Silicon 2: The Kingmaker of K-Beauty

I. Introduction: The "Intel Inside" of Beauty

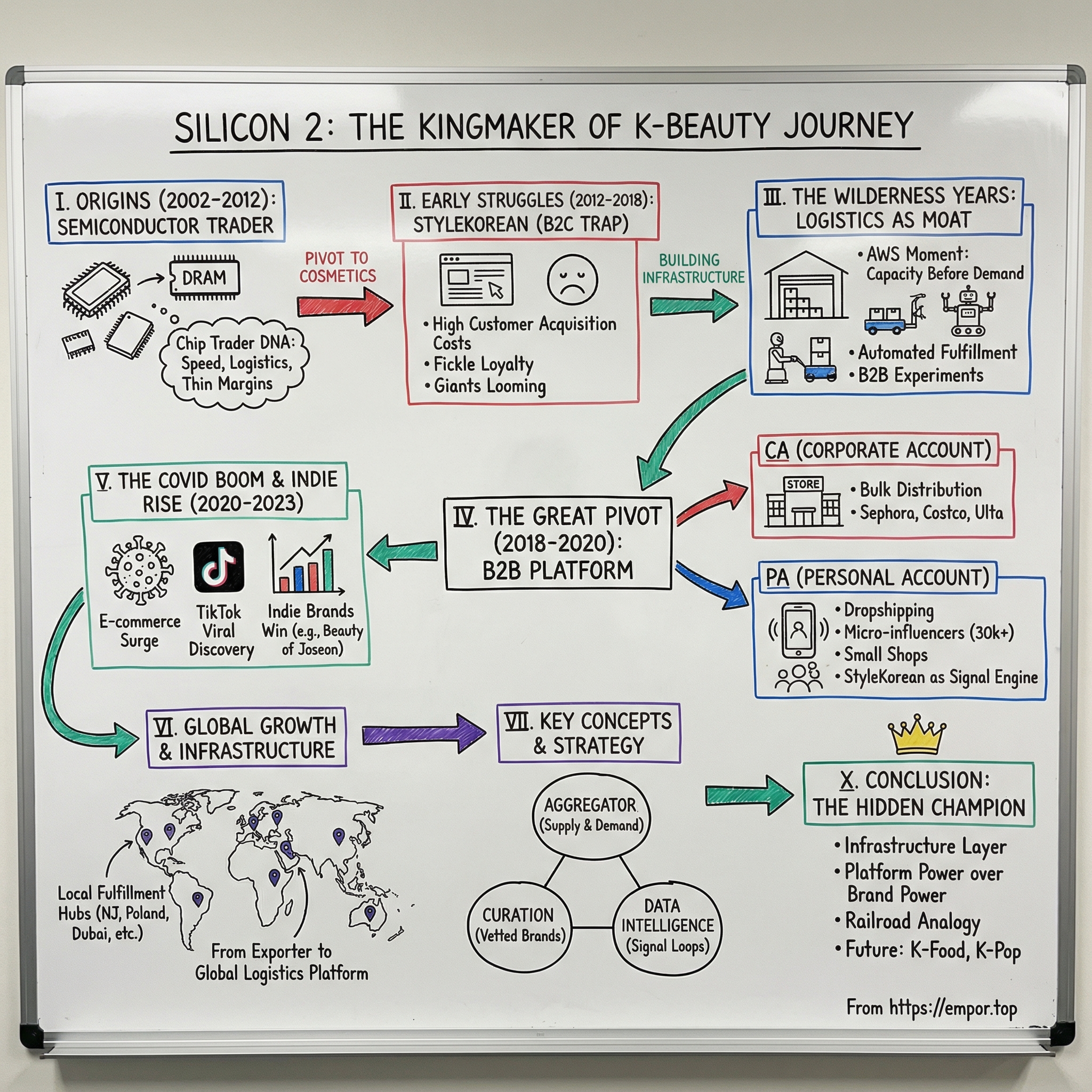

Picture this. You’re scrolling TikTok and a creator in Los Angeles holds up a small glass bottle: Beauty of Joseon’s Rice + Probiotics sunscreen. The video detonates—millions of views, comments asking where to buy, dupe-hunters, restock alerts. Almost immediately, the product disappears from carts across the U.S. Not long after, the brand that used to live in niche corners of the internet shows up in the real world: Sephora, Boots in the U.K., even Costco.

What looks like overnight success is, in reality, a logistics miracle. Someone has to source the product in Korea, decide how much to hold, move it through automated warehouses, get it to local fulfillment hubs like New Jersey and Poland, and keep thousands of small sellers and influencers stocked across dozens of countries.

That “someone” is usually a company you’ve never heard of: Silicon 2.

By 2024, Silicon 2’s sales reached 691.5 billion KRW, more than double the prior year’s 342.8 billion KRW. Operating profit surged to 137.5 billion KRW, up from 47.8 billion KRW the year before. In a period when plenty of consumer businesses were getting squeezed, Silicon 2 was doing the opposite—scaling fast.

