Pictet Asset Management: 220 Years of Private Banking Excellence

How a Geneva Partnership Survived Wars, Crises, and the Death of Swiss Secrecy—Without Ever Going Public

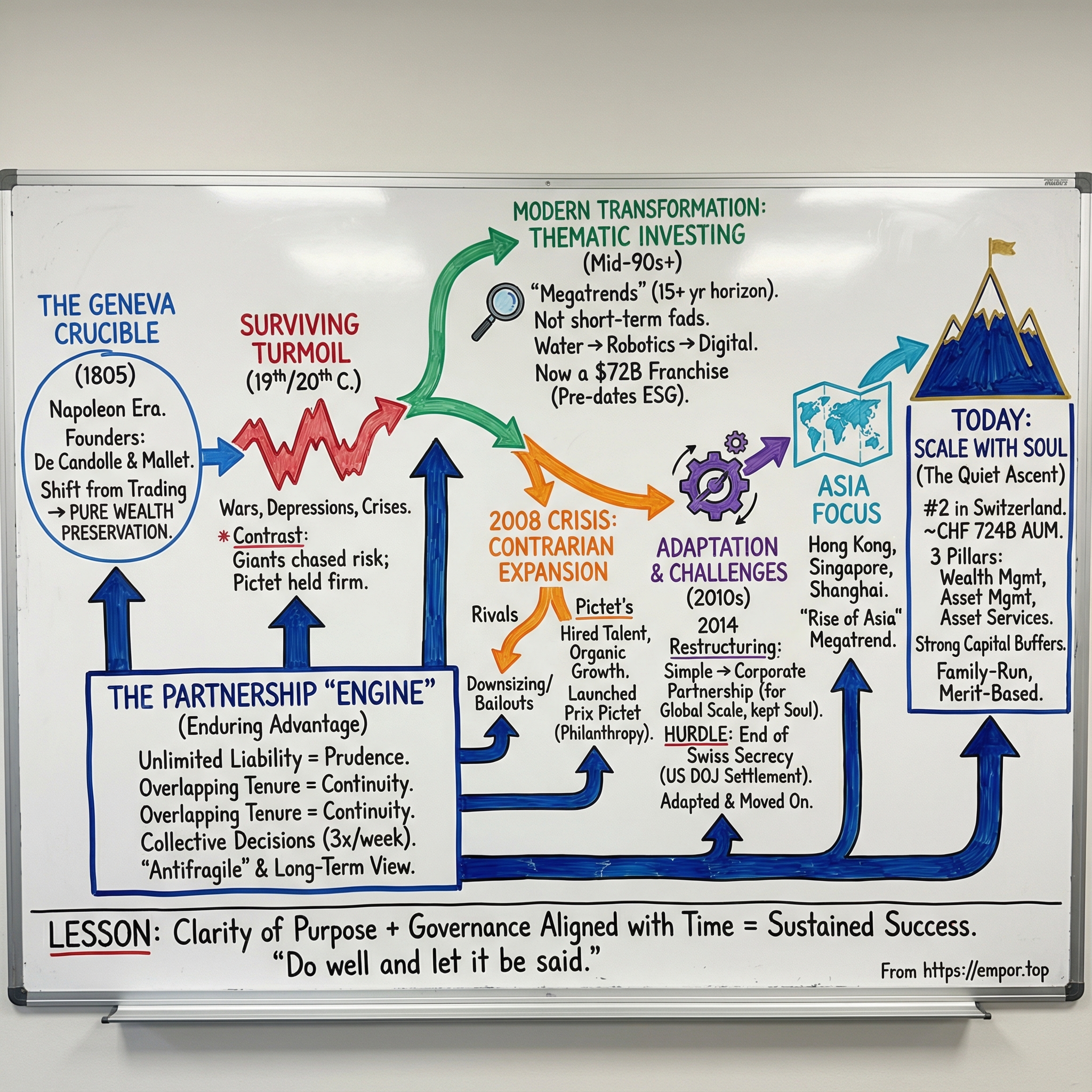

The Quiet Ascent to Swiss Banking's Summit

In March 2023, as Credit Suisse—Switzerland's storied second-largest bank—imploded in a weekend crisis that shocked global markets, most observers focused on the dramatic rescue by UBS. But a more intriguing transformation was happening in the shadows. During this crisis, it was Pictet that quietly replaced Credit Suisse as the second-largest financial institution in Switzerland by assets under management.

Few outside the rarefied world of Swiss private banking fully appreciated what had occurred. A 220-year-old partnership—one that had never gone public, never made a major acquisition, and never strayed from its core mission of managing wealth—had outlasted and outgrown one of the world's most aggressive financial conglomerates.

The Pictet Group is a Swiss multinational private bank and financial services company headquartered in Geneva. Headquartered in Geneva, it is one of the largest Swiss banks and primarily offers services in wealth management, asset management, and asset servicing, to private clients and institutions. Pictet does not engage in investment banking, nor does it extend commercial loans.

