IPA receives a monthly capitation payment—essentially a budget—and must manage all care within that budget. If costs come in below the capitation, the IPA keeps the savings. If costs exceed the budget, the IPA absorbs the losses. This creates powerful incentives for preventive care, care coordination, and appropriate utilization.

For physicians, this model offers something precious: the ability to remain independent while accessing the infrastructure, data, and risk management capabilities needed to succeed in value-based arrangements. A solo practitioner cannot negotiate effectively with Blue Shield or manage population health analytics. But that same physician, affiliated with a strong IPA backed by a sophisticated MSO, can thrive in the value-based world while maintaining clinical autonomy.

The implications for investors are significant. Value-based care isn't a fad or a policy experiment—it represents the fundamental restructuring of how American healthcare will be financed and delivered. Medicare Advantage enrollment has surged over the last decade, and projections suggest it could represent roughly half of all Medicare beneficiaries by the end of this decade. Commercial payers are following suit. The companies positioned to facilitate this transition—those with the physician networks, technology platforms, and risk management capabilities to make value-based care work—are building what could become essential infrastructure for twenty-first-century healthcare delivery.

III. Founding Origins: Physicians Building for Physicians (1992-2016)

The origin story of Astrana Health doesn't begin with a single founding moment but rather with parallel streams that would eventually converge into something greater than either could achieve alone. The company traces its roots to 1992, when physicians established the organization specifically to empower other physicians in delivering best-in-class healthcare for their local communities. This wasn't a venture capital play or a management consulting spinoff—it was doctors building for doctors, practitioners who understood intimately what their colleagues needed to succeed.

Kenneth T. Sim and Thomas S. Lam emerge as central figures in this founding narrative. Both physicians, both deeply embedded in California's managed care ecosystem, both convinced that the future belonged to organized physician networks capable of accepting risk and delivering value. Corporate filings reflect a complex lineage across multiple predecessor entities, with different documents pointing to different early founding years—an outcome of organizations evolving and combining over time into what is now Astrana. But the consistent thread is physician leadership from the very beginning.

Understanding what made these founders different requires appreciating what they weren't. They weren't hospital administrators looking to employ physicians. They weren't insurance executives seeking to control medical decisions. They weren't private equity investors hunting for healthcare arbitrage. They were practicing physicians who believed independent doctors could deliver better care than corporate medicine—if only they had the right support infrastructure.

The parallel story of ApolloMed Hospitalists illustrates another piece of the puzzle. Incorporated in California in 2001, this hospitalist company began operations at Glendale Memorial Hospital with a focused mission: providing high-quality inpatient care through dedicated hospital medicine specialists. Hospitalists—physicians who specialize in caring for hospitalized patients—represent one of medicine's fastest-growing specialties precisely because they improve care coordination and reduce length of stay. ApolloMed built its reputation on this model, expanding across Southern California hospitals throughout the 2000s.

Meanwhile, Network Medical Management was quietly becoming one of the largest MSOs in California. Throughout the 1990s and 2000s, NMM assembled the infrastructure that physician groups needed to succeed in capitated arrangements: sophisticated claims processing, credentialing systems, data analytics, payer contracting expertise. NMM signed a ten-year Management Services Agreement with Accountable Health Care IPA, one of the largest independent physician associations in California, demonstrating the long-term relationships that would become Astrana's hallmark.

By 2016, these complementary organizations had developed a shared recognition: the transformation they'd envisioned was accelerating, and scale would determine who survived. The company achieved its objective of transforming from an IPA model to an Integrated Population Health Model by facilitating best practices and creating a comprehensive healthcare organization that would be truly accessible to all. This wasn't just corporate messaging—it represented a genuine evolution from managing discrete physician networks to orchestrating entire care delivery systems.

The pre-merger landscape revealed two organizations with different strengths but aligned visions. ApolloMed brought public company infrastructure (it had previously listed on smaller exchanges), hospitalist expertise, and a growth orientation. Network Medical Management brought massive scale, deep California relationships, and decades of MSO operational excellence. Together, they could become something neither could achieve independently: a platform capable of both managing populations and delivering care directly.

