Samyang Foods: The "Fire Noodle" Empire

I. Introduction: The Spice Heard 'Round the World

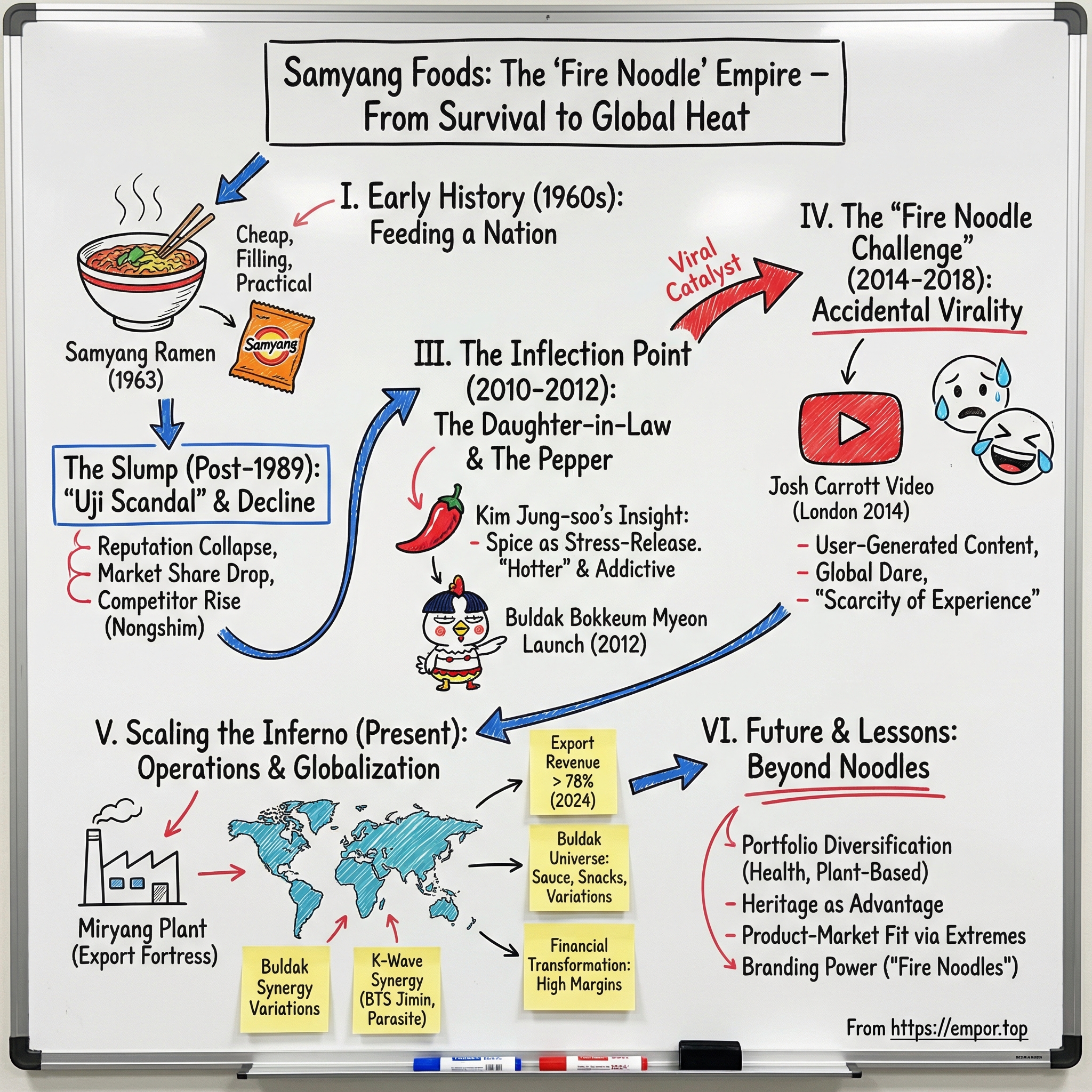

Picture this: London, early 2014. A British YouTuber named Josh Carrott leans over a pot of neon-red noodles, the steam rising like a warning. Korean fans have been mailing him boxes of the same product with the same message: you have to try this.

He does. On camera.