Assets under management or custody stood at CHF 724 billion in 2024, up 14 percent from the year before. "Investment performance was excellent and positive market effects helped us reach an all-time high in assets under management," Marc Pictet, senior managing partner, said.

The numbers tell a remarkable story of organic growth. Renaud de Planta, who joined Pictet in 1998 as Managing Partner and became its Senior Partner in 2019, helped the firm grow from around 1,000 employees in nine offices managing assets of CHF 100 billion to 5,300 employees in thirty offices managing assets over CHF 630 billion. That's sevenfold growth in roughly 25 years—without mergers or acquisitions.

How did a firm founded when Napoleon still ruled most of Europe manage to thrive while giants like Credit Suisse, with all their investment banking firepower, ultimately failed? The answer lies in a partnership model that has remained essentially unchanged for two centuries—and a distinctive investment philosophy that turned "thematic investing" from a niche experiment into a $72 billion franchise.

The Geneva Crucible: A Republic's Banking Pioneers (1805)

To understand Pictet, one must first understand Geneva in the summer of 1805. The city that would later become synonymous with Swiss neutrality and banking discretion was then under French occupation—annexed by Napoleon in 1798 and operating as a département of the French Empire.

The bank was set up while Geneva was annexed by France, being founded in the midst of the restructuring of the Geneva financial sector following major bankruptcies at the end of the eighteenth century caused by the economic consequences of the French Revolution.

Yet even under foreign rule, Geneva's banking culture remained distinct. Swiss private banks began to develop on a national scale from the 18th century onwards. At the time, Geneva was an independent republic that had gained prominence since the Reformation. Thanks to its central position in Europe, close business ties with France and vibrant economy, it became a fertile ground for the emergence of numerous private banks.

It was in this uncertain environment that two young men—both under 30 years old—decided to pool their capital and ambition. Pictet traces its origin to the foundation of Banque De Candolle Mallet & Cie in Geneva on 23 July 1805. On that day, Jacob-Michel-François de Candolle and Jacques-Henry Mallet signed, with three limited partners, a Scripte de Société (memorandum of association) to form a partnership.

At that time, it had two managing partners, Jacob-Michel-François de Candolle and Jacques-Henry Mallet, as well as three limited partners, Jean-Louis Mallet, the latter's brother, Paul Martin and Jean-Louis Falquet who was a member of government after the Restoration. The fledgling bank was located at the Cour St-Pierre in Geneva until 1819.

With share capital of 125,000 pounds, "the local currency of Geneva", the new company was established "to trade in goods and articles of all types, collect annuities and undertake speculation in commodities", a business the Bank would very quickly abandon to devote itself entirely to wealth management and exchange transactions.

Founded in 1805, Pictet was established earlier than most global financial giants, such as Goldman Sachs and Citigroup. This temporal priority matters: the firm's DNA was set before the modern era of publicly traded banks, investment banking syndicates, and complex derivatives. From the beginning, Pictet was built around a simple idea—helping wealthy families preserve and grow their capital across generations.

The historical context illuminates why this partnership model proved so durable. Formerly a city-state, Geneva joined the Swiss Confederation in 1815, largely thanks to the diplomatic pursuits of Charles Pictet de Rochemont. He represented Geneva at the Congress of Vienna in 1814 and secured a territorial extension that linked Geneva – which until then was fragmented and isolated – with the rest of Switzerland.

The Pictet family's influence thus extended far beyond banking. Charles Pictet de Rochemont (1755–1824) was a diplomat, not a banker but a central political figure. He negotiated Geneva's entry into the Swiss Confederation in 1815 and drafted the declaration of Swiss neutrality, still a cornerstone of Swiss identity.

This combination of political influence and commercial discretion would prove essential to Geneva's emergence as a banking center—and to the Pictet firm's ability to navigate the turbulent decades ahead.

From Trading House to Wealth Manager: The Pictet Name Arrives

The original founders had no way of knowing their creation would someday bear the name Pictet. That transformation came about through the peculiar dynamics of Geneva's partnership culture—and a family connection.

On the death of de Candolle in 1841, his wife's nephew Edouard Pictet joined the partnership, and the name Pictet has remained with the bank ever since. Shortly before his death, Jacob-Michel-François de Candolle, who had no son to take his place, turned to his wife's nephew, Edouard Pictet (1813-1878), who was appointed partner in 1841.

Edouard Pictet was the first Pictet banker, became Partner in 1841, and added the family name to the firm, marking the beginning of the Pictet & Cie era. He established the principles of prudence, Calvinist-inspired rigour, and discretion.

The evolution from trading house to pure wealth management had already occurred. Like all Geneva banks at the time, it started out trading in goods but soon abandoned trading to concentrate on assisting clients in their financial and commercial business and advising them on managing their wealth. By the 1830s, it held a broad range of securities on behalf of clients, to diversify their risks.

Throughout the nineteenth century the Pictet partners often succeeded each other from father to son on the board of partners, setting their stamp on the firm: a certain rigour that is said to be a legacy of Calvinism, along with prudent, discreet management of their affairs, and a considerable openness to the world as regards financial investments.

