Arcturus Therapeutics: The mRNA Challenger That Survived the Valley of Death

I. Introduction: A San Diego Gamble on the Future of Medicine

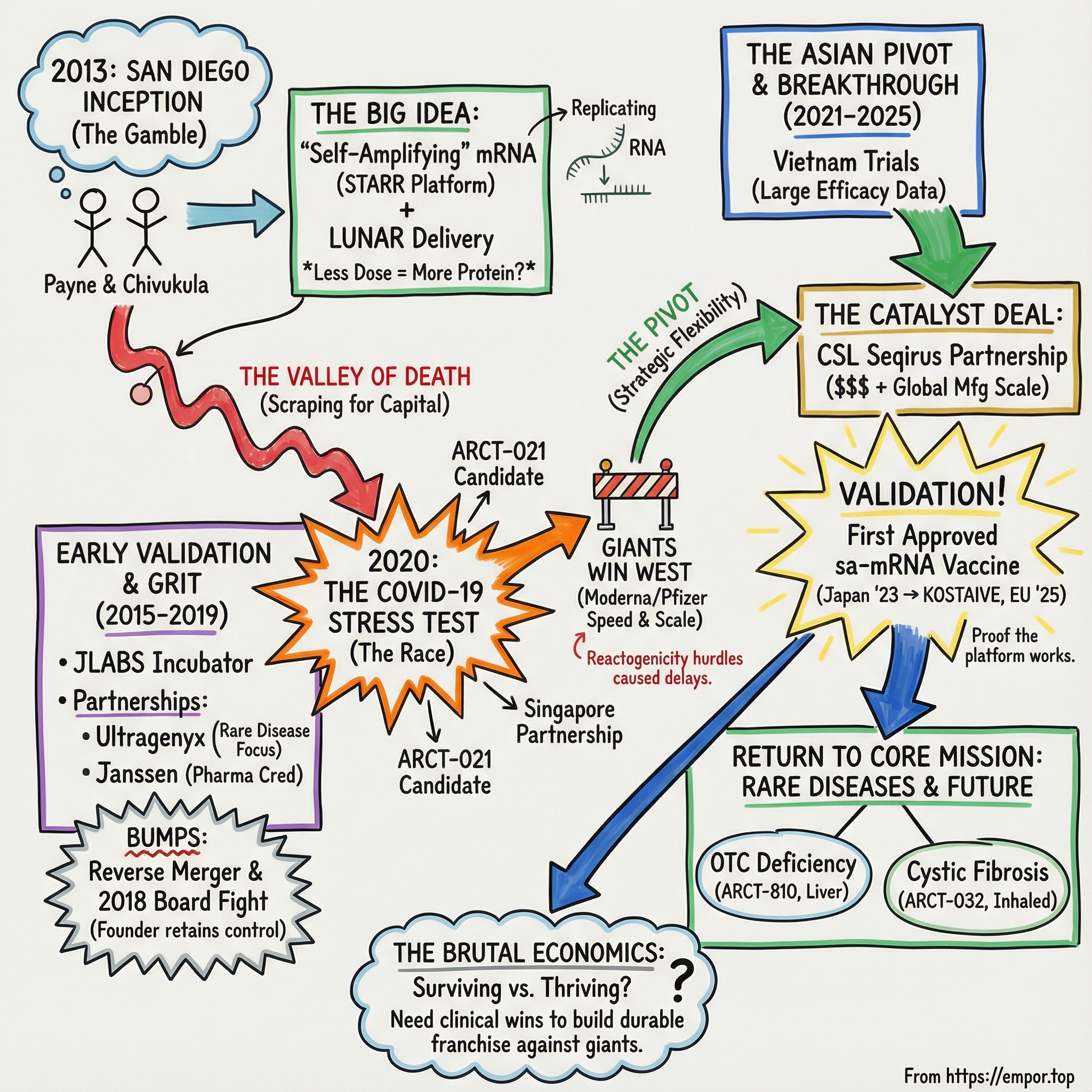

Picture a small lab in San Diego in 2013. Moderna was already raising massive rounds in Cambridge. BioNTech was quietly assembling what would become an mRNA powerhouse in Germany. And in Southern California, two scientists were making a much smaller, much riskier bet: what if messenger RNA could do more than deliver instructions—what if it could replicate inside the cell, so you could get the same effect with far less material?

As CEO Joseph Payne later put it:

"The first event is with Arcturus' inception in 2013, based on my and co-founder Pad Chivukula's belief that there was a future for mRNA therapeutics in medicine. It was a long process developing the company to what it is today. One that took innovation, hard work and our personal savings to persevere."

That bet sent Arcturus Therapeutics on a twelve-year trek through the biotech valley of death: years of scraping for capital, a sudden shot at the center of the COVID vaccine race, a painful reality check in Western markets, and then an unexpected path to validation overseas. Its COVID-19 vaccine was authorized in Japan in 2023, and later in the European Union in 2025.

This is a story about a company that refused to die. Founded in 2013 by Joseph Payne and Pad Chivukula, Arcturus Therapeutics is an American RNA medicines biotech focused on discovering, developing, and commercializing therapeutics for rare diseases and infectious diseases.

And it matters now because mRNA is entering its second chapter. COVID proved the modality works. The open question is who gets to build durable businesses on top of it. The giants—Moderna, supercharged by COVID revenue, and BioNTech, amplified by Pfizer’s distribution—have scale. Arcturus has something else: a differentiated approach that survived long enough to earn real-world validation, and a strategy that increasingly points toward rare diseases, where smaller companies can still carve out meaningful wins.

At the heart of that strategy is Arcturus’s STARR platform: self-replicating RNA paired with its LUNAR lipid nanoparticle delivery system, designed to produce proteins inside the body. Self-amplifying mRNA isn’t just a tweak—it’s a fundamentally different bet on how RNA medicines should work. Whether it becomes a lasting advantage or a fascinating footnote depends on what happens next.

Because the Arcturus story is ultimately about resilience, strategic flexibility, and the hard truth that in biotech, being early is not the same thing as being the winner.

II. The mRNA Revolution: Context and Founding Vision

To understand Arcturus, you first need to understand why mRNA was considered “undruggable” for decades—and why a small group of true believers kept pushing anyway.

For years, the problem with mRNA looked almost embarrassingly basic. You inject it into the body, and the body treats it like an alarm bell. Early experiments showed that mRNA could be highly immunogenic, triggering the very immune response you didn’t want.

This is where Katalin “Kati” Karikó enters the story. A Hungarian-American biochemist, Karikó spent years working on the idea that in vitro–transcribed mRNA could be used for protein replacement—essentially, giving the body a temporary set of instructions to make a needed protein. The scientific community was skeptical, funding was scarce, and the setbacks were constant. But she kept going.

One of her key observations was that not all RNA molecules provoked the same reaction. When she worked with transfer RNA (tRNA), she didn’t see the same immunogenic effects. That clue pushed Karikó and her collaborator Drew Weissman to explore something that, at the time, felt like a niche academic detail: modified nucleosides. Drawing on her earlier work, they tested whether swapping in different nucleoside modifications could make synthetic mRNA look less like a viral intruder.