The stock chart is even louder. An investor who put 10 million KRW into the shares in October 2023 would have been up 406% by mid-2025. These are the kinds of returns people associate with chip booms and software winners—which is especially ironic, because Silicon 2 spent its first decade as a literal semiconductor trader. It sells zero technology. It owns almost no consumer-facing brands. And yet it has become one of the most important companies in the global beauty supply chain.

Here’s the paradox at the heart of this story: the past five years of K-Beauty have minted viral brands and turned Korean skincare into one of the fastest-growing segments in global beauty. In 2024, South Korea overtook Germany to become the world’s third-largest beauty exporter, behind only France and the U.S. Most of that output is built for export, and e-commerce has been the accelerant. But while consumers fixate on the names—COSRX, Beauty of Joseon, Anua—the infrastructure that makes those names global is a different story.

Think of Silicon 2 as the operating system and logistics backbone for K-Beauty’s global expansion. If you’ve bought Korean skincare on Amazon, ordered from a small indie beauty shop in Europe, or watched a K-Beauty brand suddenly appear at Ulta or TJ Maxx, there’s a decent chance Silicon 2 touched that product’s journey—somewhere between factory and front door.

Through its platform, roughly 500 cosmetics brands are sold wholesale or retail into more than 200 countries. If companies like Kolmar Korea and Cosmax are the engine rooms—helping small and midsize brands manufacture products—Silicon 2 is the distribution layer that gets those products into overseas online carts and onto physical shelves.

This is the story of a company that pivoted from microchips to mascara, built infrastructure while others bought ads, and ended up as one of the most important picks-and-shovels players in the K-Beauty gold rush. It’s a lesson in platform economics, in logistics as a moat, and in why the most valuable seat in a fragmented market isn’t always the one with the brand name on the bottle.

Because the real shift here isn’t just Korean cosmetics. It’s the movement from Brand Power to Platform Power. The old era—dominated by giants like Amorepacific and L’Oréal—was built on scale and control of distribution. The new era is messier: thousands of indie brands, faster trend cycles, and global demand that can spike overnight. That world doesn’t run on prestige alone. It runs on infrastructure.

Silicon 2 built that infrastructure—often years before the demand showed up.

II. The Origins: From Microchips to Mascara (2002–2012)

Silicon 2 didn’t start in beauty. It started the way its name suggests: in chips.

In 2002, Kim Sung-woon set up shop in Seongnam, just south of Seoul, with 4 million won in startup capital—about $3,300 at the time. Kim, a Pusan National University graduate, had already built a career in overseas sales of semiconductor parts, first at Kiryung Electronics and later at MDI Korea. He knew the business, he knew the buyers, and he knew what Korean manufacturers needed most: someone who could actually move product across borders.

So “Silicon 2” was literal, not branding poetry. The company entered international semiconductor distribution, helping Korean manufacturers sell DRAM and electronic components overseas. Over time, it built a reputation by exporting domestic semiconductor products—including Samsung Electronics’ DRAM—to global buyers. This wasn’t glamorous work, and it wasn’t forgiving. Kim ran hard, and the company grew the old-fashioned way: by executing.

Those early years also imprinted a particular operating system on the company—a trading house mentality. Semiconductor distribution in the 2000s was ruthless: razor-thin margins, microscopic pricing differences, and inventory risk that could erase profits fast. If chips sat too long, you didn’t just miss revenue—you could get crushed by the market moving underneath you. The only way to survive was to get fanatical about speed, turnover, and precision logistics.

That “chip trader DNA” would end up mattering more than anyone could’ve guessed.

Because by the late 2000s, the ground started shifting. Korea’s semiconductor trading landscape consolidated quickly, and as electronics companies began disappearing, Silicon 2 had to rethink what it was really in business to do.

From the outside, the next move looked like corporate whiplash: turning a semiconductor trading company into a cosmetics distributor. But Kim saw a new export wave forming. Korean culture was starting to travel—K-pop gaining traction, dramas spreading across Asia—and China, in particular, was developing a serious appetite for Korean consumer goods. If chips were consolidating, maybe the next big cross-border category wasn’t hardware at all. Maybe it was skincare.

More importantly, Kim realized something simple and powerful: Silicon 2 didn’t have to be in “semiconductors” to win. It had to be in global distribution. The company already knew how to move physical products across countries, manage customs and regulations, and keep inventory flowing before conditions changed. That skill could transfer.

In 2012, Silicon 2 officially shifted its core business to cosmetics distribution, initially focusing on China. The first step was modest and very direct: launch StyleKorean.com, a B2C e-commerce site selling Korean cosmetics to overseas consumers.

Through StyleKorean, Silicon 2 pushed K-beauty into more than 100 countries. But the early days were rough. The site ran into the realities of direct-to-consumer e-commerce: expensive customer acquisition, nonstop competition for attention, and giants like Amazon looming over everything. It wasn’t naturally aligned with the company’s strengths. Silicon 2 was built for operations and distribution, not for burning money on marketing to win clicks.