The partnership structure meant constant name changes, reflecting the individuals who bore unlimited liability for the firm's obligations. The firm was known by various names during the 19th century: De Candolle, Turrettini & Cie (1807-1812), J. de Candolle & Cie (1812-1819), Turrettini, Pictet & Cie (1841-1848), Edouard Pictet (1848-1856), Edouard Pictet & Cie (1856-1878) and Ernest Pictet & Cie (1878-1909). It was only in 1926 that the company changed its name to Pictet & Cie.

The growth trajectory during this period was steady but unremarkable by later standards. Between 1890 and 1929, the Bank went through a period of substantial growth, the number of employees rising from 12 to more than 80 over 30 years.

What distinguished Pictet during this formative century was not spectacular expansion but rather institutional continuity. The firm survived the upheavals of European history—wars, revolutions, currency crises—by maintaining conservative practices and a tight focus on client wealth preservation.

Surviving the Storms: Depression, War, and Postwar Revival

The global economic crisis of the 1930s tested Geneva's private banks severely. The growth of Switzerland's major banks was brought to a standstill as the global crisis of the 1930s unfolded. In Geneva private banks such as Pictet, which specialised in wealth management, emerged from these turbulent times in a stronger position, becoming a cornerstone of Switzerland's post-war finance industry.

After a period of relative stagnation marked by the Great Depression of the 1930s and the Second World War, Pictet began to expand in the 1950s as the Western world entered a prolonged period of prosperity and economic growth.

The adoption of the Pictet lion as the company symbol in 1955 marked a turning point. The lion had first appeared in the early 17th century on the coat of arms of the Pictet family, rearing above the ramparts of the old city walls of Geneva—a symbol of strength, courage and defiance that captured both the firm's heritage and its emerging ambitions.

In the late 1960s, the Bank embarked on the new business of institutional asset management, which has since grown to account for around half of its total assets under management. This pivotal strategic expansion—moving beyond serving private clients to managing money for pension funds, foundations, and other institutional investors—would prove transformative for the firm's growth trajectory.

The partnership model that had sustained Pictet through economic depressions and world wars provided inherent conservatism that served as a natural hedge against the aggressive risk-taking that would later bring down other Swiss banks. Partners had unlimited personal liability—their personal fortunes were on the line with every decision. This created powerful incentives for prudent management.

Not only Credit Suisse, but even UBS, which acquired it, was also embroiled in the financial crisis, suffering losses of billions of dollars and even requiring a government bailout by the Swiss government. For Pictet's managing partners, these are cautionary tales in business operational risks.

François Pictet gives an example: When a financial group simultaneously owns asset and wealth management as well as investment banking departments, there is inevitably a conflict of interest. How does it reconcile managing its client's assets over the long term with the need to earn fees from distributing products to clients and encouraging them to trade in the short term?

The Modern Transformation: Thematic Investing Takes Root (1980s-1990s)

The seeds of Pictet's modern identity were planted in the mid-1980s, when the firm began exploring two investment approaches that would define its competitive positioning: emerging markets and thematic investing.

Pictet has been managing alternatives since 1989, making it one of the earliest entrants into areas such as private equity. The firm was early to recognize the potential of emerging market assets, making its first equity investment in 1989 and expanding into bonds in the late 1990s. In the decades that followed, they developed emerging market dollar-denominated, local currency and corporate debt investment strategies.

But the truly distinctive innovation came from Hans Peter Portner, who would become the architect of Pictet's thematic equity franchise. The origins of this franchise reach back to the mid-1990s, when Hans Peter Portner, now head of Thematic Equities at Pictet Asset Management, launched the firm's first thematic strategy focused on water. What was then a small experiment within a traditional Geneva partnership evolved into one of the best-known thematic equity platforms in global finance.

For Portner, thematic investing is ultimately about tracing the great rivers of global transformation — what he calls megatrends. These, he argued, are among the most reliable guides to the future, shaping industries and societies over decades. Each strategy, whether it concerns water, nutrition or robotics, is built on a time horizon of at least fifteen years, seeking long-term growth that is both focused and purposeful.

In 1997, two significant developments occurred. Pictet Asset Management was formally established as part of the Pictet Group, and the department began developing Socially Responsible Investments (SRI)—positioning the firm at the forefront of what would later become the massive ESG investing wave.

Pictet began developing thematic investing in the mid-1990s and has developed a full range of standalone thematic equity strategies, managed by teams based in Geneva and Zurich offices. Each one of their thematic strategies, from Water through to Robotics has a global reach.

The philosophy underlying thematic investing aligned perfectly with Pictet's partnership ethos. Taking twenty years to bear fruit would be intolerable for most other financial institutions or publicly traded companies. Junjie Watkins candidly stated that this is Pictet's advantage of being private and its long-term thinking.

Thematic Investing: From Water Strategy to $72 Billion Franchise

In 2000, Pictet boldly launched its Water investment strategy—a pioneering approach that has since become a cornerstone of thematic investing.