It worked. In 2005, Karikó and Weissman identified links between specific modified nucleosides and reduced immunogenicity, leading to a breakthrough: non-immunogenic, nucleoside-modified RNA—developed and patented that year.

But fixing the immune reaction still didn’t solve the other killer problem: delivery.

mRNA is fragile. It degrades easily, and it doesn’t naturally slip into cells. Researchers had been experimenting with lipid-based packaging to protect it and help it get inside the cell, but every approach seemed to trade one failure mode for another—toxicity, instability, or poor efficiency. Labs around the world kept trying new delivery substances, and Karikó, Weissman, and others kept stress-testing each one as it emerged. In 2015, Norbert Pardi, a postdoctoral fellow in Weissman’s lab, demonstrated that lipid nanoparticles, or LNPs, held enormous potential for clinical use.

That’s the backdrop Arcturus was born into: a field where the dream was getting sharper, but the practical obstacles still crushed most attempts.

Joseph Payne had spent most of his career in labs and drug discovery organizations trying to turn novel science into actual medicines. Long before the pandemic made mRNA a household term, he believed it had a future in medicine. In 2013, he founded Arcturus Therapeutics with Pad Chivukula—Arcturus’s scientific co-founder and, over time, its Chief Scientific Officer and Chief Operating Officer—to build RNA medicines aimed at serious unmet needs.

Payne came with a track record in moving therapeutics toward the clinic, including targeted RNA medicines using lipid-mediated delivery. Over more than two decades, he worked across places like Merck Research Labs, DuPont Pharmaceuticals, Bristol-Myers Squibb, Kalypsys, and Nitto, and he authored dozens of publications and patents. His training ran from chemistry at Brigham Young University, to synthetic organic chemistry at the University of Calgary, to executive training at MIT Sloan.

Chivukula brought the complementary edge: the scientific horsepower to shape a platform company from scratch, and the operating grit to keep it moving when the science got hard and the cash got tight.

And their founding thesis wasn’t “let’s build an mRNA company.” It was, in a sense, “let’s build the mRNA company that doesn’t have to play the same game.”

Instead of leaning on nucleoside-modified mRNA like Moderna, or building along the lines of BioNTech’s approach, Arcturus chose self-amplifying RNA: RNA designed to replicate inside cells. The appeal was straightforward and radical. If the RNA could copy itself once it got into the cell, you might be able to achieve the same therapeutic effect with a fraction of the dose. And that cascades into everything: potentially lower manufacturing costs, potentially a different tolerability profile, and a layer of differentiation in a crowded intellectual property landscape.

Arcturus started life at Johnson & Johnson Innovation’s JLABS incubator in San Diego, which gave the young company the lab infrastructure to get moving without raising an impossible amount of money on day one. Then, in 2015—roughly two years after opening up shop—Arcturus signed a collaboration deal with Janssen to develop RNA-based drug products, its first major partnership.

Those early choices set the pattern that would define Arcturus: big scientific ambition, constant capital pressure, and a willingness to use partnerships for validation and resources—without simply handing the whole future away.

III. Technology Deep Dive: What Makes Arcturus Different

At the heart of Arcturus is the STARR platform: Self-Transcribing And Replicating RNA. The name is the point. Conventional mRNA delivers a fixed set of instructions and then fades. STARR is designed to keep going—once it gets inside a cell, it can make more copies of itself, extending and amplifying the signal. Arcturus positioned STARR as a platform for both human and animal health vaccines, and the bet was simple: if the RNA can do more work per molecule, you can potentially use far less of it.

STARR is paired with Arcturus’s other core technology, LUNAR, its lipid nanoparticle delivery system. Together, STARR plus LUNAR is Arcturus’s “full stack”: get RNA safely into cells, then have that RNA produce enough protein to either trigger an immune response (vaccines) or drive therapeutic protein expression (treatments).

The underlying mechanics are borrowed from nature. The STARR construct includes instructions for replication machinery—four non-structural proteins, ns1 through ns4, derived from Venezuelan equine encephalitis virus, an alphavirus known for efficient RNA replication. That’s the trick: instead of relying on a single, one-and-done burst of protein production, STARR is built to replicate its RNA inside the cell, sustaining expression longer than non-self-replicating approaches.

And that translates into a very specific promise: lower dosing requirements without giving up results. Arcturus has pointed to head-to-head data, announced with CSL, suggesting a self-amplifying COVID-19 vaccine generated superior immune responses compared to Pfizer’s Comirnaty for up to a year across multiple variants—at a fraction of the dose.

One-sixth the dose. That isn’t a rounding error. If it holds up broadly, it changes the manufacturing and distribution math in a way traditional mRNA doesn’t.

Of course, none of this matters if you can’t get the RNA into the right cells reliably and at scale. That’s where LUNAR comes in. Arcturus describes LUNAR as a multi-component lipid-based delivery system, built from a large internal library of proprietary lipids, where formulations can be tuned depending on the indication and the target cell type. In their telling, it’s not just potent—it’s also scalable and reproducible, which is what separates a promising formulation from something you can actually manufacture for patients.

At a high level, LUNAR works like other lipid nanoparticle systems: it associates with the cell membrane, enters the cell via endocytosis, and then has to solve the hardest part—getting RNA out of the endosome and into the cytosol where the cell’s translation machinery can read it. Arcturus describes a pH-triggered disruption as the endosome acidifies, releasing the RNA payload as the LUNAR components biodegrade. Once the RNA reaches the cytosol, the cell can translate it into protein.

Then there’s a third differentiator that’s less about biology and more about logistics: lyophilization. One of the most painful constraints of early mRNA vaccines was distribution—especially the ultra-cold requirements that made global rollout harder. Arcturus highlighted ARCT-021 as a lyophilized, freeze-dried vaccine intended to preserve efficacy without requiring an ultra-cold supply chain. In plain terms: easier storage, easier transport, and potentially easier scale-up—particularly outside major urban hospital systems.

But the platform has a built-in tradeoff. The same self-replication that can make STARR powerful can also make it loud. More intracellular activity can mean more immune activation, and that can show up as reactogenicity—side effects that are tolerable in some settings, but limiting in others. Learning to dial that potency up or down without breaking the whole thesis became one of Arcturus’s defining challenges, especially once COVID turned mRNA into a global stress test.

Finally, Arcturus has consistently framed itself as more than a one-trick mRNA company. It has said its platforms can be applied across multiple nucleic acid modalities—including messenger RNA, small interfering RNA, circular RNA, antisense RNA, self-amplifying RNA, DNA, and gene editing therapeutics—and that these technologies are supported by a large patent portfolio spanning the U.S., Europe, Japan, China, and other countries.

The ambition is clear: a differentiated RNA engine, a delivery system to match, and enough flexibility to chase the best opportunities. Next comes the hard part—turning platform advantages into products that win in the real world.

IV. The Early Years: Partnerships, Pivots, and the Capital Chase

Biotech startups live and die on a simple clock: raise enough money to keep going until the science becomes real. In Arcturus’s early years, that meant a constant hunt for capital, plus partnerships that could validate the platform before the clinic did.

The company started with seed financing and then, in late 2013, closed a Series A of roughly $5 million. It wasn’t a war chest, but it was enough to get the first experiments moving and begin turning RNA ambition into an actual R&D program.

