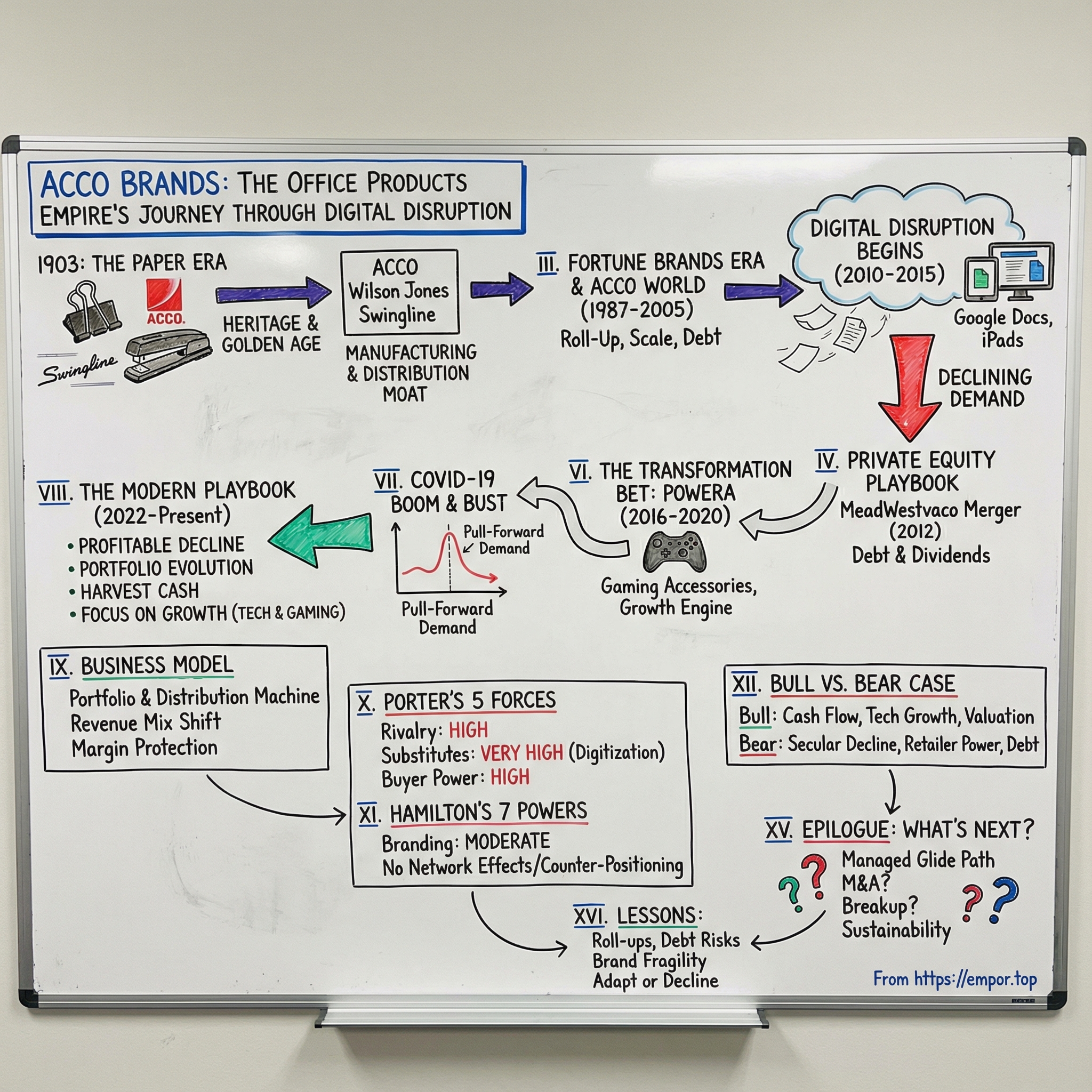

ACCO Brands: The Office Products Empire's Journey Through Digital Disruption

I. Introduction: The Hidden Giant Behind Every Desk

Walk into an American classroom and you’ll probably spot a Five Star notebook. Open the supply cabinet at an office and there’s a Swingline stapler staring back. Hand a kid a Nintendo Switch and, chances are, the “good enough” extra controller in the box says PowerA.

It feels like three different worlds—school, work, play. But they all roll up to the same company: ACCO Brands.

ACCO Brands Corporation is headquartered in Lake Zurich, Illinois. In 2024, it recorded $1.67 billion in sales and employed roughly 5,000 people. Publicly traded on the New York Stock Exchange under the ticker ACCO, it sells products in more than 100 countries and owns a portfolio of household names: AT-A-GLANCE, Five Star, GBC, Kensington, Mead, PowerA, Quartet, Rapid, Rexel, Swingline, Wilson Jones, and many others.

And that brings us to the central tension—maybe the most existential question a legacy consumer-products company can face: how does a 100+ year-old office supply empire survive when offices empty out, paperwork evaporates, and “back-to-school” increasingly means a Chromebook?

This is a story about rolling up brands and squeezing synergies. About debt, dividends, and financial playbooks that work—until they don’t. And about a company trying to stay relevant in a category that the internet didn’t just disrupt; it slowly made unnecessary.

The answer, as we’ll see, isn’t one silver bullet. It’s a mix of pragmatic moves: pushing harder into computer and gaming accessories, cutting costs, pruning portfolios, and learning to manage decline while harvesting cash. All while wrestling with a very modern question: in an Amazon-shaped world, does brand still matter?

ACCO’s 2024 results read like a case study in that approach. Net sales were $1.67 billion. Gross margins improved. The business threw off real cash—$148 million of operating cash flow and $132 million of free cash flow. It paid down debt, reducing net debt by $94 million and ending the year at a 3.4x consolidated leverage ratio. Management also delivered about $25 million in cost savings, with more expected in 2025.

Over the course of this story, you’ll see how M&A can be both a growth strategy and a trap. Why surviving secular decline requires brutal honesty about what’s actually happening. And how distribution—once a moat—can turn into quicksand when retailers consolidate, private labels rise, and the shelf gets tighter every year.

II. The Heritage: ACCO, Wilson Jones, and the Office Products Golden Age

Picture Long Island City in 1903. The Brooklyn Bridge is still a relative newcomer. Theodore Roosevelt is in the White House. And Fred J. Kline is building a business around an idea so small it’s easy to miss: the paper clip.

Kline founded the Clipper Manufacturing Company in 1903. In 1910, it became the American Clip Company—and along the way it started using “ACCO” as a shorthand initialism. By 1922, ACCO wasn’t just the nickname; it was the formal name.

Then came the product that turned a humble clip maker into an office-products innovator. Kline developed a two-pronged locking paper fastener called the ACCO Fastener. It was simple, sturdy, and wildly useful—exactly the kind of thing that spreads through offices because it solves a mundane problem better than whatever came before. That fastener opened the door to an entire ecosystem: folders, binders, punches, clamps—many sold under the ACCO brand, often becoming better known than the company itself.

But ACCO was only one strand of what would eventually become the ACCO Brands tapestry. The roots of today’s company stretch back to multiple firms born in the paper era: Wilson Jones in 1893, the American Clip Company in 1903, and Swingline in 1925. Collectively, they helped shape the physical infrastructure of information—how it was recorded, organized, and stored—using tools that feel almost invisible today precisely because they became standard.

Swingline’s origin story, in particular, has the feel of an old-school American manufacturing legend. It began in New York City in 1925, founded by Jack Linsky under the name Parrot Speed Fastener Company. The company opened early manufacturing facilities on Varick Street and later in Long Island City in 1931. Eight years after that, it changed its name to Speed Products.