The timing was notable. At the height of the dotcom bubble, when technology stocks commanded frenzied investor attention, Pictet took a different path—a strategy focused on financing solutions to the global water challenge. This counter-cyclical thinking reflected the partnership's distinctive approach to investment opportunities.

Several of the funds, such as Water or Clean Energy, have been running for more than two decades. The longevity of these strategies demonstrates the validity of Pictet's core insight: that structural forces of change—demographic shifts, technological innovation, environmental pressures—evolve independently of economic cycles and provide durable investment themes.

The Premium Brands strategy launched in 2005 with Caroline Reyl at the helm since its inception. In this interview, she offers an insider's perspective on the evolution and milestones of this journey.

In 2015, Pictet launched its Robotics strategy, being one of the pioneers in this area. Robotics, overseen by Peter Lingen and Daegal Tsang, focuses on automation and artificial intelligence. Since its launch in 2015, the strategy has generated an annualized return of 16.51 percent, outperforming the MSCI ACWI by 5.41 points. The managers noted how advances in automation continue to redefine industrial efficiency.

A decade on, they have built an important, actively managed Robotics strategy with assets under management of EUR 9.5 billion. Robotics has outperformed the MSCI ACWI by more than five percentage points annually since 2015.

Raymond Sagayam, one of Pictet's managing partners, explained how thematic investing evolved from a niche experiment in the 1990s into a platform of 16 strategies with nearly $72 billion in assets under management. These themes range from water and clean energy to robotics, healthcare innovation, and smart cities – all tied to long-term structural forces, not short-term fads.

The franchise traces back to Hans Peter Portner, who launched Pictet's first thematic strategy on water in the mid-1990s. That small experiment has since grown into a $72-billion platform supported by more than 70 professionals and 14 external advisory boards.

The analytical framework is unusually broad. The thematic universe comprises about 1,800 stocks worldwide — public companies that, taken together, have historically outperformed the MSCI All-Country Index in both sales growth and risk-adjusted performance.

With the help of outside experts from industry and academia, such as the Copenhagen Institute for Futures Studies, Pictet identifies the most dynamic areas of the global economy - those where megatrends are particularly influential. They have identified 14 such themes in the past 30 years, including robotics, clean energy and water - each of which are represented in their range of thematic strategies.

The Digital strategy, introduced by John Gladwyn, demonstrates the scale these strategies can achieve. The Digital strategy covers an investment universe of roughly 300 companies with a combined market capitalization exceeding 30 trillion dollars. From this, the team maintains between 30 and 50 high-conviction positions. With assets of about 6 billion dollars, Digital ranks among Pictet's largest thematic portfolios — and one of its strongest performers, with an annualized return of 12.23 percent and an excess return of 4.25 points over the MSCI AC World Index.

Inside Pictet, thematic investing is viewed not as a marketing construct but as an intellectual discipline rooted in research. Portfolio managers and analysts work across disciplines, combining insights from technology, science and social change to identify where capital can benefit from transformative trends. The approach has produced one of the most established thematic franchises in global asset management — and one that continues to expand even as others in the ESG space face political headwinds and investor fatigue.

What makes Pictet's thematic platform particularly interesting in today's polarized ESG environment is its pre-ESG origins. With political pushback against ESG intensifying, Pictet frames its strategies differently. Sagayam reminded the audience that themes like water, clean energy, and nutrition long predate the ESG acronym – and continue to perform because they address real economic needs.

The 2008 Financial Crisis: Contrarian Expansion

The global financial crisis of 2008-2009 provided a dramatic stress test for the world's financial institutions—and revealed stark differences in institutional culture between Pictet and its larger Swiss rivals.

During the financial crisis, while most financial institutions were downsizing, Pictet not only suffered relatively minor setbacks but also continued to recruit talent and expand its workforce, in contrast to some other Swiss peers.

While others expand through acquisitions, Pictet chooses organic growth; while others rely on star managers to lead, Pictet counts on the collective wisdom of its partners. While peers in the face of adversity choose to first abandon some crew members to lighten the ship's burden, Pictet does not abandon its crew but instead seizes the opportunity to recruit other talented crew members.

This contrarian approach during crisis periods reflects the partnership model's structural advantages. Without quarterly earnings pressure from public shareholders, partners could take a longer view, recognizing that talent availability increases during downturns and that market-share gains made during crises often prove durable.

By 2008, Pictet Asset Management Asia had established itself on firm footing, thanks to its specialist expertise in global emerging equities, Asian equities (ex-Japan), EAFE equities, emerging debt and globally diversified absolute return strategies.

The firm also chose this moment of industry retrenchment to launch a significant philanthropic initiative. Founded in 2008 by Pictet, the Prix Pictet has become the world's leading award for photography and sustainability. The partners of the Pictet Group created the Prix Pictet prize to draw worldwide attention to and stimulate action on issues of sustainability through the medium of photography.