The first major vote of confidence arrived in October 2015, when Ultragenyx Pharmaceutical—known for going after rare diseases—signed a collaboration and license agreement with Arcturus. The two companies began working together on mRNA therapeutic candidates for select rare disease targets. The first disclosed indication under the collaboration was Glycogen Storage Disease Type III. Ultragenyx’s mRNA program, UX053, was expected to have an Investigational New Drug application filed in 2020.

This deal mattered for two reasons. First, it told the market that a serious rare-disease company believed Arcturus’s platform was worth betting on. Second, it helped lock in what would become Arcturus’s long-term strategic home base: rare diseases.

Rare diseases aren’t “small” problems—just small patient populations. That comes with real advantages: tighter trials, clearer endpoints, and orphan drug incentives, including seven years of market exclusivity in the U.S. Most importantly, it comes with urgency. These are patients with few options, where meaningful biology can translate into meaningful approvals.

Over time, the scope of the Ultragenyx collaboration expanded to include up to 12 rare disease targets and broadened to cover multiple nucleic acid technologies, including approaches for mRNA, DNA, and siRNA therapeutics. For Arcturus, it was more than extra capital. It was reinforcement that the platform could stretch beyond a single shot on goal.

Then came the second big partnership—one with a very different kind of gravity.

In October 2017, Arcturus entered a research collaboration and worldwide license agreement with Janssen Pharmaceuticals, part of Johnson & Johnson. The goal: develop and commercialize nucleic acid-based drug products for Hepatitis B using Arcturus’s UNA Oligomer chemistry and its LUNAR lipid-mediated delivery platform, with an option to expand into other infectious and respiratory diseases.

The economics followed the typical Big Pharma structure: upfront cash, R&D support, milestone payments tied to development and commercial progress, and royalties if products ever reached the market. But the real signal wasn’t the term sheet—it was the counterparty. Johnson & Johnson doesn’t need to take platform risk unless it sees something it can’t easily build or buy later. Janssen signing up told the world that Arcturus wasn’t just talking.

Investors reacted fast. Arcturus shares jumped more than 40% pre-market, then kept climbing after the open, hitting about 21 cents per share.

With validation in hand, Arcturus took the next step: becoming a public company. But it didn’t do it through a clean, storybook IPO. In September 2017, Arcturus merged with Alcobra Ltd., an Israeli pharmaceutical company, in a reverse merger—an unconventional route, but one that offered access to public markets without the cost and uncertainty of the traditional IPO process.

Then, in early 2018, the company hit turbulence. In February, Joseph Payne was dismissed as president and CEO by the Arcturus board at the time. Payne—also the company’s largest shareholder—pushed back, formally requesting a shareholder meeting to elect new directors. The board delayed. Payne took the dispute to the Israeli Court, which ruled to uphold shareholder rights and sanctioned the meeting.

The result was a settlement that reshaped the board. Four new independent directors—Dr. Peter Farrell, Mr. Andrew Sassine, Mr. James Barlow, and Dr. Magda Marquet—were appointed effective May 27, 2018, while Dr. Stuart Collinson, Mr. Daniel Geffken, Dr. David Shapiro, and Mr. Craig Willett resigned. The settlement also included mutual releases and an agreement to terminate the pending litigation.

Payne was reinstated, and he made the company’s posture clear: “With the litigation behind us, the team is 100% committed to developing our pipeline of novel RNA therapeutics, to strengthening and advancing all of our pharmaceutical partnerships and to creating value for our shareholders.”

It was messy, expensive, and distracting. But it also revealed something foundational about Arcturus: the founder believed the mission required control, and he was willing to fight to keep the company pointed in the direction he and Chivukula had set in 2013.

By late 2019, Arcturus had started to look less like a science project and more like a real contender: credible partners, a differentiated RNA and delivery platform, and progress in rare disease. The FDA granted Orphan Drug Designation to Arcturus’s lead product candidate, ARCT-810, for ornithine transcarbamylase deficiency—OTCD, the most common urea cycle disorder.

And then the world changed.

V. COVID-19: The Race That Arcturus Almost Won

When the first reports of a novel coronavirus began circulating in late 2019, the mRNA world understood immediately what this could become: the first true, global stress test for the modality. The advantage mRNA had always promised—speed—suddenly mattered more than anything else. Once the viral sequence was published, the leaders moved fast. Moderna and BioNTech were designing candidates in days.

As Joseph Payne later explained:

"The second undertaking was pivoting into the vaccine space with mRNA technology. At the onset of the pandemic in 2020, we knew we had the technology to develop a vaccine that could address the global crisis of COVID-19."

Arcturus didn’t hesitate. By March 2020, it had announced its own COVID vaccine candidate. The company partnered with Duke–NUS Medical School in Singapore to develop a vaccine that paired self-replicating mRNA with Arcturus’s LUNAR delivery platform—built to increase the level and duration of protein expression. To make real doses, not just lab samples, Arcturus lined up manufacturing partners too, including Catalent and Recipharm, to produce multiple batches of its vaccine candidate.

By July 2020, the clinical program was underway. Trials of LUNAR-COV19 began in healthy volunteers, and Arcturus reported that the first cohort in its Phase 1/2 study had been dosed. The study was run with CTI Clinical Trial and Consulting Services, a global contract research organization, in collaboration with Duke–NUS.

Early signals gave the company reason to believe it could compete. Preclinical results for ARCT-021 showed 100% seroconversion for neutralizing antibodies after a single administration—at a very low 2 microgram dose. And those neutralizing antibody levels continued rising for 60 days after dosing.

That low-dose story was Arcturus’s calling card. ARCT-021—developed with Duke–NUS—was designed to generate an immune response to the SARS‑CoV‑2 spike protein. It was positioned as a single-shot, lyophilized, non-viral vector vaccine, with the potential for extended variant coverage and periodic re-dosing. And because it required dramatically less RNA per dose—Arcturus described it as up to a 40-fold smaller dose requirement—it also implied a different manufacturing equation: less material, less capacity, more shots per batch.

Singapore became more than a scientific collaborator. It became a financial and strategic backer. Arcturus announced manufacturing support and potential vaccine purchases of up to $220 million from Singapore’s Economic Development Board (EDB). Under the arrangement, the EDB would provide $45 million—contingent on documentation and delivered within 60 days—to fund equipment, materials, and services needed for manufacturing. The loan would be repaid through royalties on future ARCT-021 commercial sales, and if the vaccine never received regulatory approval, the loan would be forgiven. Separately, Arcturus and the EDB agreed to terms giving the EDB the right to purchase up to $175 million of vaccine at pre-negotiated prices, with shipments expected to start in early 2021.

Momentum continued into the end of the year. In December 2020, Phase 2 trials were cleared to proceed in both the United States and Singapore—approved by the FDA and Singapore’s Health Sciences Authority, respectively.

And the market noticed. Arcturus became one of the names traders and investors watched as a potential “next Moderna.” Expectations inflated quickly.

But COVID rewarded a very specific kind of excellence. Not just scientific novelty—execution at full sprint, clean safety, and a regulatory machine built for speed. As Moderna and Pfizer-BioNTech surged toward emergency authorizations in late 2020, Arcturus started to feel the downside of its core differentiator. Self-amplifying RNA can be powerful precisely because it does more inside the cell—but that same activity can translate into reactogenicity. In Arcturus’s trials, some participants experienced side effects, including fever and myalgia, at higher rates than the company wanted.

