Allient Inc.: The Quiet Compounder Building the Motion That Moves the World

I. Introduction: The Invisible Force Behind Modern Industry

Picture an operating room in a major hospital: a surgical robot performs a delicate spinal procedure, its servo motors executing movements with sub-millimeter precision. In a semiconductor fabrication plant halfway around the world, nano-positioning systems align silicon wafers for the next generation of microchips. On a factory floor in Michigan, electric motors power automated guided vehicles ferrying parts through a maze of assembly stations. And at a forward operating base, a defense contractor's unmanned vehicle patrols the perimeter, its motion control systems providing the reliability that soldiers depend on.

What connects these seemingly disparate scenes? In many cases, the answer is a Buffalo, New York-based company that most investors have never heard of: Allient Inc.

Allient Inc., together with its subsidiaries, designs, manufactures, and sells precision and specialty-controlled motion components and systems for various industries in the United States, Canada, South America, Europe, and the Asia-Pacific. The company operates with a market capitalization hovering around half a billion dollars, yet its products power some of the most critical applications in modern industry—from medical devices that save lives to defense systems that protect nations.

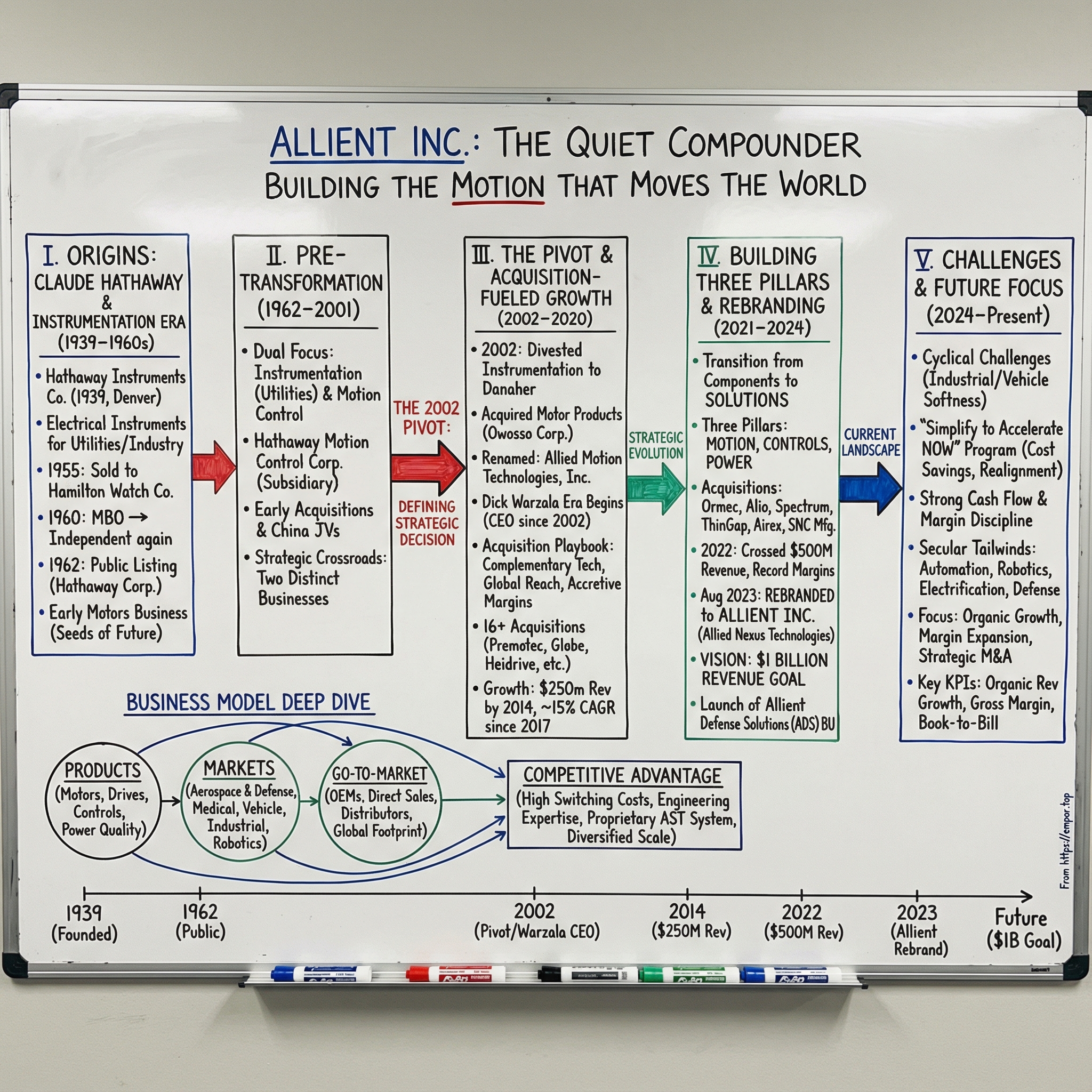

The core question that animates this story: Allient Inc. (formerly Allied Motion) was founded in January 1939 in Denver, Colorado by Claude Hathaway under the name of Hathaway Instruments Company. How did a company nearly nine decades old, originally making electrical instruments, transform itself into a global motion control solutions empire through what can only be described as disciplined serial acquisitions?