Kofi Annan was appointed Honorary President of the Prix Pictet on the inception of the prize in 2008 and continued in that role until his death in 2018. The involvement of the Nobel Peace Prize laureate and former UN Secretary-General lent immediate global credibility to the initiative.

For each cycle, 100,000 Swiss Francs is awarded to the photographer who, in the opinion of the independent jury, has produced a series of work that is both artistically outstanding and presents a compelling narrative related to the current cycle's theme. To date, there have been ten cycles of the award, each with its own theme highlighting a particular facet of sustainability.

More than 5,000 photographers have been nominated to date, with over 120 exhibitions in 48 cities across 27 countries.

The Prix Pictet exemplifies how family-controlled financial institutions can pursue initiatives that public companies typically cannot justify to shareholders—building brand equity and demonstrating values over multi-decade timeframes without immediate financial returns.

The 2014 Restructuring: Outgrowing the Partnership Form

For 209 years, Pictet operated as a simple partnership—a legal structure that had served it well through world wars, financial crises, and the evolving landscape of Swiss banking. But by the early 2010s, the firm's global ambitions had begun to strain against this ancient legal form.

In 2014, Pictet changed its legal structure from a simple partnership to a corporate partnership (société en commandite par actions) that acts as a holding company for its global business. Pictet did not publish its annual results during its 209 years as a simple partnership, then published annual results for the first time upon becoming a corporate partnership.

"The company outgrew its legal form." In overcoming this external roadblock, Pictet reinvented itself as a major international player.

Changing from a partnership of individuals to a corporation has had an impact in several dimensions that are relevant to other family businesses. The company is now required to make information public, and the unlimited personal liability of each individual partner no longer applies.

This was not merely a legal technicality—it represented a fundamental transformation in how Pictet could operate globally. This enabled the company to manage its businesses in an international environment, and also allowed the seven partners who are owner-managers of Pictet to preserve the rules of succession, which have remained unchanged for more than 200 years. Under those rules, ownership cannot be passed down to partners' children: it is a temporary status that ends once a partner has retired.

The timing coincided with broader upheaval in Swiss banking. Since the US Swiss Banking Program, numerous private banking partnerships, including Pictet in 2014, have changed business model to limit the liability of partners. The traditional Swiss private bank has become a dying breed, numbering just five such banks at the end of 2022.

Yet Pictet managed this transition while preserving the essential elements of its partnership culture—collective decision-making, long-term orientation, and the primacy of client relationships over short-term profit maximization. The new structure enabled global expansion while the partnership ethos remained intact.

The US DOJ Investigation: Confronting the End of Swiss Secrecy

No examination of Pictet's modern evolution can avoid the uncomfortable chapter of its US Department of Justice investigation—a decade-long saga that concluded in late 2023 and illustrated both the firm's vulnerability to regulatory change and its institutional resilience.

On 26 November 2012, it was reported that Pictet's wealth management unit was a target of the United States Department of Justice (DOJ), suspected of having aided tax evasion. On 4 December 2023, Pictet concluded a final settlement agreement with the DOJ to resolve a legacy investigation relating to services provided by its private banking business to US taxpayer clients between 2008 and 2014.

Banque Pictet, the private banking division of the 218-year-old Pictet Group, will pay about $122.9 million in restitution and penalties as part of an agreement with prosecutors. Between 2008 and 2014, the bank had 1,637 accounts on behalf of American clients, who collectively evaded approximately $50.6 million in U.S. taxes. The accounts held more than $5.6 billion of the roughly $20 billion in total assets from U.S. taxpayers that the bank managed during the relevant period.

If the bank complies with the terms of its deal, the Justice Department has agreed to defer prosecution for three years and then dismiss a charge of criminal conspiracy to defraud the IRS. As part of the deal, the bank also agreed to cooperate with ongoing investigations into hidden bank accounts.

The scale of the penalty—while substantial—was manageable for a firm of Pictet's financial strength. The sum payable will be absorbed by general provisions and profits of its Swiss bank. This resolution follows Pictet's extensive cooperation with US authorities, in full compliance with Swiss law.

The broader context matters. Pictet was the last of more than 100 banks to collectively pay out more than $7.5 billion during a decade-long crackdown by the US. The crackdown began when UBS admitted assisting thousands of Americans in evading taxes and avoiding prosecution by paying $780 million. Credit Suisse pleaded guilty in 2014, paying $2.6 billion, and Julius Baer paid $547 million to avoid prosecution — both admitting they enabled clients to conceal billions in assets.

Senior Partner Renaud de Planta provided candid reflection on the episode. "We didn't have a US desk initially and when we decided to develop the US private client market, we set up a dedicated company registered with the SEC back in 2007. Many clients concealed their dual nationality from us. The reality is that Swiss banks discovered the intricacies of US tax law at their own expense the hard way."

The agreement acknowledges that Pictet began evaluating and enhancing its policies and practices for conducting business with US taxpayer clients in 2008, before it became public that the DOJ was investigating similar issues at another Swiss bank. It also recognises that the Group then took additional steps beyond those required by US law to promote the tax compliance of its US taxpayer clients.