Arcturus still pushed forward. As the company said at the time:

"Based on highly promising clinical data from our Phase 1/2 study and emerging mRNA vaccine immunological data, we are advancing ARCT-021 for further development in Phase 3. We are presently preparing to move forward a 5 µg single dose regimen, to be confirmed based on pending Phase 2 data."

But the strategic reality had already shifted. By the time Arcturus could have been positioned for Western approvals, Moderna and Pfizer-BioNTech had effectively locked the market. Their vaccines were already being administered at massive scale while ARCT-021 was still working through trials.

That’s the brutal lesson of the pandemic vaccine race: being differentiated isn’t enough. The winners weren’t just the companies with good science—they were the ones who could move fastest with a safety profile regulators and governments were ready to deploy immediately, and with manufacturing ready to flood the world.

For a moment, Arcturus had looked like it might run with the leaders. Then the front of the pack pulled away.

But the story didn’t end with Arcturus walking off the field. It pivoted—still pursuing COVID, but shifting toward markets where timing, partners, and pathways looked very different.

VI. The Asian Pivot: Finding Success in Japan and Vietnam

When one door closes in biotech, survival often depends on finding another. For Arcturus, that door opened in Asia.

In August 2021, Arcturus entered a partnership with Vinbiocare, a unit of Vietnam’s Vingroup, to run clinical trials of ARCT-154 in Vietnam and work toward establishing local manufacturing. ARCT-154 was the next iteration of Arcturus’s COVID program: still built on the company’s STARR self-amplifying mRNA technology, but designed with improved tolerability compared to the earlier candidate.

Vinbiocare received regulatory approval to begin clinical testing in Vietnam in early August 2021, coordinating with the Ministry of Health on a phased program that ultimately enrolled tens of thousands of adults. The trial design was ambitious: randomized, double-blind, controlled, and integrated across Phase 1, 2, 3a, and 3b, with participants followed for a full year after their second dose. Interim analyses pulled from early enrollment through January 2023 reported strong immunogenicity and a safety profile that supported continued development, with efficacy reported at 57% against any COVID-19 and 95% against severe disease.

But the partnership that truly changed Arcturus’s trajectory came soon after, with CSL Seqirus—the vaccine arm of Australian biotech giant CSL. CSL wasn’t just looking for another COVID product; it was looking for next-generation vaccine technology it could build a franchise around. For Arcturus, it was the kind of partner that could do what smaller biotechs almost never can alone: fund, manufacture, and commercialize at global scale.

The deal economics reflected that ambition. Arcturus received a $200 million upfront payment, became eligible for billions more in potential development and commercial milestones, and secured profit sharing for COVID-19 vaccines, plus royalties for other respiratory vaccine programs covered by the collaboration. CSL Seqirus would lead development and commercialization under the partnership, while gaining access to Arcturus’s late-stage self-amplifying mRNA platform—one that had already generated large-scale Phase 3 efficacy results in Vietnam.

Then came the breakthrough moment Arcturus had been chasing since 2013: real-world regulatory validation.

Japan’s Ministry of Health, Labour and Welfare granted approval for ARCT-154 for initial vaccination and boosting in adults 18 and older—marking the first approval anywhere for a self-amplifying mRNA COVID-19 vaccine. The decision was supported by clinical evidence including the large Vietnam efficacy study and a Phase 3 booster trial that showed higher immunogenicity and a favorable safety profile versus a conventional mRNA comparator.

Joseph Payne called it what it was: proof that the platform could cross the finish line. “We are proud of the role that Arcturus has played in this collaboration to develop and validate the first approved sa-mRNA product in the world,” he said.

The booster data told the story Arcturus had always wanted to tell. In Phase 3, ARCT-154 produced a numerically higher immune response against the original Wuhan-Hu-1 strain while meeting non-inferiority criteria, and a superior immune response against the Omicron BA.4/5 subvariant compared with Comirnaty—achieved with one-sixth the dose (5 μg vs 30 μg).

In Japan, the vaccine was branded KOSTAIVE. The active ingredient, zapomeran, was approved for medical use there in November 2023, becoming the first self-amplifying mRNA-based COVID-19 vaccine authorized anywhere in the world.

Europe followed. In February 2025, the European Commission granted marketing authorization for KOSTAIVE for adults 18 and older—the first self-amplifying mRNA COVID-19 vaccine approved in the EU. The authorization drew on multiple studies, including an integrated Phase 1/2/3 program and Phase 3 booster trials showing higher immunogenicity versus a conventional mRNA comparator. A follow-up booster analysis also reported superior immunogenicity and antibody persistence for up to 12 months across multiple SARS‑CoV‑2 strains in both younger and older adults.

This was regulatory arbitrage in the best sense: go where the pathways are open, the partnerships are aligned, and the competitive landscape isn’t already locked up. Arcturus couldn’t out-execute Moderna and Pfizer-BioNTech in the U.S. market. But it could still win by being differentiated—and by finding the right countries and the right counterparties to turn that differentiation into approvals.

By the end of 2024, that strategy was showing up in the financials. Arcturus reported having received approximately $473.1 million in upfront payments and milestones from CSL as of December 31, 2024, with additional milestones expected as the program advanced. And in the quarter ended December 31, 2024, CSL reported to Arcturus that Arcturus’s share of gross profit from KOSTAIVE sales was approximately $28.0 million.

VII. Return to Core Mission: Rare Diseases and Genetic Medicines

With COVID validation in hand, Arcturus swung back to the mission it started with: using RNA medicines to treat rare diseases where biology is clear, the unmet need is brutal, and a small company can still change the standard of care.

The flagship here is ARCT-810, aimed at ornithine transcarbamylase (OTC) deficiency, a rare genetic disease that can cause life-threatening buildup of ammonia in the blood. ARCT-810 uses Arcturus’s LUNAR platform to deliver mRNA into liver cells so the body can produce functional OTC enzyme—an approach designed to be disease-modifying, not just symptom-managing.

To appreciate why that matters, you have to understand the disease. OTC deficiency is the most common urea cycle disorder. Urea cycle disorders are inherited metabolic conditions where the liver can’t properly process the toxic waste created when proteins are broken down. In OTC deficiency, mutations in the X-linked OTC gene lead to a non-functional or deficient OTC enzyme; males are typically affected more severely. OTC normally catalyzes a step that helps convert toxic ammonia into urea, which the kidneys can excrete. When that conversion fails, ammonia can rise to dangerous levels. And beyond acute ammonia risk, the disorder can also drive increased blood glutamine.

There is no cure today other than liver transplant. But transplantation is a high-stakes option—major surgery, the risk of rejection, and lifelong immunosuppressant therapy. Most patients instead live with a demanding standard of care: a tightly controlled low-protein diet, essential amino acid supplementation, and nitrogen scavenging medications. Those interventions can keep ammonia from spiking to acutely toxic levels, but they don’t fix the underlying enzymatic defect and may not prevent chronic neurotoxic effects.

In Europe and the U.S., approximately 10,000 people have OTC deficiency.