Within minutes, Josh and his friends are coughing, sweating, laughing, and visibly regretting their life choices. They’re racing each other to finish, trying not to reach for water. It’s part endurance test, part comedy, and instantly understandable in any language. The video becomes known as the “Fire Noodle Challenge,” and it spreads like wildfire—eventually racking up well over 100 million views and turning a niche Korean product into a global dare.

Those noodles were Buldak Bokkeum Myeon—Hot Chicken Flavor Ramen—from Samyang Foods. And here’s the twist: at the time, Samyang wasn’t a global brand. It was an aging Korean noodle company fighting for relevance in one of the most cutthroat instant noodle markets on earth. Buldak had only launched in 2012. It was new, loud, and, according to plenty of people inside the company, simply too spicy to work.

But the internet didn’t treat it like a normal food product. It treated it like a moment.

Today, Samyang isn’t just a noodle maker. It’s a cultural export engine—especially in the United States—pulled forward by social media and the rising tide of Korean pop culture. The company’s revenue doubled from 2022 to about US$1.5 billion in 2025. Its market cap has climbed to roughly KRW 9.4 trillion, far ahead of longtime rival Nongshim at around KRW 2.6 trillion.

And the shift isn’t subtle. In just a few years, Samyang flipped its entire business outward. Overseas sales were 43 percent of revenue in 2018. By 2022, they were 67 percent. By the third quarter of 2024, they’d reached 78 percent. A company once defined by its home market was now selling the vast majority of its product abroad—an export juggernaut with international demand outweighing domestic consumption by nearly four to one.

So no, this isn’t simply a story about food manufacturing.

It’s a story about cultural arbitrage: taking a taste that’s intensely Korean and letting the world discover that intensity on its own terms. It’s a story about the accidental brilliance of user-generated content—how one viral format did what decades of traditional marketing never could. And, most remarkably, it’s a story about the “daughter-in-law” who stepped into a family business at its lowest point and helped drag it back from the brink.

From post-war hunger in 1960s Korea to the Fire Noodle Challenge that broke the internet, Samyang’s path shouldn’t make sense on paper. And yet, it happened. Let’s trace how a desperate attempt to bottle spicy street food became a multi-billion-dollar empire—and changed what the world thinks “spicy” means.

II. The "Original" History: Feeding a Nation (1961–1980s)

To understand what Samyang Foods became, you have to start with the Korea it was born into. The early 1960s were defined by scarcity. The Korean War had ended less than a decade earlier, rice shortages were common, and the government was pushing flour as an alternative staple. This was not an era of convenience food. It was an era of, “What can we feed people, reliably, at scale?”

In 1961, Jeon Jung-yoon—a former insurance executive—walked away from his career and founded Samyang Foods on September 15. He wasn’t trying to build a lifestyle brand. He believed, in his words, that “Food Sufficiency Leads to World Peace,” and he aimed straight at the most urgent national problem: hunger.

The origin story pivots on a trip to Japan. Jeon saw instant ramen there and immediately grasped what it could mean back home: cheap, filling noodles that only required boiling water. For a country rebuilding itself, it was close to a miracle technology.

Two years later, in 1963, Samyang introduced Samyang Ramen—widely recognized as Korea’s first instant noodle. It wasn’t marketed like a snack. It functioned like a safety net. The now-iconic orange bag became a symbol of practicality and resilience: a fast, affordable meal when options were limited.

Samyang Ramen launched at 10 won per package and quickly worked its way into everyday life. Demand surged. By 1967, it was strong enough that Samyang expanded production just to keep up.

For a while, Samyang didn’t just lead the category—it was the category. By 1969, it held an 83.3 percent market share. In a sense, “ramyeon” and “Samyang” were almost interchangeable.

The Fall From Grace

But consumer empires don’t get to coast forever. In 1965, a new competitor entered the ring: Lotte Industrial Company, founded by Shin Choon-ho (the younger brother of Lotte Group founder Shin Kyuk-ho). In 1978, it would be renamed Nongshim.

Nongshim came in aggressive and product-driven. Over the early-to-mid 1980s it rolled out hit after hit—Neoguri in 1982, Ansungtangmyun in 1983—and then, in 1986, Shin Ramyun. Shin didn’t just sell well; it reset expectations. With its bold, spicy broth, it captured something Samyang’s more conservative lineup wasn’t delivering at the time: the Korean appetite for heat.