For investors examining Astrana's competitive position, these founding origins matter enormously. The physician-founder DNA isn't just marketing—it shapes culture, strategy, and relationships in ways that persist across decades. Physicians trust Astrana because physicians built Astrana. The company can recruit IPA affiliates because it genuinely understands what independent doctors need. This founder advantage proved impossible to replicate by private equity-backed rollups or hospital system spinoffs that approached physician services as commodities rather than partnerships.

IV. Inflection Point #1: The Transformational NMM Merger (2016-2017)

December 2016 brought the announcement that would reshape both companies' trajectories. Apollo Medical Holdings and Network Medical Management—one of the largest healthcare Management Services Organizations in the United States—signed a definitive merger agreement combining the companies in a stock-for-stock transaction. The strategic rationale was explicit: "Through this combination, we will create an industry leader in the transition of U.S. healthcare to value-based reimbursements."

The scale was significant. On a pro forma basis, the combined organization generated hundreds of millions in revenues for the prior period. The new entity provided medical management for hundreds of thousands of patients through a network of thousands of healthcare professionals and hundreds of employees. These weren't startup metrics—this was a substantial platform combining two proven operations into something with genuine scale advantages.

But the structure of the deal revealed something crucial about power dynamics. Under the merger agreement terms, NMM shareholders would hold the clear majority of the combined company at closing, with ApolloMed shareholders taking a much smaller minority stake. For accounting purposes, the merger was treated as a reverse acquisition with NMM considered the accounting acquirer and ApolloMed the accounting acquiree. In other words, while the combined company would carry the ApolloMed name and public listing, the substance of the deal was NMM absorbing ApolloMed rather than the reverse.

The leadership structure reflected this reality. Upon closing, Thomas Lam, M.D., NMM's Chief Executive Officer, and Warren Hosseinion, M.D., would serve as Co-Chief Executive Officers of the combined company. Kenneth Sim, M.D., serving as NMM's Chairman, would become Executive Chairman of Apollo Medical Holdings. The physician-leaders who built NMM would now guide the combined platform's national ambitions.

December 2017 brought the successful completion of the merger. The newly combined company integrated two leading, complementary healthcare organizations to form one of the nation's largest population health management companies. The numbers had grown during the integration process: the combined entity now coordinated care and provided medical management for hundreds of thousands of patients in California through a network of thousands of contracted physicians and hundreds of employees. Just twelve months after announcement, the physician network had expanded substantially.

The NASDAQ listing represented a crucial milestone for accessing growth capital. The Company's common stock began trading on NASDAQ in December 2017 under the ticker symbol "AMEH." Leadership framed the significance clearly: "This merger, along with our listing on NASDAQ, are important milestones as we continue to build shareholder value." Access to public equity markets would fuel the acquisition strategy that followed.

For investors, the reverse merger structure raised important questions about valuation and control. The public markets effectively gained access to NMM's operations—the real prize—through ApolloMed's existing shell. This isn't unusual in healthcare; many of the industry's most successful platforms reached public markets through similar structures. What mattered was execution post-merger, and on that front the early results proved compelling.

The merger also established a template that Astrana would follow repeatedly: identify complementary capabilities, structure deals that align incentives, integrate operations around shared technology platforms, and use combined scale to improve contracting leverage with payers. Each subsequent acquisition would follow variations of this playbook.

V. The Platform Build-Out: Post-Merger Execution (2018-2023)

The years following the merger demonstrated that the strategic thesis was sound. Total revenue surged in the first full post-merger year compared to the prior year—evidence that the combination was producing real momentum rather than just a bigger organizational chart. This wasn't simply acquired growth; the combined platform was generating operational synergies and expanding organically as physician networks recognized the value of affiliation.