The US crackdown transformed Swiss banking irreversibly. Today, strict banking secrecy exists only domestically within Switzerland, but is no longer applied in relation to other countries. But the most profound change to the Swiss financial sector was the severe dilution of banking secrecy, which had shielded foreign tax dodgers for generations. Secret numbered bank accounts have now been replaced by tax treaties with numerous countries that force Switzerland to reveal the extent of foreign funds held in Swiss bank coffers.

For Pictet, the resolution of the DOJ matter removed a significant uncertainty—and the firm emerged with its client relationships and institutional reputation largely intact.

The Asia Expansion: From Hong Kong to Shanghai

While navigating regulatory challenges in the West, Pictet was simultaneously executing an ambitious expansion into Asia's rapidly growing wealth markets.

In recent years, Pictet has continued to bolster its presence in Asia with significant milestones such as obtaining a wholesale banking licence in Singapore in 2018 and opening an office in Shanghai in 2020.

In 2011, Pictet Asset Management opened its first Taipei office and its second office in Japan, in Osaka. In 2012, Pictet Group was granted a full banking license for its wealth management activities in Hong Kong by the Hong Kong Monetary Authority (HKMA).

In 2015, Pictet was one of the first international asset managers to launch a UCITS fund that offered international clients access to the Chinese onshore RMB bond market.

In April 2018, Bank Pictet & Cie (Asia) Ltd received regulatory approval for a wholesale banking license from the Monetary Authority of Singapore (MAS), underlining the importance of Singapore for the Pictet Group in the Asia-Pacific region.

The Shanghai office opening in 2020 represented a landmark moment. Renaud de Planta, Senior Partner of the Pictet Group said, "The expansion into China represents a significant milestone in the 215 year history of Pictet. We are encouraged by the prospect of the country's asset management industry, which has developed into one of the world's biggest and fastest-growing, thanks to China's economic strength and its rate of capital accumulation."

Pictet Asset Management opened an office in Shanghai, Pictet's 30th office globally. Pictet Asset Management launched its first northbound fund under the Mutual Recognition of Funds scheme between mainland China and Hong Kong.

Pictet AM first opened its Shanghai WFOE in September 2020, successfully registered as a QDLP Manager with AMAC in August 2021, and announced the launch of its first QDLP product in September 2021.

As part of its Ambition 2025, Pictet identified the Rise of Asia as one of seven global themes that will have major implications for investors, clients and the financial industry.

Current Senior Partner Marc Pictet has articulated the firm's ongoing Asian commitment. Marc Pictet expresses his confidence in Hong Kong's enduring appeal as a premier financial hub, especially for family offices. As wealth accumulation in Greater China accelerates, Pictet Group plans to channel increased investment into its Hong Kong operations, underscoring the city's strategic importance in the region.

Marc Pictet confirms that the Group will continue to recruit talent, with a focus on quality rather than quantity, as it is essential to preserve Pictet's corporate culture.

The Modern Pictet: Scale with Partnership Soul

Today's Pictet bears little resemblance in scale to the 12-person firm of 1890, yet its fundamental character remains recognizable.

The Pictet Group employs more than 5,500 people, including 900 investment managers. It has a network of 31 offices in financial services centres, including registered banks in Geneva, Frankfurt, Nassau, Hong Kong, and Singapore.

The organization operates through three distinct business lines. Pictet Wealth Management had CHF 277 billion of assets under management on 31 December 2024 and employed around 1,220 full-time equivalent employees, including 361 private bankers.

Operating out of 18 Pictet offices worldwide, Pictet Asset Management had CHF 291 billion of assets under management on 31 December 2024 and employed around 1,119 full-time equivalent employees, including 489 investment professionals.

With eight booking centres accessing the single global platform, Pictet Asset Services had CHF 234 billion of assets in custody on 31 December 2024 and employed around 224 full-time equivalent employees.

The firm's financial metrics reflect its conservative culture. The liquidity coverage ratio was 212 per cent, exceeding the 100 per cent requirement under Basel III. The total capital ratio stood at 24.5 per cent, above the 12 per cent requirement set by Pictet's Swiss regulator FINMA.

Total equity amounted to CHF 3.78 billion in 2024. Banque Pictet & Cie SA is rated Prime-1/Aa2 by Moody's, and F1+/AA- by Fitch.

These capital ratios—double or more the regulatory minimums—exemplify the partnership's approach to risk management. Partners with personal capital at stake naturally maintain larger buffers than regulators require.

The Partnership Model: A Bond More Enduring Than Marriage

The most distinctive aspect of Pictet—and arguably its most important competitive advantage—is its partnership structure.

Pictet is a partnership of seven owner-managers responsible for the entire activity of the Group. Their principles of succession and transmission of ownership have remained unchanged since foundation in 1805. Over the past 220 years there have been only 47 partners, each with an average tenure of over 21 years.

Because the terms of the partners overlap, the knowledge, experience and values of each generation are absorbed and passed on without interruption. With the ninth generation of the Pictet family still active in the partnership, their structure ensures that they remain committed to maintaining the financial strength and solidity of the Group.