In 1985, Nongshim overtook Samyang for the first time. The gap wasn’t huge—40.4 percent versus 39.6 percent—but psychologically, it mattered. The crown had moved.

Then, in 1989, Samyang suffered the kind of hit that doesn’t show up in a product roadmap: the “Uji scandal,” named for the Korean word for beef tallow. After an anonymous tip alleged the company was using “industrial beef tallow” in its ramen, prosecutors investigated, headlines spread, and consumer trust collapsed. The government later confirmed the ramen posed no health risks, but the damage was already done. The scandal was devastating precisely because it stuck, even after the facts didn’t.

The fallout was brutal. Samyang’s market share plunged—reported as falling to around 10 percent after the incident, with one account describing a drop from 31 percent to 10 percent. The company also reportedly saw a mass exodus of employees, with about 1,000 of 3,000 leaving for competitors.

By the late 2000s, Samyang was still around, still manufacturing, still part of the industry’s furniture—but no longer shaping where the industry was going. Founder Jeon Jung-yoon stepped back, becoming Honorary Chairman in 2010, and his son Jeon In-jang took over. There were attempts to find growth in side ventures—a noodle shop concept, a burger chain—but they didn’t land. Meanwhile, the center of gravity in Korean ramyeon had shifted decisively to Nongshim, Ottogi, and Paldo.

The company that invented Korean instant noodles had slid to fourth place.

Samyang didn’t need incremental improvement. It needed a miracle—or at least someone willing to take a very spicy risk.

III. The Inflection Point: The Daughter-in-Law & The Pepper (2010–2012)

Every great turnaround story has an unlikely protagonist. For Samyang Foods, it was Kim Jung-soo: the founder’s daughter-in-law, a newcomer to management, and eventually the person most responsible for pulling the company out of its long post-scandal slump.

Kim married into the family through Chun In-jang, a second-generation leader at Samyang, making her the daughter-in-law of founder Jeon Jung-yoon. She entered the company during the 1998 IMF crisis and grew into larger roles over time—later becoming Vice Chair and CEO, promoted to general manager in 2017, and taking on responsibilities including ESG committee leadership and global sales from 2021.

But the moment that mattered for this story happened earlier, in the spring of 2010. Kim was out with her daughter at a restaurant known for brutally spicy dishes. They ordered a hot fried-rice dish—and they couldn’t handle it. And yet, around them, the restaurant was packed.

People were sweating, fanning their mouths, half-laughing, half-suffering… and clearly loving it.

Kim walked away with a simple, dangerous conviction: Samyang wasn’t losing because Koreans had stopped eating ramyeon. It was losing because Samyang had stopped giving people something to talk about. And spice—real spice—wasn’t just a flavor. It was a feeling.

Korea in 2010 was pressure-cooker life: long hours, academic intensity, economic anxiety. Kim’s insight was that pain could be a product feature. Spicy food delivered a jolt—thrill and relief in the same bite. Not comfort food. Stress-release food.

So she went back to Samyang and asked for something that would hit like that restaurant dish: buldak, or “fire chicken,” the spicy stir-fried chicken street food people chased specifically because it hurt so good. When the R&D team brought prototypes, Kim’s feedback was consistent and infamous: hotter.

Inside the company, the development process became legend—the “1,200 chickens and 2 tons of sauce” story. Kim tested relentlessly until the flavor and heat landed where she wanted it: not just spicy, but addictive, rich, and unmistakable.

The bigger fight wasn’t in the lab. It was in the building.

By any normal consumer-products logic, the noodles were too extreme. People cried eating them. Marketing teams balked. Who exactly was going to buy a product that caused physical distress?

Kim’s answer was essentially: the point is that it’s too much. A “pretty good” noodle vanishes on a shelf next to Shin Ramyun. But an impossibly spicy noodle becomes a dare. A story. A badge of honor. And if you’re trying to revive a legacy brand, you don’t need mild approval—you need loud obsession.

In April 2012, Samyang launched Buldak Bokkeum Myeon—Hot Chicken Flavor Ramen—packaged with a thick, fiery red sauce packet and a cartoon chicken mascot on the front. The Buldak series was born.

At first, it was positioned as a niche product for spice “maniacs”: young people chasing thrills and anyone who liked their food with a little adrenaline. The original version came in at 4,404 Scoville units—serious heat in the instant noodle aisle.

