Pro Medicus: The Forty-Year Overnight Success Story

I. Introduction: The 54,000 Percent Return That Almost Never Was

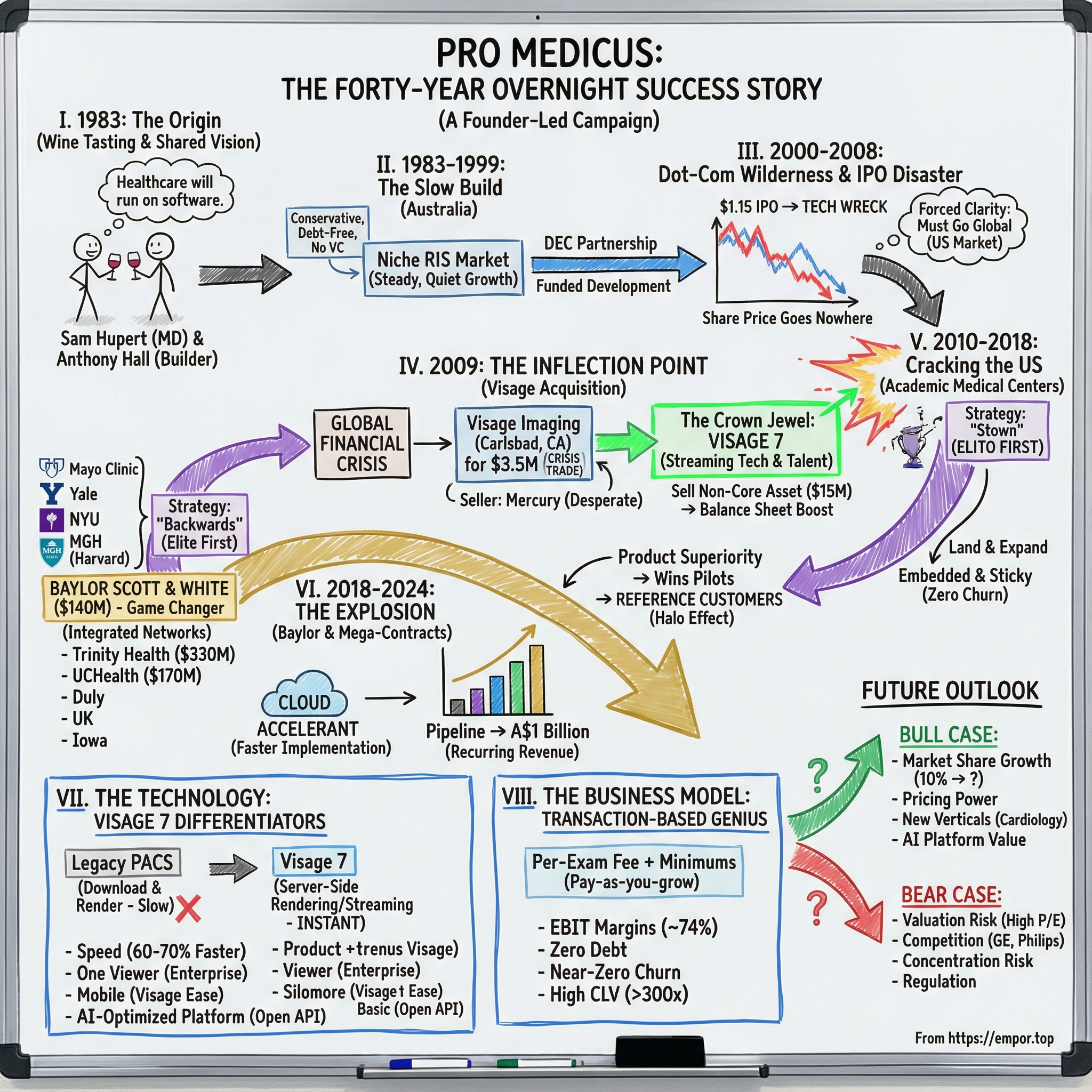

Picture a quiet stretch of Swan Street in Richmond, Melbourne. At number 450 sits a modest two-storey building that could pass for a dental practice or a small accounting office. Nothing about it signals “global software powerhouse.” And yet this is the headquarters of Pro Medicus Limited—one of the most extraordinary wealth creators in Australian market history.

In 2009, with the global financial crisis still shaking confidence everywhere, Pro Medicus made a move that barely registered outside the industry: it bought a struggling medical imaging company for $3.5 million. That deal became the hinge point. Today Pro Medicus is valued at around A$29 billion (about US$19 billion), and long-term shareholders have seen returns so extreme they read like a typo.

Its founders, Sam Hupert and Anthony Hall, didn’t come out of Silicon Valley. They didn’t raise venture capital. They met at a Burgundy tasting in the early 1980s, built for years in Australia’s small healthcare IT market, and stayed in the game through the dot-com implosion and a long stretch where the share price went nowhere. Now they sit atop one of the ASX’s newest $30 billion companies, each with a personal fortune exceeding $4 billion—and with a combined 46% stake, they’re still very much in control.

So here’s the question at the heart of the story: how did two founders from Melbourne, operating far from the spotlight, end up walking into America’s biggest hospital systems and systematically taking business from GE Healthcare, Philips, and Siemens?

The short version is decades of patience, one perfectly timed acquisition in the depths of a crisis, and a piece of technology so meaningfully better that some of the most demanding academic medical centers in the world started switching—then kept switching. This is a story about discipline and technical excellence, and about how a single inflection point can turn a solid niche business into a compounding machine.

And along the way, it offers a playbook investors should care about: why financial conservatism can be a superpower, why product superiority beats marketing noise in mission-critical software, and how switching costs—once earned—turn wins into momentum.