Arcturus has also done the regulatory groundwork to move quickly if the data hold up. ARCT-810 has received Orphan Medicinal Product Designation and an approved pediatric investigation plan (PIP) from the European Medicines Agency (EMA), and Orphan Drug Designation, Fast Track Designation, and Rare Pediatric Disease Designation from the U.S. Food and Drug Administration (FDA) for OTC deficiency.

In June 2025, Arcturus announced positive interim Phase 2 data. The headline was biochemical: ARCT-810 treatment significantly reduced glutamine levels. In a combined analysis of both Phase 2 studies, statistically significant decreases in glutamine were observed following multiple administrations (p-value = 0.0055; LMM).

Safety, as always in RNA delivery, is the other half of the story. Across single-dose Phase 1/1b and multi-dose Phase 2 studies, ARCT-810 was generally safe and well tolerated in 40 participants to date, including 20 OTC-deficient participants. Those early studies also helped Arcturus refine the infusion protocol to improve tolerability without corticosteroid pre-treatment. Using an improved three-hour IV regimen, the company reported no serious infusion-related reactions to date.

The other big swing is cystic fibrosis—an even tougher hill, and a massive one if it works.

ARCT-032 is an inhaled investigational mRNA therapeutic designed to express normal, functional CFTR in the lungs of people with cystic fibrosis. It has received Orphan Medicinal Product Designation from the EMA and Orphan Drug Designation plus Rare Pediatric Disease Designation from the FDA. ARCT-032 uses Arcturus’s LUNAR lipid-mediated aerosolized platform to deliver CFTR mRNA directly to the lungs. Lung disease is the leading cause of morbidity and mortality in CF, and the logic here is straightforward: if you can restore CFTR activity in the lungs, you may be able to mitigate the downstream effects that drive progressive lung damage.

Arcturus positioned ARCT-032 as potentially most valuable for patients who can’t benefit from CFTR modulators. According to the company, that’s about 15% of people with CF.

In October 2025, Arcturus reported interim Phase 2 results. In the second cohort, six Class I CF adults received inhaled 10 mg doses of ARCT-032 daily over 28 days. The treatment was generally safe and well tolerated. High resolution computed tomography (HRCT) scans, analyzed using FDA 501(k)-cleared AI technology from Thirona, showed reductions in mucus burden in four of six participants. Arcturus described decreases in mucus plugs and mucus volume in four of six Class I CF participants as a meaningful trend consistent with therapeutic activity.

As the company put it at the time:

"Conversations at NACFC with CF patients, physicians, investigators and global experts reinforced our commitment to advance ARCT-032 further into development. We look forward to initiating a 12-week safety and preliminary efficacy study in first half of 2026. Our team is also working diligently to achieve alignment with regulatory agencies regarding pivotal studies of ARCT-810 in adults and young children with OTC deficiency."

Strategically, this is where Arcturus’s mRNA bet looks most rational. Rare diseases mean smaller trials and clearer regulatory pathways, with orphan drug designations offering meaningful advantages, including market exclusivity. And compared to gene therapy, mRNA comes with a different set of tradeoffs that can matter a lot to patients and regulators: it’s redosable, potentially safer, and generally involves less complex manufacturing.

After the chaos of COVID, this is Arcturus back in its natural habitat—trying to turn a platform into a durable rare-disease franchise, one clinical readout at a time.

VIII. The Brutal Economics of Biotech: Cash, Dilution, and Survival

The biotech business model is simple in theory and unforgiving in practice: you burn cash until something finally works—then you hope it works big enough, fast enough, to pay for everything it took to get there. Arcturus’s financial story is that grind, in numbers.

In the first quarter of 2025, Arcturus reported revenue of $29.4 million, down from $38.0 million in the same quarter the year before. The company posted a net loss of about $14.1 million, compared to a net loss of $26.8 million in the prior-year quarter. Cash, cash equivalents, and restricted cash were $273.8 million as of March 31, 2025, down from $293.9 million at the end of 2024.

Management said that, with resources re-allocated toward therapeutics programs, the cash runway was expected to extend into 2028.

By the time Arcturus reported results through September 30, 2025, the same pattern held: revenue for the three- and nine-month periods was $17.2 million and $74.8 million, both down sharply from the same periods in 2024. Cash, cash equivalents, and restricted cash were $237.3 million as of September 30, 2025, compared to $293.9 million on December 31, 2024. The company said the runway still extended into 2028, supported by additional planned cost reductions in Q4 2025 and a decision to delay the start of its Phase 3 cystic fibrosis trial until 2027.

Zooming out, 2024 revenue was $152.31 million, down from $166.80 million in 2023, while losses widened to -$80.94 million.

What’s important here isn’t the quarterly noise—it’s what the revenue is made of. Arcturus isn’t a company that, historically, generated cash by selling products at scale. Its primary revenue streams have been license fees, consulting and technology transfer fees, reservation fees, and collaborative payments from research and development partnerships. In other words: partners, not patients, have funded the journey.

That’s why the shift inside the CSL relationship matters. Arcturus noted that the Q1 2025 revenue decline primarily reflected lower milestone revenue recognized under the CSL collaboration as KOSTAIVE moved from development into the commercial phase. Milestones are lumpy and can be huge—but they don’t repeat forever. Once a program becomes “commercial,” the economics change: fewer one-time checks, more reliance on sales performance and profit share.

Still, CSL has been the company’s financial anchor. As of December 31, 2024, Arcturus reported it had received approximately $473.1 million in upfront payments and milestones from CSL.

Arcturus also worked the other lever every biotech eventually pulls: cost. Total operating expenses in Q1 2025 were $46.2 million, down from $68.4 million a year earlier. R&D spend fell to $34.9 million from $53.6 million, driven primarily by lower manufacturing costs tied to KOSTAIVE, LUNAR-FLU, and BARDA-related programs, partially offset by increased clinical and manufacturing costs for the CF and OTC programs. The company also reported R&D declined sequentially from Q4 2024 and said it anticipated additional quarterly declines in the second half of fiscal year 2025.

Management framed this as focus, not retreat:

"We are encouraged by the clinical progress of our CF and OTC programs, and given the current market conditions, we made a strategic decision to streamline resources to focus on our mRNA therapeutics pipeline." "I am happy to report we have received the initial European Union (EU) approval milestone payment from our partnership with CSL."

And Arcturus wasn’t funded only by partners. The U.S. government has also played a role through non-dilutive support, including a $63.2 million BARDA base award for pandemic influenza preparedness to fund development from preclinical work through Phase 1 over a three-year period.

This is the core truth of Arcturus’s business—of most clinical-stage biotechs, really. Partnerships and non-dilutive awards can keep the lights on and move programs forward. But the economics don’t fully flip until you have approved products that people actually use. KOSTAIVE gave Arcturus its first commercial foothold, but the post-pandemic vaccine market is nothing like the emergency-era boom. The real long-term question is whether OTC, CF, and whatever comes next can turn Arcturus from a company that survives on deals into one that compounds on products.

IX. Competitive Landscape: The Post-Pandemic mRNA World

COVID didn’t just validate mRNA. It blew the doors off the category.

Before 2020, mRNA was still, in many corners of pharma, a “maybe someday” technology. After 2020, it became a strategic imperative. Every large vaccine and drug developer either built an internal mRNA program, partnered with someone who already had one, or bought their way into the space.