What nobody predicted was what would happen once that bright-red pack made its way beyond Korea—and into the hands of creators who weren’t looking for dinner.

They were looking for content.

IV. The Accidental Virality: The "Fire Noodle Challenge" (2014–2018)

The Fire Noodle Challenge didn’t come out of a marketing department. There was no big ad buy, no influencer list, no coordinated rollout. In the way the internet loves best, it was an accident—one that just happened to land on exactly the right product.

In 2014, the British YouTube channel Korean Englishman—Josh and Ollie—uploaded a video of foreigners trying Samyang’s Buldak Spicy Chicken Ramen. The noodles hadn’t been around long, but their audience kept mailing them boxes. Josh and Ollie later described the pattern: Fire Noodles were showing up in almost every package, with the same note implied every time—this is supposed to be insanely spicy, and it would be funny to watch you try it.

They did. And it became Josh’s first truly viral hit, helping set the foundation for a channel that eventually grew past 2.4 million subscribers. As of writing, that original video had more than 8.8 million views and thousands of comments—people trading tips, flexing their spice tolerance, or simply laughing at the suffering.

The format was perfect for YouTube-era culture. It turned eating into a game. This wasn’t “here’s a meal.” It was “can you survive it?” The stakes were instantly clear, the reactions were visual, and the punchline translated everywhere: watching someone get humbled by spice is universal.

Then the copycats came—in the best way. Creators across the U.S., Europe, and Southeast Asia started filming their own attempts. Mukbang channels picked it up and turned Buldak into repeatable content: different people, different setups, same red noodles, same tears. The trend spilled beyond YouTube into TikTok and Instagram, where clips of shocked faces and defeated bravado kept it circulating. Within a few years, the challenge had generated an enormous volume of posts, and a quick search for “Fire Noodle Challenge” returned hundreds of thousands of results.

The Pivot: Lean Into the Heat

This is where Samyang made the decision that mattered. The usual playbook for exporting food is to soften the edges—tone down the spice, tweak the flavor, make it “accessible.” Samyang did the opposite.

They leaned in.

Instead of diluting what made Buldak famous, they escalated it—most notably with the 2x Spicy version, which became infamous in its own right. And they expanded laterally too, building variety without abandoning the core identity: Carbonara, Cheese, Curry, Jjajang, and more. Each new release created a fresh reason to buy, compare, and, crucially, film.

Buldak stopped being a single SKU and became a whole universe: ramen, sauce, snacks, tteokbokki, dumplings. The company wasn’t just selling noodles anymore—it was building a brand platform. Even the cartoon chicken mascot, “Hochi,” became part of the IP: instantly recognizable, meme-ready, and consistent across every product line.

And the business results followed the attention. As the challenge took off, Samyang’s exports surged. The company set a record in 2016, reaching 110 billion won in exports—roughly quadruple the prior year’s 29.4 billion won. By the second half of 2016, Buldak had become the company’s best-seller. In 2017, the Buldak line reportedly made up more than 85% of Samyang’s exports and 55% of total sales.

What Samyang stumbled into was the purest form of earned media. They didn’t pay people to talk. They created something so extreme, so watchable, and so easy to turn into a social ritual that the internet did the marketing for them. You can’t buy that kind of distribution. You can only earn it—by making a product people can’t help but react to.

V. Scaling the Inferno: Operations & Globalization (2018–Present)

Viral success is intoxicating. It’s also fragile. The business graveyard is full of brands that caught the internet’s attention once, then discovered they couldn’t manufacture, ship, or restock their way into a real company.

Samyang’s leadership saw the Fire Noodle Challenge for what it was: a gift. But also a clock. If they wanted Buldak to be more than a moment, they had to turn chaos-level demand into repeatable supply.

The Miryang Miracle

That operational pivot has a name: Miryang.

Miryang is a city in South Gyeongsang Province, and it became Samyang’s export fortress. After the first Miryang factory was completed in May 2022, Samyang effectively pointed its domestic production capacity outward—building to feed overseas demand. The result was a revenue ramp that matched the cultural one: from 909 billion won in 2022 to 1.19 trillion won in 2023, then 1.73 trillion won in 2024, with exports making up 77 percent of revenue in 2024.

And Samyang didn’t stop at one plant.