II. The Wine Tasting Origin Story: Founding & Early Years (1983–1999)

In 1983, Bob Hawke had just become Australia’s Prime Minister. Kim Hughes was captaining the cricket team. The IBM personal computer had barely arrived on Australian shores—and in Melbourne, “venture capital” wasn’t an ecosystem so much as a foreign concept.

And this is where Pro Medicus begins: not in a lab, or a boardroom, or a startup accelerator, but over Burgundy.

Sam Hupert and Anthony Hall met at a wine tasting in the early 1980s, the kind of scene Hupert would later describe as almost cinematic. “It was almost like a scene from that movie Sideways. The two of us were called in to taste a range of burgundies by an importer. We didn’t even know each other and we were sitting across the table.” They tasted, they spit, and they did what people with shared obsessions eventually do: they started talking. Hall, who was president of the Yarra Valley Wine and Food Society at the time, tried to recruit Hupert on the spot.

What made the pairing work wasn’t just the wine. It was the fit.

Hupert was a Monash medical graduate who’d started general practice in 1980. But even then, he could see where medicine was heading. Computers weren’t a curiosity; they were going to become infrastructure. He left general practice in late 1984, effectively betting his career on the idea that healthcare would someday run on software.

Hall was the builder. He would become the principal architect and developer of Pro Medicus’ core systems—an analyst programmer with a La Trobe University background and the kind of technical depth that turns ideas into working products. Hupert brought clinical credibility and an understanding of what doctors actually needed. Hall could make it real.

Their first problem was the same problem every early software company has—except they were solving it in 1980s Australia: how do you fund the build?

There were no angel networks. No seed rounds. No term sheets floating around cafés. Hupert later put it bluntly: “The VC market was almost non-existent, unlike today where it has become the norm for many founders to seek this type of funding. Regardless of the type of funding I do think there is a role for financial conservatism that enables founders to retain greater equity, and therefore greater control of their destiny.”

So they took a different route. Instead of selling chunks of the company, they found a partner who had a direct reason to want them to succeed. They struck a deal with Digital Equipment Corp—DEC—then the second-largest computer company in the world behind IBM. DEC helped fund what was, for the time, an exceptionally expensive software development effort. In return, Pro Medicus’ software helped make DEC’s machines more valuable. It was a hardware giant underwriting a software bet, and it let the founders keep control.

That decision—stay conservative, avoid dilution, build patiently—became more than a funding solution. It became the company’s operating system.

Through the 1980s and 1990s, Pro Medicus grew the unglamorous way: methodically. They built radiology information systems for Australian medical practices and established themselves in a small, steady healthcare IT market. It wasn’t headline-grabbing growth. It was the kind that compounds quietly—product by product, customer by customer—until one day you realize the “small Australian vendor” is deeply embedded in a mission-critical workflow.

By the late 1990s, as internet mania began to sweep across the world, Pro Medicus had something rare: a real business, built on real customers, run by founders who were still playing the long game. The question was whether that disciplined, Australia-first company could ever find a path to something bigger.

III. The Dot-Com IPO Disaster & Wilderness Years (2000–2008)

By 2000, Pro Medicus had been grinding away for 17 years. It had real customers, real revenue, and founders who’d built the company the slow, disciplined way. Going public was supposed to be the moment they graduated from “solid Australian niche business” to something bigger—capital to expand, profile to recruit, and a liquid currency for whatever came next.

Pro Medicus listed on the ASX on 10 October 2000 at $1.15 a share. It wasn’t a frothy dot-com story; it was a serious company that happened to be in software. And that distinction didn’t matter at all, because the market was about to punish anything with “tech” attached to it.

Hupert remembers the timing like a bad dream. “My family and I went away on a weekend. Kids were young and I remember waking up to Jim Whaley on Sunday morning with his booming voice going, ‘Dow and NASDAQ in turmoil, World Markets decline.’ And I thought, well, wake up Sam, it’s a nightmare. But as it turned out it was true. Tech wreck occurred just the weekend before we were announcing our IPO back in March and we just thought, oh no, what awful timing, this is going to take years.”

It did take years.

The tech wreck was merciless. Companies that had raised huge sums vanished. Investors stampeded out of the category. And Pro Medicus—profitable, conservative, and selling mission-critical software to hospitals—got dragged down anyway. The IPO that was meant to fund expansion instead became the starting gun for a long stretch where the share price went nowhere and the outside world mostly stopped paying attention.

Inside the business, things kept moving. Hupert oversaw a strong period of growth from the 2000 listing through to October 2007, when he retired as Managing Director and CEO to become Deputy Chairman and an Executive Director. But the bigger vision—becoming a global imaging software leader—still wasn’t in reach. Australia was a good market, but it wasn’t a big enough market to produce the kind of outcome the founders were building toward.

Hupert would later describe that era with typical understatement: “We had a good patch around the 2000s, and then we had a little bit of a stumble at around 2008, 2009, but we were able to regroup and take a business that was largely Australian-focused and make it a lot more global. With the Visage acquisition, we all of a sudden went from an office in Melbourne, Australia to having offices globally.”

That line matters because it tells you what the wilderness years did: they forced clarity. Pro Medicus could either accept its fate as a high-quality Australian software vendor—or it could find a way to get into the only market that could really move the needle.

The U.S. was that market. It represented roughly 60% of global healthcare spending, and its biggest hospitals had both the complexity and the budgets to justify next-generation imaging technology. The problem was obvious: cracking America from Melbourne is expensive, slow, and usually requires raising a lot of capital.

Most companies would have taken the obvious route—hire a U.S. sales force, build presence brick by brick, and hope patience (and cash) held out.

Pro Medicus didn’t do that. Its path to America came from somewhere else entirely—out of the wreckage of 2008, and through a deal that, at the time, looked almost invisible.