The US-headquartered motion control specialist Allied Motion Technologies has changed its name to Allient and is aiming to almost double its revenues to more than $1bn. The company, whose headquarters are in Buffalo, New York, and employs more than 2,250 people around the world, designs and manufactures precision and specialty motion, controls and power products and systems for targeted industries and applications.

This is a story of strategic pivots, disciplined M&A compounding, and the sometimes unglamorous but highly profitable transition from component supplier to solutions provider. It's a masterclass in industrial roll-up strategy and long-term capital allocation—the kind of story that separates patient compounders from the flash-in-the-pan growth stories that dominate headlines but rarely deliver sustained shareholder value.

II. Origins: Claude Hathaway and the Instrumentation Era (1939–1960s)

In January 1939, as the world teetered on the brink of global conflict, a Denver-based entrepreneur named Claude Hathaway founded what would become one of the more remarkable corporate transformation stories in American industrial history. The company he established—the Hathaway Instruments Company—was a creature of its time, positioned to capitalize on post-war industrial America's insatiable appetite for precision instrumentation.

The company developed and successfully sold electrical instruments to a number of industries through the 1940s and early 1950s. This was the golden age of American industrialization. Utilities expanded their power generation and transmission networks across the country. Process control industries—chemicals, refining, manufacturing—demanded ever more sophisticated monitoring equipment. Hathaway's instruments found ready customers among the operators of these vast industrial systems, providing the eyes and ears that allowed engineers to manage increasingly complex operations.

The company's early success attracted the attention of a larger player. In 1955, the Hamilton Watch Company purchased the company from Mr. Hathaway. For five years, Hathaway operated as a division of Hamilton, benefiting from the larger company's resources while maintaining its focus on industrial instrumentation.

Then came a pivotal moment in the company's history. In January 1960, a group of investors—composed in part of executives working within the Hamilton division—orchestrated a management buyout, purchasing the division and establishing Hathaway Instruments, Inc. as an independent entity once more.

Two years later, in 1962, the company was incorporated as a public company under the laws of Colorado, with revenues of $15.7m, mainly from motors. Originally named 5800 Corporation—likely a reference to an address or incorporation number—the name was changed within days to Hathaway Instruments Inc. Twenty years later, in 1982, the corporate name was simplified to Hathaway Corporation.

What's remarkable about this early period is what it reveals about the company's DNA. From the very beginning, Hathaway demonstrated a willingness to evolve, to change ownership structures, to adapt to new market realities. The management buyout of 1960 showed that executives understood the value of what they had built and were willing to bet on themselves. The 1962 public listing demonstrated an appetite for growth capital and the discipline required to operate under public market scrutiny.

But here's what matters most for investors thinking about the company today: even in 1962, with revenues of $15.7 million, Hathaway was already in the motors business. The seeds of its eventual transformation into a motion control powerhouse were planted decades before that pivot became explicit strategy.

III. The Pre-Transformation Years: Hathaway Corporation (1962–2001)

The four decades between Hathaway Corporation's public listing and its strategic reinvention represent the kind of slow, steady corporate evolution that rarely makes headlines but often builds the foundation for later success. By 1995, the company had developed and was manufacturing and selling instrumentation used to monitor and control the operations of power generating, transmission, and distribution facilities of electric utility and process control companies. The company had also established a nascent motion control business.

This dual focus—one foot in the instrumentation business serving electric utilities, the other in an emerging motion control operation—would define the company's strategic challenge for years. At this time, Hathaway Corporation consisted of two wholly owned subsidiaries: Hathaway Systems Corporation (HSC) and Computer Optical Products, Inc. The motion control business was organized into two divisions and one subsidiary: Hathaway Motion Control, Hathaway Motors and Instruments, and Computer Optical Products, Inc., respectively.

Between 1962 and 2001 Hathaway executed several acquisitions and mergers of subsidiaries into the parent corporation. In addition, joint ventures in China were established and other acquisitions occurred. This period represented the company's first experiments with the acquisition-driven growth model that would later become its hallmark. The ventures in China signaled early recognition that motion control would become a global industry requiring global manufacturing footprints.

At the end of 2001, Hathaway Corporation consisted basically of the Power and Process business, selling into the electric utility market, and a motion control business operated as a wholly owned subsidiary, Hathaway Motion Control Corporation.

By the turn of the millennium, Hathaway faced a classic strategic crossroads. The company had two distinct businesses serving different markets with different growth trajectories. The instrumentation business serving electric utilities was stable but mature. The motion control business was smaller but positioned in markets with secular growth potential—automation, medical devices, and what would eventually become the robotics revolution.