Linsky himself was born into a Jewish family in northern Russia, one of seven children. His father, Zus, worked as a fabric peddler. After his father left first, the family immigrated to New York’s Lower East Side in 1904. Linsky went to work at a stationery store at just 14. By 17 he was selling. Not long after, he launched his own wholesale importing business, Jaclin Stationery, bringing in German-made staplers.

A trip to Europe in the 1920s sparked the breakthrough. Linsky wanted a stapler that didn’t require a screwdriver to open and reload. Swingline’s key innovation was the top-loading stapler—lift the top, drop in staples, close it up, and get back to work. The company also developed an adhesive that held staples together in a strip, making reloading even faster. It sounds obvious now, but it wasn’t then. This became the industry standard—and the foundation for Swingline’s rise.

By the mid-20th century, the timing couldn’t have been better. This was the golden age of paperwork: the Mad Men era of memos, contracts, ledgers, carbons, filing cabinets, and entire corporate workflows built around paper moving from tray to tray. Under the claim “ACCO originates and develops,” ACCO Products rode that wave as paperwork proliferated across business and personal life.

The expansion wasn’t just domestic. In 1924, Kline established an English subsidiary, and three years later added one in Canada. Over time, the company’s footprint broadened further—eventually building an international portfolio that included European office-products brands like Rexel and NOBO, and expanding into Australia and New Zealand with the Marbig line.

What’s important about this era is what these companies were—and weren’t. They weren’t technology companies. They were manufacturing and distribution machines. Their advantages came from production know-how, relationships with retailers and resellers, and brands that quietly became default choices. If you’ve ever worked in an office, you know how those defaults form: the office manager buys what worked last time; the teacher buys what they trust; the purchasing department standardizes. That kind of habit looks a lot like loyalty.

And it’s exactly why, by the 1980s and 1990s, office products became a perfect hunting ground for consolidation. The industry was full of strong regional and category champions, many with overlapping distribution and back-office functions. Roll them together, cut redundant costs, keep the brands, and you could build a larger platform without having to reinvent the product.

That consolidation logic is what eventually set ACCO on its path from a collection of iconic, independent names into something else: a portfolio company built to assemble, streamline, and scale.

For anyone trying to understand ACCO today, this heritage cuts both ways. A century of brand equity doesn’t disappear overnight. But it also doesn’t magically refresh itself for each new generation. In a world where the “paperwork” is increasingly a Google Doc, the real question becomes less “How famous are these brands?” and more “How many people still need what they sell?”

III. The Fortune Brands Era & Birth of ACCO World (1987-2005)

The next chapter in ACCO’s story is where a set of iconic, mostly independent office-products businesses starts to look like a modern corporation. That shift began in 1987, when American Brands—a sprawling conglomerate spanning tobacco, food, consumer products, and financial services, and later renamed Fortune Brands—stepped in.

ACCO had gone public just a few years earlier, in 1983. But in 1987, American Brands moved to buy ACCO World in a deal valued at $603 million. This was the beginning of the roll-up era: buy strong brands, stitch them together, squeeze costs out of the combined footprint, and use distribution muscle to keep winning shelf space.

One acquisition in that period ended up mattering far more than anyone could’ve predicted at the time: Kensington.

Kensington started in 1981 as Kensington Microware, co-founded by Philip Damiano. Its first hit product, the System Saver, was built for the Apple IIe—part cooling fan, part surge protector. In April 1986, it was acquired by ACCO Brands. It didn’t look like a big strategic pivot then. In hindsight, it was an early hedge against a future where “office products” wouldn’t mean paper first.

Over the decades that followed, Kensington accumulated more than 200 patents and rode the evolution of computing from desktops to laptops to tablets and pocket-sized devices. Under ACCO’s ownership, additional brands were folded into Kensington—adding know-how in ergonomics (Silicon Sports in 1995), cleaning (Statx in 1995), and even gaming (Gravis in 1996).

And Kensington wasn’t just shipping clever accessories. It was helping define standards.

In 1986, Kensington introduced its first trackball mouse—the Turbo Mouse for Macintosh—and trackballs became a signature category. In 1992, it released its first physical laptop security lock. Those locks, built around what became known as the Kensington Lock Slot, spread across laptop manufacturers and created an installed base that still generates revenue today.

While Kensington was planting a flag in the computer era, ACCO World kept consolidating the traditional office-products map. In 1990 it acquired Hetzel in Germany, a stationery company. In 1992, ACCO UK was created by integrating ACCO Europe with Rexel Ltd., forming what became the UK’s largest manufacturer of office products.

By the early 2000s, though, Fortune Brands started looking at ACCO World differently. In an October 2000 press release, Fortune’s chairman and CEO summed up the tension: “ACCO competes in an industry that will likely benefit from consolidation and we don’t see ourselves making that kind of commitment to office products.” Fortune was kicking off cost cutting and reviewing its portfolio, increasingly focused on divisions it saw as higher growth or more profitable—home products, spirits and wine, and golf.

The numbers made the decision easier. Fortune Chief Executive Norm Wesley was looking to shed the division with the weakest sales growth over the previous two years. Office supplies sales were up 6.7 percent that year—roughly a third of Fortune’s overall sales growth. ACCO’s return on capital sat at 4.9 percent, far below Fortune’s home and hardware businesses at 19.3 percent, spirits and wine at 23.6 percent, and golf at 12.8 percent. As one analyst put it, “This is one of the poorest-performing businesses for them.”

But Fortune didn’t just put a “for sale” sign on ACCO and call it a day. Instead, it engineered a more elaborate exit: a spin-off that created an independent, publicly traded company, paired with a simultaneous merger that added even more scale.

On August 17, 2005, ACCO Brands Corporation (NYSE: ACCO) was created through the spin out of Fortune’s office products division, ACCO World, and the subsequent merger of ACCO World with General Binding Corporation (NASDAQ: GBND). Overnight, the result was the largest publicly traded pure-play office products company, with annual revenues of nearly $2.1 billion.

The brand lineup told you exactly what the strategy was: combine category leaders and cover the whole office. ACCO brought Swingline, Wilson Jones, Kensington, Day-Timer, and Rexel. GBC brought GBC and Quartet. Together, they formed an office-products powerhouse with reach across binding, laminating, presentation, storage, and desktop accessories.

Then came the part that would loom over the next era. As part of the spin-off, Fortune Brands received a $625 million cash dividend from ACCO—money that didn’t come from thin air. It effectively loaded the new company with debt right out of the gate, debt that would matter a lot once the business environment got tougher.

On paper, the logic was clean. As retailers and big customers consolidated, they increasingly wanted fewer, larger suppliers with recognizable brands. The combined company could meet that demand better than either business alone. Management also pointed out that the categories the company competed in represented about $40 billion of sales in the U.S. and Europe.

With nearly $2 billion in annual revenue, operations in more than 100 countries, and roughly 8,000 employees worldwide, the new ACCO looked like a scaled platform built for the modern supply chain.

But this is where the story starts to tilt. The spin-off created independence, scale, and brand strength—and it also attached a heavy financial backpack at exactly the moment the first secular headwinds were beginning to form. The bet was that stable, category-leading cash flows would comfortably service the debt.

That assumption was about to be tested.

IV. The Private Equity Playbook: Debt, Dividends, and Roll-Ups (2005-2012)

ACCO came out of the 2005 spin with scale, household brands, and a very clear mandate: keep rolling up the category and keep the cash flowing to shareholders.

The logic was familiar and, for a while, it worked. Office products was still a sprawling, fragmented world. If you could buy competitors, combine sales forces, squeeze costs out of manufacturing and distribution, and show up to Walmart or Staples with a bigger, cleaner portfolio, you could win shelf space and protect margins.

But the thing about launching life as a newly public company with a big debt load is that you don’t get much room for error. And in 2008 and 2009, the error wasn’t theirs—it was the economy’s.