IV. The Visage Acquisition: The Inflection Point That Changed Everything

If there’s one move that flipped Pro Medicus from a strong Australian niche player into a credible global contender, it happened in January 2009—right in the middle of the worst financial crisis since the Great Depression.

That month, Pro Medicus announced it had acquired Visage Imaging, a leader in digital imaging and advanced 3D visualization technology based in Carlsbad, California.

Visage wasn’t a startup. It was the life sciences subsidiary of Mercury Computer Systems, a NASDAQ-listed company, and it reportedly had an established footprint in the U.S. and Europe, with around 1,200 clients using its health-related visualization technologies. But inside Mercury, Visage had become a problem: it was generating the company’s most significant operating losses. Mercury’s message at the time was blunt—they were selling, and they were relieved about it. The deal “removes the business that has been generating Mercury’s most significant operating losses,” Mercury said, and helped advance its “portfolio rationalization.”

The price: about $3.5 million. In hindsight it reads like a rounding error. In the moment, it was a classic crisis trade: the seller was desperate, and the buyer had both the patience and the balance sheet to move.

What Mercury treated as a money-losing distraction, Pro Medicus saw as the future. Visage had developed compression technology that let doctors view high-resolution medical images from essentially any device. Pro Medicus recognized what that implied: if you could make radiology images fast and accessible without compromise, you could win in the U.S.—the most demanding market on earth.

And crucially, Pro Medicus didn’t have to beg for capital to do it. Hupert framed the acquisition as proof that the company’s old-school conservatism wasn’t caution—it was optionality:

“We were able to secure this business at a time when asset prices have collapsed, far more so than anyone would have predicted even six months ago and have done so without the need to raise additional capital. I believe this vindicates our decision as a Board to maintain a conservative, debt-free balance sheet with significant cash reserves.”

While other companies were cutting to the bone just to survive, Pro Medicus was shopping.

But Visage wasn’t only code. It was talent. Along with the acquisition came Dr. Malte Westerhoff, who became Pro Medicus’ Global Chief Technology Officer and General Manager of Visage Imaging GmbH. He brought a deep technical background—physics and a PhD spanning computer science and mathematics—and a track record in scientific visualization, high-performance computing, and patents. More importantly, he led the Berlin-based development team behind what would become the crown jewel: Visage 7, a viewer platform built on an architecture that was fundamentally different from the legacy approaches dominating radiology.

Then Pro Medicus did something that made the deal even more astonishing. It sold off a piece of what it had acquired that didn’t fit the long-term strategy. The Amira business—which came with Visage—was sold to a Europe-based IT company, boosting Pro Medicus’ balance sheet by A$14.8 million.

So the sequence was almost absurd: acquire Visage for $3.5 million, sell a non-core asset for nearly A$15 million, and keep the most valuable part of the acquisition—Visage 7—while effectively making money on the transaction.

This was the inflection point. Mercury wanted out of life sciences so it could refocus on defense-related software. Pro Medicus wanted in—because Visage gave them what they’d never had before: an instant global footprint. Offices in San Diego and Berlin. Existing customer relationships in the U.S. and Europe. A platform that could credibly go head-to-head with the incumbents.

For investors, the lesson is simple and worth remembering: the best acquisitions often happen when the seller is trying to escape and the buyer is prepared. Mercury just wanted the losses off its books. Pro Medicus understood what it was buying—and had the cash, discipline, and conviction to act when most of the world was frozen.

V. Cracking the US Market: The Academic Medical Center Strategy (2010–2018)

With Visage in the fold and Visage 7 emerging as the product they could truly take global, Pro Medicus ran headfirst into the question that decides whether a company stays “promising” or becomes inevitable: how does a small team in Melbourne beat GE, Philips, and Siemens on their home turf?

Their answer was almost perversely ambitious. Instead of going after smaller hospitals where procurement might be easier and the sales cycles shorter, Pro Medicus aimed straight at the hardest customers in the world: America’s academic medical centers.

Hupert later said they effectively did it backwards—winning a run of top-tier institutions first. The list reads like a roll call of modern medicine: Mayo Clinic, Yale, NYU, the University of California system, and Harvard Medical School’s Massachusetts General Hospital.

This wasn’t vanity. It was strategy.

Academic medical centers are where radiology is at its most demanding. The radiologists are elite, the imaging volumes are enormous, and the IT teams are good enough to pull competing systems apart. These hospitals don’t buy because a vendor has the biggest booth at the conference. They buy because the tech holds up under pressure. If you can win at Mayo, you don’t need to argue that you’re credible. The customer just made the argument for you.

And make no mistake, the matchup was ridiculous on paper. As Hupert put it: “This was David and Goliath. It’s sort of GE and Phillips and Siemens. These are huge global businesses and little Pro Medicus at the time from Melbourne, Australia winning a contract that changed the course in many ways of the direction of your business.”

Pro Medicus didn’t win by being cheaper. It won by being better in the ways that matter when doctors are reading scans all day: speed, performance, reliability, and clinical workflow. In many competitive tenders, hospitals ran on-site pilots that forced products to prove themselves in the real world. And Pro Medicus kept coming out on top.

Once they got a foot in the door, they leaned into a classic enterprise play: land and expand. A hospital might start with the viewer, then add more components as confidence grew. Over time, contracts got bigger—not just because Pro Medicus signed new logos, but because existing customers renewed at higher prices and increasingly adopted more of the stack.

Then the flywheel kicked in.

Every academic medical center win created a halo. These are reference customers with gravity; their decisions travel through the industry. Suddenly the sales conversation wasn’t, “Trust us.” It was, “Here’s who already trusts us.” In healthcare, where risk aversion is rational, that kind of proof is priceless.