Management faced the question that confronts every diversified industrial company at some point: should it continue trying to excel at two different things, or should it pick one and commit fully? The answer would transform the company.

IV. The 2002 Pivot: The Defining Strategic Decision

If there's one moment that defines what Allient would become, it happened in 2002. In 2001 a decision was made to focus on motion and divest the instrumentation business. This was not an evolutionary change but a fundamental strategic reinvention—the kind of binary bet that separates great capital allocators from mere managers.

In 2002, the company took the decision to focus solely on motion control products and markets. The execution of this strategy was swift and decisive. As a result, on July 29, 2002, the company sold its electric utility products division along with the Hathaway brand name to the Danaher Corporation. The day following the divestiture of the Power and Process business, the company completed the acquisition of Motor Products - Owosso Corporation and Motor Products - Ohio Corporation, both manufacturers of permanent magnet DC motors, from the Owosso Corporation.

The timing here is extraordinary. On July 29, Hathaway sold its legacy business. On July 30—literally the next day—it deployed that capital into acquiring permanent magnet DC motor manufacturers. This wasn't a company stumbling into a pivot; this was a meticulously planned strategic transformation executed with military precision.

These were the first acquisitions by the company in accordance with its plan to grow its motion control business platform. On November 19, 2002, the company formally changed its name from Hathaway Corporation to Allied Motion Technologies, Inc.

Consider the significance of selling to Danaher. By 2002, Danaher had already established itself as one of the most successful serial acquirers in American industrial history. Since the early 1990s, Danaher's management team has transformed a group of under-performing industrial manufacturing companies into a global powerhouse in life sciences and diagnostics. Remarkably, they have grown the company's earnings per share by roughly 10,000% from 1990 to 2023 – an almost unbeatable track record of value creation.

There's an irony here worth noting: Allied Motion sold its legacy business to the master of industrial roll-ups, then proceeded to apply a remarkably similar playbook to build its own motion control empire. In a sense, Danaher's purchase of Hathaway's instrumentation business funded the creation of a miniature Danaher-like compounder in the motion control space.

"In July 2002, we acquired Motor Products from Owosso Corporation, and we believe there is now the opportunity to gain synergies through shared sales channels and manufacturing processes of these two previous sister companies. Stature has had a history of producing excellent profits and although it was adversely impacted by the down turn of the economy in 2001, Stature Electric has the products and engineering capabilities of producing excellent profits for Allied Motion in the future."

Dick Warzala, who would become the architect of Allied Motion's transformation, articulated the playbook clearly even in those early days: "Strategically, Stature Electric and the existing Allied Motion businesses are very well aligned, due to the extensive design and applications engineering knowledge base as well as a commitment to lean manufacturing processes and development of strategic sourcing of parts to ensure the competitiveness of our products. With the acquisition of Stature Electric, Allied Motion further expands its ability to deliver unique motor solutions to multiple and diverse markets."

This language—"extensive design and applications engineering knowledge base," "lean manufacturing processes," "strategic sourcing"—would become the repeating themes of every acquisition over the next two decades. The 2002 pivot wasn't just a strategic decision; it was the establishment of a replicable acquisition playbook.

V. The Acquisition-Fueled Growth Era (2002–2020)

With the strategic direction set, Allied Motion embarked on what would become a two-decade acquisition spree that transformed a modest motion control company into a global enterprise. Over the past 20 years, Allied has acquired 16 other businesses, including Premotec in 2004, Ostergrens in 2010, Globe Motors in 2013, Heidrive in 2016, Dynamic Controls in 2020, Ormec, Alio and Spectrum Controls in 2021, and ThinGap and Airex in 2022.

Each acquisition followed a disciplined approach. The US motion control specialist Allied Motion Technologies is buying the German motors and servodrives manufacturer, Heidrive, for €20m (about $22m). Allied says that the acquisition will broaden its geographical reach and expand its product and technical capabilities.

Consider the Heidrive acquisition as a case study in Allied Motion's approach. Headquartered in Kelheim, Germany, Heidrive designs and manufactures customized, innovative synchronous motion systems for highly demanding applications from medical technology and robotics to cargo aviation and building technologies, as well as various commercial applications. Its products include a variety of motors, gears and electronic controls. Heidrive has approximately 220 employees with manufacturing facilities in Kelheim and Mrakov, Czech Republic.

Richard Warzala explained the strategic rationale: "This acquisition brings us a well-managed, focused organization that is strategically aligned with Allied Motion and will provide us with many opportunities to advance our growth strategy through new markets, customers, products and capabilities. Heidrive brings complementary product lines and additional technical competencies in customized motor and system solutions while expanding our sales footprint and customer base in the German market. Heidrive also provides an efficient operational presence in Germany and the Czech Republic that will further enhance our global production capabilities."

The company originated from the Hathaway Corporation, which has been active in the field of energy monitoring since the 1960s. In 2002, Hathaway Corporation sold its energy and process equipment division, and the remaining company operated as Allied Motion Technologies and, later, Allient. The renaming signaled the company's strategic orientation toward motion control.