When the financial crisis hit, demand for office products dropped hard. Businesses froze spending, consumers pulled back, and the “steady, boring” cash flows the debt had been built on suddenly didn’t look so steady. The leverage that had been tolerable in good times became suffocating in bad ones. ACCO responded the way highly levered roll-ups always do when the cycle turns: cost cuts, facility closures, and debt renegotiations to stay upright.

That period forced a brutal lesson into the company’s DNA: you can’t financial-engineer your way out of a category that’s slowing down. Roll-ups are powerful in a rising market. In a shrinking one, they can turn into a trap. And debt doesn’t just magnify returns—it magnifies mistakes, timing, and bad luck.

Then, just a few years after the crisis, ACCO made one of the biggest moves in its history.

On November 17, 2011, ACCO announced a definitive agreement to merge with MeadWestvaco Corporation’s Consumer & Office Products business in a transaction valued at approximately $860 million at the time. When it closed on May 1, 2012, the deal dropped a set of iconic back-to-school and planning brands into ACCO’s portfolio: Mead, Five Star, Trapper Keeper, AT-A-GLANCE, Cambridge, Day Runner, Hilroy, plus international brands including Tilibra and Grafon’s.

This wasn’t a bolt-on. It was a step-change. On a pro-forma basis, the combined company would have generated about $2.1 billion of revenue in 2011, and the deal increased ACCO’s 2011 revenues by more than 50 percent on that same pro-forma view. Management emphasized that roughly 80 percent of the combined sales would come from category-leading brands—exactly the kind of brand-heavy mix that could justify pricing and defend shelf space.

It also reshaped ACCO geographically. Tilibra added real presence in Brazil, and Hilroy strengthened Canada. ACCO said the transaction would give it a $180 million sales leadership position in Brazil and would double its sales volume in Canada.

This whole stretch also came with leadership change at exactly the wrong moment to be learning on the job. Robert Keller joined the board in 2005, became chairman in 2008, and then took over as CEO during the crisis. Before ACCO, he had been CEO of APAC Customer Services and, earlier, president of Office Depot’s Business Services Group—experience that mattered when your fate is tied to big retailers and their purchasing power. Looking back, the company credited Keller with steering ACCO through an unusually harsh four-year stretch and restoring stability.

By the time the Mead integration got underway, the tone was finally shifting. By 2013, ACCO said the Mead C&OP integration was ahead of schedule. Despite ongoing economic headwinds, preliminary results suggested the company was on track to meet earnings guidance, and stronger-than-expected free cash flow allowed ACCO to pay down $200 million in debt—about $50 million more than it had previously anticipated.

Then came another handoff. Keller was succeeded by Boris Elisman in 2013. Elisman had joined ACCO in 2004 to run the Computer Products Group and later became President and COO in 2010. Before ACCO, he held senior marketing and general management roles at Hewlett-Packard. His education ran through Brown and Stanford’s business school, but the more important credential for where ACCO was headed was this: he understood tech-adjacent categories, and he had already been running the part of ACCO that didn’t depend on paper.

That would matter, because even after the crisis and even after a transformative merger, one reality was getting harder to ignore: traditional office products weren’t going back to organic growth. ACCO could buy scale and buy time. It couldn’t buy a return to the old world.

V. The Digital Disruption Begins: Death of Paper, Rise of Screens (2010-2015)

By the early 2010s, ACCO’s real problem was no longer competition from the other office-supply giants. It was competition from something far more efficient: the screen.

Across the industry, revenue was shrinking year after year—down at roughly a low-single-digit rate annually through this period—as the economy digitized and the basic act of “doing work” stopped producing paper. Information wasn’t being filed, clipped, or stapled. It was being synced, shared, and searched.

The shift hit right at the heart of the category. As offices digitized, demand fell for the physical ecosystem around paper—fax supplies, copy and print-related materials, and all the organizational products that only make sense when a document’s “home” is a filing cabinet. Cloud storage and collaboration tools made it easier to keep everything virtual. At the same time, laptops and smartphones made work more mobile, and mobile work tends to be lighter, faster, and less paper-bound.

This was the “paperless office” that had been predicted since the 1980s—except now it was actually happening. iPads started showing up in classrooms. Google Docs replaced printed memos. Email chains replaced interoffice mail. And the next generation entering the workforce didn’t see paper as the default. It saw it as a hassle.

Even the retail channel that had once amplified ACCO’s distribution advantage—the office supply store—was getting squeezed. The industry was dealing with declining demand from digitization and intense price competition. By 2025, industry revenue sat at about $20.9 billion, down from the year before, consistent with a steep multi-year decline.

ACCO’s response wasn’t a single pivot. It was a set of pragmatic moves designed to keep the company relevant while the ground underneath it kept shifting.

First, ACCO leaned harder into computer accessories through Kensington. If paper was fading, devices were multiplying. Laptops were everywhere, and “work” was no longer a place you went—it was something you carried. That created demand for docking stations, security locks, ergonomic accessories, and input devices, even as binders and notebooks slowed.

Kensington is a leader in desktop and mobile device accessories, trusted by organizations around the world for nearly 35 years. Kensington products empower people to be more productive and create content at the highest levels. In both desktop and mobile environments, Kensington's extensive lineup of award-winning products provide trusted security, desktop productivity innovations, and ergonomic well-being. Kensington is also the inventor and worldwide leader in laptop security locks, the acknowledged leader of Trackball innovation and offers a broad range of premium-branded desktop productivity solutions. Headquartered in San Mateo, California, Kensington operates as the Computer Products Group of ACCO Brands.

Second, ACCO pushed into adjacent categories where physical tools still mattered—whiteboards, presentation products, and planning and time management. Quartet, which came in through the GBC merger, gave ACCO a credible platform in visual communication products that stayed relevant in conference rooms and team spaces, even as the documents discussed in those rooms went digital.

Third, the company looked for growth outside the most mature markets. Developed markets were digitizing faster. Emerging markets still had room for paper-based categories to grow, especially in school and office supplies. That geographic diversification would show up more clearly later through acquisitions like Barrilito in Mexico (2018) and Foroni in Brazil (2019)—moves aimed at participating in markets where paper hadn’t peaked yet.

This multi-pronged approach eventually culminated in another major scale move in Europe. On February 1, 2017, ACCO Brands completed the acquisition of Esselte Group Holdings AB. It expanded ACCO’s European footprint and added a deep stable of brands across filing, organization, and office essentials.

Boris Elisman explained the rationale: "We are excited to add Esselte, its talented employees and its portfolio of products and brands to the ACCO Brands family. This transaction, together with the Pelikan Artline acquisition completed in May 2016, is expected to deliver approximately $31 million of annual synergies by the third anniversary of the Esselte closing." The company's newly combined European business would be run by Cezary Monko, formerly the president and chief executive officer of Esselte.

Esselte is a manufacturer and marketer of office products and business supplies with subsidiaries in 25 countries and sales in over 120 countries. Esselte makes files, binders, folders, covers, staplers, letter trays and computer accessories under the Esselte, Leitz, Oxford, Pendaflex, Rapid and Xyron brands. Customers range from wholesalers and direct marketers to office superstores and mass retailers. Founded in 1913 in Stockholm, Sweden, Esselte is today owned by American office supplies manufacturer ACCO Brands.

Underneath all of this, a quieter question was getting louder inside the company: how much did the old brands still matter?

The answer was complicated. In categories where performance and reliability were the product—binding machines, professional stapling, certain desk accessories—brand still carried weight. But in commodity items, the floor kept dropping out. Private label, store brands, and the flood of low-cost listings online made it easier than ever to trade down. In those aisles, “good enough” often beat “brand name.”