And once a system went live, it tended to stay live. Pro Medicus has retained every Visage customer since 2009—an almost unheard-of record in enterprise software, especially in something as mission-critical as imaging.

By 2018, this “backwards” strategy had become a beachhead. Pro Medicus was embedded in nine of the top twenty ranked U.S. hospitals—more than double its nearest competitor. The foundation was in place. The only question left was how fast the rest of the market would follow.

VI. The Baylor Breakthrough & Contract Explosion (2018–2024)

This is the phase of the Pro Medicus story where the wins stop sounding like “great progress” and start sounding like, how is this even possible?

For years, the company had been doing the hard, slow work in the U.S.—earning trust inside academic medical centers where the product has to perform under real clinical pressure. That reputation turned into something far more valuable than marketing: a set of reference customers so strong that the biggest health systems in America started taking the call.

The moment it became obvious was Baylor Scott & White Health.

In September 2023, Pro Medicus announced a contract with Baylor Scott & White Health for a committed minimum value of A$140 million over 10 years. It was, by a wide margin, the largest contract the company had ever signed—more than triple the previous record. Baylor Scott & White was also strategically important: it was Pro Medicus’ first major client in Texas, and one of the largest not-for-profit healthcare systems in the United States.

The deal wasn’t just “big for Pro Medicus.” It was a step-change. It was worth about $52 million more than all the other contracts Pro Medicus had signed that year combined, and once implementation is complete, nearly 500 radiologists at Baylor Scott & White will be using Visage 7. The scale of the customer says everything about how far the company had come: Baylor Scott & White has 5,000 licensed beds across 51 hospitals.

Baylor mattered because it proved something new. Up to that point, Pro Medicus’ beachhead had been elite academic medical centers. Baylor showed it could win—and deliver—inside an integrated delivery network, the kind of large, operationally complex system that represents the bulk of U.S. hospital capacity. In other words: Visage wasn’t just a best-in-class tool for the top of the market. It could be the standard platform across the entire market.

And once that door opened, the contract cadence changed.

In November 2024, Pro Medicus signed a US$330 million, 10-year contract with Trinity Health, one of the largest not-for-profit health care systems in the U.S. The deal alone lifted Pro Medicus’ U.S. market share from 7% to 8%, and it reset expectations for what “normal” looked like. The company would later report roughly A$520 million in major contracts signed across FY25, with Trinity as the headline.

Then came more. After 30 June 2025, Pro Medicus signed a $170 million, 10-year contract with UCHealth that included the Visage 7 Cardiology offering, plus a $20 million, five-year renewal with Franciscan Missionaries of Our Lady Health System that included Visage 7 Open Archive in the cloud.

Trinity, in particular, illustrated the magnitude of the shift. Its minimum annualised value of $33 million ran more than 13 times higher than Pro Medicus’ historical average of about $2.5 million per year. This wasn’t the old world of smaller departmental wins. This was enterprise-scale imaging infrastructure.

And the rest of the announcements started to read like a drumbeat: a $30 million, seven-year contract with Duly Health and Care; $33 million over nine years with the University of Kentucky; $5 million over seven years with Lurie Children’s Hospital; $53 million over seven years with BayCare; $40 million over seven years with Lucid Health; $20 million over five years with the University of Iowa Health Care.

Underneath the headlines, there was another accelerant: the cloud.

Over the past five years, 100% of Visage’s new PACS customers have been implemented in the cloud, with no limitation in scale, scope, or clinical mission. Hupert has pointed to cloud delivery as a major reason implementation speeds improved: “We are increasing the speed at which we can implement and the cloud has certainly been a factor… it provides a more standardised environment minus a hardware purchasing cycle which previously could take between six and nine months. With the cloud, we can spin up a version of Visage in a matter of days.”

So yes, the contract numbers are eye-catching. But what they really represent is something more durable: long-term relationships, typically seven to ten years, that turn a “win” into recurring revenue and predictable cash flow. The contracted forward revenue pipeline has climbed toward A$1 billion, and with it comes a kind of visibility—and momentum—that most software companies spend decades trying to earn.

VII. The Technology: What Makes Visage 7 Different?

To understand why Pro Medicus has been able to walk into the U.S. market and take deals off incumbents, you have to understand what Visage 7 actually is. This isn’t a marginally nicer interface on the same old plumbing. It’s a different way of building PACS—Picture Archiving and Communication Systems—from the ground up.

At the core is the architecture. Visage 7 uses server-side rendering and streams images to the user through an intelligent thin client. The heavy lifting happens on the server: the DICOM data is processed there, and the full dataset doesn’t need to be shipped out to every workstation just so someone can pan, zoom, and scroll. The experience is the same on PC and Mac, app-based, with no plugins.

That sounds technical, but here’s the practical point: it flips the old model on its head.

Legacy PACS generally work like this: compress the study, send it to the radiologist’s machine, decompress it, then render it locally. And in modern radiology, “a study” can mean a CT with thousands of images—several gigabytes of data. If you do that over and over, all day long, seconds turn into minutes. And minutes turn into a backlog.

Visage 7 takes the opposite approach. In its words, “Our unique streaming technology allows instant access to image data for better patient care and increased efficiency.” Instead of pushing entire image sets down to the client, Visage renders server-side and streams only what the user is actually looking at, in real time.

Under the hood, the architecture includes a virtualisable Visage Backend Server connected via patented streaming to one or more Visage Render Servers powered by commercially available GPUs. The streaming is platform-independent and designed to work even on consumer-grade bandwidth—down to about 6 Mbps—and even over setups like VPN and Citrix. And because studies aren’t cached to local disk, current and prior images can be displayed nearly instantly, on demand.

The result is simple: speed. Industry sources suggest Visage is roughly 60–70% faster than legacy PACS, which can translate into materially higher reading throughput—some customers growing volumes at two to three times the pace they could manage on older systems.