The current partnership structure was detailed following changes in 2024. From left to right, seated: François Pictet, Elif Aktuğ, Marc Pictet (Senior Partner) and Laurent Ramsey. Standing: Raymond Sagayam, Sébastien Eisinger and Sven Holstenson.

Marc Pictet took over from Renaud de Planta as Senior Partner on 1 July 2024. Marc Pictet joined Pictet in 2001 and has been a managing partner of the group since 2011.

The appointment of Raymond Sagayam as the 47th Managing Partner in 2024 illustrated both continuity and evolution. The Pictet Group announced the appointment of Raymond Sagayam as the 47th Managing Partner in the 218-year history of the firm, effective 1 January 2024.

Raymond Sagayam joined Pictet Asset Management in 2010 as Head of Total Return Fixed Income to build and expand the firm's long-short credit capabilities. His strong investment and management track record led him to be appointed Chief Investment Officer of Fixed Income for Pictet AM and a member of its Executive Committee in 2017. In addition to these responsibilities, he was named Equity Partner of the Group in 2018 and Head of Pictet AM London in 2022.

Raymond grew up in Washington D.C., Kuala Lumpur, Beijing, Singapore and London. His appointment—along with that of Elif Aktuğ as the first woman managing partner in 2021—signals the partnership's gradual internationalization while maintaining its core governance principles.

The partners meet not once a week, or once a month — they can leave that for a board of directors with a CEO — but three times a week. Because each new proposal needs to be weighed, considered, tested, slept on, until a broad consensus is achieved. And even then, a strategy may be refined as it develops.

It may seem like a recipe for indecision. Yet in business, too many decisions are taken in haste and regretted at leisure. A strategy that has been fully examined is much more likely to be — to use the former hedge fund manager and philosopher Nicholas Nassim Taleb's term — 'antifragile' than the capricious actions of a CEO at the mercy of a vote by distant or disengaged shareholders.

The virtue of Pictet's partnership since the beginning is the overlapping tenure of the partners and their collective management principles. It means the business does not suffer radical changes in direction: fresh ideas, yes, but evolution not revolution.

Each managing partner serves an average of 20 years before retirement, and new partners are appointed. "The (model) enabled us to go through world wars, economic crisis, financial crisis, turmoil, whatever has been thrown at us over the past 220 years," says François Pictet.

"Not actually a family business, but rather a family-run business"—as former senior partner Ivan Pictet described it. This distinction is crucial. Family influence persists, but merit determines advancement. Partners' children have no automatic claim to partnership status.

Investment Framework: What Makes Pictet Different

Pictet's investment approach reflects its partnership structure—patient, research-intensive, and focused on long-term structural trends rather than short-term market timing.

Thematic equity strategies invest in stocks whose returns are influenced by structural forces of change that evolve independently of the economic cycle. In other words, the approach seeks to transform long-term technological, environmental and societal megatrends into investment opportunities.

Pictet doesn't do everything; rather they focus on the areas where they can add value for their clients. Their strategic capabilities are thematics, emerging markets, alternatives and multi asset.

The "purity" concept distinguishes Pictet's thematic approach from competitors. Pictet thematic funds apply a "purity" concept, which requires investments to be linked to the percent of company revenue dedicated to the theme. This discipline ensures concentrated exposure to the intended theme rather than diluted positions in diversified conglomerates.

Each of Pictet's thematic strategies is managed by a team of dedicated specialist investment managers. In order to make sure their ideas are as robust as possible, they periodically meet with a dedicated advisory board of eminent scientists, business leaders and academics.

The advisory boards provide Pictet with the opportunity to test their views on the evolution of a theme against those of experts in their fields, providing them with deeper understanding of the structural trends and ensuring their strategies capitalise on new opportunities.

Bull Case: Structural Competitive Advantages

Hamilton Helmer's 7 Powers Analysis:

Switching Costs: Pictet's institutional client relationships span decades. Changing asset managers involves significant operational complexity, reputational risk, and relationship disruption that creates substantial switching costs—particularly for pension funds and family offices with customized mandates.

Counter-Positioning: The partnership model prevents publicly traded competitors from replicating Pictet's approach. Listed asset managers cannot credibly offer the same multi-generational time horizons or immunity from quarterly earnings pressure. This structural difference cannot be copied without fundamental corporate reorganization.

Economies of Scale: While Pictet lacks the absolute scale of BlackRock or Vanguard, it has achieved significant scale within its chosen niches—particularly thematic investing, where its $72 billion platform provides research depth and operational efficiency that smaller competitors cannot match.

Brand: Two centuries of continuity, multiple generations of wealthy families served, and the Prix Pictet's cultural positioning create brand equity that money cannot buy. The partnership's discretion and longevity attract clients who prioritize capital preservation over aggressive returns.

Process Power: The partnership's three-weekly meetings, advisory board structure for thematic strategies, and overlapping partner tenures create institutional processes that have been refined over two centuries. These embedded organizational capabilities are difficult for competitors to observe or replicate.