Building the technology stack became a strategic priority. The Company developed a data-enabled clinical platform providing care for patients across care settings—whether in the hospital, in a skilled nursing facility, or at home. The MSO platform evolved to offer a full suite of solutions for physicians, independent physician associations, medical groups, managed care organizations, hospitals, and accountable care organizations. Capabilities expanded to include claims processing and adjudication, credentialing, contracting, and sophisticated data collection, analysis, and reporting.

The technology investment matters because it creates stickiness. Once a physician practice integrates its workflows with Astrana's platform—using its EHR interfaces, claims management systems, and care coordination tools—switching costs become substantial. The practice would need to retrain staff, rebuild workflows, and potentially lose data continuity. This creates the kind of durable competitive advantage that value investors seek.

IPA network expansion continued aggressively. The company signed additional long-term Management Services Agreements with California physician associations, locking in relationships for a decade or more. Each new IPA brought not just members and revenue, but also physician relationships that could generate referrals and cross-sell opportunities. The network effects were becoming visible: more physicians meant more comprehensive care coordination, which improved outcomes, which attracted more payer contracts, which attracted more physicians.

Multi-payer diversification reduced concentration risk. While Medicare Advantage remained important, the platform expanded into Medicaid, Commercial insurance, and ACA Marketplace plans. A payer-agnostic platform enables service across all insurance types, reducing dependence on any single government program or commercial relationship. This diversification would prove prescient as different payer categories experienced varying growth trajectories.

The acquisition playbook emerged clearly during this period. Rather than building organically in new markets—a slow and expensive process—Astrana identified successful California IPAs and MSOs already operating in the value-based model. It offered these organizations something valuable: technology infrastructure, administrative scale economies, and access to growth capital. The targets gained resources to compete more effectively; Astrana gained established physician networks and member lives.

Quality performance became a differentiator. Several of Astrana's affiliated organizations achieved SOE Elite status—recognition reserved for the highest-performing organizations engaged in value-based care models. These quality achievements matter because Medicare Advantage plans increasingly tie bonus payments to quality scores. Higher quality ratings translate directly into improved economics for both the IPA and its payer partners.

By the end of this period, Astrana had proven the model worked at scale in California. The question became whether the same playbook could work nationally—and that would require a different kind of acquisition strategy.

VI. Inflection Point #2: CHS Acquisition & National Expansion (2024)

In October 2024, Astrana closed its deal for Collaborative Health Systems, a management services subsidiary of Centene. This wasn't another California IPA consolidation—CHS represented the company's first major move beyond its home market into truly national operations.

Centene, one of America's largest Medicaid managed care organizations, had built CHS to provide value-based care management services across multiple states. The acquisition gave Astrana immediate presence in markets where building organically would have taken years. More importantly, it brought relationships with state Medicaid programs and commercial payers outside California's unique delegated model ecosystem.

Integration moved quickly. Within months, Astrana completed the integration of the CHS acquisition, realizing significant general and administrative cost efficiencies and successfully onboarding CHS to Astrana's technology platform. Those early synergies demonstrated the scale economics that justify healthcare platform consolidation—spreading technology, compliance, and administrative infrastructure across more physicians and members reduces per-unit costs.

The CHS deal also signaled something important to other potential acquisition targets: Astrana could integrate acquisitions effectively, it could realize promised synergies, and it could operate successfully beyond California. This track record would matter enormously for the much larger transaction that followed.

VII. Inflection Point #3: The Rebrand to Astrana Health (2024)

Apollo Medical Holdings announced in early 2024 that it would formally change its name to Astrana Health, Inc. The Company began trading under the new ticker symbol "ASTH" on February 26, 2024. Name changes often signal strategic pivots, and this one was no exception.

The meaning behind the new name revealed the company's ambitions. Leadership explained that Astrana derives from roots referring to "a collection of stars," paying homage to the Company's founding physicians and representing the star providers and teammates allying together to deliver accessible, high-quality, and high-value care as a well-coordinated network—or constellation—to patients nationwide. The astronomical metaphor wasn't accidental: individual stars are impressive, but constellations are memorable and navigable.