On June 11, 2025, Vice Chairman Kim Jung-soo gave a congratulatory speech at the opening ceremony of Samyang’s second Miryang plant—just 15 months after construction began in March the year before. The plan was to start full operations in July, pushing even harder into international markets with Buldak at the center.

This second plant was designed as Samyang’s most advanced facility: a full smart factory, with automated noodle making, frying, cooling, packaging, and warehouse storage. It includes an automated logistics center, and autonomous mobile robots move products around the facility. Samyang’s intent was clear: use Miryang as the “mother facility” for production innovation across the company.

It’s also big. The plant runs from one basement level to three floors above ground, covering 33,000 square meters. Inside are six production lines—three for packet noodles and three for cup noodles—with annual capacity of 830 million Buldak units.

Miryang now sits alongside Samyang’s other production sites in Wonju and Iksan, lifting total annual ramyeon capacity from 2.08 billion to 2.8 billion units.

The K-Wave Synergy

Samyang didn’t create Hallyu—the Korean Wave—but Buldak rode it beautifully.

As K-pop, K-dramas, and Korean films globalized, the world became more curious about Korean culture in general, and Korean food in particular. BTS member Jimin was known as a Buldak fan. Parasite put instant noodles into pop culture with its ram-don scene—two noodles combined with premium hanwoo beef—and helped reinforce the idea that Korean convenience food could be globally interesting, even aspirational.

The Jimin connection, especially, became part of the Buldak legend. In May 2025, Star News reported remarks shared at the 16th Asian Leadership Conference in Seoul: Pick Entertainment CEO Park Myung-wan pointed to a now-famous live broadcast where Jimin casually ate Buldak Bokkeum Myeon. It played as a simple, relatable moment—and then spread fast.

A Samyang Foods representative, who sponsored BTS’s U.S. concerts, cited Jimin as a meaningful driver of Buldak’s popularity in the U.S., even sending a message and gift that said, “Thanks to Jimin, we built a new factory in Miryang.”

Kim Jung-soo echoed that impact on SBS News’ Food Talk on August 17, 2022, saying videos of Jimin eating Buldak had traveled widely. Yonhap News also reported that sales increased by 73 percent, with operating profit up 92 percent, tied to the attention.

Financial Transformation

The financials show what happens when a viral product becomes a scaled export machine.

Revenue rose from 909 billion won in 2022 to 1.1929 trillion won in 2023 and 1.728 trillion won in 2024. Over that same stretch, operating profit grew from 90.3 billion won to 147.5 billion won, then to 344.5 billion won.

That translated into a dramatic margin shift: 9.9 percent in 2022, 12.4 percent in 2023, and 19.9 percent in 2024. The company estimated margins could reach 22.0 percent in 2025, driven by higher sales and a greater mix of higher-margin products. As Buldak established itself as “premium K-ramen” abroad, Samyang gained pricing power.

In 2024, operating profit jumped 133 percent to 352.27 billion won from 147.5 billion won, with a 19.9 percent operating margin—an eye-catching figure in an industry where many Korean food companies sit closer to 5 percent. It was also the first time Samyang posted more than 300 billion won in operating profit.

The core dynamic was export economics. In Korea, instant noodle pricing faces regulatory scrutiny and brutal shelf competition. Overseas, Buldak could sell at premium prices—especially as specific flavors broke through. Samyang noted that Carbonara Buldak, in particular, entered major U.S. retailers like Walmart and Costco.

By August 2025, Samyang said first-half revenue had surpassed 1 trillion won for the first time, with quarterly sales clearing 500 billion won on double-digit growth. In the April–June quarter, Samyang reported sales of 553.1 billion won and operating profit of 120.1 billion won, up 30 percent and 34 percent, respectively.

The expansion showed up in the subsidiaries too. The company’s China unit reported roughly $90 million in sales, up 30 percent year over year. Samyang America generated $94 million in revenue, a 32 percent increase, after expanding distribution to mainstream retailers including H-E-B and Sam’s Club. Samyang’s European unit, established in July 2024, more than doubled revenue from the prior quarter to around $37 million.

The Governance Shift

Kim Jung-soo’s rise to formal leadership came with real turbulence.