Allied Motion was formerly known as Hathaway Corporation and adopted its current name in 2002 after selling off its power and instrumentation business. Since then, it has expanded through a series of acquisitions, including Stature Electric and Netherlands-based Precision Motor Technology (Premotec) in 2004, Agile Systems from Canada and Sweden's Östergrens Elmotor in 2010, and Ohio-based Globe Motors in 2013. Between 2011 and 2014, Allied's revenues grew by 125% to reach around $250m.

Since 2017, it has been growing by around 15% a year. This growth rate—sustained over multiple years through the combination of organic expansion and strategic acquisitions—represents the kind of compounding that long-term investors dream about.

The acquisition playbook became increasingly refined. Each deal needed to meet specific criteria: complementary technology capabilities that enhanced the overall portfolio, geographic reach that expanded the company's global footprint, and margin profiles that were accretive to the consolidated business. Through acquisitions and organic investments, the company strengthened its competitive position in target markets while building toward something larger than the sum of its parts.

VI. Building the Three Pillars: Motion, Controls, and Power (2021–2023)

The period from 2021 to 2023 represented another strategic evolution. Having established itself as a formidable motion control company, Allied Motion's leadership recognized an opportunity to expand the company's value proposition beyond motors and motion components.

Allied has now become Allient (Allied Nexus Technologies) with three brands: • Allied Motion, covering technologies such as brushless motors, brushed DC motors, gear-motors and encoders; • Allied Controls, serving markets including industrial automation and medical mobility; and • Allied Power, whose products include motor protection and filters, targeting multiple markets.

Dick Warzala stated: "For the past 20 years, we have successfully executed our strategy and expanded our capabilities to be a leading global provider of motion solutions. More recently, we have been building our controls and power technologies capabilities, both organically and through acquisitions."

This three-pillar structure—Motion, Controls, and Power—represented the company's transition from being a products-based business to becoming a comprehensive systems provider. The strategic logic was compelling: customers increasingly wanted integrated solutions rather than individual components. A company that could provide motors, the controls to operate them, and the power quality systems to ensure reliable operation could capture more of the value chain and deepen customer relationships.

The acquisitions of 2021 exemplified this strategy: Ormec brought servo control systems expertise, Alio added nano-precision positioning capabilities, and Spectrum Controls contributed industrial communications and I/O modules. Together, these additions filled gaps in the company's solutions portfolio.

In 2022, the company achieved what management described as impressive results: 18% organic growth, strengthening of its margin profile, and robust order levels. The company crossed a significant revenue milestone, surpassing $500 million and achieving a record gross margin of 31.3%.

These weren't just numbers on a page—they validated the strategy. The transition from component supplier to solutions provider was generating real financial results, demonstrating that customers valued the integrated approach and were willing to pay for it.

VII. The Rebranding and $1 Billion Vision (2023–2024)

On November 19, 2002, the company formally changed its name from Hathaway Corporation to Allied Motion Technologies, Inc. On August 23, 2023, the company formally changed its name from Allied Motion Technologies Inc. to Allient Inc. to showcase the diversity of the technologies offered through acquisitions.

The name change from Allied Motion to Allient was more than cosmetic rebranding—it was a statement of strategic intent. The name was chosen to better reflect the future business direction of the company.

The new name—Allient, short for Allied Nexus Technologies—captured the company's evolution. It was no longer just a motion company; it was a nexus of interconnected technologies serving critical applications across multiple industries.

Management articulated an ambitious vision alongside the rebrand. The breadth and depth of the company's technology offerings, expanded market opportunities, and increased focus on offering solutions for targeted vertical markets created a path to significant growth. Management expressed confidence that the company could, in time, generate over $1 billion in annual revenue, expand gross margins, and deliver operating margins in the mid-teens leading to adjusted EBITDA margins in the high-teens.

This $1 billion target represented nearly a doubling from current revenue levels—an ambitious but not implausible goal given the company's historical growth rates and the secular tailwinds in its end markets.

Recent acquisitions continued the strategic pattern. The acquisition of Sierramotion did not have a material impact on sales during the third quarter. Sierramotion, acquired in September 2023, brought enhanced capabilities in custom mechatronic and motion component solutions for medical, defense, robotics, and industrial applications.

Allient Inc. announced the acquisition of SNC Manufacturing Co., Inc. ("SNC"), a premier designer and global manufacturer of electrical transformers serving blue-chip customers in defense, industrial automation, alternative power generation and energy, including electric utilities and renewable energy.

Richard S. Warzala, Chairman, President and CEO of Allient, commented, "SNC is a solid addition to our Allied Power pillar. In addition to extending our capabilities in the clean power industry, SNC will provide us broader and deeper reach into industrial automation, defense, medical and in the energy and alternative energy markets."