The rebrand also served practical purposes. "Apollo Medical Holdings" tied the company to its hospitalist origins and California geography. "Astrana Health" communicated something broader: a national platform, a unified brand identity, and a focus on health rather than medical services specifically. For payers and physician groups in Texas, Arizona, or Rhode Island, the new name signaled a company that had moved beyond its California roots.

Marketing considerations aside, the timing aligned perfectly with the company's expansion strategy. As Astrana moved into new markets through CHS and contemplated even larger acquisitions, presenting a coherent national brand became essential. The rebrand represented a unifying identity reflecting the rapidly expanding national footprint and deep commitment to providing high-quality care to local communities across the country.

VIII. Inflection Point #4: The Prospect Health Acquisition (2024-2025)

November 2024 brought the announcement that would transform Astrana's scale: a definitive agreement to acquire certain businesses and assets of Prospect Health System in a deal valued in the hundreds of millions of dollars. This wasn't an incremental deal—it represented the company's largest transaction by far and the clearest statement yet of national platform ambitions.

The scope of what Astrana acquired deserves careful examination. The transaction included Prospect Health Plan in California, Prospect Medical Groups operating in California, Texas, Arizona, and Rhode Island, management service organization Prospect Medical Systems, RightRx pharmacy operations, and Alta Newport Hospital (doing business as Foothill Regional Medical Center)—an acute care hospital with 177 licensed beds in California. This wasn't just physician networks; this was a complete care delivery ecosystem including insurance, pharmacy, and hospital capabilities.

The strategic rationale combined geographic overlap with new market entry. Given the geographic overlap between Astrana and Prospect, especially in the key states of Texas, California, and Arizona, management viewed the transaction as highly strategic with potential to drive material long-term value for patients, providers, and shareholders. But the deal also opened new opportunities, particularly in geographically adjacent Orange County, California, where Astrana previously had limited operations.

The Prospect acquisition brought something Astrana hadn't possessed before: a health plan. Prospect Health Plan gave Astrana vertical integration into the insurance layer of healthcare—the ability to capture premium dollars, not just capitation payments. This creates both opportunities (improved unit economics, better data visibility) and risks (insurance reserves, regulatory complexity, actuarial challenges). The company gained a pharmacy operation as well, adding another service line and potential source of medication adherence improvement for managed populations.

The deal closed on July 1, 2025, at a lower final price than originally announced. Price adjustments between announcement and closing are common in healthcare M&A, typically reflecting working capital true-ups, regulatory requirements, or renegotiated terms. The final price still represented a substantial commitment to the growth strategy.

The scale impact was immediate and substantial. Prospect's network included thousands of providers across Southern California, Texas, Arizona, and Rhode Island. These medical groups enabled payer-agnostic, patient-centered care for hundreds of thousands of members across Medicare Advantage, Medicaid, and Commercial lines of business. Combined with Astrana's existing operations, the network expanded dramatically to encompass tens of thousands of physicians and millions of members.

Financial projections supported the strategic thesis. Astrana expected Prospect Health to contribute a substantial portion of total revenue and strong profitability on a full-year basis. If realized, these contributions represent roughly a third of Astrana's total anticipated revenue—a deal that truly moves the needle rather than incremental tuck-in.

Leadership framed the acquisition as consolidating market position: "We believe this acquisition continues to solidify Astrana as our nation's leading healthcare delivery platform, enabling us to deliver technology-driven, longitudinal, and patient-centered care to a combined member base across the country."

For investors, the Prospect deal raises important questions about integration execution, leverage, and management bandwidth. Integrating a major acquisition while also digesting CHS requires significant organizational capacity. The hospital asset introduces operational complexity unlike anything in Astrana's historical experience. And vertical integration into health plans brings regulatory, actuarial, and capital requirements that differ substantially from MSO and IPA operations. The next several quarters will reveal whether the company can execute this ambitious integration while maintaining momentum in core operations.