And yet, back-to-school held up better than almost anyone expected. Even with increasing digitization, most K–12 classrooms still ran on physical supplies. Five Star kept its premium position in notebooks. Mead continued to move volume through mass retailers like Walmart and Target. For a few more years, that seasonal surge helped smooth out declines elsewhere.

But by around 2015, management had reached the uncomfortable conclusion that would define the next era: ACCO wasn’t going to grow its way out of this. The core categories were in secular decline. The job, now, was to manage for cash—protect profitability, generate free cash flow, and use that fuel to find growth pockets that could matter.

That realization set up ACCO’s next, boldest swing: buying a gaming accessories company that, on the surface, seemed to have absolutely nothing to do with staplers and notebooks.

VI. The Transformation Bet: PowerA Gaming Accessories (2016-2020)

In November 2020, ACCO Brands announced a deal that, on the surface, sounded like a punchline: a 100+ year-old office supply company was buying a gaming accessories maker.

ACCO Brands Corporation announced that it had closed the acquisition of PowerA, a provider of third-party video gaming controllers, power charging solutions, and headsets. PowerA had built a track record partnering with the major console platforms and title publishers.

The terms were meaningful. ACCO paid $340 million upfront, with an additional earnout of up to $55 million in cash tied to PowerA hitting one- and two-year sales and profit targets. At the time, ACCO expected PowerA’s 2020 net sales to land around $200 million, up roughly 20 percent from 2019, with adjusted EBITDA of about $50 million.

If you stopped at “staplers meet Xbox,” the move looked bizarre. If you followed ACCO’s logic since the early 2010s—find categories where people still buy physical things, and where brands and distribution still matter—it started to click.

Boris Elisman framed it as a deliberate acceleration of the pivot: “This acquisition represents a major step in our continuing strategy to transition ACCO Brands into a faster growing, consumer-focused company. Our Kensington computer accessories business has shown strong growth over the past few years. PowerA is a similar business to Kensington, but is in the console gaming accessories market. It will be a great fit.”

PowerA, founded in 2009, made the kinds of products that sit right next to the console itself: controllers, chargers, cases, screen protectors, and more. The appeal wasn’t just that gaming was growing. It was that PowerA looked operationally familiar in all the ways that mattered. Like Kensington, it relied on retail distribution relationships, global sourcing (including Asian manufacturing), and brand-building with tech-savvy consumers. Different customer, same muscle.

And the market PowerA played in was big. Console gaming accessories had been growing at a strong pace historically, and PowerA’s sales were concentrated in the U.S. with the remainder largely in Europe—leaving ACCO plenty of room to push the brand internationally. Management also pointed to tailwinds from the next generation of console launches, plus longer-term potential from cloud gaming and mobile controllers.

Elisman made the portfolio point explicit: after the acquisition, more than half of ACCO’s sales would come from consumer, school, and technology products—categories expected to grow faster than traditional office supplies.

Then there was Nintendo.

The Nintendo Switch launched in 2017 and ignited a massive third-party accessory ecosystem. PowerA had positioned itself as a leading provider of officially licensed controllers and accessories across Nintendo, PlayStation, and Xbox. Its pitch was straightforward: design-forward gear that felt premium enough to trust, at a price and availability that made it an easy add-on purchase.

Eric Bensussen, PowerA’s president and co-founder, emphasized the company’s culture and momentum: “It’s incredibly rewarding to see the overwhelming love gamers have for our products, and the continued support of our retailer and licensor partners… PowerA will be in good company as part of ACCO Brands where it will maintain its pace of expansion as the gaming market continues its hypergrowth across all platforms, including mobile and cloud.”

Still, the cultural gap was real. ACCO’s legacy businesses ran on the rhythms of back-to-school and office replenishment cycles. PowerA lived and died by console launches, game trends, and what gamers were talking about this month, not next year.

So ACCO structured the integration accordingly. PowerA’s management and employees stayed in place, continuing to run sales, marketing, and product development, while plugging into ACCO’s shared services for general and administrative functions. The goal was to protect the speed and authenticity of the PowerA brand while still capturing synergies—especially across supply chain and, eventually, coordination with Kensington.

And then, almost immediately, the world changed.

By the time the acquisition closed in December 2020, COVID-19 had turned gaming into one of the most powerful at-home entertainment habits on earth. Console supply was constrained, demand was surging, and accessories were moving. PowerA didn’t just serve as a hedge against the decline in paper-based categories; it became a real growth engine at the exact moment ACCO needed one.

For investors, the message was clear: management wasn’t pretending the old playbook could save the core. Consolidation could buy time, but it couldn’t restore demand. PowerA was ACCO’s boldest attempt in decades to buy into a category with the wind at its back. Whether gaming accessories would become a durable second engine—or prove too tied to console cycles—was the question the next few years would answer.

VII. COVID-19: The Unexpected Boom and Bust (2020-2021)

When COVID-19 shut down offices and schools in March 2020, ACCO’s situation looked grim. The company’s products were built for two places that had suddenly vanished: the office and the classroom. If nobody was going anywhere, who was going to buy staplers, notebooks, planners, and docking stations?

Management moved quickly into defense mode. ACCO withdrew its annual guidance, citing the uncertainty of the global disruption. Chairman and CEO Boris Elisman said the company’s “top priority” was employee safety, and that ACCO expected “lower near-term demand in many of our markets.” At the same time, the company began aligning costs to the new reality, including salary and fee reductions for senior executives and board members, while emphasizing “minimal” permanent workforce reductions.

Then the plot flipped.

The pandemic didn’t kill demand for ACCO’s products so much as it relocated it. The office moved into spare bedrooms and kitchen corners. School moved onto dining tables. And entertainment moved deeper into living rooms.

First came the home office boom. Millions of workers suddenly needed to outfit home setups, and ACCO’s tech-adjacent portfolio was ready. Kensington docking stations, keyboards, and ergonomic products saw a surge. In March 2020, ACCO even requested Section 301 tariff relief for Kensington laptop docking stations subject to 25% tariffs from the 2018 China–United States trade dispute. In its application, the company said sales had increased 200%.

At the same time, a wave of at-home learning created a new kind of back-to-school demand. Parents who were suddenly responsible for keeping kids organized needed basics: Five Star notebooks, Mead folders, and the kinds of products that make “school” feel real when it’s happening in a house. What had normally been a tight seasonal spike around August and September became more spread out as families restocked and adapted.

And then there was gaming. With people stuck at home, gaming time surged, consoles flew off shelves, and accessories followed. PowerA’s business—affordable, officially licensed controllers and add-ons—was perfectly positioned for the moment. The timing was almost uncanny: ACCO announced the PowerA deal in November 2020 and closed it in December 2020, right into peak pandemic gaming demand.

The market noticed. ACCO’s stock, which had traded around $6 in early 2020, climbed past $15 as investors re-rated the company as a “work from home” beneficiary.

But the boom carried its own trap: it pulled demand forward.

Retailers, terrified of stockouts, ordered aggressively. Supply chain disruptions meant that when product finally arrived, it moved fast, reinforcing the instinct to keep ordering. Inventory at retail partners swelled. And as the initial pandemic surge cooled, some of the hottest categories began to decelerate—especially PPE and certain work-from-home items—while office-related consumption only partially resumed. All of this was happening against the longer-term backdrop ACCO couldn’t escape: ongoing workplace digitisation, secular declines in several traditional categories, and the continued shift toward e-commerce.

The hangover started to show up in 2021 and stretched into 2022. Retailers that had over-ordered began destocking. Demand normalized. Purchases made during the scramble—like a docking station or home-office setup—weren’t the kind that repeated every year.

In other words, COVID hadn’t rewritten ACCO’s trajectory. It had temporarily masked it.