Allient Inc. acquired SNC Manufacturing Co., Inc. for $20 million on January 11, 2024. SNC Manufacturing Co., Inc. reported revenue of approximately $40 million for the trailing twelve months. Paying roughly half of trailing revenues for a profitable transformer manufacturer with blue-chip customers represented the kind of disciplined deal-making that characterized Allient's approach.

Founded in 1946, SNC is headquartered in Oshkosh, Wisconsin, with approximately 440 employees in three locations. With approximately $40 million in revenue for the trailing twelve months, the business has other manufacturing facilities in Mexico and China. The SNC acquisition was notable as Allient's first tuck-in acquisition specifically for the Power technology pillar, validating the three-pillar strategy.

Allient Inc. announced the launch of its Allient Defense Solutions (ADS) Business Unit (BU). This vertical market initiative underscored Allient's commitment to expanding its presence in high-growth markets and driving long-term value for customers and stakeholders.

Dick Warzala, Chairman and CEO, commented, "The launch of Allient Defense Solutions is a pivotal milestone in our vertical market strategy, highlighting our dedication to delivering compact, lightweight, high-performance system solutions to the defense industry." This marks the Company's first vertical market-focused initiative, aligning with the rebranding and vertical market strategy announced at its 2023 Investor Day.

VIII. Current Challenges and the "Simplify to Accelerate NOW" Era (2024–Present)

Even the best-positioned companies face cyclical challenges, and 2024 tested Allient's resilience. Full year revenue of $530.0 million reflected anticipated demand softness in industrial and vehicle markets.

Dick Warzala, Chairman and CEO, commented, "Despite strong efforts from our team, we saw a significant demand shift during the month of June, with a notable decline in the Industrial market related to automation and the recreational industry combined with lesser declines in other served markets."

Management responded with characteristic discipline, launching the "Simplify to Accelerate NOW" program to realign the company's manufacturing footprint and streamline operations. The Simplify to Accelerate NOW program delivered $10 million in annualized savings in 2024, with additional cost savings of $6-7 million targeted for 2025.

Warzala added, "These actions to realign operations and rationalize production are elements of our overall strategy to refine our organizational structure, eliminate redundancies and optimize our operations. As we simplify our enterprise, we believe we can better serve our customers and strengthen our long-term competitiveness by making Allient easier to do business with while increasing our speed to market with new product innovations. Importantly, we are also better positioning the Company for the current macro environment and industrial headwinds."

Third quarter performance: Revenue was $125.2 million with a gross margin of 31.4% and net income of $2.1 million. Despite the revenue headwinds, the company maintained its margin profile—a testament to the effectiveness of cost discipline and operational focus.

Key highlights include a 15% sequential increase in orders, particularly in power quality and defense sectors, resulting in a book-to-bill ratio near 1.00. The strengthening orders, particularly in power quality (driven by data center demand) and defense, suggested that the demand environment was stabilizing.

Full-year 2024 performance showed revenue of $530.0 million, operating cash flow of $41.9 million, and year-end cash position of $36.1 million. The company's cash generation remained strong even during a challenging demand environment, enabling continued debt reduction and investment in strategic initiatives.

The company posted an adjusted earnings per share (EPS) of $0.31, exceeding the projected $0.22. Revenue also came in higher than expected at $122 million, compared to a forecast of $119.71 million.

IX. Business Model Deep Dive: What Allient Actually Makes and Sells

Understanding Allient requires understanding its products, customers, and go-to-market approach in detail.

The company provides motion, controls, and power quality products and systems for a range of applications in several target markets including aerospace and defense, medical, vehicle, commercial, and industrial. The company designs and manufactures electric motors, electronic motion control components, gear motors, transaxles and traction wheels, control electronics and drives, optical encoders, and power quality.

The product portfolio is remarkably broad. Key products of this company are brush and brushless DC motors, brushless servo and torque motors, coreless DC motors, brushless motors with integrated drives, gearmotors, digital servo drives, motion controllers, incremental and absolute optical encoders, powered wheels and transaxles, power quality devices for reducing or eliminating harmonic distortion, as well as power wheelchair control systems.

These products include brushed and brushless DC motors, brushless servo and torque motors, coreless DC motors, integrated brushless motor drives, gear motors, gearboxes, modular digital servo drives, motion controllers, incremental and absolute optical encoders and related motion control products.

Allient (Nasdaq: ALNT) is a global engineering and manufacturing enterprise that develops solutions to drive the future of market-moving industries, including medical, life sciences, aerospace and defense, industrial automation, robotics, semi-conductor, transportation, agriculture, construction and facility infrastructure.

The applications span critical industries: Medical: administer infusions associated with chemotherapy, pain control and antibiotics, nuclear imaging systems, radiology equipment, automated pharmacy dispensing equipment, kidney dialysis equipment, respiratory ventilators, heart pumps, and patient handling equipment (e.g., wheel chairs, scooters, stair lifts, patient lifts, transport tables and hospital beds). Aerospace & Defense: inertial guided missiles, mid-range smart munitions systems, weapons systems on armed personnel carriers, unmanned vehicles, security and access control, camera systems, door access control, airport screening scanning devices, and light-weighting vehicle technologies.