IX. The Business Model Deep-Dive: How Astrana Actually Works

Understanding Astrana requires understanding how money flows through the organization—and that flow is more complex than typical healthcare companies. The company operates through three distinct segments: Care Partners, Care Delivery, and Care Enablement. While all three contribute to the platform, Care Partners generates the majority of revenue and represents the core business model.

The risk-bearing model sits at the heart of Astrana's value proposition. The company's consolidated IPAs assume full responsibility for patient care within defined populations. Payers allocate funds per patient to Astrana, which then sub-capitates these payments to contracted physicians. Those physicians are incentivized with bonuses for exceeding care benchmarks—creating alignment between financial performance and clinical outcomes.

The shift toward full-risk arrangements has accelerated dramatically. The share of members in full-risk contracts has grown dramatically over the past year. These full-risk members generate the majority of capitated revenue despite being a minority of total members. The economics explain why: full-risk arrangements offer superior unit economics because Astrana captures more value when it successfully manages care costs below the capitation rate. The rapid shift toward full-risk demonstrates both payer confidence in Astrana's capabilities and management's willingness to accept greater performance accountability.

The MSO platform provides the administrative backbone enabling physician success in value-based arrangements. Astrana operates as a full-service management service organization providing administrative, technical, and professional support to various entities across the healthcare industry. Services include claims processing and adjudication, credentialing, payer contracting, data analytics, and regulatory compliance support. Independent physicians cannot efficiently build these capabilities individually; the MSO aggregates them at scale.

As one of the largest value-based healthcare organizations in the U.S., Astrana delivers a full spectrum of care through its management services organization, independent physician associations, and accountable care organizations. The company acts as a risk-bearing "single payer" that connects participants in the healthcare ecosystem while integrating clinical, technology, and administrative support for providers.

Technology increasingly differentiates the platform. The Care Enablement platform enhances monetization by offering value-based contracting, AI-driven analytics, and administrative services for independent physicians. The integration with Elation's electronic health record platform and practice transformation tools extends Astrana's comprehensive value-based care offering, including AI-driven population health analytics and care management capabilities.

The company leverages proprietary end-to-end technology solutions to operate an integrated healthcare delivery platform enabling providers to successfully participate in value-based care arrangements—empowering them to deliver high-quality care in a cost-effective manner. These aren't off-the-shelf systems; Astrana has invested over years in building technology specifically designed for risk-bearing physician organizations.

Management projects that investments in automation and AI will yield significant annual operating efficiencies. This demonstrates how technology creates operating leverage: the same platform can serve more physicians and members with proportionally lower administrative cost growth.

For investors analyzing the business model, the key insight is that Astrana's economics improve as it takes more risk and serves more members. Scale advantages compound: larger risk pools enable more predictable medical cost ratios; more physicians enable more comprehensive care networks; more data enables better predictive analytics; and more members spread technology infrastructure costs across a larger base. The platform creates what Hamilton Helmer would call "scale economies with network effects"—a powerful combination that rewards continued growth.

X. Competitive Dynamics: Porter's Five Forces and Strategic Positioning

Threat of New Entrants: Moderate-Low

The barriers protecting Astrana's position are substantial. Building IPA networks requires decades of physician relationships—not something a well-funded startup can accelerate. As a leader in population healthcare management, Astrana has built one of the largest networks of Independent Physician Associations in California and the U.S. That network represents relationships cultivated since the 1990s, trust built through countless successful interactions, and institutional knowledge that cannot be replicated through capital alone.

Regulatory complexity creates additional barriers. Healthcare licensing, Knox-Keene requirements in California, and state-by-state insurance regulations require extensive compliance infrastructure. Capital requirements are significant; capitated arrangements require substantial working capital to fund medical costs before payer reimbursement arrives. Technology infrastructure represents years of cumulative investment in claims systems, analytics platforms, and care management tools.

New entrants certainly exist—private equity has poured capital into physician practice management—but few possess the combination of physician trust, regulatory expertise, technology capabilities, and risk management experience that Astrana has accumulated.