On January 25, 2019, Samyang Chairman Jeon In-jang was sentenced to three years in prison for embezzling 5 billion won (US$4.43 million) of company funds. Kim, who was CEO, received a two-year prison term that was suspended for three years on the same charges. With Jeon imprisoned, Kim took on his leadership duties.

She was later pardoned, and returned as CEO in 2021.

Meanwhile, the group moved to modernize its structure and identity. In July 2023, Samyang Foods Group rebranded the group and holding company—renaming Samyang Naturals Co. as Samyang Roundsquare—framing a broader vision of providing nutrients “for life and the future.”

In April 2025, Samyang Roundsquare announced that Kim had officially resigned as CEO of the holding company after less than two years in the role, having taken it in September 2023. She remained on the board as an internal director, and continued as CEO of Samyang Foods. Jang Seok-hoon, who led the management support division at Samyang Foods, was appointed the new CEO of Samyang Roundsquare.

It was a meaningful step toward more professionalized management: separating holding-company oversight from day-to-day operations, while keeping strategic continuity at the center of the business that actually made the fire spread.

VI. The Playbook: Lessons for Builders

So what do you take from a company that went from “legacy also-ran” to global cultural export—largely because the internet decided a noodle was a good way to watch your friends suffer?

A few principles show up again and again, and they travel well beyond instant ramen.

Product-Market Fit via Extremes

On paper, Buldak looks like a bad idea. Market sizing would label it niche. How big can the audience be for a product that makes people tear up and gasp for air?

But that thinking misses the dynamic that actually matters: polarizing products don’t just create customers. They create evangelists.

A “pretty good” product earns repeat purchases. An extreme product earns stories. It turns buyers into broadcasters—people who don’t just consume the thing, but recruit other people into it. Buldak’s intensity is precisely what made it remarkable, and remarkability is the raw material of word-of-mouth. Sometimes the fastest path to a big market is to win a small group so hard they can’t stop talking about you.

The “Scarcity of Experience”

The Fire Noodle Challenge worked because it delivered something the internet can’t fully simulate: a physical sensation. The sweat. The tears. The endorphin rush. The involuntary facial expressions. Everyone understands it instantly because everyone has eaten something that was too spicy.

In a world where more and more experiences are mediated through screens, visceral experiences become valuable currency. They cut through because they’re real—and because they’re contagious. You can watch a hundred people eat Buldak, but sooner or later you want to know what it does to you.

Accidental Globalization

Samyang didn’t orchestrate a polished global launch. They didn’t do a big international ad campaign or obsess over tailoring the product to Western palates. They made something unmistakable, and the internet turned it into a format.

That’s the alternative globalization playbook: don’t spend years “preparing a market” before you have proof anyone cares. Let the world pull the product out of you first. Then, once demand shows up—loudly—do the unsexy work of scaling supply. And resist the instinct to sand off what makes the product different. Don’t localize until you have to. Authenticity tends to travel better than watered-down accessibility.

Heritage as Competitive Advantage

It’s easy to tell this story like Samyang got lucky—and they did get lucky. But luck isn’t enough if you can’t deliver.

Samyang had something most viral brands don’t: decades of manufacturing know-how. They weren’t a startup learning to make noodles; they’d been doing it since 1963. When global demand hit, they had the supplier relationships, quality systems, and operational muscle to scale into it.

The underrated lesson is that legacy can be an advantage—if the company is willing to pair old strengths with new behavior. The hard part isn’t the factory. It’s the culture. Getting a traditional organization to take a weird, risky bet like “make it even spicier.”

Managing the “One Hit Wonder” Risk

There’s a flip side to building a rocket ship around one product: dependency. In 2023, the Buldak brand accounted for 84 percent of Samyang’s global sales. That kind of concentration is powerful—until tastes shift.

Samyang’s answer has been to turn Buldak from a single product into a platform: extensions into sauces, snacks, and ready-to-eat options; constant new variations to keep the brand feeling alive; and broad geographic expansion so the company isn’t hostage to one market’s trend cycle. Kim has emphasized building ongoing “synergy” through diversification: “By expanding our core product portfolio beyond ramyeon to include sauces, snacks, ready-to-eat meals and beverages, while nurturing health care-related categories, we aim to discover new growth engines.”

The point is straightforward: virality can open the door, but only deliberate portfolio-building keeps you in the building.