Still, StyleKorean did something quietly priceless. It gave Kim and his team a front-row seat to global demand—what people actually bought, what spiked in which markets, and what started to move before the rest of the world noticed.

In other words, the semiconductor trader wasn’t just selling skincare. It was learning how to read signals—country by country, product by product—and building the foundation for the platform Silicon 2 would eventually become.

III. The Wilderness Years: The "StyleKorean" Trap (2012–2018)

On paper, the mid-2010s should’ve been Silicon 2’s coming-out party.

The first big K-Beauty wave was cresting. Chinese daigou—informal personal shoppers buying in Korea for mainland customers—were swarming duty-free stores. The industry’s incumbents were printing money. For decades, South Korea’s cosmetics market had been dominated by two giants, Amorepacific and LG Household & Health Care, and by the end of 2019 they still controlled more than 60% of the market.

But Silicon 2 wasn’t riding the wave. It was stuck.

StyleKorean was a B2C business, which meant Silicon 2 was playing the hardest game in beauty: buying attention. Customer acquisition costs were brutal. Marketing spend chewed through margins that were already thin. And loyalty was fickle—shoppers clicked, compared, and bought wherever the price was a little lower.

Worse, the market structure didn’t leave much oxygen for an upstart retailer. Amorepacific—with brands like Sulwhasoo, Laneige, and Innisfree—and LG—with The History of Whoo and The Face Shop—owned the premium shelf space and had distribution locked up through their own stores, duty-free partnerships, and flagship retail footprints. If you were a small indie brand, you didn’t just lack a marketing budget. You lacked access. No shelf space, no export team, no reliable way to reach overseas customers at scale.

And then the early K-Beauty boom—supercharged by China—started to lose momentum. Silicon 2 could feel it: the easy growth wasn’t going to last, and trying to win as a consumer storefront wasn’t going to magically get easier.

This is where Kim’s core insight crystallized.

The company didn’t have a sustainable advantage in finding customers for products. That was a spending war, and there would always be someone with deeper pockets. But finding products for customers—especially overseas buyers who wanted Korean skincare without building an entire sourcing and logistics operation—that was a different game.

Because Korea had already solved the manufacturing side. With the contract manufacturing ecosystem led by companies like Kolmar Korea and Cosmax, a brand didn’t need to own a factory to make world-class skincare. In Korea, if you had a formula and a dream, you could ship a real product.

What you couldn’t do was reliably get that product into New Jersey, London, or Dubai—and keep it in stock when demand spiked.

That gap is where Silicon 2 started to position itself. If the manufacturers were the engine room, Silicon 2 wanted to be the distribution layer: the part that turns “made in Korea” into “available everywhere.” It’s a big reason overseas K-beauty hits like APR’s Medicube and Gudai Global’s Beauty of Joseon were able to grow structurally in international markets.

And instead of throwing money at ads like everyone else, Silicon 2 placed a bet that looked almost backwards at the time: it poured capital into automated logistics.

The company built a fulfillment service around an AGV system—Automatic Guided Vehicles—warehouse robots that move product through a fulfillment center with minimal human handling. They’re not cheap. They require real upfront investment and operational know-how. While much of the K-Beauty world spent on influencer campaigns and brand awareness, Silicon 2 bought robots and built process.

This was its “AWS moment”: building capacity before demand arrived. Just as Amazon overbuilt infrastructure in the 2000s and ended up perfectly positioned for the cloud boom, Silicon 2 was building a logistics backbone for a future where K-Beauty wouldn’t be controlled by a handful of conglomerates. It would be fragmented across hundreds of indie brands—and that messy, long-tail world would need a distribution platform to function.

In hindsight, it looks inevitable. In the moment, it was a real leap. Silicon 2 was effectively saying: the future of K-Beauty is not a few giants with locked-up shelves; it’s a swarm of smaller brands, and the winner will be whoever can move their products globally, fast and reliably.

At the same time, Silicon 2 began quietly testing what that future could look like. Instead of selling only to individual consumers through StyleKorean, it started experimenting with B2B relationships: overseas retailers, small shop owners, and other buyers who wanted to stock Korean cosmetics without navigating sourcing, customs, and fulfillment themselves.

By 2018, Silicon 2 listed on the KOSDAQ. The listing brought fresh capital—but also a new kind of pressure. The company still had a B2C business with all the pain that came with it. But now it also had something far more valuable: logistics infrastructure and early B2B muscle that were about to matter a lot more than a storefront ever could.

IV. The Great Pivot: "CA" and "PA" (2018–2020)

Between 2018 and 2020, Silicon 2 finally stopped trying to win the beauty business the hard way.

Instead of fighting for attention as a consumer storefront, it formalized what it had been quietly building all along: a B2B platform with two lanes—one designed for big buyers, and one designed for everyone else. Together, they gave Silicon 2 dramatically better economics than B2C, and something even more valuable: leverage.