Speed, in radiology, is not a “nice to have.” It’s capacity.

Hospitals and outpatient practices are dealing with two forces at once: demand for imaging keeps rising, while radiologist shortages are real. And radiologists aren’t cheap. They’re among the highest-paid professionals in healthcare, often earning hundreds of thousands of dollars a year. So if software makes each radiologist meaningfully more productive—if it removes the friction of waiting for images to load, comparing priors, switching viewers—the labor economics get compelling very quickly. The value isn’t in saving a few seconds. The value is turning workflow bottlenecks into additional clinical output.

Visage 7 also aims at another pain point: tool sprawl.

The Visage 7 Enterprise Imaging Platform is designed to be fast, clinically rich, and highly scalable, and it can be delivered entirely from the cloud. It supports what the company calls a One Viewer philosophy: diagnostic, clinical, specialty, research, and mobile imaging workflows from a single platform.

That matters because big health systems often have a patchwork of viewers across departments—radiology, cardiology, and beyond—each with its own interface, training burden, and IT overhead. A single viewer reduces complexity, lowers training requirements, and makes it easier to standardize workflows across a large enterprise.

And that “enterprise” part isn’t theoretical. Visage Imaging, Pro Medicus’ wholly owned subsidiary, architected Visage 7 to support the largest healthcare organizations, where scale isn’t just “more studies,” it’s more sites, more modalities, more clinicians, more concurrent users. Visage 7 is built to be one platform across that whole footprint, including mobile support through Visage Ease.

Mobile is increasingly part of the job now. With Visage Ease Pro, physicians can interpret diagnostic imaging studies stored on a Visage 7 server from wherever they are—home, the surgical suite, another facility—with diagnostic-quality visualization. In a world where speed of decision-making can matter as much as the decision itself, that flexibility is a real feature, not a gimmick.

Then there’s the next wave: AI.

AI in medical imaging is moving fast enough that hospitals don’t just want “an AI feature.” They want an imaging foundation that can support AI-inference workflow prioritization, integrate AI results without disrupting interpretation, and accommodate different kinds of algorithms—Visage-native, third-party, co-developed, or self-developed.

That’s where Pro Medicus positions Visage 7 as an “AI optimized” enterprise imaging platform built for the cloud. And it’s why the platform’s openness matters. Pro Medicus’ open API allows third-party AI models to be embedded into Visage 7, pushing the system toward an ecosystem approach—more like a platform that can absorb whatever the next diagnostic breakthrough looks like, rather than a closed product that risks aging out.

Put it together and the differentiation becomes clear: Visage 7 isn’t just faster. It’s built to remove friction from the entire imaging workflow—across devices, across departments, and increasingly across an expanding universe of AI tools. In mission-critical enterprise software, that’s how you win.

VIII. The Business Model: Transaction-Based Genius

Pro Medicus has built one of the cleanest business models in enterprise software—one that aligns its economics with what hospitals actually care about: getting more imaging done, faster, with less friction.

Most customers sign long-term contracts, typically five to ten years. And instead of charging purely “per seat” or as a big upfront license, Pro Medicus leans on a transaction-based model tied to real-world usage. A meaningful portion of revenue comes from recurring software licensing and transaction fees, which means once a system is live, the revenue stream tends to behave more like an annuity than a one-off project.

The mechanics are straightforward. There’s a per-exam fee, usually supported by minimum volume commitments in the contract. On top of that are support fees—installation, upgrades, training—and a one-time customer data migration fee, typically around 5%, to move imaging history onto the platform.

In practice, it’s a pay-per-transaction model with baselines. Hospitals get a predictable floor, and above that, a “pay as you grow” structure. For Pro Medicus, that mix is powerful: transactions make up the bulk of revenue, with baseline/fixed revenue, on-site hardware, and professional services filling out the rest. The point isn’t just recurring revenue—it’s recurring revenue that expands automatically with usage.

That creates an unusually strong alignment. If imaging volumes rise—because the population grows, demographics age, or clinicians simply rely more on imaging—Pro Medicus shares in that growth without having to renegotiate the whole relationship. Revenue scales with customer activity.

The financial profile this produces is, frankly, rare. In FY25, underlying EBIT margins hit a record 74%. The company held about A$210 million in cash and carried no debt. And it did all of this with an exceptionally lean team: 132 employees generated A$213 million in revenue, or roughly A$1.6 million per employee—an efficiency level that puts it in the top tier of global software.

Even more important for the durability of those numbers: churn is effectively near zero, and gross margins have been reported as extremely high.

The SaaS-like shape is obvious in the mix. Around 90% of revenue is recurring from long-term hospital contracts. Gross margins exceed 85%, which is what you’d expect from best-in-class software. And customer lifetime value relative to acquisition cost is off the charts—more than 300x—meaning each hard-won customer tends to pay back sales effort many times over.

Returns on capital reinforce the same story. Return on equity has been about 51.82%, and return on invested capital about 43.93%—the kind of numbers you only see when you have real pricing power, high switching costs, and a product that customers don’t want to rip out once it’s embedded.

Cash generation matches the accounting profits, too. For the year to June 30, free cash flow conversion was close to 90%, while the balance sheet stayed strong.

And the model doesn’t just compound on volume—it compounds on price. Over the last three years, renewals have averaged 6–8% price increases. When customers expand from a single module to a full-stack PACS solution, pricing has stepped up materially, with uplifts of 30–40%. The pattern is simple: customers pay more, adopt more of the platform, and stay for a long time.

For investors, the key takeaway is that Pro Medicus doesn’t rely on constantly landing brand-new customers just to keep growing. Growth comes from two engines at once: winning new systems, and expanding inside existing ones as volumes rise and customers add more of the stack. Combined with near-zero churn, it creates unusually strong earnings visibility—and a business that can compound with very little drama.