It sells its products primarily to original equipment manufacturers (OEMs) utilizing its own direct sales force, independent sales representatives and distributors.

With 22 locations in North America, Europe and Asia and over 2,400 (in 2022) employees worldwide, Allient jointly develops, manufactures and sells products for the motion control market. These products include brushed and brushless DC motors, brushless servo and torque motors, coreless DC motors, integrated brushless motor drives, gear motors, gearboxes, modular digital servo drives, motion controllers, incremental and absolute optical encoders and related motion control products.

The geographic footprint spans global operations: The company operates facilities in the United States, Canada, Mexico, Europe and Asia and sells its products globally.

X. The Dick Warzala Era: CEO as Chief Capital Allocator

Allient's CEO is Dick Warzala, appointed in May 2002, has a tenure of 23.33 years. That date is significant—it coincides precisely with the company's strategic pivot from instrumentation to motion control. Warzala didn't inherit a motion control company; he built one.

Richard S. Warzala is Chairman of the Board, President and CEO of Allient Inc. Mr. Warzala has a strong management and technical background in the motion control industry and has served as Chairman of the Board since February 2014.

Mr. Richard S. Warzala has been the Chairman, Chief Executive Officer and President of the company since 2014. Prior to this, he served as the President and Chief Operating Officer of the company.

The Warzala playbook combines several elements: disciplined acquisition integration using the company's proprietary Allied Systematic Tools (AST), focus on margin-enhancing solutions rather than pure revenue growth, and a diversified market strategy that provides resilience through business cycles.

Total yearly compensation is $2.91M, comprised of 24.3% salary and 75.7% bonuses, including company stock and options. This compensation structure—heavily weighted toward performance-based incentives—aligns Warzala's interests with shareholders.

The family succession element adds another dimension. Steve Warzala has been appointed President of the Allient Defense Solutions BU and will assume the role of Corporate Vice President. Having the next generation of Warzalas taking leadership roles signals continuity of the strategic approach that has driven value creation over two decades.

With a record annual gross margin of 31.7% and an operating margin of 7.3%, the company's cash generation has allowed for significant debt reduction while still investing in growth initiatives. Allient's net income per diluted share saw a 36% increase, rising to $1.48, or $2.30 on an adjusted basis. The company's "simplify to accelerate" strategy is credited for driving stronger earnings power, and executives have expressed confidence in Allient's future and its potential to create additional value for stakeholders.

XI. Porter's Five Forces Analysis: Competitive Positioning

Threat of New Entrants: MODERATE-LOW

The motion control industry presents significant barriers to entry. The engineering expertise required for precision motion control takes years to develop. Customer relationships in aerospace & defense and medical markets involve lengthy qualification processes—sometimes lasting years before a new supplier can be approved. The capital intensity of manufacturing operations, combined with the need for global production capabilities, makes it difficult for new entrants to achieve competitive scale.

Allient offered the broadest range of motor types and component technologies in the motion control industry. The company could then integrate these technologies into fully customized actuators delivering the precision, efficiency, and performance that its customers required.

Bargaining Power of Suppliers: MODERATE

Raw materials like rare earth magnets, copper, and steel are commodity-like but require specialized grades for precision applications. Some supplier concentration exists for precision components. Allient mitigates supplier power through its global manufacturing footprint, which provides sourcing flexibility.

Bargaining Power of Buyers: MODERATE-HIGH

OEM customers have significant leverage due to their purchasing volumes and the availability of alternative suppliers. However, long design cycles create switching costs once Allient's products are designed into a customer's equipment. The mission-critical nature of many applications makes customers risk-averse to changing suppliers—no medical device company wants to explain to regulators why they're switching motors.

Decreases in revenues compared to the prior year period are largely impacted by elevated shipments during the prior year period as supply chains normalized, combined with elevated inventory levels and slowing demand at our customers.

Threat of Substitutes: LOW

Precision motion control is fundamental to automation, and electric motors have limited substitutes for most applications. The growing demand from electrification and automation megatrends actually increases the relevance of motion control solutions. Alternative technologies like pneumatics or hydraulics serve different applications rather than directly substituting for electric motion control.

Competitive Rivalry: HIGH

Leading players in the brushless DC motor market include AMETEK, Inc. (US), Allient, Inc. (US), NIDEC CORPORATION (Japan), Johnson Electric Holdings Limited (China), and Minebaemitsumi Group (Japan).

The industry includes formidable competitors. WEG and Nidec are significant competitors in the electric motors market. They directly challenge Regal Rexnord's Power Efficiency Solutions segment. Their competitive strategies focus on efficiency, cost-effectiveness, and global distribution.

Today, that legacy has grown to include Altra Industrial Motion Corporation. By adding the Altra team and portfolio, we will continue to transform our industry and our world. This partnership brings Altra's power transmission and automation solutions into the Regal Rexnord portfolio to enhance our offering.