The first lane was Corporate Account, or CA. This was the straightforward part of the model—bulk distribution. Silicon 2 supplied Korean cosmetics in volume to major retailers like Costco, Sephora, Watsons, and Ulta, acting as the bridge between Korean brands and large international buyers. StyleKorean still existed, but now it sat alongside a wholesale engine that could place Korean products into real global channels.

The second lane was Personal Account, or PA—and this is where Silicon 2 stopped being “a distributor” and started looking like infrastructure.

PA was, in practice, country-specific reverse direct purchase and dropshipping. A service built for the long tail: micro-influencers, small overseas beauty shops, and niche online sellers who wanted to sell K-Beauty but couldn’t afford to buy inventory upfront or manage cross-border operations.

And that constraint mattered. A beauty creator in Madrid with 50,000 Instagram followers might have taste, trust, and a highly responsive audience. What they don’t have is the cash to place big orders from Korea, the experience to deal with customs, or the ability to take inventory risk on products that might not move.

PA let them become a K-Beauty retailer anyway.

They promoted products, took orders, and Silicon 2 handled the rest—supply, packing, shipping, delivery. The seller earned margin on sales. Silicon 2 earned revenue only when product actually moved, with fulfillment and logistics baked into the system. Silicon 2 eventually worked with around 30,000 influencers across 68 countries, not just to sell products, but to create local K-Beauty content and strengthen demand at the edges.

This also unlocked something Korean brands had been missing for years: a practical export path.

Korea had no shortage of small cosmetics companies that could formulate and manufacture great products. What they lacked was the machinery to go global—export teams, foreign regulatory know-how, and reliable international logistics. Through Silicon 2, those brands could reach overseas customers without hiring a single person outside Korea. Through the platform, about 500 cosmetics brands were sold wholesale or retail into more than 200 countries.

The most elegant part of the pivot was how Silicon 2 flipped the risk profile.

Traditional distributors operate on a “buy and pray” model: take big inventory positions, push them into channels, and hope demand shows up before the product ages out. Silicon 2 moved toward the opposite. It used StyleKorean.com—the B2C business that once looked like a trap—as a signal engine. A test kitchen.

StyleKorean showed what was gaining traction in real time: which products were suddenly moving in the U.S., what European customers were searching for, which ingredients and price points were resonating. Silicon 2 could then curate a K-Beauty portfolio for its B2B buyers based on what demand was already proving, not on guesses.

And the logistics bet from the wilderness years finally paid off.

Those automated fulfillment centers—built around AGV systems—weren’t just efficiency upgrades. They made the PA model possible. Processing thousands of tiny orders economically is exactly what breaks traditional logistics operations built for pallets and containers. Silicon 2 had built for granularity, and now the business model demanded it.

By 2020, right before the world shifted again, Silicon 2 had completed its transformation: no longer a semiconductor trader dabbling in e-commerce, but a full-service platform aggregating supply (hundreds of Korean brands) and demand (global retailers plus thousands of micro-sellers), and capturing value through fulfillment, distribution, and data-driven curation.

V. The COVID Boom & The Rise of "Indie" Beauty (2020–2023)

When the world shut down in early 2020, K-Beauty’s old growth machine didn’t just slow—it broke. And that break is exactly what pulled Silicon 2 out of the background and into the role it was built for.

To see why, you have to look at what COVID did to the K-Beauty value chain.

The first K-Beauty boom of the 2010s had leaned heavily on China: Chinese tourists pouring into Korean duty-free shops, and daigou networks—informal personal shoppers—moving products from Seoul to buyers back home. But that momentum didn’t last. As travel stopped and geopolitical tensions rose, the China-driven channels that had once made Korean cosmetics feel unstoppable suddenly thinned out.

COVID demolished the two pillars of the old model at the same time. Duty-free stores—profit engines for the Big Two, Amorepacific and LG Household & Health Care—went dark. International travel evaporated. The daigou pipeline that moved product through those ecosystems got disrupted almost overnight.

Amorepacific felt that pain sharply. Its annual report showed sales falling 21% to 4.3 trillion won, while operating profit plunged 67% to 143 billion won. The core business weakened across the board: domestic sales fell 23% year over year, and overseas sales dropped 16%.

But while offline collapsed, online snapped into overdrive.

Stuck at home, consumers shifted spending to e-commerce, and the world compressed years of digital adoption into months. TikTok, in particular, became a global discovery engine—less like advertising, more like a product-finding machine.

And here’s the twist: the brands winning on TikTok weren’t the legacy prestige names. They were indie brands—often unknown outside small circles—suddenly becoming global hits.

According to Euromonitor data, the top five Korean cosmetics brands in U.S. e-commerce—including Beauty of Joseon, Medicube, and Biodance—grew online sales by an average of 71% over the past two years, versus 21% for the overall U.S. market.

“Nowadays a single viral TikTok video or influencer endorsement can turn a product into a global bestseller before it even launches outside Korea,” said South Korea-based beauty marketer Odile Monod.

This was the world Silicon 2 had been quietly preparing for.