That longer downshift became clearer as the post-pandemic environment set in: softer demand, a slower-than-anticipated return to office, and retailers keeping inventories lean. In North America, net sales fell from $998.0 million in 2022 to $887.2 million, an 11.1 percent decline, while comparable sales declined 10.7 percent. Management attributed the drop to a weaker macro environment, lower return-to-office trends, and lower inventory levels that reduced demand for both technology accessories and office products.

The pandemic era ultimately crystallized a harsh lesson. The COVID bump was real—but it was not a fundamental transformation. If anything, it accelerated the behaviors that threatened ACCO most: organizations invested further in cloud collaboration, employees proved they could work without a physical office infrastructure, and the world got even more comfortable doing less on paper.

For investors, it was a reminder of how quickly a one-time demand surge can be mistaken for durable growth—and how fast sentiment snaps back when the world normalizes.

VIII. The Modern Playbook: Profitable Decline & Portfolio Evolution (2022-Present)

By 2022, ACCO’s leadership had stopped pretending the old world was coming back. Traditional office products were in structural decline, and no amount of branding, channel tactics, or incremental cost cutting was going to reverse that. So the question changed from “How do we grow?” to “How do we win while this shrinks?”

That shift in mindset set up a leadership handoff.

In late 2023, ACCO announced that Tom Tedford would succeed Boris Elisman as CEO. Elisman would remain Executive Chairman until his retirement in the first half of 2024, and he notified the board that he would not stand for reelection at the 2024 stockholders’ meeting.

The company framed the moment as a passing of the baton after a long, disruptive era. ACCO credited Elisman’s tenure—18 years with the company, including the last 10 as CEO—with expanding the company’s growth opportunities through major change. Elisman said, “During my tenure at ACCO Brands, the Company and the industry have undergone significant changes and I am proud of our teams’ accomplishments during this period. Having worked closely with Tom for many years, I know the company is in great hands to continue to progress and accelerate profitable growth. It has been my privilege to lead this great company.”

Tedford was not an outsider brought in to “fix” ACCO. He joined in 2010, became President and Chief Operating Officer in 2021, and spent a decade running the Americas and then North America business. During that stretch, he led operational and cultural integrations for major acquisitions, introduced new products, and developed new markets. Before ACCO, he built a career across sales, marketing, operations, and executive leadership roles in highly competitive industries—experience that mattered in a business where retailers, price pressure, and shifting demand never really let up.

Under Tedford, ACCO laid out a modern strategy that was, in many ways, the distilled version of everything the company had learned since the financial crisis and the first wave of digitization: harvest cash from the legacy categories, invest in growth where it actually exists (technology and gaming accessories), and return capital through dividends and buybacks.

To make that work, the cost base had to match the new reality. In January 2024, ACCO announced a multi-year restructuring and cost-savings program targeting at least $60 million of annualized pre-tax savings when fully realized. With macro uncertainty still hanging over the category, the company later raised the target—first by $40 million—ultimately aiming for roughly $100 million in annualized savings by the end of 2026.

In 2024, ACCO said it delivered about $25 million in cost savings and expanded its multi-year cost reduction program to $100 million of cumulative savings. Those actions, along with ongoing cost discipline, showed up where management wanted them to: improved gross margins, lower SG&A, and strong free cash flow.

At the same time, ACCO tightened the lens on what it wanted to be known for. The portfolio approach didn’t go away—but the focus shifted toward fewer, stronger brands, and away from weaker brands and geographies. The core properties became Swingline, Five Star, Kensington, PowerA, AT-A-GLANCE, Leitz, and Tilibra.

Swingline, in particular, became a symbol of the company’s balancing act: honor the legacy, but keep the product relevant to how work actually happens now. “At the cornerstone of almost every modern office is the iconic Swingline stapler,” said Jed Peters, Senior Vice President and General Manager of ACCO Brands. “While the aesthetic has evolved over the years, the Swingline tenets of quality, durability, and innovation remain the same. As we look to the future, we’re committed to delivering tools that meet the needs of modern workspaces while honoring the legacy that made Swingline a household name.” As the brand marked its centennial anniversary, ACCO positioned Swingline as broader than “the office,” serving hybrid workspaces, schools, pharmacies, healthcare facilities, food service and hospitality, and households. For 2025, Swingline planned to introduce 37 new and refreshed products across seven product lines.

Kensington’s evolution continued too—away from being “laptop accessories” and toward being a fuller hybrid-work and security platform. And ACCO signaled it was willing to do targeted M&A to accelerate that shift.

ACCO announced it had entered into a definitive agreement to acquire EPOS from Demant A/S, a Danish hearing healthcare company. The logic was straightforward: broaden Kensington into enterprise headsets and become more relevant to large organizations outfitting hybrid teams. “We are excited to welcome EPOS to the ACCO Brands portfolio. This transaction aligns with our strategy to invest in markets with better growth profiles,” said Tom Tedford, ACCO Brands President and CEO. “EPOS complements and expands our global computer accessories portfolio into the attractive premium enterprise headset category, which is estimated to be $1.7 billion. The addition of EPOS will allow ACCO Brands to deliver a more complete line of workspace technology accessory solutions to our enterprise customers.”

EPOS generated about $80 million in annual revenue. ACCO expected the combination of EPOS and Kensington to drive operational efficiencies, improve sales productivity, and unlock synergies over the next two years, with ultimate cost synergies estimated in the range of $10 million to $15 million. The transaction was valued at $11.7 million, including up to $3.5 million in deferred payments, and was expected to close in January 2026 subject to customary closing conditions.

Meanwhile PowerA kept doing what ACCO bought it to do: live in the faster-moving world where consumers still buy physical add-ons for the devices they care about. PowerA continued expanding beyond Nintendo toward multi-platform accessories across Xbox, PlayStation, and PC, including an officially licensed Advantage Wireless Controller for Nintendo Switch 2 with Nintendo and Pokémon designs.

But ACCO’s biggest enemy in the legacy categories wasn’t another branded competitor. It was the relentless commoditization of everything—especially online. Private label pressure from Amazon Basics and store brands kept eating away at the low end, where “good enough” is often all the customer wants. ACCO’s response was to push in the opposite direction: premium positioning, brand loyalty, and innovation in niches where quality, durability, and features still create separation.

The financial discipline matched the story. In 2024, ACCO reduced net debt by $94 million, paid dividends of $28.4 million, and repurchased 2.9 million shares for $15.0 million. And on October 30, 2024, it extended the maturity of its credit facilities to 2029—buying time and removing near-term refinancing anxiety.

That’s the modern ACCO in a sentence: less about chasing a return to growth at all costs, and more about keeping leverage manageable, generating cash consistently, and placing selective bets where demand is still expanding.

For investors, it’s a managed-decline business with real optionality. The legacy portfolio throws off cash. Technology and gaming accessories offer growth—and, crucially, relevance. The dividend provides income today. The open question is whether this balance can hold as the secular decline continues to grind on, and as the “good enough” alternatives keep getting cheaper and easier to buy.

IX. Business Model Deep Dive & Competitive Dynamics

To understand ACCO, you have to stop thinking of it as “an office supply company” and start thinking of it as a portfolio and a distribution machine. ACCO doesn’t win because it invented a radically better binder. It wins because it can put the right mix of brands, at the right price points, in the right channels, in a lot of countries—and do it at scale.

At a high level, ACCO designs, manufactures, and markets consumer, school, technology, and office products across North America, Latin America, Europe, the Middle East, and parts of Asia-Pacific. Operationally, it reports two segments: ACCO Brands Americas and ACCO Brands International.