Regal Rexnord's acquisition of Altra Industrial Motion created a larger competitor with expanded capabilities. Competition occurs on technology, cost, and increasingly on solutions integration capability—an area where Allient's three-pillar strategy provides differentiation.

XII. Hamilton Helmer's 7 Powers Analysis: Sources of Durable Competitive Advantage

Scale Economies: MODERATE

Allient's manufacturing scale provides cost advantages, but the company isn't dominant in any single market segment. Instead, it has diversified scale across segments and geographies. The business currently generates revenues of $557.8m and has a market capitalisation of $540.6m.

Network Effects: LOW

Limited direct network effects exist in industrial components. However, some ecosystem benefits emerge from being a multi-technology solutions provider—the more technologies Allient can integrate, the more valuable it becomes as a one-stop partner for OEMs.

Counter-Positioning: MODERATE

Allient's strategy of transforming from a products-based motion control business to a solutions-oriented company offering motion, controls, and power technologies presents a form of counter-positioning. Incumbents focused on individual components may struggle to match the integrated solutions approach without cannibalizing existing product-focused business models.

Switching Costs: HIGH

This is perhaps Allient's strongest power. Design-in relationships create significant switching costs. Qualification processes in medical, aerospace & defense take years. Mission-critical applications make customers extremely risk-averse to changing suppliers. Once Allient's motor is designed into a surgical robot or missile guidance system, it's likely to remain there for the product's entire lifecycle.

Branding: MODERATE

At different times after the establishment of Allied Motion Technologies Inc., the company, through acquisition, became the owner of the following brands: Agile Systems, Globe Motors, Heidrive, Maval (steering products), Motor Products, Östergrens Elmotor, Premotec, Stature Electric, ThinGap, Trans-Coil International (TCI), Dynamic Controls, ORMEC Systems Corp, ALIO Industries, Spectrum Controls, SierraMotion.

The company maintains strong technical brand trust with OEM engineers in niche markets. While not a consumer brand, Allient's reputation for precision and reliability commands respect in its served markets.

Cornered Resource: MODERATE

Accumulated engineering expertise and application knowledge represent a form of cornered resource. The company defines itself as a "technology/know-how" driven company, and the decades of accumulated experience across thousands of applications create institutional knowledge that's difficult to replicate.

Process Power: MODERATE-HIGH

Allied Systematic Tools (AST): Allied Motion uses Allied Systematic Tools to continuously improve quality, delivery, cost and innovation. The AST system represents Allient's version of Danaher's famous DBS (Danaher Business System)—a proprietary operational improvement methodology that drives continuous enhancement in quality, delivery, cost, and innovation.

XIII. Industry Tailwinds and Secular Growth Drivers

Allient operates in markets benefiting from powerful secular trends. The global motion control market size was estimated at USD 16,630.2 million in 2023 and is projected to reach USD 24,659.7 million by 2030, growing at a CAGR of 5.8% from 2024 to 2030. Factors such as the increasing demand for automation in various industries and the rising adoption of robotics & industry 4.0 are driving market growth.

The global brushless DC motor market is expected to grow at a CAGR of 8.1% during the forecast period, from an estimated USD 14.02 billion in 2025 to USD 20.68 billion in 2030. Increasing industrialization, growing energy-efficient solutions demand, and the use of more electric vehicle (EV) motors, consumer electronic motors, and industrial automation have boosted the development of the brushless DC (BLDC) motor market worldwide. Some of the prominent trends are the transition to electric and hybrid vehicles, the government rules targeting energy efficiency and minimizing emissions, and the development of technologies in motor controls to achieve smaller and higher-performance designs.

Manufacturers are deploying autonomous mobile robots and AI-driven conveyors to raise throughput and offset labor shortages. Global robotics spending is projected to climb from USD 71.78 billion in 2025 to USD 150.84 billion by 2030, intensifying the need for controllers that manage multi-axis path planning and collision avoidance.

In 2024, the surge in demand for robotics in the automotive and electronics sectors highlighted the critical need for precise, automated power transmission components to enhance operational efficiency and throughput.

Stringent environmental regulations regarding carbon emissions are driving industries to replace inefficient mechanical systems with advanced electromechanical solutions. The shift toward IE5 ultra-premium efficiency motors and regenerative drives is becoming mandatory for process industries aiming to minimize their energy footprint and reduce operational costs.

"All these industries are adding advanced motion control to increase throughput, keep up with demand, and raise profit margins," says Garrett Wagg, ctrlX Automation product manager — automation and electrification for Bosch Rexroth.

XIV. Key Performance Indicators for Monitoring

For investors tracking Allient's ongoing performance, three metrics deserve particular attention:

1. Organic Revenue Growth Rate

While acquisitions have driven much of Allient's expansion, organic growth demonstrates the health of the underlying business and management's ability to grow what they've acquired. Excluding the unfavorable impact of foreign currency exchange fluctuations on revenue of $0.3 million, organic growth was 13%. The company's stated goal of organic growth "at more than double the industry" provides a useful benchmark. Industry growth of 5-6% annually suggests Allient should target 10%+ organic growth in favorable conditions.