It already aggregated hundreds of indie brands that didn’t have export teams or overseas distribution. It had automated logistics built to handle lots of small, messy orders. And it had a PA network—around 30,000 influencers across 68 countries—that could act like a decentralized marketing force, pushing K-Beauty content and product recommendations into local markets at internet speed.

So as the center of gravity shifted from duty-free and China to e-commerce and “viral everywhere,” Silicon 2 didn’t need to reinvent itself. It just needed to run faster.

The rise of indie brands like Beauty of Joseon became inseparable from Silicon 2’s growth—and Beauty of Joseon, in particular, shows the “kingmaker” dynamic in action.

Owned by Gudai Global, Beauty of Joseon built products around traditional Korean ingredients like ginseng, rice, and plum blossom, wrapped in packaging that nodded to Joseon Dynasty aesthetics. Silicon 2 partnered with the brand early, when it was still small, and supported its expansion through U.S. logistics and marketing coordination. Then TikTok did what TikTok does: viral moments pushed the brand up Amazon bestseller lists, and demand spikes turned into restock races.

By 2024, Beauty of Joseon’s Clear Rice Sunscreen was the best-selling K-beauty product at Boots. Chelsey Saunders, Director of Beauty at Boots, said that after visiting Korea, Boots introduced more than 10 K-beauty brands in a single year—including Beauty of Joseon, Anua, Tirtir, Biodance, and Skin1004—and saw meaningful success.

That surge showed up inside Silicon 2’s own mix. The company’s top 10 brands by sales included Beauty of Joseon (24%), Anua (11.2%), COSRX (7%), Round Lab (4.5%), Tocobo (4.2%), TIRTIR (3.6%), Skin Angel (3.5%), Pyunkang Yul (2.7%), Heimish (2.6%), and NUMBUZIN (2.3%).

Beauty of Joseon alone accounted for 24% of sales—but the more important point was structural: Silicon 2 wasn’t a one-brand story. If one brand cooled off, the platform could route demand to the next breakout. In a viral market, that flexibility is the moat.

From 2020 to 2023, Silicon 2 doubled down on what made it different: physical infrastructure.

It expanded aggressively overseas, with branches in places like California, New Jersey, Poland, the Netherlands, France, the U.K., Malaysia, Dubai, Vietnam, Singapore, Russia, and Indonesia. It also operated logistics centers in California, New Jersey, Poland, Indonesia, Malaysia, Dubai, and Vietnam.

This wasn’t just expansion for expansion’s sake. It was a change in operating model.

Historically, Silicon 2 exported from Korea. That meant longer delivery times and higher shipping costs—fine when buyers expected international shipping, but a losing proposition once consumers got used to “two-day” everything. By placing inventory in local fulfillment hubs, Silicon 2 could deliver faster, lower the friction for overseas buyers, and compete more directly with domestic retailers.

The shift from “Exporting from Korea” to “Local Fulfillment” was capital-intensive, but strategically unavoidable. It turned Silicon 2 from a Korean exporter into a global logistics platform that just happened to specialize in K-Beauty.

Meanwhile, the incumbents were still untangling themselves from the old playbook. Overseas, the Big Two began to diverge: Amorepacific showed clearer signs of recovery as it restructured its China business, while LG Household & Health Care remained constrained by a distribution structure built around China and duty-free—so much so that its cosmetics business recorded a quarterly deficit for the first time in 21 years.

That contrast captures the era change.

The old guard was built for a world where a few giant brands controlled the shelves through owned retail and duty-free partnerships. The new world was fragmented, internet-driven, and brutally fast. And in that world, the advantage didn’t belong to the biggest brand. It belonged to whoever could aggregate supply, sense demand early, and move product globally without breaking.

Silicon 2 had become that company.

VI. Playbook: Analysis & Strategy

So what, exactly, did Silicon 2 build—and why has it been so hard to copy?

The cleanest way to understand it is through the “aggregator” lens popularized by analyst Ben Thompson: a platform that creates value by sitting between fragmented supply and fragmented demand, then using one side to pull the other.

Google aggregates publishers and advertisers. Netflix aggregates studios and viewers. Silicon 2 aggregates hundreds of Korean cosmetics brands on one side, and a sprawling set of global buyers on the other—from giant retailers to thousands of small overseas sellers.

“As a distribution platform, connecting overseas buyers with Korean suppliers is essential. Securing stable suppliers helps us tap into untapped global markets,” Kim explained.

But Silicon 2 isn’t a pure digital aggregator, and that’s the crucial twist. This isn’t an open marketplace like Alibaba where anyone can list and the buyer sorts it out. It’s curated. Brands get vetted, and not every Korean cosmetics company gets access to Silicon 2’s pipes.

That curation creates value in both directions. Retailers like Sephora and Costco get a portfolio they can trust—products that clear quality expectations and, just as importantly, have signals of real demand. Meanwhile, brands that make it onto the platform get something incredibly hard to build on their own: distribution that’s already global.

As Silicon 2 describes it, the platform serves three kinds of customers at once: established cosmetics businesses adding K-Beauty, existing K-Beauty sellers trying to improve their mix, and first-timers with no cosmetics background who want to start a K-Beauty business.