IX. The Competitive Landscape: David vs. Multiple Goliaths

For most of the industry’s history, PACS wasn’t really a “software category.” It was a feature of buying imaging hardware. The big players could bundle the viewer with the scanners, wrap it into a broader enterprise contract, and make life painful for anyone trying to compete on software alone.

That bundling helped create a market that’s both huge and unusually concentrated. The top handful of vendors control the majority of global share, with names you’d expect: GE Healthcare, Philips, Siemens Healthineers, Fujifilm, McKesson, and AGFA sitting in and around the center of gravity.

But the incumbents’ grip comes with a weakness: a lot of the installed base is old. And radiology has changed faster than many of those legacy systems were built to handle. Imaging studies have ballooned in size with newer scanners. Files are bigger, workflows are more complex, and clinicians increasingly expect “open on any device, instantly” performance. When the system can’t keep up, the symptom is simple and brutal: waiting. Waiting to load, waiting to compare priors, waiting for tools to respond. And in radiology, those delays compound into lower throughput and more backlogs.

That’s the opening challengers have been running at.

Some are focused specialists. Sectra and Intelerad, for example, have pushed modern architectures and features like AI integration designed to streamline workflow and image analysis. And in a market where a single decision can lock in a platform for years, even a small shift in “who gets considered” can matter a lot.

The most direct head-to-head competitor for Pro Medicus today is Sectra, the Swedish imaging IT company with meaningful scale in Europe and North America. If you talk to buyers, the dynamic often comes down to a shortlist where Pro Medicus and Sectra are the two modern, specialist alternatives to the legacy suites. Pro Medicus has been radiology-first and has been expanding toward cardiology imaging as well.

Importantly, this is not a market where Pro Medicus wins every time. In 2020, Sectra beat Pro Medicus in Australia for a major New South Wales Health deal—about A$85 million over 13 years—for both RIS and PACS. It’s one of the clearer reminders that even with a strong product, competition is real and procurement outcomes can swing.

In the U.S., survey work on recent PACS procurements has also shown just how present Sectra is in competitive cycles: it’s frequently considered, and it’s been selected often enough to be a meaningful force.

So why has Pro Medicus still been able to grow faster—and at much higher margins—than most of the field?

A lot of it comes back to the same themes we’ve been circling all episode. Cloud delivery is no longer a nice differentiator; it’s becoming table stakes, and Pro Medicus has years of real-world cloud deployments behind it. The speed and responsiveness that come from server-side streaming are hard to match without rebuilding the product, not just polishing it. And because Pro Medicus isn’t trying to be a hardware company, it can keep its attention and R&D concentrated on the imaging software layer.

That said, there’s a serious bear case, and it’s worth taking at face value. Morningstar’s view captures it cleanly: product differentiation may not last forever. Barriers to entry aren’t insurmountable, and larger competitors are already adopting server-side rendering and cloud-native architectures. If the gap closes, pricing power and win rates could come under pressure.

The bull case is that “catching up” is harder than it sounds. Pro Medicus isn’t just selling a faster viewer; it’s selling into environments where switching is painful, risky, and politically difficult. Once a health system commits to an enterprise imaging platform on a seven-to-ten year contract, with workflows built around it and near-zero churn across the customer base, the incumbent advantage flips. Now Pro Medicus is the installed base.

Yes, GE, Philips, and Siemens can intensify competition. But displacing a platform that’s already embedded, already trusted, and already delivering speed and cloud performance isn’t just about having comparable features. It’s about convincing a hospital to take on the disruption. And that is a very high bar.

X. Playbook: Lessons from the Pro Medicus Journey

The Pro Medicus story isn’t just an outlier stock chart. It’s a case study in how a small, disciplined software company can outlast the hype cycles, outbuild much larger rivals, and compound for decades.

Lesson 1: Financial Conservatism Enables Destiny Control

“There is a role for financial conservatism that enables founders to retain greater equity, and therefore greater control of their destiny.”

Hupert and Hall never went down the venture capital path. Early on, they financed development through their partnership with Digital Equipment Corp, and after that they did the unsexy thing: they reinvested, year after year, and kept the balance sheet conservative.

That conservative posture became a strategic weapon in 2009. When Visage suddenly became available in the depths of the financial crisis, Pro Medicus didn’t need to run a funding process, ask anyone’s permission, or dilute shareholders. It could just act.

And the payoff is still visible in the cap table. Today, both founders retain roughly 24% ownership each. Together, that’s close to half the company—effective control that keeps decision-making anchored in long-term value creation, not short-term optics.

Lesson 2: Product Excellence Beats Sales Excellence

Pro Medicus has grown by winning new Visage 7 customers, renewing and expanding existing ones, and steadily lifting its price point as the platform becomes more central to hospital workflows. In fiscal 2021, it won six out of six major public tenders it competed for—competitions that often included on-site pilot tests where the software had to perform in the real world.

What’s striking is how few people it takes to do this. Pro Medicus employs about 132 people globally, a tiny footprint compared to what the big incumbents can field.

The play is simple: don’t outsell the giants; out-product them. Let Visage 7 win the pilot. Then let the customers do what customers in healthcare always do when something works: tell other hospitals they trust.

Lesson 3: Patience Is a Competitive Advantage

“This is a story of patience, persistence, and perseverance.”

Pro Medicus was founded in 1983 and didn’t start seeing meaningful U.S. traction until after 2009—more than two decades of building before the market that truly mattered opened up. The Visage acquisition itself came 26 years into the company’s life. The breakout phase didn’t arrive until the mid-2010s, more than 30 years after founding.

That timeline is the point. Most founders would have sold. Most investors would have lost interest. Pro Medicus kept building anyway, and when the right moment finally arrived, it was ready.