2. Gross Margin Progression

Gross margin was 31.7%, up 40 basis points due to higher volume and mix. Gross margin expansion reflects the success of the transition from components to solutions—higher-margin integrated offerings should drive sustained improvement. Management's target of expanding gross margins toward the $1 billion revenue goal suggests this metric deserves ongoing monitoring.

3. Book-to-Bill Ratio

Key highlights include a 15% sequential increase in orders, particularly in power quality and defense sectors, resulting in a book-to-bill ratio near 1.00. The book-to-bill ratio—orders received divided by revenue shipped—provides forward visibility into demand trends. A ratio above 1.0 indicates building backlog; below 1.0 suggests contracting demand. For a company with Allient's customer concentration and long lead times, this metric offers critical insight into future quarters.

XV. Bull and Bear Cases

The Bull Case

The optimistic view sees Allient as a well-positioned beneficiary of multiple secular tailwinds. Automation adoption continues accelerating across manufacturing, healthcare, and logistics. The defense budget cycle, particularly in unmanned systems and precision munitions, creates multi-year growth opportunities. The company's three-pillar strategy positions it to capture more value per customer relationship as OEMs seek integrated solutions rather than individual components.

"With a backdrop of macro uncertainty and other challenges, the Allient team once again delivered on a number of successes during the past year," commented Dick Warzala, Chairman and CEO. "We embarked on our next stage of growth with a refined strategy and new name while continuing to drive organic growth at more than double the industry and executing on key acquisitions."

The $1 billion revenue target, while ambitious, represents reasonable compounding from current levels. If the company can achieve this scale while hitting mid-teens operating margins, the earnings power would be substantially higher than today. The Warzala management team has a two-decade track record of execution that provides confidence in their ability to realize the vision.

Allient Defense Solutions (ADS) focuses on delivering advanced motion, control, and power, and lightweighting technology solutions tailored for the defense industry. By integrating expertise from over ten specialized companies, ADS offers comprehensive capabilities essential for modern defense applications.

The defense vertical, in particular, offers compelling growth potential. Rising geopolitical tensions, modernization programs, and the shift toward unmanned systems all create demand for the lightweight, high-performance motion solutions that Allient specializes in providing.

The Bear Case

The skeptical view highlights several concerns. The company faces formidable competition from larger, better-capitalized players like AMETEK, Regal Rexnord, and Nidec. Scale disadvantages may limit pricing power in commodity-like product categories. The 2024 revenue decline demonstrates vulnerability to industrial cycles—when customers destock inventory or delay capital equipment purchases, Allient's results suffer.

The company faces challenges due to market conditions, with an expected annualized revenue run rate below $500 million over the next several quarters.

The acquisition-driven growth model carries integration risks. While management has successfully integrated numerous acquisitions, each new deal creates potential execution challenges. The company's leverage, while manageable, limits flexibility during downturns and constrains the pace of future acquisitions.

Geographic concentration in North America and Europe means the company has less exposure to the faster-growing Asia-Pacific automation market. In terms of region, Asia Pacific was the largest revenue generating market in 2023. Missing this growth could cause Allient to lose ground to competitors with stronger Asian presence.

XVI. Conclusion: The Quiet Compounder's Next Chapter

Allient's story offers several lessons for investors interested in industrial compounders.

First, strategic clarity matters. The 2002 decision to divest the instrumentation business and focus exclusively on motion control was painful in the short term but transformational over the long term. Companies that try to be everything to everyone often end up being mediocre at all of it.

Second, disciplined acquisition execution can create substantial value. Allient's playbook—buying complementary technologies, expanding geographic reach, maintaining margin discipline—sounds simple but proves difficult to execute consistently over decades. The company's track record suggests institutional capabilities in M&A that are themselves a competitive advantage.

Third, transitions from products to solutions require patience. Allient's evolution from component supplier to integrated solutions provider took years and required significant investment in engineering capabilities and customer education. The financial payoff—higher gross margins, stickier customer relationships, expanded addressable market—justified the journey.

Founded: 1939 IPO: 1969 Nasdaq: ALNT. A technology/know-how company that will drive long-term global growth, both organically and through complementary strategic acquisitions.

Looking ahead, the company faces a familiar strategic question: how to sustain the compounding while navigating cyclical headwinds and competitive pressures. The defense initiative, the power quality business tied to data center expansion, and the ongoing automation megatrend all provide growth vectors. But execution will determine whether the $1 billion revenue vision becomes reality.

For patient investors willing to look beyond the headlines to find well-managed industrial businesses with durable competitive positions, Allient represents the kind of story that rarely generates excitement but often generates returns. It's the quiet compounder building the motion that moves the world—one precision motor at a time.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music