Bargaining Power of Suppliers (Physicians): Moderate

Physicians occupy a unique position in Astrana's model—they are simultaneously suppliers, customers, and partners. This creates a complex power dynamic. Physicians supply the medical services that generate outcomes and ultimately revenue. But they also consume MSO services and depend on Astrana's infrastructure to succeed in value-based arrangements.

Astrana's value proposition centers on making value-based care accessible to independent physicians. The affiliation with a medical group allows independent physicians to build their practices while HMOs can more efficiently contract for physician services. This mutual benefit creates alignment rather than adversarial bargaining.

Network effects reinforce physician retention: more physicians enable better care coordination, which improves outcomes, which generates more shared savings, which makes the network more attractive to additional physicians. The flywheel creates switching costs that moderate physician bargaining power even as physicians remain essential to operations.

Bargaining Power of Buyers (Payers): High

The payer market remains concentrated. Medicare Advantage is dominated by a handful of large insurers. State Medicaid programs represent monopoly buyers in their respective markets. Commercial insurance has consolidated into regional oligopolies. This concentration gives payers substantial negotiating leverage.

However, payers need risk-bearing physician networks to execute their value-based strategies. They cannot achieve quality scores, manage medical costs, or satisfy members without physicians willing and capable of accepting risk. Astrana's payer-agnostic platform enables service across Medicare, Medicaid, and Commercial lines of business—making it a valuable partner rather than a dependent supplier.

Quality performance creates additional leverage. Achieving Elite status demonstrates that Astrana's affiliated organizations rank among the highest-performing entities engaged in value-based care models. When Astrana's networks deliver superior quality scores, payers receive bonus payments from CMS. This shared benefit moderates what might otherwise be purely adversarial negotiations.

Threat of Substitutes: Low-Moderate

Traditional fee-for-service medicine still exists but continues declining as payers shift toward value-based arrangements. Hospital-employed physician models represent an alternative structure, but typically with higher cost structures and less physician autonomy. Direct-to-consumer healthcare offerings address certain primary care needs but cannot substitute for complex chronic care management.

The broader shift toward value-based care represents a secular trend rather than a cyclical phenomenon. Government policy, payer economics, and demographic pressures all push in the same direction. Substitutes that move against this trend face structural headwinds.

Competitive Rivalry: Moderate-High

The competitive landscape includes diverse players across healthcare. Aveanna Healthcare Holdings represents one of Astrana's 23 identified competitors, with top competitors including major health systems like HCA, WellSpan, and Mount Sinai. But these comparisons obscure important distinctions—a hospital system competing for employed physicians operates a fundamentally different model than an MSO supporting independent IPAs.

Regional concentration characterizes the California market, where multiple strong IPAs compete for physician affiliations and payer contracts. Differentiation comes through physician-centric culture, technology platform capabilities, and track record of successful value-based arrangements.

XI. Hamilton's Seven Powers Analysis

Scale Economies: Present

Astrana's scale advantages manifest across multiple dimensions. MSO infrastructure costs spread across its vast physician network. Technology platform investments amortize over its millions-strong member base. Administrative functions—compliance, contracting, credentialing—serve the entire network without proportional cost increases.

Projected operating efficiencies from automation and AI investments demonstrate how scale enables productivity improvements. Larger networks justify larger technology investments, which create larger productivity gains, which improve competitive position, which enables further network growth.

Risk pooling improves with scale. Larger member populations generate more predictable medical cost ratios—the statistical law of large numbers at work. This predictability enables more aggressive risk-bearing contracts, which offer superior unit economics.

Network Effects: Strong

The network effects operating within Astrana deserve particular attention because they create potentially durable competitive advantages.

More physicians enable more comprehensive care coordination. When a cardiologist, a primary care physician, an endocrinologist, and a care coordinator all operate within the same network, patient care improves measurably. Handoffs happen smoothly. Information flows appropriately. Duplicate testing disappears. These care coordination benefits translate directly into better outcomes and lower costs.