Lesson 4: Crisis Creates Opportunity

The Visage acquisition is a clean illustration of what it looks like to move when everyone else is frozen. In January 2009, the global economy was in freefall. Markets were collapsing. Mercury Computer Systems wanted out of a unit it saw as a money-losing distraction.

Pro Medicus saw the same asset and recognized it as a step-function in capability—a platform that could take it into the U.S. at the highest end of the market. It paid about $3.5 million, and that deal ultimately helped lay the foundation for a company worth around A$30 billion.

That’s the punchline: the best opportunities don’t usually show up when things feel safe. They show up when you’ve built the balance sheet, the patience, and the conviction to act in a storm.

XI. Bull Case: Why Pro Medicus Could Continue Compounding

The bullish view on Pro Medicus isn’t built on one heroic assumption. It’s built on a set of forces that reinforce each other: plenty of room left in the U.S., proven ability to raise prices, credible expansion into adjacent imaging categories, and an emerging platform position as AI becomes part of everyday clinical workflow.

Market Share Runway Remains Long

Pro Medicus CEO Dr Sam Hupert has been clear-eyed about where they are in the U.S.: “We now have around 10% of the total addressable market in the USA which is material, but it also means there is plenty of scope for further growth.”

That matters because 10% is both a milestone and a starting line. If Visage continues to outperform in real-world evaluations—and if the reference-customer flywheel keeps working—there’s no obvious structural ceiling that says Pro Medicus has to stop here. A path to something like 25–30% share over the next decade would imply a very different scale of business than today.

Pricing Power Continues to Strengthen

Pro Medicus has already shown it can lift pricing without breaking the relationship. Contract renewals have tended to land with mid-single-digit price increases, and when customers expand from point solutions to more of the full stack, the revenue uplift can be meaningfully larger.

The logic is simple: as Visage becomes more embedded, the cost and risk of switching goes up. And in mission-critical software, higher switching costs usually don’t weaken pricing power—they harden it.

New Verticals Extend the Addressable Market

Radiology is the beachhead, but it’s not necessarily the endpoint. Expansion into cardiology broadens the addressable market, and Pro Medicus has now onboarded its first cardiology clients. Cardiology imaging also tends to support stronger pricing and faces a different competitive set, making it a natural adjacency for a platform already designed to handle complex imaging workflows.

And cardiology may not be the last stop. Pathology, ophthalmology, and other specialty imaging categories offer additional vectors over time—each one extending the market opportunity while reusing the same underlying platform.

AI Integration Creates Platform Value

Visage 7 is increasingly positioned as more than a viewer. It’s becoming a workflow hub where third-party AI models can plug in and deliver results inside the same clinical environment radiologists already use. If that ecosystem grows, the platform starts to look less like a single product and more like infrastructure—something hospitals build around.

And if radiology AI continues to mature, Pro Medicus could be positioned to add per-study AI analysis fees on top of the existing imaging economics, creating an incremental recurring revenue stream that rides on the same installed base.

XII. Bear Case: The Risks That Could Derail the Story

No investment thesis is complete without a clear-eyed look at what could break the narrative.

Valuation Leaves No Margin for Error

Pro Medicus doesn’t trade like a normal “good business.” It trades like a near-perfect one. The trailing P/E has been about 269, and the forward P/E about 195. Put differently: the market is already paying today for a lot of tomorrow.

At 200+ times earnings, even a relatively small disappointment can hurt. A major contract loss. Implementations taking longer than expected. Pricing pressure showing up in renewals. Any of those could lead to sharp multiple compression—even if the company is still growing and still profitable.

There’s also a demand question hiding inside the valuation. Visage 7 clearly resonates with the most sophisticated buyers—U.S. academic medical centers and large health systems that care deeply about advanced visualization and workflow performance. But if that appeal doesn’t translate as quickly into broader adoption outside the top tier of providers, growth could slow while the stock price still assumes it won’t.

Competition Could Intensify

Pro Medicus’ edge has been product superiority—especially performance, architecture, and cloud delivery. The risk is that this differentiation is not permanent.

Larger competitors are already moving toward server-side rendering and cloud-native approaches. And the giants—GE, Philips, Siemens—have two advantages Pro Medicus can’t manufacture overnight: enormous budgets and deeply entrenched relationships across hospital systems. If they decide imaging software is strategically important again and invest aggressively, competitive pressure could rise fast.

Customer Concentration Risk

The shift to mega-contracts is a double-edged sword. Deals like Trinity Health and UCHealth can transform the revenue base—but they also concentrate it.

If a major customer were to hit financial distress, slow rollout plans, or ultimately switch vendors at the end of a contract term, the impact wouldn’t be subtle. When contracts are measured in decades and tens or hundreds of millions, a single decision can move the needle.

Regulatory and Healthcare Policy Uncertainty

Healthcare IT is a regulated environment, and imaging software can sit close to the line of what counts as a medical device, including FDA clearance requirements. On top of that, healthcare policy is never stable for long. Changes to reimbursement, shifts in procurement behavior, or tighter data privacy rules could alter buying decisions and implementation timelines in ways that are hard to predict.

XIII. Framework Analysis: Moats and Competitive Position

Porter’s Five Forces is a useful way to sanity-check what we’ve been feeling intuitively through the story: this is a tough market, but the toughest part isn’t writing the software. It’s getting in, and then staying in.

Porter’s Five Forces Assessment:

Threat of New Entrants: Moderate

Building enterprise imaging software still takes serious R&D, deep domain knowledge, and real regulatory competence. That said, cloud infrastructure has lowered the “plumbing” barrier versus the old on-prem world. The bigger gate isn’t technology. It’s the fact that hospitals don’t want to switch once they’ve committed.