The product catalog is exactly as broad as you’d expect from a century-old roll-up: note-taking and planners, dry erase boards and accessories, filing and organization, writing and art, shredding, laminating and binding machines, plus the staples-and-punches world that still defines the company in many people’s minds. Layered on top are the newer growth bets: computer accessories (Kensington) and gaming accessories (PowerA). The brand roster spans names like Five Star, AT-A-GLANCE, Kensington, Quartet, GBC, Mead, Swingline, Leitz, Esselte, Rapid, Rexel, NOBO, Marbig, Artline, Spirax, Barrilito, Foroni, Hilroy, and Tilibra.

Where ACCO really comes alive is in how it sells.

The company distributes through basically every channel that still moves physical office and school goods: mass retailers, e-tailers, warehouse clubs, discount and variety chains, drug and grocery, hardware and specialty stores, office superstores, independent dealers, wholesalers, contract stationers, and technology specialty businesses. It also sells directly to end users through its own e-commerce and direct sales efforts. That channel sprawl is both a strength and a burden: it gets ACCO everywhere, but it also adds complexity and cost.

The revenue mix has been shifting for years. Traditional office products are still the biggest chunk, but they’re no longer the story investors want to hear. Technology and gaming accessories are smaller in absolute terms, but they’re the growth vectors—the categories where demand isn’t quietly bleeding away to the cloud. Geography helps, too: Latin America (especially Brazil through brands like Tilibra and Foroni) and EMEA (supported by businesses and brands acquired over time, including Esselte and Leitz) can partially offset North America’s more mature, faster-digitizing demand.

Financially, ACCO’s margin profile tells you what kind of business this is. Gross margins can stay respectable because brands and category positions still matter in pockets of the portfolio. But SG&A tends to run heavy: you’re supporting a lot of brands, serving a lot of channels, and carrying the fixed costs of a global organization. The supply chain is mixed, with some owned manufacturing (notably in areas like binding and laminating equipment) and a lot of outsourced production, much of it in Asia for consumer-oriented items.

Then there’s the innovation problem—ACCO’s defining constraint.

In the legacy categories, the breakthrough products already happened decades ago. A stapler is a stapler. A hole punch is a hole punch. So “innovation” becomes about the edges: ergonomics, aesthetics, sustainability, and small usability upgrades, not category reinvention. That’s why the most honest way to run much of the legacy portfolio is exactly what management has been signaling for years: manage it for cash.

Brand equity is the swing factor that makes that strategy work—or fail. Five Star still means something in back-to-school. Swingline still has weight in stapling. And the Rio Red 747 Business Stapler has a strange kind of second life as pop culture shorthand, thanks in large part to the red Swingline in the movie "Office Space"—a reminder that sometimes cultural relevance arrives from places no marketing budget can reliably buy. The question hanging over the whole company is whether those brands stay meaningful as younger buyers become more price-driven online, and as “good enough” becomes one click away.

Competition is brutal, and it comes from multiple directions at once. There are the branded incumbents like 3M and Newell Brands. There are the channel giants like Staples and Office Depot, which compete both as retailers and through private label. There’s Amazon Business and the broader e-commerce ecosystem pushing commoditization harder every year. And then there’s the flood of low-cost manufacturers selling direct online, undercutting price points and making it harder for brands to defend the bottom end of the market.

So what’s ACCO’s real advantage? It isn’t a moat in the tech sense. It’s the hard-earned, operational kind: established brands, long-standing retail relationships, and a distribution footprint that’s difficult for a new entrant to replicate quickly at scale. That combination keeps ACCO relevant, even as the category pressure rises.

For investors, the takeaway is straightforward: ACCO is best understood as a cash-generating legacy platform with growth appendages. The legacy business can throw off real cash even while it declines. The bet is that the faster-moving parts—technology accessories and gaming—can become big enough, fast enough, to matter before the core shrinks too far.

X. Porter's 5 Forces Analysis

Competitive Rivalry: HIGH

ACCO is fighting on crowded shelves in a category where too many products look the same and too many competitors can make them. It goes up against branded incumbents like 3M and Newell Brands, retailer private labels, and a long tail of smaller brands—especially online. In the commodity end of the market, it’s a constant race to the bottom. Brand differentiation still matters, but mostly in the pockets where reliability and durability actually change the customer’s experience.

Threat of New Entrants: MODERATE

It’s not particularly hard to start making many office products. A lot of manufacturing can be outsourced, and the capital required is often modest. The harder part is getting real distribution.

Discount stores, supercenters, warehouse clubs, and online retailers have changed the competitive landscape because they can combine low prices with “one-stop shop” convenience. But if you want to become a meaningful player in back-to-school or office replenishment, you still need what ACCO has spent decades building: scale, brand recognition, and relationships that get you into channels like Walmart, Target, Staples, and Amazon. Retail shelf space—especially for seasonal back-to-school—still provides some protection for established brands.

Supplier Power: MODERATE

Most of ACCO’s key inputs—paper, plastic, metal—are commodities, and there are plenty of suppliers. The catch is that the supply chain is global, and a supply chain that runs heavily through Asia comes with its own set of risks: tariffs, shipping disruptions, and logistics bottlenecks. ACCO’s exposure to Section 301 tariffs on certain Kensington products is a reminder that trade policy can become a real cost line overnight. Switching suppliers isn’t impossible, but it’s rarely frictionless.

Buyer Power: HIGH

If you want to understand ACCO’s day-to-day reality, start here. A small set of powerful retailers—Walmart, Amazon, Staples, and others—has enormous leverage over pricing, promotions, and shelf space. That concentration creates real risk: lose placement, and you don’t just lose a customer, you lose volume.

And it’s not just the retailers pushing down price. Consumers do it too, especially in a post-COVID world where comparison shopping is effortless. Private label makes buyer power even stronger, because retailers can credibly threaten to replace branded goods with their own “good enough” alternatives.

Threat of Substitutes: VERY HIGH

This is the existential one. ACCO isn’t just competing with other staplers and notebooks—it’s competing with the disappearance of the need for staplers and notebooks.

Digitization has steadily reduced demand for paper-based tools: electronic document management, cloud storage, and collaboration platforms have replaced the workflows that used to require folders, binders, printed memos, and forms. Remote work and flexible office layouts accelerate that shift because fewer people are doing “office life” in a centralized place stocked with shared supplies.

The substitution story is simple and brutal: Google Docs instead of notebooks, shared drives instead of file folders, email instead of printed memos. Schools moving toward Chromebooks and iPads reduce notebook and binder needs. And when work happens at home, purchasing becomes individualized—and often more price-driven.

Summary: ACCO operates in a structurally challenged industry where buyers have leverage and substitutes keep getting better. Winning means protecting the niches where brand still matters, pushing harder into growth categories like technology and gaming accessories, and running the legacy portfolio for maximum cash while keeping costs under control.

XI. Hamilton's 7 Powers Analysis

If you run ACCO through Hamilton Helmer’s 7 Powers, you get a pretty clear—and pretty sobering—readout. ACCO is well-run, it has real brands, and it has distribution reach. But in Helmer’s language, it doesn’t have many true powers that compound over time.

1. Scale Economies: WEAK

ACCO has scale in manufacturing and distribution, but it isn’t the kind of scale that locks competitors out. Other large incumbents can reach similar unit economics, and overseas manufacturers—especially in China—can often undercut costs entirely. And scale can’t fix the core problem: no amount of efficiency makes staplers more necessary in a world that’s steadily using less paper.

2. Network Effects: NONE

Office products don’t get more valuable as more people use them. A notebook is a notebook. There’s no platform, no flywheel, no ecosystem that naturally tips the market toward one winner.

3. Counter-Positioning: NONE

ACCO isn’t pursuing a business model competitors can’t follow without self-destructing. There’s no move here that forces rivals to cannibalize themselves to respond. If ACCO leans into tech accessories, so can others. If it focuses on fewer, stronger brands, so can others. 3M, Newell, and retailers with private label all have credible ways to match ACCO’s playbook.