That scramble produced a wave of alliances and acquisitions. Sanofi spent billions to acquire Translate Bio and also bought Tidal Therapeutics. Pfizer leaned harder into the partnership that made it a household name, doubling down with BioNTech. GSK partnered with CureVac. AstraZeneca teamed up with VaxEquity. Merck & Co put $150 million upfront into a deal with Orna Therapeutics valued at up to $3.5 billion.

In other words: the market learned the same lesson at once, and the price of admission went up.

At the top of the hierarchy sits Moderna, armed with billions in cash from COVID vaccine sales and a pipeline sprawling across vaccines and therapeutics. BioNTech, with Pfizer’s distribution engine behind it, has global reach and a continuing presence in COVID. Against players like that, Arcturus can’t win by outspending. It has to win by being meaningfully different—and picking fights where “different” actually matters.

That’s the bull case for Arcturus in a post-pandemic world.

First, self-amplifying RNA is real differentiation, not branding. In head-to-head work against Comirnaty, Arcturus has pointed to comparable or superior immune responses using far less RNA per dose. If that advantage proves durable across products and populations, it has real downstream implications: manufacturing efficiency, supply flexibility, and the ability to make more doses with the same capacity.

Second, rare diseases are one of the few corners of biopharma where focus still beats scale. In orphan indications, clinical outcomes and regulatory strategy often matter more than marketing muscle. A small company with a therapy that works can become the standard of care—especially when the patient population is underserved and the endpoints are clear.

Third, partnerships let Arcturus play bigger than its size. CSL brings the development, manufacturing, and commercial infrastructure that Arcturus doesn’t have—and in exchange, Arcturus still keeps meaningful upside, including 40% profit sharing on COVID vaccines.

But there’s a reason this is still a challenger story.

The bear case is that mRNA is becoming table stakes. Big players can fund multiple shots on goal, run faster trials, and potentially replicate technical advantages. And, as always in biotech, the hardest part isn’t having an elegant platform—it’s proving it in patients. The Phase 2 cystic fibrosis results, while encouraging, are still early signals, not the kind of clean efficacy story that guarantees a commercial win.

So Arcturus’s competitive position is both clearer and more fragile than it looks on paper: it has a differentiated engine, a credible partner, and real approvals—but it’s operating in a world where the giants are now awake, well-funded, and buying anything that looks like tomorrow.

X. Leadership and Culture: The San Diego Biotech Ecosystem

Joseph Payne’s leadership style is stamped all over Arcturus: high conviction, low tolerance for wishful thinking, and a bias toward doing the hard thing only if you’re truly built for it. When asked what he’d tell aspiring entrepreneurs, he didn’t sugarcoat it:

"When in doubt, don't do it. If there is a suspicion of deficiency in skill set or work ethic don't move into this. If you are capable and have confidence in your ability, move forward."

That mindset—brutally selective, almost Darwinian—makes sense in biotech, where you can spend years and tens of millions proving that something doesn’t work. Payne has also been clear about what “winning” looks like from his seat: not just shipping a product, but building an enduring company.

"I would like to see us as one of the largest biotech companies in San Diego. Another form of success would be if we are able to partner one or many of our programs with a larger pharmaceutical company. mRNA allows us to address diseases that others cannot, and our expertise in the area will only continue to build value."

If there’s a single strategic thread running through Arcturus’s history, it’s this: stay lean, build differentiated tech, and use partnerships as force multipliers. Payne has repeatedly framed collaboration not as surrendering the upside, but as expanding the addressable map—getting into diseases, geographies, and development timelines that a small San Diego team couldn’t reach alone.

"Our platform technology can have thousands of applications to help others. Collaborative efforts have a high impact and a long reach to ultimately allow us access to areas that would not be accessible on our own. These collaborative efforts include the partnerships we have made with Johnson and Johnson, the Cystic Fibrosis Foundation, Ultragenyx, and other biopharmaceutical companies."

That partnership-first approach is also why the 2018 board fight matters in retrospect. It wasn’t just corporate drama—it was a signal. Payne was willing to fight for control because, in his view, the platform needed time, focus, and consistency. Whether you see that as principled or stubborn, it’s undeniably founder-centric: protect the long-term vision, even if it’s messy in the short term. In biotech—where conviction has to survive repeated skepticism—founder-led companies often do better than you’d expect.

Arcturus also benefits from being in the right place. San Diego is one of the most productive biotech ecosystems in the world, with major pharma footprints, dense academic research, and deep talent in RNA biology and drug delivery. That proximity is an advantage—partners are nearby, expertise is local—but it also means constant competition for the same people who can make or break a platform company.

The leadership story has continued to evolve. In February, the company announced the appointment of Moncef Slaoui, Ph.D., as Chair Designate. Slaoui, who led Operation Warp Speed during the COVID pandemic, brings a very specific kind of credibility: someone who has operated at the intersection of science, regulation, and commercial scale—exactly the set of muscles Arcturus needs as it tries to turn platform promise into a repeatable, multi-product business.

XI. Strategic Frameworks: Porter's Five Forces and Hamilton's Seven Powers

Porter’s Five Forces is a good way to pressure-test whether Arcturus can build something durable, not just interesting. Because in biotech, great science is the entry ticket. The question is whether the business can defend itself long enough for the science to pay off.

Porter's Five Forces Analysis:

Threat of New Entrants: Moderate to high. COVID proved mRNA works, which pulled in capital, talent, and new competitors. But the barriers aren’t trivial: making RNA medicines at scale is hard, running clinical trials is expensive, and delivery systems like LUNAR aren’t something you copy from a paper overnight. The bar has risen, and that helps incumbents—but it also means the fight is crowded.

Bargaining Power of Suppliers: Moderate. Arcturus relies on the ecosystem—contract manufacturers, lipid suppliers, and CROs. The pandemic made it painfully obvious how fragile those supply chains can be. Still, there are multiple vendors, and Arcturus has worked to reduce single-point risk. The ARCALIS joint venture in Japan adds another lever: more control over manufacturing, at least in one key market.

Bargaining Power of Buyers: High. In vaccines, the buyers are governments and national healthcare systems, and they negotiate like it. In rare diseases, orphan pricing can soften that pressure, but payers are increasingly demanding hard proof: outcomes, durability, and real-world value, not just mechanism.

Threat of Substitutes: High. In many of Arcturus’s target diseases, there are credible alternatives. For OTC deficiency, liver transplant remains the only curative option. For cystic fibrosis, CFTR modulators like Trikafta have reset expectations for most patients—meaning Arcturus is aiming at the group left behind, not the whole market. More broadly, gene therapy, small molecules, and protein therapies all compete for overlapping clinical ground.

Competitive Rivalry: Intense. In COVID vaccines, Moderna and BioNTech set the pace and own enormous mindshare, infrastructure, and cash. In rare diseases, Arcturus faces a different kind of crowd: a long list of companies pushing gene therapies and other genetic medicines. In both arenas, differentiation has to show up in patient data, not platform slides.

Hamilton’s Seven Powers asks a different question: not “how hard is the market,” but “what could become a moat?”

Hamilton's Seven Powers Analysis:

Scale Economies: Limited today. Arcturus doesn’t have the manufacturing footprint or commercial machine of the giants. The potential twist is the core STARR promise: if self-amplifying RNA really can deliver comparable results with far less material, lower dosing could translate into a meaningful manufacturing and cost advantage over time.