The real moat, though, isn’t just relationships. It’s information.

Back when competitors were pouring money into marketing, Silicon 2 was quietly building an advantage in data. Every transaction through StyleKorean.com—the B2C site that once looked like the company’s dead end—generated intelligence: what’s getting clicked in Germany, which ingredients are catching in Southeast Asia, which price points move in the Middle East.

The company describes its model as a combination of a retail platform, a digital order system, and K-Beauty marketing tied directly to overseas buyers—built to respond to demand quickly, not months later.

That feedback loop doesn’t just inform what Silicon 2 sells. It changes how it holds inventory. Instead of guessing, it can stage product around demand that’s already been validated. Kim said inventory was around KRW 180 billion, with another KRW 60–70 billion in transit by sea.

When you run the system like that—tight signal loops, disciplined inventory, and automation doing the heavy lifting—you start to see it in unit economics. The company’s logistics costs as a share of sales fell from 5.8% in Q2 2022 to 2% in 2023. That’s not a rounding error. That’s operational leverage.

And structurally, Silicon 2 avoids the most terrifying risk in consumer: being tied to a single hit.

It doesn’t live or die by any one brand because it doesn’t own the brand narrative—it owns the distribution lane. If one brand fades, it can elevate the next. It owns the pipeline, not the water flowing through it.

You can see that dynamic in what happened with COSRX. When Amorepacific acquired COSRX in 2023 and later increased its stake so COSRX would be integrated as a subsidiary, Silicon 2 didn’t face an existential crisis. It could shift attention and volume to other brands on the platform, even as COSRX’s trajectory changed inside a large conglomerate. As competition intensified and cheaper alternatives emerged, there were already signs of growth plateauing for some once-hypergrowth brands. “The K-beauty trend is strong,” Kim said. “But indie brands will face challenges too.”

Kim has also compared Silicon 2’s ambition to Coupang—the Korean e-commerce giant often called the Amazon of Korea. “Just as Coupang conquered the Korean logistics network with innovations like free returns and rapid delivery, we are stepping on the growth accelerator through aggressive investment in overseas logistics infrastructure, diverse brands, and media marketing centered on storytelling,” he said. “Coupang made shopping easy in Korea. Likewise, Silicon 2 is working to ensure global consumers can easily purchase their desired brands anytime with just a tap.”

The company’s investing behavior fits that same playbook. Silicon 2 has taken stakes in brands it believes have global potential, including Pyunkang Korean Herbal Dermatology Research Institute (KRW 300 million), Aid Korea Company (KRW 1.3 billion), and One& (KRW 400 million). Combined revenue from six investment companies grew from KRW 9.2 billion in 2018 to KRW 123.5 billion.

That strategy does two things at once. It lets Silicon 2 participate in the upside when a brand breaks out, and it helps lock in relationships even as ownership changes—a hedge against the classic platform problem of brands “graduating” beyond the platform.

And Silicon 2 isn’t stopping at cosmetics.

It has begun expanding into K-Food and K-Pop. Annual sales there were still modest—around KRW 10 billion—but the direction is clear, and the company was exploring M&A to scale faster. The logic is straightforward: once you’ve built global warehousing, cross-border fulfillment, influencer-driven demand creation, and retailer integrations, you can reuse the same infrastructure across Korean cultural exports, not just skincare.

VII. The Seven Powers & Five Forces Analysis

If you run Silicon 2 through Hamilton Helmer’s 7 Powers framework, three advantages jump out—and together they explain why this business has been so hard to dislodge.

Counter-Positioning is Silicon 2’s quiet wedge into an industry that didn’t think it needed a new model. Traditional distributors often demand exclusivity from brands in exchange for shelf access and overseas reach. Silicon 2 flipped that. It offered fulfillment as a service without making brands sign their lives away. That non-exclusive approach let it aggregate hundreds of brands that bigger distributors overlooked. And here’s the catch: incumbents can’t easily copy it without breaking their own economics and upsetting existing relationships built around exclusivity.

Scale Economies show up in the warehouses. Silicon 2 built automated logistics centers around AGV systems—robots designed to move goods efficiently through the facility. That matters because the PA model isn’t pallets and containers; it’s thousands of small, uneven orders. Manual fulfillment gets crushed by that complexity. Automation, plus volume, lets Silicon 2 push unit costs down as throughput rises—an advantage that compounds the bigger the platform gets.

Process Power is the company’s “semiconductor DNA” showing up in a completely different category. Chip trading teaches you that inventory is radioactive and speed is everything. Silicon 2 carried that obsession into beauty: tight operations, fast turnover, and a relentless focus on efficiency. You can see it in the numbers: logistics costs as a share of sales dropped from 5.8% in Q2 2022 to 2% in 2023. That isn’t just cost cutting—it’s an organization learning, refining, and locking in an operating advantage over time.

Now look at Silicon 2 through Porter’s Five Forces.