VII. Analysis: Frameworks (Bear vs. Bull)

Hamilton's 7 Powers Analysis

Branding (The Strongest Power): “Buldak” has pulled off something rare: it’s becoming the default word people use for this whole corner of the category. Like Kleenex or Xerox, the brand is sliding toward a proprietary eponym. In a lot of places, when someone says “fire noodles,” they’re not describing a generic product. They mean Samyang.

Scale Economies: Samyang now buys huge volumes of key inputs like wheat and sauce ingredients, which helps on cost. But the bigger advantage is that it can pair that efficiency with premium export pricing. The Miryang smart factories are the physical proof. The second plant went from groundbreaking to opening in about 15 months, backed by a 183.8 billion won investment—built to crank out Buldak at global scale, not just keep up with Korea.

Cornered Resource: The Buldak sauce itself has become valuable IP. It’s not just “the packet inside the noodles” anymore; Samyang sells Buldak Sauce as a standalone product, in the same way Sriracha escaped the bottle and became its own category shorthand.

Counter-positioning: Versus Nongshim, Samyang has carved out a different identity: not the incumbent, but the challenger. Nongshim’s Shin Ramyun is mainstream Korean spice. Buldak is the extreme edge—louder, younger, and more globally tuned. That distinction matters because it’s hard for a market leader to credibly reinvent itself as the brand of extremes without diluting what it already stands for.

Porter’s 5 Forces Analysis

Threat of New Entrants (High): Spicy noodles aren’t a technical miracle. Competitors like Nongshim, Ottogi, and Nissin can make their own versions, and manufacturing barriers in packaged food are not insurmountable.

Rivalry (High): The “Ramyeon War” is relentless, especially at home. Nongshim still dominates the Korean market with over half of domestic share, and in 2023 it placed five brands in the top ten by share, with Shin Ramyun leading at 16.05 percent. Shelf space is fought over one endcap at a time.

Power of Suppliers: Samyang lives with commodity reality: wheat, palm oil, packaging. Many Korean noodles are fried in palm oil because it’s neutral and cost-effective, but that also ties margins to global agricultural swings.

Power of Buyers: In the U.S. and other export markets, retailers like Walmart, Costco, and major supermarket chains have real negotiating leverage. Samyang’s counterweight is brand pull: when consumers come in asking for Buldak specifically, the retailer can’t treat it like a generic commodity.

Substitute Products: The enemy isn’t only “other noodles.” It’s anything competing for the same eating occasion: snacks, other cuisines, and health-oriented alternatives.

The Moat: Here’s the part that’s hard to copy. Rivals can approximate the flavor. They can match the Scoville. What they can’t reproduce is the culture—millions of user-generated videos of people eating Samyang, reacting to Samyang, daring friends with Samyang. The Fire Noodle Challenge wasn’t about instant noodles in general. It was about Buldak. That association is the moat.

The Bear Case

Health trends: Instant noodles carry structural baggage: sodium concerns, carb reduction, and broader wellness movement momentum. A product that’s both processed and famous for extreme heat could face demand pressure if consumer preferences shift hard toward “cleaner” eating.

Concentration risk: Buldak accounts for 84 percent of global sales. That’s powerful, but it’s also a “Crocs problem”: when you’re that dependent on one phenomenon, you’re exposed to attention cycles and taste shifts.

Commodity exposure: Wheat, palm oil, and packaging costs can swing sharply. Samyang noted that the won-dollar exchange rate rising through late 2024 helped results, but currency is a two-way door.

Regulatory risk: In June 2024, Denmark recalled three Samyang spicy ramen variants after the Danish Veterinary and Food Administration concluded the capsaicin in a single packet could be high enough to pose a risk of acute poisoning. The recall was partially reversed, but the message was clear: different markets have different standards, and “extreme” invites scrutiny.

Governance concerns: The company’s history includes embezzlement convictions among senior leadership and the complications that come with continued family control. For ESG-focused investors, that can translate into reputational risk and a higher governance discount.

The Bull Case

Buldak as the Coca-Cola of spicy food: Samyang has stated the ambition plainly: “Just as Coca-Cola is a household name around the world, our goal for Buldak is for it to stand shoulder to shoulder with that level of brand recognition.” If Buldak becomes the default global symbol for spicy, the ceiling is enormous. Instant noodles are a mass habit worldwide, measured in hundreds of billions of servings a year.