Better outcomes generate more shared savings. Value-based arrangements reward organizations that deliver quality care efficiently. When the network performs well, savings flow back to participating physicians through bonus distributions. This attracts additional high-quality physicians seeking to participate in successful programs.

More members generate more data, and more data enables better predictive analytics. The ability to identify high-risk patients before crises occur, to stratify populations by care needs, to measure intervention effectiveness—all improve with data volume and diversity.

Counter-Positioning: Moderate

Astrana's physician-centric model creates counter-positioning advantages against both payer-owned and hospital-employed alternatives. Independent physicians generally prefer partners who preserve their independence. The company was founded in 1992 by physicians to empower physicians—this origin story resonates with practitioners skeptical of corporate medicine.

Large health systems struggle to replicate the IPA model culturally. Hospital systems that employ physicians operate with different incentives, different cultures, and different relationships to independent practitioners. A hospital cannot credibly claim to empower physician independence while simultaneously employing physicians as W-2 workers. This creates space for Astrana's differentiated positioning.

Switching Costs: High

Once integrated, physician relationships prove sticky. Multi-year MSA contracts—some extending ten years or longer—create explicit relationship duration. But operational integration creates even stronger implicit switching costs.

Physicians embedded in Astrana's technology platform have built workflows around its systems. Their staff knows the processes. Their data lives in the platform. Their care management programs operate through Astrana's care coordination tools. Switching would require rebuilding all of this—a substantial investment of time, money, and organizational energy.

Member attribution compounds switching costs. Patient relationships follow physicians, but disrupting those relationships damages continuity of care and potentially outcomes. The institutional knowledge of local markets and care patterns accumulated within Astrana's systems would be difficult to recreate elsewhere.

Branding: Moderate

Astrana operates primarily in B2B contexts—its brand matters with physicians and payers rather than consumers. Quality ratings, Elite status recognitions, and track record of successful partnerships build reputation within these professional communities.

The "Achieving Elite status is a testament to our providers' hard work and dedication" recognition demonstrates how quality performance builds the brand that attracts future partners. In value-based care, reputation for successful risk-bearing creates competitive advantage.

Cornered Resource: Moderate

California's delegated model expertise represents geographically concentrated knowledge. The physicians who established the company have spent decades building relationships and operational knowledge within Southern California's unique healthcare ecosystem.

The experienced management team brings domain expertise that would take competitors years to develop. The combination of physician relationships, payer relationships, regulatory knowledge, and operational capabilities represents a cornered resource of sorts—though one that can be replicated given sufficient time and investment.

Process Power: Developing

Proprietary care management protocols improve outcomes and reduce costs in ways that competitors struggle to observe and replicate. The integration of AI-driven population health analytics with clinical workflows creates process advantages that compound over time. Claims processing efficiency, credentialing speed, and contracting effectiveness all improve through accumulated operational learning.

XII. Key Performance Indicators and Investment Considerations

For investors seeking to monitor Astrana's ongoing performance, two metrics deserve particular attention.

Members in Full-Risk Arrangements

The shift from partial-risk to full-risk contracts represents Astrana's most important operational trend. As noted, the share of members in full-risk arrangements has risen sharply over the past year. These members generate the majority of capitated revenue despite representing a minority of total membership. The economics are straightforward: full-risk arrangements offer superior unit economics when the organization effectively manages care costs.

Monitoring this metric reveals several things: payer confidence in Astrana's capabilities (payers don't delegate full risk to organizations they don't trust); management's risk appetite and confidence in operational performance; and the trajectory of revenue quality improvement. Continued growth in full-risk membership would suggest the value creation thesis remains intact.

Adjusted EBITDA Margin

Revenue growth matters, but profitable revenue growth matters more. Astrana's substantial revenue projections for 2025 represent impressive scale, but the business model's long-term viability depends on earning adequate returns on that revenue.