Supplier Power is low. There are thousands of indie K-Beauty brands that need an export path. Silicon 2 has breadth—500-plus brands on the platform—and that diversification keeps any one supplier from holding the company hostage. The relationship is asymmetric: most brands need Silicon 2’s distribution reach into the U.S. and Europe far more than Silicon 2 needs any single brand.

Buyer Power is mixed. On the high end, major retailers like Sephora, Costco, and TJ Maxx have real negotiating leverage. But there isn’t one buyer that dominates the whole channel, and Silicon 2 can balance them against each other and against its broader base. On the long-tail side, PA buyers—micro-influencers and small shops—have almost no leverage at all. They’re small, fragmented, and they’re using Silicon 2 precisely because they can’t replicate its infrastructure.

Threat of New Entrants is moderate to low. On the surface, “K-Beauty distribution” sounds like something a competitor could spin up quickly. In reality, the hard part is the boring part: warehouses, systems, cross-border operations, retailer integrations, and the slow accumulation of trust with both brands and overseas buyers. Kim has acknowledged competitors like Cheongdam Global, but also pointed out how capital-intensive and time-consuming it is to build real logistics capability and negotiating power with global clients. The barrier isn’t the idea—it’s the years of execution.

Threat of Substitutes is the biggest strategic risk. The clearest substitute is brands going direct. If a brand gets large enough—Beauty of Joseon is the obvious example—does it eventually decide it doesn’t need a platform partner and builds its own export and fulfillment capabilities? That’s the “brand graduation” risk, and it’s real.

Competitive Rivalry is moderate. Silicon 2 looks like the leading platform, but it’s not operating in a vacuum. Other distributors exist, and more will try to follow the playbook. The open question is whether this market ends up winner-take-most—like some infrastructure businesses do—or whether it settles into a world with a few durable platforms sharing the category.

VIII. The Bear & Bull Case

The case for Silicon 2 ultimately comes down to one question: is K-Beauty a moment, or a category?

The Bull Case is that K-Beauty keeps graduating from trend to default—and Silicon 2 ends up as the infrastructure layer underneath the entire thing.

In 2024, South Korea overtook France as the largest cosmetics exporter to the U.S., driven in large part by online demand—especially through Amazon. That matters because Amazon doesn’t reward legacy brand prestige. It rewards what’s in stock, well-reviewed, and ready to ship now. In other words: distribution.

The broader market forecast points the same direction. The global K-beauty products market was valued at USD 14.61 billion in 2024, is expected to reach USD 16.26 billion in 2025, and is projected to grow to USD 38.29 billion by 2033, expanding at a CAGR of 11.3% from 2025 to 2033.

If K-Beauty compounds anywhere near that pace, Silicon 2’s “pipes” become more valuable every year. And the company is already trying to prove it can reuse those pipes beyond skincare. It has expanded into K-Food and K-Pop merchandise. Those categories are still small for now—around KRW 10 billion in annual sales—but Silicon 2 is exploring M&A to scale faster. The long-term vision is straightforward: become a kind of “General Store of K-Culture” for the world, moving Korean products—whatever they are—into global demand.

Geographically, the company says it picks target countries by evaluating growth potential, the maturity of local beauty culture, and demand for K-beauty. The plan is to keep building presence in major hub cities and key commercial districts across the United States, Europe, and the Middle East to strengthen K-Beauty’s footprint.

It’s also leaning into offline retail through its Moida concept. Today, Silicon 2 operates six overseas offline stores: one in the United States, two in the United Kingdom, one in France, and two in Indonesia. More are planned: Moida stores are scheduled to open in Florida and in Milan in the first half of next year.

Financially, management has set an aggressive near-term target: KRW 1 trillion in sales and KRW 180 billion in operating profit this year, driven by continued logistics expansion.

On the Street, the optimism shows up in growth expectations. A Samsung Securities analyst noted, “Considering a projected 29% average annual EPS growth from 2024 to 2027, the stock price is reasonable.”

But there are real risks here—and they’re not subtle.

The Bear Case has three main pillars:

Brand Graduation: What happens when a platform customer becomes powerful enough to leave the platform? COSRX is the cleanest example. Once a fast-growing indie brand, it was acquired by Amorepacific for roughly $560 million and brought in-house. If the biggest K-Beauty brands systematically “graduate” and build their own global distribution, Silicon 2’s leverage weakens. The counterpoint is that Silicon 2 isn’t dependent on any single brand—and can keep rotating in the next breakout. But if graduation becomes the rule rather than the exception, the kingmaker loses its crown.

Geopolitics and Trade Wars: This model also carries macro risk. Tariffs, trade disruptions, and geopolitical shocks can hit both demand and margins. Tirtir’s An described the existing baseline 10% U.S. tariff as “endurable,” but said the planned 25% tariff on South Korean products due in July may force price increases “a little bit.” If trade friction rises, Korean beauty could get more expensive, less competitive, or simply harder to move.