Porter's Five Forces:

Rivalry: Intense in commodity asset management but differentiated in Pictet's specialty areas. The firm competes on expertise and relationship quality rather than fees, avoiding the destructive price competition affecting passive index funds.

New Entrants: Brand and relationship barriers are high. New entrants cannot replicate two centuries of track record or the trust built with multi-generational wealthy families.

Supplier Power: Investment talent is the key input. Pictet's partnership path provides powerful retention incentives that reduce turnover of key investment professionals.

Buyer Power: Sophisticated institutional clients have bargaining power, but switching costs and relationship depth mitigate this. Family office clients prioritize continuity over fee optimization.

Substitutes: Passive investing poses the primary substitution threat. Pictet's response—active thematic strategies offering differentiated exposure unavailable through index funds—addresses this directly.

Bear Case: Risk Factors and Structural Challenges

Scale Limitations: A former senior executive at a global private bank pointed out that Pictet's biggest disadvantage is its difficulty in scaling up. Organic growth inherently proceeds more slowly than acquisition-driven expansion. In a consolidating industry, Pictet may lack the distribution reach of larger competitors.

Succession Risk: While the overlapping partner structure provides continuity, the firm's culture depends heavily on partner selection quality. A generation of poorly chosen partners could erode the firm's distinctive character over a 20-year period.

Geographic Concentration: Despite global expansion, Pictet remains headquartered in Geneva and culturally Swiss. The firm's Asia ambitions face competition from local institutions with deeper regional relationships and lower cost structures.

Regulatory Overhang: The DOJ settlement included a three-year deferred prosecution agreement. While the firm has implemented compliance enhancements, any future regulatory issues could trigger renewed scrutiny.

ESG Headwinds: Political backlash against ESG investing could affect flows to thematic strategies perceived as sustainability-oriented, even though Pictet's themes predate and transcend the ESG label.

Thematic Concentration Risk: With $72 billion in thematic strategies, any sustained underperformance in this signature capability would disproportionately impact the firm's franchise value.

Private Company Opacity: Unlisted status limits investor access to detailed financial information. While the firm now publishes annual results, disclosure remains less comprehensive than public company requirements.

Key Performance Indicators to Monitor

For investors and analysts tracking Pictet's ongoing performance, three metrics deserve particular attention:

1. Net New Money (NNM): While net new money for 2024 totalled CHF 11 billion, a decline of about 31 per cent from the previous year. This organic growth metric—distinct from market appreciation—reveals the firm's competitive position in attracting new client assets. Sustained NNM growth indicates the firm is gaining market share; declining NNM suggests competitive challenges or market saturation.

2. Assets Under Management by Business Line: The balance between Wealth Management (CHF 277 billion), Asset Management (CHF 291 billion), and Asset Services (CHF 234 billion) reveals the firm's business mix evolution. Asset Management growth, particularly in thematic strategies, signals the success of Pictet's differentiation strategy.

3. Partner Composition and Tenure: Changes in the partner roster—new appointments, retirements, and the mix of family versus non-family partners—provide leading indicators of cultural evolution. The firm's stated commitment to long partner tenures and merit-based selection deserves ongoing monitoring.

Conclusion: Lessons from 220 Years

What can investors and business strategists learn from Pictet's remarkable longevity?

Clarity of Purpose: Pictet has never strayed from wealth and asset management. No investment banking adventures, no commercial lending forays, no financial engineering experiments. This disciplined focus has prevented the conflicts of interest and risk accumulation that destroyed Credit Suisse.

Governance Aligned with Time Horizon: The partnership structure ensures that decision-makers bear personal consequences for outcomes that may not manifest for decades. This alignment eliminated the agency problems that lead publicly traded financial institutions toward excessive risk-taking.

Counter-Cyclical Thinking: Recruiting during crises, launching the Water fund at the dotcom peak, expanding in Asia during global uncertainty—Pictet's pattern of contrarian moves reflects the long-term perspective enabled by partnership ownership.

Evolution Without Revolution: The 2014 corporate restructuring demonstrated that even ancient institutions can adapt to changing circumstances without abandoning their core identity. The key is distinguishing between essential elements (partnership ethos, client focus) and adaptable forms (legal structure, geographic footprint).

"The (model) enabled us to go through world wars, economic crisis, financial crisis, turmoil, whatever has been thrown at us over the past 220 years."

In a financial services industry increasingly dominated by massive publicly traded institutions pursuing quarterly earnings targets, Pictet represents an alternative path—proof that patient capital, disciplined focus, and governance aligned with generational time horizons can deliver sustained success.

The family's motto, which is also the core principle of the business, is: "Do well and let it be said."

For 220 years, Pictet has done well. And now, at last, more are beginning to say.

Note: Pictet is an unlisted private partnership. Readers considering any investment in Pictet-managed funds should conduct thorough due diligence and consult qualified advisors regarding suitability for their individual circumstances.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Share on Reddit

Share on Reddit

Amazon Music

Amazon Music