Adjusted EBITDA margin captures operating performance while excluding non-cash items and one-time integration costs. As Astrana digests major acquisitions like CHS and Prospect, integration costs will temporarily depress margins. But post-integration, margins should expand as scale economies realize their full potential. Projected operating efficiencies from automation investments represent one example of margin improvement opportunities.

Tracking this metric over time reveals integration execution success, competitive positioning sustainability, and management's ability to translate growth into shareholder value.

XIII. Bull Case and Bear Case

The Bull Case

Value-based care represents a secular transformation of American healthcare, and Astrana has built one of the few platforms capable of executing at scale. The combination of physician-founder DNA, decades-long relationships, sophisticated technology, and proven risk management creates durable competitive advantages that new entrants cannot easily replicate.

The Prospect acquisition positions Astrana for the next phase of growth. Vertical integration into health plans opens superior unit economics. Geographic expansion into Texas, Arizona, and Rhode Island reduces California concentration risk. The pharmacy operation and hospital asset create cross-selling opportunities and care coordination advantages.

Operating leverage should emerge as integration costs subside. The technology platform scales efficiently; marginal members cost less to serve than average members. AI investments promise additional productivity gains. Full-risk penetration growth improves revenue quality.

The physician-centric model attracts the best independent practitioners—those who could work anywhere but choose partners who respect their autonomy. This creates a talent acquisition advantage that compounds over time as high-quality physicians attract high-quality colleagues.

The Bear Case

Integration risk dominates near-term concerns. Astrana is simultaneously digesting CHS and Prospect while attempting to maintain momentum in core operations. The Prospect deal brings unfamiliar assets—a hospital, a health plan, a pharmacy—that require different capabilities than IPA and MSO management. Management bandwidth constraints could impair execution.

The health plan introduces actuarial and regulatory risks unlike anything in Astrana's historical experience. Insurance requires maintaining statutory capital reserves, managing medical loss ratios within narrow bands, and satisfying state insurance regulators. A bad flu season, a pandemic spike, or a regulatory dispute could create earnings volatility.

Payer concentration creates dependence. Medicare Advantage payment rates depend on government policy; a future administration could reduce MA reimbursement significantly. Large commercial payers possess bargaining leverage that could compress margins. Medicaid rates vary by state and budget cycle.

Competition intensifies as value-based care becomes mainstream. Private equity has poured billions into physician practice management. Hospital systems continue acquiring physician practices. Technology companies and new entrants target pieces of the value chain. Astrana's competitive advantages are real but not insurmountable.

XIV. Conclusion: The Constellation Takes Shape

From a hospitalist company operating at a single Glendale hospital to a national platform managing care for millions of members across multiple states—Astrana's journey illustrates how physician-founders can build something transformational when strategy, execution, and market timing align.

The name change to Astrana captured something real about the company's evolution. Individual physicians are stars—talented, dedicated, essential. But organized into constellations, they become something more: navigable networks that guide patients through healthcare's complexity. The physician-centric model that began in California now extends across state lines, insurance types, and care settings.

The strategic question facing Astrana is whether the California delegated model can truly go national. The ecosystem that nurtured IPAs and MSOs in Southern California doesn't exist in most American healthcare markets. Building that infrastructure elsewhere requires capital, time, regulatory navigation, and physician recruitment—all while maintaining performance in existing markets. The Prospect and CHS acquisitions accelerated geographic expansion, but integration execution will determine whether the strategy succeeds.

For the healthcare system, Astrana represents one answer to the fee-for-service problem. When physicians accept responsibility for patient outcomes rather than simply billing for services rendered, different behaviors emerge. Prevention matters. Care coordination matters. Efficiency matters. Whether this model can transform American healthcare depends partly on whether platforms like Astrana can scale nationally while maintaining the physician relationships and operational excellence that made them successful regionally.

The story of Astrana Health continues to be written. The constellation is taking shape across American healthcare's night sky. Whether it becomes a permanent fixture guiding patients toward better, more affordable care—or fades as integration challenges and competitive pressures mount—represents one of healthcare's most compelling stories to watch in the years ahead.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music