The “Hit” Risk—Is K-Beauty a fad?: Beauty trends are fickle. Japanese beauty had its moment. French beauty has endured for centuries. Where does K-Beauty land? The “glass skin” aesthetic, multi-step routines, and ingredient-driven innovation could become permanent parts of global skincare—or they could fade as consumers move on. Euromonitor’s report, Glass Skin & Global Wins: The Rise of K-Beauty, argues K-beauty 2.0 is different: stronger technology, clearer brand positioning, and proven quality at fair prices, versus the first wave’s niche ritual framing. The bullish view is that K-Beauty is becoming structural, not cyclical—but that assumption is embedded in any long-term thesis on Silicon 2.

Key Performance Indicators to Track

If you’re trying to track whether the bull case is playing out—or the bear case is creeping in—two KPIs matter most:

1. Revenue by Geography Mix: Sales by region include the U.S. (22.1%), Poland/Europe (13.1%), Korea (6.8%), UAE (5.7%), and Indonesia (4.9%). Meritz Securities analyst Park Jong-dae noted, “With European sales now greatly surpassing U.S. sales, expectations for global expansion have risen. Korean cosmetics exports are rapidly increasing across France, Spain, Italy, Central Asia, and down to the southern hemisphere.” The story to watch is diversification: do Europe, the Middle East, and other newer markets keep growing as a share of the business, or does growth reconcentrate in one region?

2. Brand Concentration: The top 10 brands by sales were Beauty of Joseon (24%), Anua (11.2%), COSRX (7%), Round Lab (4.5%), Tocobo (4.2%), TIRTIR (3.6%), Skin Angel (3.5%), Pyunkang Yul (2.7%), Heimish (2.6%), and NUMBUZIN (2.3%). Beauty of Joseon at 24% is meaningful concentration. If that share comes down because more brands scale, Silicon 2 looks sturdier. If it rises, the platform starts to look less like a diversified infrastructure play—and more like a bet on one hero product cycle.

IX. Conclusion: The "Hidden Champion"

Silicon 2’s story is a master class in the kind of pivot that looks obvious only after it works. A semiconductor trading company staring down consolidation realized its real asset wasn’t “chips.” It was the ability to move physical goods across borders quickly, predict demand, and keep inventory from becoming a liability. So instead of trying to outspend consumer brands on marketing or win loyalty one shopper at a time, it built the infrastructure that made other brands’ success possible—and took a slice of the flow.

The results were hard to ignore. From 2021 to 2024, sales grew from KRW 131 billion to KRW 691.5 billion, while operating profit climbed from KRW 8.8 billion to KRW 137.6 billion. In 2024 alone, revenue more than doubled versus the prior year, and earnings jumped as well.

And Silicon 2 didn’t get there by betting everything on one hero brand. It got there by positioning itself at the intersection of forces that are still getting stronger: the globalization of Korean culture, the shift from brand power to platform power in fragmented markets, and the relentless rise of e-commerce in beauty. Korean cosmetics exports hit a record $10.28 billion in 2024, making South Korea the world’s third-largest cosmetics exporter. By 2025, the United States had surpassed China as the largest market for K-beauty exports, with shipments reaching $1.9 billion in 2024, up 57% year over year.

People love to use the “picks and shovels” analogy for companies like this. But Silicon 2 is past that. It’s not just supplying the tools for the gold rush—it’s become the railroad. And railroads don’t merely participate in commerce; they determine where it happens.

That’s why, among Korean cosmetics professionals and M&A circles, Silicon 2 has become one of the names everyone knows. It’s a coveted partner for brands that want to export, and a company investors keep trying to get closer to—because it sits in the middle of the value chain, where wins compound.

The investing lesson is simple: look for structural advantage, not just product momentum. Kim Sung-woon built a business that benefits from the success of others without being hostage to any single brand’s arc. Every new indie label that goes viral is a potential client. Every existing brand that wants to expand globally runs into the same problem—and Silicon 2 is already there with the solution.

Kim put it bluntly: “Just as Coupang conquered the Korean logistics network with innovations like free returns and rapid delivery, we are stepping on the growth accelerator through aggressive investment in overseas logistics infrastructure, diverse brands, and media marketing centered on storytelling.” He added, “Coupang made shopping easy in Korea. Likewise, Silicon 2 is working to ensure global consumers can easily purchase their desired brands anytime with just a tap.”

In a world obsessed with brand heat and viral moments, Silicon 2 is the reminder hiding in plain sight: sometimes the most valuable position in the market isn’t the one with the spotlight. It’s the one nobody can scale without.

X. Sources & Further Reading

If you want to go deeper, here are the best starting points: - Silicon 2’s corporate website (siliconii.com) and investor relations materials - StyleKorean.com, plus Silicon 2’s wholesale ordering platform - Money Today interviews with CEO Kim Sung-woon - Samsung Securities and Meritz Securities analyst coverage - Euromonitor International reports on the K-Beauty market - Korea Ministry of Food and Drug Safety export data

Chat with this content: Summary, Analysis, News...

Chat with this content: Summary, Analysis, News...

Amazon Music

Amazon Music