Buyer Power: Low to Moderate

Yes, large health systems have leverage when they’re negotiating the initial deal. But once a seven-to-ten year contract is signed and the platform is embedded in daily clinical workflow, the balance shifts. The usage-driven economics also matter: as imaging volumes rise, Pro Medicus participates in that growth, and customers are less inclined to constantly reopen pricing midstream. The product becomes sticky, and stickiness becomes bargaining power.

Supplier Power: Low

This is software. The “suppliers” are largely standard IT infrastructure and cloud services, which gives Pro Medicus flexibility and reduces the risk of being boxed in by a single vendor relationship.

Threat of Substitutes: Low

Radiology requires diagnostic-grade visualization, workflow tools, and compliance features. A generic image viewer isn’t a substitute for a PACS that can run a hospital’s imaging operations.

Competitive Rivalry: High

This is the one force that’s unambiguously intense. Pro Medicus is competing against deep-pocketed players like GE, Philips, Siemens, Sectra, and Fujifilm. Winning requires being meaningfully better, not just slightly different.

Hamilton Helmer’s 7 Powers Analysis:

Switching Costs: Very Strong

This is the core moat. When contracts run seven to ten years, and the software is deeply integrated into workflows, training, and IT infrastructure, switching becomes disruptive and risky. Pro Medicus’ 100% customer retention since 2009 is the cleanest proof point: once customers go live, they don’t leave.

Scale Economies: Moderate

Like any software business, Pro Medicus benefits as development costs spread across more customers. But it also competes with companies that are much larger and could, in theory, outspend it. Scale helps, but it’s not the whole story here.

Network Effects: Emerging

There’s a plausible flywheel forming around AI. More customers can mean more imaging data and more real-world integration points for algorithms; better AI workflows can make the platform more valuable; more value can attract more customers. This dynamic is still early, but it’s one of the more interesting long-term levers.

Counter-Positioning: Strong

Legacy PACS vendors are constrained by their installed bases and, in many cases, hardware-centric economics. Moving customers to cloud-first deployments can cannibalize existing revenue streams and force uncomfortable transitions. For Pro Medicus, cloud is a natural posture, not a threat to the core.

Cornered Resource: Moderate

The Berlin development team and its deep expertise in server-side streaming is a real advantage. It’s specialized know-how that’s been refined over time. But it’s not impossible for well-resourced competitors to hire talent and build similar capabilities.

Process Power: Moderate

Doing implementations repeatedly—at large scale—builds playbooks, muscle memory, and operational advantages. Over time, that can become a quiet edge, especially when hospitals care as much about “will this go smoothly?” as “is it fast?”

Branding: Moderate

Within the top tier of U.S. academic medical centers, the reputation is strong. Outside healthcare IT circles, the brand isn’t broadly known—but in this market, credibility with the right reference customers matters more than consumer recognition.

XIV. Key Performance Indicators: What to Watch

If you want to track whether Pro Medicus is still executing the same playbook that got it here, three signals matter most:

1. New Contract Annual Value (New ACV)

New contract wins are the events that tend to move the share price, because they’re the clearest proof of momentum in the U.S. market. Pay attention to both the number of wins and what the average deal looks like. If new wins start skewing smaller, it can be a sign the company is bumping up against saturation in the top tier. If they keep skewing larger, it suggests Pro Medicus is still breaking into the biggest health systems—and turning those wins into enterprise-wide standardization.

2. Customer Retention / Churn Rate

The 100% retention rate since 2009 is one of the strongest “moat” data points you’ll find in any enterprise software business. That also means the bar is high: the first meaningful customer loss, especially a marquee U.S. system, would be a real crack in the story. Watch renewals, and just as importantly, watch for silence—whether big customers quietly stop appearing in announcements and case studies.

3. EBIT Margin

Pro Medicus has been operating at extraordinary profitability, with EBIT margins around the mid-70s. As long as margins stay above roughly 70%, it’s a sign that pricing power and operating discipline are intact. If margins slide toward the mid-60s, the why matters: it could be competition biting, or it could be the company deliberately spending more to capture a bigger prize. Either way, it’s the fastest way to see whether the economics are holding up as the business scales.

XV. Conclusion: The Forty-Year Overnight Success

At its core, the Pro Medicus story is about patience and discipline in a world that rewards noise.

Two founders who met over Burgundy built for decades before anyone called it an “overnight success.” They protected ownership when the easy move was dilution. They stayed debt-free when leverage was fashionable. They prioritized product performance over sales theater. And when the right asset finally appeared—cheap, overlooked, and available only because a bigger company wanted it off the books—they were ready to move.

The payoff, in hindsight, is almost absurd. After years of grinding and a low point around 2011, the company’s shares went on to rise about 30,000% over the following decade. Along the way, Sam Hupert and Anthony Hall became billionaires—though Hupert, by most accounts, still carries himself less like a tech titan and more like the doctor he started out as.

From here, the question isn’t whether Pro Medicus built something great. It clearly did. The question is whether it can keep compounding fast enough to justify the kind of valuation the market now assigns it.

The bull case is straightforward: more U.S. market share, steady pricing power, expansion into new imaging verticals, and a platform role as AI becomes part of everyday clinical workflow. The bear case is equally clear: competitors closing the product gap, the fragility that comes with mega-customer concentration, and the reality that when expectations are this high, even “good” execution can disappoint investors.

But one thing feels settled. Pro Medicus has assembled the kind of machine investors spend their whole careers looking for: mission-critical software, long contracts, high recurring margins, near-zero churn, and a founder-led culture that still behaves like it’s playing the long game.

It’s proof that world-class software businesses can be built far from Silicon Valley—and that in the right hands, time isn’t the enemy. It’s the advantage.

The forty-year overnight success story is still being written.

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music