Network Effects: Not applicable to therapeutics.

Counter-Positioning: Potentially strong. Self-amplifying RNA is meaningfully different from conventional mRNA, and that matters because it may be easy for incumbents to dismiss it. The big players are optimized—scientifically, operationally, and financially—for their existing approach. If sa-mRNA proves superior in certain settings, Arcturus could benefit from being early while others face real switching costs.

Switching Costs: Moderate in rare diseases. Once a therapy is approved, adopted, and embedded into care pathways, it’s hard to displace—especially when patients are stable and clinicians don’t want to gamble. Regulatory approvals also raise the bar for competitors trying to follow.

Branding: Weak. This is not a consumer brand business. Reputation matters, especially with regulators and partners, but Arcturus’s main “brand asset” is credibility with data. KOSTAIVE helps, but it’s not the same kind of advantage as a scaled commercial franchise.

Cornered Resource: Moderate. Arcturus’s technology is supported by a large patent portfolio—more than 500 patents and patent applications across the U.S., Europe, Japan, China, and other countries. But mRNA is an IP minefield. The portfolio matters, yet freedom-to-operate and competitive patent pressure never fully go away in this space.

Process Power: Still forming, but real. Every trial, every manufacturing run, every regulatory interaction builds organizational muscle. Arcturus’s track record managing partnerships—CSL, Janssen, Ultragenyx—also counts as process know-how: an institutional ability to turn collaboration into progress, not just press releases.

Overall Assessment: Arcturus is still “pre-Power” in most dimensions. The company has a credible counter-position, and it’s starting to build process advantage, but durable power in biotech usually follows clinical proof and repeatable commercial execution. The next step isn’t theoretical. It’s whether rare disease programs like OTC and CF can produce the kind of outcomes that turn a differentiated platform into a lasting business.

XII. Bull vs. Bear Case and Investment Considerations

Bull Case:

Platform validation is the heart of the bull thesis. KOSTAIVE’s approval is proof that self-amplifying mRNA can make it through regulators and into real-world use. For a platform company, that matters. It means this isn’t just elegant biology—it’s something that can be manufactured, shipped, and administered at scale.

Rare disease optionality gives Arcturus multiple ways to win. OTC deficiency and cystic fibrosis are very different bets, but either one could change the company’s trajectory. In OTC, the Phase 2 signal—significant reductions in glutamine—supports the core promise that ARCT-810 is doing something meaningful biologically. In CF, the data are still early, but the imaging-based reductions in mucus burden in some participants hint at therapeutic activity and provide a reason to keep pushing.

Partnership economics help de-risk the journey. CSL brings development, manufacturing, and commercial horsepower—and shares costs. Under the arrangement, amounts paid by CSL are credited against Arcturus’s share of COVID-19 program costs. Once CSL has recouped Arcturus’s share of those costs, Arcturus is eligible to receive shared net profit payments from KOSTAIVE sales, consistent with its 40% share of net profits from COVID-19 vaccine sales.

Valuation, to bulls, looks disconnected from the asset base. Arcturus Therapeutics Holdings Inc. has a market capitalization of 193.412M. For a company with an approved product, a clinically validated platform, and multiple programs in the clinic, the argument is that the setup is asymmetric if even one therapeutics program breaks through.

Technical differentiation could matter most where budgets are tight. The “less RNA per dose” advantage isn’t just scientific—it can translate into lower manufacturing costs and more flexible supply, which may be decisive in markets where price and logistics shape adoption.

Bear Case:

Commoditization is the long-term threat. mRNA is no longer exotic. Moderna and BioNTech can fund more shots on goal, move faster, and overwhelm smaller players on manufacturing and execution. Even real differentiation can get drowned out if the giants decide it matters.

Clinical uncertainty is still the near-term driver. Arcturus shares are down 48% year-to-date after reporting Phase II data of daily inhaled ARCT-032 in cystic fibrosis that did not meet management’s 3% FEV1.0 improvement goal from baseline. In biotech, early signals can fade quickly, and the distance from Phase 2 to approval is where many programs die.

Capital needs can force dilution, even with a runway. Management has said the cash runway extends into 2028, supported by planned cost reductions in Q4 2025 and by delaying the start of the Phase 3 CF trial until 2027. But pivotal trials for OTC and CF are expensive, and timelines slip all the time. If the markets close at the wrong moment, shareholders pay the price.

Reactogenicity could be a structural constraint. Self-replicating RNA is designed to be more potent, which is great for vaccines. For therapeutics—especially ones that require repeat dosing—strong immune activation can become a limiting factor.

Commercial execution remains largely unproven. Arcturus hasn’t built and scaled its own sales engine. KOSTAIVE is distributed by CSL/Meiji Seika Pharma, which reduces execution risk—but also caps how much upside Arcturus can capture directly and increases dependency on partners.

Key Metrics to Track:

Two things matter most if you’re tracking whether Arcturus is compounding—or just surviving:

-

Clinical trial outcomes (OTC and CF Phase 2/3 data): This is still a data-driven story. Watch OTC ammonia and glutamine outcomes, and in CF, watch for lung function improvements alongside other signs of clinical benefit.

-

Cash runway and operating discipline: Quarterly cash levels, R&D spending trends, and the timing of partnership milestones will tell you whether Arcturus can keep funding the next set of readouts without reaching for dilutive capital.

XIII. Recent Developments and Current State

Even as Arcturus doubled down on rare diseases, it kept one foot in the world that first proved its platform could work: infectious disease vaccines.

The company announced that the U.S. Food and Drug Administration granted Fast Track Designation to ARCT-2304, its self-amplifying mRNA vaccine candidate designed to protect against disease caused by the influenza A H5N1 subtype contained in the vaccine. In plain terms, Fast Track is the FDA signaling, “this could matter,” for a pathogen widely viewed as a serious pandemic risk. The Phase 1 clinical study for ARCT-2304 began in November 2024.

Meanwhile, KOSTAIVE kept moving through the global regulatory maze. The company said its plans included a marketing authorization application filing in the United Kingdom anticipated in Q2 2025, followed by a U.S. biologics license application filing expected in Q3 2025. Arcturus also reported it received the initial milestone payment from CSL tied to the European Union approval of KOSTAIVE.

On the safety front—the make-or-break issue for any mRNA platform—Arcturus published a comprehensive analysis of KOSTAIVE safety with 12 months of follow-up from the pivotal Vietnam study (NCT05012943), which included 17,582 participants who received at least one dose. The analysis supported a favorable reactogenicity profile. Acceptable tolerability was also observed in older participants and in individuals at high risk of severe COVID-19 due to underlying medical conditions. And importantly, the long-term follow-up did not reveal safety concerns, with no reports of myocarditis or pericarditis.

All of that progress sits alongside a clear strategic tightening: fewer distractions, more focus. As the company put it, “We are delighted with enrollment in our cystic fibrosis (CF) program, and the company is working diligently to provide meaningful Phase 2 interim data mid-year.”