Category expansion: Noodles built the brand, but the brand doesn’t have to stay inside noodles. Standalone sauce is the obvious adjacent win, and Samyang has also talked about targeting the health-functional food market while broadening its portfolio. Each step outward—sauce, snacks, frozen—expands the addressable market.

U.S. retail saturation: In the first half of 2025, U.S. sales reached US$185 million, representing 30% of Samyang’s overseas revenue. The U.S. is the biggest prize in consumer retail. Every move from Asian grocery aisles into mainstream shelves is incremental distribution—and potentially a lot of it.

Production capacity expansion: Supply has been a constraint, and Samyang is attacking it directly. The new Miryang plant increased total annual capacity from 2.08 billion to 2.8 billion units, and the company’s first overseas plant in China is slated for completion in 2027. When demand is there, capacity is growth.

Hallyu tailwinds: K-culture continues to travel—music and drama, yes, but also food, film, and everything adjacent. The Ministry of Culture, Sports and Tourism has tracked continued global interest across 11 categories. As long as that broader curiosity holds, Buldak benefits from being a simple, purchasable piece of the wave.

Key Performance Indicators to Watch

For anyone tracking whether Samyang can keep this run going, two metrics matter most:

Export Revenue Ratio: Now close to 80 percent, this is the whole thesis in one number: Samyang wins when it sells globally, where it has stronger brand positioning and more pricing power. A meaningful slide back toward domestic dependence would be a warning sign.

Operating Margin: Recently around 20–22 percent—exceptional for packaged food. This reflects both export pricing and operational leverage. If margins compress, it likely means one of three things: tougher competition, commodity inflation, or weakening pricing power.

VIII. Epilogue: The Next Course

“Samyang Foods is no longer just a ramen company,” Vice Chairman Kim said in November 2025. “We are a global food brand sharing Korean culinary culture with the world, and this marks the beginning of yet another innovation.”

She delivered that line at a launch designed to be more than a product announcement. Samyang 1963 was introduced as a premium, beef-tallow-fried ramen—an unmistakable nod to the ingredient at the center of the 1989 “Uji scandal” that had cratered the company’s reputation. Samyang even chose the date deliberately: the exact day the original complaint that triggered the scandal had been filed, thirty-six years earlier.

The event didn’t try to bury the past. It put it on stage. It opened with a montage of old TV news clips and newspaper headlines from the scandal, then rolled into ads paying tribute to former employees who had been forced to leave during that period.

It was corporate closure, performed in public—and it only works if you’re confident enough to do it. A company still trying to outrun its history doesn’t replay the footage.

“In 2025, we will not rest on our current achievements but will drive innovation, enabling Samyang Roundsquare employees to take even greater pride in their work,” Kim said. “The group will break down boundaries and stereotypes between health care and food, fostering integrated business synergies that drive transformation and progress.”

What comes next, Samyang says, is expansion beyond noodles: deeper moves into health-functional foods, plant-based proteins through the Tangle and Jack & Pulse brands, and continued geographic diversification. Tangle by Samyang Foods—a premium dried noodle brand made for global consumers—is fortified with Vitamin B1, B3, folic acid, and iron. The company has also launched an international academic-industry collaboration with Wageningen University in the Netherlands.

The company that once fed a starving nation now feeds a global appetite for bold flavors and shareable experiences. From a post-war survival product to a red-pack spectacle that became internet ritual, Samyang’s arc captures something bigger than one lucky SKU: how a Korean company turned domestic necessity into a global cultural product.

Industry observers note that, unlike Nongshim, Samyang Foods is now fundamentally built around exports. Samyang Foods is estimated to account for more than 67% of Korea’s ramen export value—an unusually concentrated share for a single company, and a signal of just how far this brand has traveled.

The fire noodle revolution began with one woman watching strangers sweat over street food and asking a dangerous question: what if we could bottle that feeling? It was amplified by creators chasing reactions and viewers chasing spectacle. It was made durable by factories, logistics, and the discipline to keep the product’s edge.

And it’s still spreading—one bowl of impossibly spicy noodles at a time.

The spice heard ’round the world is still burning.

Chat with

this content: Summary, Analysis, News...

Chat with

this content: Summary, Analysis, News...

Amazon Music

Amazon Music