4. Switching Costs: WEAK TO MODERATE

There is some loyalty. Teachers trust Five Star. Offices standardize on Swingline for consistency. And across brands like Five Star, Kensington, Leitz, and Swingline, ACCO does get real repeat purchasing and some pricing power, especially in retail channels.

But most of what ACCO sells are low-involvement purchases. For a lot of customers, switching costs are basically zero—just grabbing the generic alternative or the store brand instead.

5. Branding: MODERATE

This is where ACCO has its most durable edge. Swingline, Five Star, Kensington, AT-A-GLANCE, and Leitz have brand equity built over decades. The catch is that branding matters most where customers care about quality, reliability, and performance—and matters least in the commodity aisles where price is the entire conversation. And brand equity is not self-sustaining. If you can’t keep investing in awareness and product relevance, it slowly leaks away.

6. Cornered Resource: NONE

ACCO doesn’t have a unique, hard-to-replicate resource that confers long-term advantage. Patents in office products tend to be limited and easy to work around. And while ACCO’s retail relationships are valuable, they’re not exclusive—any sufficiently scaled supplier can get onto Walmart.com or Amazon, and retailers can always push their own labels harder.

7. Process Power: WEAK

ACCO has real operational competence, but it’s not defensible in the Helmer sense. Manufacturing know-how and supply chain execution can be matched, learned, or outsourced. There’s no “secret process” that competitors can’t copy once they see it working.

Conclusion: In Helmer’s framework, ACCO has limited moats. Branding and modest switching costs provide some protection, but there isn’t a durable power that guarantees long-term compounding. That’s why the company’s strategy leans so heavily on execution, portfolio discipline, and finding growth vectors—like PowerA and technology accessories—fast enough to offset the decline in legacy categories.

For investors, this also helps explain why ACCO can generate meaningful cash and still trade at low multiples: the market is discounting the business because it doesn’t see a strong, defensible moat protecting those cash flows over the long run.

XII. Bull vs. Bear Case

The Bull Case:

Management has already proven it can operate in a shrinking market. For more than a decade, ACCO has stayed standing while the category around it consolidated and weaker players fell away. The roll-up era left scars, but it also left scale—and in slow-moving, low-growth categories, scale can mean you’re one of the last suppliers retailers bother to keep on the shelf.

PowerA and gaming accessories can be a real offset, not just a side project. Console gaming is a large, historically fast-growing segment, and third-party accessories fill a durable gap: price-sensitive customers who want something better than the cheapest no-name option, without paying first-party prices. If gaming remains a mainstream habit, accessories remain a repeat-purchase business.

Kensington’s hybrid-work portfolio is another plausible long-term anchor. Work may be more distributed, but it’s not less dependent on devices. Docking, security, ergonomics, and audio solve real problems for employers and employees. And ACCO’s planned expansion into premium enterprise headsets through EPOS targets a category the company estimates at $1.7 billion.

Back-to-school is still a shock absorber. Even with Chromebooks in classrooms, K–12 education continues to consume physical supplies, and Five Star has held onto a premium position with parents and students who equate “better supplies” with better outcomes. Paper doesn’t need to grow to be valuable—it just needs to decline slowly.

Cash flow creates options. In 2024, ACCO generated $132 million in free cash flow, which gives management flexibility: pay the dividend, buy back stock, reduce debt, or make targeted acquisitions in higher-growth adjacencies.

Valuation can do some of the heavy lifting. ACCO trades at low multiples, and its dividend yield—8.41%—signals deep skepticism about the future. If the decline proves more gradual than the market expects, or if the growth businesses scale up faster, the upside could come from sentiment as much as fundamentals.

Stable cash generation also makes the company a plausible take-private candidate. Predictable, harvestable cash flows are exactly what some financial buyers look for—especially if they believe they can run leaner, refinance, and pull cash out over time.

And there’s still a geographic argument. In parts of Latin America and Asia, paper-based categories can remain relevant longer, supported by younger populations and less fully digitized infrastructure.

The Bear Case:

The secular decline may be speeding up, not easing. Gen Alpha is growing up fully digital—tablets and screens from the earliest years. If the next generation simply doesn’t form paper habits, the demand curve can steepen.

The pandemic bump distorted the picture. COVID temporarily made ACCO look like a work-from-home winner, but the post-pandemic reset has been harsh. In 2024, revenue fell to $1.67 billion from $1.83 billion the year before, reinforcing that the underlying trajectory is still down.

PowerA might not be a savior—it might be a cyclical add-on. Gaming accessories can surge around console launches, then flatten between cycles. And platform owners have every incentive to pull accessory profits in-house, which can squeeze third-party margins over time.

Retailers keep getting bigger and tougher. As customer concentration rises, negotiating leverage shifts further to the channel. Amazon keeps taking share, mass retailers demand better terms, and every supplier fights harder for fewer slots.

Private label and “good enough” online listings erode brand power. Amazon Basics and store brands can undercut pricing in many core categories. For a large portion of buyers, office and school supplies are not identity purchases—they’re commodity purchases. That makes it hard for brand equity to defend premiums.

Even ACCO’s own disclosures underline the risk: it repeatedly cites “the continued decline in the use of certain of our products” as a risk factor. The company isn’t hiding the core problem—its largest categories face structural headwinds.

Debt remains a constraint. Leverage is more manageable than in past crises, but the debt load still limits flexibility if demand drops faster or the economy turns. In a squeeze, management may have to choose between debt service, dividends, and investment.

And the darkest version of the bear case is simple: “managed decline” is just a slower route to irrelevance. You can harvest cash for years, but if the endpoint is a much smaller market, the only real question is how quickly the floor drops out.

There’s also a cultural tailwind against paper. As sustainability becomes a stronger purchasing filter—especially for institutions—paper-heavy consumption can be seen as wasteful, accelerating substitution.

Ten to twenty years out, it’s hard to argue the world will need more staplers, binders, and planners than it does today. The bear case is that the long-term direction is obvious, even if the timing isn’t.

For investors, the choice largely comes down to horizon and temperament. If you want income today, the dividend and cash flow can be compelling. If you’re underwriting a long-term compounder, you’re betting that ACCO’s growth bets become meaningful before the legacy base erodes too far.

XIII. Key Metrics & What to Watch

If you’re tracking ACCO, most of the noise falls away if you keep your eyes on a short list of signals—the ones that tell you whether this is a controlled glide path, or a steeper descent.

Comparable Revenue Growth (excluding acquisitions and currency): This is the cleanest read on underlying demand, stripped of M&A and FX. In Q4 2024, comparable sales fell 5.9 percent. When comps are negative, it’s the secular decline thesis showing up in black and white. If ACCO ever starts posting sustained positive comps, that’s your first real hint of stabilization.

Free Cash Flow Conversion: In a managed-decline story, cash is the story. In 2024, ACCO generated $132 million of free cash flow—the fuel for dividends, buybacks, and paying down debt. If that number starts slipping, it usually means one of three things: margins are getting squeezed, working capital is getting harder to manage, or the core is weakening faster than cost cuts can keep up.

Technology and Gaming Performance: This is the bet inside the bet. PowerA and Kensington don’t have to become the whole company, but they do have to grow fast enough to matter. In 2024, sales declines elsewhere were partially offset by growth in technology accessories. The key is whether those categories can keep compounding while the legacy portfolio shrinks.

Together, these three metrics—comparable revenue growth, free cash flow, and technology/gaming momentum—pretty much define ACCO’s investment case. Comps tell you the pace of decline. Free cash flow tells you how much value the company can harvest along the way. And the growth businesses tell you whether ACCO is building a second engine, or just slowing the descent.

Beyond that, watch leverage (3.4x consolidated leverage at year-end 2024), dividend sustainability, and any guidance changes that suggest the decline is speeding up—or finally leveling out.