XIV. Lessons and Playbook: What Founders and Investors Can Learn

Technology risk vs. market timing: Arcturus had differentiated technology from day one. Self-amplifying RNA really does operate differently than conventional mRNA. But being right about the science doesn’t guarantee commercial success. Moderna and BioNTech won the COVID vaccine race not because their approach was inherently “better,” but because they executed faster, scaled manufacturing earlier, and moved through regulators with momentum. The takeaway is blunt: differentiation is necessary, but it’s not sufficient.

The partnership dance: Arcturus survived by treating partnerships as a strategy, not a lifeline. Ultragenyx validated the rare disease bet. Janssen brought capital and credibility. CSL delivered the kind of funding and commercial infrastructure that a small San Diego biotech couldn’t build quickly on its own—while still leaving Arcturus with meaningful upside. The skill is knowing what to give up (near-term economics, some control) to gain what you can’t manufacture internally (speed, scale, validation), without selling the whole future.

Pivoting with purpose: When Western COVID markets effectively locked up, Arcturus didn’t just keep running into the wall. It pivoted to Asia. That wasn’t retreat—it was repositioning. Vietnam delivered large-scale efficacy data. Japan offered a viable regulatory path and a real commercial launch. Geographic flexibility didn’t just help; it saved the company. The lesson is to look for open doors, not just familiar ones.

Surviving the valley of death: Most biotechs don’t die in a dramatic implosion. They die slowly, when the cash runs out before the next proof point arrives. Arcturus stayed alive through capital discipline, a focus on milestones that could unlock the next tranche of funding, and partnership timing that brought in resources when markets or internal budgets couldn’t. In biotech, “survival” is often the most underrated form of execution.

Platform vs. product: Arcturus has always led with the platform—LUNAR delivery, STARR self-amplification. But platforms don’t pay the bills. Products do. The trick is constantly balancing breadth (proving the engine can run in many settings) with depth (proving it can win in one setting that matters). KOSTAIVE showed the platform can cross the regulatory finish line. OTC and CF need to show the platform can meaningfully change disease.

The long game in biotech: Arcturus was founded in 2013. Its first approval arrived about a decade later. That’s not an outlier—it’s the job. This business is built on long timelines, repeated setbacks, and the occasional breakthrough that makes the whole decade make sense in hindsight. Founders and investors who can’t stomach that arc usually self-select out.

Managing volatility: Arcturus’s stock has been volatile, and that’s the rule, not the exception, for clinical-stage biotech. Trial readouts and regulatory decisions are binary events that reprice the future in a single day. If you’re involved in biotech—building or investing—your edge isn’t predicting every swing. It’s having a framework strong enough to survive them.

The power of resilience: The 2018 board dispute could have ended Arcturus. Instead, Joseph Payne fought, regained control, and kept the company pointed at the mission. That willingness to persist through scientific, corporate, and financial adversity is what separates the companies that become case studies from the ones that become cautionary tales. As one observer put it, “Joseph’s love for science, innovation, and his wish to help the world is reflected in the values, goals, and culture” of Arcturus.

XV. Epilogue: The Future of mRNA and Arcturus's Place in It

The mRNA revolution is real—but chapter one, COVID, is over. Chapter two—everything else—is just beginning.

COVID vaccines were developed, tested, and authorized at breathtaking speed, and they demonstrated very high efficacy. But the bigger legacy wasn’t a single product cycle. It was proof, in public, that you can use RNA to turn the body into a temporary drug factory.

That proof cracked open a much larger map: vaccines beyond COVID, yes, but also therapeutics—cancer, cardiovascular and metabolic diseases, and conditions where protein replacement could change outcomes.

So where could self-amplifying RNA matter most? A few arenas stand out.

Pandemic preparedness is the obvious one: if lower-dose vaccines can be manufactured faster and stretched further, that’s not just a scientific advantage—it’s logistics, equity, and speed when the clock is running again. Rare genetic diseases are another: mRNA can deliver missing proteins without permanently changing the genome, and it can be re-dosed—an attribute that can matter as much as efficacy. And there’s a third category that doesn’t get as much attention in Western biotech conversations: neglected tropical diseases, where cost, distribution constraints, and limited infrastructure shape what’s even possible.

As Nobel laureate Dr. Drew Weissman put it: "Self-amplifying mRNA technology has the potential to be an enduring vaccine option."

Arcturus is a case study in the difference between pioneering and winning. It helped push self-amplifying mRNA from theory into clinical reality, achieved the first approval for the class, and stayed alive while the field consolidated around a few household names. But “winner,” in biotech, usually means something more specific: sustained impact for patients and a business model that doesn’t depend on the next partnership check.

That’s still the open question. The range of outcomes from here is wide. Independent success likely means approvals in OTC deficiency and/or cystic fibrosis, followed by real commercial execution and, possibly, additional partnerships that expand the platform’s reach. Acquisition is also plausible: if larger players decide sa-mRNA is strategically important, Arcturus could be an attractive way to buy time and capability. The journey could also stretch out through continued clinical development funded by more capital raises. And, of course, the hard downside exists too: clinical failures that shrink the company back toward platform value and whatever economics its partnerships can support.

What to watch in the coming year isn’t complicated. It’s the proof points: Phase 2/3 clinical data in OTC deficiency, continued progress and interim signals in CF, KOSTAIVE’s commercial trajectory in Japan and Europe, U.S. regulatory submissions, and any renewals or expansions in the partner network.

The Arcturus story is a reminder that innovation isn’t linear, and the companies that endure aren’t always the ones that sprint fastest. Twelve years after two scientists bet their savings on self-amplifying RNA, the bet hasn’t fully paid off. But it also hasn’t broken. The next chapters decide whether Arcturus becomes a durable biotech success—or a fascinating, important footnote in the mRNA revolution.

For long-term investors, it’s the classic biotech trade-off. The upside is real if the rare-disease programs land. The downside is real if they don’t. In between is a company with validated technology, meaningful partners, and a demonstrated ability to survive long enough to get the next set of answers. The platform is real. The data are encouraging, but not definitive. The competition is formidable, but not unbeatable. And Arcturus has already proven the one thing most biotechs never do: it made it through the valley of death.

XVI. Resources and Further Reading

If you want to go deeper than this narrative—and see the primary documents, trial records, and third-party analysis—these are the best starting points:

- Arcturus Therapeutics Investor Relations – SEC filings, earnings transcripts, and corporate presentations at ir.arcturusrx.com

- ClinicalTrials.gov – Official trial listings and status updates for OTC deficiency (ARCT-810) and cystic fibrosis (ARCT-032)

- CSL Seqirus partnership announcements – Deal terms, program updates, and commercialization details for KOSTAIVE

- FDA Orphan Drug database – Designations and regulatory status for ARCT-810 and ARCT-032

- Nature Communications publication on ARCT-154 – Peer-reviewed Phase 3 efficacy and safety data

- The Lancet Infectious Diseases – Head-to-head clinical comparison of ARCT-154 versus conventional mRNA vaccines

- BioPharma Dive and Fierce Biotech – Ongoing reporting on Arcturus and the broader RNA medicines landscape

- Nobel Prize announcement (2023) – Background on Karikó and Weissman’s foundational mRNA work

- BARDA contract documentation – Details on U.S. government support for pandemic influenza preparedness programs

- San Diego biotech ecosystem reports – Context on the region’s talent base, institutions, and partnership density

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music