XIV. Lessons for Founders & Investors

ACCO’s 120-year journey leaves a surprisingly practical set of lessons—especially for anyone building, buying, or operating businesses that don’t have the luxury of riding a forever-growing market.

Lesson 1: Roll-ups work until they don’t. Consolidation creates real value when there’s enough growth to cover the messiness of integration. But you can’t acquire your way out of secular decline. Eventually there’s less to buy, and the underlying demand drop starts to overwhelm whatever synergies you can squeeze out.

Lesson 2: Debt amplifies everything. Leverage can boost shareholder returns when the world is calm. When it isn’t, it turns into an existential risk. ACCO’s 2008–2009 experience made the point the hard way: “stable” cash flows aren’t stable when demand suddenly collapses.

Lesson 3: Brand equity is real but fragile. Swingline, Five Star, and Kensington earned trust over decades. But brand value isn’t a museum piece—you have to keep it relevant and keep investing in it. If a brand stops connecting with new buyers, it can fade faster than you think.

Lesson 4: Portfolio management is a core competency. The difference between a well-run legacy company and a value trap often comes down to one skill: knowing what to harvest and what to fund. ACCO’s shift toward technology and gaming, while using legacy categories to generate cash, is portfolio management as strategy—not just a finance exercise.

Lesson 5: Distribution relationships can be moats, but retailers have memories and power. ACCO’s scale and relationships help it stay on shelves and in catalogs. But those same customers can squeeze margins, push private label, and demand concessions. A channel partner can be an advantage and a threat at the same time.

Lesson 6: Adjacent expansion is hard, but sometimes it’s survival. PowerA sounded odd when it was announced—what do staplers have to do with Xbox controllers? But the strategic rationale was coherent: use the same muscles (distribution, sourcing, operational infrastructure) to compete in categories that are actually growing.

Lesson 7: “Managed decline” can be profitable for a long time—if you’re disciplined. Declining industries don’t automatically mean bad businesses. They often produce cash for years. The trap is ego: chasing growth through the wrong deals or the wrong reinvention story instead of running the decline efficiently.

Lesson 8: Public market investors hate ambiguity. ACCO trades at a discount partly because it doesn’t fit neatly in a box. Is it a declining office products company, a gaming accessories growth story, or a workplace technology platform? When the narrative isn’t clean, the valuation usually isn’t either.

Lesson 9: Sometimes the best move is accepting reality and maximizing cash. Plenty of legacy companies destroy value by fighting the trend instead of managing it. ACCO’s own risk language—about “the continued decline in the use of certain of our products”—isn’t inspiring, but it is honest. And honesty is what makes a viable strategy possible.

Lesson 10: Legacy businesses can last longer than tech optimists expect—but the direction is clear. The paperless office was forecast in the 1980s, and it took decades to really show up. That delay bought companies like ACCO time. But time isn’t the same as reversal. The only debate left is how fast the endpoint arrives.

For founders, the takeaway is simple: aim for durable advantages in markets with real tailwinds. For investors, the takeaway is more nuanced: there can be value in decline—but only if you buy it at the right price and underwrite the trajectory with your eyes open.

XV. Epilogue: What's Next for ACCO?

The most likely future for ACCO is the one it has been preparing for: a long, managed glide path. Traditional office products keep shrinking year after year. Technology and gaming accessories keep growing, but not fast enough to completely outrun the gravity of the legacy portfolio. The result is probably flat to modestly declining revenue, with management doing what it has learned to do best—protecting margins through cost reduction, sharper brand focus, and constant portfolio tuning.

A take-private deal is the obvious “what if.” At the right price, the LBO math could work, because private equity has always liked businesses that throw off cash even when they’re not growing. ACCO has no debt maturities until March 2029, and its amended credit facility added covenant flexibility—both of which matter if you’re underwriting stability and time. In private hands, ACCO could cut harder, restructure faster, and potentially run the playbook without the pressure of quarterly earnings calls.

Then there’s the breakup question. Could ACCO separate PowerA and Kensington—the newer, faster-growing businesses—from the legacy office products cash cow? In theory, yes. In practice, it’s messy. The “growth” businesses might command higher multiples as pure-plays, and the legacy business could be harvested more aggressively. But you’d also face transaction costs, stranded overhead, and a lot of management distraction for a company whose competitive advantage is largely execution.

The future of work adds another layer of uncertainty. AI could accelerate digitization by making documents easier to create, share, and manage without printing—a direct headwind for anything paper-adjacent. At the same time, if hybrid work remains the default, the home office doesn’t disappear; it becomes a permanent second workplace. That’s a world where workspace accessories, security, ergonomics, and conferencing gear can stay relevant, even if the office supply closet keeps shrinking.

Sustainability is one of the few ways to put a fresh premium wrapper around a mature category. “Eco-friendly office” products can command higher prices with environmentally conscious consumers and institutional buyers. ACCO’s scale gives it room to invest in sustainable materials and recycling programs in ways smaller competitors may not be able to match.

Emerging markets remain a real swing factor, especially places like Brazil and Mexico where education and business infrastructure can still expand demand for physical supplies. But those markets come with their own volatility—currency swings, economic instability, and intense local competition—so they’re opportunity and risk bundled together.

Which brings us to the only question that really matters: in 20 years, will ACCO still exist—and if so, will it look anything like it does today?

The most plausible answer is yes, but different. A smaller office products business. A larger technology accessories business, assuming Kensington and PowerA keep evolving. And maybe categories that aren’t even on today’s map. Just as the ACCO of 2025 barely resembles the paper clip company of 1903, the ACCO of 2045 will almost certainly surprise us.

For now, ACCO is a case study in what it looks like when an industrial-era company runs headfirst into digital disruption—and refuses to die. The company has made smart moves. PowerA was creative and strategically coherent. The cost discipline has been real. But no amount of execution can reverse the fundamental trend: a world that keeps needing less paper.

As of 2025, ACCO’s President and CEO is Thomas W. Tedford. He inherits a company with genuine challenges, but also real assets: iconic brands, experienced teams, strong cash generation, and a few strategic options that still have upside. What he does with the next decade will determine whether ACCO becomes a meaningfully transformed business—or a well-managed decline that eventually runs out of road.

ACCO’s story is, in the end, the story of industrial America trying to stay relevant in a software world: a paper clip company that became a stapler empire that became, increasingly, a technology accessories portfolio. Survival required continuous reinvention. Whether reinvention is enough is the part the market—and history—hasn’t decided yet.

XVI. Further Reading & Resources

Primary Sources:

- ACCO Brands 10-K Annual Reports (SEC.gov) - The best place to see how ACCO describes its segments, risks, and performance in its own words

- ACCO Brands Investor Presentations (ir.accobrands.com) - How management frames the strategy, priorities, and outlook for investors

Industry Context:

- IBISWorld Office Supply Stores Industry Analysis - Helpful background on market size, category decline, and who still controls the channel

- OPI (Office Products International) State of the Industry Reports - A solid pulse check on distribution, retail dynamics, and what’s changing in office products

Strategic Frameworks:

- "The Outsiders" by William Thorndike - A lens on capital allocation, especially for cash-generating businesses

- "Competition Demystified" by Bruce Greenwald - A practical way to think about competitive advantage in mature, price-pressured categories

- "7 Powers" by Hamilton Helmer - A framework for judging whether a company has true, durable moats

- "Creative Destruction" by Richard Foster - Context for how incumbents survive when technology makes their core products less relevant

Company-Specific:

- Fortune Brands historical archives - Background on the roll-up era that shaped ACCO’s portfolio

- Kensington company history (kensington.com) - How ACCO’s tech-accessories arm evolved over time

- PowerA brand history - Useful context on where PowerA came from and how the gaming accessories market works

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music